Market Overview

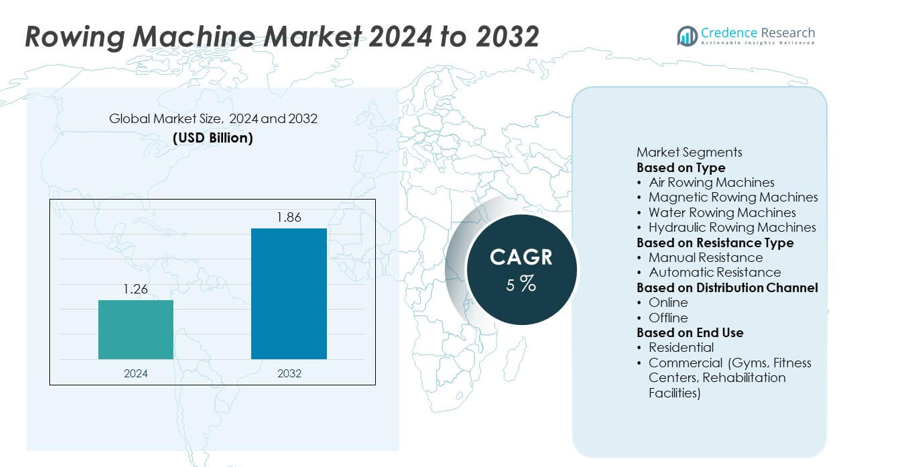

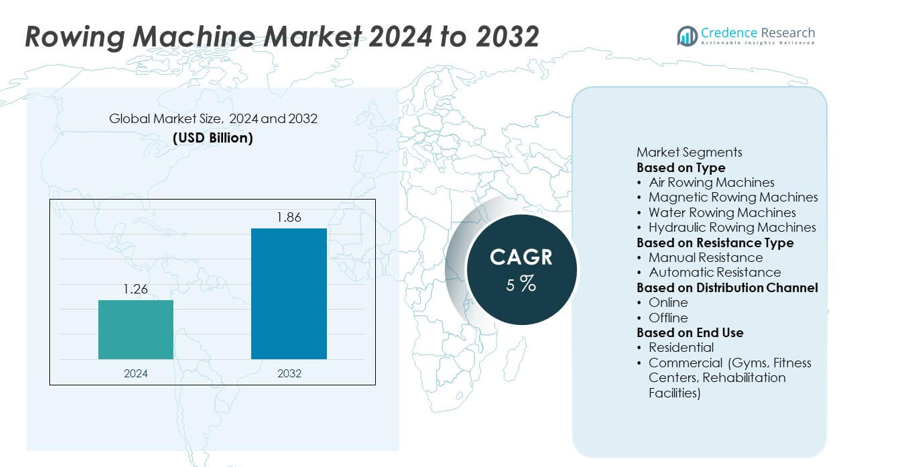

The rowing machine market was valued at USD 1.26 billion in 2024 and is projected to reach USD 1.86 billion by 2032, growing at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rowing machine market Size 2024 |

USD 1.26 billion |

| Rowing machine market, CAGR |

5% |

| Rowing machine market Size 2032 |

USD 1.86 billion |

The rowing machine market is led by major players including Concept2 Inc., WaterRower Inc., Technogym S.p.A., Life Fitness, NordicTrack (ICON Health & Fitness Inc.), Stamina Products Inc., Bodycraft, JTX Fitness, XTERRA Fitness Inc., and Sunny Health & Fitness. These companies emphasize advanced resistance technologies, connected fitness integration, and ergonomic designs to enhance performance and user engagement. Product innovation and sustainability are key competitive strategies. Regionally, Asia-Pacific dominated the global market in 2024 with a 33.8% share, driven by rapid urbanization and growing home fitness adoption, followed by North America with 31.6% and Europe with 27.4%, supported by expanding gym infrastructure and increasing digital fitness penetration.

Market Insights

- The rowing machine market was valued at USD 1.26 billion in 2024 and is projected to reach USD 1.86 billion by 2032, growing at a CAGR of 5%.

