Market Overview

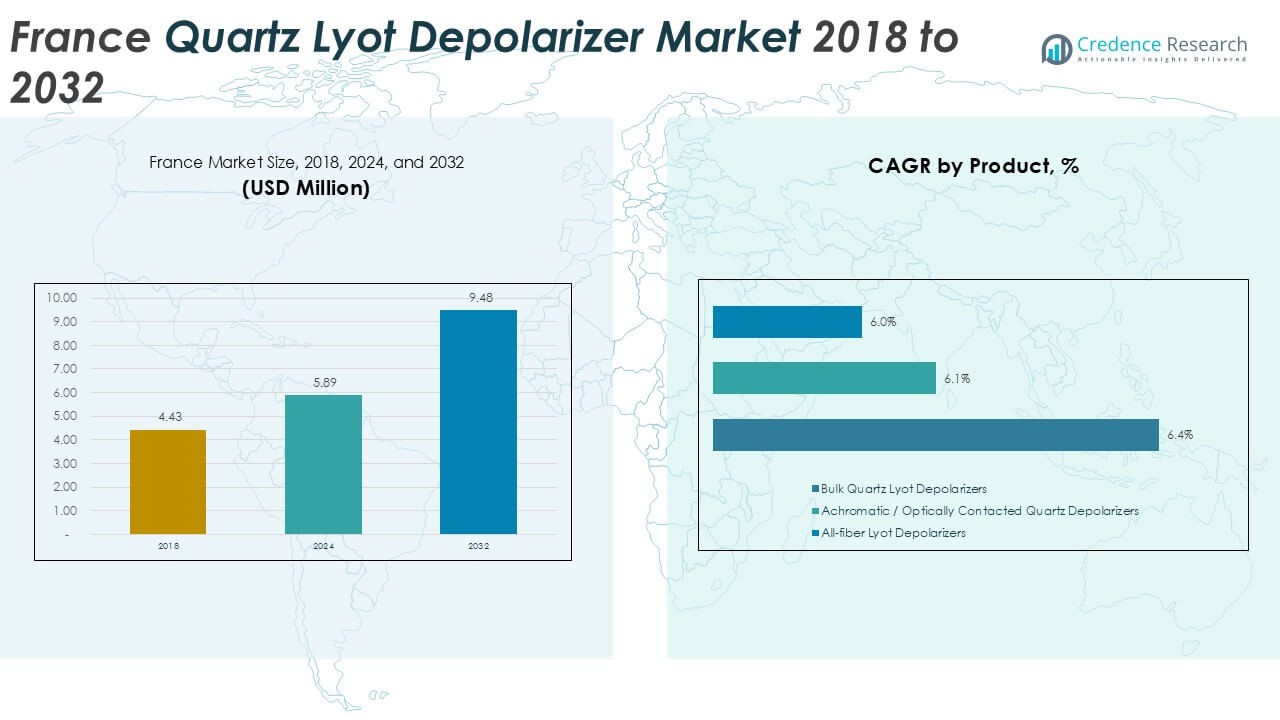

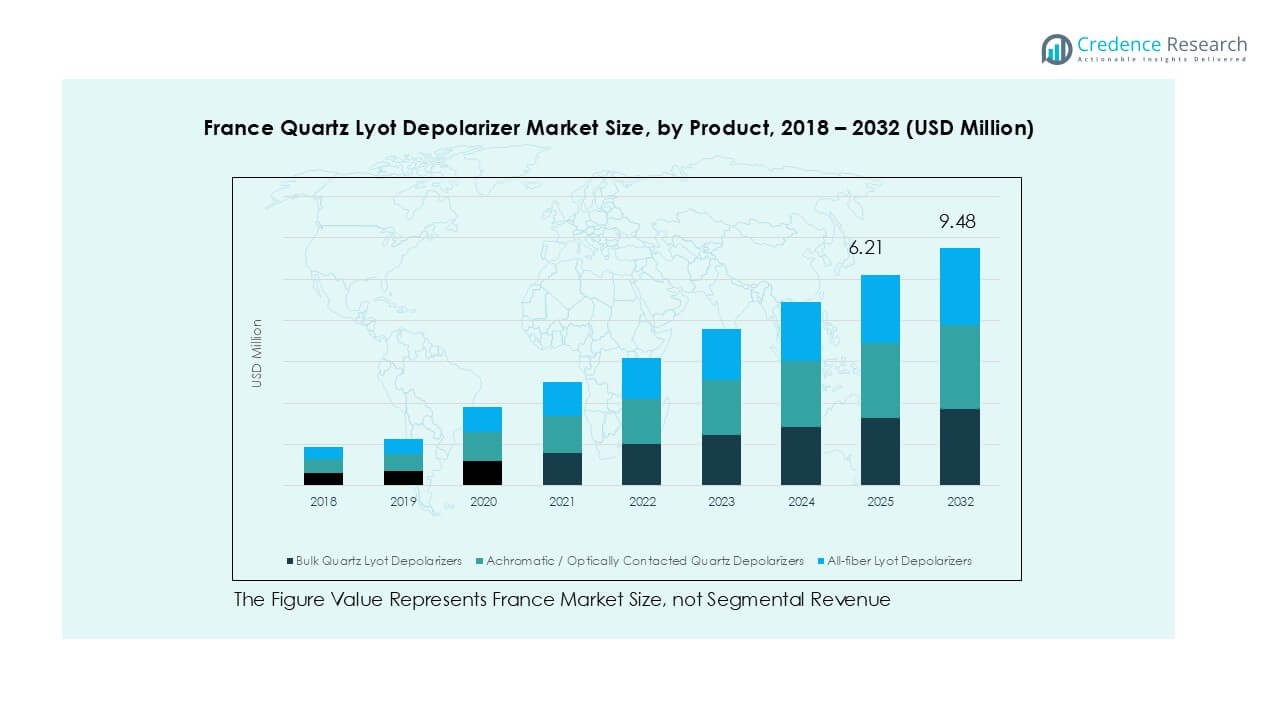

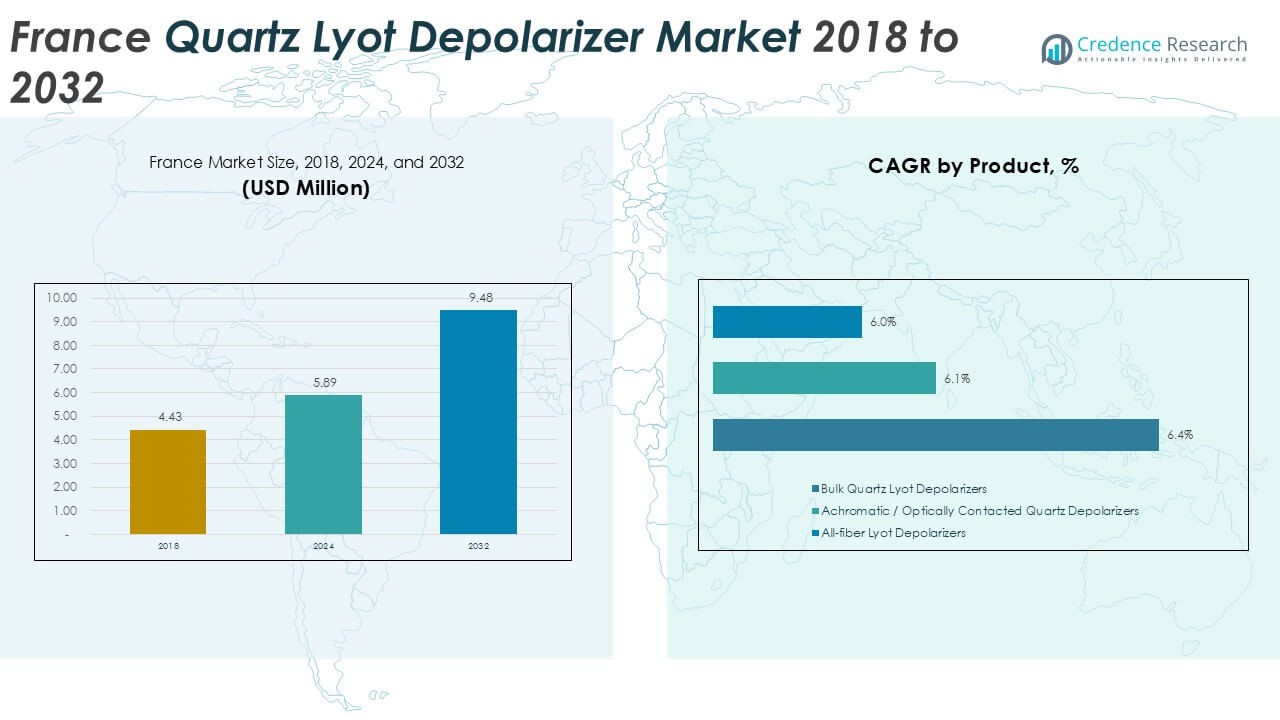

