Market Overview:

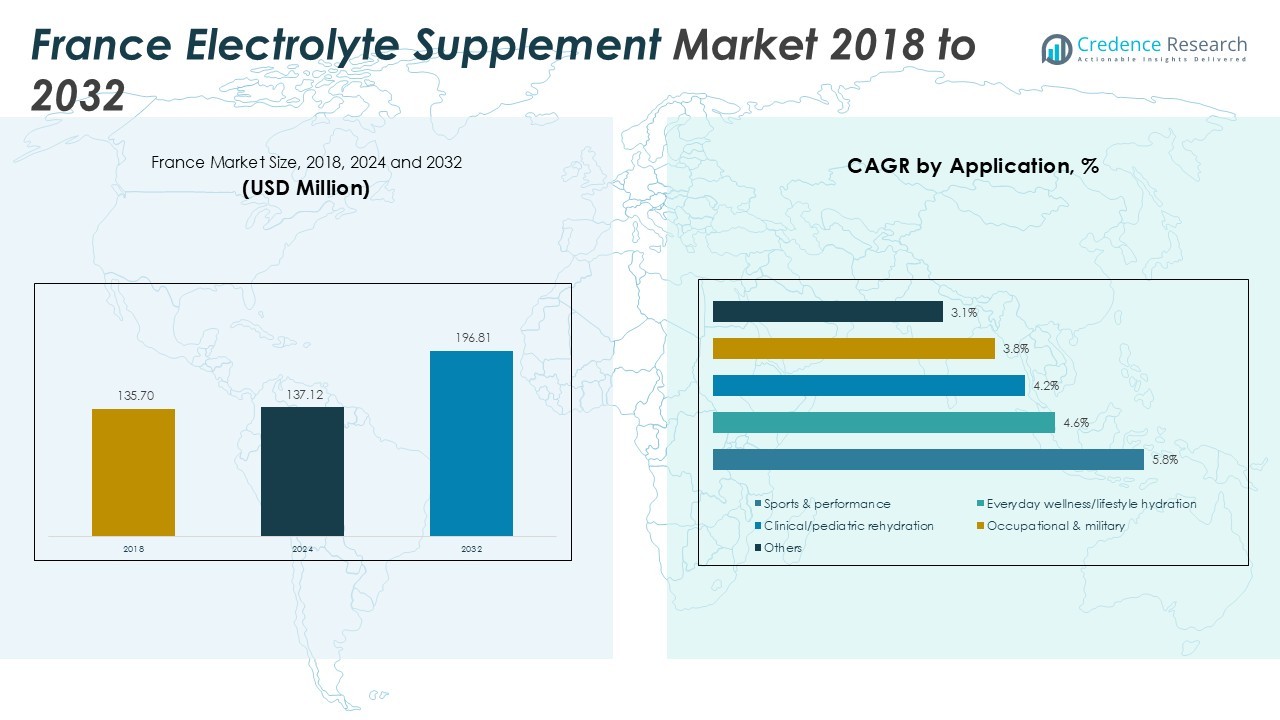

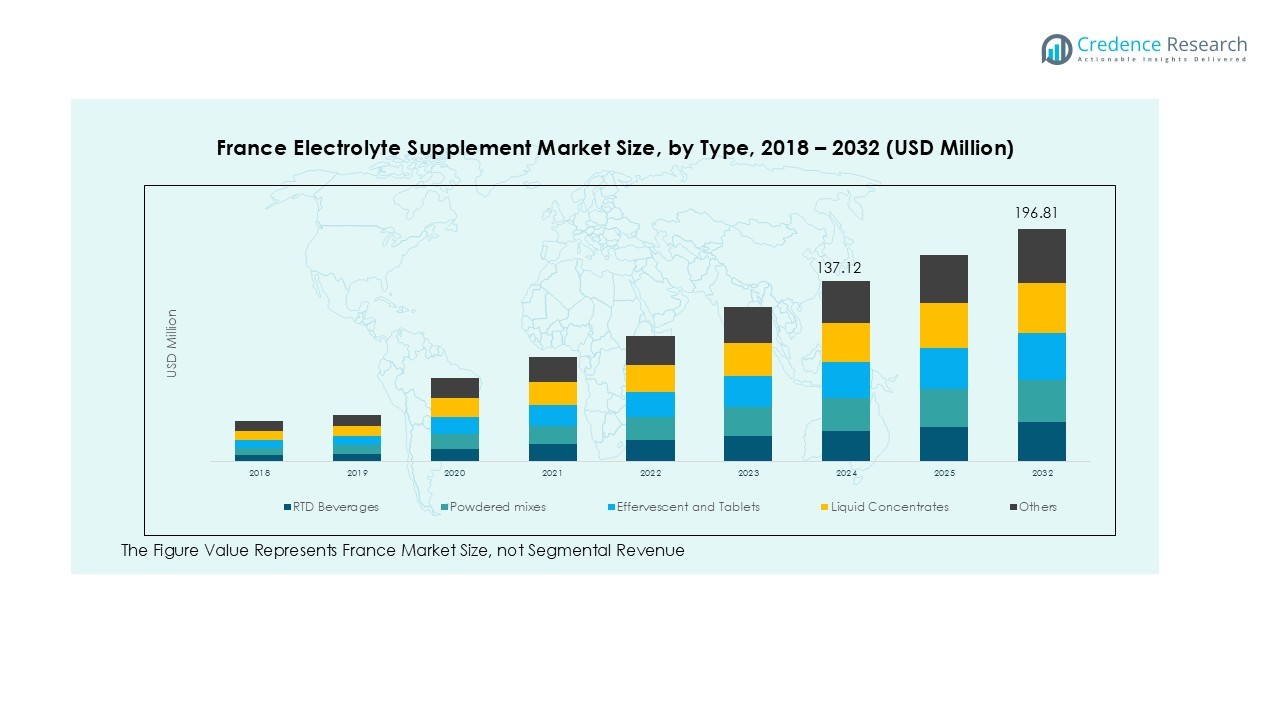

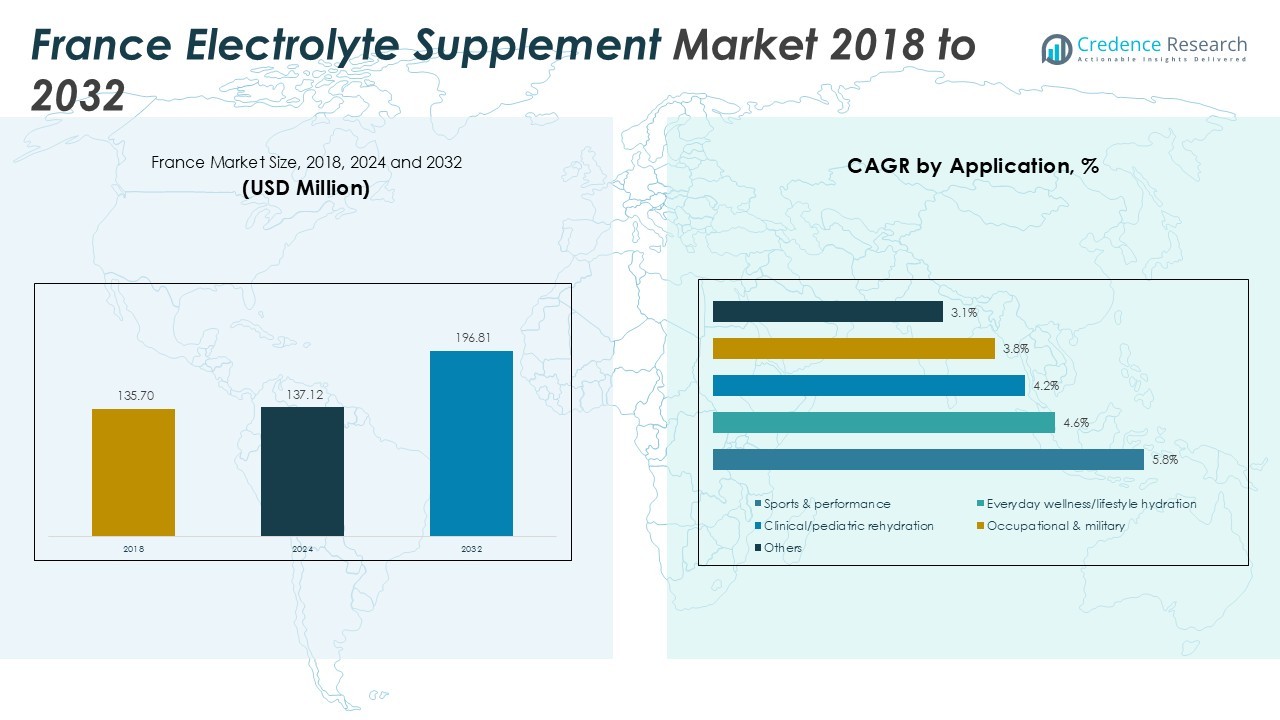

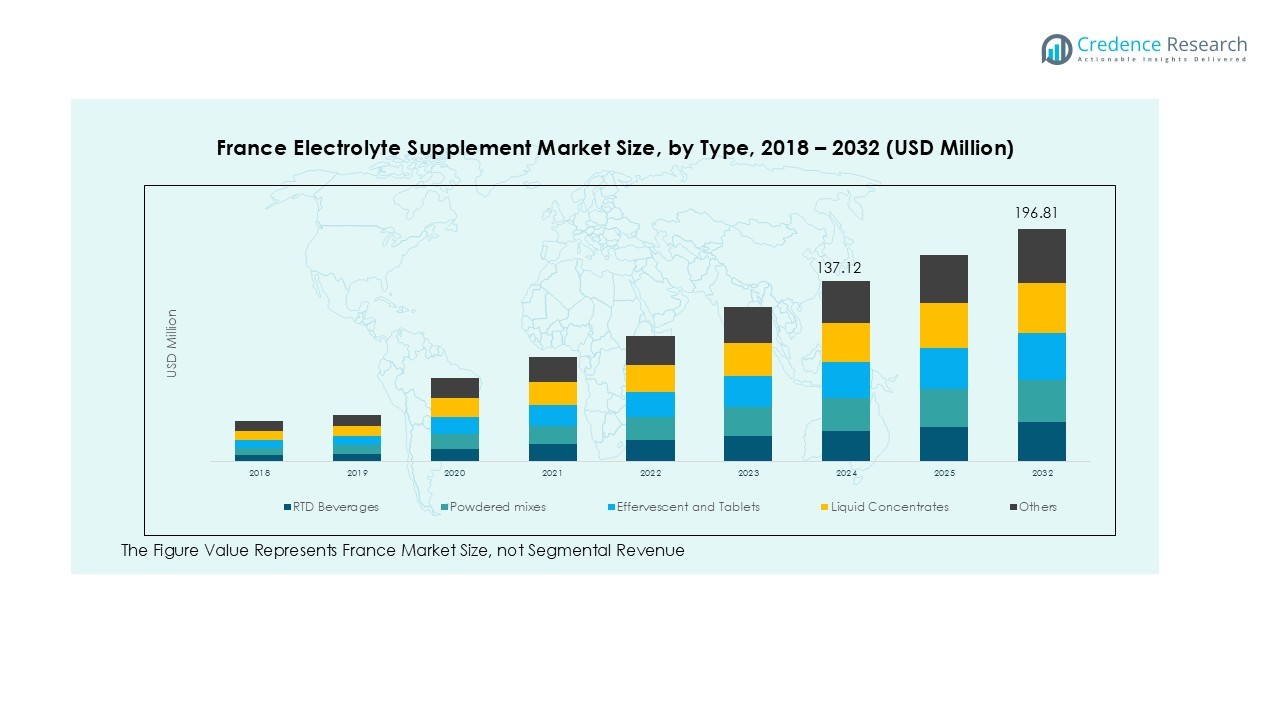

The France Electrolyte Supplement size was valued at USD 135.70 million in 2018 to USD 137.12 million in 2024 and is anticipated to reach USD 196.81 million by 2032, at a CAGR of 4.62% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Electrolyte Supplement Market Size 2024 |

USD 137.12 Million |

| France Electrolyte Supplement Market, CAGR |

4.62% |

| France Electrolyte Supplement Market Size 2032 |

USD 196.81 Million |

Key drivers of the market include the rising popularity of sports drinks and powders, especially among athletes and fitness enthusiasts. Furthermore, the growing prevalence of health conditions such as dehydration and muscle cramps has increased the consumption of electrolyte supplements. The shift towards natural and organic supplements is also a prominent trend, aligning with consumer preferences for clean and functional foods. These factors combined have resulted in a higher adoption rate across various consumer groups.

