Market Overview:

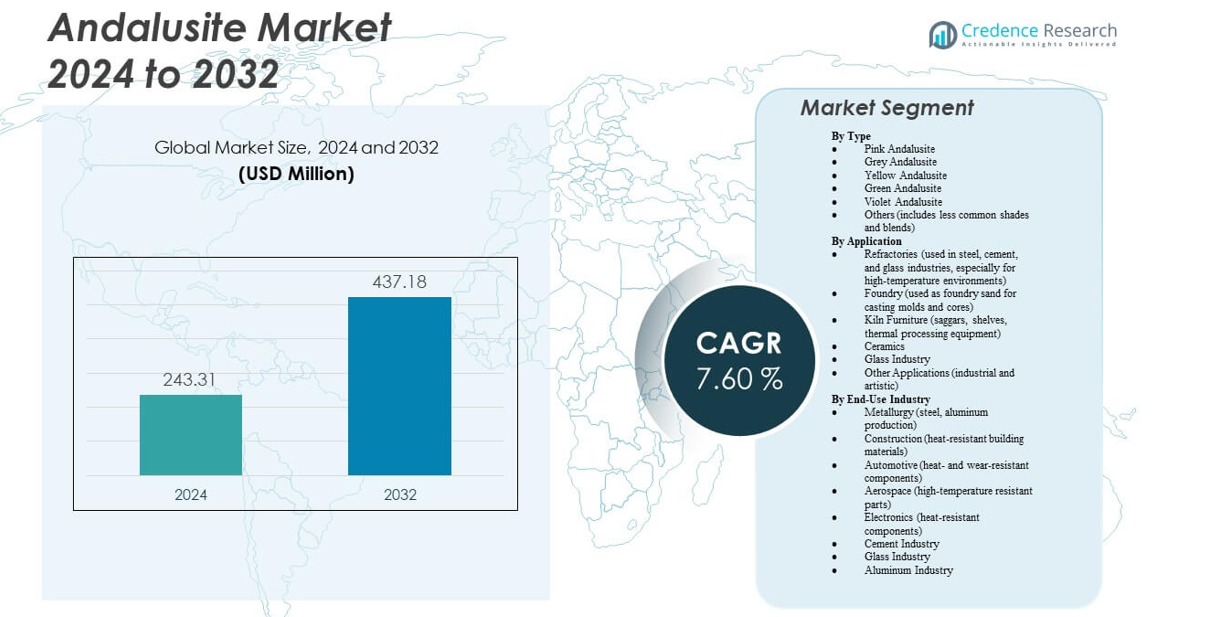

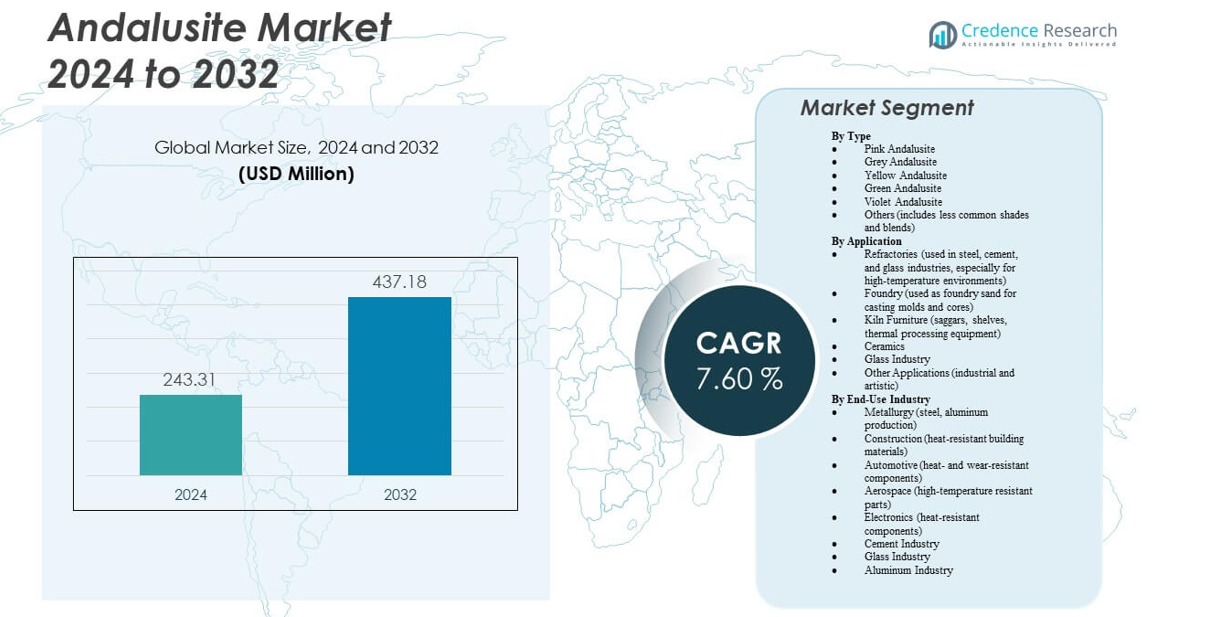

The Andalusite Market is projected to grow from USD 243.31 million in 2024 to an estimated USD 437.18 million by 2032, with a compound annual growth rate (CAGR) of 7.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Andalusite Market Size 2024 |

USD 243.31 Million |

| Andalusite Market, CAGR |

7.6% |

| Andalusite Market Size 2032 |

USD 437.18 Million |

The market growth is driven by strong demand from steel, cement, and glass industries that rely on andalusite for high-performance refractory materials. Its superior thermal stability, chemical resistance, and energy efficiency make it vital for high-temperature applications. Expanding infrastructure projects and industrialization in emerging economies continue to stimulate consumption. Increasing environmental awareness also supports the shift toward sustainable and long-lasting refractory products.

Asia-Pacific leads the global market due to its extensive industrial base and abundant mineral resources, especially in China and India. Europe follows with strong demand from metallurgical and glass manufacturing sectors emphasizing sustainability and advanced refractories. North America shows steady growth with modernization of production facilities, while Latin America and Africa are emerging markets with rising investments in mining and industrial infrastructure.

Market Insights:

- The Andalusite Market is valued at USD 243.31 million in 2024 and is projected to reach USD 437.18 million by 2032, growing at a CAGR of 7.6%.

- Demand is rising due to its critical use in refractories across steel, glass, and cement industries.

- Superior thermal stability and chemical resistance make andalusite a preferred material for high-temperature processes.

- Industrial expansion and infrastructure development in emerging economies continue to boost global consumption.

- Environmental initiatives promote the use of energy-efficient and durable refractory materials.

- Asia-Pacific dominates the market due to strong manufacturing and mineral availability in China and India.

- Europe and North America maintain steady growth, while Latin America and Africa are gaining traction through industrial investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Refractory Applications Across the Steel and Metallurgy Sector

