Market Overview

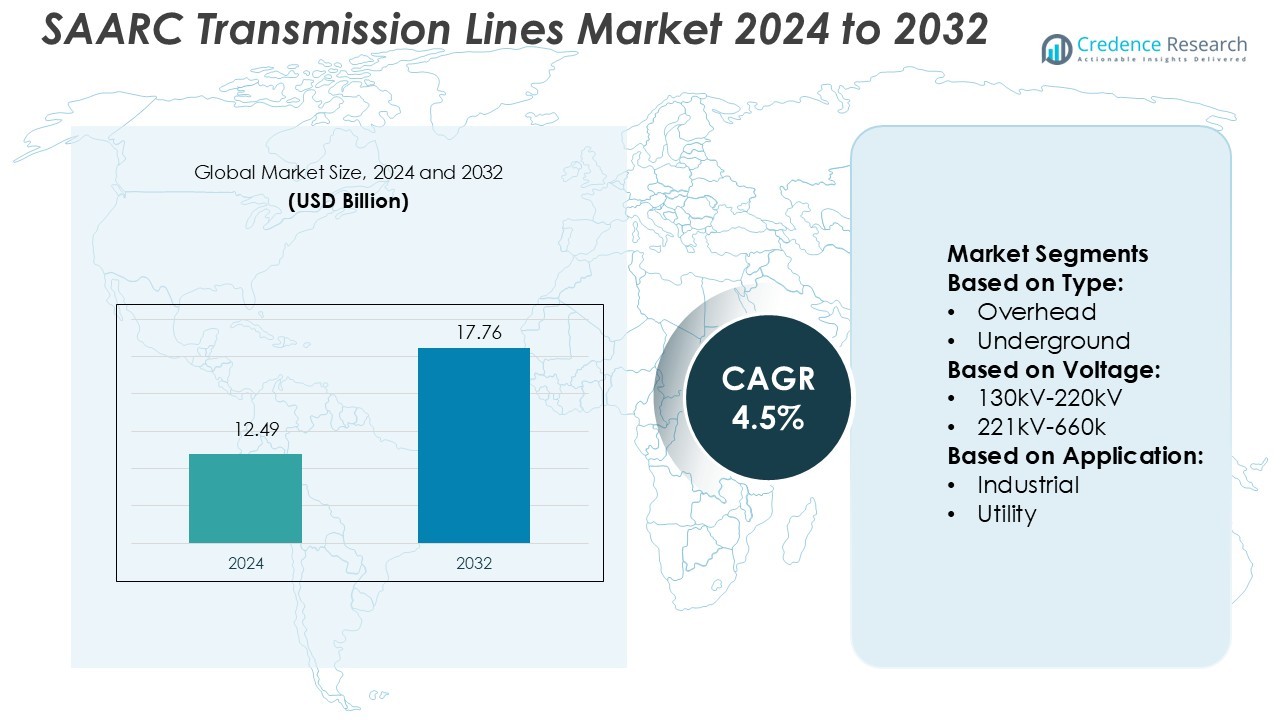

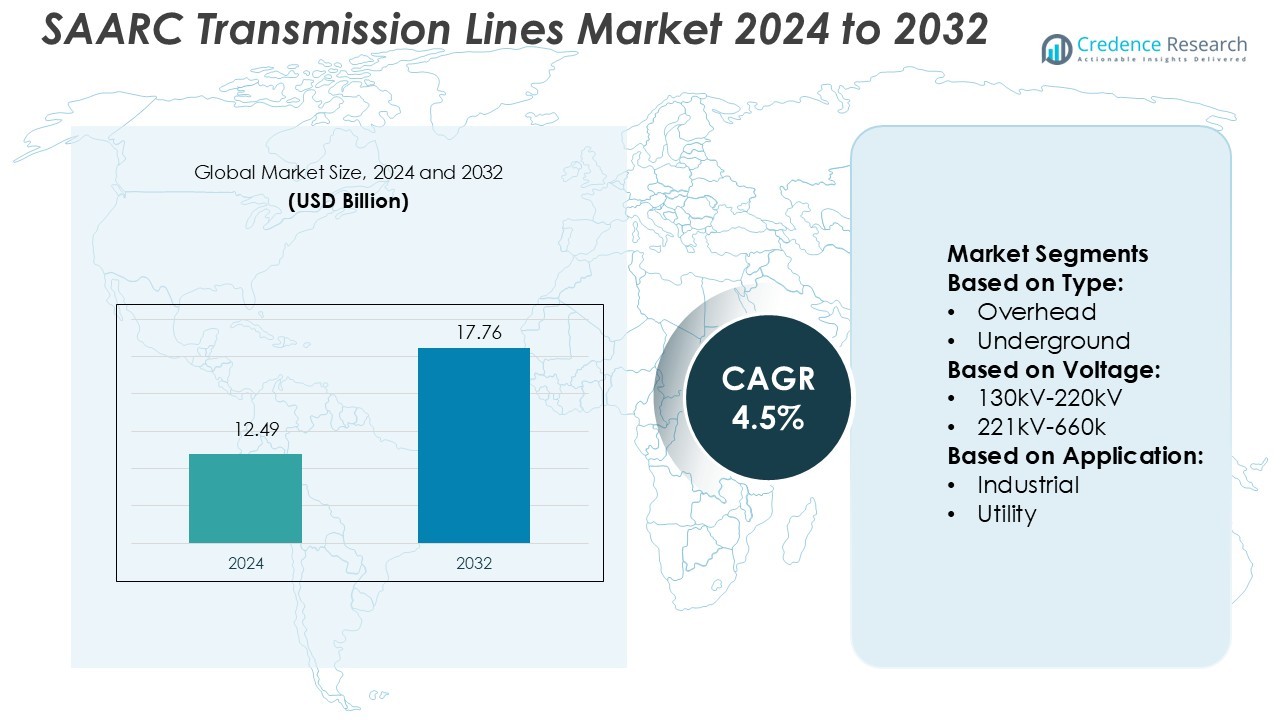

SAARC Transmission Lines Market size was valued USD 12.49 billion in 2024 and is anticipated to reach USD 17.76 billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| SAARC Transmission Lines Market Size 2024 |

USD 12.49 Billion |

| SAARC Transmission Lines Market, CAGR |

4.5% |

| SAARC Transmission Lines Market Size 2032 |

USD 17.76 Billion |

The SAARC transmission lines market is led by Surana Group of Industries, KEC International Ltd., Gupta Power Infrastructure Ltd., Prysmian Group, Apar Industries Limited, CTC Global Corporation, UNIVERSAL CABLE LIMITED., Nexans, Special Cable Pvt. Ltd., and Siemens Energy, which drive technological innovation and infrastructure expansion across the region. India emerges as the leading market, holding 42% of the regional share, supported by large-scale grid modernization, renewable energy integration, and rural electrification initiatives. High-voltage overhead and underground lines dominate demand, while smart grid technologies and cross-border interconnections strengthen regional connectivity. Government policies, infrastructure investments, and industrial growth further enhance market adoption. These top players leverage advanced materials, automated monitoring systems, and reliable project execution to maintain competitiveness, ensuring long-term growth and supporting the expansion of efficient, resilient transmission networks throughout the SAARC region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The SAARC transmission lines market was valued at USD 12.49 billion in 2024 and is projected to reach USD 17.76 billion by 2032, growing at a CAGR of 4.5%.

- India leads the regional market with a 42% share, driven by grid modernization, renewable integration, and rural electrification projects.

- Overhead transmission lines dominate the market, followed by underground lines, due to cost-effectiveness and long-distance efficiency.

- Key players focus on technological innovation, smart grid adoption, automated monitoring, and reliable project execution to maintain competitiveness.

- Growth is supported by industrial expansion, urbanization, cross-border interconnections, and government policies, while challenges include high capital costs and regulatory constraints.