In terms of regional distribution, the market is dominated by England, which accounts for a significant share due to a high concentration of sports and fitness enthusiasts. London, in particular, leads the market, supported by its large population and active lifestyle trends. Other regions, including Scotland and Wales, are also witnessing steady growth as consumer demand for fitness and wellness products continues to rise.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The France Electrolyte Supplement Market was valued at USD 135.70 million in 2018 and is expected to reach USD 196.81 million by 2032, growing at a CAGR of 4.62%.

- Increased health-consciousness is driving demand for electrolyte supplements, particularly among athletes and fitness enthusiasts.

- Rising health issues like dehydration and muscle cramps have significantly boosted the consumption of electrolyte supplements.

- There is a growing preference for natural, plant-based, and organic electrolyte supplements, aligning with clean-label trends.

- The market benefits from wider accessibility through both e-commerce platforms and physical retail outlets.

- Regulatory challenges and the demand for ingredient transparency are significant factors affecting product development and market entry.

- England leads the market with a 34% share, driven by a high concentration of health-conscious individuals and active lifestyles.

Market Drivers:

Increasing Demand for Health and Fitness Products

The growing health-consciousness among consumers has significantly boosted the France Electrolyte Supplement Market. More individuals are turning to fitness regimes, resulting in greater consumption of sports drinks and supplements. Athletes, gym-goers, and health enthusiasts are increasingly seeking electrolyte-rich products to enhance performance and recover from exertion. This shift towards healthier lifestyles supports the demand for products that aid in rehydration and replenish essential minerals after physical activities.

- For instance, a study involving the energy drink Red Bull showed that it enabled elite field hockey players to increase their high-intensity running distance to 358 meters.

Prevalence of Health Conditions Driving Supplement Consumption

Rising health issues like dehydration and muscle cramps have created a higher demand for electrolyte supplements in France. With more consumers seeking solutions to manage these conditions, the market has gained significant traction. Electrolyte imbalances, commonly caused by heat, intense physical activities, and certain medical conditions, contribute to the market’s growth. As consumers become more proactive in managing their health, electrolyte supplements are viewed as essential for maintaining hydration and muscle function.

Shift Towards Natural and Organic Supplements

The trend toward natural and organic products has shaped the France Electrolyte Supplement Market. Consumers are increasingly inclined to choose clean, plant-based supplements free from artificial additives and preservatives. This preference for organic ingredients drives the market as companies respond with cleaner, healthier electrolyte options. This shift is in line with the overall demand for functional foods that offer additional health benefits and align with consumers’ clean-label preferences.

- For instance, in February 2025, the French biotechnology company Valbiotis launched Valbiotis PRO Metabolic Health, a plant-based dietary supplement with a patented active ingredient validated by 4 separate clinical trials.

Growing Availability Through Online and Retail Channels

The France Electrolyte Supplement Market benefits from the increasing availability of products through diverse sales channels. With more retailers offering a variety of electrolyte supplements both online and in-store, consumers have easy access to these products. E-commerce platforms, in particular, provide convenient purchasing options and delivery, further expanding the market’s reach. This wide availability ensures that products are accessible to a broader consumer base, supporting the continued growth of the market.

Market Trends:

Rise in Demand for Electrolyte Supplements Among Non-Athletes

A significant trend in the France Electrolyte Supplement Market is the growing demand from non-athletes seeking to improve their health and well-being. Traditionally, electrolyte supplements were popular primarily among athletes and fitness enthusiasts. However, increasing awareness of the importance of hydration and electrolyte balance has driven more consumers, including office workers and individuals with busy lifestyles, to adopt these products. This trend reflects a broader shift in health-conscious behaviors, with many people seeking supplements to address fatigue, dehydration, and improve overall energy levels. As this consumer base continues to expand, companies are adapting their product offerings to meet the diverse needs of these new users.

- For instance, in a clinical study on hydration, participants consuming only water experienced a body weight loss of 0.57 kg over four hours, while those consuming water with Nuun electrolyte tablets lost only 0.38 kg, indicating improved fluid balance.

Innovation in Electrolyte Supplement Formats and Ingredients

The France Electrolyte Supplement Market is also experiencing innovation in product formats and ingredients. Manufacturers are introducing a wide range of products, including electrolyte tablets, powders, and ready-to-drink beverages, catering to varying consumer preferences. Furthermore, there is a growing focus on incorporating clean, natural ingredients into these supplements, such as coconut water, sea salt, and plant-based electrolytes. This trend is closely tied to the rising demand for organic and natural products, with consumers increasingly prioritizing healthier, sustainable options. The emphasis on innovative formats and ingredient transparency is expected to drive product differentiation and foster continued growth in the market.

- For instance, in 2025, the Korean company Enchem will establish a new electrolyte production facility in Dunkirk, which is set to create 100 jobs by 2026 and bolster the region’s battery manufacturing ecosystem.

Market Challenges Analysis:

Regulatory Challenges and Ingredient Transparency

One of the main challenges in the France Electrolyte Supplement Market is navigating the complex regulatory environment surrounding dietary supplements. Manufacturers must comply with stringent guidelines set by French and European authorities to ensure product safety and efficacy. The use of certain ingredients and claims about health benefits are subject to rigorous testing and approval processes. This can delay product launches and increase costs for companies. Moreover, consumers are increasingly seeking transparency regarding the ingredients used in supplements, placing additional pressure on manufacturers to meet strict labeling and certification standards.

Competition and Market Saturation

The France Electrolyte Supplement Market faces intense competition, particularly with the growing number of brands entering the space. Many of these brands offer similar products, making it difficult for companies to differentiate themselves. With low barriers to entry, new entrants constantly introduce innovative formulations and packaging, further intensifying the competition. This saturation makes it challenging for established players to maintain market share and command premium prices. In a crowded market, companies must invest heavily in marketing, innovation, and brand loyalty to stay competitive.

Market Opportunities:

Expansion of Product Offerings for Non-Sporting Segments

A key opportunity in the France Electrolyte Supplement Market lies in catering to the growing demand from non-athletic consumers. With increasing awareness about health and wellness, consumers are looking for supplements that can improve daily hydration, energy, and overall health. Companies can expand their product portfolios to include electrolyte supplements targeting specific health concerns, such as stress reduction, immune support, and digestive health. Tailoring products for everyday consumers, beyond athletes, allows brands to tap into a broader market base and drive long-term growth.

Leveraging E-Commerce and Direct-to-Consumer Models

The rise of e-commerce presents significant opportunities for the France Electrolyte Supplement Market. With a growing number of consumers preferring online shopping for its convenience, brands can reach a wider audience through digital channels. Direct-to-consumer models, such as subscription services and personalized supplement kits, are also gaining popularity. These models allow companies to build stronger customer relationships, offer customized products, and enhance brand loyalty. Expanding online presence and adopting such business models will enable companies to capture more market share and offer greater convenience to their customers.

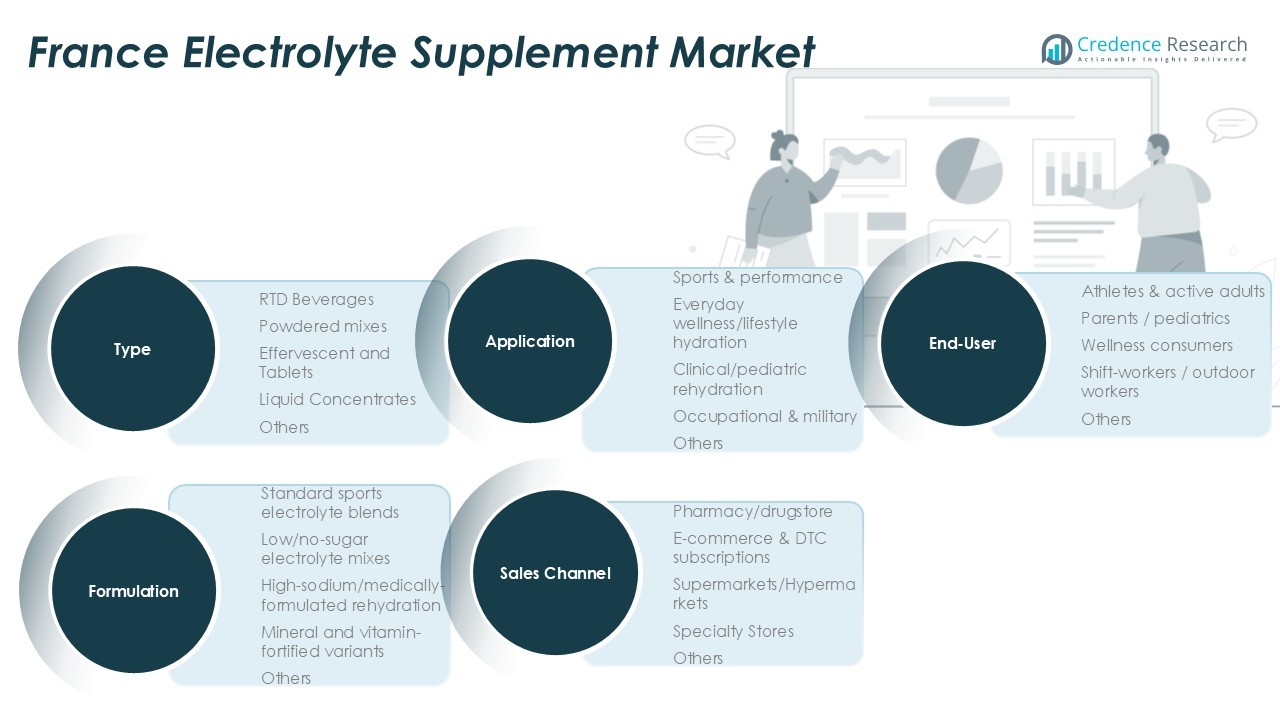

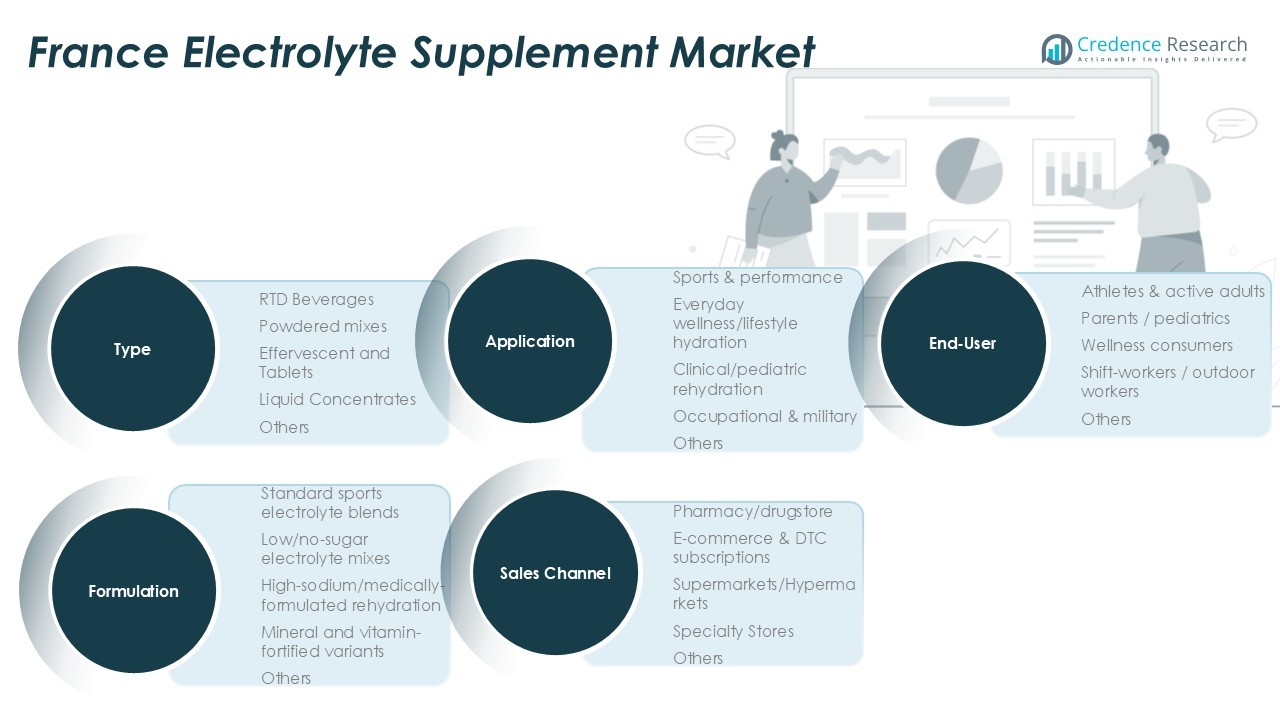

Market Segmentation Analysis:

By Type Segment Analysis

The France Electrolyte Supplement Market is segmented by type into RTD beverages, powdered mixes, effervescent and tablets, liquid concentrates, and others. RTD beverages dominate the market, offering convenience and ease of consumption for on-the-go hydration. Powdered mixes are also widely popular, providing flexibility in serving sizes and customization. Effervescent tablets and liquid concentrates offer quick dissolution and absorption, catering to specific consumer preferences. The growing trend towards convenience and portability in electrolyte supplements is expected to continue driving demand across these segments.

By Application Segment Analysis

The France Electrolyte Supplement Market is primarily driven by sports & performance, everyday wellness/lifestyle hydration, clinical/pediatric rehydration, and occupational & military applications. The sports & performance segment leads the market, driven by athletes and fitness enthusiasts seeking to replenish electrolytes during intense physical activity. Everyday wellness and lifestyle hydration products are growing in popularity, with consumers increasingly incorporating supplements into their daily routines. Clinical and pediatric rehydration applications are gaining traction as more health-conscious parents prioritize hydration for children. Occupational and military applications are also expanding as workers in physically demanding jobs require effective hydration solutions.

- For instance, PowerBar’s 5 Electrolytes sports drink specifies that athletes should consume 150-200ml every 15 minutes during a workout to ensure optimal hydration.

By End-User Segment Analysis

The France Electrolyte Supplement Market is segmented by end-users into athletes & active adults, parents/pediatrics, wellness consumers, and shift-workers/outdoor workers. Athletes and active adults form the largest group, relying on electrolyte supplements to support their physical performance. Parents are increasingly purchasing electrolyte supplements for their children to manage dehydration and muscle cramps. Wellness consumers, seeking better overall hydration and health, are contributing to market growth. Shift-workers and outdoor workers, who face higher risks of dehydration, are also a significant consumer group. These end-users are driving increased demand across various product categories.

- For instance, the French company Baouw Organic Nutrition has developed electrolyte tablets for athletes that deliver 706 mg of total electrolytes per tablet, a formulation designed to effectively balance mineral losses during physical exertion.

Segmentations:

By Type Segment Analysis:

- RTD Beverages

- Powdered Mixes

- Effervescent and Tablets

- Liquid Concentrates

- Others

By Application Segment Analysis:

- Sports & Performance

- Everyday Wellness/Lifestyle Hydration

- Clinical/Pediatric Rehydration

- Occupational & Military

- Others

By End-User Segment Analysis:

- Athletes & Active Adults

- Parents/Pediatrics

- Wellness Consumers

- Shift-Workers/Outdoor Workers

- Others

By Formulation Segment Analysis:

- Standard Sports Electrolyte Blends

- Low/No-Sugar Electrolyte Mixes

- High-Sodium/Medically-Formulated Rehydration

- Mineral and Vitamin-Fortified Variants

- Others

By Sales Channel Segment Analysis:

- Pharmacy/Drugstore

- E-commerce & DTC Subscriptions

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Regional Analysis:

England Dominates the France Electrolyte Supplement Market

England holds the largest share of the France Electrolyte Supplement Market, accounting for 34%. The high concentration of health-conscious individuals and fitness enthusiasts in urban centers like London contributes significantly to this dominance. London’s robust fitness culture, alongside a widespread awareness of health trends, continues to drive strong demand for electrolyte supplements. The city’s active lifestyle trends further boost the market, supported by a growing number of gyms, wellness centers, and fitness programs. This dominance positions England as a key player in the market.

