Market Overview

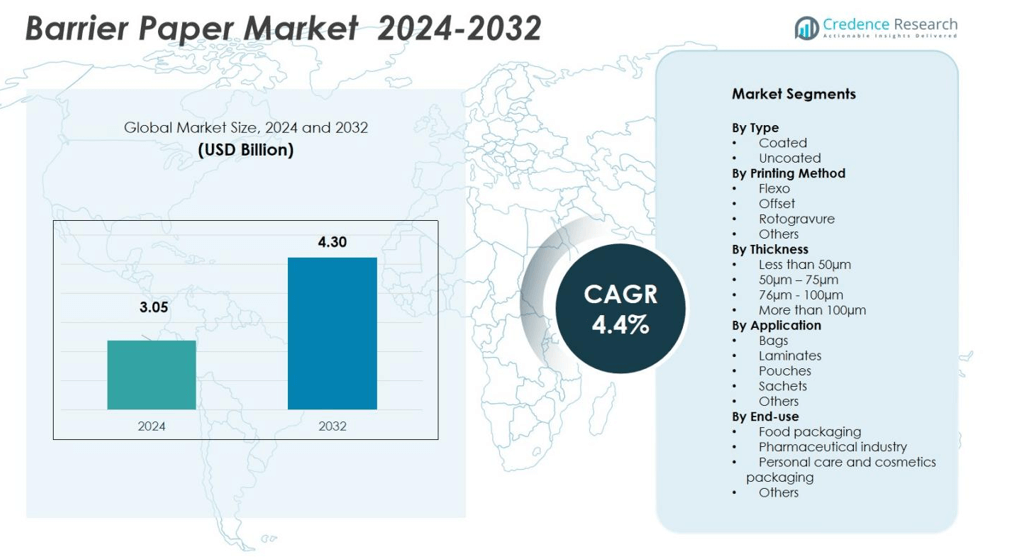

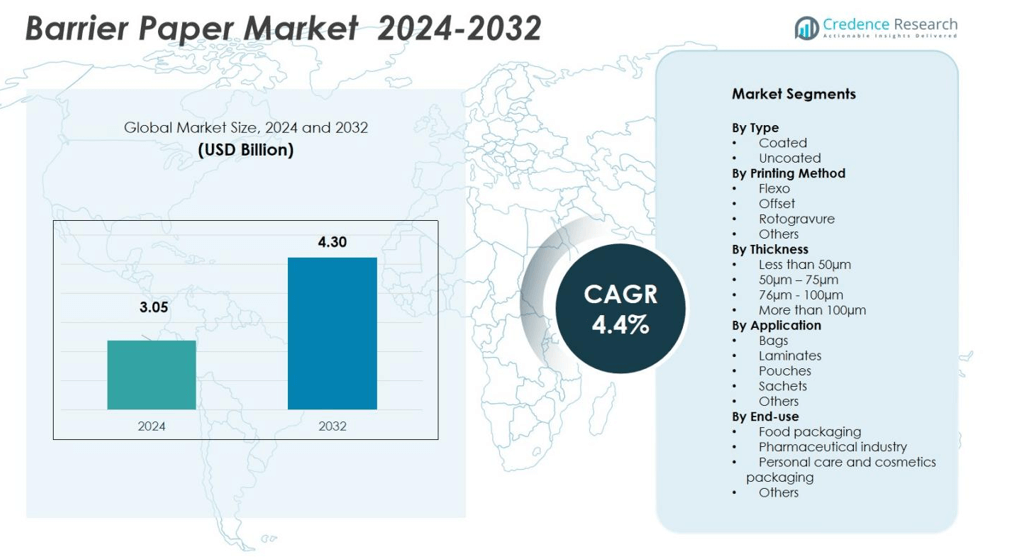

The Barrier Paper Market size was valued at USD 3.05 billion in 2024 and is anticipated to reach USD 4.30 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Barrier Paper Market Size 2024 |

USD 3.05 billion |

| Barrier Paper Market, CAGR |

4.4% |

| Barrier Paper Market Size 2032 |

USD 4.30 billion |

The Barrier Paper Market is driven by major players such as Stora Enso, Nippon Paper, Koehler Paper, UPM Specialty Papers, Sappi, Mondi Group, Pudumjee Paper Products, Delfortgroup, Mitsubishi HiTec Paper, and BillerudKorsnäs. These companies focus on sustainable innovation through recyclable and bio-based coating technologies. Continuous investments in water-based and solvent-free barrier solutions strengthen their presence across key applications, particularly in food, pharmaceutical, and personal care packaging. Europe led the global market with a 32% share in 2024, supported by strict environmental regulations, advanced recycling infrastructure, and high consumer preference for eco-friendly packaging materials.

