Market Overview

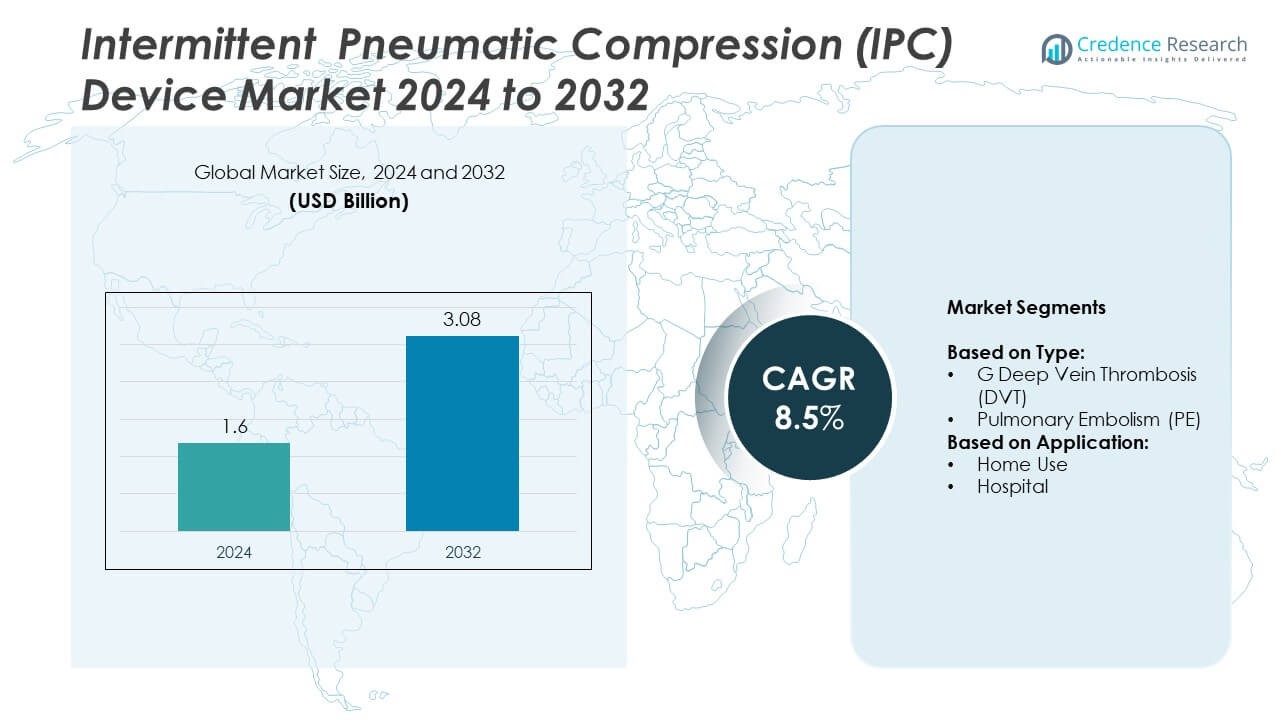

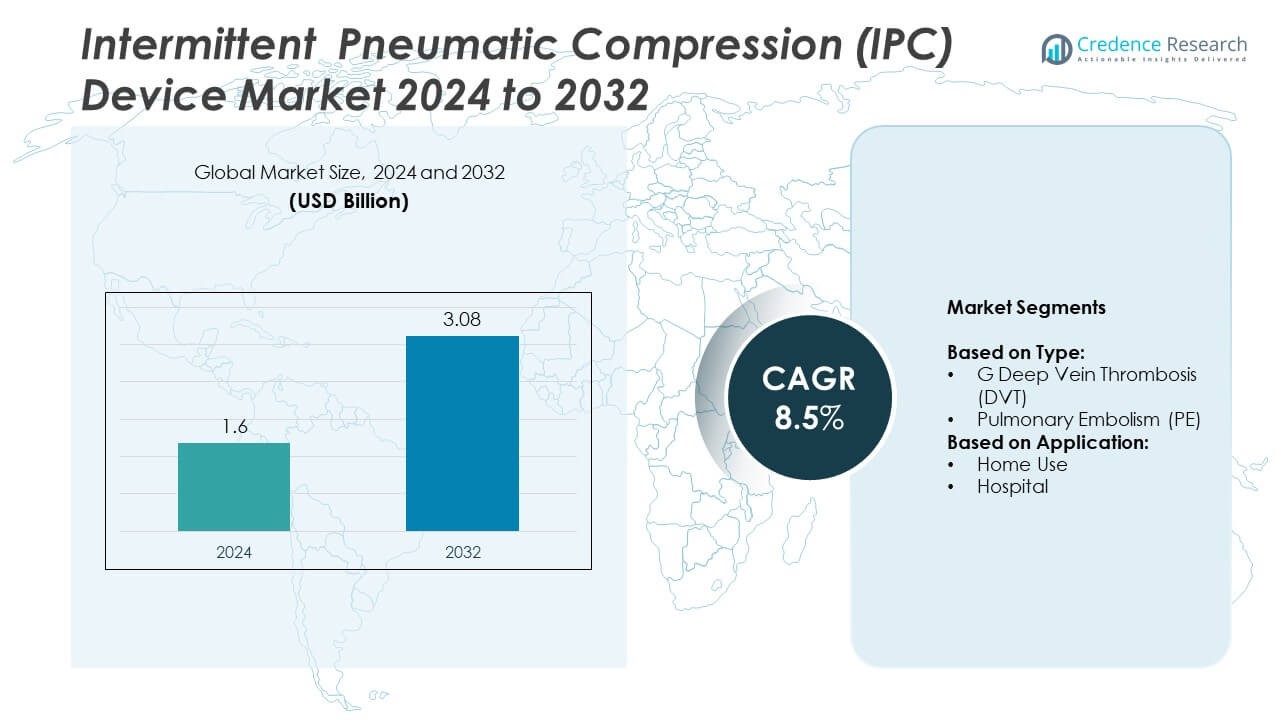

Intermittent Pneumatic Compression (IPC) Device market size was valued at USD 1.6 billion in 2024 and is projected to reach USD 3.08 billion by 2032, growing at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intermittent Pneumatic Compression (IPC) Device Market Size 2024 |

USD 1.6 Billion |

| Intermittent Pneumatic Compression (IPC) Device Market, CAGR |

8.5% |

| Intermittent Pneumatic Compression (IPC) Device Market Size 2032 |

USD 3.08 Billion |

The intermittent pneumatic compression (IPC) device market is led by key players such as ThermoTek USA, Mego Afek AC LTD, Medline Industries, Breg, Bio Compression Systems, Tactile Medical, Zimmer Biomet, Cardinal Health, DJO, LLC, and DevonMedicalProducts.com. These companies focus on developing advanced devices with automated pressure control, multi-chamber compression, and compliance-tracking features to enhance patient outcomes. Strategic collaborations with hospitals and expansion into home healthcare segments strengthen their market presence. North America dominates the global IPC device market with approximately 38% share in 2024, driven by strong clinical adoption, favorable reimbursement policies, and high surgical procedure volumes.

Market Insights

- The intermittent pneumatic compression (IPC) device market was valued at USD 1.6 billion in 2024 and is projected to reach USD 3.08 billion by 2032, growing at a CAGR of 8.5%.

- Rising surgical procedures, growing focus on VTE prevention, and preference for non-pharmacological prophylaxis are major drivers of market growth.

- Key trends include adoption of portable home-use IPC devices, integration with digital health platforms, and development of smart compliance monitoring systems.

- The market is competitive, with players focusing on innovation, strategic partnerships, and expansion into emerging markets to strengthen their position.

