Market Overview:

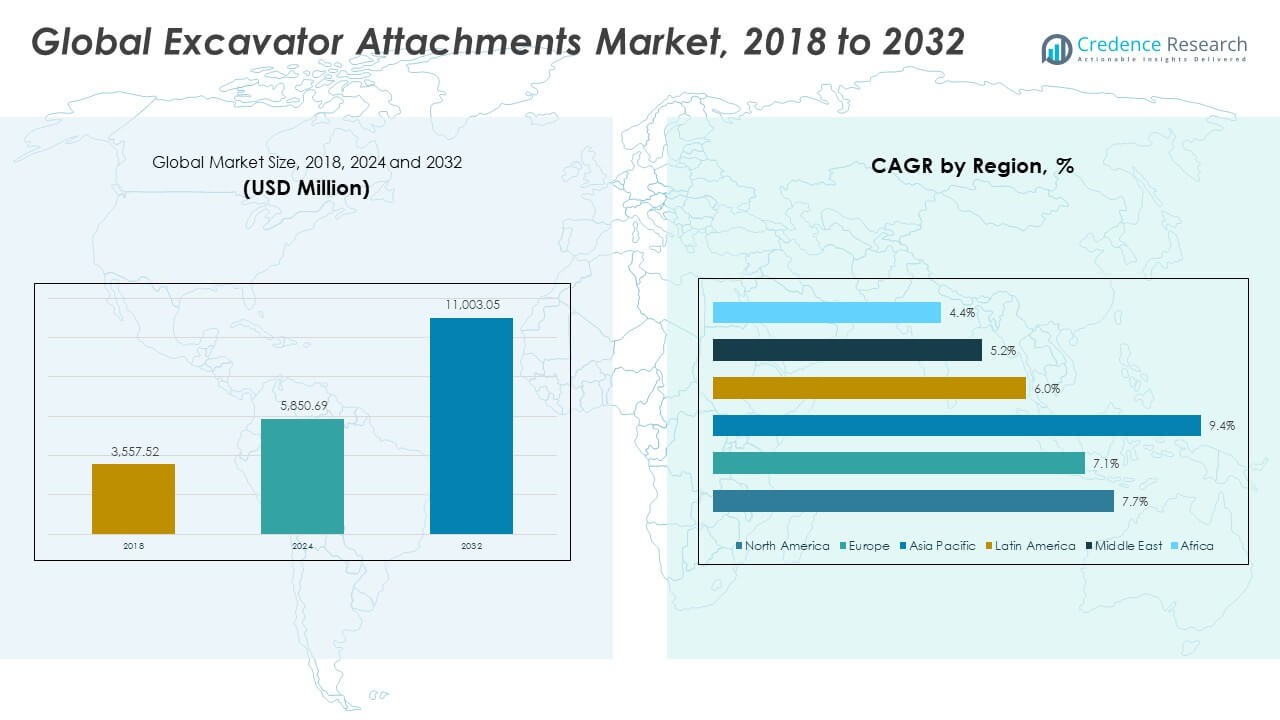

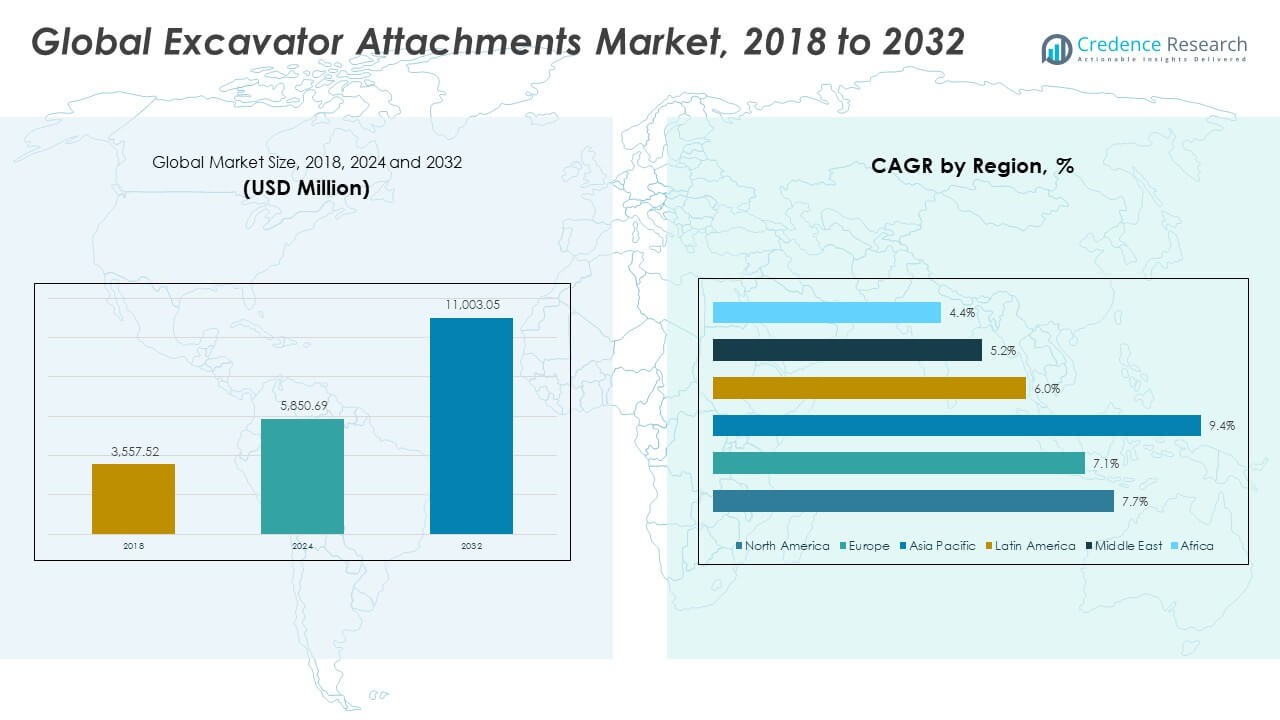

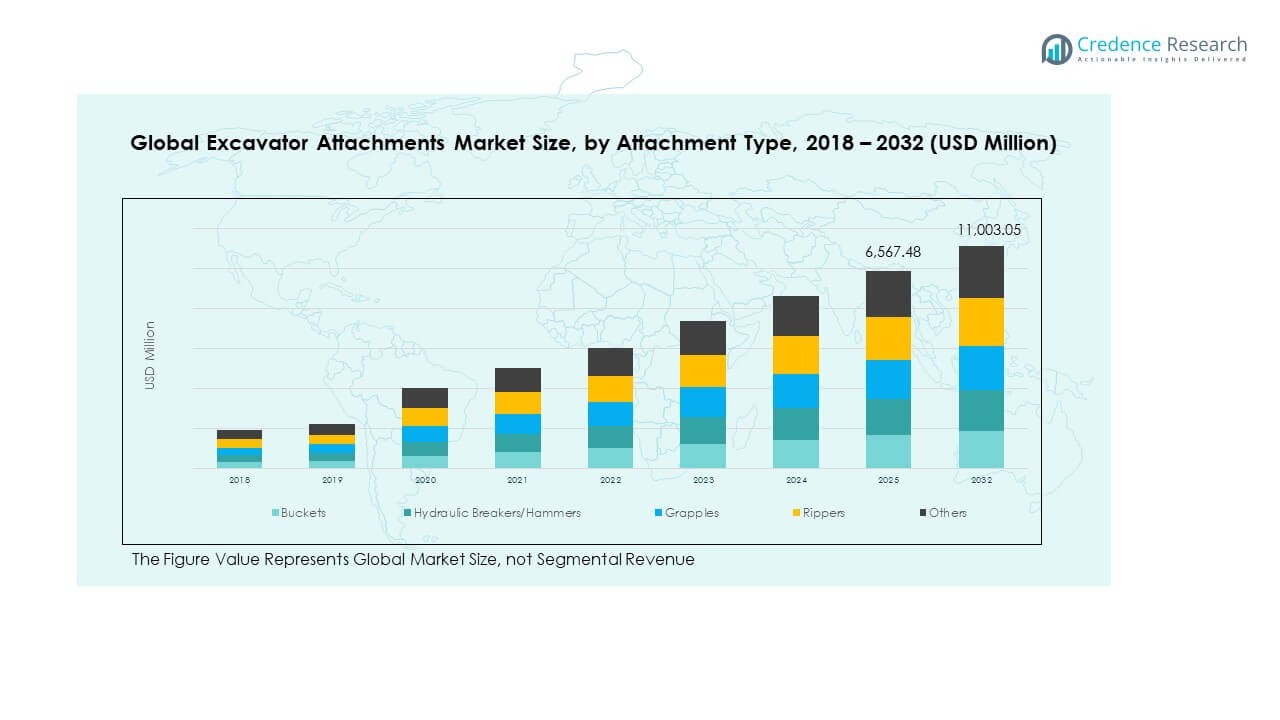

The Global Excavator Attachments Market size was valued at USD 3,557.52 million in 2018 to USD 5,850.69 million in 2024 and is anticipated to reach USD 11,003.05 million by 2032, at a CAGR of 7.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Excavator Attachments Market Size 2024 |

USD 5,850.69 Million |

| Excavator Attachments Market, CAGR |

7.65% |

| Excavator Attachments Market Size 2032 |

USD 11,003.05 Million |

The Global Excavator Attachments Market is driven by the growing adoption of advanced construction and mining machinery, supported by increasing infrastructure development and urbanization. Rising demand for efficient and versatile equipment has encouraged the use of specialized attachments like buckets, hammers, and grapples. Continuous advancements in hydraulic systems and quick coupler technologies further enhance operational efficiency, reduce downtime, and improve safety across work sites.

