Market Overview

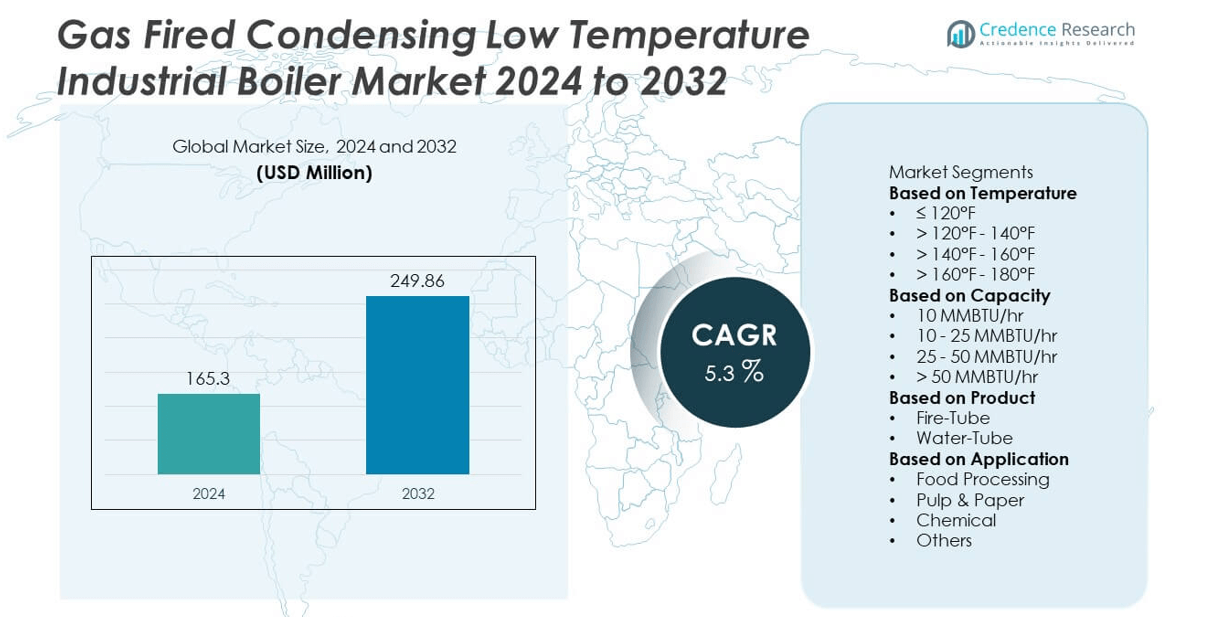

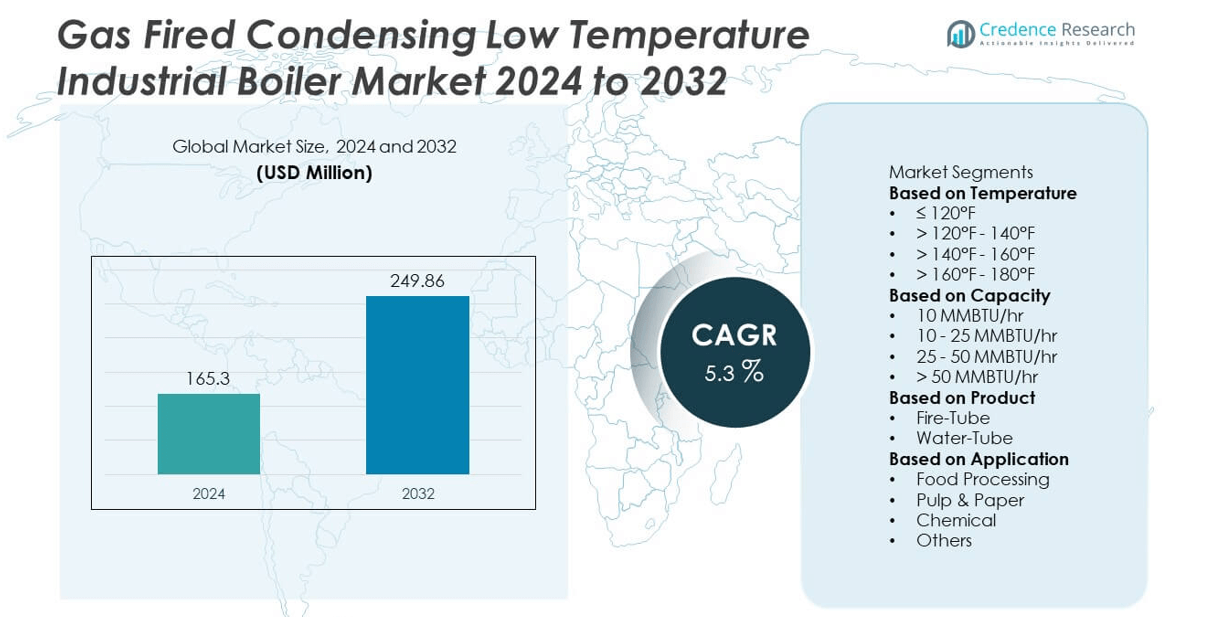

The Gas Fired Condensing Low Temperature Industrial Boiler market was valued at USD 165.3 million in 2024 and is projected to reach USD 249.86 million by 2032, registering a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Condensing Low Temperature Industrial Boiler Market Size 2024 |

USD 165.3 million |

| Gas Fired Condensing Low Temperature Industrial Boiler Market , CAGR |

5.3% |

| Gas Fired Condensing Low Temperature Industrial Boiler Market Size 2032 |

USD 249.86 million |

The Gas Fired Condensing Low Temperature Industrial Boiler market is driven by leading companies such as Clayton Industries, EPCB Boiler, Johnston Boiler, Fulton, Cleaver-Brooks, Babcock Wanson, IHI Corporation, ALFA LAVAL, Hurst Boiler & Welding, and Babcock & Wilcox. These manufacturers focus on high-efficiency heat exchangers, low-NOx burner systems, and advanced heat-recovery design to reduce fuel consumption and support industrial decarbonization. Automation, remote diagnostics, and modular boiler platforms further strengthen competitiveness across food processing, chemical, and manufacturing sectors. Asia Pacific leads the global market with a 39% share, supported by expanding processing facilities and strong energy-efficiency mandates. North America holds 33%, driven by modernization of industrial heat systems, while Europe accounts for 31% due to strict emission compliance and carbon-reduction policies.

Market Insights

- The Gas Fired Condensing Low Temperature Industrial Boiler market reached USD 165.3 million in 2024 and is projected to reach USD 249.86 million by 2032, registering a CAGR of 5.3% during the forecast period.

