Market overview

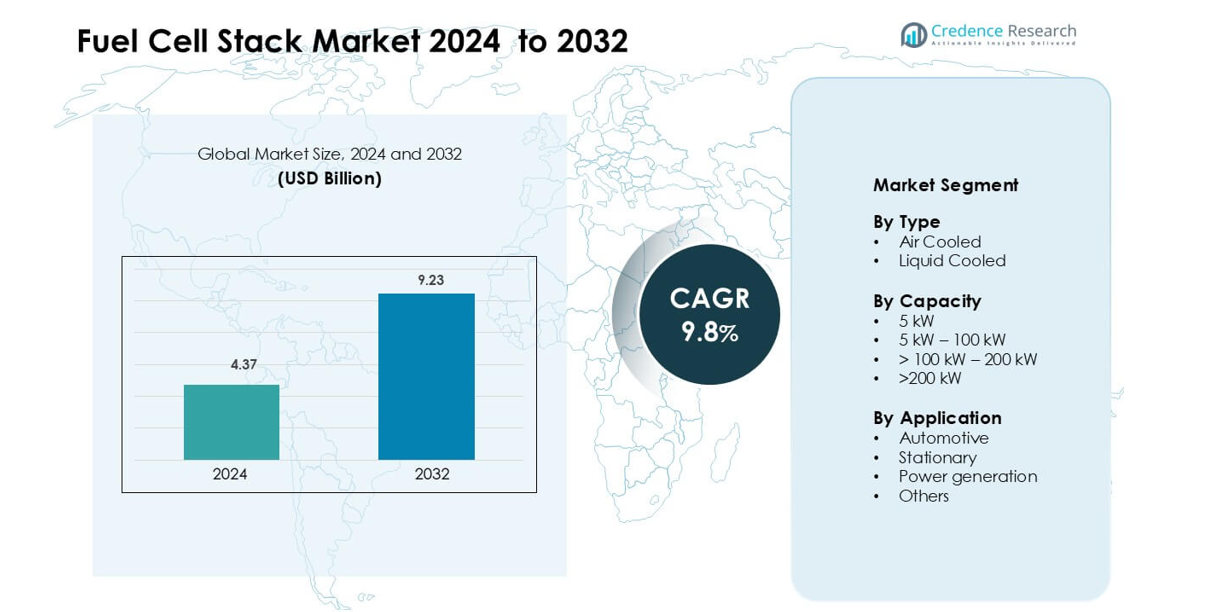

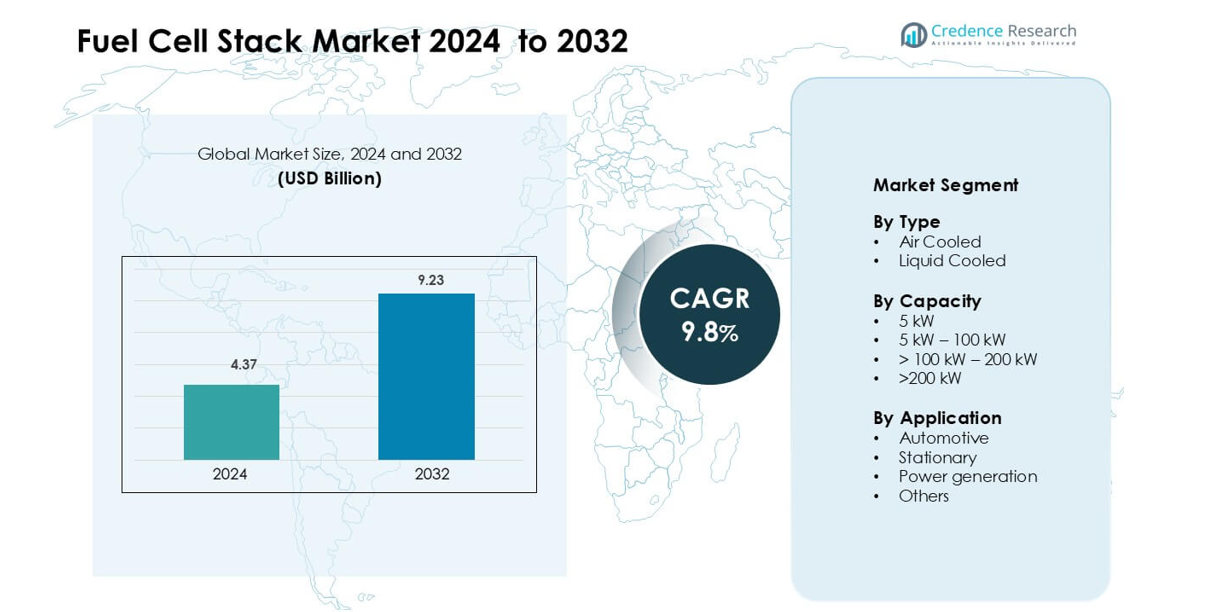

Fuel Cell Stack Market was valued at USD 4.37 billion in 2024 and is anticipated to reach USD 9.23 billion by 2032, growing at a CAGR of 9.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fuel Cell Stack Market Size 2024 |

USD 4.37 billion |

| Fuel Cell Stack Market, CAGR |

9.8% |

| Fuel Cell Stack Market Size 2032 |

USD 9.23 billion |

The Fuel Cell Stack Market is led by key players such as Ballard Power Systems, Advent Technologies Holding, ElringKlinger, FuelCell Energy Solutions, Dana Incorporated, Freudenberg Group, Nedstack Fuel Cell Technology, Horizon Fuel Cell Technologies, Intelligent Energy Limited, and Commonwealth Automation Technologies. These companies emphasize product innovation, material optimization, and large-scale collaborations to expand hydrogen-based energy applications. Strategic partnerships with automotive and industrial sectors strengthen their market footprint globally. Asia-Pacific leads the global Fuel Cell Stack Market with a 34.7% share, driven by strong hydrogen infrastructure development, government incentives, and the large-scale adoption of fuel cells in transportation and power generation sectors.

Market Insights

- The global Fuel Cell Stack Market was valued at USD 4.37 billion in 2024 and is projected to reach USD 9.23 billion by 2032, growing at a CAGR of 9.8 % during the forecast period.

- Increasing demand for hydrogen-powered vehicles and clean energy systems is driving market growth, supported by strong government incentives and zero-emission policies.