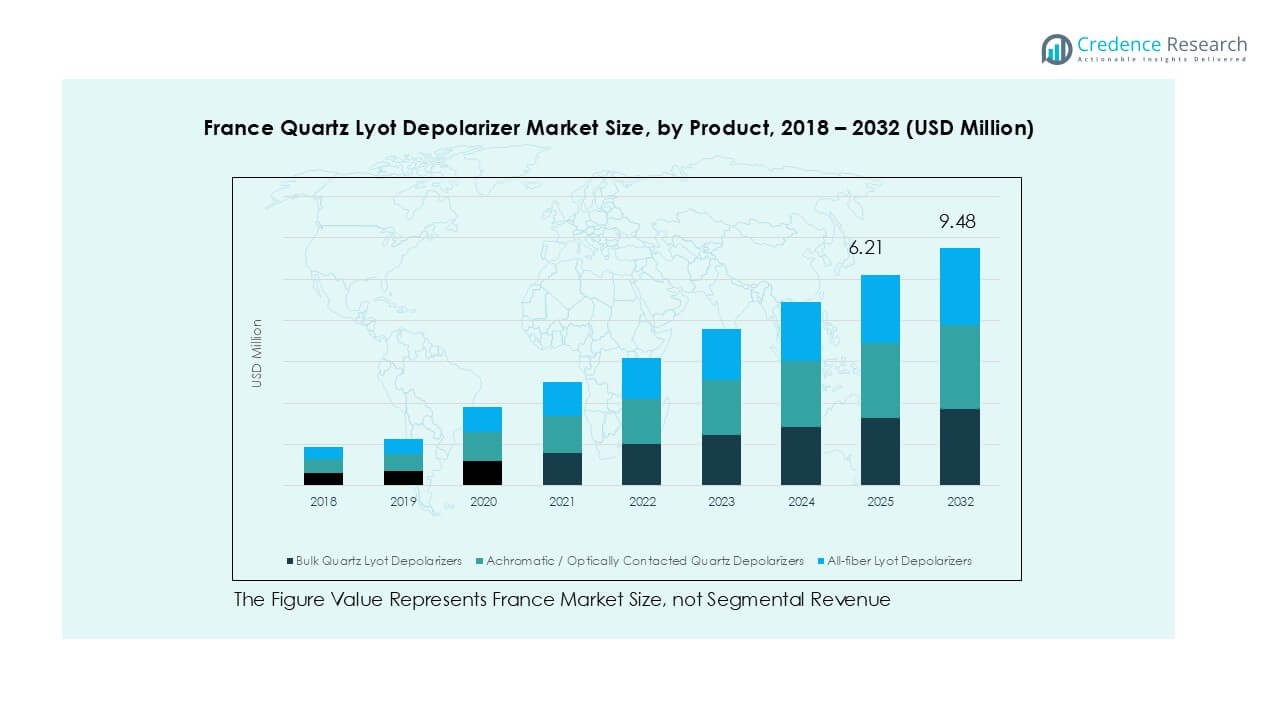

The France Quartz Lyot depolarizer market size was valued at USD 4.43 million in 2018 and reached USD 5.89 million in 2024. It is anticipated to reach USD 9.48 million by 2032, growing at a CAGR of 6.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Quartz Lyot Depolarizer Market Size 2024 |

