Market Overview

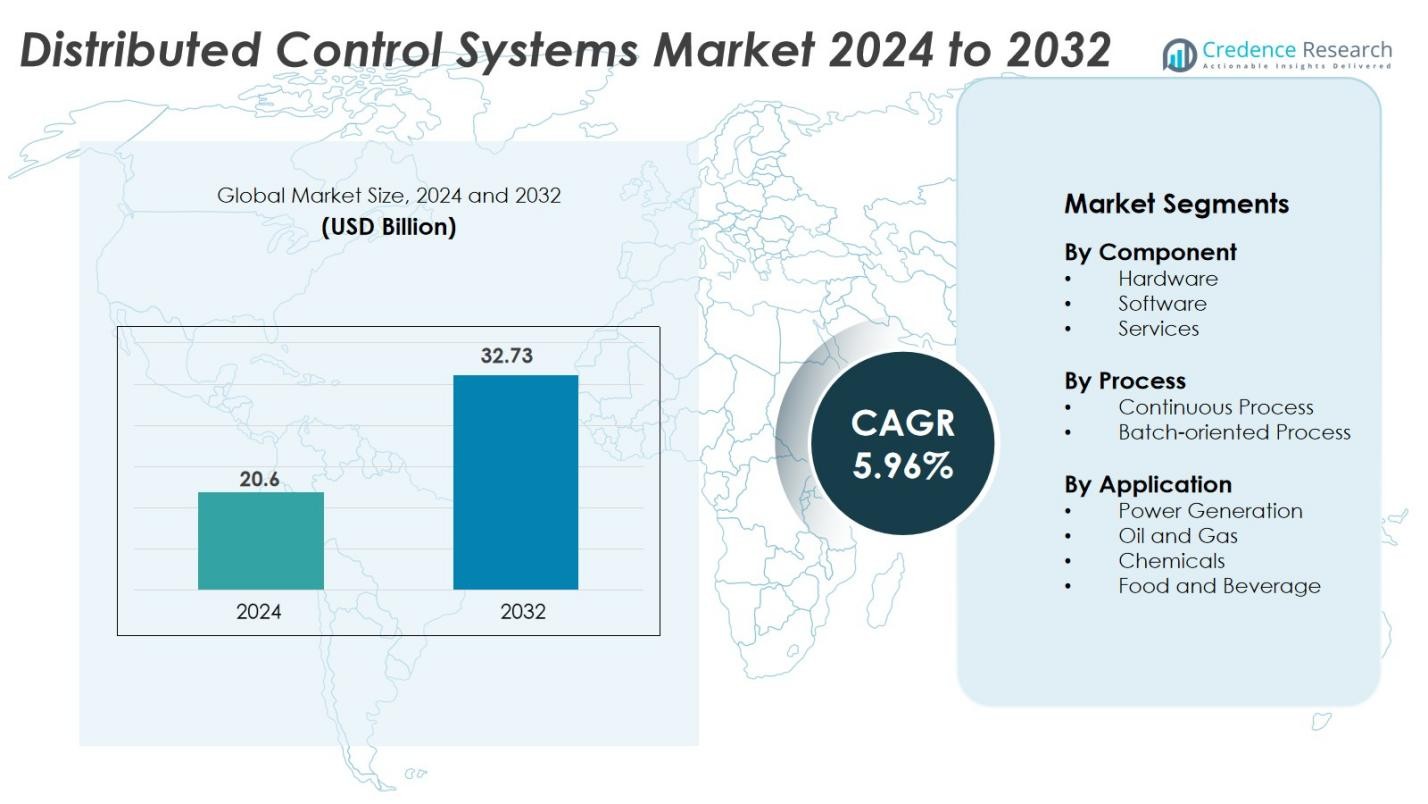

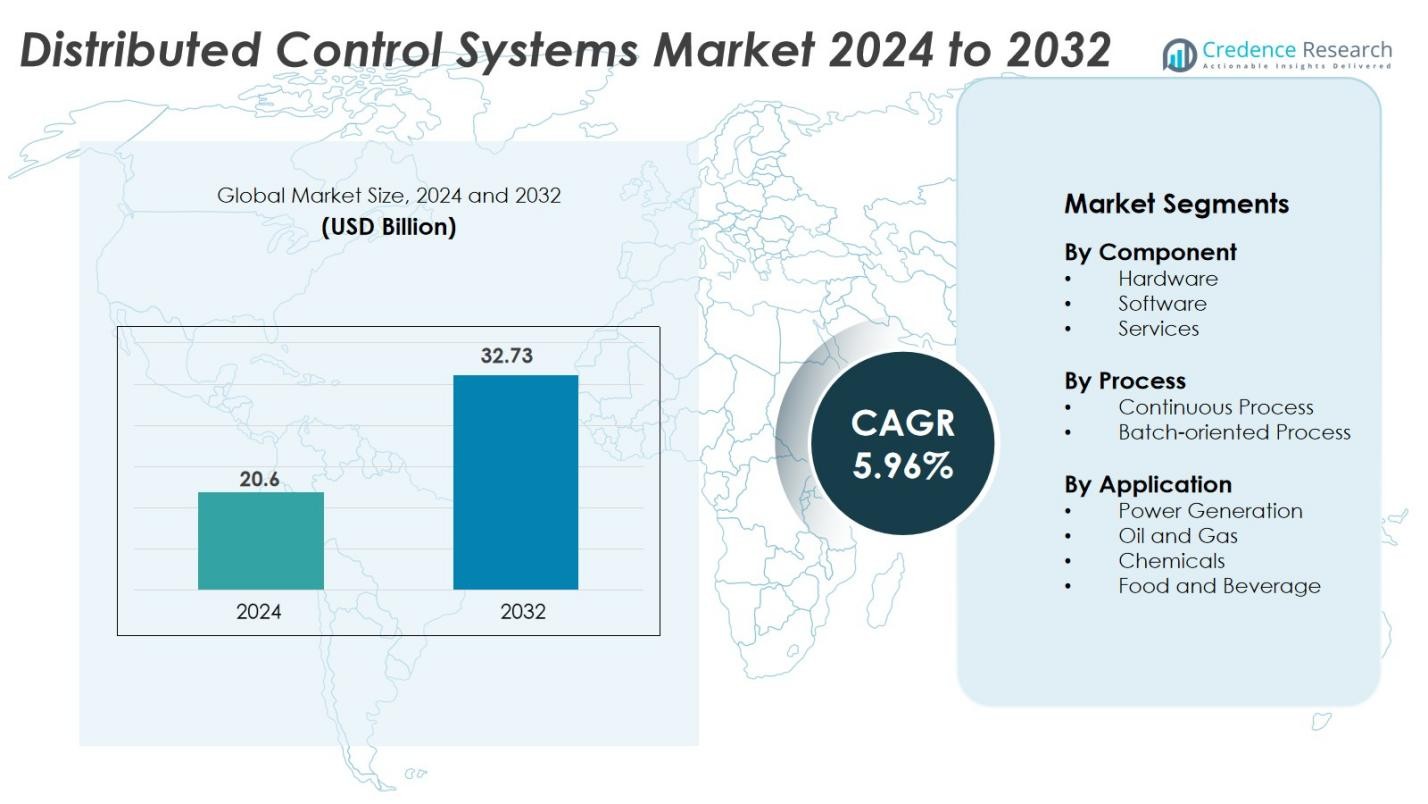

Distributed Control Systems Market size was valued at USD 20.6 billion in 2024 and is anticipated to reach USD 32.73 billion by 2032, growing at a CAGR of 5.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Distributed Control Systems Market Size 2024 |

USD 20.6 Billion |

| Distributed Control Systems Market, CAGR |

5.96% |

| Distributed Control Systems Market Size 2032 |

USD 32.73 Billion |

The Distributed Control Systems market features prominent players such as Honeywell, ABB, Emerson Electric, Mitsubishi Electric, Ingeteam, NovaTech, Azbil, Hitachi, HollySys, and Concept Systems. These companies dominate through advanced automation technologies, modular control architectures, and integration of AI and IoT capabilities. Asia-Pacific leads the global market with a 34% share in 2024, driven by industrial expansion, automation investments, and the growth of manufacturing and energy sectors in China, India, and Japan. North America follows with a 29% share, supported by modernization of legacy systems and the strong presence of global automation vendors across process-intensive industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Distributed Control Systems market was valued at USD 20.6 billion in 2024 and is projected to reach USD 32.73 billion by 2032, growing at a CAGR of 5.96% during the forecast period.