The steel and metallurgy industries represent the major consumers of andalusite due to its exceptional refractoriness and resistance to thermal shock. These properties make it ideal for use in high-temperature environments such as furnaces, kilns, and foundries. The growing global steel production directly drives the consumption of andalusite-based refractories. It offers extended service life and reduced maintenance costs, making it a preferred choice for industrial users. Infrastructure growth and urbanization continue to create a strong need for steel, sustaining demand for andalusite. The Andalusite Market benefits from the increasing focus on durable and energy-efficient refractory materials. Manufacturers invest in advanced processing technologies to enhance the purity and performance of andalusite products. The industry outlook remains positive with rising investments in industrial and metallurgical expansion projects.

- For example, Imerys, a global leader in industrial minerals, operates its Thabazimbi and Apiesdoring andalusite mines in South Africa with a combined annual andalusite production of approximately 100,000 tons, supplying the steel and metallurgy sectors worldwide.

Expanding Use in Ceramic and Glass Manufacturing for High-Performance Materials

Ceramic and glass industries increasingly rely on andalusite due to its ability to withstand extreme heat and retain structural integrity. The mineral enhances product strength and minimizes deformation during high-temperature processing. It supports the manufacturing of sanitaryware, tiles, and glass molds with superior quality and durability. The rise in household construction and remodeling activities strengthens the demand for ceramic-based materials. The Andalusite Market gains traction from the use of high-performance ceramics in advanced engineering applications. Industrial ceramics are becoming critical components in automotive, aerospace, and electronic sectors. The shift toward energy-efficient kilns and sustainable raw materials encourages wider adoption. It continues to drive technological integration for product uniformity and quality improvement.

Infrastructure Growth in Emerging Economies Fueling Industrial Consumption

Developing economies across Asia-Pacific, Africa, and Latin America are witnessing rapid industrial and infrastructure development. Growing demand for refractories and ceramics from construction and manufacturing sectors strengthens andalusite utilization. Governments are investing heavily in industrial projects and public infrastructure to support economic expansion. The Andalusite Market experiences growth supported by industrialization and foreign investments in refractory production plants. It benefits from domestic availability of raw materials and competitive production costs. Urbanization trends in emerging countries create higher demand for steel, glass, and cement, boosting refractory consumption. The material’s high resistance to chemical corrosion provides long-term performance advantages in industrial operations. Energy efficiency standards are also encouraging industries to adopt advanced refractory materials to reduce energy losses.