Market Segmentation Analysis:

By Type

The overhead segment dominates the SAARC transmission lines market, capturing 62% of total market share in 2024. Its growth is driven by lower installation costs, ease of maintenance, and faster deployment compared with underground and submarine lines. Additionally, government initiatives to expand rural electrification and enhance inter-country connectivity favor overhead lines. Underground transmission lines hold a smaller share due to higher installation and operational costs but are gaining traction in urban areas with space constraints. Submarine lines remain niche, primarily used for cross-border or coastal connections.

- For instance, Gujarat Power Corporation Limited (GPCL) commissioned a 5 MW solar power plant in the Gujarat Solar Park in 2012, as part of a larger initiative to support solar power generation in the state.

By Voltage

The 221kV–660kV segment leads the voltage-based market, accounting for 54% of the total share in 2024. Its dominance stems from its capacity to transmit large amounts of electricity over long distances with minimal losses. Regional infrastructure expansion projects, including cross-border grids, heavily rely on this voltage class. The 130kV–220kV segment primarily supports local industrial and urban networks, while the above 660kV segment sees limited adoption due to high capital requirements and technological complexities. Rising energy demand and grid modernization drive the adoption of mid- to high-voltage lines.

- For instance, KEC International Ltd. has recently secured a significant order valued at ₹1,064 crore for the design, supply, and installation of a 380 kV transmission line in Saudi Arabia.

By Application

The utility segment commands a 68% market share in the SAARC transmission lines market, reflecting its role in national power distribution networks. Government-led projects to strengthen national grids, reduce transmission losses, and integrate renewable energy sources drive growth in this segment. Industrial applications, though smaller, are growing steadily as private sector investments in energy-intensive sectors increase. Utility demand is particularly strong in countries like India and Bangladesh, where electrification expansion and cross-border interconnections are prioritized. Policy support and investment incentives further reinforce utility segment dominance.

Key Growth Drivers

Expansion of Regional Power Infrastructure

Rapid urbanization and industrial growth across SAARC countries drive extensive investments in transmission infrastructure. Governments prioritize upgrading national grids, enhancing cross-border interconnections, and reducing transmission losses. Large-scale projects, supported by multilateral funding and public-private partnerships, increase demand for high-voltage and overhead transmission lines. Continuous electricity demand growth in rural and urban areas further propels infrastructure expansion. Adoption of smart grid technologies and modernization initiatives accelerates network efficiency, ensuring reliability and long-term market growth across the region.

- For instance, Gupta Power upgraded a 16.4 km stretch of 132/220/400 kV transmission lines from Mendhasal to Khurda in Odisha, India, utilizing 273.7 sqmm Casablanca-size ACCC® conductors.

Integration of Renewable Energy Sources

Rising renewable energy deployment, particularly solar and wind, fuels transmission line expansion. Grid networks require additional capacity to transmit electricity from remote renewable sites to urban demand centers. Government policies and subsidies promoting clean energy accelerate integration, necessitating high-capacity transmission infrastructure. Hybrid grid systems and renewable-focused corridors create new market opportunities. The shift toward sustainable energy reduces dependency on fossil fuels and drives long-term investments in advanced transmission technologies, ensuring both growth and environmental compliance in the SAARC market.

- For instance, Prysmian Group was awarded a contract valued at approximately $900 million for the SOO Green HVDC Link project in the U.S. This project involves the installation of a 525 kV HVDC cable system designed to transmit 2.1 GW of electricity over approximately 563 km (350 miles) entirely underground along existing railroad rights-of-way.

Government Initiatives and Policy Support

Policy frameworks and financial incentives across SAARC countries encourage investment in transmission infrastructure. National electrification plans, energy access programs, and cross-border connectivity projects enhance market attractiveness. Regulatory support, including streamlined approvals and tariff mechanisms, facilitates faster project execution. Multilateral funding and foreign direct investment complement domestic efforts, expanding transmission networks across regions. Focused government initiatives on reducing technical losses, improving reliability, and modernizing grids act as strong growth catalysts for the transmission lines market, attracting both local and international players.

