Market Overview:

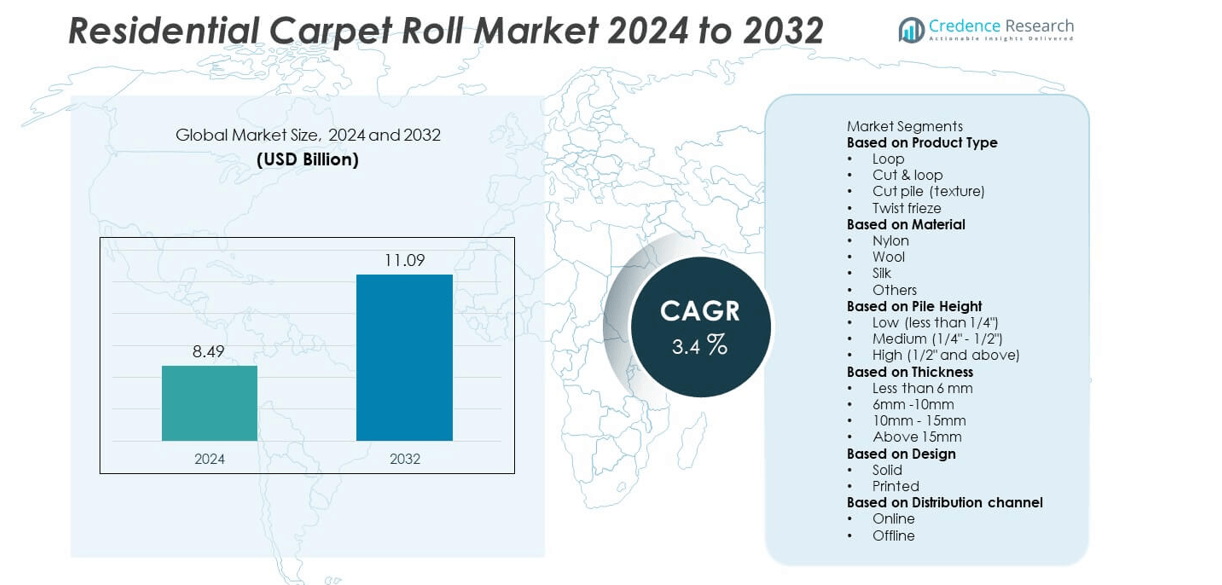

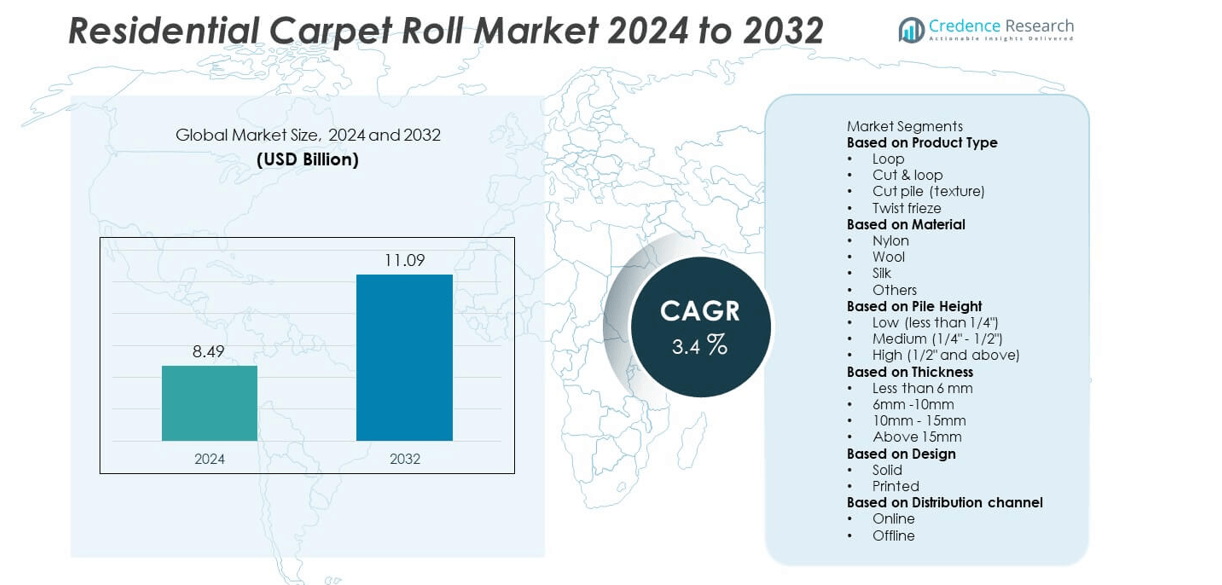

The Residential Carpet Roll market was valued at USD 8.49 billion in 2024 and is projected to reach USD 11.09 billion by 2032, registering a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Carpet Roll Market Size 2024 |

