Market Overview:

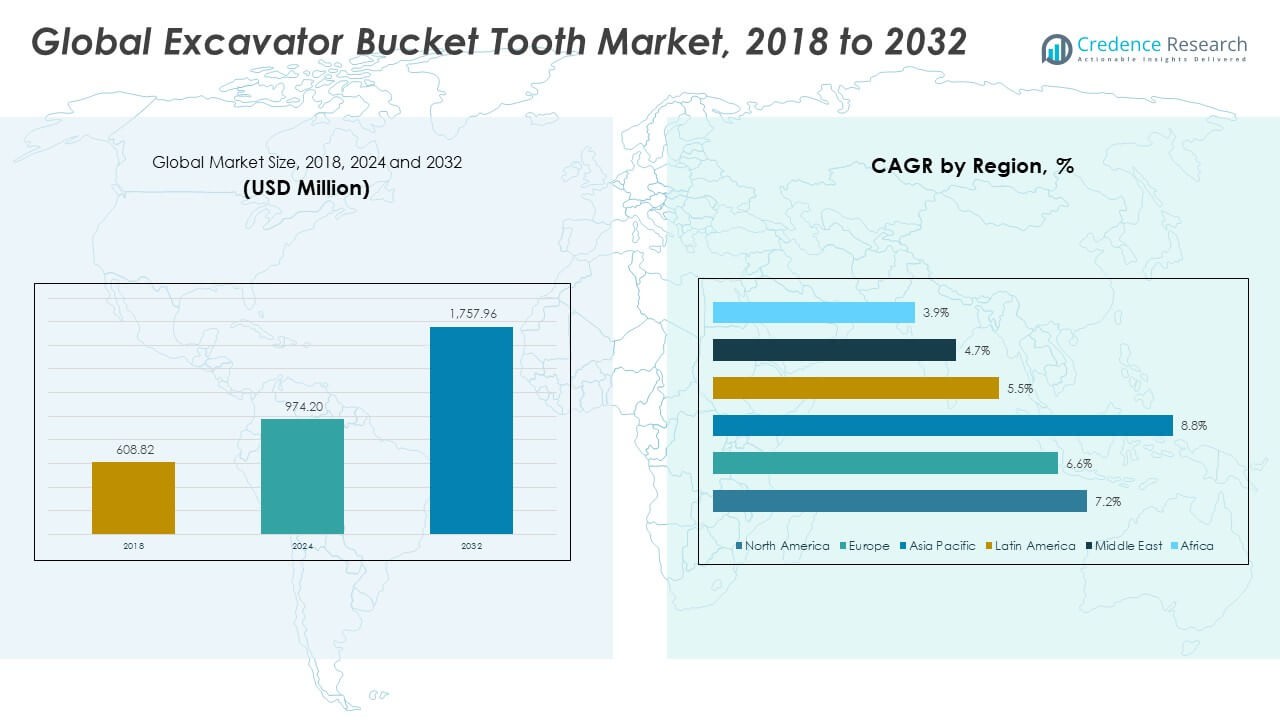

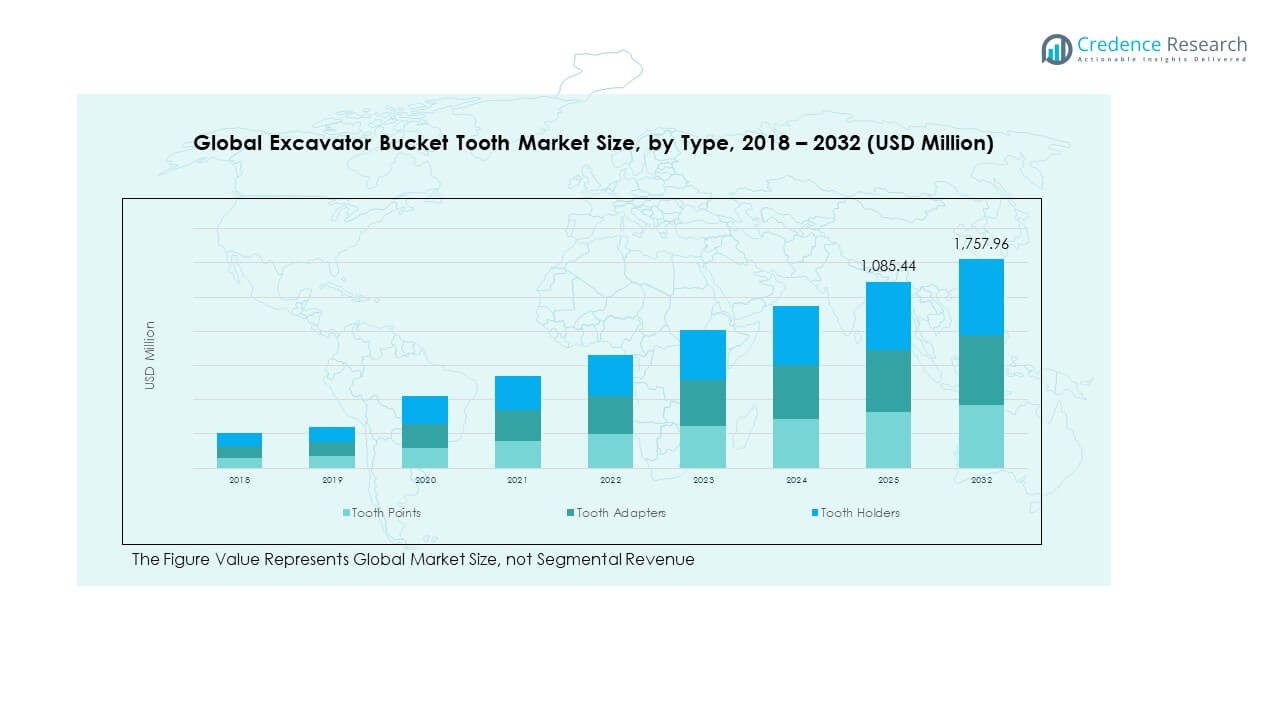

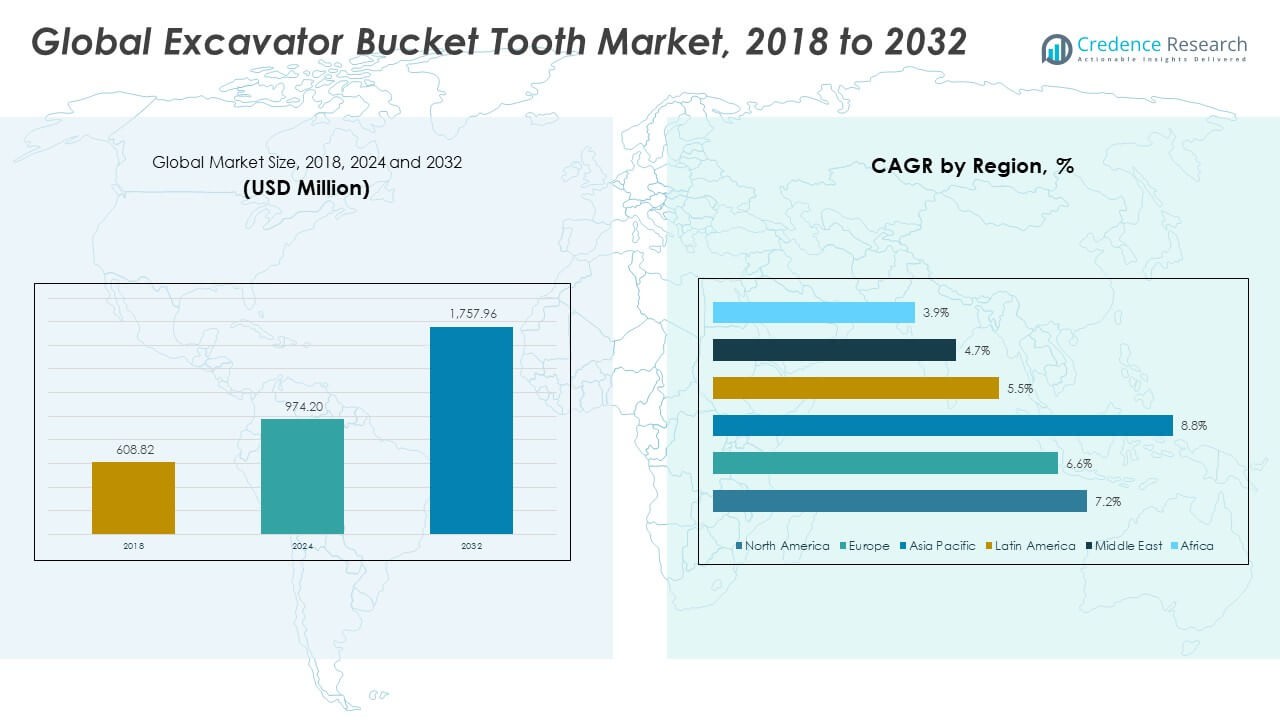

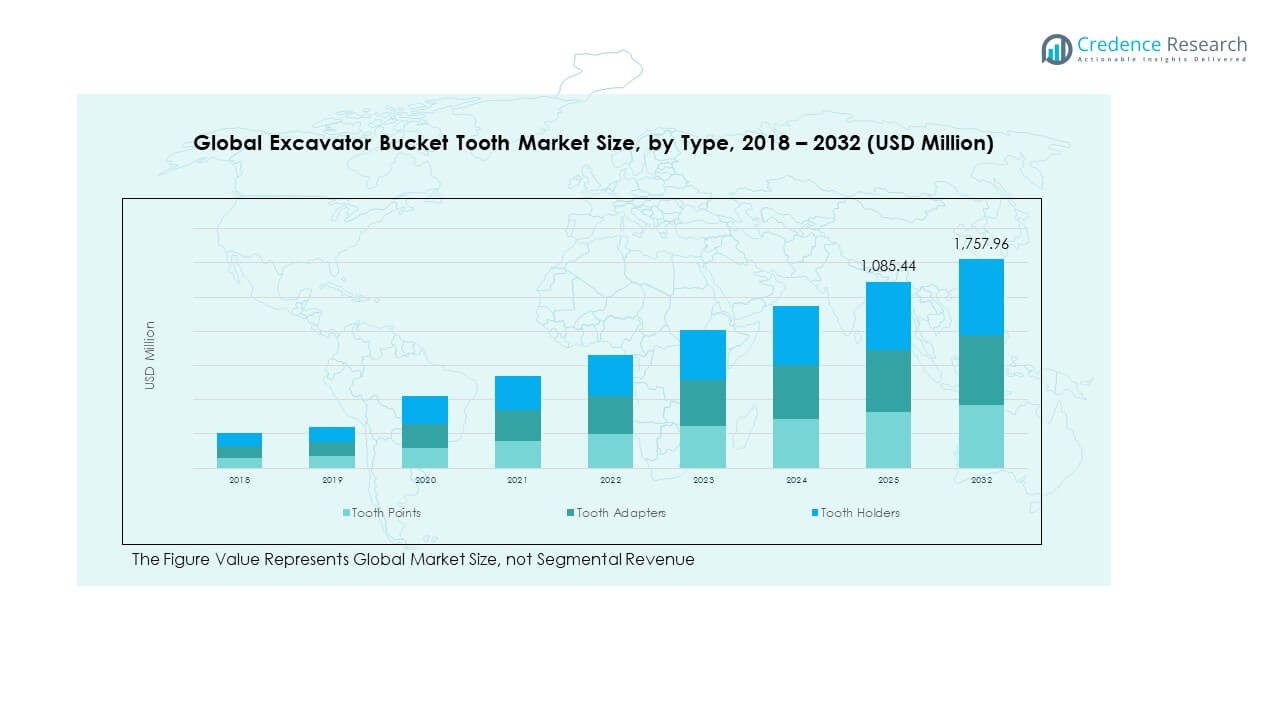

The Global Excavator Bucket Tooth Market size was valued at USD 608.82 million in 2018 to USD 974.20 million in 2024 and is anticipated to reach USD 1,757.96 million by 2032, at a CAGR of 7.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Excavator Bucket Tooth Market Size 2024 |

USD 974.20 Million |

| Excavator Bucket Tooth Market, CAGR |

7.13% |

| Excavator Bucket Tooth Market Size 2032 |

USD 1,757.96 Million |

The market growth is driven by rising demand for durable and high-performance construction equipment components. Rapid urbanization, expansion of mining operations, and increased infrastructure investments worldwide are propelling product demand. Manufacturers are developing advanced materials and designs to enhance wear resistance, efficiency, and productivity. The shift toward smart construction machinery and the growing emphasis on reducing equipment downtime further strengthen the market outlook.