USD 5.89 Million |

| France Quartz Lyot Depolarizer Market, CAGR |

6.0% |

| France Quartz Lyot Depolarizer Market Size 2032 |

USD 9.48 Million |

The France Quartz Lyot depolarizer market is shaped by a competitive mix of international leaders and specialized suppliers. Global players such as Thorlabs, Jenoptik, Excelitas Technologies, and Edmund Optics lead with broad portfolios and strong distribution capabilities, ensuring wide adoption across telecom and research applications. Specialized firms like Leysop Ltd, Tower Optical, Foctek Photonics, Hunan Dayoptics, and OptoSigma cater to niche requirements, offering custom-built depolarizers for spectroscopy, imaging, and industrial instrumentation. Regionally, Northern France accounted for 35% of the market share in 2024, driven by research clusters and fiber-optic investments, followed by Eastern France with 28%. Western and Southern France contributed 22% and 15% respectively, supported by academic research and industrial laser applications. This balance of global presence and regional demand fosters innovation and sustains market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Quartz Lyot depolarizer market was valued at USD 5.89 million in 2024 and is projected to reach USD 9.48 million by 2032, growing at a CAGR of 6.0%.

- Growing demand from telecom and fiber-optic systems acts as a major driver, with network expansion and 5G rollout boosting adoption of all-fiber depolarizers across the country.

- Market trends highlight increasing use of depolarizers in spectroscopy, biomedical imaging, and industrial laser systems, supported by academic research investments and advanced manufacturing applications.

- Competition is shaped by global leaders such as Thorlabs, Jenoptik, and Excelitas, alongside niche players like Leysop Ltd and Tower Optical, with innovation in wavelength versatility and customization strengthening positions.

- Regionally, Northern France leads with 35% share, driven by research hubs, followed by Eastern France at 28% due to industrial laser adoption; Western France holds 22% supported by spectroscopy applications, while Southern France contributes 15%, driven by aerospace and biomedical growth.

