Market Overview

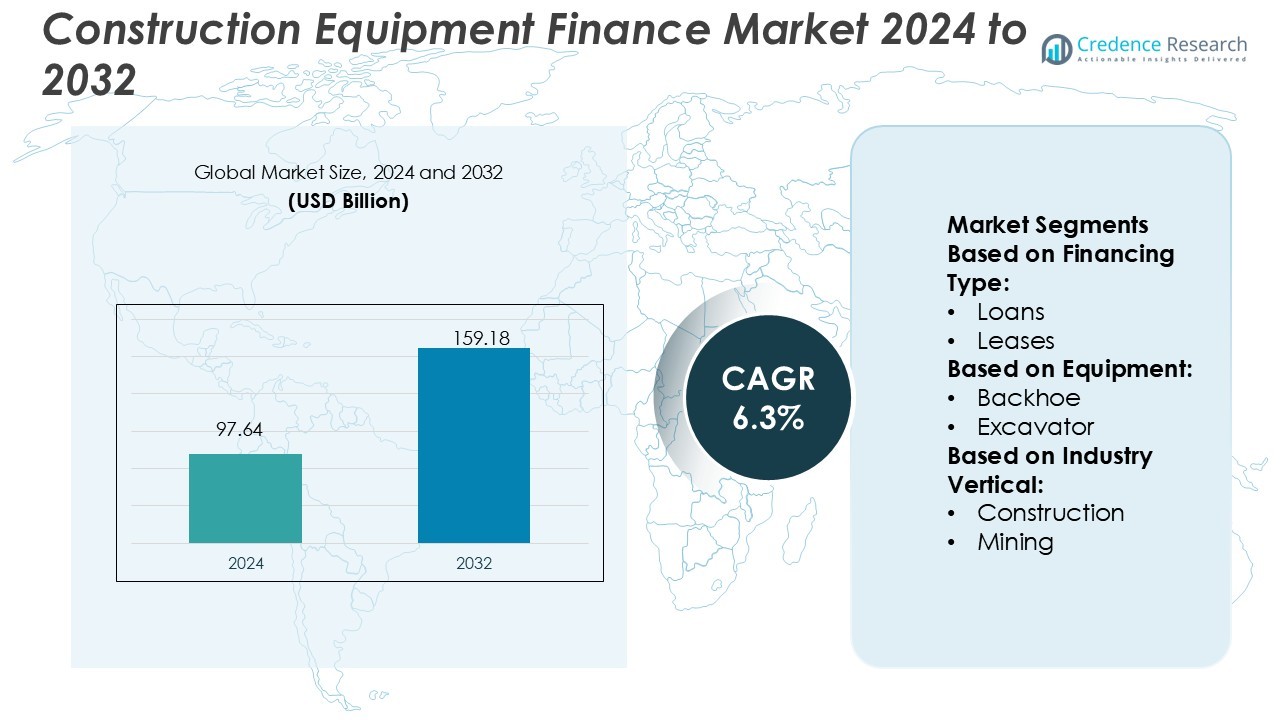

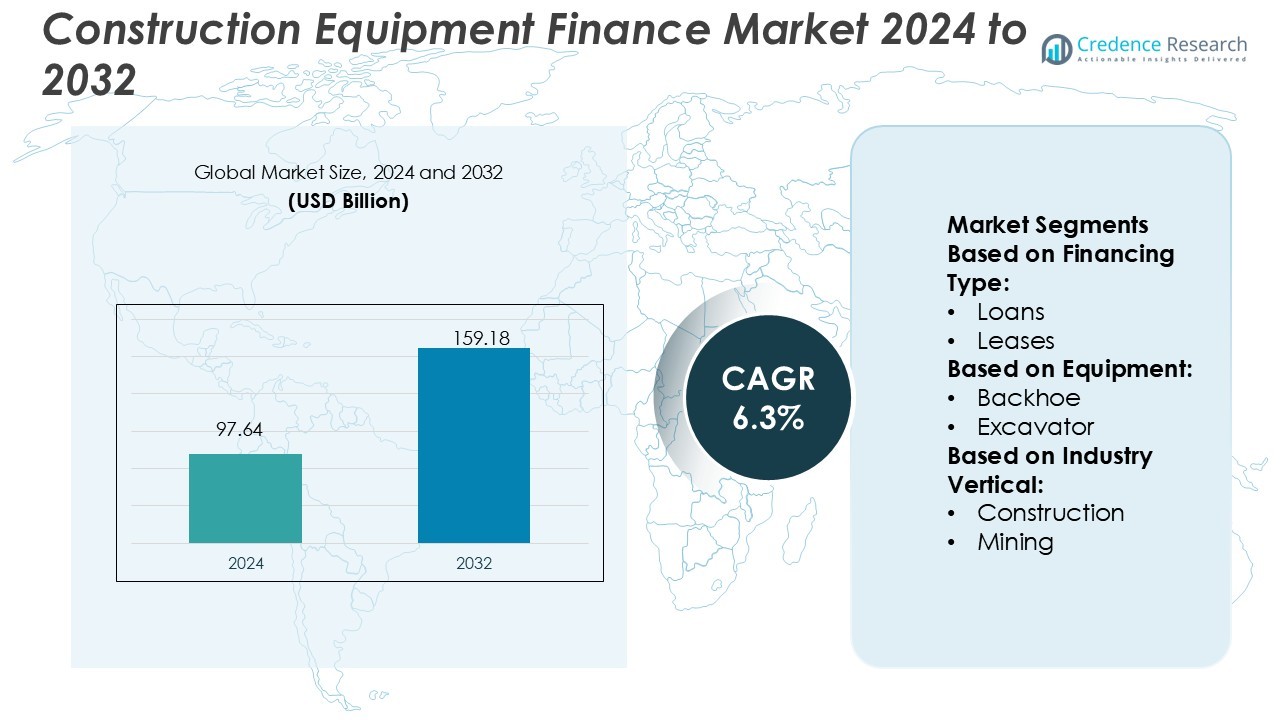

Construction Equipment Finance Market size was valued USD 97.64 billion in 2024 and is anticipated to reach USD 159.18 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Equipment Finance Market Size 2024 |

USD 97.64 Billion |

| Construction Equipment Finance Market, CAGR |

6.3% |

| Construction Equipment Finance Market Size 2032 |

USD 159.18 Billion |

The Construction Equipment Finance Market features strong competition among major players such as Komatsu, Caterpillar Inc., Deere & Company, CNH Industrial, AB Volvo, GE Capital, Bank of America, JP Morgan Chase, Wells Fargo, and John Deere. These companies focus on providing tailored financing solutions, including equipment loans, leases, and rental support, to meet diverse construction project needs. They emphasize digital transformation, customer-centric loan models, and strategic partnerships with contractors and equipment dealers. Asia-Pacific leads the global market with a 34% share in 2024, driven by large-scale infrastructure development, rapid urbanization, and increasing equipment modernization. The region’s robust construction pipeline and government-backed financing programs continue to strengthen its dominance in the global landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Equipment Finance Market was valued at USD 97.64 billion in 2024 and is projected to reach USD 159.18 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

- Market growth is driven by increasing infrastructure investments, smart city projects, and high demand for technologically advanced construction machinery requiring flexible financing solutions.

- Digital financing platforms, AI-based risk assessments, and telematics-linked equipment monitoring are key trends improving loan processing and asset management efficiency.

- The market is highly competitive, with major players focusing on leasing innovations, customer-centric funding models, and sustainability-focused financing strategies.

- Asia-Pacific leads with a 34% share, supported by rapid industrialization and public infrastructure projects, while the loans segment dominates financing types due to its widespread use among contractors for high-value equipment purchases.

Market Segmentation Analysis:

By Financing Type

Loans dominate the Construction Equipment Finance Market with a 52% share in 2024. The dominance stems from flexible repayment terms, lower interest rates, and easy availability through banks and NBFCs. Leasing is gaining traction as companies prefer asset-light models to preserve capital. Mortgages remain limited due to ownership transfer complexities. The strong loan segment growth is driven by rising equipment costs, government infrastructure investments, and financial institutions’ focus on tailored loan products with faster approvals and reduced processing times for contractors and builders.