USD 8.49 billion |

| Residential Carpet Roll Market, CAGR |

3.4% |

| Residential Carpet Roll Market Size 2032 |

USD 11.09 billion |

The residential carpet roll market is led by major players such as Milliken & Company, Engineered Floors, Beaulieu International Group, Godfrey Hirst Carpets, Interface, Bentley Mills, Dixie Group, Kraus Flooring, Masland Carpets, and J+J Flooring Group. These companies focus on innovation in fiber technology, eco-friendly manufacturing, and premium design solutions to enhance competitiveness. North America emerged as the leading region with a 36.4% market share in 2024, driven by robust home renovation trends and sustainable product demand. Europe followed with a 27.8% share, supported by strong adoption of energy-efficient and recyclable carpet materials across residential construction projects.

Market Insights

- The residential carpet roll market was valued at USD 8.49 billion in 2024 and is projected to reach USD 11.09 billion by 2032, growing at a CAGR of 3.4%.

- Rising home renovation activities and growing consumer preference for soft, insulated flooring drive market expansion. The cut pile (texture) segment led with a 42.7% share due to superior comfort and aesthetics.

- Technological advances in eco-friendly and stain-resistant fibers are shaping new product innovations and improving performance longevity.

- Market competition remains strong among key players focusing on sustainable production, digital tufting, and customizable design offerings.

- North America dominated the market with a 36.4% share, followed by Europe at 27.8%, while Asia-Pacific showed strong growth potential with 24.6%, driven by rapid residential construction and urbanization.

Market Segmentation Analysis:

By Product Type

The cut pile (texture) segment dominated the residential carpet roll market with a 42.7% share in 2024. Its popularity stems from soft texture, durability, and comfort, making it ideal for living rooms and bedrooms. The segment benefits from enhanced fiber resilience and easy maintenance compared to loop and frieze types. Growing preference for plush aesthetics and diverse color options further boosts adoption. Manufacturers are introducing stain-resistant and fade-proof textured carpets to cater to modern residential interiors, especially in North America and Europe, where premium home décor trends are expanding.

- For instance, Engineered Floors expanded its PureColor® SoftTouch collection with high-twist cut pile fibers extruded at 3,000 denier, delivering increased crush resistance and colorfastness. The manufacturing line produces over 2 million square meters annually, utilizing a solution-dyed process that locks pigment molecules within fiber structure to maintain vibrancy and resist UV fading.

By Material

The nylon segment led the market with a 48.5% share in 2024, owing to its superior resilience, stain resistance, and affordability. Nylon carpets maintain appearance and texture over time, even in high-traffic areas. Continuous innovations in solution-dyed nylon fibers enhance fade resistance and sustainability. Wool and silk segments are gaining traction in luxury homes due to natural feel and eco-friendly appeal. However, nylon remains preferred for its cost efficiency and compatibility with advanced tufting technologies across residential installations.

- For instance, Milliken & Company utilizes its Millitron® digital dye technology to produce nylon carpet with a precise color placement. This proprietary technology supports a vast range of color options for nuanced and complex patterns. It is used for both commercial and residential applications, offering design flexibility.

By Pile Height

The medium pile (1/4″–1/2″) segment accounted for the largest 51.2% share in 2024. This category offers an optimal balance between softness, durability, and ease of cleaning, suitable for family rooms and bedrooms. Medium pile carpets reduce noise and provide improved insulation, aligning with energy-efficient housing trends. The increasing use of blended fibers enhances comfort without compromising wear resistance. Demand for this pile height continues to rise in newly constructed and remodeled homes due to its versatile design adaptability and affordable installation costs.

Key Growth Drivers

Rising Home Renovation and Remodeling Activities

Growing investment in residential renovation is a major growth driver for the carpet roll market. Homeowners are increasingly replacing hard flooring with soft coverings for comfort and insulation benefits. Expansion of the housing sector and urban redevelopment projects in North America, Europe, and Asia-Pacific strengthen market growth. Enhanced consumer spending on home aesthetics and comfort further accelerates adoption. Manufacturers are responding with modern carpet designs and easy-installation options to meet evolving interior preferences across premium and mid-range households.

- For instance, The Dixie Group, headquartered in Dalton, Georgia, focuses on marketing and manufacturing high-end residential and commercial carpets under brands such as Fabrica, Masland, and Dixie Home. The company has focused on cost reductions and operational efficiencies, particularly in its soft surface products, to improve margins and navigate a challenging market.

