Market Overview

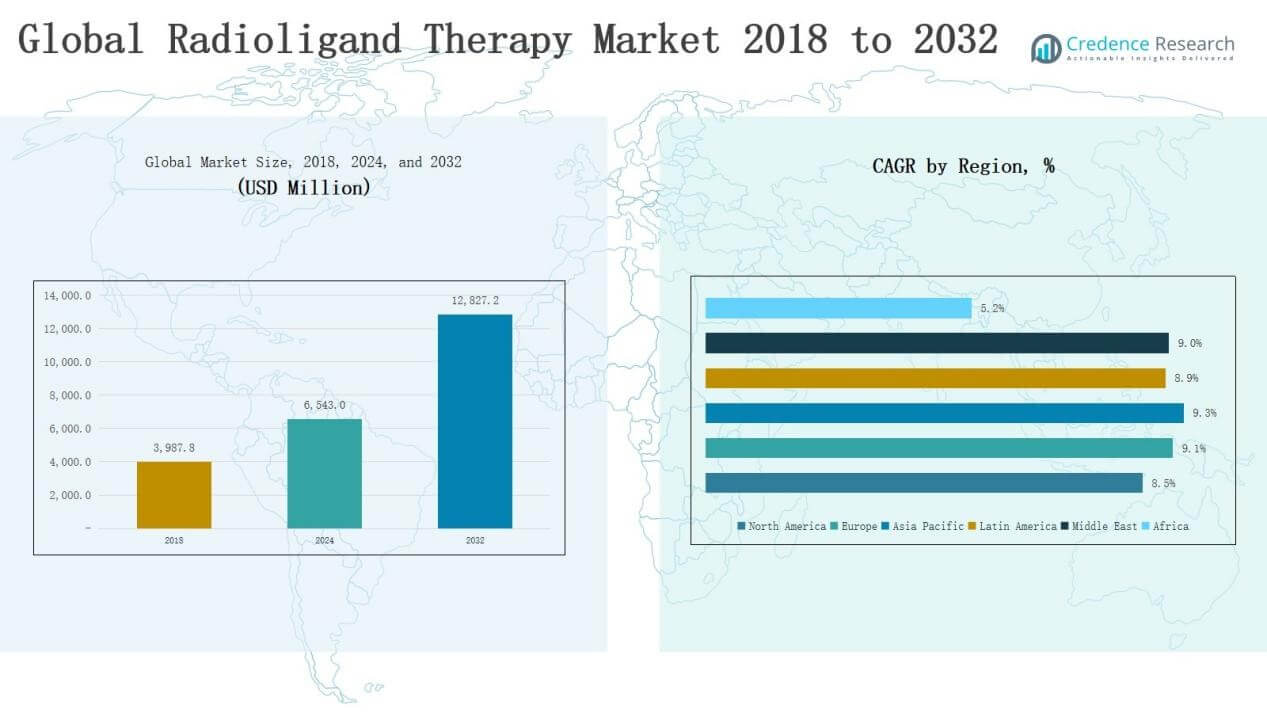

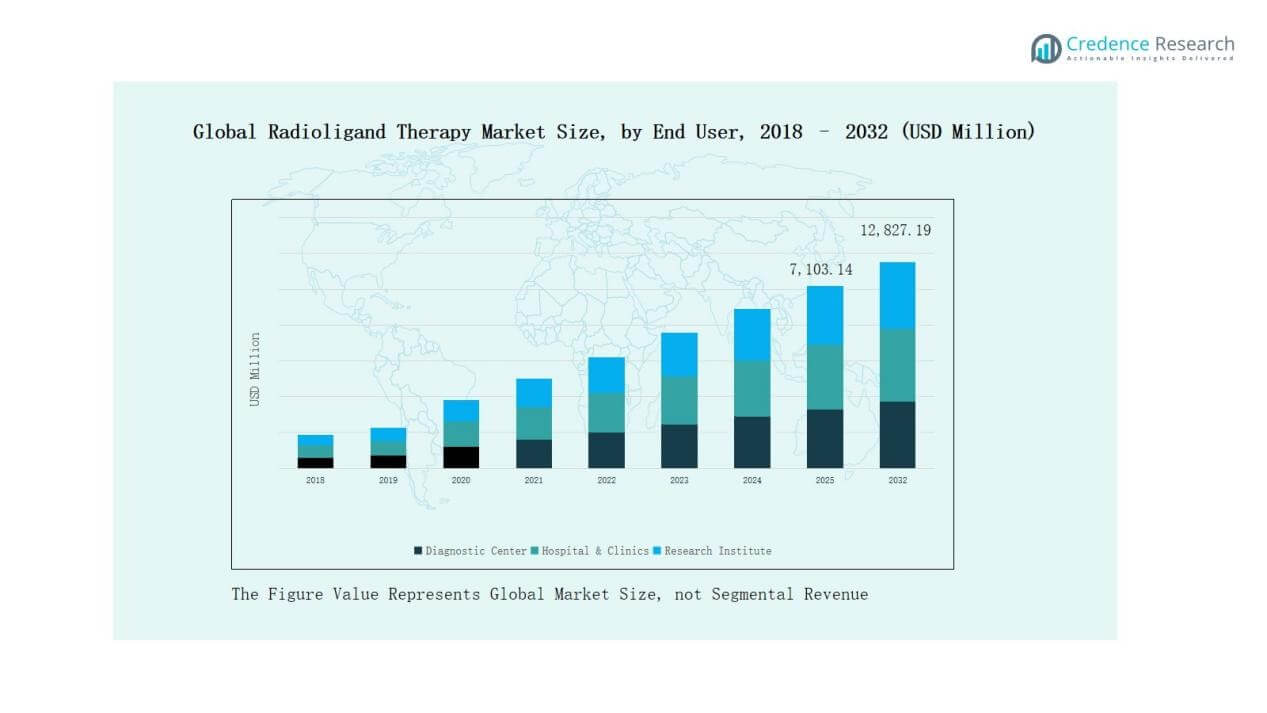

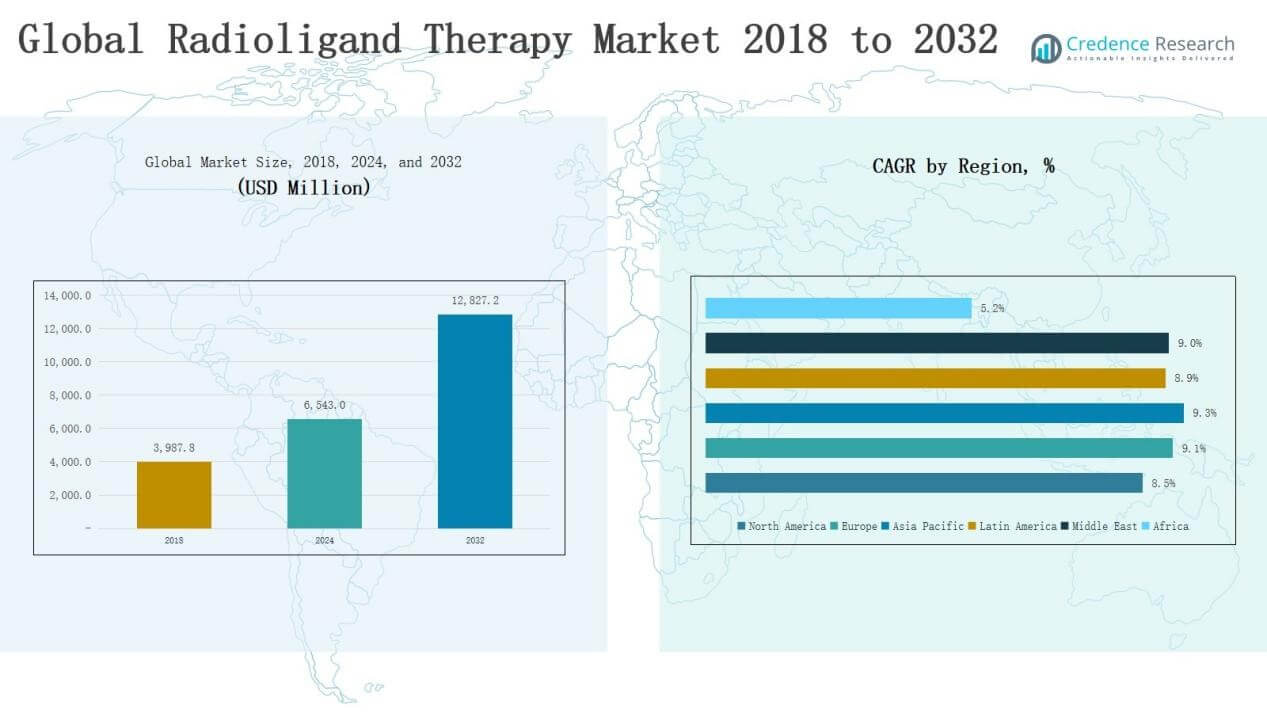

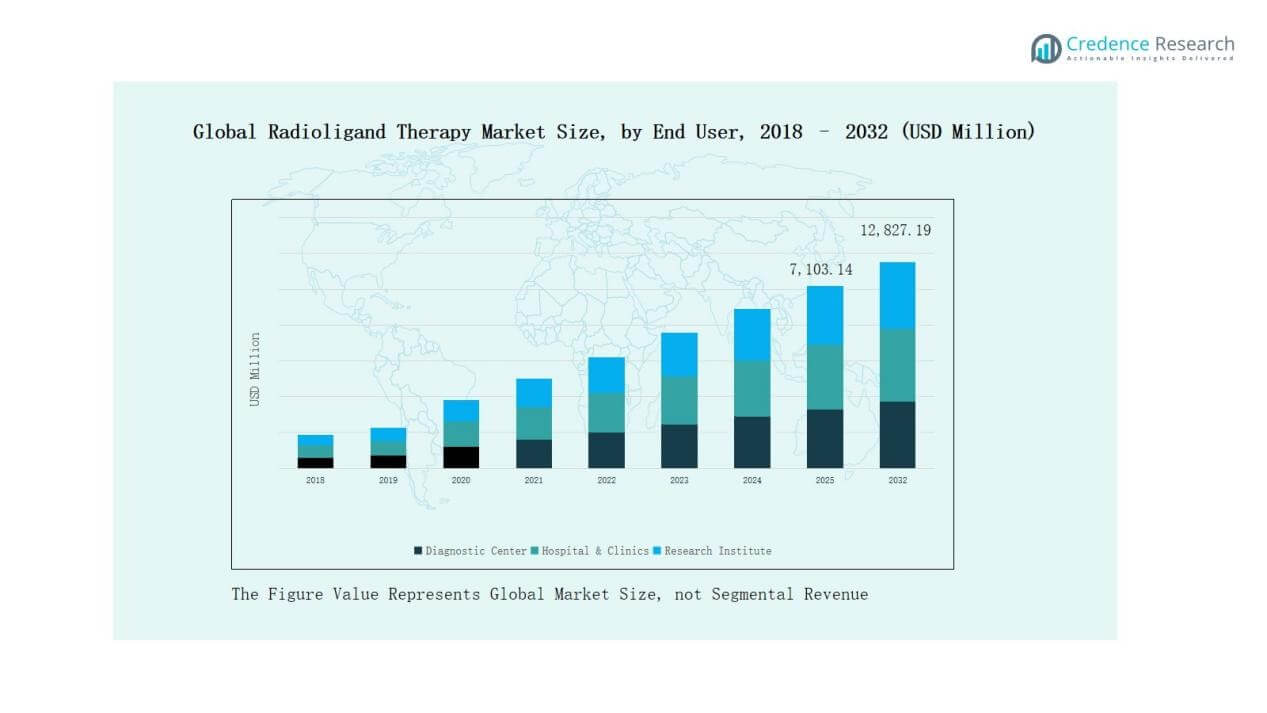

Global Radioligand Therapy Market size was valued at USD 3,987.8 million in 2018, rising to USD 6,543.0 million in 2024, and is anticipated to reach USD 12,827.2 million by 2032, at a CAGR of 8.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Radioligand Therapy Market Size 2024 |

USD 6,543.0 Million |

| Radioligand Therapy Market, CAGR |

8.81% |

| Radioligand Therapy Market Size 2032 |

USD 12,827.2 Million |

The Global Radioligand Therapy Market is shaped by leading companies such as Novartis AG, Bayer, Curium LLC, Eli Lilly and Company, Telix Pharmaceuticals Limited, Fusion Pharma, and Artios Pharma, along with other emerging players focusing on targeted radiopharmaceuticals. These companies drive competition through strong product pipelines, regulatory approvals, strategic collaborations, and advancements in isotope technologies. North America emerged as the leading region in 2024, commanding 36.9% of the global market share, supported by advanced healthcare infrastructure, favorable reimbursement policies, and high adoption of novel radioligand therapies.