- Advancements in membrane electrode assemblies and cost reduction initiatives are key trends, enhancing system efficiency and expanding industrial and transportation applications.

- The market is moderately consolidated, with major players such as Ballard Power Systems, ElringKlinger, and Advent Technologies Holding investing in product innovation and strategic collaborations to maintain competitiveness.

- Asia-Pacific leads with a 7% share, followed by North America (31.6%), while the Proton Exchange Membrane Fuel Cell (PEMFC) segment dominates with 41.3% share due to its efficiency and suitability for automotive and stationary applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Fuel Cell Stack Market is segmented by type into Proton Exchange Membrane Fuel Cells (PEMFC), Solid Oxide Fuel Cells (SOFC), Molten Carbonate Fuel Cells (MCFC), Phosphoric Acid Fuel Cells (PAFC), and others. The Proton Exchange Membrane Fuel Cell (PEMFC) segment dominates the market with a share of 41.3%, driven by its highpower density, low operating temperature, and fast start-up time. Its growing application in passenger vehicles, forklifts, and portable power systems strengthens its dominance, supported by rising investments in hydrogen-powered mobility and government clean energy initiatives.

- For instance, Ballard Power Systems has delivered PEM fuel cell modules that power nearly 4,000 commercial vehicles globally. These modules come in various power outputs, including the current high-performance 9th generation engine with a capacity of 120 kW from a single stack.

