Market Overview:

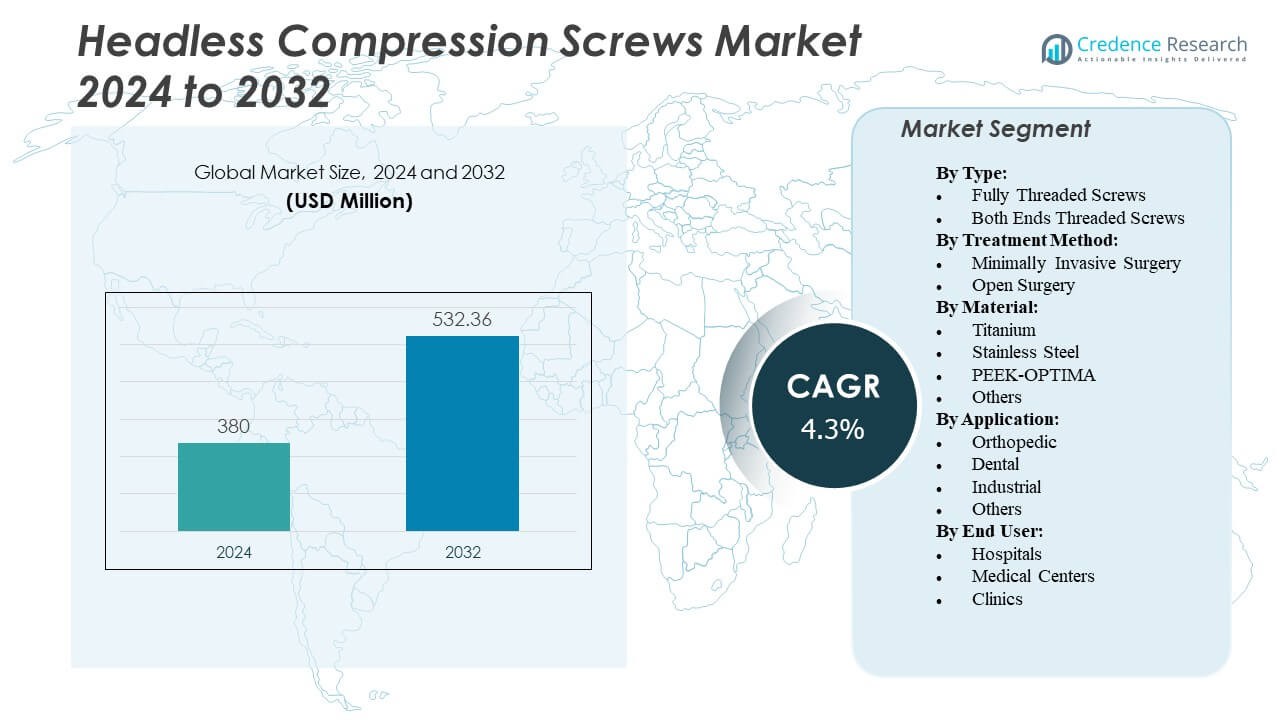

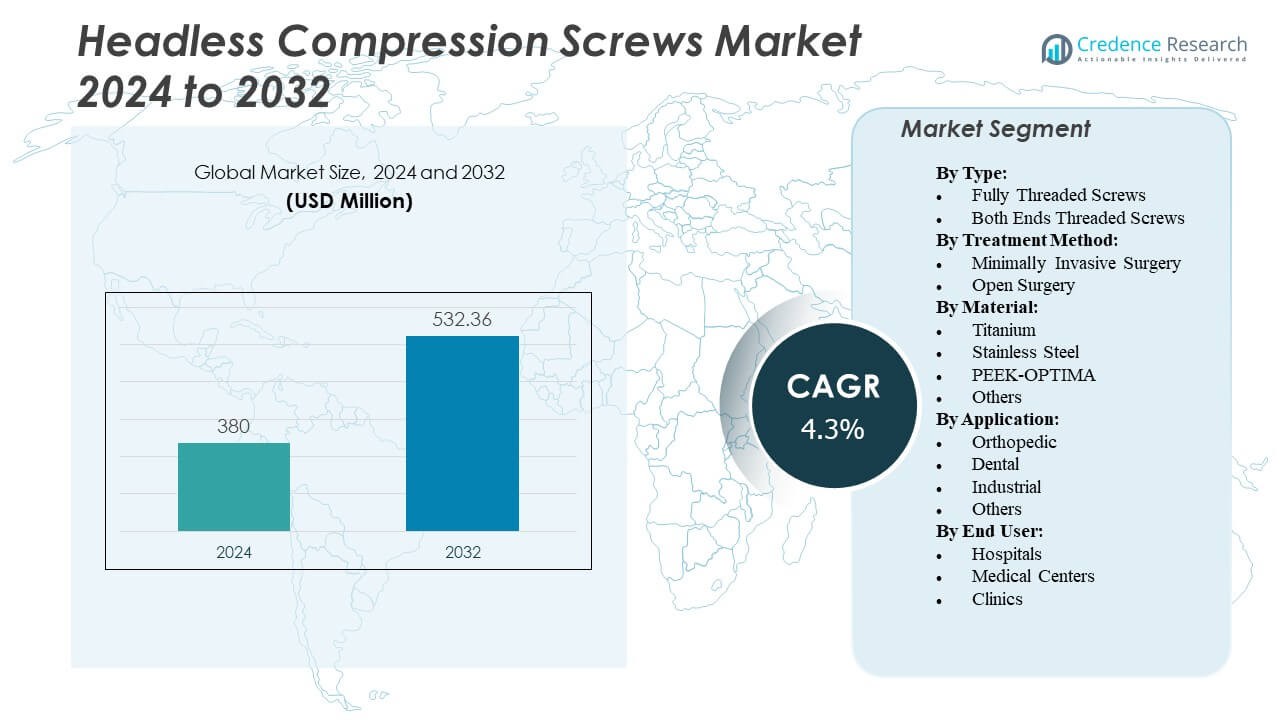

The Headless Compression Screws Market is projected to grow from USD 380 million in 2024 to an estimated USD 532.36 million by 2032, with a compound annual growth rate (CAGR) of 4.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Headless Compression Screws Market Size 2024 |

USD 380 Million |

| Headless Compression Screws Market, CAGR |

4.3% |

| Headless Compression Screws Market Size 2032 |

USD 532.36 Million |

Rising cases of orthopedic trauma, fractures, and degenerative bone conditions are key factors driving growth. Increasing adoption of minimally invasive surgeries and improved biocompatible materials such as titanium and PEEK-OPTIMA are supporting higher usage rates. The market also benefits from the growing elderly population and expanding sports-related injury treatments. Hospitals and surgical centers continue to invest in precision fixation systems that enhance recovery time and reduce post-surgical complications.

North America leads the market due to strong healthcare infrastructure, early adoption of advanced implants, and the presence of major orthopedic device manufacturers. Europe follows, supported by favorable reimbursement systems and an aging population requiring bone fixation procedures. Asia Pacific is emerging rapidly, driven by growing medical tourism, rising healthcare spending, and expanding access to modern surgical facilities in China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Headless Compression Screws Market is projected to grow from USD 380 million in 2024 to USD 532.36 million by 2032, registering a CAGR of 4.3%.

- Rising orthopedic trauma cases and fracture treatments are strengthening global product demand.

- Growing adoption of minimally invasive surgeries is supporting faster recovery and reducing hospital stays.

- High product costs and limited access in developing economies remain key restraints to wider adoption.

- North America leads the market due to strong healthcare infrastructure and advanced surgical technologies.

- Europe shows steady demand driven by favorable reimbursement and aging population trends.

- Asia Pacific emerges as a high-growth region supported by rising healthcare investments and medical tourism.

Market Drivers

Rising Orthopedic Surgical Procedures and Trauma Cases Drive Product Demand

The Headless Compression Screws Market is driven by the growing number of orthopedic and trauma surgeries worldwide. Increasing incidents of fractures caused by road accidents and sports injuries are creating strong demand. Hospitals and surgical centers are using advanced screws to enhance fixation stability and recovery outcomes. The product’s low-profile design minimizes tissue irritation and supports bone healing. Surgeons prefer these screws for complex procedures involving small bones and joints. The global rise in osteoporotic fractures is reinforcing the need for durable fixation systems. It benefits from expanding patient awareness regarding modern orthopedic treatments. The market’s growth reflects the shift toward high-precision surgical interventions.

