Market overview

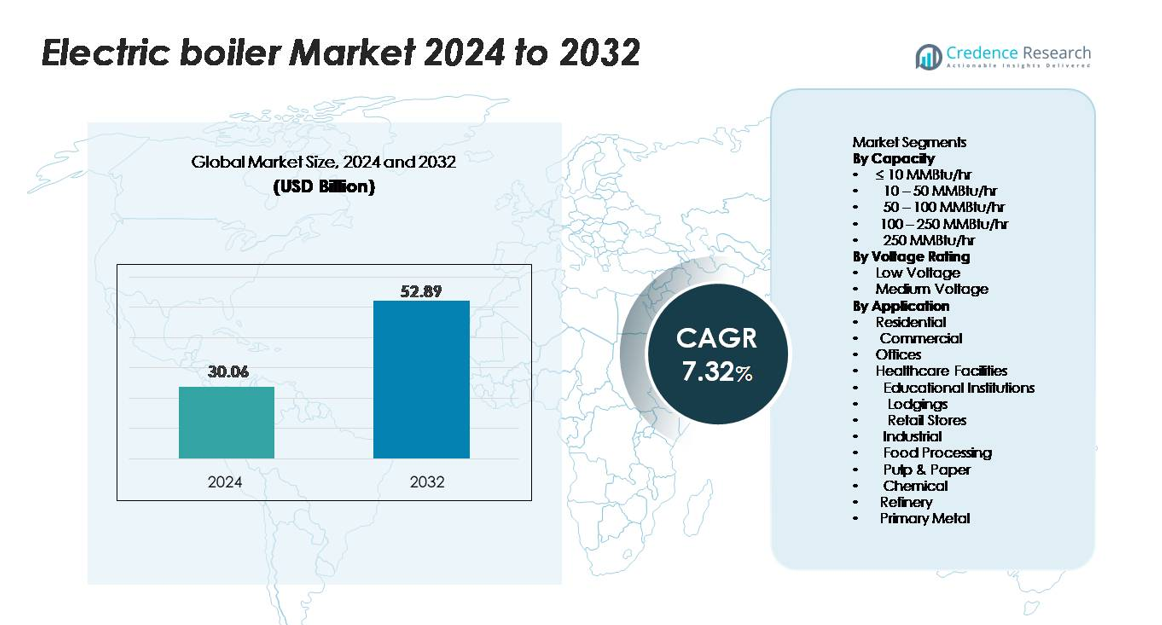

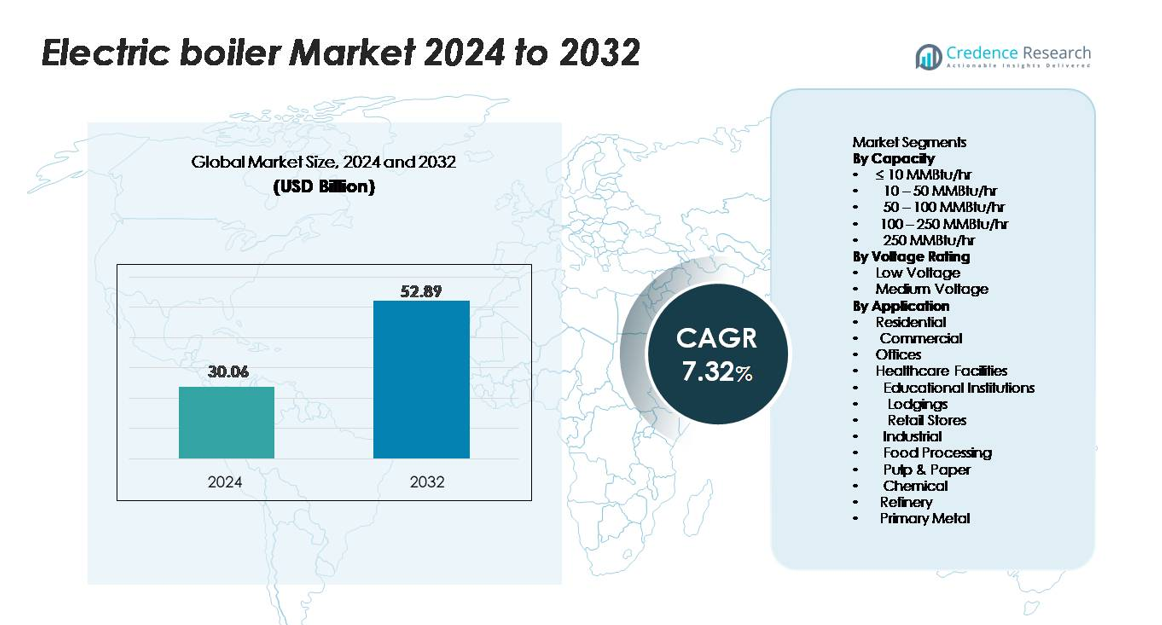

The Electric Boiler Market size was valued at USD 30.06 billion in 2024 and is projected to reach USD 52.89 billion by 2032, growing at a CAGR of 7.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Boiler Market Size 2024 |

USD 30.06 billion |

| Electric Boiler Market, CAGR |

7.32% |

| Electric Boiler Market Size 2032 |

USD 52.89 billion |

Major players in the Electric Boiler market compete through high-efficiency systems, automated controls, and flexible installation options across industrial and commercial facilities. Companies such as Bosch, Cleaver-Brooks, Chromalox, Acme Engineering, Atlantic Boilers, Thermodyne, and Fulton focus on medium-voltage and high-capacity units to support district heating, food processing, chemicals, and metal production. Many manufacturers invest in digital monitoring, smart load management, and turnkey service packages to strengthen customer adoption. Europe leads the market with a 42% share, driven by strong emission regulations, renewable integration, and public-sector heating modernization. North America follows due to industrial electrification and clean-building initiatives.