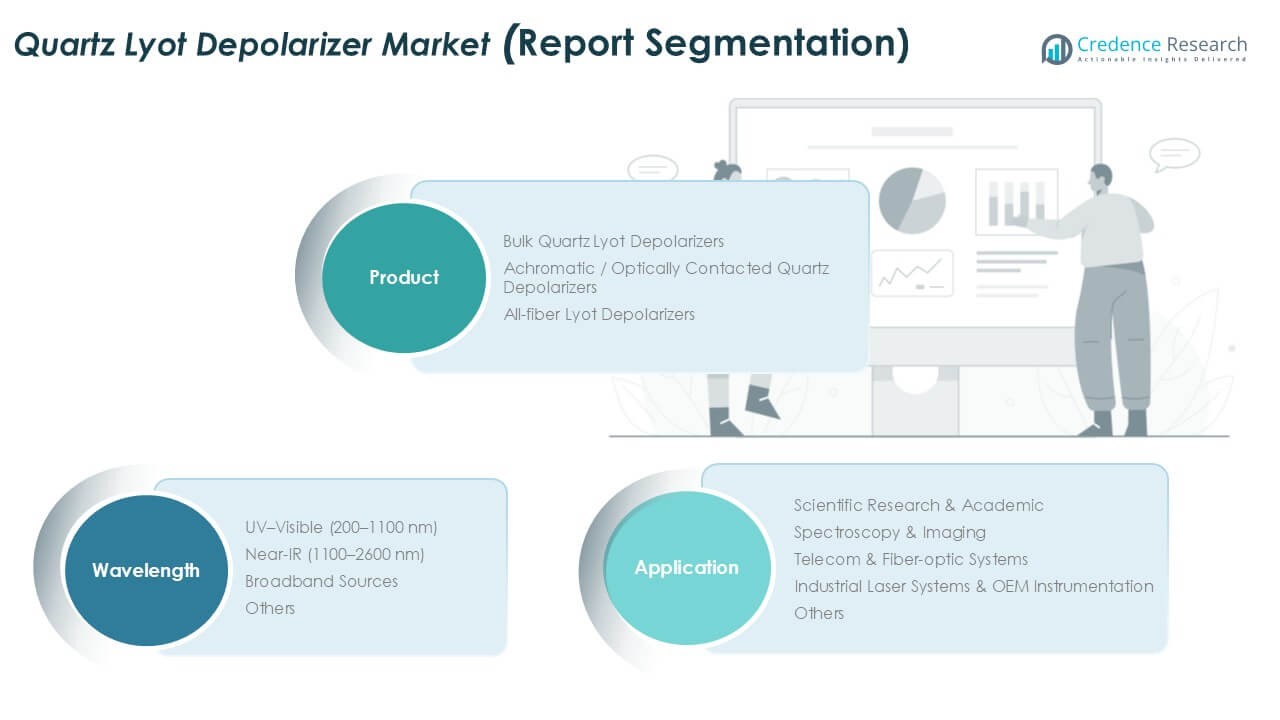

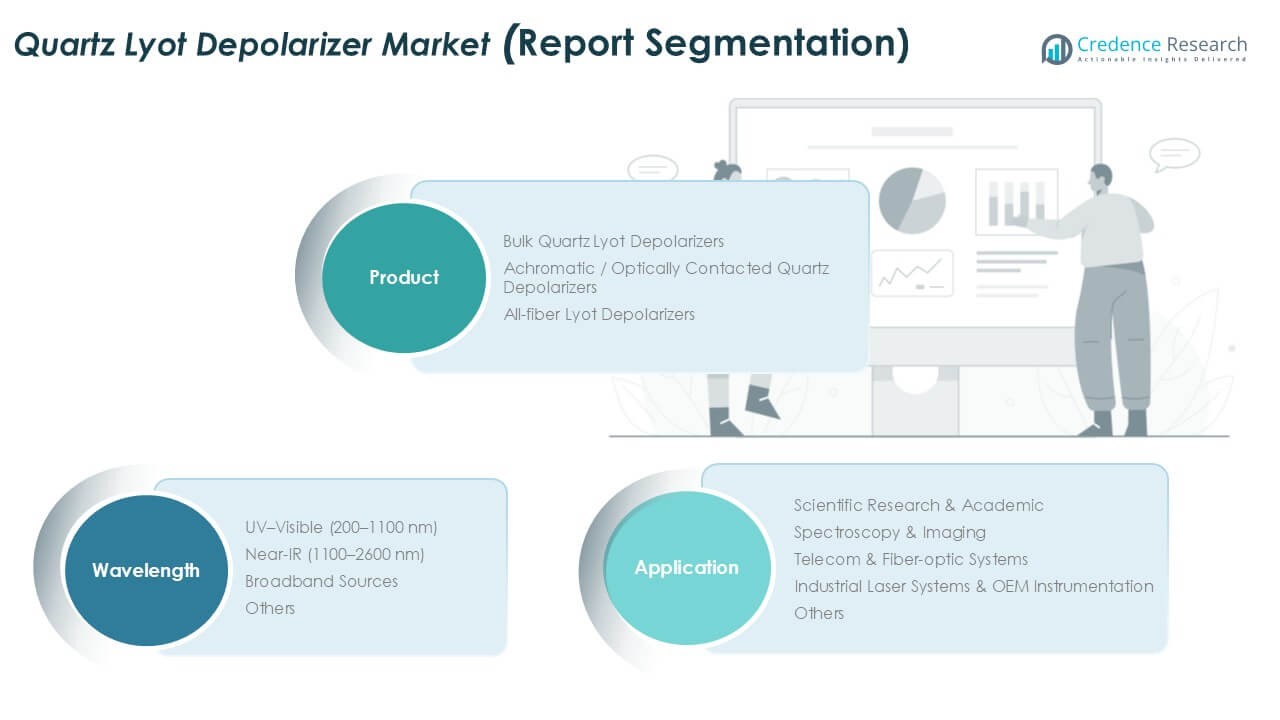

Market Segmentation Analysis:

By Product

In the France Quartz Lyot depolarizer market, Bulk Quartz Lyot Depolarizers held the largest share in 2024, accounting for over 45% of the market. Their dominance is driven by widespread use in spectroscopy, imaging, and research applications due to stability and precision. These devices are cost-effective compared to achromatic and all-fiber variants, making them suitable for academic and laboratory use. Achromatic depolarizers are gaining traction in high-end optical systems requiring broad wavelength coverage, while all-fiber depolarizers are increasingly used in telecom networks where compact design and fiber compatibility are critical.

