Market Overview

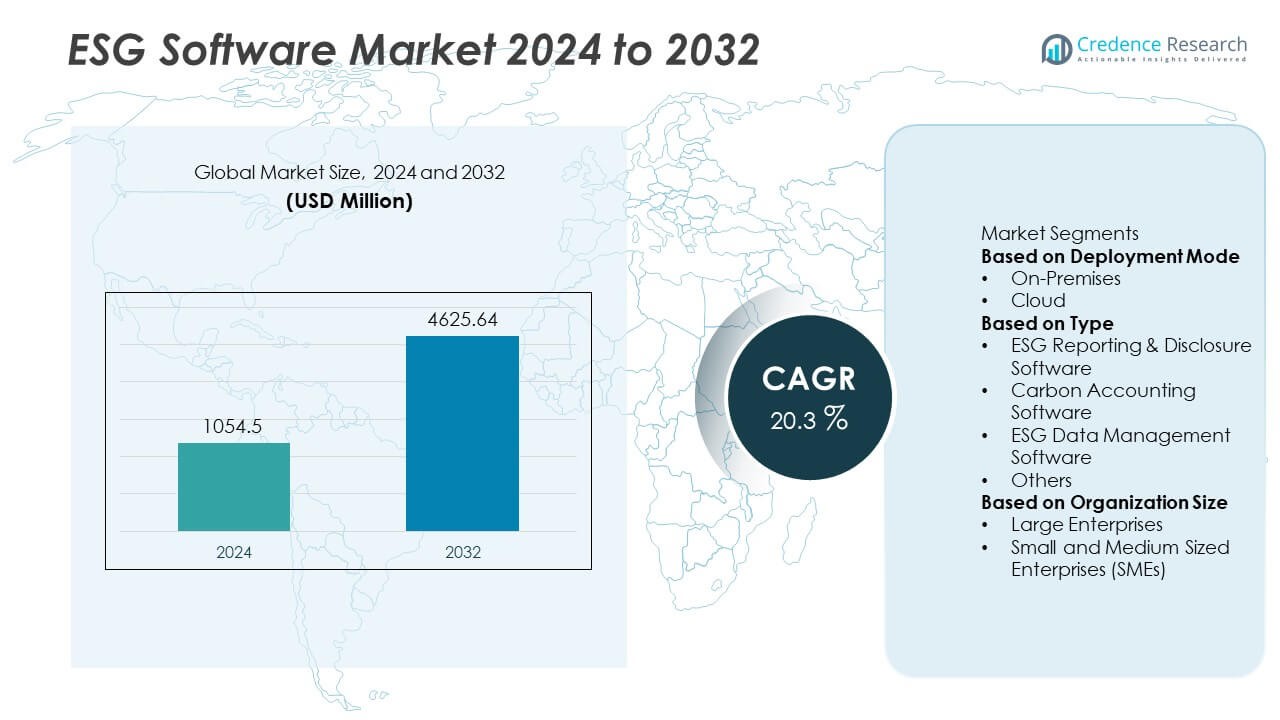

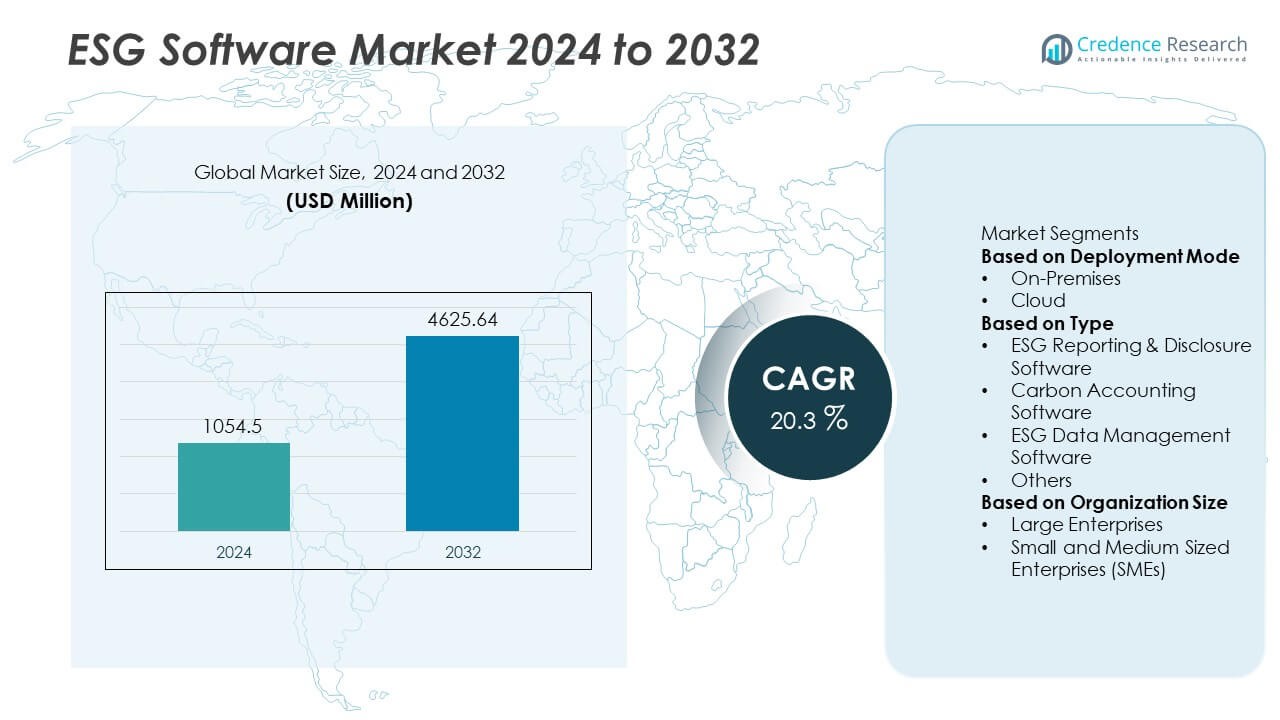

The ESG Software market size was valued at USD 1,054.5 million in 2024 and is projected to reach USD 4,625.64 million by 2032, growing at a CAGR of 20.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ESG Software Market Size 2024 |

USD 1,054.5 Million |

| ESG Software Market, CAGR |

20.3% |

| ESG Software Market Size 2032 |

USD 4,625.64 Million |

The ESG software market is led by prominent players including LogicManager Inc., Enablon SA, Novisto Inc., ESG Enterprise Inc., Intelex Technologies Inc., Nasdaq Inc., IsoMetrix Software (Pty) Ltd, Envizi Pty Ltd, Diligent Corporation, and Benchmark Gensuite Inc. These companies drive innovation through AI-enabled reporting, cloud deployment, and integrated sustainability solutions to meet evolving disclosure and compliance demands. North America emerged as the leading region in 2024, holding 38% of the total market share, supported by strong regulatory frameworks and early technology adoption. Europe followed closely with 32% share, driven by the EU’s stringent ESG disclosure mandates. Asia-Pacific accounted for 20% share, reflecting rapid adoption fueled by regulatory alignment and investor expectations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The ESG software market was valued at USD 1,054.5 million in 2024 and is projected to reach USD 4,625.64 million by 2032, expanding at a CAGR of 20.3% during the forecast period.

- Rising regulatory mandates such as EU CSRD and SEC climate disclosure rules are fueling demand for ESG reporting and carbon accounting platforms, with large enterprises driving over 70% of adoption.

- AI-driven automation, cloud-based deployment capturing 65% share, and expansion into supply chain sustainability represent the key trends shaping future opportunities in the market.

- Leading players including LogicManager Inc., Enablon SA, Novisto Inc., and Nasdaq Inc. are focusing on partnerships, acquisitions, and product enhancements to strengthen their global presence amid increasing competition.

- North America leads with 38% share, followed by Europe at 32% and Asia-Pacific at 20%, while ESG reporting software dominates by type with 40% market share in 2024.

