Market Overview

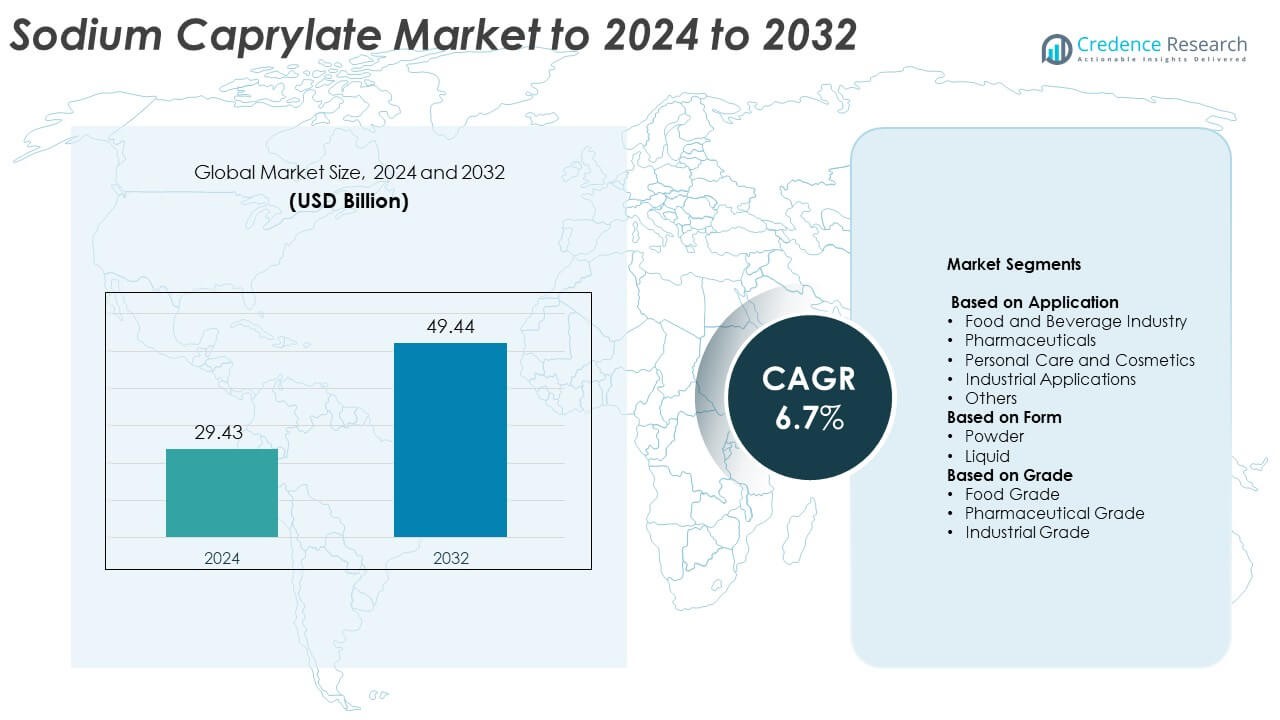

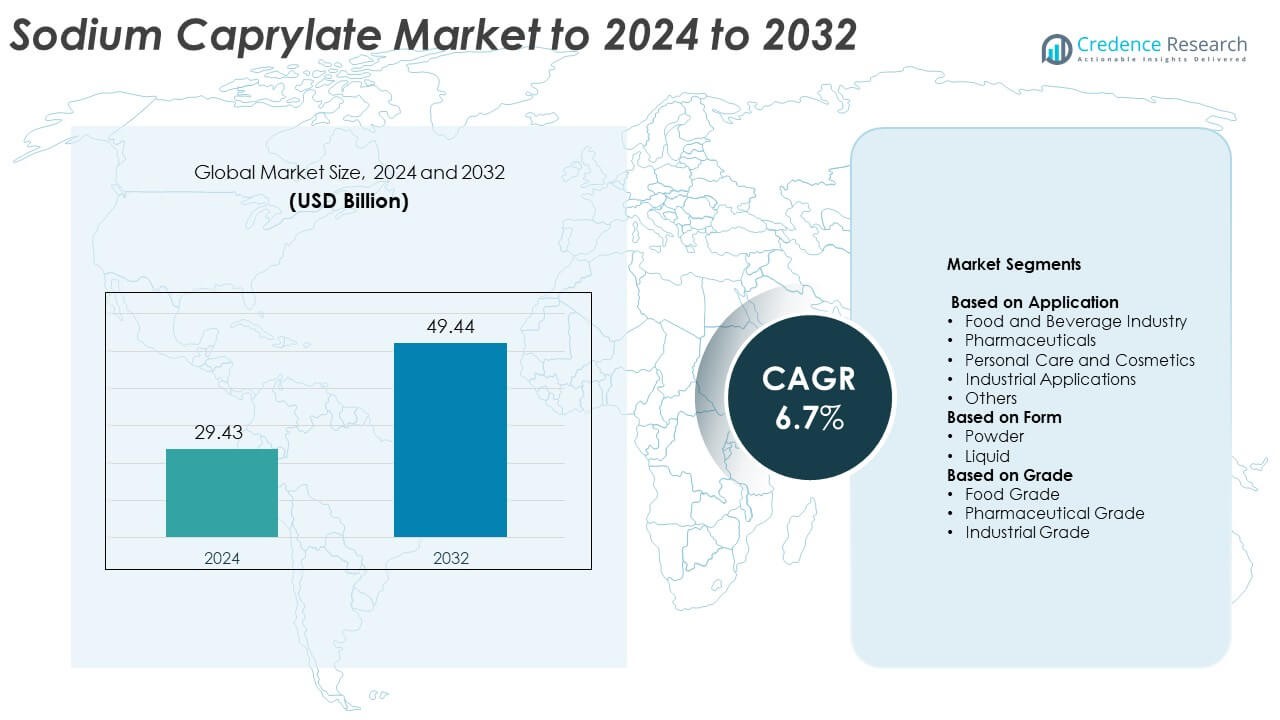

The sodium caprylate market size was valued at USD 29.43 billion in 2024 and is anticipated to reach USD 49.44 billion by 2032, at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Caprylate Market Size 2024 |

USD 29.43 Billion |

| Sodium Caprylate Market, CAGR |

6.7% |

| Sodium Caprylate Market Size 2032 |

USD 49.44 Billion |

The sodium caprylate market is led by major players such as Thermo Fisher Scientific, Merck KGaA, Spectrum Chemical, Tokyo Chemical Industry Co., Ltd. (TCI), and BOC Sciences. These companies dominate through advanced production technologies, global distribution networks, and strong compliance with pharmaceutical and food-grade quality standards. Strategic investments in high-purity and bio-based sodium caprylate support their market leadership. North America emerged as the leading region with a 34.9% market share in 2024, driven by robust biopharmaceutical manufacturing and established food preservation industries. Europe and Asia-Pacific followed, supported by expanding healthcare and personal care sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The sodium caprylate market was valued at USD 29.43 billion in 2024 and is projected to reach USD 49.44 billion by 2032, growing at a CAGR of 6.7%.

- Growing demand from the pharmaceutical sector for viral inactivation and plasma fractionation processes is a key market driver.

- Manufacturers are focusing on bio-based and high-purity sodium caprylate production to meet sustainability and safety standards.

- The market is moderately competitive, with leading players expanding capacity and improving product purity to strengthen their global presence.

- North America led the market with a 34.9% share in 2024, followed by Europe at 28.7% and Asia-Pacific at 24.3%, while the pharmaceuticals segment held the largest 41.6% share among all applications.

Market Segmentation Analysis:

By Application

