Market overview

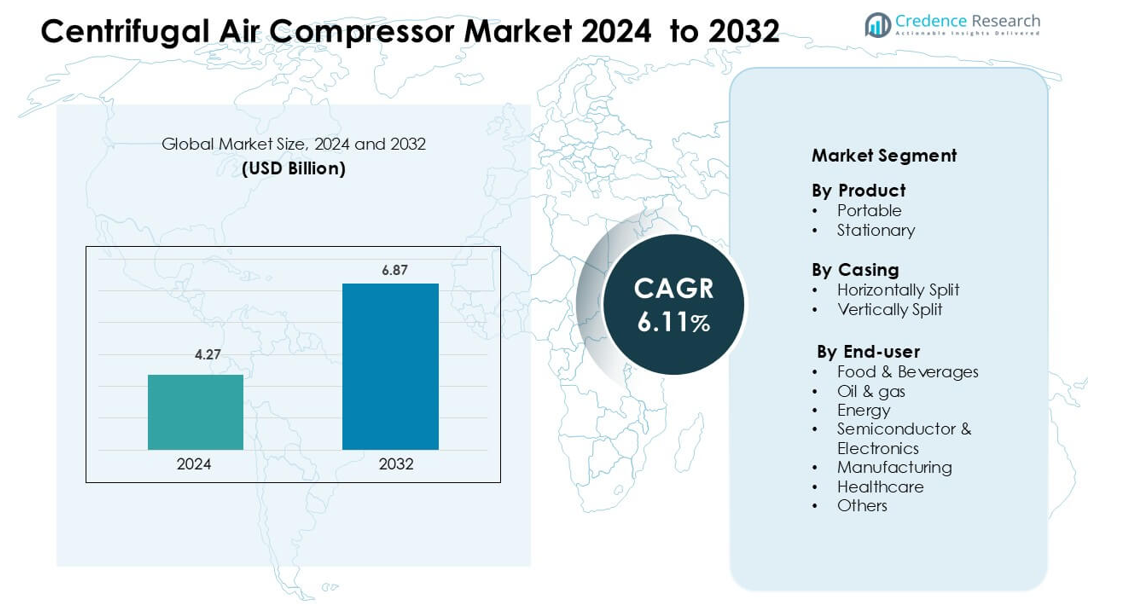

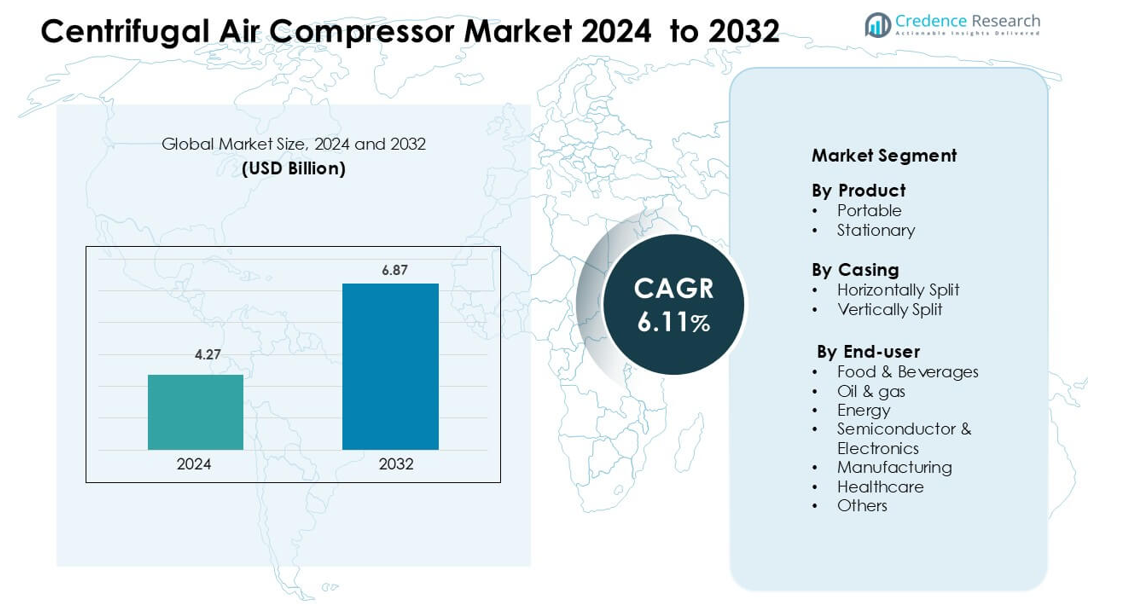

Centrifugal Air Compressor Market was valued at USD 4.27 billion in 2024 and is anticipated to reach USD 6.87 billion by 2032, growing at a CAGR of 6.11 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Centrifugal Air Compressor Market Size 2024 |

USD 4.27 billion |

| Centrifugal Air Compressor Market, CAGR |

6.11% |

| Centrifugal Air Compressor Market Size 2032 |

USD 6.87 billion |

The centrifugal air compressor market is led by prominent companies such as Ingersoll-Rand, Hitachi, Kobelco Compressors America, Elliott Group, Kirloskar Pneumatic Company, Atlas Copco, General Electric, Sullair, Gardner Denver, and Danfoss. These players compete through advanced product innovation, strategic partnerships, and expansion into high-growth industrial sectors. Asia-Pacific emerges as the leading region, holding a 36.8% market share, driven by rapid industrialization, energy infrastructure development, and expanding manufacturing activities in China, India, and Japan. The region’s focus on efficient, oil-free, and digitally controlled compressor systems further enhances its dominance in the global centrifugal air compressor market.

Market Insights

- The Centrifugal Air Compressor Market was valued at USD 4.27 billion in 2024 and is projected to reach USD 6.87 billion by 2032, growing at a CAGR of 6.11%.

- Expanding industrialization, rising energy efficiency standards, and growing adoption across oil & gas and manufacturing sectors are driving market growth.

- The market trends highlight the integration of smart monitoring, IIoT-enabled systems, and increasing demand for oil-free compressors in food, healthcare, and semiconductor industries.

- Major players such as Ingersoll-Rand, Atlas Copco, Hitachi, and General Electric emphasize R&D, sustainability, and strategic collaborations, intensifying global competition.

