Market Overviews

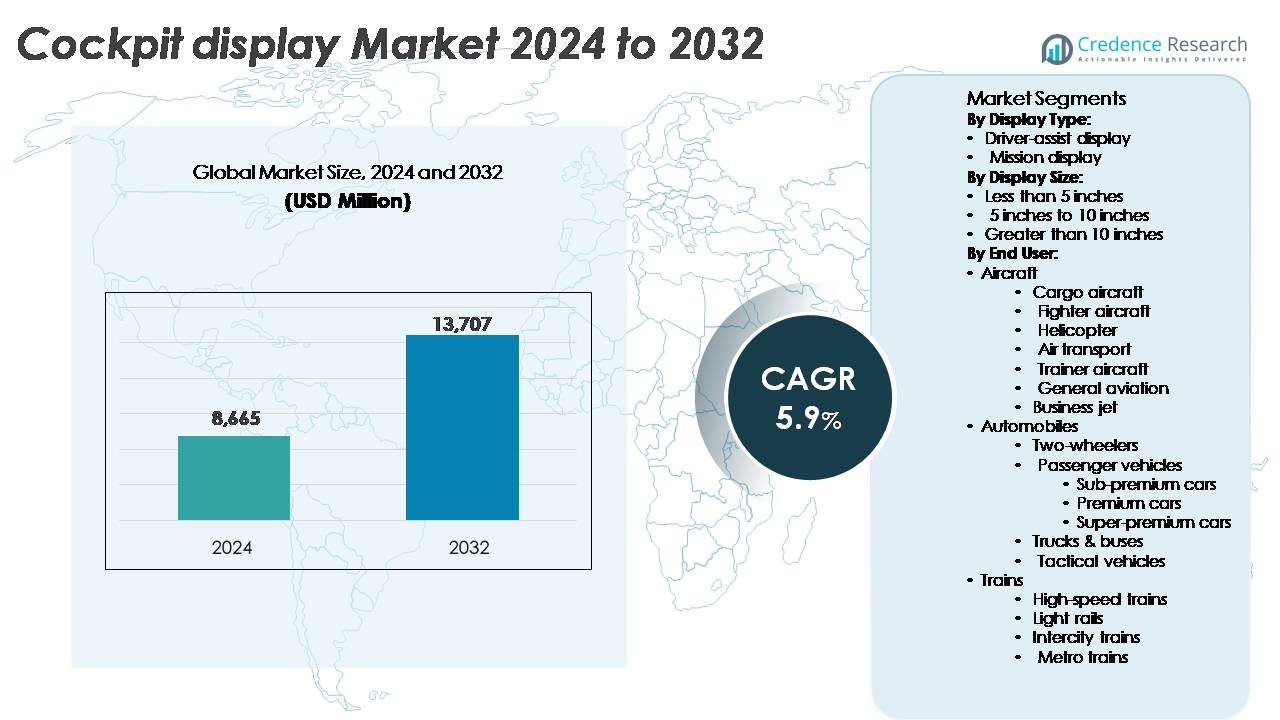

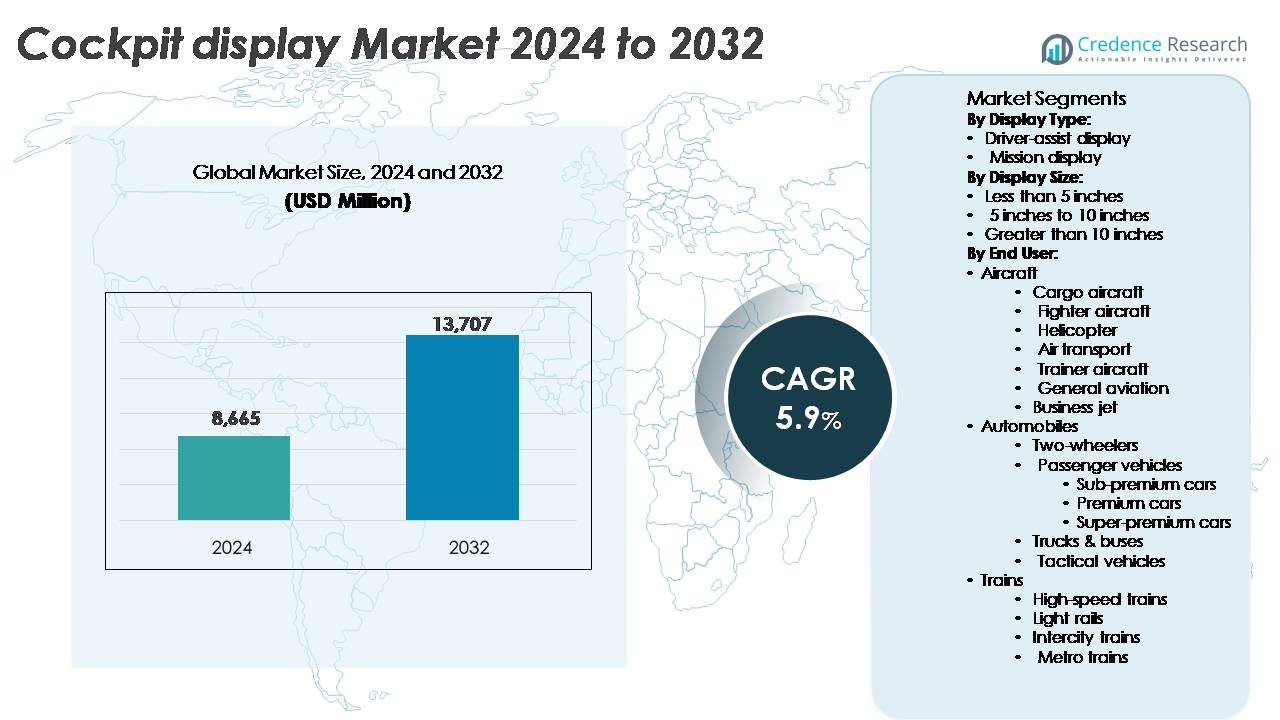

The Cockpit Display Market was valued at USD 8,665 million in 2024 and is projected to reach USD 13,707 million by 2032, growing at a compound annual growth rate (CAGR) of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cockpit Display Market Size 2024 |

USD 8,665 Million |

| Cockpit Display Market, CAGR |

5.9% |

| Cockpit Display Market Size 2032 |

USD 13,707 Million |

The cockpit display market includes major players such as Honeywell International, Garmin Ltd., Collins Aerospace, Thales Group, Alpine Electronics, and Japan Display Inc. These companies compete through high-resolution panels, advanced human-machine interfaces, augmented reality overlays, and integrated situational awareness systems for civil and military platforms. They also focus on touchscreen avionics, enhanced night-vision compatibility, and multi-function displays that reduce pilot workload and improve flight safety. North America leads the global market with 35% share, supported by strong aircraft production, defense modernization, and rapid adoption of digital avionics across commercial fleets and business jets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cockpit display market reached USD 8,665 million in 2024 and is projected to grow at a CAGR of 5.9% through 2032.

- Growing demand for digital avionics, touchscreen panels, and real-time flight data drives adoption across commercial, military, and business aircraft segments.

- Key trends include augmented reality head-up displays, multi-function screens, and advanced human-machine interfaces that enhance pilot awareness and reduce cockpit clutter.

- Competition remains high among players such as Honeywell, Garmin, Collins Aerospace, Thales, Alpine Electronics, and Japan Display Inc., with companies focusing on high-resolution screens, night-vision support, and integrated navigation systems.