The pharmaceuticals segment dominated the sodium caprylate market in 2024, accounting for a 41.6% share. Its dominance stems from extensive use as a stabilizing and antiviral agent in plasma fractionation and immunoglobulin formulations. Growing demand for effective viral inactivation methods in biologics manufacturing drives adoption. Expanding production of therapeutic proteins and vaccines further supports market growth. Rising healthcare investments in North America and Asia-Pacific reinforce the pharmaceutical sector’s leadership, while ongoing advancements in biopharmaceutical purification processes continue to enhance sodium caprylate utilization.

- For instance, Kedrion’s QIVIGY is a 10% IVIG, supplied in 50-mL and 100-mL vials, which is manufactured using a process that includes caprylate precipitation.

By Form

The powder form segment held the largest 56.3% share of the sodium caprylate market in 2024. The preference for powder stems from its superior stability, longer shelf life, and ease of transport and storage compared to liquid variants. It is widely used in pharmaceuticals, food preservation, and industrial emulsification processes. Manufacturers prefer powder for its precise dosage control and compatibility with automated mixing systems. Increasing production of dry-form dietary supplements and biopharmaceutical ingredients boosts demand for sodium caprylate powder globally.

- For instance, Thermo Scientific lists sodium caprylate powder with ≥97.5% assay (on dry basis) and ≤5% water, supplied specifically as a powder.

By Grade

The pharmaceutical grade segment led the sodium caprylate market in 2024, capturing a 48.7% share. High purity and strict compliance with pharmacopeial standards make it essential in vaccine stabilization, plasma-derived medicines, and protein purification. Growing adoption of biologics and therapeutic proteins has intensified the need for pharmaceutical-grade sodium caprylate. Its antimicrobial and antiviral efficacy enhances product safety in medical applications. Expanding biologics manufacturing facilities and stringent regulatory frameworks in Europe and North America further propel demand for this high-quality grade.