Adoption of Minimally Invasive Surgical Techniques Enhances Market Growth

Increasing preference for minimally invasive surgeries is supporting the expansion of this market. These procedures reduce recovery time and hospital stays, making them more popular among patients. Headless compression screws play a crucial role in such techniques by providing efficient bone compression with reduced hardware visibility. Hospitals are adopting these devices for small bone fixation in wrists, ankles, and feet. It benefits from reduced infection risks and shorter rehabilitation periods. Surgeons prefer them due to improved clinical outcomes and aesthetic appeal. The growing use of robotic-assisted systems further strengthens their accuracy and placement. Rising focus on patient comfort is accelerating adoption across orthopedic centers.

Material Innovation and Advanced Manufacturing Techniques Improve Performance

Continuous improvements in materials are enhancing the reliability and lifespan of these screws. Titanium and bioabsorbable materials are replacing stainless steel due to superior biocompatibility. It supports faster osseointegration and reduced allergic reactions. Manufacturers are using advanced CNC machining and surface coating methods to increase product strength. Enhanced corrosion resistance and precision threading contribute to improved stability during fixation. These advancements enable better bone healing in small joints and complex fractures. Hospitals are demanding customized and lightweight designs to meet diverse surgical needs. The development of hybrid materials is expected to redefine mechanical efficiency.

- For example, DePuy Synthes’ bioabsorbable MILAGRO screw is composed of poly(lactic-co-glycolic acid) (PLGA) and β-tricalcium phosphate, and clinical follow-up has shown the screw to be fully resorbed within several years after surgery, with evidence of bone fill at the site. Studies of hydroxyapatite-PLLA screws (PLLA-HA) also show eventual resorption and replacement by bone tissue, confirming the utility of these material innovations in headless compression screws.

Aging Population and Rising Awareness of Bone Health Boost Market Adoption

The global rise in the geriatric population is fueling demand for bone fixation devices. Older adults face higher risks of fractures and degenerative bone diseases. It gains traction as healthcare providers focus on improving quality of life through surgical intervention. Awareness campaigns on early orthopedic care encourage patients to seek advanced treatment. Increasing healthcare expenditure in developed nations supports adoption in both public and private hospitals. Surgeons recommend headless compression screws for faster rehabilitation in elderly patients. Strong focus on post-operative outcomes ensures steady market penetration. Growing access to specialized orthopedic care further strengthens global adoption.

- For example, Smith+Nephew’s EVOS Mini Plating System is clinically utilized for treatment of tibial plafond and other small bone fractures, with published data confirming “low hardware failure and complication rates” in elderly patient populations. Ongoing clinical studies (e.g., NCT03898003) are further evaluating outcomes and safety for geriatric fracture repair using the EVOS Mini Plating and Screw System.

Market Trends

Integration of 3D Printing and Customization in Screw Design

The integration of 3D printing technology is redefining how headless compression screws are produced. Customized screw designs ensure better anatomical fit and fixation precision. Manufacturers are developing patient-specific implants that match bone geometry. It supports complex orthopedic surgeries requiring exact alignment and minimal complications. Hospitals benefit from reduced inventory costs due to on-demand production. 3D printing allows microstructural optimization to improve strength and biocompatibility. Research teams are testing composite materials for better performance and reduced weight. Increasing collaboration between medtech companies and additive manufacturing firms is reshaping production standards.

- For instance, Stryker’s 3D-printed titanium orthopedic implant components, including additively manufactured spinal implants and patient-specific knee and hip replacement instruments, use laser powder bed fusion and are FDA-cleared for clinical use as of 2024.

