Market Overview

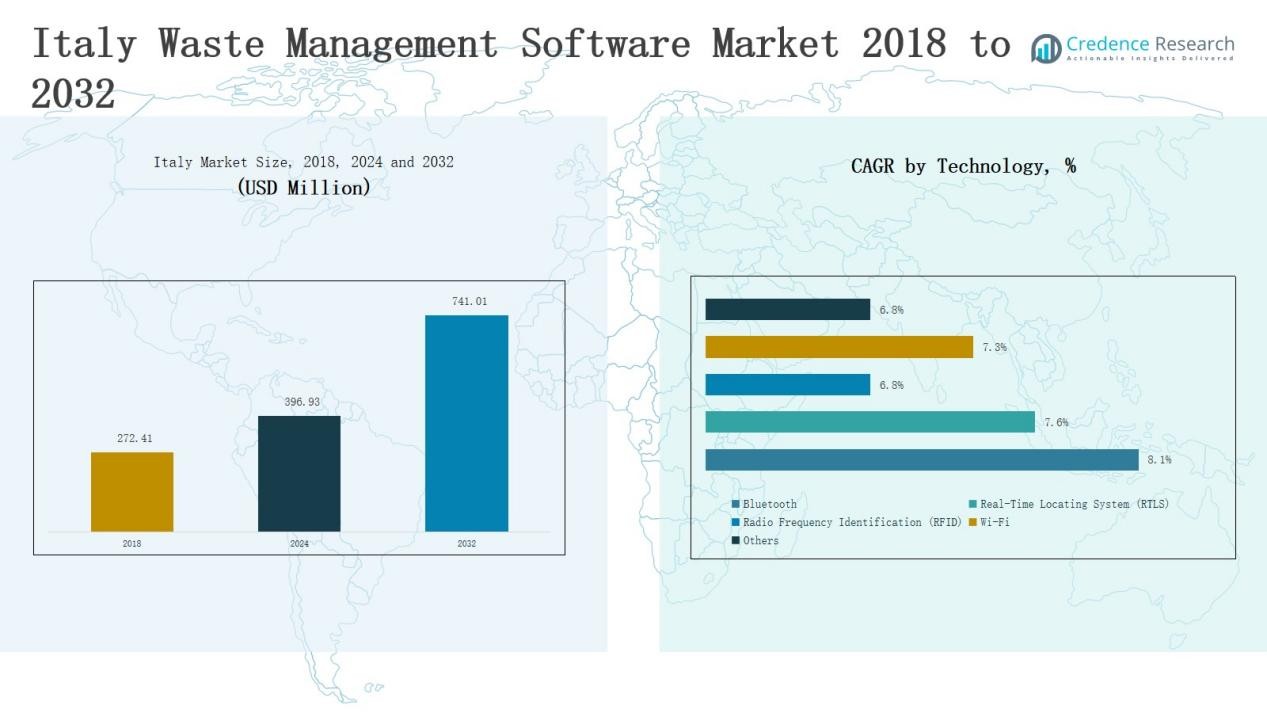

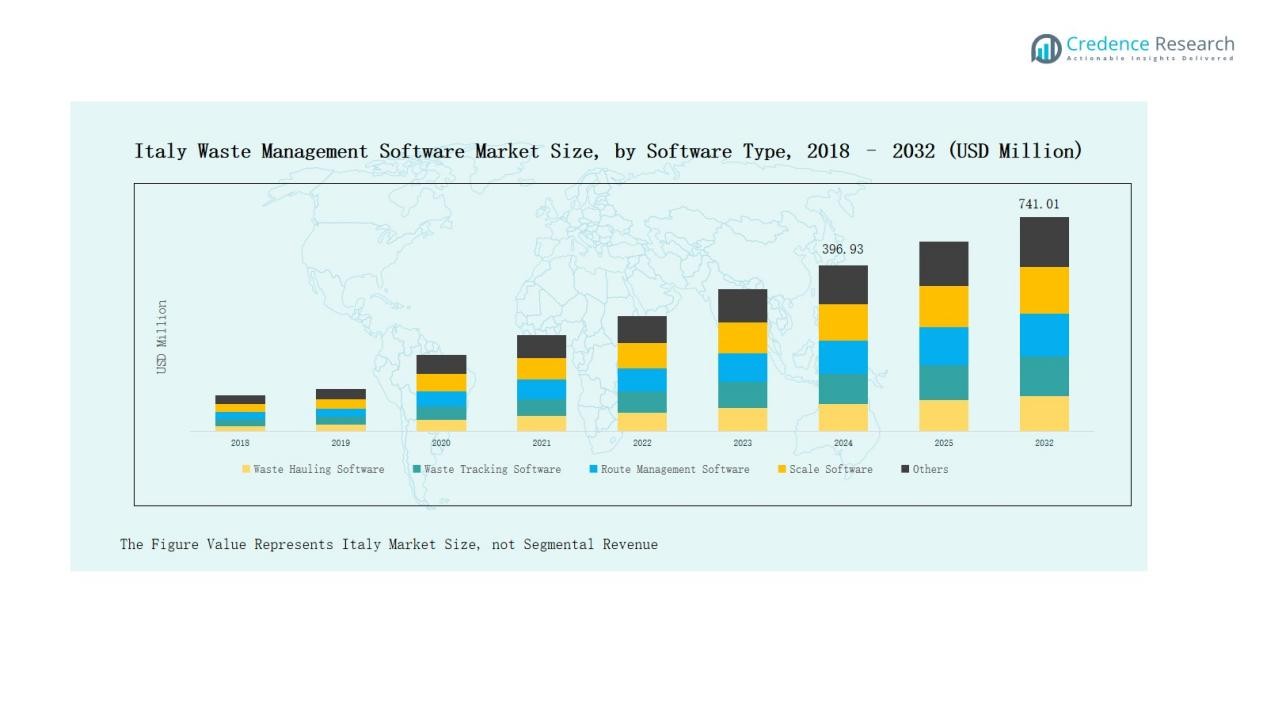

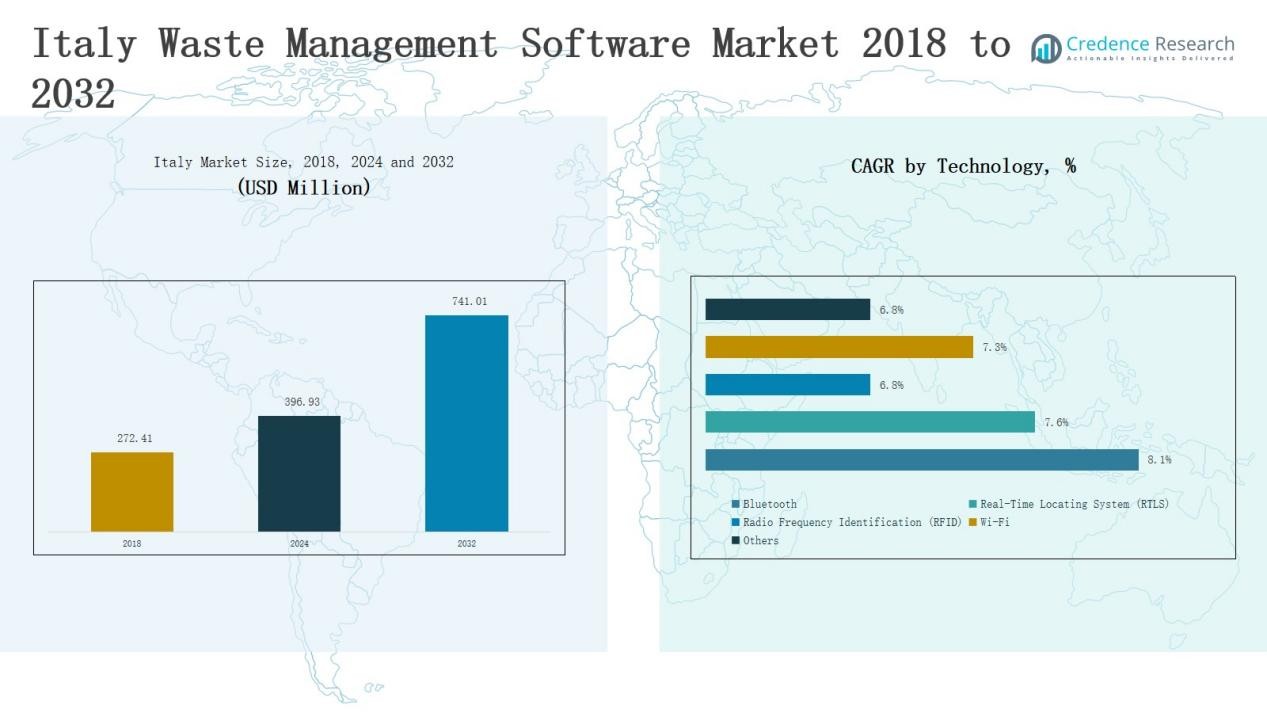

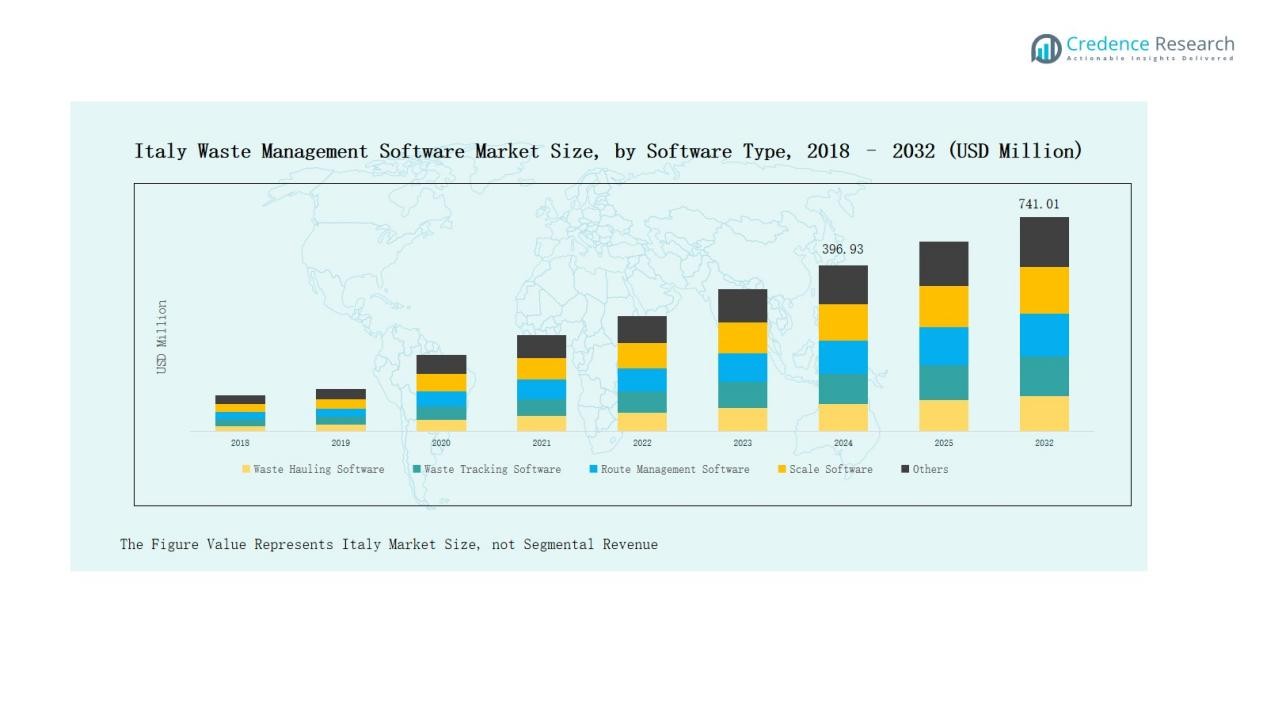

Italy Waste Management Software Market size was valued at USD 272.41 million in 2018 to USD 396.93 million in 2024 and is anticipated to reach USD 741.01 million by 2032, at a CAGR of 8.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Waste Management Software Market Size 2024 |

USD 396.93 Million |

| Italy Waste Management Software Market, CAGR |

8.12% |

| Italy Waste Management Software Market Size 2032 |

USD 741.01 Million |

The Italy Waste Management Software Market features a competitive mix of domestic and international providers addressing diverse municipal and enterprise needs. Key players include EcoFacile, AMCS Group, SEE Forge, TRUX, WAM Software, Sequoia Waste Solutions, DesertMicro, SFS Chemical Safety, and Delta Equipment Systems, Inc. These companies focus on expanding portfolios with modules for waste hauling, tracking, recycling, and compliance, while emphasizing cloud-based integration and IoT-enabled