- North America leads with 38% market share, followed by Europe at 30% and Asia Pacific at 22%, while DVT prevention devices dominate the type segment with over 65% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Deep Vein Thrombosis (DVT) prevention devices dominate the IPC device market, accounting for over 65% share in 2024. Rising incidence of post-surgical DVT and hospital-acquired venous thromboembolism drives adoption. Growing emphasis on patient safety and clinical guidelines recommending mechanical prophylaxis over pharmacological options in high-bleeding-risk patients support this segment’s leadership. Technological advancements, such as automated cycle pressure systems and portable DVT prophylaxis pumps, further accelerate usage across surgical wards and intensive care units, reinforcing its position as the preferred solution for clot prevention.

- For instance, Tactile Medical launched its Flexitouch Plus system in April 2018. While the device does have automated cycles and is portable, the exact cycle times and battery life vary depending on the specific program and usage, a full leg treatment is a 45-minute program, while a head and neck treatment is a 32-minute program. The system is designed for enhanced patient mobility and at-home use.

By Application

Hospitals represent the largest application segment, contributing more than 70% market share in 2024. Increased surgical volume, particularly orthopedic and bariatric procedures, drives demand for IPC devices to reduce VTE risk. The presence of advanced monitoring infrastructure, skilled staff, and integration with hospital-wide thromboprophylaxis protocols further support adoption. Hospitals prioritize IPC systems with compliance tracking and data logging features, ensuring adherence to quality and safety standards. Rising focus on reducing hospital readmissions and treatment costs also drives investments in IPC devices within inpatient and perioperative care settings.

- For instance, The Kendall SCD 700 system inflates leg sleeves with a sequential gradient pressure, starting with 45 mmHg at the ankle, then 40 mmHg at the calf, and 30 mmHg at the thigh. Foot cuffs are inflated to a uniform set pressure of 130 mmHg. The system also includes audible and visual alarms to indicate high-pressure events.

Key Growth Drivers

Rising Surgical Volume and VTE Prevention Needs

The growing number of surgical procedures globally drives IPC device adoption. Orthopedic, cardiovascular, and bariatric surgeries often require VTE prophylaxis to reduce post-operative clot risk. Hospitals and surgical centers are adopting IPC systems as part of standardized thromboprophylaxis protocols. Rising awareness of venous thromboembolism prevention among clinicians supports consistent usage. Increased focus on patient safety and regulatory recommendations encouraging mechanical prophylaxis further accelerate demand, making surgical volume a major growth contributor for the IPC device market.

- For instance, Mego Afek’s Phlebo Press 603 offers 45 mmHg or 130 mmHg modes, weighs 2.5 kg, and measures 17.6 × 22.7 × 19.7 cm.

Technological Advancements in IPC Devices

Innovations such as portable, battery-operated IPC systems and smart compliance monitoring boost adoption rates. Advanced devices now feature automated pressure adjustments, multiple chamber designs, and user-friendly interfaces. Integration with digital health platforms allows remote monitoring of patient adherence, improving outcomes. These developments reduce device complexity, enhance patient comfort, and encourage extended use in both hospital and home settings. Technological progress ensures that IPC devices remain an attractive choice for clinicians seeking efficient and reliable VTE prevention solutions.

- For instance, Devon Medical’s Cirona 6300 is a portable deep vein thrombosis (DVT) prevention system cleared for use in home, ambulatory, and clinical settings. The device applies an intermittent pressure, with a default pressure of 50 mmHg, to stimulate blood flow and aid in the prevention of DVT. The pump operates by inflating the sleeve and then deflating for a rest period, which lasts 50 seconds. It is a single-patient-use device that can be used on the go and has a rechargeable battery.