Market Segmentation Analysis:

By Deployment Mode

The cloud-based deployment segment dominated the ESG software market in 2024, accounting for nearly 65% of total share. Its growth is driven by scalability, cost efficiency, and ease of integration with enterprise systems. Companies increasingly prefer cloud platforms to support real-time ESG data reporting and global accessibility, aligning with regulatory requirements and sustainability disclosures. On-premises solutions, holding the remaining share, remain relevant in organizations with strict data security mandates. However, the flexibility and faster implementation cycles of cloud-based ESG solutions reinforce its leading position across industries.

- For instance, Envizi, integrated within IBM’s cloud ecosystem, supports sustainability reporting for a range of companies, including Digital Realty, across their global facilities. Envizi is also used by other major companies like Microsoft, Cigna, and Unilever, with IBM having acquired the software in 2022.

By Type

ESG reporting and disclosure software emerged as the leading type in 2024, representing around 40% of the market share. The dominance reflects rising global regulations, such as EU CSRD and SEC climate disclosure rules, which mandate transparent ESG reporting. Companies are investing in advanced reporting platforms to manage compliance, improve investor relations, and enhance stakeholder trust. Carbon accounting software and ESG data management tools also gained momentum due to climate goals and pressure to monitor supply chain impacts. Still, reporting and disclosure solutions remain the most widely adopted, driving compliance-led growth.

- For instance, Novisto’s ESG reporting platform manages disclosures for global enterprises, processing large amounts of structured and unstructured data to help clients align with CSRD and ISSB standards.

By Organization Size

Large enterprises held the dominant share of over 70% of the ESG software market in 2024. Their leadership comes from stronger regulatory exposure, broader sustainability commitments, and higher budgets to adopt advanced ESG platforms. These organizations prioritize robust ESG frameworks to address investor expectations and achieve net-zero goals. Small and medium-sized enterprises (SMEs), while holding a smaller share, are steadily adopting ESG tools to enhance competitiveness and meet supply chain requirements set by larger corporations. Growing demand for affordable, user-friendly platforms supports SME adoption, though large enterprises continue to drive the bulk of market revenues.

Key Growth Drivers

Regulatory Compliance and Disclosure Mandates

Global regulatory frameworks are the primary driver of ESG software adoption. Rules such as the EU Corporate Sustainability Reporting Directive (CSRD) and proposed SEC climate disclosure mandates require organizations to track, measure, and publish ESG performance. This increasing regulatory scrutiny compels enterprises to adopt software solutions for structured reporting, audit-ready documentation, and compliance alignment. The pressure to demonstrate transparency and accountability strengthens demand for ESG platforms that streamline data collection, verification, and disclosure across diverse operational and supply chain environments.

- For instance, Enablon supports hundreds of leading enterprises with ESG compliance tools for reporting, aligning with frameworks like CSRD and SASB. Novisto processes ESG disclosures for numerous enterprises, ensuring compliance with standards from the IFRS Foundation and EU directives, including CSRD.

Rising Investor and Stakeholder Demand

Growing emphasis from investors and stakeholders on ESG performance significantly drives software adoption. Asset managers, rating agencies, and institutional investors rely on ESG data to assess company resilience and long-term value creation. Companies are leveraging ESG platforms to improve ratings, attract green capital, and strengthen reputational standing. Transparent disclosure enabled by advanced ESG software enhances credibility and trust. As investor focus on ESG-linked financial performance intensifies, businesses increasingly adopt reporting and management platforms to meet expectations and ensure continuous access to sustainable funding sources.

- For instance, Diligent provides ESG and governance tools to more than 750,000 board members and executives worldwide, ensuring transparency for investors across 25,000 organizations.

Corporate Sustainability and Net-Zero Goals

Commitments toward sustainability and net-zero targets are fueling ESG software demand. Large enterprises and multinational corporations set ambitious goals for reducing emissions, improving social responsibility, and ensuring governance excellence. ESG platforms help organizations measure progress against science-based targets, manage energy usage, and assess supplier sustainability performance. By integrating ESG metrics into corporate strategy, companies gain actionable insights to achieve long-term sustainability goals. The need to demonstrate tangible progress toward net-zero and broader ESG commitments further accelerates adoption of software-driven ESG management frameworks.

