Market Overview

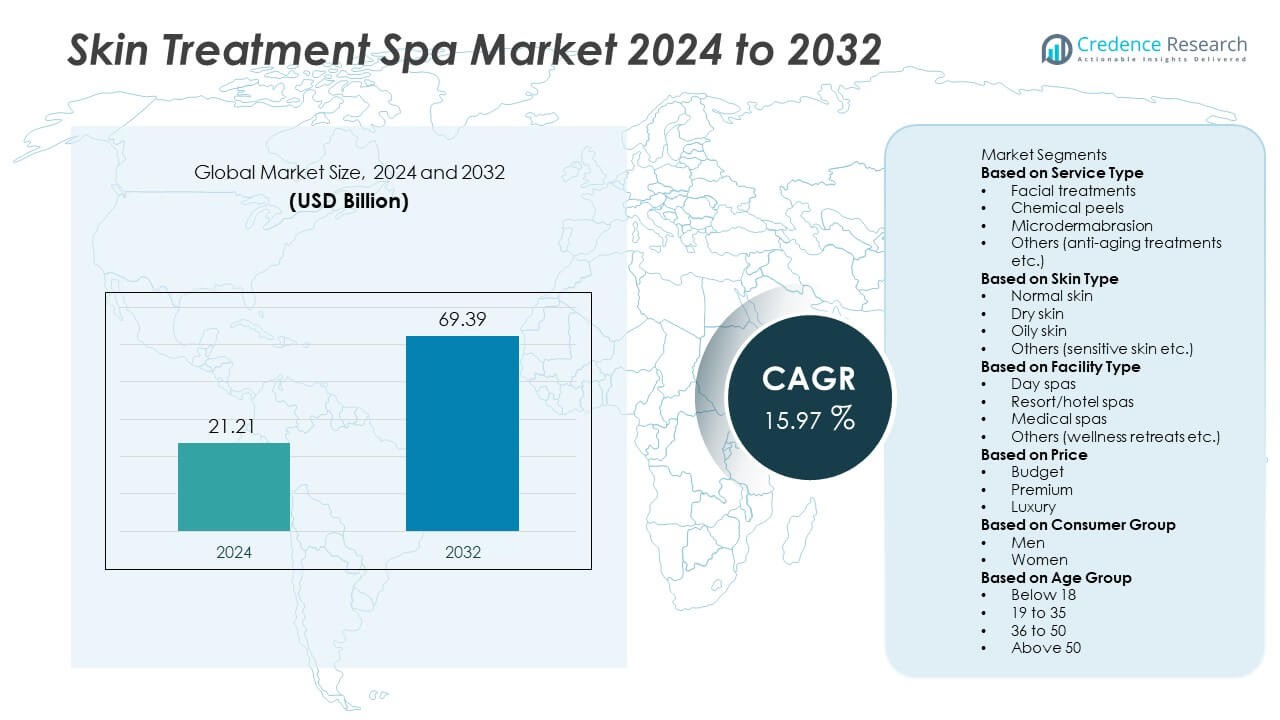

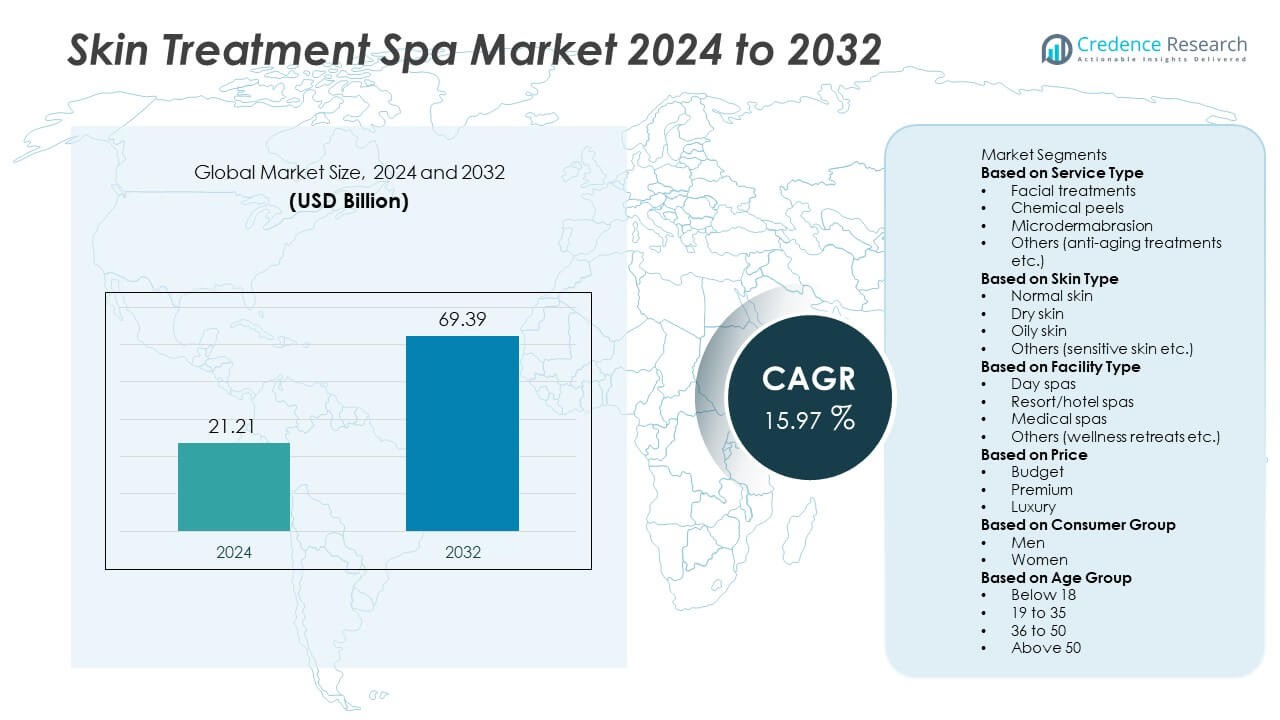

The skin treatment spa market was valued at USD 21.21 billion in 2024 and is projected to reach USD 69.39 billion by 2032, expanding at a strong CAGR of 15.97% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Skin Treatment Spa Market Size 2024 |

USD 21.21 Billion |

| Skin Treatment Spa Market, CAGR |

15.97% |

| Skin Treatment Spa Market Size 2032 |

USD 69.39 Billion |

The skin treatment spa market is led by prominent players such as ESPA Life at Corinthia, Clarins, Bamford Spa, Cowshed, Bvlgari Hotel London, and COMO Shambhala. These companies excel through innovative skincare services, luxury wellness experiences, and strong brand positioning across global spa destinations. North America emerged as the leading region, accounting for a 34.2% market share in 2024, supported by a high concentration of medical spas and growing consumer focus on advanced skin rejuvenation treatments. Europe followed with a 28.5% share, driven by wellness tourism and premium spa culture, while Asia-Pacific held a 27.3% share, supported by rapid urbanization and increasing demand for personalized skincare solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The skin treatment spa market was valued at USD 21.21 billion in 2024 and is projected to reach USD 69.39 billion by 2032, growing at a CAGR of 15.97%.

- Rising demand for wellness and aesthetic treatments drives market growth, with facial treatments holding a 41.8% share due to strong consumer preference for non-invasive skincare services.

- Technological advancements such as AI-based skin analysis and LED therapy are transforming treatment precision, enhancing personalized skincare experiences across luxury and medical spas.

- The market is competitive, with leading players including ESPA Life at Corinthia, Clarins, Bamford Spa, and COMO Shambhala focusing on premium services and sustainable practices to strengthen brand loyalty.

- North America led with a 34.2% share in 2024, followed by Europe at 28.5% and Asia-Pacific at 27.3%, supported by rising disposable incomes, expanding wellness tourism, and growing urban interest in advanced skincare treatments.

Market Segmentation Analysis:

By Service Type

The facial treatments segment dominated the skin treatment spa market in 2024, accounting for a 41.8% share. Its leadership is attributed to the rising popularity of rejuvenating and anti-aging facials among both women and men. Facial treatments offer visible results in hydration, texture improvement, and wrinkle reduction, making them a preferred choice in spas globally. Advancements such as LED light therapy, oxygen facials, and collagen-boosting techniques enhance effectiveness and attract premium clientele. Increasing urbanization, stress-related skin issues, and the availability of personalized skincare programs further support strong demand in this segment.

- For instance, ELEMIS introduced its BIOTEC 2.0 facial technology featuring a dynamic galvanic current combined with oxygen infusion, along with other technologies like microcurrent and LED light therapy.

By Skin Type

The normal skin segment led the market in 2024, holding a 38.6% share. Spas prefer targeting this category as it accommodates a wide range of treatments and products. Consumers with normal skin are more likely to explore preventive and maintenance-based therapies, boosting regular spa visits. The rising focus on maintaining youthful and balanced skin through natural ingredients and non-invasive methods supports this segment’s growth. Additionally, innovations in multi-functional skincare products and personalized treatment plans enhance customer satisfaction and repeat engagement.

- For instance, Clarins developed its Hydra-Essentiel treatment line, which features organic leaf of life extract to help boost the skin’s natural hyaluronic acid production and moisture retention. In consumer testing, some Hydra-Essentiel products have been reported to improve skin hydration and comfort.

By Facility Type

Medical spas dominated the market in 2024, capturing a 46.2% share. These facilities combine medical expertise with spa-like environments, offering advanced skin rejuvenation, laser treatments, and non-surgical cosmetic procedures. Growing demand for safe, results-driven therapies such as Botox, dermal fillers, and micro-needling drives the segment’s growth. Consumers increasingly prefer medical spas for their certified professionals and customized solutions. Rising interest in aesthetic wellness and technological integration, including AI-based skin analysis and personalized treatment mapping, further strengthens the dominance of this segment across global markets.

Key Growth Drivers

Rising Awareness of Skincare and Wellness

Growing consumer focus on personal appearance and wellness is fueling the expansion of skin treatment spas. Social media influence, celebrity endorsements, and lifestyle shifts have heightened awareness of professional skincare treatments. Consumers seek preventive care and long-term skin health solutions rather than basic cosmetic fixes. This awareness encourages regular spa visits and adoption of advanced treatments like chemical peels and anti-aging therapies, boosting overall market demand across urban and high-income demographics.

- For instance, Champneys offers various skincare treatments, which may include glycolic and lactic acid peels for skin renewal, though specific treatments and their outcomes require verification. These chemical peels are generally known to exfoliate the skin by removing dead epidermal cells, which can help improve texture and skin tone.

Expansion of Medical and Hybrid Spa Facilities

The rising popularity of medical spas that combine dermatological expertise with relaxation services is a major market driver. These facilities offer evidence-based treatments such as laser resurfacing, micro-needling, and injectables. Consumers prefer medically supervised services that deliver faster and more lasting results. The integration of wellness and aesthetics appeals to clients seeking both rejuvenation and therapeutic care, driving investments in technology-equipped spa centers worldwide.

- For instance, fractional CO2 laser treatment systems operate at 10,600 nm wavelength to stimulate collagen and improve dermal elasticity. The effectiveness of such systems in skin rejuvenation can be measured by tools like a cutometer, and clinical studies have shown significant improvements after a series of sessions. Such treatments are offered in various aesthetic and luxury spa settings.

Technological Advancements in Skin Treatment Equipment

Rapid innovation in skincare technology is transforming spa services. AI-powered skin analysis, LED therapy, microcurrent facial devices, and cryotherapy machines enable precise and personalized treatments. These technologies improve treatment outcomes and customer satisfaction while reducing downtime. Automation and data-driven customization enhance spa efficiency and elevate the client experience. Growing accessibility of advanced equipment also supports small and mid-sized spa businesses in expanding premium offerings.

Key Trends & Opportunities

Adoption of Personalized and AI-Based Skincare Solutions

Skin treatment spas increasingly use AI and digital diagnostics to customize treatments based on individual skin conditions. Personalized regimens enhance customer satisfaction and loyalty. Technology allows real-time skin analysis, monitoring, and progress tracking. This trend opens opportunities for data-driven product recommendations and tailored service plans, creating new revenue streams for spa operators.

- For instance, Lanesborough Club & Spa has integrated the Aura AI SkinAnalysis system, which uses advanced 3D imaging to evaluate individual skin concerns. This technology creates a comprehensive digital replica of a client’s face, allowing therapists to analyze and track factors like texture, pores, and pigmentation.

Growing Demand for Organic and Natural Products

Consumers are shifting toward clean-label, toxin-free skincare formulations. Spas are introducing organic peels, herbal masks, and natural serums to meet this demand. Sustainable sourcing and eco-friendly practices strengthen brand trust among environmentally conscious customers. This trend supports product innovation and strategic collaborations between spas and organic skincare brands, expanding premium service portfolios globally.

- For instance, Bamford Spa offers organic facial treatments using the brand’s own certified organic skincare products. The company is known to use high-quality, plant-based ingredients in its formulations, such as those that contain essential fatty acids.

Key Challenges

High Equipment and Maintenance Costs

Establishing a modern skin treatment spa requires significant investment in technology, skilled professionals, and infrastructure. Advanced equipment such as laser machines and cryotherapy systems entails high acquisition and maintenance expenses. Smaller operators often struggle to compete with larger, technology-driven chains. Managing cost efficiency while maintaining premium service quality remains a core challenge.

Lack of Standardized Regulations and Skilled Professionals

The absence of uniform global standards in spa operations and technician qualifications affects service consistency. Many regions lack certified professionals for advanced procedures like laser or injectables. This gap can lead to safety concerns and reduced consumer trust. Investing in structured training programs and regulatory compliance is essential for maintaining credibility and ensuring sustainable growth.

Regional Analysis

North America

North America held a 34.2% share of the skin treatment spa market in 2024, driven by high consumer spending on wellness and beauty services. The U.S. dominates due to the strong presence of medical spas offering advanced skin rejuvenation, anti-aging, and laser treatments. Growing awareness of personalized skincare and the availability of technologically advanced equipment fuel market expansion. The region benefits from well-established spa chains, skilled professionals, and favorable reimbursement for certain dermatological procedures. Increasing demand for minimally invasive treatments continues to position North America as a leading market globally.

Europe

Europe accounted for a 28.5% share of the skin treatment spa market in 2024, supported by a well-developed wellness tourism sector and widespread adoption of non-invasive cosmetic procedures. Countries such as Germany, France, and the U.K. lead due to high consumer awareness and spending on luxury spa services. The region’s strong regulatory environment promotes safety and standardization in skin treatments. The popularity of organic skincare and anti-aging facials also drives steady demand. Growing investment in medical spas and skin clinics strengthens Europe’s competitive position in the global market.

Asia-Pacific

Asia-Pacific captured a 27.3% share of the skin treatment spa market in 2024, emerging as the fastest-growing region. Rising disposable income, rapid urbanization, and beauty-conscious millennial consumers drive market growth. Countries like Japan, South Korea, China, and India dominate due to increasing demand for facial rejuvenation and brightening treatments. The rise of K-beauty trends and the expansion of luxury spa chains enhance regional competitiveness. Government support for wellness tourism and the integration of traditional therapies with modern skincare further boost Asia-Pacific’s market potential.

Latin America

Latin America held a 6.2% share of the skin treatment spa market in 2024, led by Brazil and Mexico. Growth is driven by increasing awareness of skincare and the popularity of beauty enhancement treatments among urban populations. Expanding spa networks and collaborations with dermatologists contribute to regional development. However, economic constraints and limited access to advanced equipment restrict large-scale adoption. The growing influence of wellness tourism and demand for affordable facial treatments are expected to strengthen the region’s market presence in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for a 3.8% share of the skin treatment spa market in 2024. Rapid urbanization, expanding hospitality sectors, and rising beauty awareness among younger consumers drive regional demand. The UAE and Saudi Arabia lead due to significant investments in luxury spas and aesthetic centers. High-income consumers prefer premium skincare treatments and personalized spa services. However, limited professional training and high equipment costs challenge market growth. Increasing focus on wellness tourism and medical aesthetics is expected to enhance market potential across the region.

Market Segmentations:

By Service Type

- Facial treatments

- Chemical peels

- Microdermabrasion

- Others (anti-aging treatments etc.)

By Skin Type

- Normal skin

- Dry skin

- Oily skin

- Others (sensitive skin etc.)

By Facility Type

- Day spas

- Resort/hotel spas

- Medical spas

- Others (wellness retreats etc.)

By Price

By Consumer Group

By Age Group

- Below 18

- 19 to 35

- 36 to 50

- Above 50

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The skin treatment spa market is highly competitive, featuring key players such as ESPA Life at Corinthia, Clarins, Bamford Spa, Cowshed, Bvlgari Hotel London, Lanesborough Club and Spa, Champneys, Harrods, COMO Shambhala, and Elemis. These brands dominate through premium service offerings, advanced skincare technologies, and strong brand reputation in wellness and luxury segments. Leading players focus on expanding their service portfolios by integrating medical-grade treatments such as laser facials, chemical peels, and non-invasive anti-aging therapies. Strategic partnerships with skincare product manufacturers and investments in AI-driven skin diagnostics enhance personalized client experiences. Sustainability and organic product use are becoming key differentiators, attracting environmentally conscious consumers. Moreover, the expansion of wellness tourism and the introduction of hybrid spa models combining health, beauty, and fitness services further intensify competition. Continuous innovation in service design and customer engagement remains essential for maintaining market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ESPA Life at Corinthia

- Clarins

- Bamford Spa

- Cowshed

- Bvlgari Hotel London

- Lanesborough Club and Spa

- Champneys

- Harrods

- COMO Shambhala

- Elemis

Recent Developments

- In September 2025, ELEMIS announced a partnership with Anantara Spa to roll out its EXPERT™ TECH FACIALS across several European destinations, integrating its BIOTEC machine technology with six targeted treatment modes such as cryotherapy, ultrasonic peel and LED-light mask.

- In March 2025, Clarins and Air France launched a spa facility in the Air France Lounge at LAX (Los Angeles International Airport), featuring two treatment cabins offering four signature skin spa treatments for premium passengers.

- In 2025, ESPA Life at Corinthia introduced the Immune Fortifying Ritual, a therapeutic skin and body experience featuring a lymphatic compression suit to detoxify and elevate vitality, alongside bespoke mind-body treatments such as the ESPA Nurture Ritual and Mindful Massage that blend breathwork, aromatherapy, and advanced skincare.

- In June 2024, The Bvlgari Spa (at Bvlgari Hotel London) unveiled three new holistic wellness journeys focused on recovery, sleep and longevity, including hyperbaric oxygen therapy and a zero-gravity body-float experience.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Skin Type, Facility Type, Price, Consumer Group, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for personalized and technology-driven skincare treatments will continue to grow.

- AI-based skin diagnostics will enhance customization and treatment accuracy in spas.

- Medical spas offering advanced non-invasive procedures will expand rapidly.

- Wellness tourism will play a major role in driving global spa industry growth.

- Organic and clean-label skincare products will dominate treatment offerings.

- Partnerships between skincare brands and spa chains will strengthen service quality.

- Consumers will increasingly prefer holistic therapies combining relaxation and aesthetics.

- Expansion of luxury and hybrid spa facilities will boost market competitiveness.

- Digital booking platforms and online consultation services will improve customer access.

- Sustainability initiatives and eco-friendly practices will shape the future of spa operations.