Growing Use of Bioabsorbable and Biocompatible Materials

A major trend in this market is the transition toward bioabsorbable polymers and alloys. These materials eliminate the need for secondary surgeries to remove implants. It enhances patient comfort and reduces healthcare costs. The trend is expanding rapidly in trauma and pediatric care segments. Companies are introducing polymer-based screws that naturally dissolve after bone healing. This approach aligns with sustainable healthcare objectives. R&D initiatives are focusing on biodegradable composites with high tensile strength. Hospitals are shifting preference from metallic to bioabsorbable devices to improve long-term outcomes. The trend promotes innovation in eco-friendly surgical materials.

Digital Planning and Image-Guided Surgery Improve Accuracy

The adoption of computer-assisted surgery and imaging tools is transforming orthopedic practices. Real-time imaging enables precise screw placement with minimal margin of error. It ensures accurate bone alignment, reducing complications post-surgery. Hospitals are integrating navigation systems and AI-based planning tools for enhanced predictability. Surgeons use 3D modeling software to map optimal insertion points before surgery. These technologies support better visualization during complex bone reconstruction. Continuous training programs are enhancing surgeon proficiency in image-guided systems. Integration of robotics in orthopedic procedures is further strengthening precision and consistency.

- For instance, the Zimmer Biomet ROSA Knee System demonstrated an average of 98.18% accuracy in predicting femoral component size (within one size) in clinical practice (2025), with surgical bone cuts completed at a margin of less than 1 mm from preoperative plans, according to peer-reviewed clinical studies and official company evidence summaries.

Increasing Focus on Aesthetic and Postoperative Outcomes

Surgeons and patients are increasingly prioritizing aesthetics and faster recovery. Headless compression screws, being less visible under the skin, provide a cleaner post-surgical appearance. It supports cosmetic outcomes while maintaining strong fixation. The market benefits from the shift toward patient-centric treatment. Manufacturers are designing ultra-low profile screws to enhance comfort and appearance. Hospitals highlight these advantages to attract patients seeking minimal scarring. The trend is evident in elective and reconstructive surgeries. Continuous refinement in screw head design is ensuring improved tissue compatibility and reduced irritation.

Market Challenges Analysis

High Product Costs and Limited Access in Developing Economies

The Headless Compression Screws Market faces cost-related barriers that limit adoption in low-income regions. High manufacturing and regulatory compliance costs make products expensive for smaller hospitals. It struggles with affordability in rural healthcare systems lacking insurance coverage. Import tariffs and distribution challenges further increase prices. Many developing nations depend on low-cost substitutes that compromise on quality. Limited awareness about advanced surgical solutions restricts market expansion. Healthcare infrastructure gaps slow down the adoption rate of modern fixation technologies. Price-sensitive consumers often delay or avoid surgical treatment, affecting overall penetration.

Regulatory Hurdles and Complex Approval Pathways Restrict Innovation

Stringent regulatory frameworks across major regions create barriers for new product launches. Obtaining FDA or CE approvals demands extensive clinical validation and long timelines. It causes delays in bringing advanced technologies to market. Smaller manufacturers face challenges in meeting documentation and post-market surveillance requirements. Differences in regional approval standards complicate international expansion. Frequent policy changes increase compliance costs and discourage R&D investments. Manufacturers must navigate these constraints to maintain competitiveness. Ensuring patient safety while sustaining innovation remains a major industry balancing act.

Market Opportunities

Expansion in Emerging Healthcare Markets with Growing Orthopedic Infrastructure

Developing nations are creating strong opportunities due to expanding healthcare infrastructure and surgical capacity. Rising government investment in hospital modernization is improving access to orthopedic care. It benefits from growing demand for trauma management and sports medicine solutions. The shift toward advanced surgical practices in Asia-Pacific and Latin America is unlocking new revenue streams. Medical tourism in countries like India and Thailand attracts international patients seeking cost-effective orthopedic procedures. Local manufacturing initiatives are reducing import dependency. Partnerships with regional distributors are helping global firms penetrate underserved markets. Rising focus on quality healthcare access will continue supporting long-term growth.