Key Trends & Opportunities

Adoption of Smart Transmission Technologies

SAARC countries increasingly implement smart grid technologies, including real-time monitoring, automated fault detection, and predictive maintenance. These solutions improve network reliability, reduce operational costs, and optimize power flow. Integration of IoT-based systems and SCADA platforms presents opportunities for technology providers. Digitalization in transmission networks also enables better energy management and planning. The trend toward automation and grid intelligence creates new investment avenues and enhances efficiency, making smart transmission systems a critical growth opportunity in the region.

- For instance, CTC Global’s ACCC® Conductor can carry up to twice the current of a similarly sized ACSR conductor, thanks to its higher thermal limits and 28% more conductive aluminum without a weight or diameter penalty.

Rising Cross-Border Interconnections

Cross-border transmission projects gain traction to support energy trade and regional power stability. Initiatives like interconnection between India, Nepal, Bhutan, and Bangladesh strengthen energy security and balance supply-demand gaps. These projects provide opportunities for high-voltage transmission line deployment and technological collaboration. Regional cooperation promotes sustainable power sharing and renewable energy integration. The increasing focus on interconnected grids presents long-term market potential for developers, contractors, and technology providers, reinforcing SAARC’s strategic emphasis on energy connectivity and regional integration.

- For instance, UCL has been a pioneer in the supply and turnkey execution of Extra High Voltage (EHV) cable projects, delivering robust underground transmission solutions up to 400kV.

Increasing Demand from Industrial Sectors

Industrial expansion across manufacturing, mining, and large-scale commercial facilities drives demand for dedicated transmission infrastructure. Energy-intensive industries require high-voltage lines for stable and reliable power supply. Investments in industrial corridors, smart industrial parks, and renewable-powered facilities further support transmission network growth. This trend offers opportunities for private sector participation and specialized line installations. Rising industrialization, coupled with government support for infrastructure development, positions industrial demand as a key opportunity in the SAARC transmission lines market.

Key Challenges

High Capital Expenditure and Operational Costs

Transmission line projects require substantial upfront investment in materials, land acquisition, and technology. Operational expenses, including maintenance and monitoring, further increase project costs. Limited financial resources in certain SAARC countries can delay project implementation. The high cost of advanced technologies, such as underground or high-voltage systems, adds to financial challenges. Securing funding and ensuring project profitability remain critical hurdles for developers, slowing adoption rates despite strong market potential.

Regulatory and Environmental Constraints

Complex regulatory approvals, land acquisition issues, and environmental concerns pose challenges to transmission line deployment. Clearance delays and compliance requirements increase project timelines and costs. Opposition from local communities and environmental groups can further hinder construction. Policies vary across SAARC nations, complicating cross-border or multi-jurisdictional projects. Navigating these regulatory and environmental constraints remains a significant challenge for developers, requiring strategic planning and stakeholder engagement to ensure timely execution of transmission projects.

Regional Analysis

North America

North America holds 28% of the global transmission lines market, driven by grid modernization and renewable energy projects. The United States invests heavily in smart grids, high-voltage lines (221kV–660kV), and interconnections across states. Canada focuses on hydroelectric and wind power transmission, increasing demand for long-distance overhead lines. Government incentives, technological adoption, and private sector participation support consistent growth. Rising electricity consumption and aging infrastructure upgrades reinforce expansion in both utility and industrial transmission networks across the region.

Europe

Europe accounts for 22% of the global transmission lines market, driven by renewable energy integration and cross-border grid projects. Germany, France, and the UK invest in underground and high-voltage lines to transmit solar, wind, and hydroelectric power. EU energy policies and carbon reduction targets accelerate grid modernization. Smart grid deployment improves network efficiency and reliability. Industrial electricity demand and interconnection initiatives, particularly in Central and Eastern Europe, further strengthen growth. Sustainability and advanced technology adoption underpin Europe’s transmission infrastructure development.