- Market growth is driven by demand for energy-efficient industrial heating, heat-recovery solutions, and low-NOx combustion systems, with the > 140°F – 160°F temperature segment holding a 41% share due to strong suitability for food processing, chemical, and pharmaceutical applications.

- Key trends include the rise of modular and skid-mounted boiler systems, increasing integration of IoT-based controls, and hybrid heating solutions combining gas boilers with renewable or waste-heat sources to reduce operational fuel consumption.

- Competitive dynamics involve companies such as Clayton Industries, EPCB Boiler, Johnston Boiler, Fulton, Cleaver-Brooks, Babcock Wanson, IHI Corporation, ALFA LAVAL, Hurst Boiler & Welding, and Babcock & Wilcox, focusing on high-efficiency heat exchangers, digital monitoring, and lifecycle cost optimization.

- Asia Pacific leads with a 39% share, followed by North America at 33% and Europe at 31%, supported by industrial modernization, regulatory emission standards, and replacement of older high-temperature boiler systems across regional manufacturing hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Temperature Segment

The > 140°F – 160°F temperature segment holds the dominant position with a market share of 41% in the Gas Fired Condensing Low Temperature Industrial Boiler market. Industrial facilities select this range for efficient heat transfer, lower fuel usage, and compatibility with diverse process heating requirements. The > 160°F – 180°F segment accounts for 27% share, serving higher-load operations in food processing, chemicals, and pharmaceuticals. The > 120°F – 140°F category captures 22% share, supporting moderate heating and hot water distribution in manufacturing utilities. Systems operating at ≤ 120°F represent the remaining 10% share, catering to low-temperature sanitation and HVAC-support functions.