Market Insights

- The Barrier Paper Market was valued at USD 3.05 billion in 2024 and is projected to reach USD 4.30 billion by 2032, growing at a CAGR of 4.4% during the forecast period.

- Rising demand for sustainable and recyclable packaging materials drives market growth, with food and beverage packaging emerging as the dominant end-use segment.

- Key trends include the adoption of bio-based and water-based coatings that enhance recyclability while maintaining strong barrier protection.

- The market is moderately competitive, with major players like Stora Enso, Mondi Group, Sappi, and Koehler Paper investing in advanced coating technologies and expanding production capacities

- Europe led with a 32% market share, followed by North America at 29% and Asia-Pacific at 27%; among types, coated barrier paper dominated with 68% share, reflecting the region’s focus on eco-friendly and high-performance packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Coated barrier paper held the dominant share of 68% in 2024, driven by its superior moisture, grease, and oxygen resistance. Its use in food and pharmaceutical packaging continues to rise due to sustainability trends and growing restrictions on plastic. Manufacturers favor coated paper for its printability and protection against contamination. Uncoated variants, while less costly, are mainly used in dry goods applications. The demand for bio-based coatings and recyclable layers further supports the strong position of coated paper in the global market.

- For instance, Smart Planet Technologies released EarthCoating-Bio, a biopolymer barrier coating combining a bio-based PLA resin with a mineral blend to produce compostable and recyclable paper cups.

By Printing Method

The flexographic printing segment led the Barrier Paper Market with a 47% share in 2024, supported by high-speed printing capabilities and compatibility with water-based inks. Flexo printing is preferred for food, beverage, and personal care packaging due to its ability to deliver vivid colors on coated substrates. Offset printing followed due to its precision and popularity in premium packaging. Rotogravure and other methods continue to serve niche applications, especially where fine detailing and durability are needed.

- For instance, Mondi Group produces functional barrier papers and high-barrier laminates that are widely used in food packaging, leveraging flexographic printing for vibrant and durable finishes.

By Thickness

Barrier paper with a thickness range of 50µm – 75µm dominated the market in 2024, accounting for 42% share, driven by its balance of strength, flexibility, and cost efficiency. This thickness range is widely adopted in packaging for snacks, bakery products, and frozen foods. It provides sufficient barrier protection while remaining lightweight and easy to process. Papers below 50µm serve lightweight wrappings, while those above 100µm cater to industrial and heavy-duty packaging applications, offering enhanced durability and resistance.

Key Growth Drivers

Rising Demand for Sustainable Packaging

The growing shift toward eco-friendly and recyclable materials is a primary growth driver for the Barrier Paper Market. Rising awareness of plastic waste and stricter environmental regulations encourage industries to adopt paper-based packaging solutions. Barrier papers provide comparable protection while being biodegradable and compostable. Leading food and beverage brands are transitioning to paper-based laminates for snacks, dairy, and takeaway products. This transition helps reduce carbon footprints and supports circular economy initiatives, strengthening the adoption of barrier paper worldwide.

- For instance, Tetra Pak collaborated with Lactogal in Portugal to launch the Tetra Brik Aseptic 200 Slim Leaf carton featuring a paper-based barrier that increases paper content to about 80% and renewable content to 90%, reducing the carton’s carbon footprint by one-third.

Expansion of the Food and Beverage Industry

Rapid growth in processed and ready-to-eat food segments significantly boosts demand for barrier paper. The material provides grease, moisture, and oxygen resistance essential for product preservation and shelf-life extension. Food service brands increasingly prefer coated paper for wrapping and takeaway packaging due to its safe contact properties. The rising consumption of packaged foods, particularly in Asia-Pacific, accelerates the use of barrier papers. Global manufacturers are investing in advanced coatings to meet food safety standards and improve recyclability.