Market Insights

Market Insights

- The Global Radioligand Therapy Market was valued at USD 3,987.8 million in 2018, reached USD 6,543.0 million in 2024, and is projected at USD 12,827.2 million by 2032.

- Novartis AG, Bayer, Curium LLC, Eli Lilly and Company, Telix Pharmaceuticals, Fusion Pharma, and Artios Pharma lead the market with strong pipelines and strategic collaborations.

- By isotopes, Fluorine-18 holds 42% share, followed by Lutetium-177 at 28% and Gallium-68 at 15%, with the rest covered by alpha-emitting therapies.

- By target, PSMA dominates with over 55% share, while SSTR holds 25%, EGFR about 10%, and other emerging molecular targets account for the remaining 10%.

- North America led with USD 2,413.81 million in 2024, supported by advanced healthcare systems, while Europe and Asia Pacific followed as key growth regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Isotopes Segment

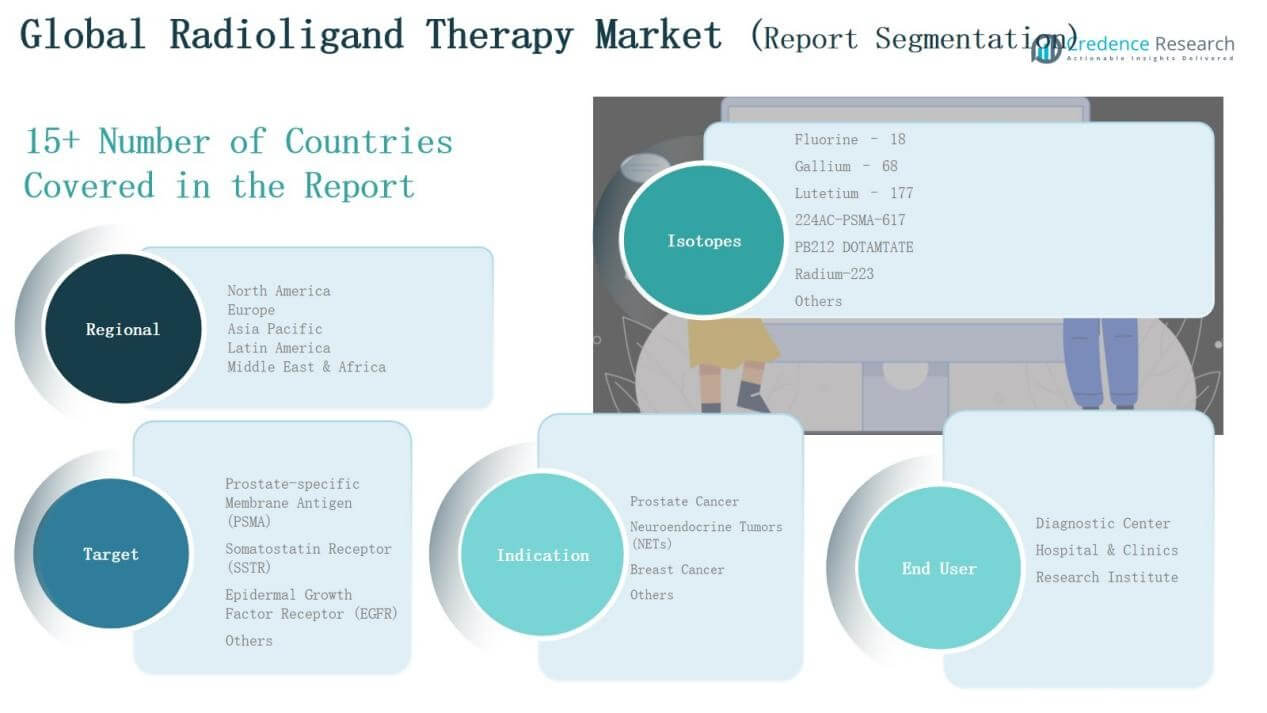

Fluorine-18 accounts for the largest share at around 42% of the isotopes market, driven by its extensive application in PET imaging and strong adoption in oncology diagnostics. Lutetium-177 follows with about 28% share, showing rapid growth due to its proven effectiveness in treating PSMA-positive prostate cancer and neuroendocrine tumors. Gallium-68 contributes approximately 15%, supported by rising use in diagnostic radiopharmaceuticals. The remaining isotopes, including 224AC-PSMA-617, PB212 DOTAMTATE, Radium-223, and others, collectively hold about 15% share, with growth expected from clinical advances in alpha-emitting therapies.

For instance, Telix Pharmaceuticals received FDA approval for Illuccix® (Ga-68 gozetotide), a PET imaging agent for prostate cancer, marking significant adoption of Gallium-68 tracers in diagnostics.

By Target Segment

Prostate-Specific Membrane Antigen (PSMA) dominates the target segment with over 55% share, supported by high incidence of prostate cancer and recent product approvals. Somatostatin Receptor (SSTR) represents around 25% share, driven by established use in neuroendocrine tumor treatments. Epidermal Growth Factor Receptor (EGFR) accounts for roughly 10% share, while other emerging molecular targets make up the remaining 10%, reflecting ongoing pipeline development.

For instance, Novartis received U.S. FDA approval for Pluvicto (lutetium Lu 177 vipivotide tetraxetan), a PSMA-targeted radioligand therapy for metastatic castration-resistant prostate cancer.

By Indication Segment