Asia

Asia dominates with 38% of the global transmission lines market, led by China and India. Rapid industrialization, urbanization, and renewable energy expansion drive demand for 221kV–660kV and above 660kV transmission networks. Government projects, smart grids, and cross-border interconnections enhance regional connectivity. High electricity consumption in urban and industrial sectors boosts overhead line deployment. Renewable integration, infrastructure modernization, and favorable policies position Asia as the largest and fastest-growing transmission lines market globally.

Latin America

Latin America holds 7% of the global transmission lines market, driven by hydropower, wind energy, and rural electrification projects. Brazil and Mexico lead with overhead and underground high-voltage lines to support renewable integration. Government programs promote energy efficiency, industrial electrification, and smart grid adoption. Cross-border interconnections enhance regional energy security. Urbanization, industrial growth, and infrastructure modernization further fuel market expansion. International funding and technological partnerships strengthen Latin America’s position as a growing market for transmission lines.

Middle East

The Middle East accounts for 5% of the global transmission lines market, supported by industrial expansion and renewable energy integration. Saudi Arabia, UAE, and Qatar invest in high-voltage overhead and underground lines for solar and natural gas-based power. Grid modernization, cross-border connectivity, and efficient electricity distribution drive growth. Industrialization and urban development further increase transmission infrastructure demand. Focus on smart grids, automation, and renewable integration ensures the Middle East remains a key growth region within the global transmission lines market.

Market Segmentations:

By Type:

By Voltage:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The SAARC transmission lines market players such as Surana Group of Industries, KEC International Ltd., Gupta Power Infrastructure Ltd., Prysmian Group, Apar Industries Limited, CTC Global Corporation, UNIVERSAL CABLE LIMITED., Nexans, Special Cable Pvt. Ltd., and Siemens Energy. The SAARC transmission lines market is witnessing robust growth driven by increasing electricity demand, grid modernization, and renewable energy integration. Expansion of high-voltage overhead and underground lines supports urban and industrial electrification while reducing transmission losses. Cross-border interconnections enhance regional energy trade and reliability, creating opportunities for infrastructure development. Technological advancements, including smart grid systems, automated monitoring, and predictive maintenance, improve efficiency and reduce operational costs. Government policies and funding initiatives further accelerate project implementation. Rising industrialization, rural electrification, and urban power requirements position the market for sustained growth, making transmission network modernization a strategic priority across the SAARC region.

Key Player Analysis

Recent Developments

- In June 2025, ZF India entered into a partnership agreement with an Indian commercial vehicle manufacturer to supply a large quantity of 9-speed transmissions designed for vehicles with over 300 horsepower, manual and automatic transmissions for trucks in the heavy-duty segment.

- In October 2024, Larsen & Toubro (L&T) secured new orders for its Power Transmission & Distribution vertical in the Middle East and Africa, which includes the implementation of an Energy Management System for a country-wide electricity network and the construction of high-voltage transmission lines in Saudi Arabia, along with a National System Control Centre in Kenya.

- In April 2024, Stellantis launched its new electrified dual-clutch transmission (eDCT) at the Mirafiori Automotive Park in Italy. The company also planned in the site and the Italian automotive industry to create the Mirafiori Automotive Park 2030.

- In February 2024, Nexans received a contract for a power utility to support energy transition in Italy. Nexans is signed to provide 6,000 km of low- and medium-voltage power distribution cables and services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Voltage, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Transmission line expansion will accelerate to meet rising electricity demand across SAARC countries.

- Overhead and high-voltage lines will dominate due to cost-effectiveness and long-distance efficiency.

- Integration of renewable energy sources will drive demand for advanced transmission infrastructure.

- Smart grid adoption will enhance network reliability and optimize energy distribution.

- Cross-border interconnections will increase, supporting regional power trade and energy security.

- Rural electrification projects will continue to expand, improving access to electricity in remote areas.

- Technological advancements will reduce transmission losses and improve operational efficiency.

- Industrial and urban growth will create sustained demand for reliable high-capacity networks.

- Government policies and funding initiatives will accelerate transmission line projects.

- Infrastructure modernization and digitalization will remain key drivers of long-term market growth.