Asia Pacific dominates the Global Excavator Bucket Tooth Market due to large-scale construction and mining projects in China and India. North America and Europe hold significant shares, supported by technology adoption and equipment modernization. Emerging regions in Latin America and the Middle East are witnessing strong growth due to rising investments in energy and infrastructure development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Excavator Bucket Tooth Market was valued at USD 608.82 million in 2018, reached USD 974.20 million in 2024, and is projected to hit USD 1,757.96 million by 2032, expanding at a CAGR of 7.13%.

- Europe led the market with about 34% share in 2024, supported by a robust construction industry, advanced equipment manufacturing, and sustainable material adoption. North America followed with 28% due to high infrastructure spending, while Asia Pacific accounted for nearly 20% driven by rapid urbanization.

- Asia Pacific is the fastest-growing region, expanding at a CAGR of 8.8%, fueled by infrastructure investments, mining expansion, and the presence of major OEMs in China and India.

- Tooth Points held the largest segmental share, contributing around 45% of total market revenue, driven by frequent replacement needs and their essential role in excavation efficiency.

- Tooth Adapters and Tooth Holders together accounted for nearly 55% share, supported by their use in structural stability and load optimization in construction and mining equipment.

Market Drivers:

Rising Global Construction and Infrastructure Development Accelerating Demand

The Global Excavator Bucket Tooth Market is witnessing strong growth driven by rapid urban expansion and infrastructure upgrades. Governments are increasing investments in roads, bridges, and urban housing, driving higher demand for heavy-duty machinery. Construction companies prefer advanced bucket teeth for efficiency and durability under harsh conditions. The rise in smart city projects and public-private partnerships has also expanded equipment utilization. It benefits from modernization in construction fleets that require frequent replacement of wear parts. Increased mechanization in developing countries strengthens product adoption. Growing awareness of productivity improvement supports consistent sales. Manufacturers are focusing on innovative designs to cater to diverse soil and operational needs.

- For instance, Caterpillar’s Advansys Tips and Adapters system offers up to 50% stress reduction compared to previous designs and features hammerless removal that can reduce installation and removal time by half, according to verified product documentation and field customer reports.

Increasing Mining and Quarrying Activities Enhancing Product Utilization

Rising global demand for minerals and natural resources is driving excavation activity. Mining companies are investing in equipment upgrades to improve extraction efficiency and reduce operational downtime. Bucket teeth play a crucial role in cutting performance and durability during ore excavation. It benefits from the surge in coal, iron ore, and copper mining projects across Asia and Africa. Higher focus on cost-effective ground engagement tools promotes market growth. The demand for high-strength alloys and impact-resistant materials is rising. Companies are developing specialized tooth profiles to improve penetration in hard rock formations. Increased replacement cycles due to abrasive working conditions continue to support product demand.

- For instance, Komatsu’s Kprime Tooth System for excavators and loaders delivers 10% increased durability and 10–15% more usable wear material over earlier models, thanks to an optimized tooth profile and a secure snap-fit pin for reduced maintenance, as documented in official Komatsu system releases and mining sector reviews.

Technological Advancements and Material Innovation Improving Product Efficiency

Material innovation and manufacturing advancements are reshaping market performance. New materials such as tungsten carbide and heat-treated steel enhance strength and lifespan. Manufacturers are integrating smart design techniques using CAD modeling and simulation to improve precision. It gains traction from automation and digital monitoring in modern excavators that optimize wear prediction. Enhanced metallurgy reduces maintenance needs, improving total cost of ownership for end users. Additive manufacturing technologies are helping create custom designs for specialized uses. The growing focus on sustainability is encouraging recyclable metal usage. Continuous R&D investments strengthen product efficiency and competitive differentiation among key players.

Expansion of Construction Equipment Rental and Leasing Market Supporting Growth

Growing adoption of equipment rental services fuels replacement demand for bucket teeth. Rental operators replace components more often to ensure reliability and performance. It benefits from shorter equipment lifecycles and frequent usage in multi-project environments. The surge in small and medium contractors renting excavators for cost savings supports consistent sales. Manufacturers are supplying standardized models compatible with a wide range of excavators. The rental industry’s expansion across emerging markets strengthens aftersales revenues. Global brands are forming supply partnerships with rental firms to secure long-term contracts. Increasing project diversity and usage intensity continue to drive replacement frequency and market stability.

Market Trends:

Adoption of Wear-Resistant and Smart Design Solutions in Excavator Components

The Global Excavator Bucket Tooth Market is experiencing a transition toward advanced, wear-resistant designs. Manufacturers are developing teeth with self-sharpening geometries and improved heat treatment processes. These innovations enhance digging precision and reduce fuel consumption. It benefits from technologies that allow predictive maintenance through sensors and digital wear monitoring. 3D design modeling supports uniform material distribution, improving performance across soil conditions. Integration of ergonomic mounting systems enables faster replacements. The demand for multi-application bucket teeth suited for mixed terrains is rising. These design improvements are strengthening customer preference for premium-grade products.

- For instance, ESCO’s Nemisys Lip System for large mining excavators includes tooth and shroud designs that cover up to 77% more area than previous solutions and require 10% less force to penetrate, supported by fast, tool-free maintenance and wear monitoring, according to verified product announcements and company documents.

Sustainable Manufacturing Practices and Circular Economy Adoption Gaining Traction

Manufacturers are adopting eco-friendly production processes to reduce carbon emissions. Recycling of worn-out teeth into new products supports circular economy initiatives. It is witnessing higher emphasis on green metallurgy and energy-efficient furnaces. Companies are optimizing production by using low-emission alloys and renewable power sources. The shift aligns with environmental compliance in regions like Europe and North America. Global brands are also implementing take-back programs for used components. Such sustainability-focused efforts enhance corporate reputation and long-term customer loyalty. The trend reflects a shift toward responsible manufacturing across the industrial equipment supply chain.

- For instance, Volvo Construction Equipment’s collaboration with SSAB on fossil-free steel resulted in an 80% reduction of CO₂ emissions for excavator components manufactured in Sweden starting September 2024, validated in company and steel industry announcements.

Rising Integration of Automation and Digital Monitoring in Equipment Maintenance

Automation is transforming the maintenance process of heavy equipment across industries. Excavator manufacturers are integrating sensors that track the wear and tear of bucket teeth. It allows predictive replacement, reducing downtime and improving operational efficiency. Data analytics platforms help users monitor usage intensity and replacement cycles. These solutions are supporting fleet managers in optimizing inventory and maintenance planning. The integration of IoT-enabled systems enhances remote diagnostics and performance evaluation. Growth in connected machinery is expected to raise the adoption of intelligent wear components. This trend is driving a shift toward proactive maintenance across the construction and mining sectors.

Customization and OEM Collaboration Enhancing Product Development Capabilities

Growing collaboration between OEMs and component manufacturers is improving compatibility and performance. It encourages the development of custom-designed teeth tailored for specific ground conditions. Manufacturers are working closely with equipment makers to optimize fitment, design, and wear behavior. Increasing demand for brand-specific attachments is boosting OEM partnerships globally. Co-development efforts help standardize materials and streamline manufacturing quality. This collaboration ensures better durability and performance consistency across machine types. Product differentiation through co-engineered solutions enhances customer loyalty. The trend supports sustainable innovation and strengthens long-term supplier relationships across regions.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Chain Disruptions Impacting Profitability

The Global Excavator Bucket Tooth Market faces challenges due to volatile prices of metals such as steel and tungsten. Price instability directly affects manufacturing costs and profit margins for producers. It also creates uncertainties in procurement strategies for smaller manufacturers. Supply chain disruptions caused by geopolitical tensions or logistic delays further strain operations. Global dependence on specific raw material suppliers increases vulnerability during market fluctuations. These factors make it difficult to maintain consistent pricing for customers. The need for advanced procurement planning and diversified sourcing is becoming critical. Maintaining stable production despite cost variations remains a key challenge for the industry.

Intense Market Competition and Technological Barriers Limiting Small Manufacturers

The market is highly competitive, with global and regional players offering similar products. Continuous innovation and product differentiation are essential to maintain market presence. It poses challenges for smaller companies with limited R&D budgets. Rapid advancements in metallurgy and smart technology adoption require substantial capital investment. The growing preference for branded, performance-tested bucket teeth reduces opportunities for new entrants. Compliance with stringent quality standards in regions like North America and Europe adds additional barriers. Balancing affordability with quality remains difficult in price-sensitive markets. The need for sustainable materials and advanced designs continues to pressure smaller manufacturer s to modernize.

