Market Overview:

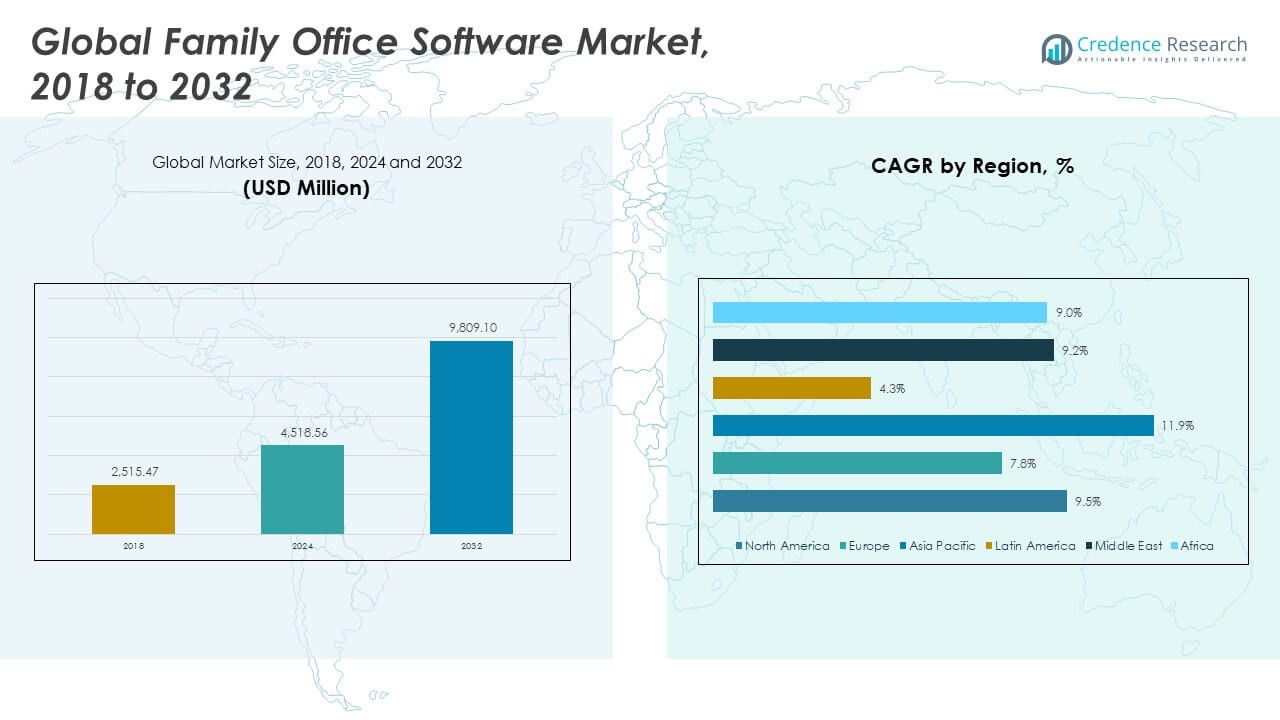

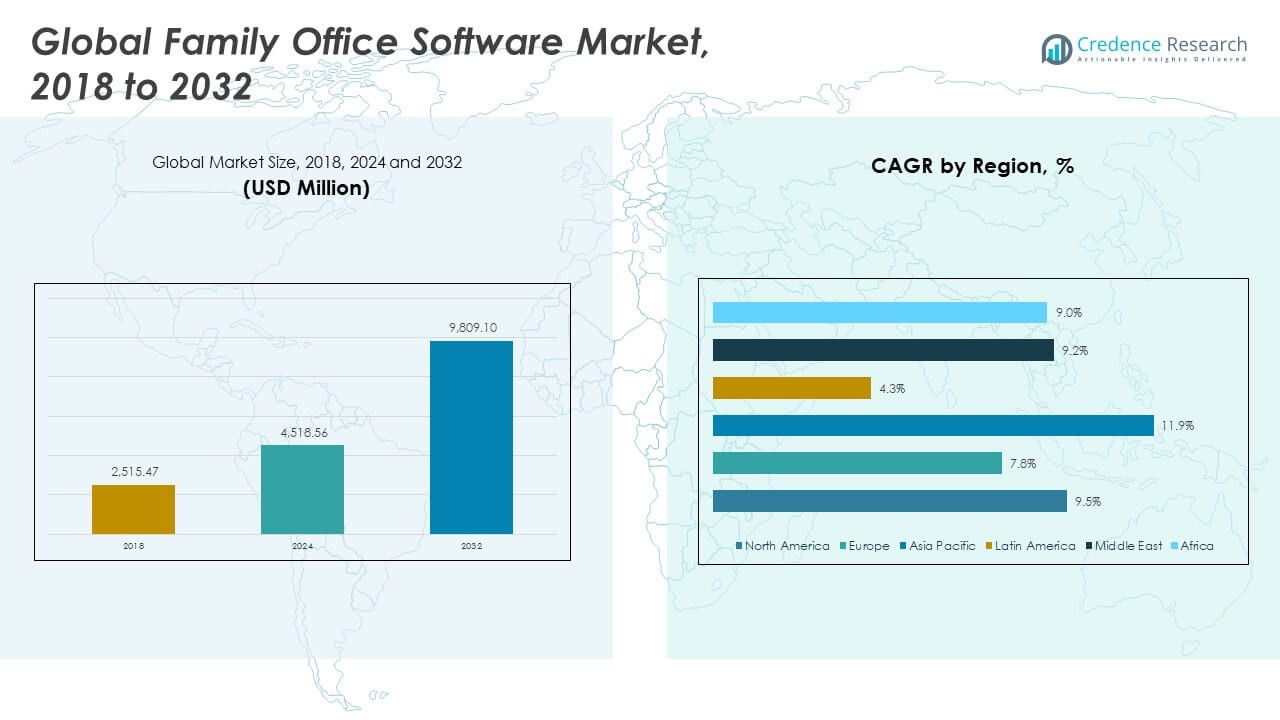

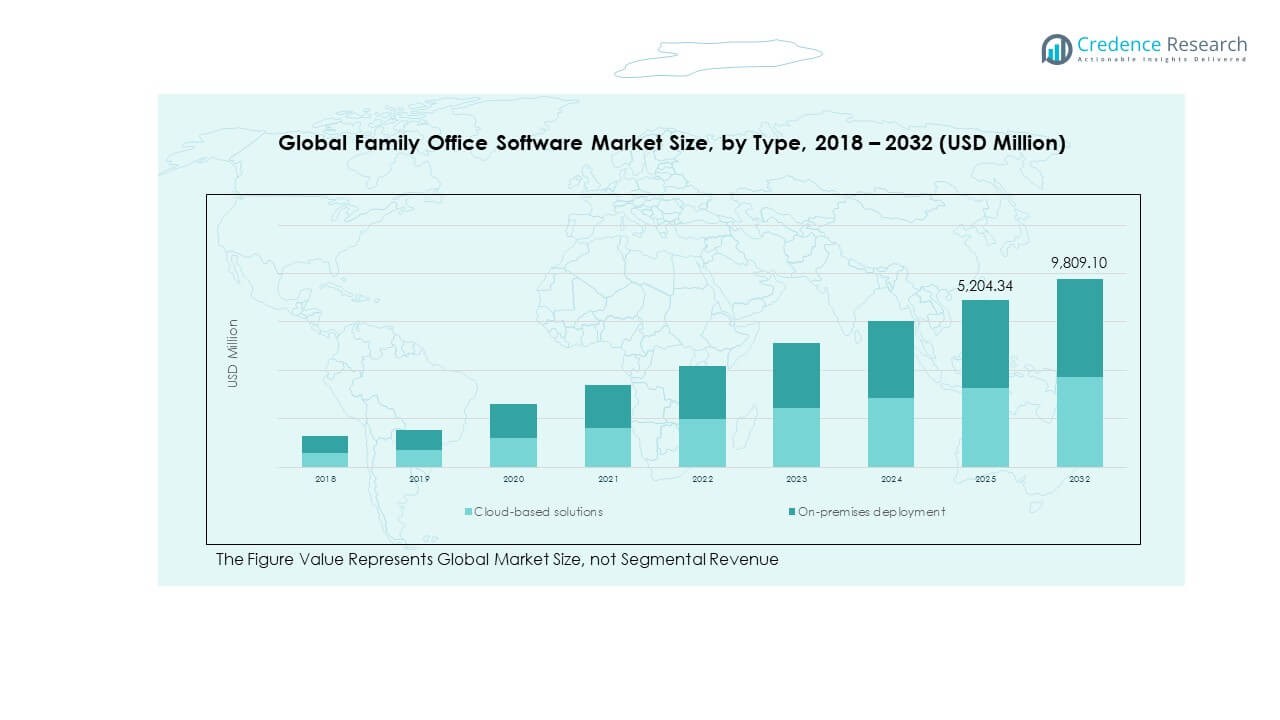

The Global Family Office Software Market size was valued at USD 2,515.47 million in 2018, increased to USD 4,518.56 million in 2024, and is anticipated to reach USD 9,809.10 million by 2032, at a CAGR of 9.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Family Office Software Market Size 2024 |

USD 4,518.56 Million |

| Family Office Software Market, CAGR |

9.48% |

| Family Office Software Market Size 2032 |

USD 9,809.10 Million |

Growing demand for advanced wealth management tools and digital transformation in family offices drives market expansion. Software adoption helps streamline portfolio tracking, compliance, and reporting processes for multi-generational asset management. Cloud-based platforms, enhanced