- Increasing health awareness and rising participation in home-based workouts drive market demand, with the air rowing machine segment holding a 39.6% share in 2024.

- Integration of smart connectivity, digital tracking, and virtual training programs continues to shape market trends and attract tech-savvy users.

- Leading players such as Concept2 Inc., WaterRower Inc., Technogym S.p.A., Life Fitness, and NordicTrack focus on innovation, ergonomic designs, and sustainable materials to strengthen their market position.

- Regionally, Asia-Pacific led the market with a 33.8% share in 2024, followed by North America at 31.6% and Europe at 27.4%, supported by expanding gym infrastructure, digital fitness growth, and rising adoption of compact home workout equipment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The air rowing machine segment dominated the rowing machine market in 2024 with a 39.6% share. Its popularity stems from its smooth, variable resistance and ability to simulate real rowing dynamics, making it preferred among athletes and fitness enthusiasts. The segment’s demand is supported by widespread use in gyms and professional training facilities. Water and magnetic rowing machines are also gaining traction for their quiet operation and aesthetic appeal, while hydraulic models remain popular in home-use categories due to affordability and compact design, especially in emerging markets.

- For instance, Concept2’s Model D Indoor Rowing Machine, renowned for durability and an advanced performance monitor, remains the preferred choice among athletes and gyms worldwide.

By Resistance Type

The automatic resistance segment held the largest market share of 56.4% in 2024, driven by the increasing integration of digital controls and connected fitness technologies. These systems allow users to automatically adjust resistance levels for personalized and adaptive workouts. Growing adoption of smart fitness equipment with Bluetooth and app connectivity supports this dominance. Manual resistance machines continue to serve budget-conscious consumers and home fitness setups, though demand is gradually shifting toward programmable and interactive workout systems across both residential and commercial environments.

- For instance, the Speediance Gym Monster offers up to 220 pounds of digital resistance and various attachments, enabling users to seamlessly switch resistance modes for a tailored workout experience.

By Distribution Channel

The offline segment accounted for a dominant 62.7% share of the rowing machine market in 2024, supported by strong presence in fitness equipment stores, specialty retailers, and gym suppliers. Consumers prefer physical outlets for product trials, demonstrations, and after-sales services. However, the online segment is expanding rapidly, driven by e-commerce growth and rising consumer preference for convenience and price transparency. Manufacturers are enhancing digital sales strategies through direct-to-consumer platforms and partnerships with online retailers, contributing to increased market penetration across domestic and international markets.

Key Growth Drivers

Rising Health and Fitness Awareness

Increasing global awareness of fitness and preventive healthcare is a major driver for the rowing machine market. Consumers are adopting rowing workouts for their full-body benefits, improving cardiovascular endurance and muscle strength. The trend toward home-based fitness, fueled by hybrid work lifestyles, further supports demand. Fitness influencers and digital platforms are promoting rowing as an efficient low-impact exercise, boosting adoption across age groups. This growing focus on personal health and holistic wellness continues to drive consistent market expansion.

- For instance, Technogym S.p.A, a leading fitness equipment company, reported strong adoption of its state-of-the-art rowing machines integrated with wellness technology, particularly in high-end gyms and health clubs, reflecting growing consumer interest in holistic fitness solutions.

Expansion of Commercial Fitness Facilities

The rapid expansion of gyms, health clubs, and rehabilitation centers is fueling market growth for rowing machines. Commercial fitness chains prioritize durable, versatile equipment offering high-intensity and endurance training benefits. Rowing machines provide multi-muscle engagement and compact design, making them ideal for professional setups. Rising investments in corporate wellness programs and boutique fitness studios also drive installations. Manufacturers cater to this segment by developing advanced models with digital tracking and interactive training options to enhance user engagement and retention.

- For instance, companies like Afton Fitness supply heavy-duty rowing machines from trusted brands such as Spirit and Impulse, designed for smooth, low-impact, full-body workouts favored in professional gym setups.

