Market Overview

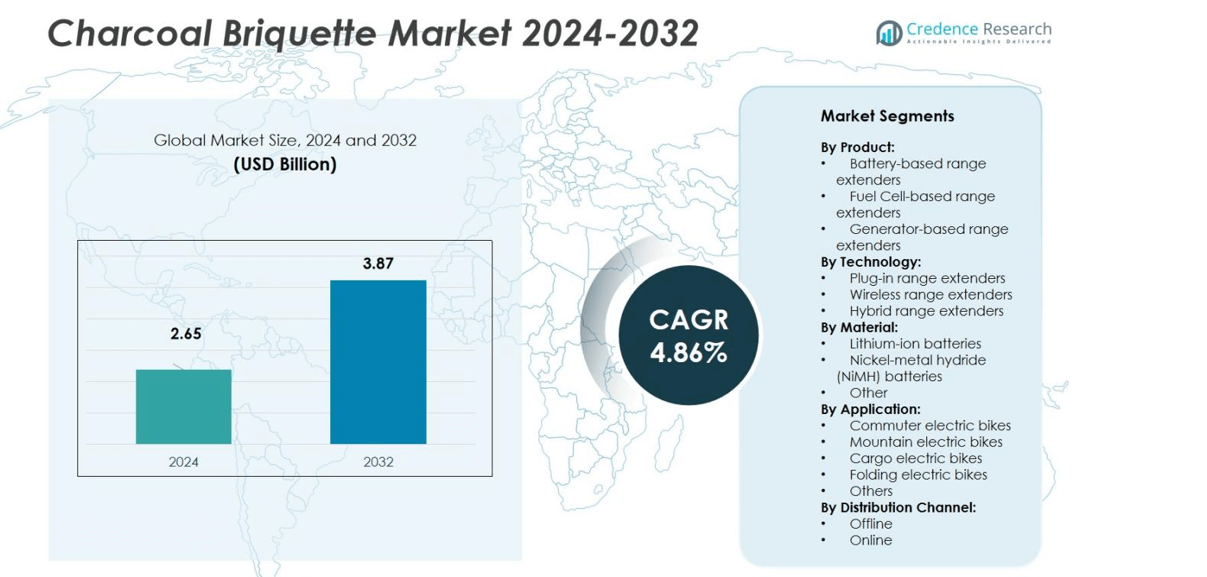

Charcoal Briquette Market size was valued USD 2.65 Billion in 2024 and is anticipated to reach USD 3.87 Billion by 2032, at a CAGR of 4.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Charcoal Briquette Market Size 2024 |

USD 2.65 Billion |

| Charcoal Briquette Market, CAGR |

4.86% |

| Charcoal Briquette Market Size 2032 |

USD 3.87 Billion |

The Charcoal Briquette Market features Kingsford Products Company, Royal Oak Enterprises LLC, Duraflame Inc., Gryfskand, Namchar, Ignite Products, and Matsuri International. These players expand capacity, optimize retail reach, and launch low-smoke, odorless lines. Many prioritize coconut-shell sourcing and automation to improve quality and margins. Asia Pacific leads with 45% share in 2024, supported by abundant biomass and strong exports. Europe holds 22% share, driven by eco-certified demand and strict emissions norms. North America accounts for 17% share on the back of a robust barbeque culture and premium offerings. Competitors pursue private-label partnerships, greener binders, and longer-burn formulas to defend share and unlock higher price realization.

Market Insights

- The Charcoal Briquette Market was valued at USD 2.65 Billion in 2024 and is projected to reach USD 3.87 Billion by 2032, growing at a CAGR of 4.86%.

- Rising demand for low-emission, eco-friendly fuels and government support for renewable energy adoption are key market drivers.

- The market is witnessing trends like automation in production, use of sustainable raw materials such as coconut shells, and growth of eco-certified premium briquettes.

- Leading players such as Kingsford Products Company, Royal Oak Enterprises, and Duraflame focus on product innovation and strategic expansion across export-driven regions.

- Asia Pacific dominates with 45% share in 2024, followed by Europe at 22% and North America at 17%, while pillow-shaped briquettes lead with 42% share among product segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Shape:

Pillow-shaped briquettes dominate the charcoal briquette market with nearly 42% share in 2024, driven by their consistent shape, high combustion efficiency, and ease of packaging. Their uniform density ensures steady heat output, making them preferred for household cooking, barbeque, and foodservice applications. Hexagonal briquettes follow closely, favored for longer burn duration and low smoke generation, appealing to export markets in Europe and the Middle East. Square, stick, and other specialty shapes serve niche demands in artisanal cooking and industrial use, contributing to the overall diversification of the product portfolio.

- For instance, Kingsford Products Company launched a “Professional Series” pillow-shaped briquette in 2024 featuring enhanced binding technology that improves burn consistency and durability in grilling contexts.

By Type:

Hardwood charcoal briquettes hold the largest share of 58% in 2024, attributed to their high calorific value, low ash residue, and superior heat retention. These qualities make hardwood variants ideal for restaurants and outdoor barbeque applications. Softwood briquettes, although less dense, exhibit growing demand in household and camping sectors due to faster ignition and affordability. The expanding preference for high-performance fuel among hospitality and commercial users continues to reinforce hardwood briquettes’ dominance within this market segment.

- For instance, Duraflame Char·Logs™, engineered with THERMACORE™ Airflow Technology, provide quick lighting and extended burn times, catering to both commercial and premium home users seeking reliable, high-performance charcoal for grilling and smoking.

By Material:

Coconut shell charcoal briquettes lead the market with a 36% share in 2024, supported by strong availability in Southeast Asia and their eco-friendly nature. These briquettes burn longer, emit minimal smoke, and produce less odor, making them popular in residential and foodservice sectors. Bamboo and sawdust briquettes gain traction as sustainable and renewable alternatives, particularly in regions promoting green energy. Coal dust-based products remain significant in industrial applications due to lower costs, while mixed-material briquettes cater to consumers seeking balance between price and performance.

Key Growth Drivers

Rising Demand for Sustainable and Low-Emission Fuel

Growing environmental awareness and the shift toward cleaner energy sources drive charcoal briquette adoption. Consumers increasingly prefer briquettes over traditional firewood due to lower carbon emissions and consistent heat output. Governments in emerging economies promote eco-friendly fuels to reduce deforestation and indoor air pollution. This sustainability-driven demand enhances the use of biomass-based briquettes made from agricultural residues and coconut shells, fueling long-term market expansion in both residential and industrial sectors.

- For instance, Eco-charcoal Limited in Kenya produces briquettes from sustainably harvested tree trimmings, significantly reducing indoor air pollution and lowering greenhouse gas emissions while supporting local livelihoods.

Expansion of Outdoor Cooking and Barbeque Culture

The growing popularity of outdoor cooking, especially barbeques and camping, significantly boosts market growth. Charcoal briquettes offer uniform heating, portability, and easy ignition, making them ideal for such leisure activities. Urban consumers in North America, Europe, and Asia-Pacific are adopting premium briquette products for cleaner and smokeless grilling experiences. Manufacturers focus on producing odor-free and long-lasting briquettes, aligning with evolving lifestyle trends that emphasize convenience and outdoor entertainment.

- For instance, PT Coco Total Karbon Indonesia produces ISO 9001:2015-certified coconut charcoal briquettes for shisha and barbeque use, offering a clean, odorless burn with consistent heat, and ships bulk supplies to markets including the USA and Europe.

Increased Industrial Utilization and Export Demand

Rising industrial applications in metallurgy, cement, and food processing sectors enhance the demand for high-energy briquettes. Developing nations such as Indonesia and Vietnam have become leading exporters, meeting global demand for efficient, low-smoke fuel alternatives. These countries leverage abundant raw materials and low production costs to strengthen their export base. The growing international focus on renewable and sustainable fuel products supports a favorable trade environment, accelerating industry profitability.