Increasing Focus on Energy Efficiency and Environmental Sustainability in Industrial Processes

Industries are emphasizing sustainable production and energy-efficient solutions to meet environmental regulations. Andalusite contributes to these goals due to its low thermal conductivity and stability under extreme temperatures. It minimizes energy waste and extends equipment life in furnaces and kilns. The Andalusite Market gains momentum from industries shifting toward eco-friendly refractory solutions. Refractory producers are investing in low-emission processing techniques and recycling technologies. It plays a critical role in helping manufacturers comply with sustainability goals and emission targets. The rising need for materials with longer operational life and reduced carbon footprint enhances demand. Environmental awareness and regulatory frameworks push industries toward mineral-based refractories offering high efficiency.

- For example, Calderys, a leading European refractory company, plays a key role in the EU-funded HEATERNAL project aimed at developing thermal energy storage solutions for industrial decarbonization. The company collaborates with CEA and the University of Ghent to test advanced refractory materials designed for durability and energy efficiency under the EU Green Deal framework.

Market Trends

Shift Toward Synthetic and High-Purity Andalusite Grades for Improved Performance

Manufacturers are investing in synthetic and high-purity andalusite grades to improve performance consistency and reduce impurities. These products offer greater control over thermal expansion and chemical composition. The Andalusite Market benefits from advancements in mineral purification and processing technologies. High-purity grades enhance refractory durability and lower replacement frequency in steel and glass furnaces. The focus is on achieving predictable performance under fluctuating temperature and pressure conditions. Synthetic andalusite also supports uniformity in ceramic applications, ensuring consistent strength. It helps manufacturers meet stringent quality standards in critical industrial processes. This trend is reshaping the competitive landscape through innovation and product differentiation.

- For example, Imerys Refractory Minerals operates major andalusite mining and processing sites in South Africa and France, supplying high-purity grades used in refractory applications for the steel, glass, and cement industries. The company continues to focus on improving mineral quality and sustainability within its global refractory operations.

Integration of Automation and Smart Manufacturing in Andalusite Production

Automation and digitalization are transforming andalusite mining and processing operations. Advanced monitoring systems ensure better control over particle size distribution and chemical uniformity. The Andalusite Market is influenced by the use of AI and robotics to enhance production efficiency. Automated sorting and crushing systems reduce material waste and improve yield. Smart manufacturing enables real-time tracking of quality parameters across production lines. It helps producers maintain uniform quality, improve resource efficiency, and lower operational costs. Automation reduces dependency on manual labor and ensures safety in high-temperature environments. These technological advancements create a competitive edge for companies optimizing production performance.

Growing Adoption in Non-Metallic Industrial Sectors Beyond Refractories

The market is witnessing a growing shift toward non-metallic industrial uses such as ceramics, abrasives, and kiln furniture. The Andalusite Market benefits from expanding applications in non-refractory industries seeking heat-resistant materials. High thermal stability makes it suitable for advanced ceramics used in electronic and automotive components. Its role in insulation materials and composite manufacturing is also gaining recognition. Manufacturers are exploring new blends combining andalusite with alumina and mullite for high-strength composites. It supports industries demanding lightweight, durable, and high-temperature-resistant materials. The diversification of applications reduces dependency on steel and metallurgy segments. This trend strengthens long-term stability across the industrial minerals market.

- For example, in October 2023, RHI Magnesita completed the acquisition of P-D Refractories Group, strengthening its European production network and expanding its portfolio of advanced refractory materials, including andalusite-based bricks. The deal reinforced RHI Magnesita’s market position in industrial and process industries across Europe.

Sustainability and Circular Economy Practices Shaping Industry Transformation

Global industries are adopting circular economy models emphasizing waste reduction and material recycling. The Andalusite Market aligns with this shift through sustainable mining and resource-efficient processing. Companies are focusing on water conservation, energy management, and emission control during extraction. Refractory manufacturers are recycling spent materials to recover valuable minerals. It helps reduce reliance on virgin resources and lower environmental footprints. Eco-friendly production practices improve brand perception and compliance with global sustainability standards. The trend reflects rising customer preference for responsibly sourced and processed minerals. Sustainability now drives innovation, encouraging the development of closed-loop production systems.