- Asia-Pacific leads with a 36.8% regional share, while the stationary product segment dominates with 68.2%, supported by heavy industrial usage and technological advancements across energy and power generation industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product

The stationary segment dominates the centrifugal air compressor market, accounting for 68.2% of total revenue. Its dominance stems from widespread use in manufacturing, energy, and oil & gas industries where continuous, high-volume air supply is essential. Stationary compressors offer higher efficiency, longer service life, and superior output stability compared to portable variants. Their integration in large-scale facilities ensures uninterrupted operations and reduced maintenance downtime. Growing adoption of multi-stage designs and energy-efficient models further strengthens their market position across industrial applications.

- For instance, the T-Series centrifugal compressor by Atlas Copco is rated up to 16,000 kW and has been certified to API 617 Chapter 2 standards for continuous, heavy-dutyoperation in chemical and petrochemical facilities. These compressors handle flow volumes up to 150,000 m³/h and discharge pressures of up to 45 bar.

By Casing

Horizontally split compressors hold the dominant market share of 61.7%, driven by their ease of maintenance and suitability for high-capacity operations. This design allows simpler disassembly, reducing downtime during servicing and inspection. Industries such as oil & gas, power generation, and chemical processing favor this configuration due to its ability to handle higher flow rates and pressures. Technological advancements in impeller design and sealing systems also enhance reliability and efficiency. These advantages make horizontally split casings the preferred choice in large-scale continuous-duty installations.

- For instance, Hitachi Industrial Products, Ltd.’s MCH-type horizontally split process compressors are rated for discharge pressures around 4 to 5 MPa in a casing structure designed for ease of access.