- For instance, Fulton supplied a single VMP-100 boiler installation for the Green Field Farms dairy, supporting the vat pasteurization process where milk is gently heated to 145°F for 30 minutes, with system dependability critical to daily operations.

By Capacity Segment

The 10–25 MMBTU/hr capacity segment leads the market with a market share of 48%, driven by strong adoption in medium-scale industrial facilities requiring balanced thermal output and reduced fuel consumption. The 10 MMBTU/hr segment holds 26% share, supporting smaller operations with lower peak heating demand. The 25–50 MMBTU/hr range represents 18% share, serving continuous production sites with higher temperature requirements. Boiler systems above 50 MMBTU/hr account for the remaining 8% share, deployed in heavy-duty processing and large plant utilities requiring stable high-capacity heat performance.

- For instance, Babcock Wanson is a legitimate supplier of industrial process heating equipment and solutions for a wide range of industries, including cosmetics manufacturing, and provides systems designed to enable precise heat control for processes like emulsification.

By Product Segment

The fire-tube boiler segment dominates with a market share of 63%, driven by compact design, simplified operation, and strong applicability in low-temperature industrial heating. Manufacturers integrate advanced heat exchangers and condensation modules to enhance efficiency and minimize fuel cost. The water-tube boiler segment holds a 37% share, favored in facilities with higher pressure needs and rapid steam or hot water generation. Demand for water-tube systems rises in chemical, pharmaceutical, and food processing operations involving continuous and high-load thermal cycles. Both product types benefit from digital monitoring adoption, heat recovery improvements, and stricter emission control standards across industrial environments.

KEY GROWTH DRIVERS

Rising Focus on Energy Efficiency and Fuel Cost Reduction

Industrial facilities increase their use of gas fired condensing low temperature boilers to reduce fuel consumption and operational costs. These systems recover latent heat from exhaust gases, improving thermal efficiency while supporting decarbonization initiatives. Sectors such as food processing, chemicals, and pharmaceuticals benefit from lower temperature heat delivery that maintains product integrity while minimizing energy waste. Companies adopt these boilers to meet sustainability targets and reduce lifecycle operating expenses. As fuel prices fluctuate and energy-saving regulations strengthen, demand for condensing low temperature industrial boilers continues to expand across global manufacturing markets.

- For instance, a food manufacturing plant installed a Clayton Industries steam generator system equipped with an economizer to replace older, less efficient units. The facility benefited from the new system’s high fuel-to-steam efficiency and rapid start-up, which led to significant annual energy savings and improved operational reliability, allowing the plant to maintain consistent production temperatures.

Stringent Emission Reduction and Compliance Regulations

Regulatory pressure to reduce greenhouse gas emissions, NOx levels, and operational pollutants drives the adoption of clean combustion boiler systems. Condensing boilers support lower carbon output and enable compliance with environmental and industrial safety standards. Governments and industry bodies encourage the transition from traditional high-temperature systems to low-emission alternatives. Industrial plants adopt monitoring and control technologies to maintain combustion efficiency and meet reporting requirements for sustainability audits. This regulatory environment accelerates replacement of outdated boiler systems and fosters investment in advanced low temperature heating technologies.

- For instance, ALFA LAVAL offers various technologies, such as the Alfa Laval PureSOx exhaust gas cleaning system, designed to meet global sulfur emissions regulations by removing sulfur oxides from flue gases, thus enabling regulatory compliance.

Increasing Integration of Smart Controls and Automation

Automation in industrial heating supports consistent boiler performance, remote monitoring, and predictive maintenance. Smart boiler control platforms optimize fuel-air ratios, manage heating loads, and reduce temperature fluctuation across process lines. Digital diagnostics minimize downtime and allow facilities to operate with reduced maintenance labor. Cloud-based monitoring improves asset management and supports energy performance tracking. The integration of heat recovery technology, water quality control, and IoT-enabled sensors accelerates adoption of condensing low temperature boiler systems among digitally transforming industrial operations.