Key Trends & Opportunities

Shift Toward Eco-Certified and Premium Briquettes

Manufacturers increasingly invest in producing eco-certified, organic, and odorless briquettes. These products appeal to environmentally conscious consumers seeking clean-burning fuel options. The trend toward premium-quality briquettes often made from coconut shells or bamboo supports higher margins and brand differentiation. With global certification standards such as FSC and ISO gaining importance, suppliers adopting sustainable production practices are likely to capture greater market share and attract export opportunities in developed regions.

- For instance, GREENLINE JSC in Vietnam produces FSC-certified briquettes from wood sources that burn hotter and longer, targeting premium markets in Japan and the Middle East.

Integration of Automation and Advanced Manufacturing

Technological innovation in briquette production offers significant opportunities. Automated presses, dryers, and carbonization systems improve output consistency, reduce labor costs, and ensure uniform quality. Smart manufacturing enables producers to scale efficiently while maintaining low emissions and minimal waste. This advancement also supports large-scale industrial users requiring high-density briquettes with stable combustion. Companies adopting these technologies gain a competitive advantage through better energy efficiency and stronger supply reliability.

- For instance, Biomass Briquette Systems’ BP-1500 mechanical press automates briquette production with a capacity of up to 1,500 pounds per hour, supporting small-scale and commercial producers with consistent two-inch diameter briquettes.

Key Challenges

Fluctuating Raw Material Availability and Cost

Dependence on biomass sources such as coconut shells, sawdust, and bamboo exposes producers to supply fluctuations. Seasonal variations and competition from other industries impact raw material pricing and availability. Inconsistent input supply often results in unstable production rates and profit margins. Manufacturers must establish robust sourcing networks and invest in waste utilization technologies to mitigate volatility and ensure consistent material quality across global markets.

Competition from Alternative Fuel Sources

The growing adoption of LPG, electricity, and natural gas in cooking and heating poses a major challenge. These fuels offer convenience and cleaner combustion, particularly in urban households. As energy infrastructure expands, traditional charcoal-based products risk losing relevance in certain markets. To stay competitive, producers must emphasize sustainability, cost-effectiveness, and performance improvements in briquette formulations to retain consumer preference and industrial demand.

Regional Analysis

Asia Pacific

Asia Pacific dominates the charcoal briquette market with a 45% share in 2024, driven by strong production and consumption across Indonesia, China, India, and Vietnam. These countries benefit from abundant raw materials such as coconut shells, bamboo, and sawdust, supporting large-scale manufacturing. Rising urbanization and growing export demand to Europe and the Middle East further enhance regional growth. Government initiatives promoting renewable biomass fuels and low-cost labor availability strengthen Asia Pacific’s leadership, positioning it as the primary global supplier of eco-friendly charcoal briquettes.

Europe

Europe accounts for a 22% market share in 2024, supported by a mature consumer base emphasizing sustainability and low-emission fuels. Countries such as Germany, the U.K., and France lead demand for premium, eco-certified briquettes for barbeque and home heating applications. The region’s stringent carbon regulations and preference for renewable biomass sources encourage adoption of clean-burning products. Growing imports from Asia, particularly coconut shell briquettes, also support the regional market. Ongoing innovation in odorless and smokeless briquette formulations sustains steady market expansion.

North America

North America holds a 17% share in 2024, fueled by a thriving barbeque culture and the increasing use of briquettes in outdoor cooking. The United States remains the largest market, with rising consumer demand for high-performance and easy-to-light briquettes. Environmental awareness and the shift toward eco-friendly grilling options are driving product diversification. Technological advancements in production and packaging enhance convenience and appeal. Manufacturers are also targeting premium segments, offering organic and long-lasting briquettes to meet the evolving lifestyle preferences of consumers across the U.S. and Canada.