- For instance, The Bobcat T7X all-electric compact track loader features a 72.6-kilowatt-hour lithium-ion battery and can run for up to six hours of continuous operation on a single charge.

By Equipment

Earthmoving and roadbuilding equipment hold the largest share of 48% in 2024, driven by high demand for excavators, loaders, and backhoes in infrastructure and real estate development. Excavators lead the sub-segment due to their multipurpose usage in construction, mining, and road projects. Financing institutions prioritize this segment due to consistent utilization and high resale value. Increasing urbanization, smart city projects, and road expansion initiatives fuel sustained demand for financed equipment, enabling firms to modernize fleets while managing cash flow efficiently.

- For instance, Abbott’s HeartMate 3 heart pump, in the MOMENTUM 3 trial involving more than 1,000 patients, showed that the five-year survival rate was 58.4%, compared to 43.7% in the control arm with HeartMate II.

By Industry Vertical

The construction industry dominates the market with a 56% share in 2024, reflecting its dependence on financed heavy equipment for project execution. Mining and government sectors follow, driven by public infrastructure and resource extraction activities. Rental companies also contribute significantly due to the surge in short-term project contracts. Market growth is supported by public-private partnerships, rising infrastructure budgets, and financial institutions offering specialized schemes for construction SMEs. These developments ensure consistent equipment renewal and operational scalability across major industry segments.

Key Growth Drivers

Rising Infrastructure Development and Urbanization

Global urban expansion and public infrastructure projects are driving high demand for heavy equipment financing. Governments are investing in transportation, smart cities, and energy infrastructure to accelerate growth. Financial institutions are offering structured loans and leasing solutions tailored to contractors’ needs. This surge in public and private construction activity directly fuels the need for flexible financing models. Equipment finance providers benefit from long-term partnerships with developers and contractors, ensuring steady revenue through project-based leasing and recurring investment cycles.

- For instance, Henry Schein’s Blood Control IV Catheter 20-Gauge has a 1-inch beveled tip and comes 50 units per box, 4 boxes per case, ensuring standardization and ease of supply chain handling.

Increasing Adoption of Technological Equipment

Modern construction sites are adopting advanced machinery with telematics, automation, and fuel efficiency features. These high-cost assets require financial support through loans, leases, or mortgage-based funding. Financiers are providing customized solutions to help firms upgrade to efficient and sustainable equipment. The growing shift toward electric and hybrid machines, enabled by digital monitoring tools, enhances productivity and lowers emissions. This technological transformation increases financing demand as firms modernize fleets to stay competitive and meet sustainability targets.

- For instance, Terumo’s MEDISAFE WITH patch pump’s main unit dimensions are 77.9 mm x 40.1 mm x 18.9 mm, weight is 34 g. Also, its remote control measures 136.2 mm x 75.0 mm x 14.3 mm, weighs 152 g with 2 AAA batteries.

Expansion of Rental and Leasing Business Models

Contractors are shifting from ownership to usage-based models to reduce capital expenses. Leasing offers operational flexibility and reduces maintenance burdens, promoting financial liquidity. Financial companies and OEMs now collaborate to offer tailored leasing packages for short-term projects. The popularity of equipment rentals in small and mid-scale firms is accelerating this trend. By supporting asset-light strategies, the leasing model broadens market access and drives repeat financing cycles in construction-heavy economies.

Key Trends & Opportunities

Digital Transformation and Fintech Integration

Digital lending platforms and AI-driven credit scoring are revolutionizing equipment finance operations. Online approval systems, automated risk assessment, and blockchain-based documentation simplify loan processing. Fintech collaboration enhances transparency and speeds up transactions between financiers, contractors, and equipment suppliers. These innovations reduce paperwork and improve accessibility for small enterprises. As digital platforms expand, market players gain opportunities to scale financing networks and reach underserved regions more efficiently.