By End-Use Industry

Based on end-use industry, the market is categorized into transportation, stationary power generation, and portable power. The transportation segment holds the largest share of 47.8%, attributed to the rapid adoption of hydrogen fuel cell electric vehicles (FCEVs). Increasing demand for zero-emission transport and government policies promoting green mobility are key drivers. Fuel cell stacks in buses, trucks, and passenger cars offer higher efficiency and range compared to battery-electric counterparts, boosting their integration across developed and emerging economies.

- For instance, the Hyundai Motor Company Hyundai NEXO model reached approximately 38,594 units in total as of July 2024, representing the cumulative global sales since the model’s introduction in 2018.

By Material

The market is further segmented by material into bipolar plates, membrane electrode assemblies (MEA), gaskets, and others. The membrane electrode assembly (MEA) segment dominates with a market share of 39.5%, due to its critical role in ensuring efficient electrochemical reactions and enhanced performance. Advancements in catalyst-coated membranes and cost-effective ion exchange materials drive adoption. Continuous R&D efforts to improve MEA durability and reduce platinum loading are contributing to improved system lifespan and lower manufacturing costs, supporting large-scale commercialization of fuel cell stacks across industries.

Key Growth Drivers

Increasing Adoption of Hydrogen-Powered Vehicles

The rising adoption of hydrogen-powered vehicles is a major driver of the Fuel Cell Stack Market. Fuel cell electric vehicles (FCEVs) offer longer driving ranges, faster refueling times, and higher efficiency than battery-electric alternatives. Governments across Asia-Pacific, Europe, and North America are promoting hydrogen mobility through subsidies and zero-emission mandates. Automakers such as Toyota, Hyundai, and Honda are expanding production of FCEVs, creating strong demand for fuel cell stacks. The integration of fuel cells into buses, trucks, and commercial fleets supports decarbonization efforts. This trend, combined with growing hydrogen infrastructure investments, is accelerating fuel cell deployment in the transportation sector.

- For instance, Toyota has sold over 21,000 Mirai FCEVs globally as of November 2022, a figure that is higher now due to ongoing, albeit declining, sales. These vehicles are equipped with a fuel cell stack (producing 134 kW in the second-generation model and 114 kW in the first) and are capable of refueling in under 5 minutes.

Rising Demand for Clean Energy Solutions

Growing concerns over carbon emissions and energy security are driving demand for clean and reliable power generation technologies. Fuel cell stacks enable efficient energy conversion with minimal environmental impact, making them ideal for renewable energy integration and backup systems. Stationary fuel cells are gaining adoption across data centers, hospitals, and commercial facilities due to their high efficiency and grid independence. Countries like Japan and South Korea are investing heavily in hydrogen-based distributed power systems to achieve sustainability goals. These initiatives, along with corporate commitments toward carbon neutrality, are fueling consistent market growth for fuel cell stacks globally.

- For instance, Bloom Energy has deployed significantly more than 700 MW of solid oxide fuel cell (SOFC) systems; that figure is now outdated. As of late 2025, the company has an installed capacity of over 1.5 gigawatts (GW) (which is 1,500 MW) worldwide.” The company is also planning to double its annual manufacturing capacity to 2 GW by the end of 2026 to meet growing demand, particularly from AI data centers.

Technological Advancements and Cost Optimization

Continuous technological innovation is improving fuel cell stack efficiency, durability, and cost-effectiveness. Advancements in catalyst materials, bipolar plate design, and membrane electrode assemblies are reducing system weight and boosting performance. Manufacturers are adopting automation and modular designs to streamline production and lower costs. For instance, developments in non-platinum catalysts and advanced coating processes are addressing cost constraints while enhancing durability. Integration of smart monitoring systems and AI-based diagnostics further enhances reliability. These technological breakthroughs are expanding fuel cell applications across mobility, industrial, and residential sectors, making fuel cell stacks more commercially viable in large-scale energy projects.