solutions. Strategic partnerships with municipalities and private enterprises strengthen their market presence. Northern Italy emerged as the leading region in 2024, holding 41% share, driven by advanced infrastructure, strong industrial adoption, and smart city initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Italy Waste Management Software Market grew from USD 272.41 million in 2018 to USD 396.93 million in 2024 and is expected to reach USD 741.01 million by 2032.

- Waste hauling software led in 2024 with 27% share, supported by municipal demand for optimized collection and efficiency, while tracking and route management followed closely.

- Municipal applications dominated with 38% share in 2024, as local governments adopted cloud and route optimization tools, supported by retail, manufacturing, and healthcare adoption.

- Cloud-based software held 64% share in 2024, favored for scalability, lower costs, and IoT integration, while on-premise solutions maintained relevance in secure industries.

- Northern Italy commanded 41% share in 2024, driven by industrial strength, advanced infrastructure, and smart city projects, with Central Italy at 33% and Southern Italy at 26%.

Market Segment Insights

By Software Type

The waste hauling software segment led the Italy Waste Management Software Market in 2024, accounting for 27% share. Its dominance is driven by rising municipal needs for optimized collection schedules and reduced operating costs. Waste tracking software and route management software follow closely, supported by demand for real-time monitoring and efficient logistics. Recycling software is gaining traction as Italy strengthens compliance with EU recycling mandates. Maintenance and scale software remain niche but essential for industrial and retail users.

- For instance, Partitalia introduced an IoT-based Smart Waste Management System with PAYT (Pay-As-You-Throw) solutions that use wearable RFID readers and fill-level sensors to help Italian municipalities optimize collection routes and reduce unnecessary pickups, addressing the drive for efficiency and cost reduction.

By Application

The municipal segment represented the largest application area in 2024 with a 38% share. Local governments prioritize cloud-based and route optimization tools to manage urban waste streams effectively. The retail sector is expanding its use of tracking and recycling software, supported by strict packaging disposal laws. Manufacturing industries adopt scale and maintenance software to streamline hazardous waste handling. Healthcare accounts for a growing portion, reflecting regulatory compliance needs for medical waste.

- For instance, Casella Waste Systems deployed its data-driven software to help regional manufacturers optimize hazardous waste handling, tracking container movement, and automating compliance documentation.

By Component

The cloud-based software segment dominated the component category in 2024 with a 64% share. Cloud deployment is preferred due to scalability, lower upfront costs, and integration with IoT-enabled waste tracking systems. Municipal and enterprise users rely on cloud solutions for regulatory reporting and cross-site coordination. On-premise software, holding 36% share, continues to serve clients requiring higher data security and localized control, particularly in healthcare and industrial facilities.

Key Growth Drivers

Rising Municipal Waste Management Demands

The Italy Waste Management Software Market benefits from increasing municipal focus on urban waste handling. With cities generating higher volumes, municipalities require advanced digital tools to improve collection schedules and route planning. Cloud-based hauling and tracking software help reduce operational inefficiencies while ensuring compliance with EU recycling targets. This demand for scalable solutions drives adoption across local authorities, positioning municipalities as the largest application segment in the market.

- For instance, Moovegreen Srl launched a digital platform enabling Italian companies to collect and calculate sustainability KPIs for annual waste management and ESG reporting.

Compliance with EU Environmental Regulations

Strict EU regulations on recycling, emissions, and landfill reduction are fueling adoption of digital waste platforms in Italy. Software that ensures precise reporting, traceability, and compliance minimizes penalties and streamlines audits for enterprises and municipalities. Growing emphasis on circular economy goals further pushes organizations to implement recycling and tracking modules. These compliance-driven needs make regulatory alignment a central growth driver, boosting investment in software that supports sustainability objectives.

- For instance, Enel X expanded its Circular Economy Platform to Italian municipalities, offering real-time dashboards for recycling rates and CO2 savings to meet the European Green Deal requirements.

Shift Toward Cloud-Based Solutions

The cloud-based segment leads with a strong share, supported by Italy’s digital transformation initiatives. Cloud deployment enables scalability, cost efficiency, and integration with IoT-based sensors and tracking systems. Municipal bodies, healthcare providers, and manufacturing companies prefer cloud solutions for real-time monitoring and cross-site coordination. This shift accelerates software adoption, as organizations prioritize flexible platforms over costly on-premise models. Enhanced accessibility and data-driven decision-making capabilities further strengthen demand for cloud-based waste management software.

Key Trends & Opportunities

Integration of IoT and RFID Technology

IoT and RFID integration is transforming waste management by providing real-time tracking and data analytics. Italy’s municipalities and enterprises increasingly adopt sensor-enabled systems to monitor bin levels, optimize collection routes, and reduce emissions. This trend creates opportunities for software vendors to expand their offerings with predictive maintenance, AI-enabled analytics, and smart city waste solutions. The growing adoption of connected infrastructure aligns with Italy’s push for digitalization and sustainability.

- For instance, Partitalia showcased this system at international sustainability events, demonstrating its real-time bin level monitoring and collection scheduling capabilities.

Rising Private Sector Adoption

Private enterprises, especially in retail and manufacturing, are adopting waste management software to enhance efficiency and meet sustainability goals. Companies integrate recycling and compliance modules to manage packaging, industrial, and hazardous waste. The adoption trend opens opportunities for vendors to deliver sector-specific solutions tailored to diverse requirements. As corporate ESG commitments rise, software that provides transparent reporting and cost savings is expected to gain traction in Italy’s private sector.

- For instance, Ferrero Group partnered with SAP’s Responsible Design and Production software to manage packaging compliance data, enabling the company to track material use and support Italy’s recycling targets.

Key Challenges

High Implementation and Integration Costs

Despite benefits, the Italy Waste Management Software Market faces barriers from high implementation costs. Small and medium enterprises often struggle with initial deployment expenses, integration challenges, and staff training requirements. Limited budgets can restrict adoption, especially in regions where digital infrastructure remains underdeveloped. This cost factor slows widespread uptake and favors larger organizations with stronger financial capacity.

Data Security and Privacy Concerns

Cloud-based software dominance raises concerns over data security and compliance with privacy regulations. Municipalities and healthcare providers handle sensitive operational and medical waste data, making cybersecurity risks a critical barrier. Fear of breaches or non-compliance with data protection laws discourages some organizations from transitioning to cloud platforms. Ensuring robust security frameworks remains essential to overcoming adoption hesitations.