- For instance, Edmund Optics Europe is a significant supplier of optical components, including depolarizers, which are utilized in various applications like spectroscopy and research instrument integration. Edmund Optics has operations and a presence in France, Wiley Industry News.

By Application

Among applications, Telecom & Fiber-optic Systems represented the dominant segment with more than 40% share in 2024. This leadership is supported by the rapid expansion of high-speed broadband infrastructure and increasing deployment of fiber-optic networks across France. The need for high signal clarity in long-distance communication drives demand for Lyot depolarizers to minimize polarization effects. Scientific research and academic use also show steady growth, while spectroscopy and industrial laser systems are increasingly adopting depolarizers for advanced imaging, precision instrumentation, and high-power laser operations.

- For instance, Orange S.A. deployed over 1.2 million kilometers of fiber across France by the end of 2023, integrating polarization-control solutions such as depolarizers to stabilize optical performance in its high-capacity telecom networks.

By Wavelength

The UV–Visible (200–1100 nm) range emerged as the leading segment, holding over 50% share in 2024. Its dominance stems from its extensive use in spectroscopy, biomedical imaging, and academic research, where UV–Vis analysis is a critical tool. Strong demand for accurate light depolarization in laboratory instruments and optical testing platforms further drives adoption. Near-IR depolarizers are growing in telecom and laser-based systems, while broadband sources are finding niche applications in advanced industrial optics. This wavelength versatility ensures steady growth across research, communication, and industrial laser applications.

Key Growth Drivers

Expansion of Telecom and Fiber-Optic Networks

The rapid rollout of high-speed broadband and 5G infrastructure across France is a major growth driver for the Quartz Lyot depolarizer market. These devices play a crucial role in maintaining signal stability and minimizing polarization noise in long-distance fiber-optic communication. Telecom operators in Northern and Eastern France are increasingly deploying depolarizers to enhance performance in dense fiber networks. Rising demand for reliable internet and the government’s digitalization initiatives further boost market adoption. This expansion creates strong opportunities for bulk and all-fiber depolarizers, aligning with the nation’s push toward digital connectivity and advanced communication systems.

- For instance, Orange S.A. significantly contributed to France’s superfast broadband plan, reaching 37.4 million connectable fiber optic households in France by the end of 2023. By November 2023, Orange had covered 21 million of the 36 million eligible premises in France, with a goal of achieving widespread fiber deployment by 2025.

Strong Academic and Research Investments

France’s significant investment in research institutions and universities has strengthened demand for Quartz Lyot depolarizers, particularly in spectroscopy, imaging, and optical testing. Northern France, home to leading research clusters, drives usage in advanced laboratories where UV–Visible and broadband sources are extensively applied. Funding programs from the French National Research Agency and EU Horizon initiatives further support adoption in scientific research. Universities are expanding their optical technology departments, creating steady demand for depolarizers in experimental setups. This emphasis on academic excellence ensures France remains a leader in photonics, with depolarizers serving as vital tools in advanced optical exploration.

- For instance, the Centre National de la Recherche Scientifique (CNRS) is a major supporter of optics and photonics research, a field with applications in areas like spectroscopy and laser-based experiments.

Industrial Laser Systems and OEM Instrumentation Growth

Industrial expansion across Eastern and Southern France is fueling demand for depolarizers in laser systems and OEM instrumentation. Industries such as aerospace, automotive, and advanced manufacturing increasingly rely on depolarizers to ensure precise light quality in high-power laser operations. OEM manufacturers integrate depolarizers in imaging systems and measurement devices to enhance accuracy. Strong collaborations between French optical companies and European partners drive innovation and commercial deployment. Industrial modernization programs and adoption of smart manufacturing practices further expand the role of depolarizers. This industrial alignment positions depolarizers as key enablers of France’s advanced manufacturing competitiveness.