KEY TRENDS & OPPORTUNITIES

Growth of Hybrid and Multi-Source Heating Systems

Industries explore hybrid energy systems combining gas fired condensing boilers with renewable or electrically driven heat sources. This approach enhances energy resilience and reduces reliance on a single fuel supply. Hybrid boiler configurations support flexible load distribution and lower peak fuel consumption. Facilities incorporating solar thermal, heat pumps, or waste heat recovery systems improve energy efficiency and operational sustainability. As decarbonization goals intensify, demand for integrated hybrid heating designs creates opportunities for engineering services, control system providers, and boiler manufacturers.

- For instance, an industrial facility can incorporate advanced control software enabling dynamic load switching between high-efficiency energy sources, such as a large-capacity boiler and an industrial heat pump, with operational data points logged to optimize thermal sequencing and improve overall system efficiency. This is a common practice in optimizing energy use in commercial and industrial settings.

Expansion of Modular and Skid-Mounted Boiler Solutions

Modular boiler systems enable quick installation, efficient maintenance, and scalable expansion for dynamic industrial heating requirements. Skid-mounted packaged boilers reduce site preparation time and integration complexity, supporting plant modernization and capacity upgrades. Industries favor modular systems in process expansions, temporary heating setups, and decentralized plant utilities. This trend creates opportunities for manufacturers offering pre-assembled, factory-tested units with integrated controls, condensate recovery, and minimal commissioning requirements. The approach supports facility uptime and cost optimization in diverse manufacturing environments.

- For instance, Hurst Boiler & Welding assembled a skid-mounted boiler with integrated controls, which can lead to significant installation time and cost savings.

KEY CHALLENGES

High Initial Capital Investment and Payback Considerations

Condensing low temperature boiler systems require higher upfront investment compared to traditional units due to advanced heat exchangers, control systems, and condensation management components. Small and mid-sized facilities may delay adoption due to budget constraints and longer payback expectations. Fuel savings and emission reduction benefits accumulate over time, but financial planning becomes critical for cost-sensitive industries. Access to incentives, leasing models, and energy performance contracts will play an important role in overcoming cost barriers and accelerating market penetration.

Maintenance Complexity and Skilled Workforce Limitations

Condensing boiler systems involve complex condensation handling, advanced burner controls, and corrosion-resistant components. Reliable performance depends on skilled technicians capable of maintaining water chemistry, inspecting condensate systems, and tuning combustion settings. Regions with limited technical service infrastructure experience challenges achieving optimal efficiency and uptime. As industrial automation increases, workforce training and specialized service networks become essential. Market growth will require enhanced technician training programs and improved availability of aftermarket support solutions.

Regional Analysis

North America

North America holds a market share of 33% driven by strong industrial modernization and energy efficiency policies. The United States leads adoption as factories replace older high-temperature boilers with condensing low temperature units to reduce fuel use and emissions. Canada supports market growth through investments in food processing, chemical production, and district heating. Manufacturers introduce boilers with advanced heat recovery and low-NOx burners to meet air quality regulations. Service networks, technician training, and digital control integration strengthen long-term system performance across industrial facilities.

Europe

Europe accounts for a market share of 31% supported by strict carbon reduction targets and incentives for low-emission heating systems. Germany, France, Italy, and the Netherlands deploy condensing low temperature industrial boilers to lower operating costs and meet environmental rules. Food, beverage, chemical, and manufacturing plants increase adoption for stable hot water and process heating needs. High energy prices encourage investments in heat recovery and hybrid boiler systems. Digital monitoring and automated load control improve efficiency and support rapid maintenance planning across facilities.

Asia Pacific

Asia Pacific leads the market with a market share of 39% driven by rapid industrial expansion and rising energy demand. China, India, Japan, and South Korea invest in efficient boiler systems for food processing, pharmaceuticals, electronics, and manufacturing clusters. Local production and competitive fuel pricing support high-volume deployment of condensing low temperature units. Companies adopt smart controls and IoT-enabled heating to improve productivity and reduce fuel waste. Urban development and industrial policy initiatives continue to support strong long-term boiler demand across regional production hubs.