Prostate Cancer is the leading indication, holding nearly 50% share of the global market, supported by large patient pool and growing PSMA-targeted therapy adoption. Neuroendocrine Tumors (NETs) contribute about 30% share, driven by rising prevalence and effective therapies such as Lutetium-177-based treatments. Breast Cancer holds around 10% share, reflecting early-stage adoption of radioligand applications. The “Others” category, covering lymphoma, lung, and pancreatic cancers, makes up the remaining 10%, with steady growth expected as new targets gain clinical validation.

Key Growth Drivers

Rising Incidence of Cancer

The increasing prevalence of prostate cancer and neuroendocrine tumors strongly drives market demand for radioligand therapy. Growing cancer incidence worldwide, coupled with aging populations, creates a large patient base for targeted radionuclide treatments. Screening programs, awareness campaigns, and advanced diagnostic tools further support early detection, boosting adoption of radioligand therapies. The clear therapeutic benefits, including precision targeting and improved patient outcomes, position this treatment as a preferred option, thereby fueling sustained market growth across developed and emerging regions.

For instance, ITM Isotope Technologies Munich collaborated with Chengdu Gaotong Isotope Co. in China to expand clinical supply of lutetium-177, strengthening global access to therapeutic radionuclides used in radioligand treatments.

Advancements in Radiopharmaceutical Technology

Rapid innovations in isotopes and molecular targeting agents strengthen the appeal of radioligand therapy. Lutetium-177, Gallium-68, and alpha-emitting isotopes provide enhanced therapeutic efficacy, safety, and imaging accuracy. Improved production, supply chain efficiency, and radiopharmacy facilities enable broader availability of these isotopes. The integration of PET and SPECT technologies further enhances treatment monitoring and personalized medicine. These advancements not only improve therapeutic outcomes but also expand potential applications beyond prostate and neuroendocrine tumors, significantly contributing to future market expansion.

For instance, the FDA approved lutetium-177 PSMA-617 for patients with PSMA-positive metastatic prostate cancer, marking a regulatory milestone that broadened access to this effective targeted therapy.

Regulatory Approvals and Clinical Success

Regulatory endorsements and successful clinical trial outcomes accelerate the adoption of radioligand therapy globally. Approvals of treatments like Lutathera and Pluvicto validate the clinical effectiveness of targeted radionuclide therapies. Favorable results from ongoing Phase II and Phase III trials support wider use across multiple cancer types. Regulatory incentives, such as orphan drug designations and fast-track approvals, encourage pharmaceutical companies to invest in R&D. This pipeline momentum, coupled with increasing insurance coverage, ensures broader patient access and drives consistent market growth.