Market Opportunities:

Emerging Demand from Developing Economies and Infrastructure Expansion Projects

The Global Excavator Bucket Tooth Market is witnessing growing opportunities across developing regions. Expanding construction activities in Asia, Africa, and Latin America are driving equipment demand. It benefits from rising public infrastructure budgets, housing projects, and mining expansion. Governments are investing in roads, ports, and power sectors, increasing heavy machinery usage. Local manufacturing initiatives are creating opportunities for regional component suppliers. Partnerships between global and local firms are improving market reach. Increasing urbanization and industrialization continue to generate sustainable growth prospects for key players.

Innovation in Material Science and Additive Manufacturing Offering Future Potential

Technological innovation presents vast growth avenues in material science and 3D printing. Manufacturers are experimenting with composites that extend wear life and reduce maintenance costs. It is encouraging the development of lightweight yet durable bucket teeth. Additive manufacturing allows customization for specific ground and operational requirements. Integration of digital design tools helps reduce production errors and lead times. Global research in metallurgy supports the creation of environmentally friendly alloys. These advancements open doors for differentiation and long-term product evolution in the global market.

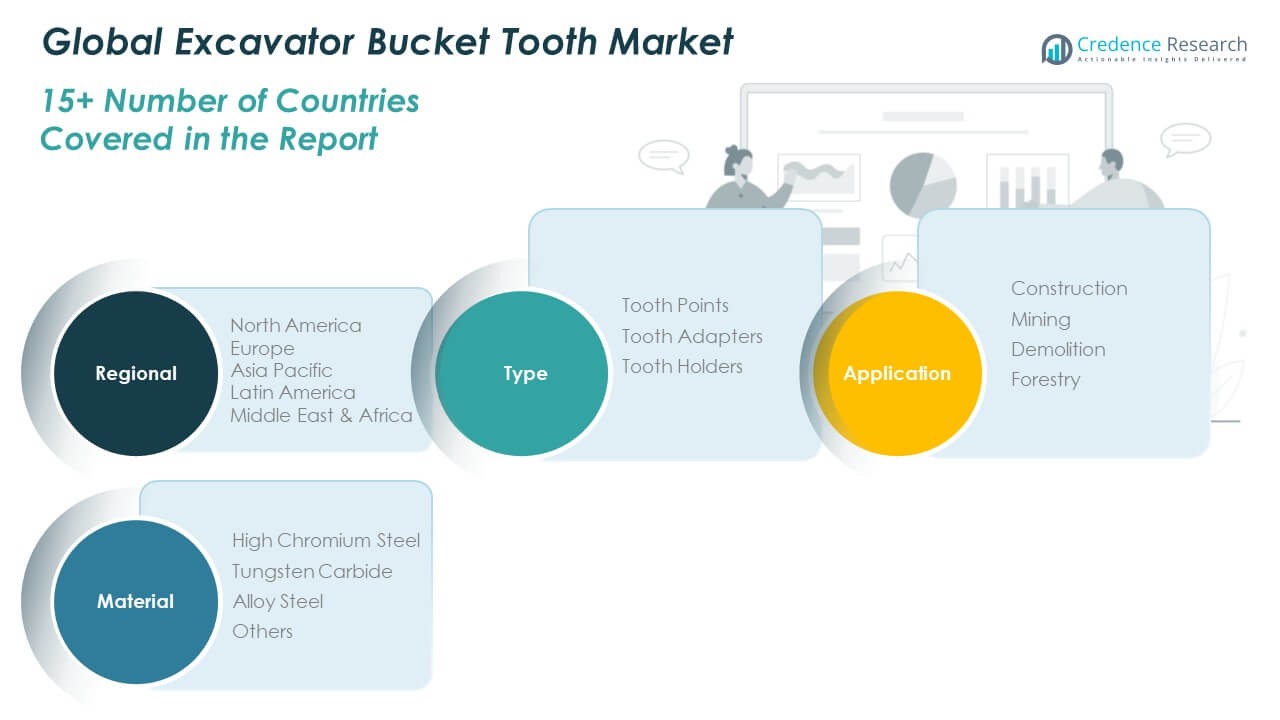

Market Segmentation Analysis:

By Type

The Global Excavator Bucket Tooth Market is segmented into tooth points, tooth adapters, and tooth holders. Tooth points hold the largest share due to their direct role in excavation and soil penetration. High wear resistance and frequent replacement cycles make them a key revenue contributor. Tooth adapters support efficient load transfer and enhance structural integrity in heavy-duty operations. Tooth holders ensure stability and accurate alignment of bucket assemblies, improving equipment durability. Demand for modular and easy-to-replace designs continues to rise, driven by construction and mining applications.