- Rising automation across industries such as power generation, oil and gas, and chemicals drives market expansion, with hardware components holding a 46% share due to their essential role in control and monitoring.

- Trends such as cloud-based control platforms, edge computing integration, and modular DCS architectures enhance scalability and real-time performance across complex operations.

- Leading players like Honeywell, ABB, and Emerson Electric invest in AI-enabled DCS solutions, while high installation and maintenance costs restrain adoption among small and mid-sized industries.

- Asia-Pacific leads with a 34% share, followed by North America at 29% and Europe at 27%, supported by rapid industrialization, infrastructure modernization, and strong adoption of smart automation technologies.

Market Segmentation Analysis

By Component

The hardware segment held the dominant market share of 46% in 2024, driven by rising automation in power and process industries. Hardware components such as controllers, I/O modules, and networking devices form the backbone of DCS infrastructure, ensuring operational stability and precision. Continuous advancements in modular hardware and enhanced communication protocols improve control efficiency and scalability. Increased capital investments in industrial modernization projects across manufacturing and energy sectors further boost demand for high-performance DCS hardware systems.

- For instance, Huawei’s PowerPOD hardware solution notably cut installation footprint by consolidating ultra-high-density UPS systems and lithium batteries into a single container, enabling rapid on-site deployment and flexible capacity scaling in data centers across China.

By Process

The continuous process segment accounted for 63% of the market share in 2024, owing to its widespread use in oil and gas, chemical, and power generation industries. These sectors require real-time monitoring, uninterrupted operation, and consistent output quality. DCS enables seamless integration of control loops and automation systems to maintain steady production flows. The growing focus on energy optimization and minimal downtime in continuous production environments strengthens the segment’s leadership in the overall market.

- For instance, Emerson Electric’s DeltaV™ Distributed Control System is deployed extensively in oil and gas processing plants, supporting thousands of control loops and enabling real-time operational decisions that minimize downtime.

By Application

The power generation segment dominated the market with a 38% share in 2024, supported by ongoing modernization of power plants and integration of renewable energy systems. Distributed control systems enhance plant efficiency, load balancing, and grid stability through advanced monitoring and predictive control. Growing adoption of DCS solutions in thermal, hydro, and nuclear power plants underscores their critical role in ensuring safety and reliability. The sector’s push toward smart grids and digitalization further reinforces DCS deployment across power generation facilities.

Key Growth Drivers

Rising Industrial Automation and Digitalization

Industrial facilities increasingly adopt distributed control systems to enhance operational efficiency, minimize downtime, and optimize production processes. The transition toward Industry 4.0 encourages integration of IoT, AI, and machine learning with DCS platforms to enable predictive maintenance and real-time analytics. This digital transformation reduces manual intervention and improves plant safety and productivity. Manufacturing, power, and oil and gas industries are investing heavily in automation to remain competitive. These investments, coupled with the demand for intelligent, interconnected control systems, continue to propel DCS adoption across major industrial sectors worldwide.

- For instance, Honeywell offers its Honeywell Forge Predictive Maintenance solution, which has been deployed at various facilities, including an industrial site connecting over 100 major assets, and a hospital that reduced electricity usage by an average of 8%. In the logistics sector, Honeywell solutions have been used by companies like Pall-Ex, which deployed 500 Honeywell handhelds and vehicle-mounted computers for workflow optimization.

Growing Energy Demand and Power Infrastructure Modernization

Rising global electricity consumption and the expansion of renewable energy projects drive the need for advanced control systems in power plants. DCS solutions offer enhanced process control, reliability, and scalability essential for managing complex power generation networks. Utilities deploy DCS to integrate renewable sources such as solar and wind while maintaining grid stability. Government initiatives promoting smart grids and clean energy technologies further increase DCS deployment. The modernization of thermal and nuclear facilities with digital control platforms is also a major growth catalyst for the market.