Key Trends & Opportunities

Key Trends & Opportunities

Expansion into New Indications

Radioligand therapy is moving beyond prostate and neuroendocrine tumors into breast, lung, and hematologic cancers. Strong clinical pipelines and early positive results support this expansion. As researchers identify novel molecular targets, new radiopharmaceuticals are being developed to address unmet medical needs. This diversification creates strong opportunities for pharmaceutical companies and enhances the therapy’s overall market scope. Expanding indications ensure long-term sustainability, opening pathways to treat multiple tumor types with higher precision and lower toxicity compared to conventional treatments.

For instance, Clovis Oncology announced encouraging early clinical results of its radioligand candidate FAP-2286, targeting fibroblast activation protein, showing potential application in breast, lung, and pancreatic tumors.

Strategic Collaborations and Partnerships

Collaborations between pharmaceutical companies, diagnostic firms, and research institutes are creating growth opportunities in the market. Partnerships focus on co-developing novel ligands, improving isotope production, and expanding commercialization capabilities. Alliances also address supply chain challenges, ensuring wider accessibility of radioligand therapies in both mature and emerging markets. These partnerships accelerate innovation, reduce time-to-market, and strengthen global distribution networks. As more companies join forces, the competitive landscape intensifies, supporting advancements in precision oncology and reinforcing the therapy’s clinical and commercial value.

For instance, , Eli Lilly entered a strategic collaboration with POINT Biopharma to co-develop and commercialize radioligand therapies for prostate cancer, with Lilly providing up to $1.4 billion in potential milestone payments.

Key Challenges

High Cost of Treatment and Isotope Production

The significant cost of radioligand therapies remains a major barrier to adoption, particularly in price-sensitive regions. Isotope production requires specialized infrastructure, strict regulatory compliance, and advanced facilities, which increase operational expenses. Patients and healthcare providers face high treatment costs, limiting accessibility despite proven therapeutic benefits. Reimbursement coverage varies widely across regions, further complicating adoption. Unless production and distribution costs decrease, affordability issues will remain a critical challenge, restricting the widespread clinical adoption of radioligand therapy.

Limited Isotope Supply and Distribution Barriers

Radioligand therapy relies on timely isotope availability, but global supply remains constrained. Production capacity for Lutetium-177, Gallium-68, and alpha emitters is limited due to dependence on nuclear reactors and specialized facilities. Short half-lives of isotopes complicate storage and transport, requiring robust distribution networks. Emerging markets particularly face accessibility issues due to limited radiopharmacy infrastructure. These constraints create bottlenecks in treatment delivery, slowing down adoption rates. Expanding isotope supply chains is essential to support the market’s long-term scalability.

Regulatory and Safety Complexities

Strict regulatory frameworks governing the use, handling, and disposal of radioactive materials pose operational challenges. Compliance with radiation safety standards requires significant investment in training, facilities, and monitoring systems. These regulations often delay product approvals and lengthen time-to-market for new therapies. Moreover, safety concerns regarding radiation exposure create hesitation among healthcare providers and patients. Without streamlined regulatory processes and clear safety protocols, market players face obstacles in accelerating product commercialization and scaling radioligand therapy adoption globally.

Regional Analysis

North America

The North America market was valued at USD 1,497.82 million in 2018, rising to USD 2,413.81 million in 2024, and is projected to reach USD 4,617.79 million by 2032, growing at a CAGR of 8.5%. Growth is driven by advanced healthcare infrastructure, high prevalence of prostate and neuroendocrine cancers, and strong regulatory support for novel therapies. The U.S. leads adoption, supported by extensive clinical trial activity, early product approvals, and favorable reimbursement policies, making North America the largest regional contributor.

Europe

Europe recorded a market size of USD 1,081.09 million in 2018, expanding to USD 1,799.61 million in 2024, and is forecasted to reach USD 3,595.46 million by 2032 at a CAGR of 9.1%. The region benefits from established nuclear medicine infrastructure, strong research networks, and widespread use of Lutetium-177 therapies across Germany, France, and the UK. Favorable regulations and government-backed cancer care programs further reinforce growth, positioning Europe as the second-largest market with consistent expansion.