Market Challenges Analysis

Fluctuating Raw Material Prices and Limited Mining Reserves Affecting Production Stability

The market faces challenges from volatile raw material costs and constrained supply chains. Andalusite mining depends on specific geological formations concentrated in a few countries. The Andalusite Market is vulnerable to disruptions caused by regulatory restrictions, labor shortages, and logistical barriers. Price fluctuations impact the profitability of refractory producers and downstream industries. It pressures companies to adopt cost-optimization strategies and diversify supply sources. Environmental regulations further restrict exploration, limiting access to high-grade deposits. The limited number of mining sites increases production risk and raises transportation costs. Maintaining supply stability remains critical for ensuring long-term industry resilience and competitiveness.

Technological and Environmental Barriers in Scaling Sustainable Production

Producers encounter obstacles in scaling up sustainable mining and processing technologies. The energy-intensive nature of extraction raises environmental and operational costs. The Andalusite Market faces pressure to adopt cleaner technologies while maintaining economic efficiency. It is challenging to balance performance standards with environmental compliance requirements. Waste management and water recycling practices need further innovation to achieve full sustainability. The lack of standardized frameworks for environmental performance adds complexity to compliance efforts. Capital investment requirements for modern processing facilities are also high. These factors limit the speed of transition toward greener and more efficient production systems.

Market Opportunities

Expanding Demand for Advanced Ceramics and High-Temperature Industrial Applications

Growing industries such as aerospace, automotive, and energy are creating new growth avenues. The Andalusite Market benefits from its role in producing advanced ceramics and high-performance components. It supports applications requiring resistance to extreme heat, corrosion, and pressure variations. The material’s versatility enables its integration into precision-engineered products and technical ceramics. Rapid development of renewable energy plants also increases demand for heat-resistant linings. It provides opportunities for suppliers to develop customized mineral grades for specialized applications. Collaboration between mining companies and end-users encourages innovation and product optimization. These advancements strengthen the global reach and industrial relevance of andalusite-based solutions.

Strategic Investments and Technological Innovation Supporting Long-Term Growth

Investments in mining expansion and processing innovation are shaping new opportunities. The Andalusite Market is evolving with automation, AI-based sorting, and environmentally safe extraction methods. It enhances production capacity and supports consistent quality across different grades. Governments in resource-rich nations are encouraging foreign participation through favorable policies. Expanding industrial infrastructure in developing economies creates strong regional prospects. Partnerships between raw material suppliers and refractory manufacturers accelerate innovation cycles. It enables the development of energy-efficient, eco-friendly materials aligned with sustainability targets. Long-term opportunities lie in strengthening global supply chains and advancing sustainable mineral technologies.

Market Segmentation Analysis:

By Type

Pink andalusite holds notable appeal due to its visual quality and stability in thermal applications. It finds use in decorative ceramics and refractories that require both strength and aesthetic value. Grey andalusite dominates the Andalusite Market owing to its wide industrial availability and strong refractory performance in steel and glass production. Yellow and green variants are used in specialized ceramic and artistic applications, offering color stability under heat. Violet andalusite caters to niche decorative markets. It shows growth from increasing use in blended refractory products designed for superior heat resistance and low porosity.

By Application

Refractories remain the leading application segment in the Andalusite Market due to high demand from steel, cement, and glass industries. The mineral’s low thermal expansion and chemical resistance make it ideal for linings, furnaces, and kilns. Foundries use it in casting molds and cores to ensure precision and reduce deformation under heat. Kiln furniture applications are growing as industries seek materials with longer life and consistent temperature resistance. It supports stable performance in ceramic and glass manufacturing units. Ceramics and glass applications benefit from its thermal endurance and dimensional stability, while other industrial and artistic uses expand its versatility.

- For example, Andalusite refractory bricks are widely used in kiln linings and torpedo-type hot metal tanks for their superior thermal shock resistance and longer service life compared to standard high-alumina bricks, as demonstrated in various industrial refractory performance studies.

By End-Use Industry

The metallurgy industry dominates the Andalusite Market due to its crucial role in producing heat-resistant linings and molds for steel and aluminum manufacturing. Construction follows with its use in heat-resistant materials for high-temperature environments. Automotive and aerospace sectors utilize it for components that require high durability and temperature resistance. Electronics benefit from its insulating properties, enhancing device reliability under thermal stress. Cement, glass, and aluminum industries rely on it for improved furnace performance and energy efficiency. It continues to gain relevance across industrial operations where durability, resistance, and stability are critical.

- For example, in Al₂O₃-SiO₂ castables for steel and cement industry use, andalusite added to the mix delivers improved high-temperature strength and lower creep due to its in-situ mullite formation and stable volume at high temperatures.