Resistance to Digital Transformation

Cultural and organizational resistance to digital transformation challenges the adoption of advanced waste management software in Italy. Many traditional waste handling operators rely on manual processes and hesitate to invest in digital tools. Lack of digital literacy among staff and uncertainty about long-term ROI add to reluctance. This resistance hampers full-scale adoption, particularly among smaller municipalities and private operators.

Regional Analysis

Northern Italy

Northern Italy accounted for 41% share of the Italy Waste Management Software Market in 2024, supported by advanced industrial and municipal infrastructure. The region shows strong adoption of cloud-based and route optimization platforms, driven by dense urban populations in Milan, Turin, and Bologna. Enterprises in manufacturing and retail sectors implement recycling and compliance modules to align with EU environmental directives. Local governments invest heavily in smart city projects that integrate IoT-enabled waste monitoring. It benefits from significant municipal budgets and partnerships with technology vendors. Growth in this region remains driven by industrial expansion and regulatory enforcement.

Central Italy

Central Italy represented 33% share of the Italy Waste Management Software Market in 2024. Rome and Florence lead adoption due to growing municipal waste management needs in densely populated areas. Municipalities deploy tracking and recycling software to improve collection efficiency and reduce landfill dependency. Retail and healthcare industries contribute to demand, using compliance modules to meet waste reporting standards. It attracts investments in cloud-based platforms that support scalable, cost-efficient operations. Public-private collaboration strengthens market growth, creating steady opportunities for vendors. This region’s position reflects the balance of urbanization and sustainability policies.

Southern Italy

Southern Italy held 26% share of the Italy Waste Management Software Market in 2024, with growth influenced by ongoing infrastructure upgrades. Cities such as Naples and Bari focus on adopting waste hauling and tracking software to modernize municipal operations. Local governments emphasize recycling initiatives to meet EU environmental goals, though adoption rates lag behind the North and Central regions. It faces challenges of budget constraints and limited digital literacy, especially in smaller municipalities. Vendors find opportunities through cloud-based solutions that require lower upfront investment. Despite challenges, demand continues to rise due to regulatory pressure and urban expansion.