- North America holds 35% market share due to strong aircraft deliveries and defense upgrades, while Europe follows with 30%, and Asia-Pacific accounts for 25% driven by expanding commercial fleets; the driver-assist display segment leads with 42% share owing to rising safety compliance in modern aircraft.

Market Segmentation Analysis:

By Display Type:

The cockpit display market is segmented into Driver-assist display and Mission display. The Driver-assist display sub-segment is dominant, driven by the increasing demand for safety features in vehicles, particularly in premium and high-end cars. These displays provide critical data, such as speed, navigation, and hazard warnings, enhancing driving safety and efficiency. The Mission display segment is growing, primarily driven by its use in military and aviation sectors for real-time mission-critical data visualization, which is essential for effective operation in complex environments.

- For instance, Continental AG introduced a high-resolution 12.3-inch digital driver display that receives and presents data processed by control units from multiple vehicle sensors (such as radar and cameras) to support adaptive cruise control and lane-keeping functions.

By Display Size:

The cockpit display market is also segmented by Display Size, including Less than 5 inches, 5 inches to 10 inches, and Greater than 10 inches. The 5 inches to 10 inches display size is the dominant sub-segment, favored in both automotive and aviation sectors for offering a balance between visibility and compactness. Displays of this size are commonly used in both passenger vehicles and aircraft due to their ability to provide essential information without occupying excessive dashboard space. Larger displays, greater than 10 inches, are gaining traction in premium cars and advanced aircraft for more detailed and immersive display options.