Regionally, Asia Pacific leads the market due to large-scale infrastructure investments, industrial expansion, and high equipment utilization in China, India, and Japan. North America and Europe follow, supported by modernization of construction fleets and focus on energy-efficient attachments. Emerging regions such as Latin America and the Middle East are witnessing rising demand driven by expanding construction, mining, and oil & gas projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Excavator Attachments Market was valued at USD 3,557.52 million in 2018, reached USD 5,850.69 million in 2024, and is projected to attain USD 11,003.05 million by 2032, expanding at a CAGR of 7.65% during the forecast period.

- Europe (31%), North America (28%), and Asia Pacific (26%) together account for over 85% of the global share, driven by strong industrial bases, infrastructure modernization, and high construction activity in developed economies.

- Asia Pacific, holding about 26% of the total market, is the fastest-growing region, fueled by rapid urbanization, government-backed infrastructure projects, and rising equipment demand in China, India, and Southeast Asia.

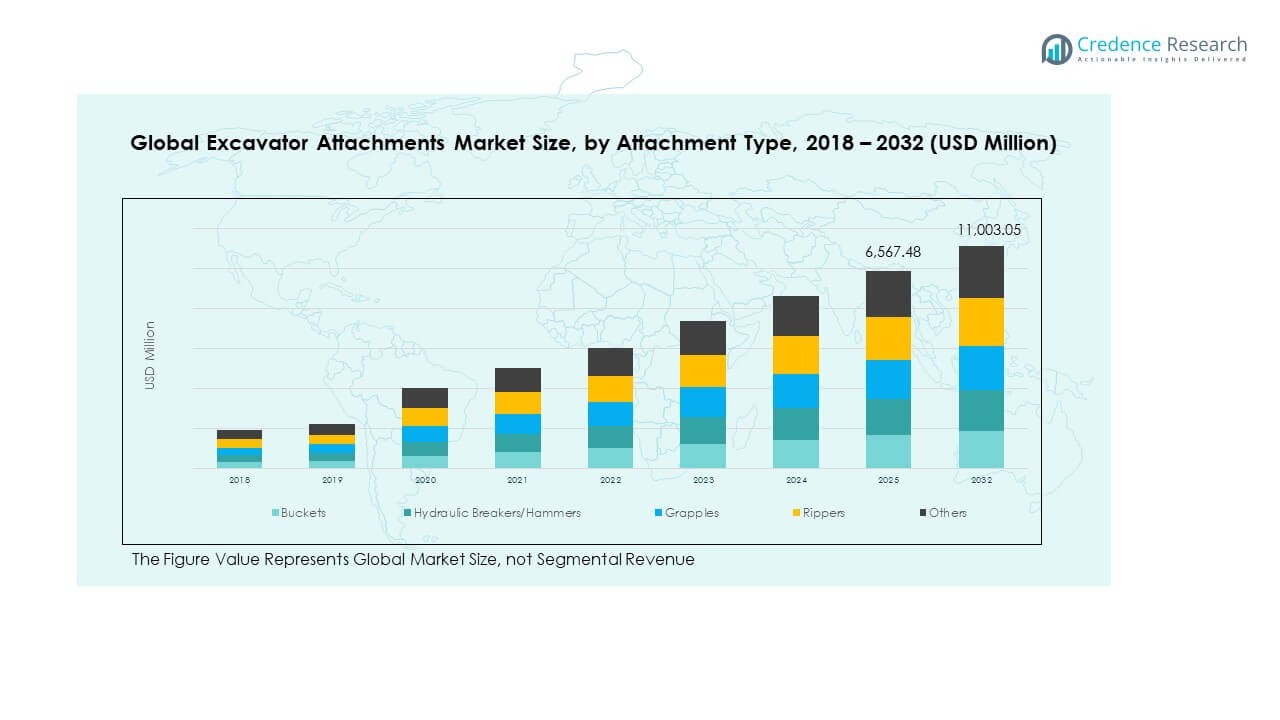

- By attachment type, buckets account for roughly 35% of the market, supported by their widespread use in excavation, trenching, and loading operations across industries.

- Hydraulic breakers/hammers represent around 25% of the share, driven by high utilization in demolition, quarrying, and mining applications requiring efficient rock and concrete breaking solutions.

Market Drivers:

Rising Infrastructure Development and Urbanization Fueling Equipment Demand

Rapid urban expansion and large-scale construction are increasing the need for advanced excavation tools. Governments are investing heavily in smart cities, transport, and energy infrastructure to boost productivity. The Global Excavator Attachments Market benefits from such initiatives across developing economies. Demand for high-efficiency tools grows as contractors focus on minimizing labor and project delays. Attachments like buckets, rippers, and hammers are key for earthmoving and demolition activities. Manufacturers are designing durable and high-performance attachments for extreme working conditions. Increased housing and industrial construction projects sustain continuous equipment demand. Global investments in renewable and commercial sectors further drive market momentum.

- For instance, Caterpillar launched eight next-generation Cat compact track loaders in September 2024 with enhanced lift height, tilt breakout forces, and new Smart Attachments that automatically integrate with machine controls for higher operational productivity.

Growing Preference for Equipment Versatility and Customization

Contractors prefer equipment that can handle multiple tasks using interchangeable attachments. The Global Excavator Attachments Market is expanding due to rising demand for flexibility and cost efficiency. Quick coupler systems allow faster switching, improving operational productivity and reducing downtime. Custom-built attachments cater to specific industries like demolition, forestry, and mining. Rental companies benefit from versatile tools that serve different projects with minimal replacements. Manufacturers design modular systems compatible with varied excavator models. Such innovations improve usability and appeal to both small and large contractors. Market players focus on ergonomic and lightweight materials to enhance operator control and fuel efficiency.

- For instance, Komatsu’s Kprime modular bucket system features a tooth design with 10% increased strength and improved interlocking components, allowing rapid replacement and compatibility with multiple excavator models for enhanced on-site versatility.

Technological Advancements Enhancing Operational Efficiency and Safety

Integration of smart systems, telematics, and automation boosts accuracy and reliability. The Global Excavator Attachments Market experiences growing adoption of connected tools offering real-time performance tracking. Sensors provide data on pressure, wear, and usage to improve asset management. Hydraulic innovations enhance power distribution, fuel savings, and precision. Safety remains a major priority, with manufacturers introducing anti-vibration and noise-reduction features. Predictive maintenance tools prevent breakdowns and extend attachment lifespan. IoT-based monitoring enhances project management and cost efficiency. Companies investing in intelligent technology maintain a strong competitive edge in this evolving market.

Expansion of Mining and Quarrying Activities Increasing Adoption

Global mining growth creates significant demand for specialized heavy-duty attachments. The Global Excavator Attachments Market gains traction from large extraction projects in mineral-rich regions. Attachments such as rock breakers, augers, and crushers support demanding excavation tasks. Energy, metals, and construction material industries rely on durable equipment for continuous operations. Manufacturers design wear-resistant attachments that perform in extreme conditions. Automation in mining improves productivity while reducing safety risks. Equipment replacement cycles shorten due to heavy workloads, boosting aftermarket demand. Expanding exploration in Africa, Latin America, and Asia ensures long-term market growth.

Market Trends:

Adoption of Smart and Connected Attachment Technologies

Digital transformation is reshaping excavation operations through connected and data-driven tools. The Global Excavator Attachments Market witnesses strong adoption of IoT and telematics-based attachments. These systems track real-time parameters such as usage hours, hydraulic pressure, and efficiency. Predictive analytics enhances maintenance planning and minimizes downtime. Smart tools provide insights into operator behavior and improve performance consistency. Manufacturers integrate connectivity features that enhance safety and fuel optimization. Remote diagnostics reduce operational costs for contractors and fleet owners. Integration of AI-driven systems strengthens automation and reliability in construction and mining projects.

- For instance, Volvo CE expanded its Dig Assist portfolio in April 2025, integrating operator coaching, attachment detection, and machine control features that improve productivity, streamline site safety, and give excavators real-time digital feedback through the Co-Pilot tablet system.

Growing Popularity of Electrification and Eco-Friendly Attachments

Environmental regulations and sustainability goals encourage manufacturers to create low-emission tools. The Global Excavator Attachments Market is shifting toward electric and hybrid-powered attachments. Electrification reduces fuel consumption, noise, and carbon footprint during operations. Lightweight materials and efficient hydraulic systems further optimize performance. Urban construction projects favor eco-friendly equipment for compliance and community safety. Manufacturers are launching recyclable components to reduce waste generation. Clean technology adoption improves energy savings and lowers maintenance costs. Growing awareness of sustainable operations strengthens this transformation across industrial sectors.

- For instance, JCB’s 220X excavator, launched with the DIESELMAX engine tested over 110,000 hours, features advanced hydraulics for greater fuel efficiency and comes with LiveLink telematics for real-time monitoring, enabling operators to optimize usage and reduce emissions during heavy-duty operations.