Latin America

Latin America represents a 9% share in 2024, led by Brazil and Argentina, where charcoal briquettes are used extensively in cooking and hospitality sectors. The region’s rich biomass availability, particularly eucalyptus and sawdust, supports domestic production. Growing exports to Europe and North America strengthen industry profitability. Increasing focus on sustainable manufacturing and reduced deforestation promotes the adoption of renewable briquette materials. Governments across the region are encouraging formalized production processes to improve product quality and reduce environmental impact, driving consistent growth.

Middle East & Africa

The Middle East & Africa capture a 7% share in 2024, fueled by rising demand for household cooking and heating solutions. African nations such as Kenya, South Africa, and Nigeria are witnessing rapid adoption of briquettes as alternatives to traditional charcoal due to affordability and environmental benefits. In the Middle East, demand is expanding for high-quality briquettes in hotels, restaurants, and barbeque applications. Abundant agricultural waste, combined with growing investments in clean fuel technologies, supports steady market development across the region.

Market Segmentations:

By Shape:

- Pillow-shaped briquettes

- Hexagonal briquettes

- Square/rectangular briquettes

- Stick charcoal briquettes

- Other

By Type:

- Hardwood charcoal briquettes

- Softwood charcoal briquettes

By Material:

- Coconut shell charcoal briquettes

- Bamboo charcoal briquettes

- Coal dust charcoal briquettes

- Saw dust charcoal briquettes

- Other

By Application:

- Grilling

- Heating

- Barbequing

- Industrial processes

- Metallurgy

By End Use:

- Residential

- Industrial

- Commercial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Charcoal Briquette Market features key players such as Kingsford Products Company, Royal Oak Enterprises LLC, Duraflame Inc., Gryfskand Sp. z o.o., The Clorox Company, Sagar Charcoal Depot, Namchar (Pty) Ltd, Matsuri International, Ignite Products, and Timber Charcoal Company. These companies focus on product innovation, sustainable sourcing, and efficient distribution to strengthen market presence. Kingsford and Royal Oak lead the segment with extensive retail networks and advanced manufacturing technologies. Several manufacturers emphasize eco-friendly production using renewable biomass materials such as coconut shells and bamboo to meet green fuel regulations. Export-driven companies in Asia-Pacific, particularly in Indonesia and Vietnam, continue to dominate global supply due to low production costs and abundant raw materials. Mergers, acquisitions, and product diversification strategies, including odorless and quick-light briquettes, remain key growth enablers, driving competition across domestic and international markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Duraflame Inc.

- Namchar (Pty) Ltd

- The Clorox Company

- Timber Charcoal Company

- Ignite Products

- Kingsford Products Company

- Gryfskand Sp. z o.o.

- Sagar Charcoal Depot

- Matsuri International

- Royal Oak Enterprises LLC

Recent Developments

- In July 2025, Duraflame reported that a fire severely damaged the W.W. Wood Inc. production facility in Pleasanton, Texas, which served as a major supplier of cooking wood fuel.

- In May 2025, Kingsford expanded its partnership with Miller Lite to relaunch the limited-edition Beercoal briquettes for the summer grilling season.

- In February 2025, Royal Oak Enterprises LLC introduced its new Super Size™ Briquets with Hickory pellets blended for enhanced flavor and longer burning performance.

Report Coverage

The research report offers an in-depth analysis based on Shape, Type, Material, Application, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising demand for sustainable fuel alternatives.

- Manufacturers will focus on eco-friendly production using renewable biomass materials.

- Asia Pacific will remain the leading producer and exporter due to strong resource availability.

- Technological innovations will improve briquette efficiency, ignition time, and burn duration.

- Premium odorless and smokeless briquettes will gain popularity among urban consumers.

- Government policies supporting clean energy will boost domestic and industrial usage.

- Expansion in barbeque and outdoor cooking trends will continue to drive global consumption.

- Strategic partnerships and mergers will enhance production capacity and market reach.

- Online retail and private-label products will increase accessibility across key regions.

- Investments in carbon-neutral manufacturing will shape the long-term competitiveness of major players.