Key Growth Drivers

Rising Demand from Biopharmaceutical Manufacturing

The growing use of sodium caprylate in biopharmaceutical processing is a major driver of market growth. It plays a vital role in protein purification, viral inactivation, and stabilization of plasma-derived therapeutics. The increasing production of monoclonal antibodies and immunoglobulin-based treatments enhances demand for high-purity sodium caprylate. Expanding healthcare infrastructure and bioprocessing facilities, particularly in North America and Asia-Pacific, further boost its adoption across pharmaceutical manufacturing applications.

- For instance, Novo Nordisk’s oral semaglutide tablets co-formulate 300 mg SNAC (a caprylate derivative) per tablet, demonstrating caprylate technology adoption in drug delivery.

Expanding Use in Food Preservation

Sodium caprylate’s antimicrobial and antifungal properties make it valuable in extending food shelf life. The rising consumer preference for natural and safe preservatives drives its use in processed and packaged foods. It effectively prevents microbial spoilage without altering food quality, supporting clean-label product trends. The food and beverage industry’s shift toward preservative alternatives that meet safety standards strengthens sodium caprylate’s position in food-grade applications worldwide.

- For instance, Jost Chemical’s sodium caprylate “Purified Powder” is offered as a dietary ingredient and nutrient with assay 94.0–102.0% and loss on drying (LOD) $\le$2.5%, and is packed in either 55-lb/25-kg cartons or 26.4-lb poly pails.

Growth in Personal Care and Cosmetics Industry

The personal care sector increasingly adopts sodium caprylate for its emollient, surfactant, and antimicrobial benefits. It enhances product stability and prevents contamination in creams, lotions, and hair care formulations. Rising awareness of natural and multifunctional ingredients in cosmetic formulations supports market expansion. Manufacturers focus on developing mild and sustainable formulations, increasing sodium caprylate’s use in premium skincare and hygiene products across developed and emerging economies.

Key Trends & Opportunities

Shift Toward High-Purity and Bio-Based Production

Manufacturers are investing in advanced synthesis technologies to produce high-purity and bio-based sodium caprylate. This shift aligns with growing regulatory emphasis on safety and sustainability. Bio-based production methods using renewable fatty acids reduce environmental impact and attract eco-conscious industries. Such innovations enhance supply chain reliability and meet the rising demand from pharmaceutical and food manufacturers for environmentally sustainable ingredients.

- For instance, KLK Oleo’s PALMERA caprylic-capric acid contains C8 at 53–63% and C10 at 35–45%, from RSPO-certified operations.

Growing Applications in Antimicrobial Coatings

Sodium caprylate’s antimicrobial activity has led to its increasing use in coatings for healthcare and industrial environments. It helps inhibit bacterial growth on surfaces, improving hygiene standards. Rising investments in antimicrobial materials for medical devices, packaging, and food processing facilities create new opportunities. The expansion of research into caprylate-based surface protection supports long-term market growth in both developed and emerging markets.

- For instance, Inolex’s Lexgard® GMCY MB (glyceryl caprylate) is used at 1.0–1.5% recommended level in formulations to provide antimicrobial control.

Key Challenges

Fluctuations in Raw Material Availability

Sodium caprylate production depends heavily on caprylic acid derived from natural fats and oils. Variations in palm and coconut oil prices significantly affect production costs. Seasonal disruptions and regional supply constraints impact raw material availability, influencing overall market stability. Manufacturers are exploring synthetic and bio-based alternatives to reduce dependency on traditional feedstocks and stabilize long-term pricing.

Regulatory Compliance and Safety Standards

Stringent global regulations governing chemical additives and pharmaceutical excipients pose a major challenge. Sodium caprylate producers must comply with food safety, pharmaceutical purity, and environmental norms across multiple regions. Meeting these evolving standards requires significant investment in quality control, documentation, and testing. Smaller manufacturers face difficulties maintaining consistent compliance, limiting their ability to compete in regulated markets such as North America and Europe.

Regional Analysis

North America

North America held the largest 34.9% share of the sodium caprylate market in 2024. Strong demand from the pharmaceutical and biotechnology sectors supports this dominance. The region benefits from advanced bioprocessing infrastructure and a high number of plasma fractionation facilities. Increasing healthcare spending and strong regulatory frameworks promote consistent product quality and adoption. The United States leads due to its significant biopharmaceutical production capacity and extensive R&D investments, while Canada’s growing food processing industry further contributes to the region’s overall market growth.