- For instance, Ascor S.A.’s AP31 volumetric infusion pump handles infusion volumes from 9 ml to 999 ml, adjustable in 0.1 ml increments. The flow rate range is programmable from 1 ml/h to 1000 ml/h, with a user-selectable drug library and the ability to store up to 2,000 events in real-time or as XML files.

Growing Focus on Green Financing

The construction finance sector is increasingly aligning with sustainability goals. Financial institutions are introducing green credit products for energy-efficient and low-emission machinery. Governments are supporting green bonds and tax incentives for sustainable construction projects. Financing eco-friendly equipment not only reduces carbon footprints but also attracts ESG-focused investors. This opportunity strengthens long-term growth as the industry transitions toward cleaner and more efficient operations.

- For instance, BD’s primary IV administration sets for pediatric use often feature microbore tubing under 2 mm internal diameter, which minimizes priming volume and suits low-volume infusions.

Expansion into Emerging Markets

Rapid industrialization in Asia-Pacific, Latin America, and Africa presents lucrative financing opportunities. Infrastructure investments, urban housing demand, and public works projects are creating large-scale financing requirements. Local banks and global finance firms are forming partnerships to meet equipment funding needs. The growing availability of credit and simplified cross-border leasing frameworks further enhances market potential in these regions.

Key Challenges

High Default Risks and Credit Constraints

The construction industry faces delayed payments, project cancellations, and fluctuating cash flows. These risks raise default rates, challenging lenders’ ability to manage asset recovery. Financing institutions must employ advanced credit analytics and risk-based pricing to mitigate exposure. Small contractors often lack strong credit histories, limiting their access to loans or leases. This credit gap restricts market penetration and increases the reliance on government-backed financial guarantees.

Volatility in Equipment Prices and Interest Rates

Fluctuating equipment costs, driven by raw material and supply chain issues, impact financing margins. Rising interest rates further increase borrowing costs for contractors. Financial institutions must adapt pricing models and maintain flexible terms to retain clients. Currency fluctuations in global markets also affect import-based machinery financing. These economic uncertainties make long-term financial planning difficult for both lenders and borrowers.

Regional Analysis

North America

North America holds a 31% share of the Construction Equipment Finance Market in 2024. The region benefits from strong infrastructure investments, government stimulus packages, and rapid adoption of advanced equipment. The U.S. Infrastructure Investment and Jobs Act supports large-scale road, bridge, and smart city projects, boosting financing demand. Leasing and rental services are growing as contractors seek flexible funding for short-term projects. Major financial institutions and OEMs offer tailored credit programs to support small and mid-sized contractors. Digital financing solutions and equipment telematics integration further enhance transparency and operational efficiency across the market.

Europe

Europe accounts for a 29% share of the Construction Equipment Finance Market in 2024. The region’s growth is driven by sustainable construction initiatives, public infrastructure upgrades, and modernization projects. Countries such as Germany, the UK, and France are prioritizing low-emission machinery through green finance schemes. Financial institutions offer leasing and loan products that promote eco-friendly fleet transitions. The European Investment Bank’s funding for renewable and smart infrastructure projects supports steady financing activity. Equipment financing firms are focusing on digital credit processing and ESG-aligned asset management to attract environmentally conscious contractors and investors.

Asia-Pacific

Asia-Pacific dominates the global market with a 34% share in 2024, driven by large-scale infrastructure development and rapid urbanization. Countries including China, India, and Japan are major contributors due to government-backed public works and industrial expansion. The demand for construction machinery loans and leases continues to rise as small and medium contractors modernize operations. Rapid digitalization in financial services enables faster loan approvals and asset monitoring. Strong collaborations between banks, OEMs, and fintech firms enhance credit accessibility. Expanding construction activity across residential and commercial sectors ensures sustained growth for equipment financing in the region.

Latin America

Latin America holds a 4% share of the Construction Equipment Finance Market in 2024. The region’s growth is supported by infrastructure modernization, mining activities, and public housing projects. Brazil and Mexico lead with increasing investments in renewable energy and transport networks. Financial institutions and global OEMs are expanding leasing and rental programs to support local contractors with limited capital. Currency fluctuations and regulatory barriers pose challenges, yet digital finance adoption is improving accessibility. Partnerships between government agencies and private financiers are helping drive sustainable infrastructure growth and steady financing demand in emerging markets.