Technological Advancements and Smart Integration

Technological innovation is transforming rowing machine design and performance. Integration of smart connectivity features such as Bluetooth synchronization, live performance tracking, and app-based coaching enhances user experience. Connected rowing platforms allow users to join virtual classes and monitor progress in real time. Manufacturers are introducing AI-enabled resistance adjustment and performance analytics to personalize workouts. This technological shift is attracting tech-savvy consumers and fitness enthusiasts, aligning with the growing global trend toward connected fitness ecosystems.

Key Trends & Opportunities

Growth of Home Fitness and E-Commerce Channels

The rise of home fitness trends and online retail channels presents major opportunities for rowing machine manufacturers. Consumers increasingly purchase fitness equipment online for convenience, affordability, and access to a wide product range. Compact, foldable, and easy-to-install models are gaining popularity among urban users. Brands are enhancing digital marketing and direct-to-consumer sales strategies to tap into this expanding segment. Subscription-based online training programs and interactive virtual classes further boost the appeal of home-based rowing workouts.

- For instance, Concept2 dominates online sales with its RowErg indoor rowing machine consistently leading Amazon’s top seller lists, reflecting strong customer trust in its durability and performance.

Increasing Demand for Eco-Friendly and Ergonomic Designs

Manufacturers are focusing on sustainable materials and ergonomic designs to meet evolving consumer preferences. Wooden rowing machines made from renewable sources and low-noise mechanisms are attracting environmentally conscious buyers. Ergonomic designs improve posture and comfort, appealing to both beginners and rehabilitation users. The shift toward eco-friendly manufacturing also aligns with broader sustainability goals across fitness equipment production. This growing focus on design innovation and environmental responsibility is creating long-term opportunities in the premium product category.

- For instance, WaterRower and its sister company NOHrD produce high-end wooden rowing machines crafted from sustainably sourced woods, emphasizing environmental protection and premium design.

Key Challenges

High Equipment Costs and Maintenance Needs

High upfront investment and ongoing maintenance requirements remain major barriers to market growth. Advanced rowing machines equipped with digital consoles, sensors, and connectivity features are expensive for home users. Regular maintenance of moving parts and resistance systems increases long-term ownership costs. Price sensitivity in developing regions limits adoption, particularly in residential applications. Manufacturers are addressing this challenge by introducing mid-range models that balance performance, durability, and affordability to reach a wider consumer base.

Limited Awareness in Emerging Economies

In developing regions, lack of awareness about rowing’s fitness benefits and the availability of advanced equipment hinders market penetration. Consumers often prefer treadmills or stationary bikes due to familiarity and accessibility. Limited distribution networks and higher import costs further restrict product reach. To overcome these barriers, global brands are partnering with local retailers and fitness influencers to promote awareness and affordability. Expanding marketing efforts and offering localized product variations can help unlock significant untapped demand in these markets.

Regional Analysis

North America

North America held a 31.6% share of the rowing machine market in 2024, driven by the strong culture of fitness and wellness across the U.S. and Canada. The region benefits from widespread gym memberships, growing home fitness adoption, and high awareness of digital workout technologies. Consumers favor connected and interactive rowing machines offering real-time tracking and virtual training experiences. The presence of leading brands and e-commerce expansion further supports growth. Increasing corporate wellness programs and health-conscious lifestyles continue to strengthen regional demand for advanced rowing equipment.

Europe

Europe accounted for a 27.4% share of the rowing machine market in 2024, supported by the rising popularity of indoor rowing as a low-impact, full-body exercise. The UK, Germany, and France are leading contributors due to strong gym infrastructure and increasing investment in home fitness solutions. The region’s focus on sustainable product design and digital connectivity drives product innovation. Manufacturers are introducing eco-friendly materials and ergonomic models to meet European sustainability standards. Growing participation in rowing-based training and rehabilitation programs further enhances regional market expansion.

Asia-Pacific

Asia-Pacific dominated the global rowing machine market in 2024 with a 33.8% share and is expected to record the fastest growth through 2032. Rising disposable incomes, urbanization, and the expansion of fitness centers in China, India, and Japan drive market development. The growing preference for home fitness equipment, supported by compact and affordable product options, fuels adoption. Increasing awareness of physical wellness and rising e-commerce penetration enhance accessibility. Regional manufacturers are also introducing smart and connected models tailored for younger, tech-oriented consumers seeking digital workout solutions.