Rising Influence of Equipment Rental and Leasing Services

Contractors increasingly adopt equipment rental models to cut ownership costs. The Global Excavator Attachments Market benefits from this growing rental culture in both developed and developing regions. Renting attachments provides flexibility for short-term or seasonal projects. Rental companies offer a wide range of quick couplers, buckets, and grapples for various tasks. Frequent technology upgrades attract small contractors seeking advanced capabilities without heavy investments. Standardized attachment interfaces improve compatibility across different machine brands. Rental expansion supports continuous product utilization and strong aftermarket sales. Global partnerships between OEMs and rental firms strengthen market accessibility.

Integration of Advanced Materials and Manufacturing Techniques

Material science innovations are transforming attachment design and durability. The Global Excavator Attachments Market is adopting high-strength steel, composite alloys, and wear-resistant coatings. These materials improve load-bearing capacity and operational lifespan. Advanced fabrication techniques, including 3D printing and laser cutting, enhance precision and customization. Lightweight designs reduce energy consumption while maintaining high performance. Manufacturers invest in robotic welding to ensure consistency and strength. Enhanced surface finishing processes extend corrosion resistance in harsh environments. Adoption of such innovations boosts product reliability and performance standards globally.

Market Challenges Analysis:

High Initial Costs and Maintenance Complexity Restraining Adoption

High capital investment remains a major concern for small and mid-sized contractors. The Global Excavator Attachments Market faces adoption barriers due to expensive hydraulic and advanced systems. Frequent maintenance and part replacements increase operational expenses. Technologically advanced attachments require trained operators and specialized service support. Lack of standardization between attachment types complicates interchangeability and adds cost. Supply chain disruptions cause delays in spare parts and aftermarket service. Small contractors often rely on traditional equipment, limiting advanced tool adoption. Rising component costs impact affordability, slowing growth in emerging markets.

Regulatory Barriers and Environmental Compliance Challenges

Environmental and safety regulations vary widely across regions, affecting product design and certification. The Global Excavator Attachments Market must align with emission control and noise-level standards. Manufacturers face difficulties meeting compliance while keeping performance efficient. Stringent workplace safety norms increase design complexity and production costs. Limited awareness of regulatory updates among small manufacturers restricts international competitiveness. Import-export barriers and changing policies affect global trade dynamics. The transition toward electric or eco-friendly systems demands high R&D spending. Adapting to evolving standards remains a major operational challenge for global suppliers.

Market Opportunities:

Rising Demand for Electrification and Automation Across Construction Equipment

Automation and electrification create strong prospects for manufacturers worldwide. The Global Excavator Attachments Market benefits from increasing use of smart and energy-efficient equipment. Demand for noise-free, low-maintenance, and eco-friendly attachments grows in urban and mining projects. Manufacturers developing hybrid systems gain a technological advantage. Partnerships between OEMs and technology firms enhance innovation and scalability. Advanced control systems improve accuracy, safety, and resource utilization. The shift toward connected, automated tools opens new revenue streams across global industries.

Growing Expansion of Rental and Aftermarket Services Boosting Accessibility

Rising equipment rental and leasing models provide strong opportunities for steady revenue growth. The Global Excavator Attachments Market benefits from expanding aftermarket networks and service contracts. Rental firms offer end-users access to advanced attachments without heavy investments. OEMs are forming alliances with distributors to ensure faster delivery and regional coverage. Growing focus on refurbishment and remanufacturing improves sustainability and profitability. Aftermarket service expansion strengthens customer loyalty and operational continuity. Enhanced availability of maintenance and training programs drives higher attachment utilization rates globally.

Market Segmentation Analysis:

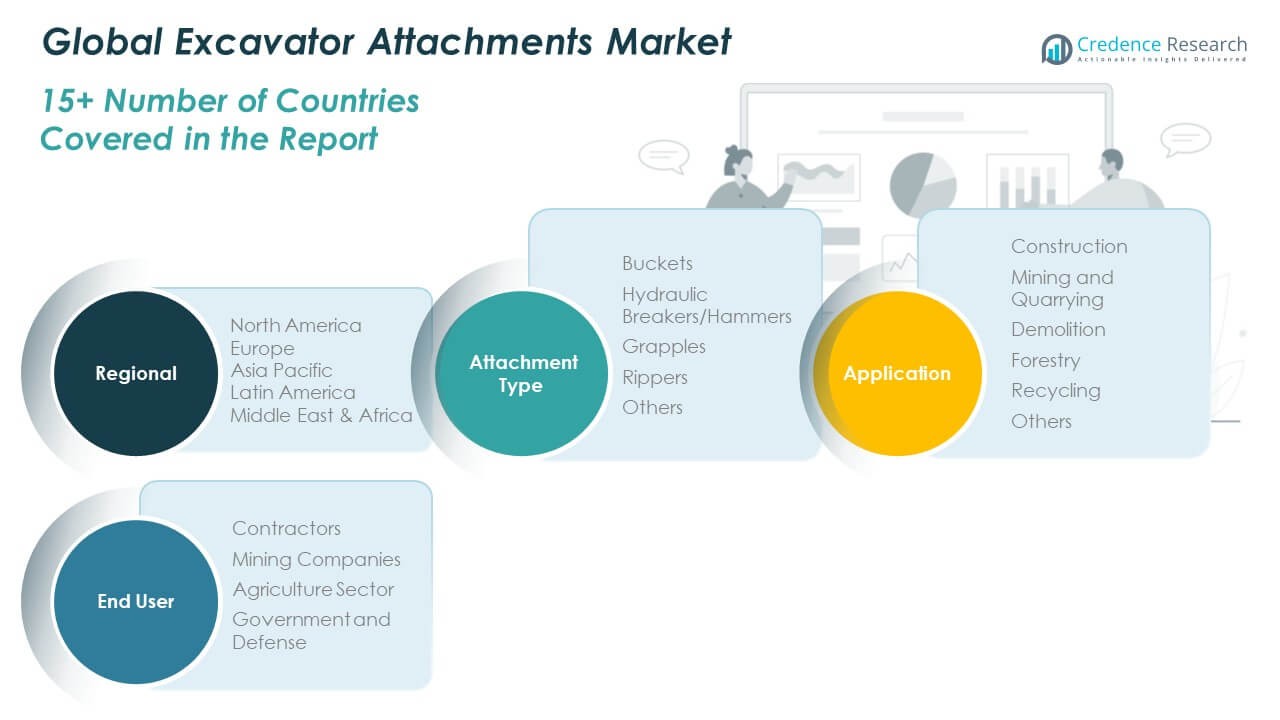

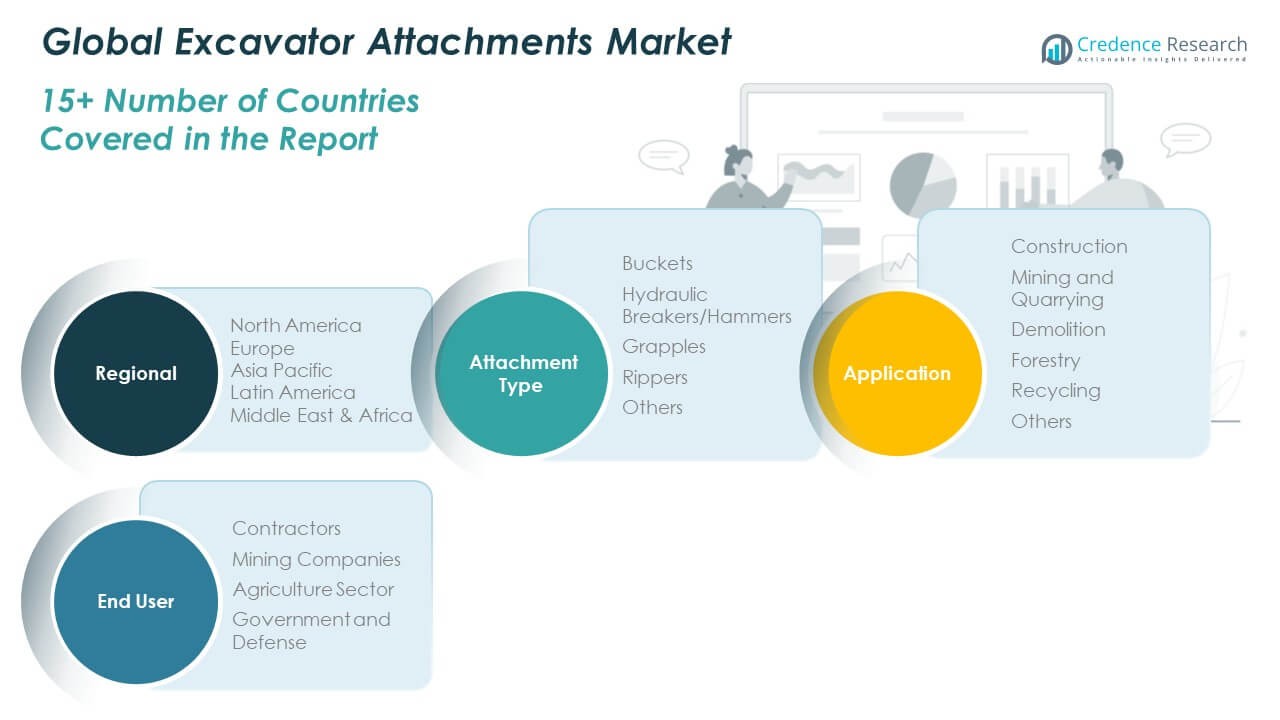

By Attachment Type

The Global Excavator Attachments Market is segmented into buckets, hydraulic hammers, grapples, rippers, quick couplers, augers, pulverizers, compactors, thumbs, and others. Buckets hold the largest share due to their extensive use in earthmoving and material handling. Hydraulic hammers and rippers are vital for demolition and quarrying applications, while quick couplers improve flexibility and equipment efficiency. Increasing demand for specialized attachments such as pulverizers and grapples is driven by construction and recycling activities. Technological advancements in hydraulic performance and lightweight materials enhance productivity and reduce operating costs.

- For instance, Epiroc’s HB 10000 hydraulic breaker, weighing 10 tons and delivering single impact blow energy of 16,000 joules, uses DustProtector II and ContiLube II systems as standard to optimize quarrying and demolition productivity in harsh environments.

By Application

Key applications include construction, mining and quarrying, demolition, forestry, recycling, and others. The construction segment leads due to large-scale infrastructure and residential projects. Mining and quarrying follow, driven by the expansion of resource extraction and industrial projects. The demolition sector benefits from urban redevelopment and renovation initiatives. Forestry and recycling applications are growing due to sustainable operations and circular economy trends. Expanding industrialization across emerging economies supports steady adoption across all end-use applications.

- For instance, Liebherr’s R 9800 G6 mining excavator—with modular design and a payload capacity over 42 m³—achieves up to 120,000 liters annual fuel savings and delivers cycle times that exceeded budgeted productivity rates by 20–25% at operating sites in 2025.

By End User

Major end users include contractors, mining companies, the agriculture sector, and government and defense organizations. Contractors dominate the Global Excavator Attachments Market owing to their wide equipment usage in multiple projects. Mining companies rely on durable and high-capacity attachments for productivity. The agriculture sector uses smaller excavator attachments for land preparation and irrigation projects. Government and defense agencies adopt attachments for infrastructure, disaster response, and defense engineering operations, strengthening demand diversity across the industry.