By Application

Construction dominates the market, supported by ongoing infrastructure projects and urban development. Mining follows closely, fueled by resource extraction activities across developing regions. The demolition segment is expanding with growing renovation and redevelopment projects in cities. Forestry applications are steadily increasing, where customized bucket teeth enhance performance in tough terrains. It benefits from growing mechanization in logging operations and industrial land clearing.

- For instance, Liebherr’s R 9300 Generation 8 excavator, launched for commercial mining in 2024, averaged 486 operational hours per month and achieved 94% machine availability in field validation at Indonesian coal mines, according to Liebherr’s product report and technical documentation.

By Material

High chromium steel leads the market due to superior hardness and wear resistance. Tungsten carbide products are gaining popularity in high-impact mining environments. Alloy steel remains widely used for its balance of toughness and cost efficiency. Other materials, including advanced composites, are entering the market for lightweight applications. Continuous R&D in metallurgy aims to extend component lifespan and improve energy efficiency.

Segmentation:

By Type:

- Tooth Points

- Tooth Adapters

- Tooth Holders

By Application:

- Construction

- Mining

- Demolition

- Forestry

By Material:

- High Chromium Steel

- Tungsten Carbide

- Alloy Steel

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Excavator Bucket Tooth Market size was valued at USD 173.05 million in 2018 to USD 272.48 million in 2024 and is anticipated to reach USD 493.81 million by 2032, at a CAGR of 7.2% during the forecast period. North America holds a market share of around 28%. The region benefits from high infrastructure spending, advanced construction practices, and strong demand from mining and oil exploration industries. The United States dominates regional growth, supported by steady urban renewal projects and road expansions. Canada and Mexico contribute through increasing industrial activity and equipment modernization. It gains traction from growing adoption of technologically advanced and wear-resistant products. Strong presence of key OEMs and equipment rental companies strengthens supply availability. Sustainability goals and advanced material adoption also drive innovation and competition in the region.

Europe

The Europe Global Excavator Bucket Tooth Market size was valued at USD 268.70 million in 2018 to USD 419.99 million in 2024 and is anticipated to reach USD 729.76 million by 2032, at a CAGR of 6.6% during the forecast period. Europe holds a market share of nearly 34%. The region demonstrates mature demand supported by large-scale construction and quarrying activities. Germany, France, and the UK remain major markets due to high equipment utilization rates and strong industrial bases. Increasing focus on renewable energy and urban transit projects supports steady product consumption. The market benefits from stringent environmental standards encouraging durable and recyclable materials. Technological integration within equipment manufacturing enhances operational efficiency. It continues to evolve through innovation and adoption of automation in excavation processes.

Asia Pacific

The Asia Pacific Global Excavator Bucket Tooth Market size was valued at USD 113.45 million in 2018 to USD 197.26 million in 2024 and is anticipated to reach USD 404.54 million by 2032, at a CAGR of 8.8% during the forecast period. Asia Pacific accounts for about 20% of the global market share. China and India dominate growth due to extensive infrastructure expansion and mining development. Japan, South Korea, and Australia contribute through advanced manufacturing and export-oriented industries. The region benefits from government investment in urban infrastructure and housing. Rising industrialization and mechanization in agriculture create steady product demand. It is also seeing increased presence of global manufacturers setting up regional facilities. Continuous technological advancement and cost competitiveness drive strong growth prospects.

Latin America

The Latin America Global Excavator Bucket Tooth Market size was valued at USD 28.83 million in 2018 to USD 45.55 million in 2024 and is anticipated to reach USD 72.78 million by 2032, at a CAGR of 5.5% during the forecast period. Latin America holds a market share of roughly 8%. Brazil and Argentina are key contributors, supported by growing mining exploration and public infrastructure projects. Increasing urban development and road construction activities in emerging economies are supporting steady demand. It benefits from regional government investments in industrial zones and energy projects. The aftermarket segment plays a major role due to frequent replacement needs. The presence of international equipment brands ensures better product accessibility. Continued investments in economic diversification and construction expansion enhance market potential.