Middle East & Africa

The Middle East & Africa region captures a 2% share of the global Construction Equipment Finance Market in 2024. Growth is fueled by ambitious construction projects across the UAE, Saudi Arabia, and South Africa. Mega-projects such as NEOM and Expo City are driving high equipment financing demand. Leasing services are expanding due to cost-efficient models preferred by regional contractors. Financial institutions collaborate with international banks to introduce Sharia-compliant financing options. Although market maturity remains limited, digital credit solutions and public infrastructure initiatives are improving credit penetration and supporting long-term industry expansion.

Market Segmentations:

By Financing Type:

By Equipment:

By Industry Vertical:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Construction Equipment Finance Market is highly competitive, featuring key players such as Komatsu, Bank of America, Caterpillar Inc., JP Morgan Chase, Deere & Company, AB Volvo, GE Capital, CNH Industrial, John Deere, and Wells Fargo. The Construction Equipment Finance Market is characterized by strong competition among financial institutions, equipment manufacturers, and leasing companies. Market participants focus on expanding product portfolios, enhancing digital financing platforms, and providing flexible repayment solutions to attract a wider customer base. The increasing adoption of online loan processing, AI-driven credit scoring, and telematics-based asset tracking has transformed financing operations. Companies are forming strategic partnerships with OEMs and contractors to strengthen customer loyalty and reduce default risks. The growing emphasis on sustainable and green financing further drives innovation, encouraging investments in eco-friendly construction machinery and technology-driven funding models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Komatsu

- Bank of America

- Caterpillar Inc.

- JP Morgan Chase

- Deere & Company

- AB Volvo

- GE Capital

- CNH Industrial

- John Deere

- Wells Fargo

Recent Developments

- In August 2025, JCB is about to transform the construction equipment scenario in India, when it will introduce a new generation of machines. It will be equipped with prototypes that are hydrogen-powered, fully electric, low-fuel consumption hybrid equipment, and enhanced diesel-powered machines that are approved to the CEV Stage-V norms.

- In July 2025, New Holland Construction introduces W100D Compact Wheel Loader with an all-new operator-centric cab and cab features. Constructed with landscapers, agricultural operators, snow removers and others in mind, the W100D is a dependable powerhouse with a deliberate design to provide productivity and performance in a small class size where there has been scarce choice.

- In March 2025, Healing Innovations partnered with Barrett Medical to expand access to advanced rehabilitation technology across the U.S., combining Healing Innovations’ Rise&Walk InClinic with Barrett’s Burt robotic trainer to create a comprehensive neurorehabilitation solution.

- In March 2024, United Rentals has finalized its acquisition of Yak Access. Yak Access, a leader in the North American matting industry, provides surface protection solutions, primarily serving utility and midstream sectors. The acquisition, funded through a mix of senior unsecured notes and existing resources, is expected to enhance United Rentals’ offerings and growth potential. The company plans to update its 2024 financial outlook to reflect the integration.

Report Coverage

The research report offers an in-depth analysis based on Financing Type, Equipment, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rising demand due to large-scale infrastructure and urban development projects.

- Digital lending platforms will streamline equipment financing and enhance accessibility for small contractors.

- Green financing solutions will expand as governments promote low-emission and energy-efficient machinery.

- Leasing and rental models will gain preference over ownership to improve cash flow flexibility.

- Collaboration between OEMs and financial institutions will strengthen integrated financing ecosystems.

- Artificial intelligence and data analytics will enhance credit risk assessment and loan management.

- Emerging markets in Asia-Pacific and Africa will drive new growth opportunities through infrastructure investments.

- Fintech integration will reduce approval times and improve transparency in financing transactions.

- Construction companies will adopt telematics-linked financing to align payments with equipment usage.

- Market players will focus on sustainability-driven financing strategies to attract ESG-conscious investors and clients.