Segmentation:

By Attachment Type

- Buckets

- Hydraulic Hammers

- Grapples

- Rippers

- Quick Couplers

- Augers

- Pulverizers

- Compactors

- Thumbs

- Others

By Application

- Construction

- Mining and Quarrying

- Demolition

- Forestry

- Recycling

- Others

By End User

- Contractors

- Mining Companies

- Agriculture Sector

- Government and Defense

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Excavator Attachments Market size was valued at USD 1,011.17 million in 2018 to USD 1,636.43 million in 2024 and is anticipated to reach USD 3,090.75 million by 2032, at a CAGR of 7.7% during the forecast period. North America holds nearly 28% of the global market share, driven by extensive infrastructure development and strong construction activity across the United States and Canada. It benefits from high equipment adoption in mining, road building, and residential projects. Advanced technology integration and rising demand for energy-efficient attachments strengthen regional competitiveness. The presence of leading OEMs and rental service providers enhances accessibility for contractors. Governments continue to fund large-scale transportation and industrial projects that require durable and efficient attachments. The region also sees growth in replacement demand due to aging machinery fleets. Sustainable construction practices and digitalization trends further shape the market landscape.

Europe

The Europe Global Excavator Attachments Market size was valued at USD 1,570.09 million in 2018 to USD 2,522.33 million in 2024 and is anticipated to reach USD 4,567.56 million by 2032, at a CAGR of 7.1% during the forecast period. Europe accounts for approximately 31% of the global market share, supported by mature construction and industrial sectors. It experiences steady demand from infrastructure renewal, mining, and waste management projects. The European Union’s focus on energy-efficient and low-emission machinery drives continuous innovation. Key countries such as Germany, the UK, France, and Italy remain major consumers due to ongoing urban redevelopment and public works. Manufacturers emphasize product standardization and compliance with safety norms. The region’s advanced automation and digital connectivity initiatives contribute to long-term market stability. Growing adoption of electric and hybrid attachments supports the transition to sustainable construction technologies.