- For instance, Lactogal in Portugal collaborated to launch the Tetra Brik® Aseptic 200 Slim Leaf carton with a paper-based barrier, a pioneering innovation in aseptic food cartons distributed under ambient conditions.

Technological Advancements in Coating Materials

Ongoing innovation in coating technologies enhances the performance and versatility of barrier papers. Developments in bio-based coatings, such as PLA, starch, and PVOH, improve moisture and oxygen barriers without compromising recyclability. Companies are also developing solvent-free and water-based coatings to meet regulatory norms. These advancements help replace plastic laminates in flexible packaging. Improved printability, thermal stability, and sealability of coated papers further widen their use across healthcare, cosmetics, and industrial sectors, driving market growth.

Key Trends & Opportunities

Growth of Recyclable and Compostable Paper Solutions

The market is witnessing a strong trend toward fully recyclable and compostable barrier papers. Governments and global brands are prioritizing sustainable packaging initiatives to minimize landfill waste. Innovations in fiber sourcing, biodegradable coatings, and mono-material structures are expanding applications across industries. Companies are also investing in closed-loop recycling systems to improve paper recovery rates. These advancements create opportunities for manufacturers to cater to the demand for eco-certified, plastic-free barrier solutions.

- For instance, International Paper has developed a Closed Loop Circularity system that collects and processes nearly 7 million tons of recovered paper annually to create new fiber-based products.

Adoption of Water-Based and Bio-Based Coatings

An increasing number of packaging producers are replacing conventional polymer coatings with bio-based alternatives. Water-based and bio-derived coatings reduce volatile organic compound emissions and enable paper recyclability. This transition supports compliance with EU and FDA food-contact safety regulations. Key players are focusing on PVOH, starch, and chitosan coatings for food packaging. The shift toward renewable resources and low-impact manufacturing offers opportunities for innovation and long-term market competitiveness.

- For instance, ALTANA’s ACTEGA partnered with Standridge Color Corporation to develop water-based barrier-coated paperboard for high-speed application.

Key Challenges

High Production and Material Costs

The cost of developing barrier paper remains a major restraint for manufacturers. Advanced coatings and specialized fibers increase production expenses compared to standard paper or plastic packaging. Equipment modification for coating application also adds capital cost. Small- and mid-sized producers face challenges in maintaining competitive pricing while meeting performance standards. Fluctuations in raw material availability and pulp prices further affect profit margins, limiting large-scale adoption in price-sensitive regions.

Limited Moisture and Heat Resistance

Although barrier papers offer sustainable advantages, they often struggle to match plastic’s resistance to high moisture and temperature conditions. This limitation restricts use in liquid or frozen food packaging. Prolonged exposure to humidity can weaken the paper’s integrity and barrier performance. Research into hybrid coatings and multilayer designs is ongoing to address this drawback. Until such advancements become commercially viable, barrier papers may face adoption challenges in heavy-duty or high-moisture applications.

Regional Analysis

North America

North America held a 29% share in 2024, driven by strong demand for sustainable and recyclable packaging solutions. The United States leads the market due to high consumption in the food, beverage, and quick-service restaurant sectors. Regulatory initiatives promoting eco-friendly materials have encouraged companies to replace plastics with coated paper alternatives. Major packaging producers are investing in advanced coating technologies and paper recycling infrastructure. Growing e-commerce activity and consumer preference for paper-based wraps further enhance regional market growth.

Europe

Europe accounted for a 32% share in 2024, making it the largest regional market for barrier paper. The region benefits from stringent environmental policies and consumer awareness about sustainable packaging. Countries such as Germany, France, and the U.K. drive adoption through plastic reduction directives and recycling mandates. Leading packaging firms are investing in bio-based coatings and recyclable materials. The rise in demand from food service, confectionery, and frozen food industries continues to support market expansion across Western and Northern Europe.