Key Trends & Opportunities

Integration of AI and Automation

AI-driven analytics and automation are reshaping the ESG software landscape. Platforms increasingly integrate machine learning for predictive insights, anomaly detection, and automated reporting. This trend reduces manual errors, enhances efficiency, and supports real-time ESG tracking. Automated solutions also enable companies to map supplier risks and track carbon footprints at scale. The rising adoption of AI in ESG platforms represents a strong opportunity for vendors to differentiate their solutions, offering advanced analytics and strategic decision support to businesses navigating complex sustainability landscapes.

- For instance, LogicManager applies machine learning across datasets, enhancing automated risk identification and predictive compliance monitoring.

Expansion of ESG in Supply Chain Management

Supply chain sustainability is emerging as a critical opportunity area for ESG software. Companies face growing pressure to monitor supplier practices, carbon intensity, and labor conditions. ESG platforms now include tools for mapping risks, assessing compliance, and managing supplier disclosures. This expansion aligns with regulatory and stakeholder expectations that extend beyond company boundaries. Vendors offering supply chain-focused ESG solutions can capture strong growth, as businesses prioritize full value chain accountability. This shift creates new opportunities in sectors like manufacturing, retail, and logistics.

- For instance, Benchmark Gensuite manages ESG and supply chain sustainability reporting for over 1.5 million users, covering 400 enterprises across manufacturing and logistics.

Key Challenges

Data Fragmentation and Standardization Issues

A major challenge in the ESG software market is fragmented and inconsistent data. Companies struggle to align ESG reporting with multiple frameworks such as GRI, SASB, and TCFD, leading to duplication and inefficiencies. Variations in regional regulations further complicate reporting. Inconsistent supplier disclosures and limited access to reliable ESG data add complexity. Vendors must develop solutions that streamline data collection, enable cross-framework reporting, and enhance comparability. Overcoming these issues is critical for ensuring credible ESG insights and achieving scalable adoption across industries.

High Implementation Costs and SME Barriers

The high cost of ESG software adoption creates barriers, especially for small and medium-sized enterprises. Comprehensive platforms require investment in licenses, integration, training, and maintenance, which often exceed SME budgets. While large enterprises can absorb these costs, smaller firms struggle to justify spending amid competing priorities. The lack of tailored, cost-effective solutions restricts SME adoption and slows overall market penetration. Vendors need to address this challenge by offering modular, scalable platforms or subscription-based pricing to make ESG solutions more accessible.

Regional Analysis

North America

North America held the largest share of the ESG software market in 2024, accounting for 38% of total revenue. The region’s dominance is driven by strong regulatory frameworks, including SEC climate disclosure proposals, and significant adoption by large enterprises. U.S.-based corporations are investing heavily in ESG reporting platforms to align with investor demands and sustainability goals. Canada also contributes to growth, particularly with its carbon accounting initiatives and renewable energy transition policies. High penetration of cloud-based ESG solutions and advanced technology infrastructure ensure North America remains a leading market throughout the forecast period.

Europe

Europe accounted for 32% of the ESG software market share in 2024, making it the second-largest region. The European Union leads ESG adoption with binding frameworks such as the Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy. These policies mandate detailed ESG disclosures, accelerating adoption across industries. Companies in Germany, France, and the Nordics actively integrate ESG platforms to strengthen compliance, investor relations, and net-zero commitments. The region’s focus on carbon neutrality, supply chain sustainability, and social governance accountability further drives demand. Europe’s mature sustainability ecosystem positions it as a key growth hub for ESG solutions.

Asia-Pacific

Asia-Pacific captured 20% of the ESG software market share in 2024, supported by rapid digital transformation and rising sustainability initiatives. Countries such as Japan, Australia, and China are adopting ESG frameworks to align with global reporting standards. Large enterprises in the region increasingly use ESG platforms to attract foreign investments and strengthen global competitiveness. Regulatory momentum, such as Japan’s corporate governance codes and China’s carbon neutrality pledges, further accelerates adoption. SMEs are also showing growing interest, supported by affordable, cloud-based platforms. Asia-Pacific is projected to be the fastest-growing regional market, driven by regulatory and investor pressures.