By End-user

The oil & gas sector leads the centrifugal air compressor market with a 32.5% share, supported by its vital role in upstream, midstream, and downstream operations. Compressors are essential for gas processing, refining, and enhanced oil recovery. The industry’s focus on efficiency, safety, and emission reduction drives adoption of advanced multi-stage centrifugal units. Moreover, increasing exploration activities and LNG infrastructure expansion strengthen demand. The segment benefits further from modernization of existing facilities and investments in high-performance compressor systems for offshore and onshore operations.

Key Growth Drivers

Expanding Industrialization and Infrastructure Development

Rapid industrial expansion and infrastructure growth worldwide are major drivers for the centrifugal air compressor market. Manufacturing, energy, and petrochemical industries increasingly depend on continuous, high-pressure air systems for operations such as pneumatic tools, cooling, and material handling. Emerging economies like India, China, and Indonesia are investing heavily in industrial parks and power generation, fueling compressor demand. Furthermore, the need for efficient and reliable air compression systems in large-scale manufacturing enhances market growth. The integration of smart monitoring and automated control systems in modern compressors further attracts industries seeking higher productivity and operational stability.

- For instance, Atlas Copco India’s facility in Chakan uses solar panels to generate 80 % of its manufacturing and testing electricity, underscoring the demand for large-scale, continuous air systems in evolving industrial setups.

Rising Energy Efficiency Regulations and Sustainability Goals

Governments and industries are adopting energy efficiency standards to lower carbon emissions, accelerating the shift toward energy-efficient centrifugal compressors. These compressors offer superior flow stability and minimal energy loss compared to traditional models. Companies are investing in variable speed drives, optimized impeller designs, and waste heat recovery systems to reduce energy consumption. For instance, global energy-saving programs like ISO 50001 encourage industries to upgrade to efficient equipment. This trend drives the adoption of oil-free and energy-efficient centrifugal systems, particularly in process industries where sustainability is now a priority.

- For instance, VSDs are well-known to offer significant energy savings in compressor applications, particularly when demand fluctuates. Savings of tens of thousands of kWh annually are a typical and plausible range for industrial equipment modifications, depending on the size of the compressor and operating hours.

Increasing Use in Oil & Gas and Power Generation

The growing oil & gas and power generation sectors are significant contributors to market expansion. Centrifugal compressors are crucial in processes such as gas injection, refining, and liquefied natural gas (LNG) production. The global increase in offshore exploration and LNG infrastructure investment boosts the need for durable, high-capacity compressors. In the power sector, gas turbine plants rely on centrifugal compressors for efficient air compression and combustion. Continuous upgrades in refinery modernization and cleaner fuel initiatives also enhance market growth, as companies demand advanced compressors that ensure high reliability and low maintenance under harsh operating conditions.

Key Trends & Opportunities

Integration of Digitalization and Smart Monitoring Systems

The integration of Industrial Internet of Things (IIoT) and predictive maintenance systems is reshaping the centrifugal air compressor market. Smart compressors equipped with sensors and real-time data analytics improve performance tracking, fault detection, and energy management. Manufacturers like Atlas Copco and Ingersoll Rand are developing connected compressors that allow remote monitoring and AI-driven optimization. These advancements reduce downtime, extend equipment lifespan, and improve operational transparency. The growing shift toward Industry 4.0 presents opportunities for manufacturers to offer intelligent, cloud-connected compressors that cater to energy-intensive industries seeking enhanced automation and efficiency.

- For instance, Atlas Copco Air Compressors’ SMARTLINK platform monitors more than 30 datapoints (such as pressure, temperature, running hours) in real time and uploads data every 5 minutes for proactive servicing.