- For instance, ABB’s Ability Symphony Plus DCS (or its preceding Symphony family systems) have been implemented in over 7,000 installations worldwide, with more than 5,000 in power and water applications. It is recognized as a leading DCS in the power generation and water industries.

Increasing Adoption in Oil and Gas and Chemical Industries

Process-intensive sectors such as oil and gas, petrochemicals, and refining rely heavily on DCS for precise monitoring and safety management. These industries demand consistent process control and data integration to ensure operational continuity in harsh environments. Distributed control systems enable seamless plant automation, reducing the risk of errors and equipment failures. With ongoing global exploration projects and expansion of refining capacity, demand for DCS solutions continues to rise. Integration with advanced sensors, cybersecurity features, and remote monitoring further strengthens adoption in these mission-critical industries.

Key Trends & Opportunities

Integration of Cloud and Edge Computing

The adoption of cloud and edge technologies within DCS environments is transforming industrial automation. Cloud-based architectures provide centralized data access, enabling predictive analytics and remote diagnostics. Edge computing enhances local data processing, improving response times and operational reliability. This hybrid architecture supports flexible, scalable, and secure control systems suitable for multi-site operations. Vendors increasingly offer cloud-enabled DCS platforms to support smart factories and real-time decision-making, creating new opportunities for advanced industrial control ecosystems.

- For instance, Schneider Electric’s on-device analytics for grid optimisation maintained temperature compliance over 85% of the time and delivered an average daily HVAC energy reduction of 5%.

Shift Toward Modular and Open Systems Architecture

Manufacturers increasingly prefer modular and open DCS platforms for scalability and interoperability. These systems simplify upgrades and reduce lifecycle costs by allowing integration with third-party devices and software. Open architecture fosters innovation through compatibility with emerging technologies like AI, digital twins, and cybersecurity modules. This shift enables industries to transition smoothly from legacy systems to modern, flexible control environments. The trend aligns with the growing focus on digital transformation and sustainability across industrial automation sectors.

- For instance, ABB’s Adaptive Execution™ tool enables virtual application testing and commissioning in cloud environments, decoupling hardware engineering and software development tasks across multiple teams.

Key Challenges

High Implementation and Maintenance Costs

Implementing distributed control systems involves substantial capital expenditure, particularly for large-scale industrial plants. Hardware installation, system integration, and software licensing contribute to high initial costs. Additionally, maintenance and periodic upgrades add to long-term expenses. Small and medium enterprises often struggle to justify such investments, limiting adoption in cost-sensitive sectors. Despite long-term operational benefits, financial constraints and uncertain ROI slow DCS deployment, especially in emerging markets with limited automation budgets.

Cybersecurity Risks and Integration Complexities

As DCS platforms become more connected through IoT and cloud networks, cybersecurity threats pose significant risks. Unauthorized access or data breaches can disrupt operations and compromise safety. Integrating DCS with existing IT and OT systems adds further complexity, requiring advanced security frameworks and skilled personnel. The lack of standardized protocols across vendors complicates interoperability and increases vulnerability. Ensuring secure communication and real-time data integrity remains a critical challenge for industries adopting connected DCS solutions.

Regional Analysis

North America

North America held a 29% market share in 2024, driven by strong industrial automation and advanced manufacturing adoption across the U.S. and Canada. The region’s oil and gas, chemical, and power generation sectors widely implement DCS to enhance process efficiency and safety. Government initiatives promoting energy optimization and the modernization of legacy infrastructure further stimulate demand. Leading vendors such as Emerson Electric and Honeywell strengthen the regional presence through continuous innovation and expansion of digital control platforms that support Industry 4.0 and IIoT applications across industrial operations.

Europe

Europe accounted for 27% of the market share in 2024, supported by stringent energy-efficiency regulations and the adoption of smart manufacturing technologies. Major industries in Germany, the U.K., and France deploy DCS to optimize production and reduce carbon emissions. The region’s transition toward renewable energy and modernization of existing power facilities boosts demand for advanced control systems. European companies like ABB and Siemens focus on open and modular DCS architectures, enabling seamless integration with digital ecosystems and sustainability-focused industrial operations.