Latin America

Latin America represented 6% of the ESG software market share in 2024, with adoption concentrated in Brazil, Mexico, and Chile. Growing regulatory pressure, rising ESG-linked financing, and sustainability initiatives in extractive industries are key drivers. Multinational corporations in the region demand ESG platforms to meet global supply chain and investor requirements. Brazil is advancing climate reporting frameworks, while Mexico and Chile are enhancing corporate governance standards. Limited digital infrastructure in smaller economies poses challenges, yet increased adoption of cloud-based solutions provides opportunities. Regional growth is strongly tied to sustainability in mining, energy, and agriculture sectors.

Middle East & Africa

The Middle East & Africa accounted for 4% of the ESG software market share in 2024, emerging as a developing but strategic region. ESG adoption is accelerating in Gulf Cooperation Council (GCC) countries, driven by diversification agendas and net-zero commitments, particularly in the UAE and Saudi Arabia. South Africa leads in ESG integration within Africa, with growing demand from the mining and energy industries. The region faces challenges in regulatory standardization and data availability, yet rising investor pressure and the need for transparency are driving uptake. Cloud-based ESG platforms are gaining traction as cost-efficient solutions in this market.

Market Segmentations:

By Deployment Mode

By Type

- ESG Reporting & Disclosure Software

- Carbon Accounting Software

- ESG Data Management Software

- Others

By Organization Size

- Large Enterprises

- Small and Medium Sized Enterprises (SMEs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ESG software market is characterized by the presence of leading players such as LogicManager Inc., Enablon SA, Novisto Inc., ESG Enterprise Inc., Intelex Technologies Inc., Nasdaq Inc., IsoMetrix Software (Pty) Ltd, Envizi Pty Ltd, Diligent Corporation, and Benchmark Gensuite Inc. These companies focus on offering advanced ESG reporting, disclosure, and data management solutions to meet the rising demand for compliance, transparency, and sustainability performance. Strategic initiatives such as partnerships, acquisitions, and product innovations remain central to strengthening market positions. Vendors are increasingly integrating AI, automation, and cloud-based models to enhance real-time data analysis and improve user experience. The push for alignment with global frameworks like CSRD, TCFD, and SASB is further driving innovation and competitiveness. Growing demand from both large enterprises and SMEs encourages players to develop scalable, cost-effective platforms, ensuring their relevance in an evolving regulatory and sustainability-driven landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Egnyte / IBM Envizi (via Envizi, now part of IBM) is cited in ESG software comparisons as powering its Sustainability Reporting Manager with support for multiple frameworks (CDP, GRI, IFRS, SASB).

- In 2025, Novisto partnered with Broadridge Financial Solutions to roll out an integrated ESG data management and reporting platform to 500 pilot firms initially.

- In 2025, Novisto said it had nearly tripled its revenue since its Series B round, showing rapid growth in its ESG software adoption.

Report Coverage

The research report offers an in-depth analysis based on Deployment Mode, Type, Organization Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ESG software market will continue to expand rapidly driven by stricter global disclosure regulations.

- Companies will adopt advanced ESG tools to strengthen transparency and investor trust.

- Cloud deployment will remain dominant as enterprises prefer scalability and real-time accessibility.

- AI and automation will enhance predictive insights and streamline reporting processes.

- Supply chain sustainability integration will emerge as a major growth driver.

- Large enterprises will sustain leadership, while SME adoption will grow through affordable platforms.

- Vendors will focus on aligning solutions with evolving global frameworks like CSRD and TCFD.

- Partnerships and acquisitions will intensify as players expand geographic reach and capabilities.

- Europe and North America will remain core markets, while Asia-Pacific records fastest growth.

- Demand for standardized, comparable ESG data will shape innovation and product development strategies.