- For instance, Continental AG introduced a 12.3-inch digital instrument cluster in its digital cockpit platform, delivering a resolution of 1920 x 720 pixels and enabling real-time vehicle data visualization across multiple driver-assist functions.

By End User:

The end-user segment includes Aircraft, Automobiles, and Trains. Within Aircraft, the Air transport sub-segment leads, driven by the increasing demand for advanced cockpit displays in commercial airliners to enhance navigation, safety, and operational efficiency. The Automobiles segment is further divided into Two-wheelers, Passenger vehicles, and Trucks & buses, with Passenger vehicles representing the dominant sub-segment, especially in Premium and Super-premium cars, where advanced cockpit displays are essential for enhanced driving experiences. Trains, particularly High-speed trains, are rapidly adopting cockpit display systems to improve passenger and operational safety, with high-speed and metro trains holding significant shares in the market.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Advanced Safety Features in Vehicles

The increasing demand for advanced safety technologies in both automotive and aerospace sectors is a major driver for the cockpit display market. In the automotive industry, there is a surge in the adoption of driver-assist displays in premium and luxury vehicles, which provide real-time data for enhanced driving safety, such as collision warnings, lane departure alerts, and navigation aids. This trend is further bolstered by the growing integration of autonomous driving technologies and electrification in vehicles. In aviation, safety remains a priority, with mission-critical cockpit displays offering real-time data to pilots, supporting flight navigation, weather tracking, and system diagnostics. As safety standards evolve and regulations become more stringent across both sectors, the demand for sophisticated cockpit display systems is expected to increase, driving market growth.

- For instance, Honeywell Aerospace supplies its Primus Epic cockpit system with a 15-inch high-resolution display panel that processes more than 200 aircraft system parameters and provides pilots with real-time engine, terrain, and weather data to support safer decision-making.

Technological Advancements in Display Technologies

The continuous advancements in display technologies such as OLED, LED, and LCD are significantly driving the cockpit display market. In automotive and aviation sectors, these innovations enable higher resolution, better contrast ratios, and improved brightness, offering clearer and more readable displays in various lighting conditions. The integration of augmented reality (AR) into cockpit displays is also gaining traction, enhancing user interaction by overlaying critical data directly onto the windshield, aiding pilots and drivers in decision-making. For example, in aircraft, AR allows pilots to view flight path information, altitude, and weather patterns directly in their line of sight. In automobiles, AR is increasingly used in head-up displays (HUDs). The development of these cutting-edge display technologies enhances user experience, providing a more immersive, safer, and intuitive environment, driving adoption across various end-use applications.

- For instance, Panasonic Avionics developed its Astrova OLED display platform with 4K resolution and support for real-time flight data overlays, enabling a sharp, clear visual output for cabin applications.

Growth of Electric and Autonomous Vehicles

The transition to electric and autonomous vehicles (EVs and AVs) is another key driver in the cockpit display market. With the growing popularity of EVs, automakers are integrating more sophisticated cockpit displays that provide real-time battery status, driving range, and regenerative braking feedback, improving the overall driving experience. As autonomous vehicles gain traction, cockpit displays are evolving from traditional instrument clusters to multi-functional screens that provide detailed data on vehicle status, navigation, and passenger interaction. In the aviation sector, electric aircraft are also expected to leverage advanced cockpit displays, given the increasing interest in reducing carbon footprints. These developments in EV and AV technologies require highly adaptive cockpit display solutions, pushing the market to adopt next-gen display systems to meet the evolving needs of electric and autonomous transportation.

Key Trends & Opportunities

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

One of the most promising trends in the cockpit display market is the integration of artificial intelligence (AI) and machine learning (ML) into display systems. These technologies enable predictive maintenance and data analytics, helping to forecast potential failures and optimizing the performance of cockpit systems. In aviation, AI is being used to analyze flight data and suggest optimal flight paths, while in automotive applications, AI enhances driver-assist systems and autonomous driving features. Additionally, AI-powered cockpit displays are able to adapt to the driver’s or pilot’s behavior, offering personalized settings for comfort and efficiency. The growing focus on AI-driven cockpit innovation presents a significant opportunity for OEMs to enhance user experiences and improve operational safety, positioning the market for long-term growth.

- For instance, Collins Aerospace introduced its Perigon computing platform in July 2021, designed to deliver 20 times the processing power of the company’s existing flight control computers by using high-integrity multicore processors and an open-system architecture.