Segmentation:

By Type

- Pink Andalusite

- Grey Andalusite

- Yellow Andalusite

- Green Andalusite

- Violet Andalusite

- Others (includes less common shades and blends)

By Application

- Refractories (used in steel, cement, and glass industries, especially for high-temperature environments)

- Foundry (used as foundry sand for casting molds and cores)

- Kiln Furniture (saggars, shelves, thermal processing equipment)

- Ceramics

- Glass Industry

- Other Applications (industrial and artistic)

By End-Use Industry

- Metallurgy (steel, aluminum production)

- Construction (heat-resistant building materials)

- Automotive (heat- and wear-resistant components)

- Aerospace (high-temperature resistant parts)

- Electronics (heat-resistant components)

- Cement Industry

- Glass Industry

- Aluminum Industry

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific leads the Andalusite Market with a 43% share, driven by strong industrial growth in China, India, and Japan. The region benefits from rapid expansion of steel, glass, and cement industries, which are major consumers of refractory materials. High infrastructure investments and increasing metallurgical operations continue to strengthen demand for andalusite-based refractories. It supports energy-efficient manufacturing processes and durable furnace linings across regional industries. China remains the dominant producer and consumer, supported by abundant raw material reserves and large-scale refractory plants. India’s construction boom and expansion of foundry operations further enhance regional consumption.

Europe holds a 28% market share, supported by advanced refractory technologies and strict environmental regulations. The region emphasizes sustainable material sourcing and high-performance refractories for steel, cement, and glass applications. Germany, France, and the UK represent key markets due to their industrial base and technological expertise. It benefits from well-established supply chains and consistent adoption of high-purity andalusite for critical manufacturing processes. European producers focus on low-emission, eco-friendly refractories that comply with regulatory standards. Rising demand for energy-efficient kiln furniture and ceramics also supports steady market expansion in this region.

North America accounts for 17% of the Andalusite Market, primarily driven by the U.S. and Canada. The region benefits from industrial modernization and increased demand for durable refractories in glass and cement manufacturing. It is also seeing renewed investments in domestic mining and advanced material technologies to reduce import dependency. Latin America contributes around 7% share, supported by mining and metallurgical activities in Brazil and Chile. The Middle East and Africa collectively represent 5% share, led by South Africa, a key global producer of andalusite. These regions are expanding export capacities and strengthening industrial sectors that utilize refractory materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Andalusite Market features a consolidated competitive landscape dominated by a few global and regional producers. Key companies include Imerys Refractory Minerals, Andalusite Resources, Damrec, and LKAB Minerals, focusing on quality enhancement and production efficiency. It emphasizes technological innovation in mining, purification, and thermal processing to improve product consistency and purity. Leading players invest in capacity expansion, strategic mergers, and supply chain optimization to secure market positions. Regional firms in South Africa and China strengthen their global reach through export partnerships. The market witnesses growing competition in high-purity grades driven by demand from advanced refractory and ceramic applications. Companies are adopting sustainable mining practices and energy-efficient production systems to meet regulatory and environmental standards. Competitive differentiation increasingly relies on innovation, reliability, and long-term supply agreements with major industrial clients.

Recent Developments:

- In October 2025, Kerui Refractory announced its participation in METAL-EXPO 2025, scheduled for November 11–14, 2025, at Expoforum. The company plans to showcase new innovative refractory solutions, including advancements centered around andalusite-based products designed for high-temperature industrial applications.

- In May 2024, Imerys inaugurated a water-treatment plant at its Glomel site in France, targeting reduction of manganese concentration in discharge waters. This environmental investment supports its andalusite operations and reinforces sustainable supply chain positioning in the market.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Andalusite Market is expected to experience steady expansion driven by industrial demand for refractories in steel and cement production.

- Growth in infrastructure development and energy-intensive industries will sustain long-term consumption.

- Advancements in processing technologies are set to improve product purity and expand application scope.

- Rising demand for sustainable and energy-efficient refractories will shape future investment patterns.

- Emerging economies across Asia-Pacific and Latin America will become key production and consumption hubs.

- Strategic partnerships between mining firms and refractory manufacturers will enhance supply chain resilience.

- Increasing adoption of high-performance ceramics and glass products will support market diversification.

- Automation and digital mining technologies will reduce production costs and improve operational efficiency.

- Environmental regulations will encourage a shift toward cleaner and low-emission mineral processing.

- Continuous R&D efforts will lead to new andalusite-based materials suited for advanced industrial uses.