Key Trends & Opportunities

Expansion of Hydrogen Infrastructure Worldwide

The global expansion of hydrogen infrastructure presents a strong opportunity for fuel cell stack manufacturers. Nations are investing in hydrogen refueling networks and large-scale electrolysis projects to support clean mobility and industrial applications. Europe’s Hydrogen Backbone initiative and Japan’s national hydrogen roadmap aim to create cross-border supply chains, encouraging private investments. This infrastructure growth ensures stable hydrogen supply and lowers distribution costs. As refueling stations increase, the operational feasibility of FCEVs improves significantly. The synergy between hydrogen production, storage, and utilization boosts overall adoption of fuel cell stacks in transportation and energy systems.

- For instance, Air Liquide has installed more than 200 hydrogen refueling stations globally over the last two decades and has partnered with TotalEnergies in a joint venture (TEAL Mobility) to develop and deploy 100 additional stations across Europe by 2030, which are primarily aimed at heavy-duty trucks.

Growing Integration in Industrial and Backup Power Applications

Fuel cell stacks are increasingly deployed in industrial and backup power systems due to their reliability and low emissions. Data centers, telecommunication towers, and remote facilities are replacing diesel generators with hydrogen-based fuel cells for continuous power supply. Companies are adopting these systems to meet sustainability targets and minimize carbon footprint. The high efficiency and modular scalability of fuel cells make them suitable for microgrids and distributed power setups. Moreover, the growing demand for uninterrupted power in healthcare, manufacturing, and logistics is creating lucrative opportunities for fuel cell stack suppliers across global markets.

- For instance, Plug Power’s primary business has historically been in providing GenDrive hydrogen fuel cell systems for material handling electric vehicles (e.g., forklifts in logistics warehouses for companies like Amazon and Walmart).

Key Challenges

High Production and Infrastructure Costs

Despite technological progress, high production costs remain a key challenge in the Fuel Cell Stack Market. The use of precious metals like platinum, along with complex manufacturing processes, increases system expenses. In addition, the lack of a widespread hydrogen refueling network limits large-scale adoption. Storage, transport, and distribution of hydrogen involve high capital costs and safety concerns. These financial barriers restrict deployment in cost-sensitive sectors. To address this, companies are investing in scalable manufacturing, recycling of catalysts, and public-private partnerships to reduce overall costs and enable broader commercialization.

Durability and Performance Limitations

Durability and long-term performance remain significant hurdles in fuel cell stack deployment. Prolonged operation at high temperatures or humidity can degrade membrane and electrode materials, reducing system lifespan. Contaminants in hydrogen fuel can further impact performance and efficiency. Ensuring consistent output under variable load conditions poses engineering challenges, particularly in transportation applications. Manufacturers are focusing on improving material stability, optimizing thermal management, and adopting predictive maintenance systems to enhance reliability. Overcoming these limitations is essential for achieving large-scale adoption and sustaining competitiveness in the clean energy transition.

Regional Analysis

North America

North America holds a 31.6% share of the global Fuel Cell Stack Market, driven by strong government policies supporting clean energy adoption. The U.S. leads regional growth with extensive hydrogen infrastructure and large-scale investments in fuel cell-powered transportation. Major automakers and energy firms are collaborating to develop hydrogen refueling networks and integrate fuel cells in trucks and buses. Canada’s focus on renewable hydrogen production and industrial decarbonization further supports regional expansion. Continuous funding for research programs and incentives for zero-emission vehicles strengthen North America’s position as a key innovation hub for fuel cell technologies.

Europe

Europe accounts for 27.8% of the market, supported by its ambitious clean energy and emission reduction policies. Countries such as Germany, the U.K., and France are leading hydrogen adoption through national strategies and public-private collaborations. The region emphasizes fuel cell deployment in commercial vehicles, maritime transport, and stationary power applications. The European Union’s Hydrogen Backbone initiative promotes cross-border hydrogen transport infrastructure, boosting system integration. Strong participation from manufacturers like Ballard Power Systems and Bosch enhances technological advancements, ensuring Europe remains a frontrunner in fuel cell stack innovation and sustainability-driven energy solutions.