Asia Pacific

The Asia Pacific market was valued at USD 825.48 million in 2018, increasing to USD 1,390.85 million in 2024, and is expected to reach USD 2,821.98 million by 2032, at the fastest CAGR of 9.3%. Rising cancer incidence, expanding healthcare access, and growing investments in nuclear medicine infrastructure are driving demand. China, Japan, India, and South Korea are the key growth engines, supported by increasing collaborations, diagnostic facility expansion, and medical tourism, making Asia Pacific the fastest-growing region globally.

Latin America

Latin America registered USD 297.09 million in 2018, increasing to USD 490.54 million in 2024, and projected to reach USD 969.74 million by 2032, growing at a CAGR of 8.9%. Brazil and Mexico dominate the regional market due to improving oncology care facilities and rising investments in radiopharmaceutical supply chains. Although infrastructure limitations remain, ongoing clinical trials, international collaborations, and increased awareness of advanced cancer therapies support steady market expansion.

Middle East

The Middle East market was valued at USD 186.23 million in 2018, rising to USD 308.64 million in 2024, and is anticipated to reach USD 613.14 million by 2032, at a CAGR of 9.0%. Growth is supported by rising investments in healthcare infrastructure, particularly in Saudi Arabia, the UAE, and Israel. Expanding diagnostic imaging centers, adoption of radionuclide therapies, and a strong research base in Israel drive regional development, making the Middle East a promising emerging market.

Africa

Africa recorded USD 100.09 million in 2018, increasing to USD 139.55 million in 2024, and is projected to reach USD 209.08 million by 2032, at a slower CAGR of 5.2%. Limited access to nuclear medicine facilities, high treatment costs, and uneven healthcare infrastructure restrain rapid adoption. South Africa and Egypt lead the regional market, while most other countries face challenges in availability and affordability. Gradual investments and international collaborations may improve growth prospects in the long term.