Europe

Europe accounted for a 28.7% share of the global sodium caprylate market in 2024. The region’s dominance is attributed to stringent quality standards and expanding applications in pharmaceuticals and cosmetics. Growing awareness of clean-label preservatives in food manufacturing supports market demand. Germany, France, and the United Kingdom drive regional growth with strong biotechnology and skincare industries. European Union regulations encouraging sustainable ingredient sourcing further promote adoption of high-purity sodium caprylate, while continuous innovation in natural preservatives strengthens market presence across the region.

Asia-Pacific

Asia-Pacific captured a 24.3% share of the sodium caprylate market in 2024. Rising demand from pharmaceuticals, personal care, and food industries drives strong regional expansion. Rapid industrialization, growing healthcare infrastructure, and increasing disposable income fuel consumption across China, India, and Japan. The region benefits from large-scale production facilities and cost-effective raw material availability. Expanding biotechnology research and adoption of advanced purification techniques further enhance sodium caprylate usage in pharmaceutical formulations and high-performance cosmetic products, positioning Asia-Pacific as a major growth hub.

Latin America

Latin America held a 7.6% share of the sodium caprylate market in 2024. Growth is supported by increasing adoption in food preservation, cosmetics, and pharmaceuticals. Brazil and Mexico lead the market with expanding manufacturing sectors and improving regulatory frameworks. Rising investments in healthcare and the growing demand for antimicrobial additives in food processing strengthen the market outlook. Efforts to expand local production capacity and reduce import dependency are further enhancing regional competitiveness in sodium caprylate production and applications.

Middle East & Africa

The Middle East & Africa accounted for a 4.5% share of the sodium caprylate market in 2024. The market is driven by growing pharmaceutical manufacturing and rising investments in food safety solutions. Saudi Arabia, South Africa, and the United Arab Emirates lead regional demand due to expanding healthcare infrastructure. Increasing awareness of sustainable and high-quality chemical ingredients supports sodium caprylate adoption. The region’s gradual diversification into specialty chemicals and personal care applications is expected to enhance growth over the coming years.

Market Segmentations:

By Application

- Food and Beverage Industry

- Pharmaceuticals

- Personal Care and Cosmetics

- Industrial Applications

- Others

By Form

By Grade

- Food Grade

- Pharmaceutical Grade

- Industrial Grade

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sodium caprylate market is moderately fragmented, with key players such as Thermo Fisher Scientific, Merck KGaA, Spectrum Chemical, Tokyo Chemical Industry Co., Ltd. (TCI), Glentham Life Science, BOC Sciences, and others shaping the competitive landscape through innovation and capacity expansion. Companies focus on maintaining product purity, optimizing synthesis processes, and strengthening global distribution networks to meet pharmaceutical and food-grade standards. Strategic initiatives include mergers, collaborations, and portfolio diversification to expand geographical presence and serve biopharmaceutical, food, and cosmetic industries. Market participants are investing in advanced production technologies, bio-based raw materials, and regulatory compliance enhancements to achieve sustainable growth and differentiation in high-value applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermo Fisher Scientific

- Merck KGaA

- Spectrum Chemical

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Glentham Life Science

- BOC Sciences

- Acme Synthetic Chemicals

- Penta Manufacturing Company

- Cambridge Isotope Laboratories, Inc.

- Jost Chemical

- Central Drug House

- Sisco Research Laboratories Pvt. Ltd.

- AB Enterprises

- Ambeed

- Beantown Chemical Corporation

Recent Developments

- In 2023, Spectrum Chemical Mfg. Corp. continued to offer high-quality sodium caprylate, catering to the pharmaceutical and personal care sectors.

- In 2023, Jost Chemical Co. announced an increase in the availability of sodium caprylate (C8) and sodium caprate (C10) to meet heightened market demand.

- In 2023, Glentham Life Science continued to offer a range of chemicals, including sodium caprylate, to the research and pharmaceutical industries.

Report Coverage

The research report offers an in-depth analysis based on Application, Form, Grade and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The sodium caprylate market will expand steadily with rising pharmaceutical and biopharmaceutical applications.

- Growing demand for plasma-derived therapies will strengthen sodium caprylate’s role in viral inactivation processes.

- Food manufacturers will increasingly adopt sodium caprylate as a natural preservative alternative.

- Advancements in bio-based and high-purity production will enhance product sustainability and quality.

- Personal care brands will use sodium caprylate more in skincare and cosmetic formulations.

- Regulatory focus on clean-label and safe ingredients will promote wider adoption across industries.

- Asia-Pacific will emerge as the fastest-growing region due to expanding industrial capacity.

- Continuous R&D in antimicrobial and stabilization technologies will drive product innovation.

- Strategic partnerships between chemical producers and pharma companies will boost production efficiency.

- Expansion in emerging markets will create new opportunities for local sodium caprylate suppliers.