Latin America

Latin America represented a 4.2% share of the rowing machine market in 2024, led by Brazil and Mexico. The region’s growing fitness culture and the establishment of mid-tier gyms are supporting equipment demand. Awareness of the health benefits of rowing as a full-body exercise is expanding, particularly among urban consumers. However, economic instability and high import costs limit premium equipment penetration. Manufacturers are partnering with regional distributors to offer cost-effective models and flexible payment options, driving gradual market expansion in both residential and commercial fitness sectors.

Middle East & Africa

The Middle East & Africa accounted for a 3.0% share of the rowing machine market in 2024, supported by growing investment in sports and wellness infrastructure. Countries such as the UAE, Saudi Arabia, and South Africa are adopting rowing machines across premium gyms, hotels, and rehabilitation centers. Rising tourism and government initiatives promoting healthy lifestyles contribute to market growth. However, limited consumer awareness and high equipment prices restrict adoption in low-income areas. Increasing retail presence and expanding fitness chains are expected to gradually strengthen regional market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Air Rowing Machines

- Magnetic Rowing Machines

- Water Rowing Machines

- Hydraulic Rowing Machines

By Resistance Type

- Manual Resistance

- Automatic Resistance

By Distribution Channel

By End Use

- Residential

- Commercial (Gyms, Fitness Centers, Rehabilitation Facilities)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The rowing machine market is characterized by strong competition among key players such as Concept2 Inc., WaterRower Inc., Technogym S.p.A., Life Fitness, NordicTrack (ICON Health & Fitness Inc.), Stamina Products Inc., Bodycraft, JTX Fitness, XTERRA Fitness Inc., and Sunny Health & Fitness. These companies focus on product innovation, digital connectivity, and ergonomic design to enhance user experience and maintain brand leadership. Leading manufacturers are integrating smart technologies such as Bluetooth connectivity, performance tracking, and app-based training programs. Strategic collaborations with fitness studios, online training platforms, and retail distributors are strengthening market reach. Sustainability and the development of eco-friendly materials are also gaining importance in premium product lines. As competition intensifies, companies are expanding global distribution networks, improving affordability, and investing in R&D to meet the growing demand for home fitness and commercial gym applications.

Key Player Analysis

- Concept2 Inc.

- WaterRower Inc.

- Technogym S.p.A.

- Life Fitness

- NordicTrack (ICON Health & Fitness Inc.)

- Stamina Products Inc.

- Bodycraft

- JTX Fitness

- XTERRA Fitness Inc.

- Sunny Health & Fitness

Recent Developments

- In September 2025, Hydrow introduced its most advanced Hydrow Arc Rower, equipped with a 24-inch HD display, premium sound system, and an upgraded “HydroMetrics” performance tracking feature.

- In March 2025, Hydrow partnered with Soho House to integrate its connected rowing machines across select luxury club fitness centers worldwide.

- In July 2024, Ergatta collaborated with CityRow to incorporate instructor-led studio sessions into its game-based rowing platform, enhancing user engagement and workout diversity.

Report Coverage

The research report offers an in-depth analysis based on Type, Resistance Type, Distribution Channel, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for rowing machines will continue to rise with growing fitness awareness.

- Smart and connected rowing machines will dominate future product development.

- Home fitness adoption will expand due to compact and foldable equipment designs.

- Integration of virtual training and subscription-based workout platforms will increase.

- Manufacturers will focus on eco-friendly and durable materials to meet sustainability goals.

- The commercial gym segment will continue to invest in high-performance rowing systems.

- Asia-Pacific will remain the fastest-growing region due to urbanization and rising incomes.

- AI-enabled resistance and performance tracking will enhance personalized training experiences.

- Collaborations between fitness equipment makers and digital wellness platforms will grow.

- Increasing corporate wellness programs will create new opportunities for rowing machine adoption.