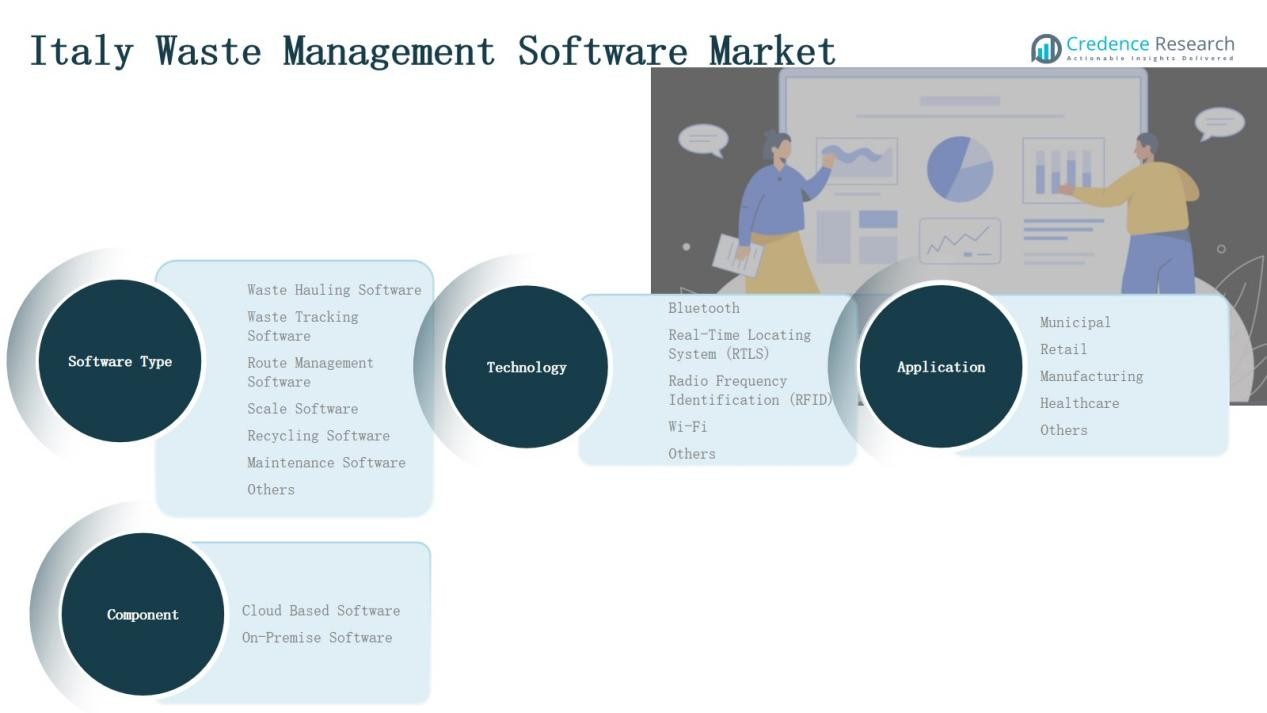

Market Segmentations:

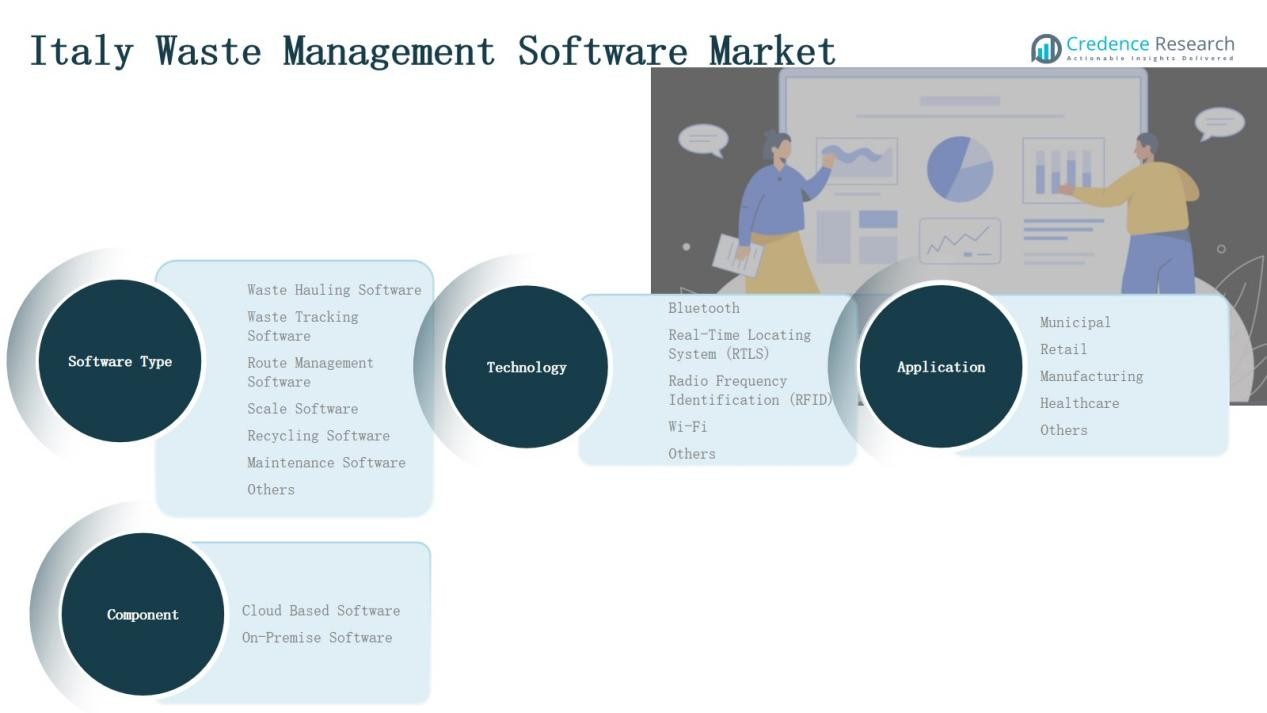

By Software Type:

- Waste Hauling Software

- Waste Tracking Software

- Route Management Software

- Scale Software

- Recycling Software

- Maintenance Software

- Others

By Application:

- Municipal

- Retail

- Manufacturing

- Healthcare

- Others

By Component:

- Cloud-Based Software

- On-Premise Software

By Technology:

- Bluetooth

- Real-Time Locating System (RTLS)

- Radio Frequency Identification (RFID)

- Wi-Fi

- Others

By Region

- Northern Italy

- Central Italy

- Southern Italy

Competitive Landscape

The Italy Waste Management Software Market is characterized by strong competition among domestic vendors and international solution providers. Companies such as EcoFacile, AMCS Group, SEE Forge, TRUX, and WAM Software play a significant role in addressing diverse municipal and enterprise needs. Vendors focus on expanding product portfolios with modules for waste hauling, tracking, and recycling to support compliance with EU environmental regulations. Cloud-based solutions dominate strategies, with providers emphasizing integration of IoT, RFID, and real-time analytics to improve efficiency and sustainability. Strategic partnerships with municipalities and private enterprises strengthen market presence, while mergers and product launches enhance competitive positioning. It remains fragmented, with leading players targeting niche applications such as healthcare and manufacturing, while emerging firms focus on low-cost and scalable cloud platforms. Continuous innovation, compliance alignment, and sustainability-focused offerings define the competitive dynamics, ensuring steady growth opportunities across Italy’s waste management software ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- EcoFacile

- AMCS Group

- SEE Forge

- TRUX

- WAM Software, Inc.

- Sequoia Waste Solutions

- DesertMicro

- SFS Chemical Safety

- Delta Equipment Systems, Inc.

Recent Developments

- In November 2024, TEIMAS launched its cloud-based waste management SaaS platform Zeroin Italy. The platform enables large companies to centralize waste data, automate MUD and FIR submissions, integrate with RENTRI, and streamline ESG and ISO 14001 reporting.

- In April 2025, Envac in partnership with Gruppo SAVE introduced a pneumatic waste collection systemat Venice Marco Polo Airport. The €2.1 million project uses underground pipes to transport separated waste streams to sealed containers, enhancing efficiency and supporting circular economy practices.

- In October 2024, Tomra Systems ASAacquired C-trace GmbH, a German provider of digital waste management solutions, to broaden its sustainability-focused digital portfolio.

- In November 2024, TEIMASlaunched its Zeroplatform in Italy, offering cloud-based waste management tools that automate compliance tasks, integrate with RENTRI, and support ESG reporting.

Report Coverage

The research report offers an in-depth analysis based on Software Type, Component, Application, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Municipalities will increase adoption of digital platforms to manage rising urban waste volumes.

- Cloud-based deployment will strengthen further, driven by scalability and cost efficiency.

- IoT and RFID integration will expand real-time tracking and predictive analytics capabilities.

- Private enterprises in retail and manufacturing will drive demand for compliance-focused solutions.

- Healthcare facilities will adopt specialized modules for safe and traceable medical waste disposal.

- Vendors will focus on sector-specific customization to gain competitive advantage.

- Public-private partnerships will accelerate smart city waste management initiatives.

- Data security and privacy solutions will become critical for cloud-based adoption.

- Recycling software demand will grow with stricter EU circular economy policies.

- Regional disparities will narrow as Southern Italy improves digital infrastructure and adoption rates.