Asia-Pacific

Asia-Pacific dominates the global Fuel Cell Stack Market with a 34.7% share, fueled by aggressive hydrogen economy initiatives in Japan, South Korea, and China. Japan leads adoption through the ENE-FARM residential fuel cell program and widespread use in vehicles and microgrids. China’s government-backed investments in hydrogen refueling stations and heavy-duty fuel cell vehicles drive rapid growth. South Korea’s focus on large-scale power generation using fuel cells strengthens its energy resilience. Expanding industrialization, coupled with national clean energy mandates, positions Asia-Pacific as the fastest-growing region for fuel cell stack deployment across transportation and stationary applications.

Rest of the World (RoW)

The Rest of the World region, comprising Latin America, the Middle East, and Africa, holds a 5.9% share of the Fuel Cell Stack Market. Growth is emerging through renewable hydrogen projects and clean energy partnerships. The Middle East is investing in green hydrogen infrastructure to diversify energy portfolios, while Latin America explores fuel cell integration in power backup systems and transport fleets. Africa’s interest in off-grid fuel cell power solutions for remote communities is also rising. Increasing international collaborations and technology transfer initiatives are expected to enhance adoption and long-term regional potential.

Market Segmentations:

By Type

By Capacity

- 5 kW

- 5 kW – 100 kW

- > 100 kW – 200 kW

- >200 kW

By Application

- Automotive

- Stationary

- Power generation

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Fuel Cell Stack Market features a competitive landscape characterized by continuous innovation, strategic alliances, and global expansion initiatives. Leading players such as Ballard Power Systems, ElringKlinger, Advent Technologies Holding, and FuelCell Energy Solutions focus on advancing stack efficiency, durability, and cost reduction through material and design improvements. Companies are investing in large-scale production facilities and forming partnerships with automotive OEMs and energy firms to strengthen hydrogen mobility and stationary power solutions. Emerging participants like Nedstack Fuel Cell Technology and Intelligent Energy Limited are expanding their presence through modular stack designs and flexible integration capabilities. Strategic mergers, joint ventures, and government-backed pilot projects enhance market penetration and accelerate commercialization. Continuous research in membrane electrode assemblies, bipolar plate technology, and fuel processing efficiency remains central to gaining a competitive edge, positioning these companies to capitalize on the growing global transition toward hydrogen-based clean energy systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FuelCell Energy Solutions

- ElringKlinger

- Horizon Fuel Cell Technologies

- Ballard Power Systems

- Advent Technologies Holding

- Nedstack Fuel Cell Technology

- Freudenberg Group

- Dana Incorporated

- Commonwealth Automation Technologies

- Intelligent Energy Limited

Recent Developments

- In September 2025, Horizon Fuel Cell Technologies: Launched a new 3 MW hydrogen fuel‑cell module aimed at data‑centre backup power applications

- In July 2025, FuelCell Energy, Inc. The company signed a 7‑year repowering agreement with CGN‑Yulchon Generation Co., Ltd. in South Korea to supply eight advanced carbonate fuel‑cell modules and maintenance services for four units at the Gwangyang facility.

- In April 2025, ElringKlinger AG: Announced the NM20 stack will be showcased at Auto Shanghai 2025, targeting mobility and stationary markets.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising hydrogen adoption in transportation will accelerate large-scale fuel cell vehicle deployment.

- Continuous innovation in membrane and catalyst materials will improve fuel cell efficiency and durability.

- Expanding hydrogen refueling infrastructure will enhance mobility applications across major economies.

- Integration of fuel cell stacks in backup and off-grid power systems will increase reliability.

- Strategic partnerships between automakers and energy providers will strengthen market presence.

- Governments will continue supporting clean hydrogen production and fuel cell commercialization through subsidies.

- Modular and compact stack designs will expand use in residential and portable energy systems.

- Advancements in AI-based monitoring will improve stack performance and predictive maintenance.

- Asia-Pacific will maintain its dominance, supported by strong policy frameworks and industrial growth.

- Cost optimization through mass production and material recycling will drive broader global adoption.