Asia-Pacific

Asia-Pacific captured a 27% share in 2024, fueled by growing food processing and packaging industries in China, Japan, and India. Rising disposable income and changing lifestyles have boosted packaged food demand, strengthening the need for sustainable packaging materials. Government initiatives promoting plastic reduction and local paper manufacturing support market expansion. The region is witnessing significant investments from global players in eco-friendly coating technologies. Rapid industrialization and expansion of e-commerce also contribute to higher demand for flexible and protective paper packaging.

Latin America

Latin America held a 7% market share in 2024, supported by the increasing adoption of eco-friendly packaging in Brazil, Mexico, and Argentina. Rising demand for processed and on-the-go food products fuels the use of coated barrier paper. Governments are encouraging the shift from plastic to paper packaging through sustainability regulations. Local manufacturers are focusing on cost-effective production and recyclable materials. Expanding retail and e-commerce sectors, along with rising environmental awareness among consumers, are expected to sustain market growth in the region.

Middle East & Africa

The Middle East & Africa accounted for a 5% share in 2024, driven by the gradual adoption of sustainable packaging solutions. Growth in the food service and retail sectors supports rising consumption of coated barrier papers. The United Arab Emirates and South Africa are key markets due to government-led green initiatives and expansion in food processing industries. Import dependency for high-quality barrier materials remains a challenge, yet local investments in paper production and recycling infrastructure are expected to improve regional competitiveness.

Market Segmentations:

By Type

By Printing Method

- Flexo

- Offset

- Rotogravure

- Others

By Thickness

- Less than 50µm

- 50µm – 75µm

- 76µm – 100µm

- More than 100µm

By Application

- Bags

- Laminates

- Pouches

- Sachets

- Others

By End-use

- Food packaging

- Pharmaceutical industry

- Personal care and cosmetics packaging

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Barrier Paper Market features prominent players such as Stora Enso, Nippon Paper, Koehler Paper, UPM Specialty Papers, Sappi, Mondi Group, Pudumjee Paper Products, Delfortgroup, Mitsubishi HiTec Paper, and BillerudKorsnäs. The market is moderately consolidated, with companies focusing on developing recyclable, compostable, and bio-based barrier papers to meet sustainability goals. Leading players are expanding production capacities and investing in advanced coating technologies, including water-based and solvent-free formulations. Strategic partnerships with food and beverage manufacturers are helping strengthen market positions. Firms are also introducing lightweight and high-barrier papers for flexible packaging and e-commerce applications, enhancing their competitiveness across regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stora Enso

- Nippon Paper

- Koehler Paper

- UPM Specialty Papers

- Sappi

- Mondi Group

- Pudumjee Paper Products

- Delfortgroup

- Mitsubishi HiTec Paper

- BillerudKorsnäs

Recent Developments

- In August 2025, Mondi Group expanded its product line with the launch of FunctionalBarrier Paper Ultimate, a high-performance paper-based solution that offers strong protection against oxygen, water vapor, and grease while meeting recycling standards.

- In February 2025, Delfortgroup introduced thinbarrier 302, an advanced barrier paper designed for both heat-sealing and cold-sealing applications, delivering effective moisture, aroma, and oxygen resistance in line with CEPI recycling criteria.

- In March 2025, Ahlstrom unveiled LamiBak™ Flex, a new base paper grade for flexible food packaging that supports recyclability, minimizes primer usage, and enhances coating compatibility.

- In August 2024, Sappi Limited launched three new products Guard ICC, Guard OHS, and Guard Twist Gloss offering improved printability, durability, and barrier performance for both food and non-food flexible packaging applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Printing Method, Thickness, Application, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for recyclable and compostable packaging materials will continue to rise globally.

- Coated barrier paper will maintain dominance due to superior performance and flexibility.

- Bio-based coatings will gain traction as companies move away from synthetic polymers.

- Food and beverage packaging will remain the largest application segment in the market.

- Investments in advanced coating and fiber treatment technologies will strengthen production efficiency.

- Asia-Pacific will emerge as the fastest-growing regional market driven by industrial expansion.

- E-commerce and retail sectors will create new opportunities for durable paper packaging.

- Partnerships between paper producers and packaging converters will increase innovation speed.

- Regulatory pressure against single-use plastics will continue driving market adoption.

- Sustainability certification and circular economy initiatives will shape future market strategies.