Growth of Digital Cockpit Systems

A significant opportunity in the cockpit display market lies in the rise of digital cockpit systems in vehicles and aircraft. Digital cockpits provide a seamless integration of different systems such as infotainment, navigation, and control, replacing traditional dials and gauges with customizable touchscreens and digital displays. In the automotive industry, digital cockpit systems are being integrated into premium and luxury cars, offering advanced features like gesture control, voice recognition, and multi-display setups. In aviation, modern commercial aircraft are adopting digital cockpits that offer real-time data visualization, reducing pilot workload and increasing operational efficiency. As consumer preferences shift towards intuitive, customizable interfaces, digital cockpit systems will become a standard feature in both the automotive and aerospace industries, further driving the demand for advanced cockpit display solutions.

- For instance, Mercedes-Benz equips its MBUX Hyperscreen with three digital displays totaling 56 inches of glass, powered by an AI software layer that processes up to 41,000 user inputs per hour to deliver navigation, climate, and driver-assist data through one seamless cockpit interface.

Key Challenges

High Costs of Advanced Display Systems

One of the major challenges facing the cockpit display market is the high cost of advanced display technologies. Premium cockpit display systems incorporating augmented reality, OLED, or curved displays can be expensive to manufacture, limiting their adoption in low- to mid-range vehicles and aircraft. Additionally, integrating multiple features such as touchscreen interfaces, multi-functionality, and AI-based systems significantly increases the cost. This can be a barrier for manufacturers in the automobile and aerospace sectors, particularly when trying to maintain affordability while integrating advanced technologies. The high cost of these systems often limits their use to premium segments, reducing the overall market reach and slowing mass adoption.

Integration and Compatibility with Existing Systems

The integration of modern cockpit displays with legacy systems in both aviation and automotive sectors poses a significant challenge. Older aircraft or vehicles with traditional cockpit systems may face difficulties in upgrading to newer digital and AR-enabled displays due to compatibility issues with existing hardware and software. In aviation, the integration of mission-critical systems with new display technologies must meet stringent regulatory standards and pass rigorous certification processes. Similarly, in automobiles, retrofitting existing vehicles with new cockpit display systems may require substantial modifications, raising installation costs and complexity. As a result, the challenge of ensuring seamless integration with legacy systems may hinder the pace of adoption, particularly in non-premium vehicle segments.

Regional Analysis

North America

North America holds the largest share at around 35% of the Cockpit Display Market, supported by strong aerospace production, continuous fleet upgrades, and high defense procurement. Airlines modernize narrow-body and wide-body fleets with LCD, AMLCD, and emerging OLED platforms. Automotive OEMs accelerate adoption of digital clusters and HUD units due to rising EV sales and safety-focused interface design. Defense programs sustain demand for ruggedized cockpit screens across fighter, tanker, and trainer aircraft. A mature supplier ecosystem, advanced certification standards, and steady avionics R&D investment strengthen the region’s leadership position across civil and military applications.

Europe

Europe accounts for about 30% of the global market, driven by strong aviation manufacturing, cockpit-modernization cycles, and strict regulatory norms that favor advanced digital interfaces. Airbus production lines, major MRO hubs, and expanding business-jet upgrades increase adoption of high-resolution, low-power cockpit displays. Automotive OEMs integrate AR-HUD systems and multi-display dashboards to improve driver awareness and meet rising EV penetration. Defense modernization raises requirements for mission-ready avionics across fixed-wing and rotorcraft fleets. Strong focus on lightweight components and energy efficiency supports sustained demand for next-generation cockpit-display technologies across commercial, military, and automotive sectors.

Asia Pacific

Asia Pacific holds nearly 25% market share, supported by rapid fleet expansion, strong commercial aircraft deliveries, and rising domestic aerospace programs in China, India, Japan, and South Korea. Airlines upgrade cockpits to meet growing passenger traffic and stricter operational standards. Automotive manufacturers boost demand for digital instrument clusters and HUD units due to strong EV growth. Defense agencies invest in indigenous fighter and trainer platforms that require modern display systems. Expanding MRO capabilities and high-volume automotive production strengthen the region’s role as a fast-growing market for multi-function, high-brightness cockpit displays.