Advancements in Fiber and Manufacturing Technologies

Innovations in fiber engineering and tufting technologies are significantly improving carpet performance and lifespan. Developments in solution-dyed nylon, PET, and triexta fibers enhance stain resistance, color retention, and recyclability. Automated tufting and digital dyeing systems support mass customization and faster production. These advancements make carpet rolls more durable and sustainable for residential use. Manufacturers such as Mohawk and Shaw are investing in eco-efficient production facilities to reduce energy use and improve overall product quality.

- For instance, Beaulieu International Group has invested €25 million in new, energy-efficient BCF lines at its yarn production site in Comines, France. This investment, announced in April 2025, enhances the company’s ability to produce sustainable solution-dyed yarns and strengthens its position in the European market.

Growing Focus on Sustainable and Eco-Friendly Flooring

Sustainability is shaping purchasing decisions in the residential flooring sector. Consumers prefer carpets made from recycled fibers, bio-based materials, and low-VOC adhesives. Governments and green building standards promote environmentally responsible products through certification programs like Green Label Plus. Carpet producers are adopting closed-loop recycling and reduced waste manufacturing to meet regulatory and consumer expectations. This shift toward eco-conscious materials positions the residential carpet roll market for long-term growth in the sustainable interior design segment.

Key Trends & Opportunities

Integration of Smart and Modular Carpet Solutions

Smart carpets with embedded sensors and modular roll systems are emerging as key innovations. These technologies enhance indoor air monitoring, underfoot comfort, and ease of maintenance. Modular designs allow partial replacements, reducing long-term costs and waste. Growing smart-home adoption supports demand for intelligent flooring solutions that combine functionality with style. Manufacturers are leveraging IoT connectivity and eco-friendly fiber integration to differentiate their product lines in a competitive market landscape.

- For instance, Interface, Inc. offers modular carpet tiles under its FLOR residential brand, which are recognized for their low-VOC emissions and sustainability. Interface has incorporated intelligent technologies, such as sensor systems, into some of its flooring products to analyze foot traffic and detect occupancy for use in various Internet of Things (IoT) applications.

Rising Popularity of Luxury Textures and Custom Designs

Consumers increasingly seek personalized designs that reflect lifestyle and comfort preferences. Demand for luxury cut-pile and wool-based carpets is growing in high-end residential projects. Advanced printing and weaving technologies allow custom colors and patterns that complement interior themes. Premium collections emphasizing tactile richness, acoustic insulation, and aesthetic appeal are expanding across metropolitan markets. This trend is encouraging manufacturers to enhance product portfolios with versatile and design-oriented carpet roll options.

- For instance, Bentley Mills has expanded its portfolio to include Prima Vista™, a collection of luxurious, fully customizable, hand-tufted wool area rugs. In addition to their custom options through COLORCAST™, Bentley also offers broadloom and carpet tile products, with broadloom available in standard 12-foot widths.

Key Challenges

High Maintenance and Allergen Concerns

One of the key challenges for carpet roll adoption is maintenance complexity. Carpets can trap dust, allergens, and moisture, affecting indoor air quality if not cleaned regularly. Consumers in humid climates prefer hard-surface flooring options due to easier upkeep. Manufacturers are addressing this issue with antimicrobial and stain-resistant fiber coatings. However, the perception of high cleaning costs continues to limit growth potential, particularly in allergy-prone households and regions with poor ventilation.

Competition from Alternative Flooring Solutions

The growing availability of cost-effective alternatives such as vinyl, laminate, and engineered wood floors presents a strong competitive challenge. These materials offer durability, easy maintenance, and modern aesthetics that appeal to urban homeowners. Increasing adoption of waterproof and scratch-resistant vinyl planks further constrains carpet demand. To remain competitive, carpet manufacturers are focusing on enhancing durability, acoustic performance, and sustainability credentials to regain consumer confidence in soft flooring options.

Regional Analysis

North America

North America dominated the residential carpet roll market with a 36.4% share in 2024, supported by strong residential renovation and remodeling activity. High consumer preference for comfort-driven flooring solutions in colder climates drives demand. The U.S. leads regional consumption due to a well-established construction sector and wide product availability. Increasing adoption of nylon and polyester-based carpets enhances market penetration. Manufacturers are focusing on eco-friendly fibers and recyclable materials to align with sustainability goals. Expansion of luxury housing projects across Canada and the U.S. continues to strengthen product demand in premium home interiors.

Europe

Europe accounted for a 27.8% share in 2024, driven by rising adoption of sustainable and design-oriented flooring solutions. The region’s emphasis on eco-certifications and circular manufacturing supports the demand for wool and bio-based carpet rolls. The U.K., Germany, and France remain key markets due to ongoing home renovation programs. Increased focus on acoustic comfort and thermal insulation further promotes carpet usage. European manufacturers are investing in low-emission production and recycling infrastructure. Demand for high-quality cut-pile and loop-style carpets continues to grow across modern residential and urban apartment projects.

Asia-Pacific

Asia-Pacific held a 24.6% share in 2024, supported by rapid urbanization, expanding middle-class income, and rising residential construction. China, India, and Japan are key contributors, fueled by growing consumer awareness of interior aesthetics. The region’s preference for cost-effective synthetic carpets, particularly nylon and polyester blends, drives volume growth. Increasing investment in smart homes and luxury apartments further strengthens demand. Local manufacturers are expanding production capacity to cater to domestic and export markets. The shift toward affordable, durable, and easy-maintenance flooring supports long-term market growth in Asia-Pacific.

Latin America

Latin America captured a 6.5% share in 2024, with demand concentrated in Brazil, Mexico, and Chile. Growth is driven by rising urban housing development and an increasing focus on home décor aesthetics. Consumers are gradually shifting from traditional hard flooring to soft, comfortable carpet rolls for bedrooms and living spaces. Manufacturers are introducing cost-efficient nylon and polyester carpets suited for regional climates. Expansion of retail distribution channels and renovation projects further boosts market accessibility. Economic recovery and middle-income growth continue to create steady opportunities across urban residential sectors.

Middle East & Africa

The Middle East & Africa accounted for a 4.7% share in 2024, supported by growing construction in urban housing and hospitality sectors. Demand for premium carpet rolls is rising in the UAE, Saudi Arabia, and South Africa. Increasing residential investments and government housing initiatives contribute to growth. Consumers prefer durable, heat-resistant carpets suited for regional climates. The market is witnessing gradual adoption of eco-friendly and custom-designed carpets. Global brands are expanding regional presence through partnerships with local distributors to meet rising demand from luxury and mid-segment residential projects.

Market Segmentations:

By Product Type

- Loop

- Cut & loop

- Cut pile (texture)

- Twist frieze

By Material

By Pile Height

- Low (less than 1/4″)

- Medium (1/4″ – 1/2″)

- High (1/2″ and above)

By Thickness

- Less than 6 mm

- 6mm -10mm

- 10mm – 15mm

- Above 15mm

By Design

By Distribution channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the residential carpet roll market is characterized by strong participation from key players such as Milliken & Company, Engineered Floors, Kraus Flooring, Beaulieu International Group, Godfrey Hirst Carpets, J+J Flooring Group, Masland Carpets, Interface, Bentley Mills, and Dixie Group. These companies focus on advanced fiber technologies, eco-friendly materials, and digital design capabilities to strengthen product portfolios. Leading manufacturers are investing in sustainable production processes and recycling initiatives to meet environmental standards. Continuous innovation in stain-resistant and fade-proof fibers enhances durability and aesthetic appeal. Strategic mergers, product launches, and regional expansions remain central to maintaining market leadership. Players are increasingly emphasizing brand differentiation through smart carpet integration, customization, and design versatility to meet evolving consumer preferences across both premium and mid-range residential flooring segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, The Dixie Group announced its “Step Into Color” initiative at The International Surface Event (TISE). The company enhanced its custom-color dyeing capabilities across its family of brands. This expanded a service previously available only on high-end brands like Fabrica to include the mid-priced DH Floors line.

- In January 2025, Engineered Floors showcased its PureColor® High-Def carpet line during Surfaces 2025. Innovations included new color burst and space-dye capabilities, which expanded the number of individual colors that can be used in a single carpet.

- In April 2024, Interface launched their new carpet tile collection which is specifically design for stylish interiors. This creates competitive edge in the market as they offer sophisticated color options which are in high demand

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Pile Height, Thickness, Design, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and recyclable carpet materials will continue to increase globally.

- Smart and modular carpet rolls with integrated sensors will gain wider adoption in modern homes.

- Manufacturers will focus on improving fiber durability and stain resistance using advanced materials.

- Growth in renovation and remodeling projects will sustain steady product demand.

- Digital printing and tufting technologies will enable greater design customization.

- Eco-certifications and green building initiatives will drive preference for low-emission carpets.

- The Asia-Pacific region will experience rapid growth due to urbanization and rising income levels.

- Partnerships and mergers among leading companies will enhance global production capacities.

- Premium and luxury carpet segments will expand in high-end residential developments.

- Ongoing innovation in acoustic and thermal insulation features will strengthen product competitiveness.