Middle East

The Middle East Global Excavator Bucket Tooth Market size was valued at USD 15.97 million in 2018 to USD 23.21 million in 2024 and is anticipated to reach USD 34.86 million by 2032, at a CAGR of 4.7% during the forecast period. The region contributes about 6% of the market share. Rapid expansion in infrastructure, particularly in GCC countries, drives steady demand for construction equipment. Oil and gas exploration and new city developments like NEOM in Saudi Arabia strengthen market outlook. The UAE and Qatar are leading adopters, focusing on large-scale public and commercial projects. It benefits from ongoing investments in ports, transport, and industrial hubs. Local distributors are partnering with global brands to improve product availability. Increasing emphasis on heavy equipment modernization supports consistent growth in replacement demand.

Africa

The Africa Global Excavator Bucket Tooth Market size was valued at USD 8.83 million in 2018 to USD 15.70 million in 2024 and is anticipated to reach USD 22.22 million by 2032, at a CAGR of 3.9% during the forecast period. Africa represents around 4% of the global market share. The region’s growth is driven by expanding mining and infrastructure projects in South Africa, Egypt, and Nigeria. Rising investment in roads, housing, and energy infrastructure contributes to steady product adoption. It faces challenges related to supply chain limitations and import dependency. However, local manufacturing initiatives are emerging in select countries. Demand for cost-effective, durable bucket teeth is growing among contractors and rental companies. Increasing regional trade and government-funded construction initiatives are expected to sustain long-term growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Caterpillar Inc.

- Liebherr Group

- Komatsu Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery

- JCB

- Sandvik AB

- SANY Group

- Doosan Infracore

- Furukawa Rock Drill

Competitive Analysis:

The Global Excavator Bucket Tooth Market is highly competitive, with major players focusing on durability, material innovation, and cost optimization. Companies such as Caterpillar, Komatsu, Liebherr, and Volvo Construction Equipment lead the market through robust product portfolios and strong global distribution networks. It experiences consistent mergers and technology collaborations to enhance wear resistance and extend product lifespan. Regional manufacturers compete by offering low-cost alternatives and customized solutions. Continuous R&D investments and quality enhancements are key strategies driving market leadership and customer retention.

Recent Developments:

- In July 2025, Caterpillar Inc. launched the Cat Fleet Bucket Program, allowing customers to outfit their machine buckets—including excavators—with Cat ground engaging tools (GET) compatible with third-party buckets, thereby supporting operational flexibility and offering thousands of GET products universally.

- In August 2025, Liebherr Group secured a strategic equipment acquisition deal with Glencore for 17 advanced Liebherr mining excavators that include various bucket tooth technologies. This partnership, executed for Australian coal operations, represents one of the largest recent investments in the region’s mining sector.

- In October 2025, Komatsu Ltd. introduced the new PC950-11 hydraulic excavator in Australia and New Zealand, featuring powerful new bucket tooth systems (notably the Kprime tooth) that raise productivity by 48% while delivering 40% lower fuel use compared to previous models.

- In June 2025, Volvo Construction Equipment announced a strategic global investment of 2,500 MSEK to expand its crawler excavator production footprint, ensuring more localized manufacturing and advanced GET solutions for various excavator models and bucket teeth systems at sites in South Korea, Sweden, and North America.

Report Coverage:

The research report offers an in-depth analysis based on type, application, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising infrastructure investments will continue driving demand across developing regions.

- Advanced materials and coatings will enhance durability and performance efficiency.

- Mining expansion in Asia and Africa will create sustained equipment demand.

- Manufacturers will focus on digital monitoring and smart wear management.

- Regional partnerships will boost supply chain efficiency and local manufacturing.

- Product customization will grow to address diverse terrain and operational needs.

- Sustainability and recyclable alloys will gain prominence in design innovation.

- OEM collaborations will strengthen standardization and compatibility.

- The aftermarket segment will expand due to shorter replacement cycles.

- Increasing automation in heavy machinery will support long-term market stability.