Growing Demand for Oil-Free Compressors in Sensitive Applications

Rising hygiene and quality standards in industries such as food & beverages, healthcare, and electronics are boosting demand for oil-free centrifugal compressors. These systems deliver clean, contaminant-free air suitable for critical processes like packaging, fermentation, and semiconductor production. Oil-free models also reduce operational costs by eliminating the need for filtration and oil disposal. Leading players are expanding their oil-free product lines with ISO Class 0 certification to address sustainability and compliance goals. The increasing awareness of environmental responsibility and quality assurance continues to drive this high-growth segment.

- For instance, CompAir’s “Quantima” oil-free two-stage centrifugal compressor operates at rotor speeds up to 76,000 rpm and has been certified to ISO 8573-1 Class 0, delivering completely oil-free air in contamination-sensitive environments.

Expansion in Renewable Energy and Hydrogen Production

Centrifugal air compressors are gaining traction in renewable energy applications, particularly in hydrogen production and carbon capture systems. As nations target net-zero emissions, hydrogen fuel and green energy projects demand high-capacity compressors for gas storage and transportation. Compressor manufacturers are investing in designs tailored for high-pressure hydrogen applications, enabling greater efficiency and safety. This transition to clean energy infrastructure creates long-term opportunities for market growth. The integration of centrifugal compressors into renewable systems highlights their evolving role in supporting sustainable industrial transformation.

Key Challenges

High Initial Cost and Maintenance Complexity

One of the primary challenges for market adoption is the high initial investment and maintenance cost of centrifugal compressors. These machines require specialized components, skilled technicians, and precise installation, which can be expensive for small and medium enterprises. The complex design also demands regular inspection and maintenance to ensure optimal performance, increasing operational costs. Moreover, the availability of cost-effective alternatives like rotary screw compressors in smaller applications often limits centrifugal compressor deployment. Balancing advanced features with affordability remains a critical challenge for manufacturers aiming to penetrate developing markets.

Volatility in Raw Material Prices and Supply Chain Constraints

Fluctuations in raw material costs, particularly for steel, aluminum, and alloys used in compressor manufacturing, significantly affect production expenses. Supply chain disruptions, geopolitical tensions, and rising logistics costs further challenge manufacturers. The COVID-19 pandemic and subsequent material shortages exposed vulnerabilities in compressor supply chains, leading to production delays and cost escalation. These factors impact profitability and delivery schedules, forcing companies to adopt localized sourcing strategies. Stabilizing supply networks and developing alternative materials are essential for maintaining competitiveness and ensuring sustainable market growth amid global uncertainties.

Regional Analysis

North America

North America holds a 27.6% share of the centrifugal air compressor market, driven by advanced manufacturing, energy, and oil & gas sectors. The United States dominates regional demand with significant investments in shale gas exploration and power generation projects. Technological innovations in oil-free and energy-efficient compressors further support adoption across industries. Moreover, stringent environmental regulations and industrial automation enhance the shift toward sustainable compressor systems. Key players such as Ingersoll Rand and GE Oil & Gas focus on R&D and service network expansion to strengthen their presence in this competitive and technologically mature market.

Europe

Europe accounts for 23.4% of the global centrifugal air compressor market, fueled by strong demand from automotive, power, and food processing industries. Germany, the UK, and France lead adoption through energy-efficient and oil-free compressor systems that align with the EU’s carbon neutrality goals. Growing emphasis on digitalization and predictive maintenance also drives market expansion. The region’s mature industrial base and supportive regulatory frameworks encourage upgrades to low-emission, high-performance compressors. Manufacturers like Atlas Copco and Siemens Energy play a pivotal role in advancing eco-friendly compressor technologies across industrial and energy applications.

Asia-Pacific

Asia-Pacific dominates the global centrifugal air compressor market with a 36.8% share, supported by rapid industrialization and infrastructure development. China, India, and Japan lead the region due to expanding oil & gas, electronics, and manufacturing industries. Rising investments in energy projects and large-scale production facilities fuel strong compressor demand. Governments promoting industrial automation and renewable energy integration further stimulate market growth. Regional manufacturers such as Hitachi Industrial Equipment and Kobe Steel focus on cost-effective, high-efficiency compressor designs to cater to increasing local demand and export potential across developing economies.