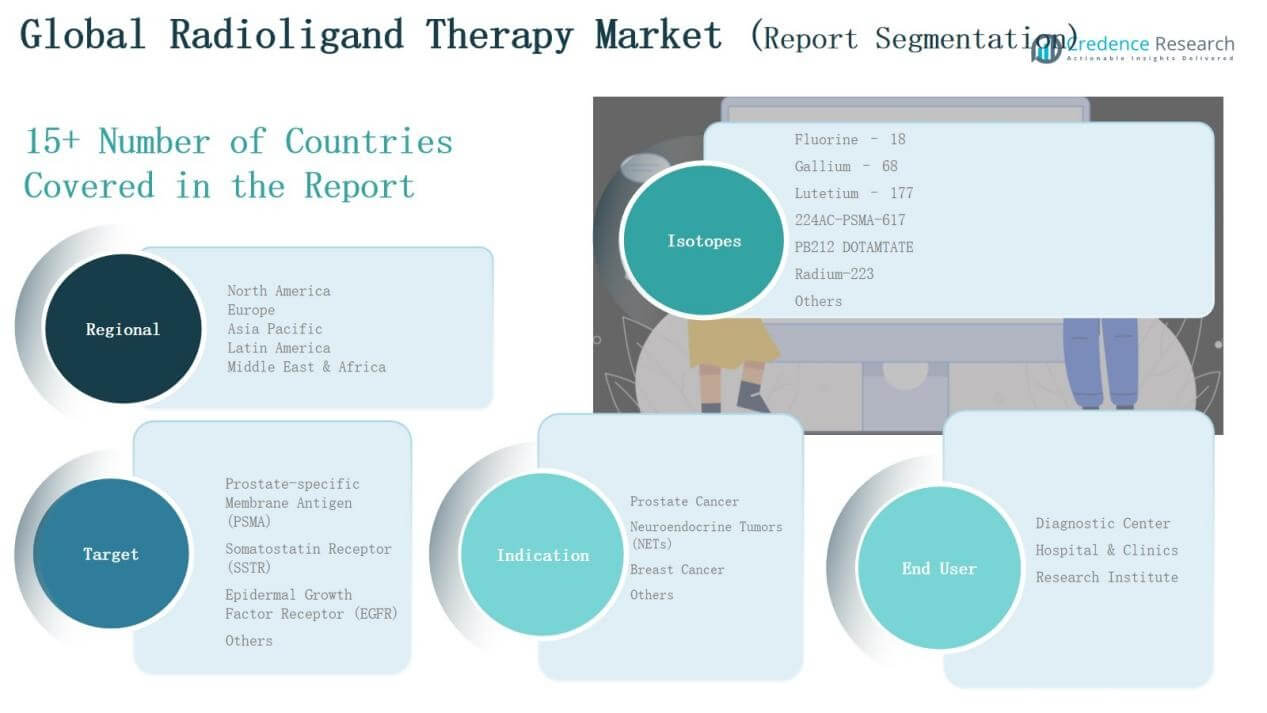

Market Segmentations:

Market Segmentations:

By Isotopes

- Fluorine-18

- Gallium-68

- Lutetium-177

- 224AC-PSMA-617

- PB212 DOTAMTATE

- Radium-223

- Others

By Target

- Prostate-specific Membrane Antigen (PSMA)

- Somatostatin Receptor (SSTR)

- Epidermal Growth Factor Receptor (EGFR)

- Others

By Indication

- Prostate Cancer

- Neuroendocrine Tumors (NETs)

- Breast Cancer

- Others

By End User

- Diagnostic Centers

- Hospitals & Clinics

- Research Institutes

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The Global Radioligand Therapy Market features strong competition led by multinational pharmaceutical companies and emerging biotechnology firms. Novartis AG and Bayer dominate with established products such as Lutathera and Xofigo, supported by strong clinical pipelines and extensive global distribution networks. Companies like Curium LLC, Telix Pharmaceuticals, and Fusion Pharma focus on expanding therapeutic applications and securing regulatory approvals across multiple regions. Eli Lilly and Company and Artios Pharma are strengthening their presence through acquisitions, partnerships, and research investments in novel isotopes and targeted ligands. The market is characterized by significant R&D spending, collaboration between pharma and diagnostic firms, and growing interest in alpha-emitting radiopharmaceuticals. Strategic alliances with academic institutes and contract manufacturing organizations help overcome isotope supply challenges and accelerate commercialization. Competition is expected to intensify as clinical success in new indications expands therapeutic scope, while cost reduction and improved accessibility remain key differentiators among market players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Novartis AG

- Bayer

- Curium LLC

- Eli Lilly and Company

- Telix Pharmaceuticals Limited

- Fusion Pharma

- Artios Pharma

- Other Key Players

Recent Developments

- In March 2025, Novartis received FDA approval to expand Pluvicto (lutetium-177 vipivotide tetraxetan) for PSMA-positive mCRPC patients eligible for treatment prior to chemotherapy.

- In June 2025, Nordic Capital partnered with Minerva Imaging to accelerate global growth in radiopharmaceutical development and build a stronger CRO/CDMO platform.

- In 2025, Eli Lilly & Co., through its acquisition of Point Biopharma, entered the radioligand therapy market with late-stage candidates like PNT2002 for prostate cancer and PNT2003 for neuroendocrine tumors, bolstering its oncology portfolio.

- In 2023, Bristol Myers Squibb acquired RayzeBio for $4.1 billion, marking a significant acquisition in the radioligand therapy space.

Report Coverage

The research report offers an in-depth analysis based on Isotopes, Targets, Indication, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow as cancer prevalence continues to rise worldwide.

- Adoption will expand with wider regulatory approvals of new therapies.

- Advances in isotope production will improve supply reliability and accessibility.

- Clinical trials will broaden therapeutic applications beyond prostate and neuroendocrine tumors.

- Strategic collaborations will accelerate innovation and strengthen global distribution networks.

- Hospitals and diagnostic centers will increasingly integrate radioligand therapy into oncology care.

- Emerging markets will adopt radioligand therapy as healthcare infrastructure improves.

- Personalized medicine approaches will drive demand for targeted radionuclide therapies.

- Rising investment in alpha-emitting isotopes will create new treatment opportunities.

- Competitive intensity will increase as biotech startups and large pharma expand pipelines.

Market Insights

Market Insights Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: