Market Overview

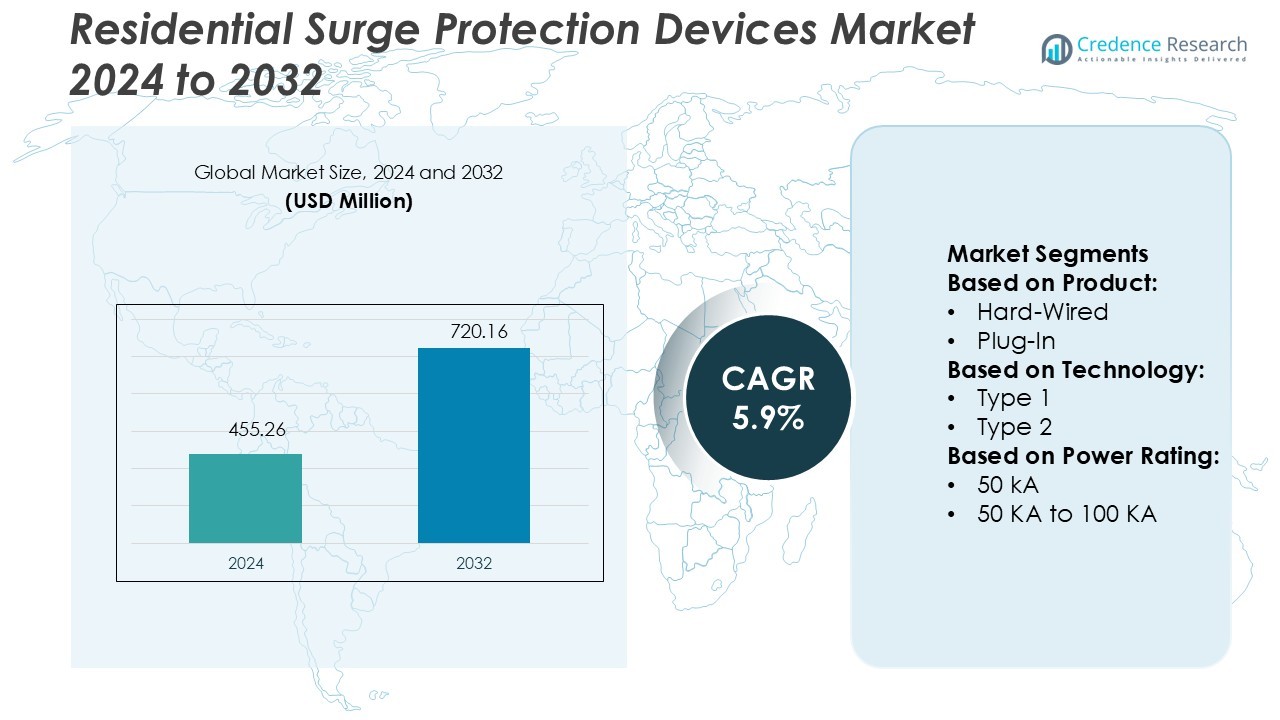

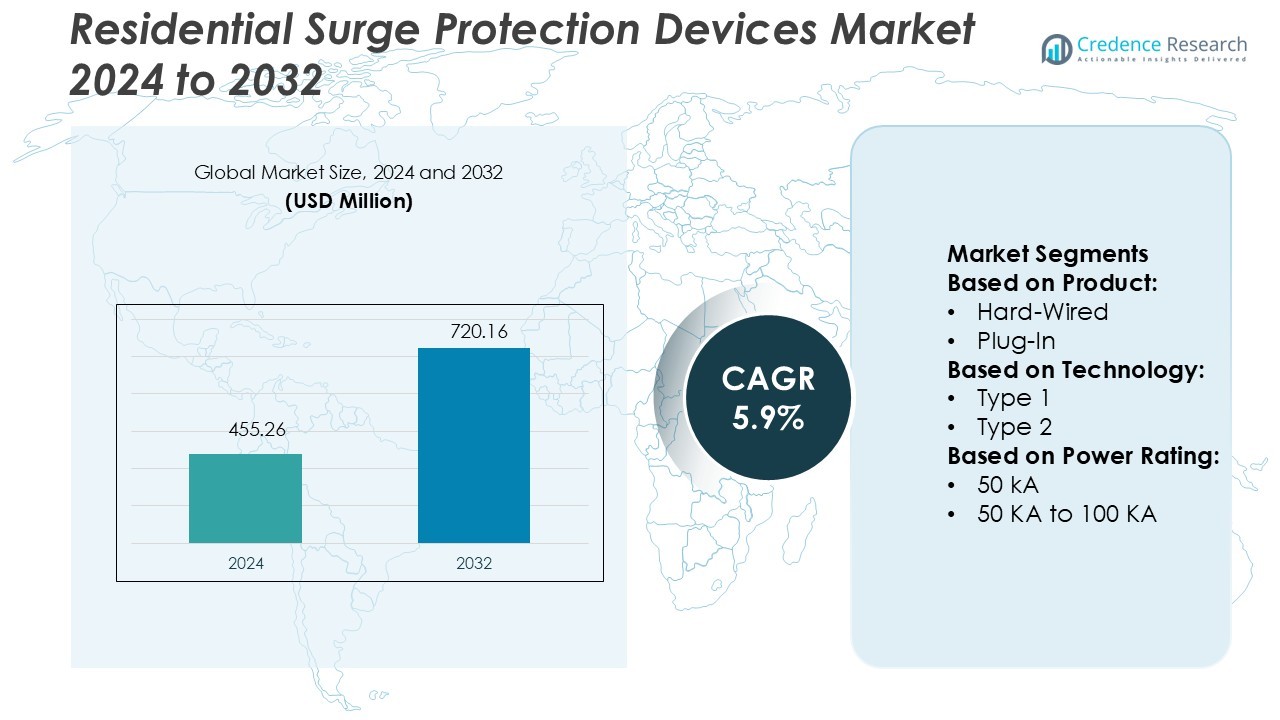

Residential Surge Protection Devices Market size was valued USD 455.26 million in 2024 and is anticipated to reach USD 720.16 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Surge Protection Devices Market Size 2024 |

USD 455.26 Million |

| Residential Surge Protection Devices Market, CAGR |

5.9% |

| Residential Surge Protection Devices Market Size 2032 |

USD 720.16 Million |

The residential surge protection devices market is shaped by leading players such as Havells, Eaton, Infineon Technologies AG, Emerson Electric Co., Belkin, CG Power and Industrial Solutions Limited, General Electric, Bourns, Inc., Hubbell, and ABB. These companies focus on integrating smart technologies, improving energy efficiency, and expanding their global reach to strengthen their competitive positions. Product innovation, safety compliance, and strategic partnerships with utility providers and builders are key priorities. Asia Pacific leads the global market with a 33% share, supported by rapid urbanization, strong infrastructure development, and growing smart home adoption. This regional dominance is further reinforced by rising investments in modern residential power systems and increasing demand for reliable surge protection solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The residential surge protection devices market was valued at USD 455.26 million in 2024 and is expected to reach USD 720.16 million by 2032, growing at a CAGR of 5.9%.

- Rising smart home installations, increasing power fluctuations, and strict electrical safety standards are driving steady market growth across developed and emerging regions.

- Integration of IoT and energy-efficient technologies is a key trend, with manufacturers focusing on compact and modular designs to meet evolving residential demands.

- Intense competition defines the landscape, with major players investing in innovation, partnerships, and compliance to strengthen their market positions.

- Asia Pacific leads with a 33% share, followed by North America at 31% and Europe at 27%, while the ≤ 50 kA power rating segment dominates product adoption due to its cost efficiency and suitability for standard residential applications.

Market Segmentation Analysis:

By Product

Hard-wired devices hold the dominant share in the residential surge protection devices market. These systems offer high reliability and permanent installation, providing robust protection for the entire household electrical network. The growing use of sensitive electronic equipment and rising instances of voltage spikes are boosting demand. Homeowners prefer hard-wired solutions for long-term protection of HVAC systems, security systems, and home automation setups. The need for better power quality and uninterrupted device operation further strengthens this segment’s position compared to plug-in, line cord, and power control devices.

- For instance, Havells’ “Type 1+2 AC Surge Protection Device (SKU DHSAARAC50320)” supports a maximum discharge current (Imax) of 50 kA (L-N) and 70 kA (N-E), thus catering to whole-house protection contexts.

By Technology

Type 2 surge protection devices lead the market due to their effective balance between protection level and cost. They are typically installed at main distribution boards and protect against indirect lightning strikes and switching surges. Their compatibility with residential power networks and ability to safeguard connected home electronics drive their adoption. Rising awareness about mid-level surge protection for smart homes and energy-efficient appliances boosts demand. Type 1 and Type 3 devices follow, addressing specific entry-point and point-of-use applications respectively.

- For instance, Eaton’s CHSPT2SURGE Type 2 SPD supports a nominal discharge current of 5 kA and a one-time surge current rating of 36 kA for single-phase 120/240 V systems.

By Power Rating

The ≤ 50 kA segment accounts for the largest market share, supported by widespread use in standard residential applications. These devices are cost-efficient, easy to install, and adequate for protecting typical household appliances. Their dominance is driven by growing smart home penetration and demand for compact protection units in low and medium surge risk areas. Homeowners prefer these ratings for everyday protection against minor voltage fluctuations, which occur more frequently than severe surges. Higher rating devices are used mainly for large or high-risk residential buildings.

Key Growth Drivers

Rising Incidence of Power Fluctuations

Increasing frequency of voltage spikes and power surges is driving strong demand for residential surge protection devices. Growing dependence on smart home electronics makes households more vulnerable to electrical damage. Homeowners are adopting surge protectors to safeguard appliances like HVAC systems, entertainment units, and lighting. Expanding power infrastructure in emerging economies adds to demand for reliable protection solutions. This growing awareness of surge-related risks and preventive maintenance strengthens market penetration and adoption rates globally.

- For instance, Infineon’s TVS diode model TVS3V3L4U offers a line-capacitance of 2 pF, supports ±30 kV ESD, and delivers ±20 A surge protection on Gigabit Ethernet interfaces.

Rapid Growth of Smart Home Installations

The expanding smart home ecosystem significantly boosts the surge protection devices market. Connected appliances, home automation systems, and IoT devices require stable and uninterrupted power flow. Surge protectors offer critical safety, ensuring device longevity and uninterrupted operation. Rising disposable incomes and growing awareness of home safety solutions support wider adoption. Governments and utility companies are also promoting residential electrical safety, further encouraging consumers to invest in modern surge protection infrastructure.

- For instance, Belkin’s 12-Outlet Home/Office Surge Protector (model SRA009p12tt8) offers a surge energy rating of 3,940 joules or 3,780 joules, depending on the version. It includes an 8-foot (2.4 m) cord and 12 AC outlets for home automation setups.

Rising Energy Efficiency and Safety Standards

Stringent building codes and energy regulations encourage residential surge protection adoption. Regulatory bodies increasingly require safety measures to protect electrical networks from power surges and short circuits. These standards enhance consumer trust and drive replacement of outdated systems with advanced surge protection devices. Builders and contractors integrate these systems during new housing projects to ensure compliance. The combination of regulatory enforcement and growing safety awareness positions surge protection as a standard residential requirement.

Key Trends & Opportunities

Integration with Smart Energy Management Systems

Manufacturers are integrating surge protection devices with smart energy platforms. This allows real-time monitoring, fault detection, and predictive maintenance. Consumers can track energy flow and surge events through mobile applications, improving device efficiency and safety. Integration also enables automated power cutoffs during severe fluctuations, preventing appliance damage. This trend aligns with the growing demand for connected home solutions and creates new product development opportunities for technology-driven manufacturers.

- For instance, CG Power’s “Surge Counter & Monitor” units often reference a 6-digit cyclometer. A 6-digit display records events up to 999,999.The unit includes an analog milli-ammeter for monitoring leakage current, with a typical scale of 0-5mA.

Increased Use of Advanced Protection Technologies

Surge protection devices are evolving with higher durability, faster response times, and compact designs. Innovations such as modular designs and thermal protection enhance device performance and simplify maintenance. Manufacturers are investing in hybrid surge protectors that offer layered protection for multiple appliances. These technological improvements make the devices more appealing for both new installations and retrofitting. The trend supports market growth, particularly in regions with rapid urban development.

- For instance, GE’s DIN-rail mounted Tranquell Series (Type 2) supports ratings from 25 kA per mode / 50 kA per phase up to 65 kA per mode / 130 kA per phase for branch-panel applications.

Rising Adoption in Emerging Markets

Emerging economies offer strong growth opportunities due to infrastructure expansion and increasing middle-class households. Many regions are modernizing power grids, which raises the need for reliable residential surge protection. Government-led rural electrification programs and housing projects are boosting adoption. Cost-effective and easy-to-install plug-in surge devices are seeing strong demand in these markets. This creates significant opportunities for global and regional manufacturers to expand their presence.

Key Challenges

High Initial Installation Costs

The upfront cost of surge protection systems remains a barrier, especially in price-sensitive markets. Hard-wired solutions and advanced Type 2 devices require professional installation, adding to overall expenses. Many consumers still consider surge protection optional rather than essential. This perception slows large-scale adoption, particularly in older homes where retrofitting costs are higher. Manufacturers must focus on cost reduction and clear value communication to overcome this challenge.

Limited Consumer Awareness

Many homeowners lack awareness of surge protection benefits and underestimate surge-related risks. As a result, they often delay or avoid installing these devices until after experiencing equipment damage. This lack of understanding hinders market expansion, especially in developing regions. Manufacturers and government agencies need to increase consumer education campaigns, highlighting long-term cost savings and safety advantages. Addressing this challenge can significantly boost residential adoption rates.

Regional Analysis

North America

North America holds a 31% share of the residential surge protection devices market. The region’s growth is driven by widespread adoption of smart homes, stringent electrical safety standards, and strong awareness of power surge risks. The U.S. leads the market with advanced infrastructure and high penetration of hard-wired surge protectors. Frequent weather-related power fluctuations further boost the demand for reliable protection systems. Regulatory bodies such as UL and NEC enforce strict compliance, supporting product standardization. Growing investments in modernizing the residential grid also strengthen the region’s market position, ensuring steady growth across urban and suburban households.

Europe

Europe accounts for 27% of the market, supported by advanced residential infrastructure and strict energy efficiency standards. Countries such as Germany, France, and the U.K. are key contributors, emphasizing reliable power management and grid stability. Surge protection is increasingly integrated into residential construction under EU regulatory frameworks. High adoption of smart meters and connected appliances boosts the need for integrated surge protection solutions. Sustainability-focused housing projects also promote durable, energy-efficient devices. Rising replacement demand in older housing stock and strong enforcement of electrical codes ensure consistent market growth across the region.

Asia Pacific

Asia Pacific leads the global market with a 33% share, driven by rapid urbanization and large-scale residential construction. China, Japan, India, and South Korea are major markets, benefiting from expanding power infrastructure and increasing smart home adoption. The region faces frequent power fluctuations, pushing households toward surge protection solutions. Government initiatives promoting electrification and energy safety drive penetration in both urban and semi-urban areas. Cost-effective plug-in devices dominate in price-sensitive markets, while hard-wired solutions gain traction in metropolitan regions. Growing awareness and infrastructure investment are expected to accelerate the region’s market growth further.

Latin America

Latin America holds a 5% market share, with steady growth supported by expanding power networks and rising residential electrification. Brazil and Mexico are key contributors, focusing on improving power reliability and adopting modern protection systems. Frequent voltage spikes and unstable grids drive demand for affordable surge protection solutions. Consumers prefer plug-in and line cord devices due to lower installation costs. Government housing programs and infrastructure upgrades are creating favorable conditions for market expansion. As energy security improves, the region is expected to gradually shift toward more advanced surge protection technologies in residential buildings.

Middle East & Africa

The Middle East & Africa region represents a 4% share of the residential surge protection devices market. Infrastructure modernization, electrification initiatives, and urban development projects are driving demand. The UAE and Saudi Arabia lead adoption with large-scale residential projects integrating surge protection during construction. In Africa, grid instability and voltage irregularities increase the need for affordable and reliable devices. Market penetration remains lower compared to other regions, but government-backed power projects and rising smart home installations are creating opportunities. Growing investments in energy infrastructure are expected to support long-term regional market expansion.

Market Segmentations:

By Product:

By Technology:

By Power Rating:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the residential surge protection devices market is shaped by key players such as Havells, Eaton, Infineon Technologies AG, Emerson Electric Co., Belkin, CG Power and Industrial Solutions Limited, General Electric, Bourns, Inc., Hubbell, and ABB. The residential surge protection devices market is defined by strong product innovation, advanced technology integration, and growing regional expansion strategies. Leading manufacturers focus on enhancing product reliability, incorporating smart monitoring systems, and offering scalable solutions for different residential needs. Companies are prioritizing energy efficiency, compact design, and compliance with global safety standards to strengthen their market position. Many firms are expanding their distribution networks to reach price-sensitive and emerging markets. Strategic partnerships with builders and energy providers also support wider product adoption. Continuous investment in R&D, coupled with a focus on safety and durability, drives intense competition and sustained market growth.

Key Player Analysis

- Havells

- Eaton

- Infineon Technologies AG

- Emerson Electric Co.

- Belkin

- CG Power and Industrial Solutions Limited

- General Electric

- Bourns, Inc.

- Hubbell

- ABB

Recent Developments

- In October 2025, Delta unveiled an 800 V HVDC architecture for AI data centers that boosts efficiency by more than 4% and integrates high-capacity SPDs for rack-level protection.

- In August 2024, Hitachi Energy introduced the EconiQ high-voltage portfolio using fluoronitrile gas mixtures with less than 1% of SF6’s global-warming impact, incorporating surge arresters for transmission applications.

- In May 2024, Phoenix Contact expanded its production network to the North American market by establishing Phoenix Contact Production S.A. de C.V. in Mexico. The new 20,000 m² facility in Querétaro, with aimed to begin production by the end of 2025, employing approximately 700 people by 2032.

- In February 2024, ABB announced that they have acquired SEAM Group. This strategic acquisition is poised to enhance ABB’s Electrification portfolio in electrical safety, renewables, and asset management advisory services. With the acquisition, ABB aims to meet the escalating demand for modernizing and optimizing assets for safer, smarter, and more sustainable operations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, Power Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise with increasing smart home installations worldwide.

- Integration with IoT platforms will enhance real-time surge monitoring.

- Hard-wired systems will gain wider adoption in new residential projects.

- Energy efficiency standards will drive the use of advanced surge protection.

- Manufacturers will focus on compact and modular product designs.

- Emerging markets will see faster adoption due to electrification programs.

- Surge protection will become a standard requirement in residential buildings.

- Strategic partnerships will expand distribution in both urban and rural areas.

- Innovation in semiconductor components will improve response time and durability.

- Regulatory support will strengthen product quality and safety compliance.