R&D Advancements in Smart and Hybrid Orthopedic Implants

Innovation in smart orthopedic devices is creating major opportunities for differentiation. Integration of sensors within compression screws enables real-time monitoring of bone healing. It provides valuable post-operative data to surgeons and improves recovery management. Companies are developing hybrid materials that combine metal strength with polymer flexibility. Advanced surface coatings are reducing infection risks and enhancing biocompatibility. Collaboration between biomedical engineers and orthopedic specialists is driving continuous improvements. Governments and private investors are funding research on next-generation orthopedic materials. These advancements are shaping a future where intelligent fixation systems support precision medicine goals.

Market Segmentation Analysis:

By Type

The Headless Compression Screws Market by type includes fully threaded and both ends threaded screws. Fully threaded screws offer uniform compression and stability, making them ideal for small bone fixation and joint fusion procedures. Both ends threaded screws are preferred for specific applications that require precise bone fragment alignment and variable compression control. It benefits from surgeons’ increasing demand for fixation devices providing consistent mechanical performance. The versatility of screw types supports wider adoption across trauma and reconstructive surgeries. Manufacturers continue improving thread geometry for better load distribution and reduced bone stress. The segment’s growth reflects innovation in orthopedic fixation technologies.

By Treatment Method

The market by treatment method includes minimally invasive surgery and open surgery. Minimally invasive procedures are gaining popularity due to reduced recovery time, lower infection risk, and minimal scarring. It supports the trend toward patient comfort and efficient rehabilitation. Open surgeries remain relevant in complex fractures where greater exposure is required. Hospitals increasingly favor techniques that shorten hospital stays and improve surgical precision. The adoption of robotic-assisted systems enhances accuracy during screw placement. Growing awareness of surgical advancements strengthens both categories. The segment demonstrates continuous evolution in response to clinical needs and surgical innovations.

By Material

The market by material includes titanium, stainless steel, PEEK-OPTIMA, and others. Titanium dominates due to high strength, corrosion resistance, and biocompatibility. Stainless steel continues to serve cost-sensitive applications with proven durability. PEEK-OPTIMA is emerging for its lightweight nature and radiolucency, aiding better imaging outcomes. It enables surgeons to achieve precise visualization during healing assessment. Manufacturers are investing in hybrid materials combining metal strength with polymer flexibility. Ongoing R&D enhances surface coatings to prevent bacterial growth. The segment’s progress highlights the balance between mechanical performance and patient safety.

- For instance, controlled trials report that Invibio’s PEEK-OPTIMA™ HA Enhanced achieved up to 75% direct bone contact and greater new bone formation within six weeks compared to standard PEEK in animal models, supporting its improved osseointegration characteristics.

By Application

The market by application covers orthopedic, dental, industrial, and other uses. Orthopedic applications hold the largest share, driven by rising fracture cases and sports injuries. Dental applications are expanding due to growing use in maxillofacial and reconstructive procedures. Industrial applications involve specialized uses in research and mechanical testing. It benefits from increasing medical advancements and cross-disciplinary innovation. Surgeons prefer headless compression screws for smaller anatomical regions requiring precise fixation. Technological integration supports improved stability and shorter healing times. The segment continues to diversify as healthcare practices evolve.

- For instance, a 2023 biomechanical study with 3.5-mm headless compression screws documented high peak compression forces comparable to locking screws in synthetic bone models, validating reliability for orthopedic and dental fracture fixation procedures.

By End User

The market by end user includes hospitals, medical centers, and clinics. Hospitals account for a major portion due to advanced surgical infrastructure and skilled professionals. Medical centers are expanding adoption through specialized orthopedic departments. Clinics are integrating smaller-scale surgical units to perform minor fixation procedures. It experiences growing demand in urban and semi-urban regions with improved healthcare access. Surgeons prefer settings equipped with modern imaging and navigation tools. Healthcare investments are improving procedural efficiency and patient throughput. The segment’s development underscores expanding access to high-quality orthopedic care.