Key Trends & Opportunities

Shift Toward All-Fiber Depolarizers in Telecom Applications

A strong trend in the France market is the increasing adoption of all-fiber Lyot depolarizers for telecom and broadband networks. These devices provide superior integration with fiber systems, ensuring compact designs and reduced insertion loss. With 5G expansion and higher reliance on fiber-optic communication, operators prefer all-fiber solutions to improve efficiency. Market opportunities lie in upgrading older infrastructure with fiber-compatible depolarizers. Companies investing in R&D to enhance wavelength flexibility and reduce costs are well-positioned to capture growth. This trend also aligns with sustainability, as all-fiber solutions minimize bulk material use and enable more efficient installations.

- For instance, Alcatel Submarine Networks (ASN), a major player in the submarine cable market based in France, did not deploy 45,000 km of new fiber-optic cable in 2023. While ASN did lead and work on several key projects and upgrades that year, the 45,000 km figure is the approximate length of a different project called the 2Africa cable system, for which ASN was a key supplier, but not the sole operator responsible for its total length.

Rising Applications in Spectroscopy and Biomedical Imaging

Another key opportunity is the expanding use of Quartz Lyot depolarizers in spectroscopy and biomedical imaging applications. France has a strong base of healthcare and life sciences research, especially in Western and Southern regions, where academic institutions collaborate with hospitals. UV–Visible depolarizers are vital for fluorescence imaging, optical coherence tomography, and analytical spectroscopy, enabling high-precision diagnostics. Growing interest in photonics-based medical solutions drives further adoption. Companies developing depolarizers with enhanced stability and broader wavelength ranges stand to benefit significantly. This trend supports both scientific advancement and commercialization in France’s rapidly developing healthcare optics segment.

Key Challenges

High Manufacturing Costs and Technical Complexity

One of the major challenges in the France Quartz Lyot depolarizer market is the high cost of production. Manufacturing requires precise optical alignment, high-purity quartz, and advanced polishing techniques, which significantly increase capital expenditure. Smaller companies often face barriers to entry due to cost-intensive processes and limited economies of scale. Additionally, ensuring wavelength flexibility and maintaining stability across temperature variations add technical complexity. These factors slow mass adoption in cost-sensitive industries. Unless manufacturing efficiency improves, pricing will remain a barrier, particularly for research labs and mid-tier industrial users in France.

Competition from Alternative Depolarization Technologies

Another key challenge is the growing competition from alternative depolarization methods, such as fiber Bragg gratings and polarization-maintaining components. These alternatives offer lower costs and easier integration in some telecom and laser applications. As optical system designers seek simpler and cost-efficient solutions, reliance on traditional Quartz Lyot depolarizers faces pressure. Additionally, photonic integrated circuits (PICs) are emerging as replacements in compact systems, creating long-term substitution risks. French manufacturers must innovate with higher-performance, achromatic, or fiber-integrated depolarizers to remain competitive. Without strategic innovation, Quartz Lyot depolarizers risk losing share to evolving optical technologies.

Regional Analysis

Northern France

Northern France commanded the largest share of 35% in 2024, establishing itself as the leading regional hub for the Quartz Lyot depolarizer market. The dominance is supported by strong research infrastructure, including major universities and optical research institutes located in Lille and surrounding areas. The presence of established photonics clusters has boosted adoption in academic and scientific research applications. Growing investment in fiber-optic networks and industrial laser systems also drives regional demand. The concentration of OEM instrumentation companies further positions Northern France as a critical market, supporting both domestic supply and export opportunities.

Eastern France

Eastern France accounted for 28% of the market share in 2024, ranking second in the regional landscape. The strong industrial base in Alsace and Lorraine supports significant adoption of depolarizers in industrial laser systems and OEM instrumentation. Cross-border collaboration with Germany further accelerates research and commercialization in advanced optics. The telecom and fiber-optic systems segment is also expanding rapidly due to dense infrastructure investments in this region. Eastern France benefits from a strong engineering workforce and close ties with European optical technology leaders, ensuring continuous growth in precision optical device applications.