Growing Focus on Non-Pharmacological Prophylaxis

Rising concerns about bleeding risks from anticoagulants drive demand for mechanical prophylaxis. IPC devices offer a safer option for patients with contraindications to drug-based therapy. Healthcare guidelines from bodies like ACCP recommend IPC as a preferred option for high-risk surgical patients. Hospitals are increasingly integrating IPC therapy into multimodal thromboprophylaxis strategies. The shift toward evidence-based, non-invasive preventive measures strengthens the device market’s position as a vital component in reducing VTE incidence.

Key Trends & Opportunities

Expansion of Home-Based Therapy

The rise in outpatient procedures and telehealth adoption supports IPC use at home. Portable, lightweight devices enable patients to continue VTE prevention after discharge, reducing readmissions. Home therapy adoption is encouraged by payers seeking to lower hospitalization costs. Manufacturers are focusing on patient-friendly designs with easy setup and compliance tracking. This trend creates significant opportunities for growth in the post-acute care market, supported by aging populations and the increasing preference for home recovery settings.

- For instance, Cardinal Health’s PlasmaFlow™ portable compression device features a rechargeable battery that can provide approximately 7 to 9 hours of battery life on a single charge.

Integration with Digital Health and AI

IPC devices are evolving to include digital health connectivity and AI-based analytics. These solutions monitor patient compliance, generate real-time alerts, and help clinicians optimize therapy duration. Data-driven insights support personalized treatment plans, improving clinical outcomes. Integration with hospital EMRs ensures seamless tracking and reporting for quality audits. This digital shift opens new opportunities for manufacturers to differentiate products and offer value-added services that align with hospitals’ focus on connected care ecosystems.

- For instance, the GZ Longest LGT-2200L device offers 18 compression modes, a pressure range of 37-187 mmHg, and treatment times adjustable between 1-99 minutes and 1-99 hours.

Key Challenges

High Device and Maintenance Costs

The significant cost of advanced IPC systems can limit adoption in cost-sensitive healthcare settings. Hospitals with budget constraints may rely on reusable devices with higher maintenance needs, impacting efficiency. Reimbursement limitations in certain regions further restrict access, particularly for home-based therapy. Manufacturers face pressure to balance pricing with innovation while ensuring affordability. Addressing these cost barriers through rental programs or bundled service models is key to widening market penetration.

Patient Compliance and Usability Issues

Ensuring patient adherence to IPC therapy remains a challenge, particularly in home settings. Discomfort, noise, or complexity of device setup can reduce usage duration. Lack of education about the importance of continuous therapy leads to poor outcomes. Manufacturers are working to develop quieter, more comfortable devices with simple controls to improve patient experience. Enhanced training and compliance tracking solutions are crucial to overcome this challenge and maximize the clinical effectiveness of IPC therapy.

Regional Analysis

North America

North America holds around 38% market share in the IPC device market in 2024. The region benefits from high awareness of venous thromboembolism prevention and well-established reimbursement policies. The U.S. leads adoption with widespread integration of IPC devices into hospital thromboprophylaxis protocols. Rising surgical volumes, aging population, and advanced healthcare infrastructure drive demand. Presence of key players focusing on technological innovations, such as portable and smart compliance-tracking devices, strengthens growth. Canada shows steady uptake supported by government initiatives to reduce VTE incidence. Increasing home healthcare services and emphasis on reducing readmissions further support IPC device adoption.

Europe

Europe accounts for nearly 30% of the IPC device market share in 2024. The region’s growth is supported by strong regulatory frameworks and rising awareness of VTE prevention programs across hospitals. Countries like Germany, France, and the UK lead demand with high surgical procedure rates and focus on patient safety standards. Adoption is driven by growing emphasis on non-pharmacological prophylaxis, especially in patients with bleeding risks. Reimbursement coverage for mechanical prophylaxis and technological advancements contribute to higher usage. Increasing home-based recovery solutions and focus on reducing healthcare costs further expand market opportunities in this region.