Asia Pacific

The Asia Pacific Global Excavator Attachments Market size was valued at USD 662.93 million in 2018 to USD 1,184.65 million in 2024 and is anticipated to reach USD 2,532.02 million by 2032, at a CAGR of 9.4% during the forecast period. Asia Pacific dominates with nearly 26% of the global market share, driven by rapid industrialization and extensive construction investments. China, India, Japan, and South Korea are major contributors due to expanding infrastructure and mining activities. Strong government funding in smart city projects and public transportation boosts demand for attachments. Local manufacturing and lower equipment costs enhance accessibility for regional contractors. Rising urbanization and industrial projects stimulate continuous fleet expansion. The shift toward automation and hydraulic innovation supports productivity improvements. Export-oriented manufacturing also drives adoption of high-performance tools. Growing foreign investments in infrastructure development further reinforce market growth.

Latin America

The Latin America Global Excavator Attachments Market size was valued at USD 168.43 million in 2018 to USD 273.57 million in 2024 and is anticipated to reach USD 455.51 million by 2032, at a CAGR of 6.0% during the forecast period. Latin America represents about 5% of the global market share, supported by growth in mining, oil and gas, and construction sectors. Brazil and Mexico are major markets, driven by industrial expansion and regional development programs. Infrastructure modernization and housing initiatives contribute to rising equipment utilization. The demand for rental equipment increases among small and medium contractors. Manufacturers focus on cost-efficient and durable attachments suitable for rugged terrain. Political and economic reforms encourage foreign investments in infrastructure. Ongoing energy projects and urban renewal plans provide steady market opportunities.

Middle East

The Middle East Global Excavator Attachments Market size was valued at USD 93.33 million in 2018 to USD 139.41 million in 2024 and is anticipated to reach USD 218.17 million by 2032, at a CAGR of 5.2% during the forecast period. The region holds around 4% of the global market share, supported by continuous investments in construction and oil-related infrastructure. Saudi Arabia, the UAE, and Qatar lead in demand due to major development programs. Large-scale urban and tourism projects boost utilization of attachments in building and land preparation. Companies invest in advanced hydraulic systems for performance in desert conditions. Mining and energy exploration also drive regional adoption. Governments promote industrial diversification, increasing machinery demand. Expansion of trade and logistics hubs further strengthens growth potential. Focus on modernizing fleets through international partnerships supports long-term industry progress.

Africa

The Africa Global Excavator Attachments Market size was valued at USD 51.57 million in 2018 to USD 94.30 million in 2024 and is anticipated to reach USD 139.05 million by 2032, at a CAGR of 4.4% during the forecast period. Africa contributes about 6% of the global market share, led by South Africa, Egypt, and Nigeria. Growing construction in urban centers and government infrastructure programs supports steady equipment adoption. Mining exploration in mineral-rich countries sustains demand for durable and cost-effective attachments. The region is witnessing rising foreign investments in energy and transportation. Manufacturers focus on low-maintenance, high-durability products suited for challenging environments. Expansion of road, rail, and housing projects continues to drive market activity. Increasing local dealership networks improve availability and aftersales support. Regional modernization efforts and public-private collaborations ensure gradual market development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- JCB

- Case Construction Equipment

- Hitachi Construction Machinery

- Hyundai Construction Equipment

- Sandvik AB

- Bobcat Company

- Takeuchi

Competitive Analysis:

The Global Excavator Attachments Market is highly competitive, with major players focusing on innovation, expansion, and partnerships to enhance market presence. It features established brands such as Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, and Hitachi Construction Machinery. Companies compete based on product quality, technological advancement, and distribution networks. Continuous R&D investment drives development of lightweight, energy-efficient, and durable attachments. Strategic alliances with rental and service firms help expand customer access. The market favors players offering comprehensive product portfolios and robust aftersales support. Innovation in hydraulic systems and quick coupler designs remains a key differentiator.

Recent Developments:

- In October 2025, Caterpillar Inc. entered into an agreement to acquire RPMGlobal Holdings Limited, an Australian-based software provider, in a strategic move to integrate advanced mining software with its existing equipment expertise and further enhance its digital solutions for global mining operations.

- In June 2025, Komatsu Ltd. finalized a major agreement with Barrick Gold Corporation for the delivery of primary mining equipment to the substantial Reko Diq copper-gold project in Pakistan, reflecting the company’s expanding relationships and global footprint in strategic partnerships for mining equipment supply.

Report Coverage:

The research report offers an in-depth analysis based on attachment type, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of smart and connected attachments will drive operational efficiency.

- Electrification and eco-friendly designs will gain preference in urban projects.

- Asia Pacific will remain the fastest-growing region with strong infrastructure expansion.

- Mining and demolition sectors will continue generating stable equipment demand.

- OEM collaborations with rental companies will improve product accessibility.

- Innovation in hydraulic systems and automation will enhance equipment versatility.

- Sustainable and recyclable materials will influence product design trends.

- Advanced telematics integration will reduce downtime and improve asset management.

- Expansion of aftermarket services will strengthen long-term profitability.

- Global manufacturers will focus on regional customization and lightweight attachment designs.