Middle East & Africa

The Middle East & Africa region captures about 6% of the market, supported by strong aviation spending in Gulf countries and ongoing fleet-renewal programs. Leading airlines modernize wide-body and narrow-body cockpits, increasing demand for durable, high-brightness displays. Defense procurement strengthens the need for mission-capable avionics across fighter, transport, and rotary platforms. Automotive adoption remains slower but improves with rising luxury-vehicle penetration. Growing MRO investments, new airport developments, and regional carrier expansion help sustain demand for modern cockpit-display systems designed for high-temperature and long-haul operational environments.

Latin America

Latin America holds around 4% market share, driven by steady commercial aviation growth, selective cockpit-upgrade programs, and expanding regional fleets. Airlines adopt digital cockpit displays to reduce maintenance costs and align with global operational standards. Business jets and turboprops fuel moderate replacement demand for AMLCD and integrated multi-function displays. Automotive usage grows gradually due to rising mid-range vehicle production and increased interest in digital clusters. Infrastructure development, MRO expansion, and economic recovery support incremental adoption of advanced cockpit-display solutions across commercial, business, and light-military aviation.

Market Segmentations:

By Display Type:

- Driver-assist display

- Mission display

By Display Size:

- Less than 5 inches

- 5 inches to 10 inches

- Greater than 10 inches

By End User:

- Aircraft

- Cargo aircraft

- Fighter aircraft

- Helicopter

- Air transport

- Trainer aircraft

- General aviation

- Business jet

- Automobiles

- Two-wheelers

- Passenger vehicles

- Sub-premium cars

- Premium cars

- Super-premium cars

- Trucks & buses

- Tactical vehicles

- Trains

- High-speed trains

- Light rails

- Intercity trains

- Metro trains

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cockpit display market is moderately consolidated, with leading firms such as Garmin Ltd. and Rockwell Collins, Inc. commanding a combined market share exceeding 19 %. These companies leverage strong aeronautics and vehicle OEM relationships, robust R&D investments, and integrated display solutions to maintain leadership. Other prominent players—including Collins Aerospace (RTX Corporation), Thales Group, Honeywell International Inc., and Continental AG—compete through strategic acquisitions, partnerships, and product expansion across automotive and aviation segments.The competitive dynamics place emphasis on technology differentiation, system integration capabilities and regulatory compliance, as firms seek to expand into high‑growth regions and end‑user applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- General Dynamics Canada Ltd.

- L3Harris Technologies

- Alpine Electronics, Inc.

- AU Optronics Corp.

- Esterline Technologies Corp.

- Japan Display Inc.

- Garmin Ltd.

- Airbus SE

- Continental AG

- Innolux Corp.

Recent Developments

- In May 2025, General Dynamics Canada remains a prominent participant in the cockpit display market for land vehicles and aerospace. They are supporting the development of digital instrument clusters and integrating advanced electronics into tactical and commercial land vehicles. While specific innovations in 2025 are not detailed, the company continues to be influential in system integration and software development for cockpit displays.

- In April 2025, AU Optronics continues to be a key player in the cockpit display market for land vehicles. They are contributing to the development of advanced TFT-LCD and AMOLED display technologies. Their innovative manufacturing and assembly capabilities support the trend toward higher resolution, flexible, and curved cockpit displays, which is contributing to the global market expansion projected through 2025 and beyond.

- In March 2025, Alpine Electronics has been actively advancing cockpit display technologies for land vehicles. The company is emphasizing larger high-resolution displays integrated with advanced driver-assistance systems (ADAS), augmented reality head-up displays, and improved connectivity features. Alpine has also partnered with industry players to develop next-generation digital cockpit systems that enhance the driver experience through advanced sensor integration and added safety functions.

Report Coverage

The research report offers an in-depth analysis based on Display type, Display size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of digital and fully integrated cockpit systems will grow across automotive and aviation platforms.

- Demand for augmented-reality head-up displays will rise as safety and navigation features advance.

- Autonomous and electric vehicles will increase the need for multi-screen, data-rich cockpit environments.

- Aviation operators will continue modernizing older fleets with high-resolution and lightweight display units.

- Compact, curved, and flexible displays will become more common in premium vehicles and aircraft.

- AI-enabled displays will support predictive alerts, adaptive interfaces, and real-time data analytics.

- Defense and tactical vehicle programs will further adopt ruggedized cockpit screens with enhanced durability.

- Manufacturers will integrate voice, gesture, and eye-tracking controls to reduce driver and pilot workload.

- Cybersecurity protection for connected cockpit displays will become a standard requirement across industries.

- Partnerships among automakers, avionics suppliers, and semiconductor firms will accelerate display innovation.

Key Growth Drivers

Key Growth Drivers