Middle East & Africa

The Middle East & Africa region captures an 8.7% market share, primarily driven by the oil & gas and petrochemical industries. Countries like Saudi Arabia, the UAE, and Qatar rely heavily on centrifugal compressors for gas processing and refining operations. Ongoing energy diversification efforts and industrial expansion projects create consistent demand. Africa’s emerging mining and energy sectors also present growth opportunities. Additionally, partnerships between international and regional players for technology transfer and infrastructure enhancement contribute to market advancement, particularly in the Gulf Cooperation Council (GCC) region’s expanding industrial landscape.

Latin America

Latin America holds a 3.5% share of the centrifugal air compressor market, supported by growing industrialization and the recovery of oil & gas and manufacturing sectors. Brazil and Mexico lead regional adoption with investments in refineries, automotive plants, and power infrastructure. The region’s shift toward cleaner energy solutions is driving demand for efficient and low-maintenance compressor systems. Moreover, government-led initiatives to modernize industrial facilities enhance compressor deployment. Global players such as Atlas Copco and Siemens are expanding service networks in Latin America to support increasing demand for high-performance air compression solutions.

Market Segmentations:

By Product

By Casing

- Horizontally Split

- Vertically Split

By End-user

- Food & Beverages

- Oil & gas

- Energy

- Semiconductor & Electronics

- Manufacturing

- Healthcare

- Others

By Geograph

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the centrifugal air compressor market is characterized by the presence of global and regional manufacturers focusing on innovation, energy efficiency, and aftersales support. Leading companies such as Ingersoll-Rand, Hitachi, Kobelco Compressors America, Elliott Group, Kirloskar Pneumatic Company, Atlas Copco, General Electric, Sullair, Gardner Denver, and Danfoss dominate the market through advanced product portfolios and strong distribution networks. These players emphasize the development of oil-free, high-capacity, and digitally integrated compressors to meet growing industrial automation and sustainability demands. Strategic mergers, partnerships, and regional expansions are key growth tactics, enabling firms to strengthen technological capabilities and market penetration. Continuous R&D investments aimed at enhancing performance, reliability, and energy optimization further intensify competition. The market also witnesses rising participation from Asian manufacturers offering cost-effective solutions, fostering healthy rivalry and innovation within the global centrifugal air compressor industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ingersoll-Rand

- Hitachi

- Kobelco Compressors America

- Elliott Group

- Kirloskar Pneumatic Company

- Atlas Copco

- General Electric

- Sullair

- Gardner Denver

- Danfoss

Recent Developments

- In July 2025, Hitachi Global Air Power (via Hitachi Industrial Equipment Systems Co., Ltd.): The company launched the Sullair OFE1550 oil‑free electric portable air compressor delivering 1,550 cfm at 125 psi, targeting industries needing Class 0 oil‑free air.

- In February 2025, Kobelco Compressors America, Inc. (via Kobe Steel, Ltd.): Kobe Steel announced expansion of the KCA Houston service plant to boost overhaul, maintenance and technical support capacity for large compressors

Report Coverage

The research report offers an in-depth analysis based on Product, Casing, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The centrifugal air compressor market is expected to grow steadily due to rising industrial automation and manufacturing activities.

- Increasing demand from the energy and power generation sectors will drive market expansion.

- Adoption of advanced compressors with high efficiency and lower maintenance requirements will accelerate growth.

- Emerging industries in developing regions will create new opportunities for centrifugal air compressors.

- Integration of smart technologies and IoT in compressors will enhance operational efficiency.

- Stringent environmental regulations will boost demand for energy-efficient and low-emission compressors.

- Rising need for compressed air in chemical, petrochemical, and oil & gas industries will sustain market growth.

- Manufacturers will focus on product innovation to cater to customized industrial applications.

- Expansion of infrastructure and construction projects globally will support market demand.

- Increasing awareness of cost-effective and sustainable solutions will drive adoption across sectors.