Western France

Western France held a 22% market share in 2024, with growth largely driven by the presence of academic institutions and spectroscopy-focused research centers. Cities like Rennes and Nantes contribute to innovation in spectroscopy and imaging applications. The telecom sector is also expanding in this region, supported by government-backed broadband initiatives that increase the use of fiber-optic systems. Western France’s market demand is boosted by partnerships between research institutes and local manufacturers, ensuring steady adoption of Lyot depolarizers across both industrial and academic uses. This region shows consistent growth momentum in scientific and communication-based applications.

Southern France

Southern France represented a 15% market share in 2024, making it the smallest but steadily expanding regional market. The region benefits from a growing presence of high-tech industries in Toulouse and Marseille, particularly in aerospace and laser-based research facilities. Demand is mainly driven by broadband sources and spectroscopy applications, supported by collaborations with Mediterranean research networks. While smaller compared to other regions, Southern France shows strong growth potential through increasing adoption in industrial laser systems and telecom networks. Targeted government investment in R&D and advanced optics further positions the region as an emerging growth contributor.

Market Segmentations:

By Product

- Bulk Quartz Lyot Depolarizers

- Achromatic / Optically Contacted Quartz Depolarizers

- All-fiber Lyot Depolarizers

By Application

- Scientific Research & Academic

- Spectroscopy & Imaging

- Telecom & Fiber-optic Systems

- Industrial Laser Systems & OEM Instrumentation

- Others

By Wavelength

- UV–Visible (200–1100 nm)

- Near-IR (1100–2600 nm)

- Broadband Sources

- Others

By Geography

- Northern France

- Eastern France

- Western France

- Southern France

Competitive Landscape

The competitive landscape of the France Quartz Lyot depolarizer market is characterized by a mix of global optical component leaders and niche precision-optics manufacturers. Companies such as Thorlabs, Jenoptik, Excelitas Technologies, and Edmund Optics dominate through broad product portfolios, strong distribution networks, and established brand recognition in research and telecom markets. Specialized players like Leysop Ltd, Tower Optical, Foctek Photonics, and Hunan Dayoptics focus on custom-built quartz depolarizers, serving both academic research and industrial OEMs. Local demand in France benefits from European collaborations, especially with German and UK suppliers, while regional research clusters support sustained adoption. Market competition emphasizes product innovation, wavelength versatility, and cost efficiency. Firms investing in all-fiber depolarizer technologies are gaining an advantage due to telecom and broadband expansion. At the same time, partnerships with academic institutes and industrial laser system providers further reinforce market presence. This competitive environment ensures continuous innovation, with both established corporations and niche firms contributing to growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leysop Ltd

- Thorlabs, Inc.

- Tower Optical Corporation

- Jenoptik AG

- Excelitas Technologies Corp.

- Foctek Photonics, Inc.

- Hunan Dayoptics, Inc.

- OptoSigma Corporation

- Edmund Optics India Private Limited

- Fujian Enlumen Tech Co., Ltd.

- Other Key Players

Recent Developments

- In 2023, Thorlabs launched a new generation of integrated depolarizers focused on improving efficiency and reducing device size.

- In 2023, OptoSigma released a smaller, more compact version of its popular depolarizer model.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Wavelength and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding with steady growth driven by telecom and fiber-optic applications.

- Research and academic institutions will remain strong adopters of quartz Lyot depolarizers.

- Industrial laser systems will generate increasing demand across aerospace and automotive sectors.

- All-fiber depolarizers will gain higher preference due to compact design and efficiency.

- UV–Visible range depolarizers will dominate because of their wide use in spectroscopy.

- Manufacturers will focus on innovation to improve wavelength flexibility and thermal stability.

- Competition will intensify as global and niche players expand presence in France.

- Partnerships between universities and optical companies will strengthen market penetration.

- Regional growth will remain strongest in Northern and Eastern France.

- Rising biomedical imaging applications will create new opportunities for specialized depolarizers.