Growing Demand in Scotland and Wales

Scotland and Wales hold a combined share of 22% in the France Electrolyte Supplement Market. Rising consumer awareness regarding hydration and electrolyte balance is driving growth in these regions. A growing number of fitness enthusiasts in both countries are increasingly incorporating electrolyte supplements into their daily routines. This shift in consumer behavior, combined with broader acceptance of functional foods, is contributing to steady market expansion. Retailers and e-commerce platforms are enhancing product availability, providing better access to these supplements and fostering further growth.

Increasing Interest in Rural and Suburban Areas

Rural and suburban regions of France account for 15% of the France Electrolyte Supplement Market share. Increasing awareness of the benefits of electrolyte replenishment is driving demand in these areas. Consumers are incorporating supplements into their health regimens, contributing to market growth. The availability of products through physical retail outlets and online platforms ensures wider access for these regions. As the demand for healthier lifestyle choices increases, rural and suburban areas show considerable potential for future market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nestlé S.A.

- Liquid I.V.

- LyteLine LLC

- Hydralyte LLC

- First Endurance

- Atlantic Essential Products, Inc.

- Denver Bodega LLC

- Sequel Natural LLC

- Nutricost

- Vitalyte Electrolyte

- Kent Corporation

- Roar Organic

- Purity Organic, LLC

- GNC Holdings, Inc.

- Osmo Nutrition

Competitive Analysis:

The France Electrolyte Supplement Market is characterized by a competitive landscape comprising both established global brands and emerging local players. Global companies such as Nestlé S.A., PepsiCo, and Unilever PLC leverage their extensive distribution networks and brand recognition to maintain a strong market presence. These corporations offer a diverse range of products, including ready-to-drink beverages, powders, and tablets, catering to various consumer preferences. Emerging brands like Nuun Hydration, Liquid I.V., and LyteLine LLC are gaining traction by focusing on clean-label formulations, natural ingredients, and functional benefits. These companies often emphasize sustainability and wellness, appealing to health-conscious consumers seeking transparency and quality. The market is also witnessing increased competition from regional players who are innovating with localized flavors and formulations to meet specific consumer needs. Strategic partnerships, acquisitions, and direct-to-consumer models are common strategies employed by companies to enhance market reach and customer loyalty. Overall, the France Electrolyte Supplement Market remains dynamic, with companies continuously adapting to consumer trends and regulatory requirements to maintain a competitive edge.

Recent Developments:

- In September 2025, Nestlé Professional Solutions announced a partnership with Sofia Vergara and her son, Manolo Gonzalez Vergara, to launch a new line of empanadas called TOMA Empanadas for the foodservice industry.

- In February 2025, Roar Organic launched a new Dragon Fruit Punch flavor for its line of organic ready-to-drink beverages.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-User, Formulation and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The France Electrolyte Supplement Market will continue to benefit from the increasing health-consciousness among consumers.

- Rising demand for convenience and on-the-go hydration products will drive growth in RTD beverages and powdered mixes.

- Growing awareness about the importance of hydration in daily wellness routines will expand the market beyond athletic consumers.

- The shift toward natural and organic ingredients in electrolyte supplements will gain further momentum, aligning with clean-label trends.

- Consumer demand for sugar-free and low-calorie options will fuel the development of healthier electrolyte formulations.

- Innovations in packaging, such as eco-friendly and sustainable materials, will enhance product appeal among environmentally conscious consumers.

- E-commerce and direct-to-consumer models will grow in prominence, offering convenience and personalized options to a wider audience.

- The pediatric and clinical rehydration segment will expand, with more families seeking hydration solutions for children and health-conscious parents.

- Strategic partnerships and acquisitions will help companies enhance their product offerings and expand distribution channels.

- Regional players will continue to innovate with localized products and flavors, catering to specific consumer preferences in France.