cybersecurity, and integration with AI-driven analytics support improved transparency and efficiency. Vendors focus on customizable dashboards and automation to simplify decision-making for high-net-worth clients managing complex global portfolios.

North America leads the market, supported by strong technology infrastructure and concentration of ultra-high-net-worth families. Europe follows with rising digital adoption among established family offices in the UK, Switzerland, and Germany. Asia-Pacific shows the fastest growth due to expanding wealth in China, India, and Singapore. Emerging markets in the Middle East and Latin America also demonstrate increasing adoption of software solutions to optimize asset tracking and governance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Family Office Software Market was valued at USD 2,515.47 million in 2018, increased to USD 4,518.56 million in 2024, and is projected to reach USD 9,809.10 million by 2032, growing at a CAGR of 9.48% during the forecast period.

- North America leads with about 42% market share, driven by strong fintech adoption, high concentration of ultra-high-net-worth families, and advanced digital infrastructure across the U.S. and Canada.

- Europe ranks second with roughly 14% share, supported by regulatory compliance demands, legacy wealth institutions, and strong presence of private banking hubs. Middle East follows with 18% share, led by large family conglomerates and Sharia-compliant financial systems.

- Asia Pacific is the fastest-growing region, holding nearly 20% share in 2024. Its growth is fueled by rapid wealth creation, fintech innovation, and government-backed financial transparency initiatives across China, India, and Singapore.

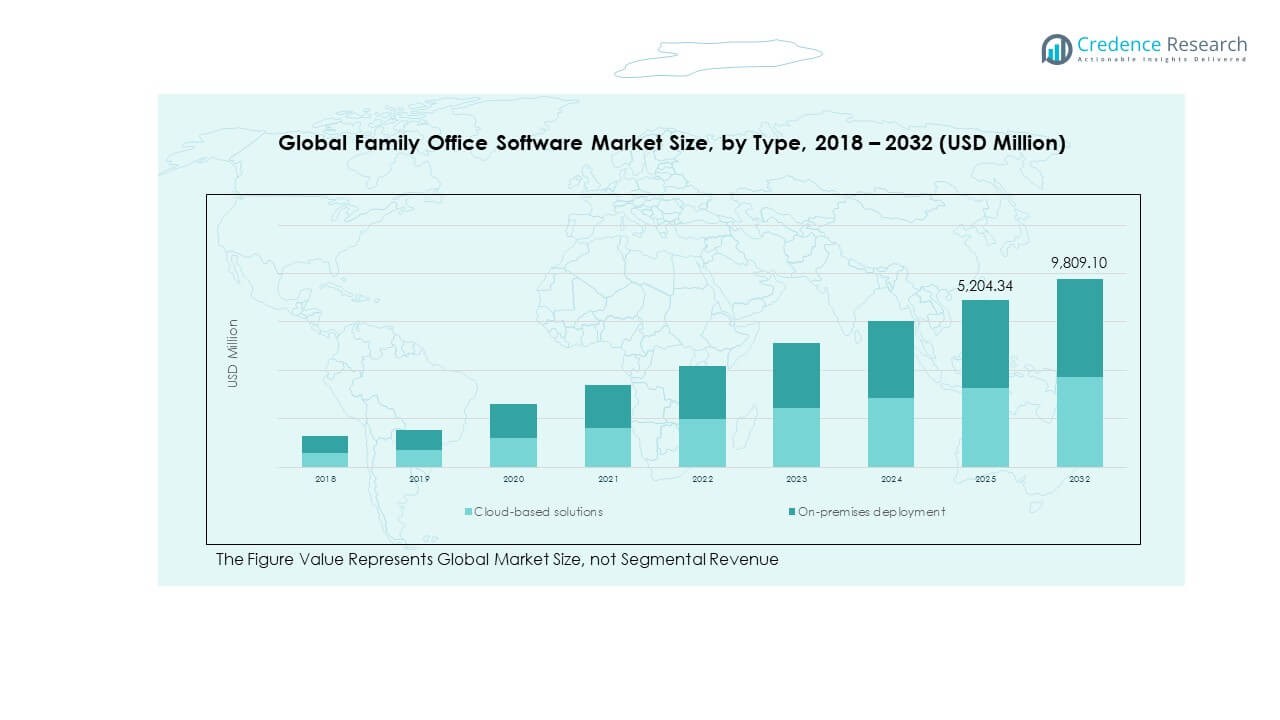

- By type, cloud-based solutions account for around 68%, reflecting strong demand for scalability and real-time access, while on-premises deployment holds about 32%, favored by traditional offices prioritizing data control and privacy.

Market Drivers:

Growing Need for Centralized Wealth Management Platforms Among Multi-Generational Families

The Global Family Office Software Market is driven by rising demand for unified platforms that consolidate financial data across assets, portfolios, and entities. Wealthy families seek software solutions that streamline reporting, governance, and compliance processes. It enables real-time visibility into investments, improving control over multi-generational wealth. Automation tools reduce administrative burdens and minimize manual data errors. Enhanced portfolio tracking supports strategic decision-making and risk management. Growing complexity in global asset diversification increases the need for centralized control. Software providers integrate accounting, tax, and performance analytics modules to meet such needs. These capabilities strengthen operational efficiency across single and multi-family offices.

- For instance, Addepar serves over 1,300 client firms and aggregates more than US$8 trillion in assets across more than 50 countries/markets. Automation tools reduce administrative burdens and minimize manual data errors. Enhanced portfolio tracking supports strategic decision-making and risk management. Growing complexity in global asset diversification increases the need for centralized control.

Increasing Digital Transformation and Adoption of Cloud-Based Solutions

Rapid digital transformation is reshaping traditional wealth management systems. Cloud-based solutions dominate deployments, offering flexibility, scalability, and cost efficiency. The Global Family Office Software Market benefits from secure cloud environments that enable remote access and collaboration. It supports real-time updates, reducing delays in financial reporting. Vendors leverage advanced encryption and data privacy tools to build user trust. Integration with external financial platforms further improves data accuracy and agility. Family offices adopt SaaS models to lower infrastructure costs and simplify upgrades. This transition encourages continuous innovation in AI-based portfolio and compliance automation tools.

Rising Emphasis on Regulatory Compliance and Transparency in Wealth Management

Tightening global regulations push family offices to adopt compliance-ready digital systems. The Global Family Office Software Market gains traction due to mandatory reporting standards like FATCA, CRS, and GDPR. It helps automate compliance checks, audit trails, and tax filings across multiple jurisdictions. Transparency requirements from regulators and beneficiaries drive adoption of digital record-keeping. Advanced analytics enhance accuracy in financial reporting and internal audits. Family offices rely on these solutions to mitigate non-compliance risks and reputational damage. Automated alerts and built-in compliance dashboards ensure continuous oversight. Vendors offering real-time compliance monitoring attract a growing client base.

Integration of Artificial Intelligence and Data Analytics Enhancing Investment Decisions

AI and predictive analytics drive intelligent insights for investment strategy optimization. The Global Family Office Software Market benefits from algorithms that identify performance trends and risk exposures. It transforms large datasets into actionable intelligence through advanced data visualization. AI tools enhance forecasting accuracy, portfolio rebalancing, and tax optimization. Machine learning models improve asset allocation and identify emerging investment opportunities. Automated financial reporting reduces manual workloads for staff. Integration with APIs allows cross-platform data synchronization for better decision-making. These innovations elevate the strategic value of family office management platforms worldwide.

Market Trends:

Shift Toward Personalized and Modular Software Architectures

Family offices increasingly seek software tailored to their specific investment structures. The Global Family Office Software Market observes a shift toward modular architectures allowing customized functionalities. It enables users to select only essential modules like accounting, CRM, or risk analytics. Modular systems reduce complexity and streamline user experience. Customization improves compatibility with legacy systems and third-party integrations. Family offices prefer scalable solutions that adapt to changing portfolio dynamics. This trend encourages software developers to offer plug-and-play interfaces. Personalization enhances operational efficiency while maintaining confidentiality and control.

- Customized functionalities — for instance, Juniper Square supports more than 2,000 general partners and 650,000 investor accounts via a modular platform managing over 40,000 investment entities. It enables users to select only essential modules like accounting, CRM, or risk analytics. Modular systems reduce complexity and streamline user experience.

Growing Adoption of Automation and Artificial Intelligence for Efficiency

Automation and AI integration dominate emerging technology trends. The Global Family Office Software Market witnesses rising adoption of robotic process automation for repetitive financial tasks. It enables predictive cash flow modeling and automated reconciliation of transactions. AI-driven insights improve investment accuracy and risk forecasting. Natural language processing tools simplify client communication and reporting. Automation reduces time spent on manual data entry and enhances productivity. Vendors deploy AI chatbots for instant query resolution. Intelligent automation improves compliance and decision support in complex family wealth environments.

- Robotic process automation for repetitive financial tasks — for instance, SESAMm processes in excess of 20 billion documents in real-time using AI and NLP to support ESG and sentiment analysis for investment managers. It enables predictive cash-flow modeling and automated reconciliation of transactions. AI-driven insights improve investment accuracy and risk forecasting.

Expansion of Multi-Family Offices and Outsourced Service Providers

The growing number of multi-family offices is transforming market dynamics. The Global Family Office Software Market benefits from the shift toward shared service models that reduce operational costs. It supports scalability and multi-entity management through unified dashboards. Outsourced providers use these systems to manage client data securely across geographies. Consolidated reporting enhances transparency among investors. Software solutions designed for multi-client operations improve workflow automation. Vendors target multi-family setups by offering flexible licensing and cloud integration. This evolution strengthens technology adoption among small and emerging family offices.

Increased Focus on Cybersecurity and Data Protection Measures

Cybersecurity remains a key trend influencing market growth. The Global Family Office Software Market emphasizes enhanced protection for sensitive client information. It incorporates encryption, two-factor authentication, and intrusion detection systems. Rising cyber threats prompt family offices to adopt secure cloud frameworks. Compliance with global data privacy laws ensures client trust and regulatory alignment. Vendors invest in AI-based security analytics for proactive threat detection. Regular security audits and encrypted communications enhance digital safety. Advanced security features have become a top selection criterion for new software implementations.

Market Challenges Analysis:

High Implementation Costs and Limited IT Expertise Among Traditional Family Offices

The Global Family Office Software Market faces constraints due to high setup and integration costs. Many traditional family offices lack in-house IT infrastructure or expertise for digital adoption. It creates barriers to implementing sophisticated platforms with advanced analytics or automation features. Initial training and data migration costs add to operational challenges. Smaller family offices often prefer manual processes to avoid capital expenditure. Limited staff proficiency in digital tools slows system adoption. Vendors need to simplify onboarding and provide training support. Addressing these issues remains critical for broader market penetration.

Data Privacy Concerns and Integration Difficulties with Legacy Systems

Legacy infrastructure creates integration challenges across financial entities and custodians. The Global Family Office Software Market must address compatibility gaps between old accounting tools and modern software. It faces obstacles in real-time data synchronization and standardization across platforms. Cybersecurity and data privacy remain top concerns for family offices managing confidential information. Fear of data leaks limits cloud adoption among conservative users. Interoperability issues between global banking systems and APIs further delay digital transformation. Vendors must enhance data encryption and offer seamless migration solutions. Tackling these gaps can improve adoption rates and long-term client trust.

Market Opportunities:

Expansion in Emerging Economies and Growing Number of High-Net-Worth Individuals

The Global Family Office Software Market holds strong potential in Asia-Pacific, the Middle East, and Latin America. Rapid wealth creation in these regions increases demand for structured financial management systems. It encourages local family offices to digitize their operations and adopt modern tools. Regional players invest in software partnerships to improve service offerings. Expanding private wealth management sectors create new opportunities for software vendors. Governments promoting financial transparency further support adoption. This expansion phase opens avenues for vendors to localize solutions for cultural and regulatory needs.

Integration of Advanced Technologies to Enhance Client Experience and Insights

The Global Family Office Software Market can capitalize on the integration of AI, blockchain, and data analytics. These technologies enable improved transparency, faster reporting, and advanced decision-making capabilities. It enhances client experience through personalized dashboards and predictive investment tools. Blockchain adoption supports secure and immutable record-keeping for transactions. Advanced analytics empower family offices with actionable insights on risk and performance. Vendors investing in these technologies can strengthen their competitive positioning. The evolving digital ecosystem offers sustained opportunities for innovation-driven players.

Market Segmentation Analysis:

By Type

The Global Family Office Software Market is segmented into cloud-based solutions and on-premises deployment. Cloud-based solutions dominate due to scalability, remote accessibility, and lower infrastructure costs. It enables real-time collaboration and integration with third-party financial platforms. Enhanced data security and automatic updates further strengthen adoption among modern family offices. On-premises deployment appeals to organizations prioritizing full data control and customized architecture. It remains favored by traditional family offices handling confidential investment portfolios. Vendors continue to offer hybrid models to balance flexibility and security needs. Growing digital transformation across wealth management accelerates the preference for cloud-based systems worldwide.

By Application

Based on application, the market is divided into Single Family Offices (SFOs) and Multi-Family Offices (MFOs). SFOs leverage these solutions to manage personalized investment strategies, risk tracking, and compliance reporting. It allows seamless consolidation of assets across generations while maintaining transparency. MFOs utilize software to handle diverse client portfolios efficiently and ensure centralized data governance. Automated reporting and analytics tools enhance decision-making accuracy in both segments. The growing number of high-net-worth individuals drives the establishment of new family offices. Vendors design flexible platforms catering to both large and boutique operations. This segmentation highlights the software’s expanding role in professionalized wealth management.

Segmentation:

By Type

- Cloud-based Solutions

- On-premises Deployment

By Application

- Single Family Offices (SFOs)

- Multi-Family Offices (MFOs)

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Global Family Office Software Market size was valued at USD 1,059.88 million in 2018 to USD 1,883.38 million in 2024 and is anticipated to reach USD 4,100.30 million by 2032, at a CAGR of 9.5% during the forecast period. North America holds the largest market share, accounting for nearly 42% of the global revenue in 2024. The region benefits from a mature wealth management ecosystem and early adoption of digital solutions. It drives innovation through advanced software development and strong fintech infrastructure. Family offices in the U.S. increasingly use automation and AI tools for asset monitoring and compliance. High penetration of cloud-based platforms enhances operational efficiency and data security. The presence of major players and rising demand for portfolio transparency strengthen market dominance. Canada and Mexico follow with growing adoption among emerging high-net-worth families.

Europe

The Europe Global Family Office Software Market size was valued at USD 370.64 million in 2018 to USD 619.57 million in 2024 and is anticipated to reach USD 1,188.06 million by 2032, at a CAGR of 7.8% during the forecast period. Europe represents around 14% of the global market share in 2024. The region’s strong financial hubs, including the UK, Germany, and Switzerland, drive steady adoption. It emphasizes regulatory compliance and risk governance, prompting digital transformation across family offices. Growing intergenerational wealth transfer and sustainable investing trends expand software utilization. Vendors provide GDPR-compliant platforms to ensure secure data handling. Integration with wealth planning tools and multi-currency support remains a key advantage. The European market’s stability and transparency sustain its position among leading regions.

Asia Pacific

The Asia Pacific Global Family Office Software Market size was valued at USD 323.13 million in 2018 to USD 653.34 million in 2024 and is anticipated to reach USD 1,689.43 million by 2032, at a CAGR of 11.9% during the forecast period. Asia Pacific accounts for nearly 20% of the global market share in 2024. It witnesses rapid expansion driven by rising numbers of ultra-high-net-worth individuals in China, India, and Singapore. Family offices adopt digital platforms to manage diversified investments and succession planning. Governments promoting financial transparency and wealth regulation encourage software uptake. Local and international vendors introduce scalable solutions tailored for regional tax systems. Cloud adoption and fintech innovation create strong market momentum. Asia Pacific’s young wealth demographic fuels modernization of family office operations.

Latin America

The Latin America Global Family Office Software Market size was valued at USD 43.91 million in 2018 to USD 76.22 million in 2024 and is anticipated to reach USD 112.89 million by 2032, at a CAGR of 4.3% during the forecast period. Latin America contributes about 2% of the global market share in 2024. The region’s market remains small but gradually evolving with expanding private wealth. Brazil and Mexico lead adoption due to growing family office networks and regional investment activities. It faces challenges such as economic instability and limited technology infrastructure. Increasing focus on wealth preservation and cross-border investments supports gradual software integration. Vendors target the market with affordable, localized cloud solutions. Awareness of digital wealth management tools is rising among new generations of investors.

Middle East

The Middle East Global Family Office Software Market size was valued at USD 466.22 million in 2018 to USD 826.60 million in 2024 and is anticipated to reach USD 1,755.18 million by 2032, at a CAGR of 9.2% during the forecast period. The region holds nearly 18% of the global market share in 2024. Strong family-owned conglomerates in GCC countries drive significant software adoption. It supports wealth diversification, succession planning, and Sharia-compliant investment management. Rising oil wealth and expanding sovereign fund operations create demand for digital platforms. Family offices prioritize secure data hosting and integration with global financial systems. Vendors offering Arabic-language interfaces and local compliance features gain traction. Increasing institutional collaboration across Dubai and Saudi Arabia accelerates technology penetration.

Africa

The Africa Global Family Office Software Market size was valued at USD 251.69 million in 2018 to USD 459.44 million in 2024 and is anticipated to reach USD 963.24 million by 2032, at a CAGR of 9.0% during the forecast period. Africa contributes about 4% of the global market share in 2024. The region experiences steady growth due to rising family wealth in South Africa, Nigeria, and Egypt. It adopts digital tools for estate management and international investment oversight. Limited local infrastructure slows full-scale adoption but cloud platforms bridge accessibility gaps. Growing awareness of financial transparency supports gradual modernization. Vendors emphasize cost-effective, mobile-accessible platforms to capture smaller offices. Family offices increasingly seek compliance-ready systems to manage cross-border assets securely. Africa remains an emerging but promising growth frontier for global providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Addepar

- Black Diamond (SS&C Technologies)

- Envestnet | Tamarac

- Juniper Square

- Archway Platform

- Backstop Solutions

- Canopy

- SESAMm

- Family Office Software Limited

- Atlanta Vision

Competitive Analysis:

The Global Family Office Software Market is characterized by intense competition among established players and emerging technology firms. It includes global vendors such as Addepar, Envestnet | Tamarac, SS&C Technologies (Black Diamond), and Backstop Solutions. These companies focus on expanding digital portfolios through cloud-based, AI-integrated, and compliance-driven platforms. It emphasizes innovation in automation, reporting, and investment analytics to meet complex family wealth needs. Strategic mergers and acquisitions strengthen product ecosystems and global reach. The market shows strong differentiation based on customization, scalability, and data security features. Vendors compete by offering personalized user experiences and enhanced integration with external financial systems.

Recent Developments:

- In 2025, Addepar continued expanding its global footprint with announcements around new offices and increased cross-border client servicing. These developments typically accompany broader platform enhancements and expansions in data integration capabilities to support multi-jurisdictional family offices.

- SS&C Technologies tracked a wave of conversions and deployments where hundreds of advisory firms transitioned to Black Diamond’s wealth-management platform from legacy or competing offerings, highlighting improved portfolio management, reporting, and client engagement features.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for AI-powered analytics will expand across multi-family offices.

- Cloud adoption will remain the preferred deployment model for scalability.

- Integration of blockchain will strengthen transparency and data security.

- Regional customization will increase adoption in Asia-Pacific and the Middle East.

- Wealth management firms will seek end-to-end automation for compliance and reporting.

- Partnerships between fintech companies and private banks will rise.

- The market will shift toward hybrid platforms combining AI and human advisory.

- Focus on ESG and sustainable investing will influence software innovation.

- Data privacy regulations will drive investment in advanced security layers.

- Vendor competition will intensify around modular, client-centric digital platforms.