Asia-Pacific

Asia-Pacific dominated the market with a 34% share in 2024, driven by rapid industrialization, rising energy consumption, and large-scale infrastructure projects in China, India, and Japan. Expanding manufacturing bases and government investments in automation and smart factories fuel strong regional growth. The oil and gas, power generation, and chemical industries increasingly deploy DCS for operational reliability and cost optimization. Regional players and global vendors invest heavily in advanced automation and edge-based DCS platforms, catering to the evolving industrial needs of emerging economies.

Latin America

Latin America captured a 6% market share in 2024, with growth primarily supported by the oil and gas and mining industries in Brazil and Mexico. Rising investments in industrial automation, process control, and power plant modernization enhance regional adoption. Companies adopt DCS to reduce operational downtime and improve production quality in energy and process sectors. Partnerships between global automation providers and regional integrators are increasing, enabling cost-effective system deployment and technical support across diverse industrial environments.

Middle East & Africa

The Middle East & Africa held a 4% market share in 2024, fueled by strong demand from oil refineries, petrochemical plants, and power utilities. Nations such as Saudi Arabia, the UAE, and South Africa invest heavily in automation to support energy diversification and efficient production. DCS systems help optimize refinery operations, improve plant safety, and ensure energy conservation. Strategic initiatives like Vision 2030 and infrastructure expansion projects further accelerate automation demand, creating growth opportunities for international and regional control system suppliers.

Market Segmentations

By Component

- Hardware

- Software

- Services

By Process

- Continuous Process

- Batch-oriented Process

By Application

- Power Generation

- Oil and Gas

- Chemicals

- Food and Beverage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Distributed Control Systems market is highly competitive, featuring global players such as ABB, Honeywell, Emerson Electric, Mitsubishi Electric, Ingeteam, NovaTech, Azbil, Hitachi, HollySys, and Concept Systems. These companies focus on technological innovation, strategic collaborations, and digital transformation to strengthen their market position. Key players invest heavily in R&D to enhance system integration, cybersecurity, and real-time monitoring capabilities. Partnerships with industrial automation firms and software developers support the development of modular, cloud-enabled, and AI-integrated DCS solutions. Mergers, acquisitions, and expansion into emerging markets remain central to growth strategies. Vendors also emphasize service contracts, lifecycle management, and remote operations support to build long-term customer relationships. The competitive landscape continues to evolve as companies integrate IoT, edge computing, and predictive analytics into their control architectures to meet rising industry demand for smarter, more resilient automation systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell

- Mitsubishi Electric

- Emerson Electric

- Ingeteam

- NovaTech

- ABB

- Azbil

- Concept Systems

- Hitachi

- HollySys

Recent Developments

- In 2025, Siemens unveiled its Industrial Foundation Model co-developed with Microsoft to accelerate digital-twin deployment and improve shop-floor decision-making.

- In May 2025, Scale Computing launched the SC//Platform designed for autonomous edge infrastructure, supporting real-time workloads across distributed control systems.

- In November 2023, Emerson introduced the DeltaV Edge Environment, enabling secure one-way data flow for monitoring and analytics while maintaining isolated core control.

- In November 2023, Siemens presented the Industrial Copilot, a generative AI assistant that provides real-time operational guidance for complex industrial tasks.

Report Coverage

The research report offers an in-depth analysis based on Component, Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for digitalized control systems will increase with Industry 4.0 adoption.

- Integration of AI and machine learning will enhance predictive maintenance capabilities.

- Cloud-enabled DCS platforms will support remote monitoring and real-time analytics.

- Growth in renewable energy projects will boost DCS deployment in power generation.

- Modular and open system architectures will gain preference for flexibility and scalability.

- Cybersecurity solutions will become critical to safeguard industrial automation networks.

- Emerging economies will witness rapid industrial automation and process control upgrades.

- Strategic collaborations between hardware and software providers will drive innovation.

- Service-based DCS models will expand as industries seek lifecycle management support.

- Advancements in edge computing and IoT connectivity will strengthen system performance and reliability.