Latin America

Latin America holds a market share of 7% driven by growing industrial heat needs in food processing, beverages, and chemicals. Brazil, Mexico, and Argentina invest in efficient low temperature boiler systems to reduce energy expenses and support production quality. Manufacturers introduce modular and skid-mounted boiler configurations to simplify installation and meet space-limited facility requirements. Fuel price variations affect adoption speed, but efficiency benefits support gradual growth. Increased focus on export-oriented food and beverage production strengthens future deployment of condensing boiler technology across the region.

Middle East & Africa

The Middle East & Africa region represents a market share of 5% supported by industrial diversification initiatives and rising demand for energy-efficient heating. Gulf countries invest in condensing boiler systems to support food processing, pharmaceuticals, and manufacturing linked to long-term economic development strategies. South Africa, Egypt, and Morocco expand packaged food and beverage production, creating opportunities for low temperature boiler integration. Limited technical expertise and capital constraints slow adoption in some markets, but natural gas availability and industrialization plans support future growth.

Market Segmentations:

By Temperature

- ≤ 120°F

- > 120°F – 140°F

- > 140°F – 160°F

- > 160°F – 180°F

By Capacity

- 10 MMBTU/hr

- 10 – 25 MMBTU/hr

- 25 – 50 MMBTU/hr

- > 50 MMBTU/hr

By Product

By Application

- Food Processing

- Pulp & Paper

- Chemical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis in the Gas Fired Condensing Low Temperature Industrial Boiler market features key players including Clayton Industries, EPCB Boiler, Johnston Boiler, Fulton, Cleaver-Brooks, Babcock Wanson, IHI Corporation, ALFA LAVAL, Hurst Boiler & Welding, and Babcock & Wilcox. Competition centers on high-efficiency heat exchangers, low-NOx combustion systems, and integrated heat recovery solutions that reduce fuel consumption and operating costs. Manufacturers expand portfolios with modular, skid-mounted units and digital boiler management platforms that support remote diagnostics, predictive maintenance, and automated load control. Partnerships with industrial end users, engineering firms, and gas utilities accelerate system upgrades and replacement of conventional high-temperature boilers. Companies also strengthen aftersales service networks and training programs to enhance equipment lifecycle performance. As environmental compliance pressures increase across industrial sectors, the market shifts toward advanced condensing boiler technologies that support emission control, energy efficiency, and long-term operational reliability.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2024, Babcock & Wilcox has received a contract for the replacement of renewable energy boilers in Asia.

- In February 2023, Babcock Wanson launched the “Navinergy – the connected boiler room” platform, enabling remote monitoring of boiler-room performance and thus supporting digital-enabled condensing solutions.

- In January 2023, Babcock Wanson purchased Parat and PBS Power Equipment to broaden its industrial boiler scope. Norwegian-based Parat possesses deep knowledge of high voltage boilers and PBS Power Equipment specializes in boiler systems.

- In 2023, Fulton has introduced a new model in its existing range of steam boilers, the classic vertical steam boiler unit, which has a steam output capacity of 100 to 300 kW coupled with an operating pressure of 10.34 Barg

Report Coverage

The research report offers an in-depth analysis based on Temperature, Capacity, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of high-efficiency condensing boilers will expand across industrial heating applications.

- Heat recovery and waste-energy utilization will play a larger role in reducing fuel consumption.

- IoT-enabled controls and predictive maintenance will strengthen boiler reliability and uptime.

- Low-NOx and ultra-low emission combustion systems will grow to meet strict air quality rules.

- Modular and skid-mounted boiler designs will support faster installation and system upgrades.

- Hybrid heating systems combining gas boilers with renewable heat sources will gain momentum.

- Local production and service networks will increase to improve maintenance response times.

- Digital energy management platforms will enhance monitoring of boiler performance and fuel efficiency.

- Replacement of older high-temperature units will support long-term market expansion.

- Growth in food, chemical, and pharmaceutical processing will continue to drive new boiler investments.