Asia Pacific

Asia Pacific represents close to 22% of the IPC device market in 2024 and is the fastest-growing region. Rising healthcare expenditure, growing surgical procedures, and awareness campaigns on VTE prevention drive adoption. Countries such as China, Japan, and India are key contributors, with hospitals increasingly integrating IPC devices into post-surgical care. Expanding medical tourism and infrastructure development further accelerate demand. Local manufacturers introducing cost-effective devices are improving accessibility. The shift toward home care solutions and government efforts to improve post-operative care outcomes strengthen growth prospects across emerging economies in the region.

Latin America

Latin America accounts for nearly 6% of the IPC device market share in 2024, with Brazil and Mexico leading demand. Growth is driven by rising hospital investments, improved access to surgical care, and efforts to reduce post-surgical complications. Adoption remains concentrated in urban centers with better healthcare infrastructure. Limited reimbursement coverage and budget constraints pose challenges, but increasing awareness of mechanical prophylaxis benefits is boosting gradual uptake. Partnerships with global device makers and government-led healthcare modernization programs are expected to improve accessibility and support steady growth of IPC device adoption across the region.

Middle East and Africa

Middle East and Africa capture around 4% market share in the IPC device market in 2024. The region’s growth is fueled by rising surgical procedures, particularly orthopedic and bariatric surgeries, in countries such as Saudi Arabia, UAE, and South Africa. Healthcare investments under national transformation programs are improving hospital infrastructure and availability of advanced medical devices. However, limited awareness and affordability challenges in low-income countries restrain wider adoption. Gradual expansion of private healthcare facilities and focus on post-operative care are expected to create opportunities, with demand likely to increase steadily over the coming years.

Market Segmentations:

By Type:

- G Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the intermittent pneumatic compression (IPC) device market features key players such as ThermoTek USA, Mego Afek AC LTD, Medline Industries, Breg, Bio Compression Systems, Tactile Medical, Zimmer Biomet, Cardinal Health, DJO, LLC, and DevonMedicalProducts.com. The market is characterized by strong innovation, with manufacturers focusing on portable, lightweight systems and advanced compliance-tracking technologies to enhance patient adherence. Companies are investing in product differentiation through features like automated pressure control, multi-chamber compression, and integration with digital monitoring platforms. Strategic partnerships with hospitals, distributors, and home healthcare providers strengthen market presence. Continuous efforts are made to expand access in emerging markets through cost-effective solutions. Research and development initiatives are aimed at improving patient comfort and usability, which remain critical competitive factors. Regulatory approvals and expansion of manufacturing capabilities also support growth, while after-sales support and training services play a key role in building long-term customer relationships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Tactile Medical presented new clinical data at ASCO showing quality-of-life improvements using its Flexitouch Plus device for head and neck cancer-related lymphedema.

- In May 2025, Zimmer Biomet lowered its profit forecast citing trade tariff uncertainties, highlighting cost pressures in global supply chains.

- In November 2024, Cardinal Health launched the Kendall SCD SmartFlow™ compression system, the next generation in its series designed to prevent both deep vein thrombosis and pulmonary embolism. The system features enhanced clinician-and‐patient experience with customized intermittent pneumatic compression to increase blood flow.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising surgical procedures and VTE prevention needs.

- Adoption of portable and home-use IPC devices will increase with expansion of telehealth services.

- Technological innovations such as smart compliance tracking and automated pressure systems will gain popularity.

- Integration with digital health platforms and hospital EMRs will enhance monitoring and reporting efficiency.

- Emerging markets in Asia Pacific and Latin America will contribute significantly to future demand growth.

- Focus on non-pharmacological prophylaxis will strengthen as concerns about anticoagulant-related bleeding rise.

- Hospitals will continue to be the dominant end-user segment, but home healthcare adoption will grow rapidly.

- Manufacturers will invest in affordable solutions to penetrate cost-sensitive regions and expand access.

- Strategic collaborations and partnerships will increase to improve distribution networks and training programs.

- Regulatory support for thromboprophylaxis initiatives will further accelerate adoption across healthcare systems globally.