Segmentation:

By Type:

- Fully Threaded Screws

- Both Ends Threaded Screws

By Treatment Method:

- Minimally Invasive Surgery

- Open Surgery

By Material:

- Titanium

- Stainless Steel

- PEEK-OPTIMA

- Others

By Application:

- Orthopedic

- Dental

- Industrial

- Others

By End User:

- Hospitals

- Medical Centers

- Clinics

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America dominates the Headless Compression Screws Market with a 38% share, supported by advanced healthcare systems and high surgical volumes. The United States leads due to its well-established orthopedic infrastructure, extensive insurance coverage, and strong adoption of innovative implant technologies. It benefits from continuous R&D investments by major manufacturers focused on improving biocompatibility and fixation performance. Canada contributes through an expanding network of trauma care and orthopedic facilities. The presence of leading medical device companies ensures faster access to regulatory approvals and early adoption of advanced products. The region’s technological leadership and skilled workforce sustain its competitive edge in the global landscape.

Europe holds a 29% share of the market, driven by the growing aging population and favorable reimbursement frameworks. Germany, the United Kingdom, and France represent major contributors, emphasizing patient safety and precision in orthopedic procedures. It experiences rising demand for bioabsorbable and titanium-based implants across hospitals and clinics. The European Union’s focus on quality standards and regulatory compliance strengthens market transparency. Research partnerships between universities and orthopedic firms enhance innovation and material development. Increasing awareness of minimally invasive surgery supports the steady growth trajectory across the region.

Asia Pacific accounts for a 23% market share and is the fastest-growing regional segment. Rapid infrastructure development and a growing middle-class population drive healthcare spending in China, India, and Japan. It gains momentum from expanding access to orthopedic care and rising trauma cases linked to urbanization. Medical tourism in countries like India and Thailand enhances the market’s reach through affordable treatment options. Governments are supporting domestic manufacturing through policy reforms and quality certifications. The region’s growing medical device sector and improving surgeon expertise create a strong foundation for sustained expansion. Latin America, the Middle East, and Africa collectively hold the remaining 10% share, showing gradual adoption driven by healthcare modernization efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Headless Compression Screws Market is characterized by strong competition among global and regional manufacturers offering advanced fixation solutions. Key players focus on innovation in materials, design optimization, and surface technologies to enhance product reliability. It features companies such as DePuy Synthes, Stryker Corporation, Smith & Nephew plc, Zimmer Biomet Holdings, and Medartis AG. These firms emphasize strategic collaborations, product launches, and mergers to strengthen global presence. Smaller companies and start-ups are entering the market with specialized screw systems targeting niche surgical needs. Manufacturers are investing in automation and additive manufacturing to improve precision and reduce production costs. Continuous technological progress and surgeon partnerships are shaping the next phase of competitive differentiation.

Recent Developments:

- In October 2025, Johnson & Johnson announced its intent to separate its orthopaedics division, DePuy Synthes, as a standalone orthopaedics business. The move aims to create the largest, most comprehensive orthopaedics-focused company, strengthening its focus and leadership in high-growth, high-margin medical device markets, including trauma and implant segments such as headless compression screws.

- In October 2025, Zimmer Biomet also completed the acquisition of Monogram Technologies. While Monogram is best known for robotics and joint reconstruction, the acquisition underscores Zimmer Biomet’s strategic intent to expand its digital, orthopedic, and musculoskeletal platforms, which also benefit their fixation and screw technologies.

- In July 2025, Zimmer Biomet revealed a strategic partnership with Getinge to distribute Getinge’s operating room products to ambulatory surgery centers, alongside Zimmer Biomet’s orthopedic implants, including solutions that complement their headless compression screws portfolio.

Report Coverage:

The research report offers an in-depth analysis based on Type, Treatment Method, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for minimally invasive procedures will continue to enhance adoption across orthopedic centers.

- Technological advancements in screw design will improve fixation stability and postoperative recovery outcomes.

- Integration of smart materials and bioabsorbable compounds will support long-term patient safety.

- 3D printing and additive manufacturing will enable customized, patient-specific screw designs.

- Rising geriatric population and fracture incidence will strengthen the need for durable fixation devices.

- Ongoing collaborations between medical device firms and hospitals will accelerate innovation in surgical solutions.

- Expanding healthcare infrastructure in Asia-Pacific and Latin America will boost market penetration.

- Increased use of robotics and image-guided surgery will enhance procedural precision and adoption rates.

- Regulatory harmonization and quality standard improvements will foster consistent product availability.

- Growing focus on patient satisfaction and aesthetic outcomes will shape the next phase of market evolution.