Market Insights

- The Electric Boiler market reached USD 30.06 billion in 2024 and will hit USD 52.89 billion by 2032 at a 7.32% CAGR, driven by rising clean-heat demand.

- Strong market drivers include decarbonization targets, fuel-to-electric boiler replacement, and lower maintenance costs. Medium-voltage units lead the voltage segment with nearly 60% share, supported by industrial steam demand.

- Key trends include integration with renewable energy, heat-pump hybrids, and thermal storage for peak-load balancing. Digital monitoring, automation, and smart controls increase adoption in commercial and industrial facilities.

- Competition intensifies as Bosch, Cleaver-Brooks, Chromalox, Acme Engineering, and Atlantic Boiler focus on high-capacity units, turnkey installations, and remote diagnostics. Service contracts and modular systems help vendors retain large customers.

- Europe holds 42% share, driven by green-building laws and district heating electrification. North America follows with 28%, while Asia-Pacific holds 21%, supported by fast industrial growth. The industrial segment leads with over 55% share due to high steam requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Capacity

Electric boilers ranging from 10–50 MMBtu/hr hold the dominant share due to strong adoption in district heating, mid-sized manufacturing units, and commercial buildings that require stable thermal output with low emissions. This sub-segment captures over 35% market share as facility owners prioritize compact installation, automated control, and lower maintenance. Growth is boosted by rising clean-heat targets and higher electricity penetration across Europe, North America, and Asia. Large-capacity units above 100 MMBtu/hr gain traction in industrial steam systems, but mid-range units remain preferred for cost-efficiency and flexible load management.

- For instance, Bosch Industriekessel offers electric boiler systems within this range, providing a continuous steam capacity of up to 7,500 kg/h (or 8,300 kg/h, depending on model) at pressures up to 24 bar while operating at up to 99.6% efficiency and reaching full load in next to no time (typically within minutes).

By Voltage Rating

Medium-voltage electric boilers account for the largest share of the market, representing nearly 60% of total installations. Industrial manufacturing plants, food processing units, and chemical producers rely on medium-voltage systems to support high steam output and energy-intensive operations. Demand increases as factories replace aging fossil-fuel boilers to meet emission norms and decarbonization goals. Low-voltage units are widely used in small commercial spaces and residential buildings but remain secondary in revenue contribution. Policy incentives, grid modernization, and focus on energy-efficient electrification continue to drive the dominance of medium-voltage installations.

- For instance, Chromalox supplies medium-voltage electric steam boilers with a heating capacity of 3 MW and design pressures up to 17 bar, allowing continuous steam generation for heavy industrial processes.

By Application

The industrial segment leads the market with over 55% share, driven by consistent demand from food processing, pulp and paper, chemical, refinery, and primary metal industries. Manufacturers adopt electric boilers to reduce carbon taxes, achieve zero-emission steam generation, and lower operational noise and fuel handling costs. The commercial segment grows steadily through adoption in offices, hospitals, lodgings, and retail stores requiring reliable, low-maintenance heating. Residential users expand with rising electrification and renewable-powered heat systems. However, industrial facilities remain the core revenue contributor due to high load requirements and round-the-clock operations.

Key Growth Drivers

Shift Toward Decarbonized Heating Systems

Governments and industries are replacing fuel-based boilers with electric units to reduce greenhouse gas emissions and comply with carbon-neutral goals. Regulations on coal and gas boilers, carbon pricing, and incentives for electrification accelerate this transition. Electric boilers offer zero on-site emissions, no fuel storage, and low noise, which makes them ideal for retrofitting urban buildings and industrial sites. As large corporations adopt sustainability targets, demand rises in sectors such as food processing, chemicals, district heating, and commercial infrastructure. Grid expansion, higher renewable energy penetration, and falling electricity prices further support adoption. Many countries now mandate clean heating in public buildings, schools, and hospitals, boosting procurement of electric boiler systems. The shift toward green heat production creates strong long-term demand in both developed and emerging economies.

- For instance, Danstoker supplied an electric steam boiler delivering 4 tons per hour at 10 bar pressure to a textile manufacturer, achieving full operation without fossil-fuel combustion and ensuring continuous production with zero CO₂ emissions.

Rising Need for Energy-Efficient and Low-Maintenance Equipment

Electric boilers deliver higher energy conversion efficiency than fossil-fuel units because they avoid combustion losses, flue gas release, and fuel handling. Industries seeking lower operating costs and reduced downtime prefer these systems due to minimal moving parts and simplified maintenance. Automation, remote monitoring, and load-management features improve reliability in continuous operations, making them suitable for 24/7 facilities. Commercial buyers, including hotels, lodgings, and healthcare facilities, favor electric boilers for consistent heat output and space-efficient installation. With smart controls and digital diagnostics, operators can track consumption, optimize heating cycles, and cut energy waste. The growing focus on maintenance-free operations, workforce reduction, and building electrification continues to increase adoption across major end-use segments.

- For instance, Chromalox supplies electric steam boilers with a rated output of 3 MW and automated control systems capable of maintaining set-point stability within ±1 °C, reducing manual supervision and service frequency in continuous-process industries.

Increasing Installation in District Heating and Industrial Steam Applications

District heating networks and process industries are major contributors to market growth, driven by high heat demand and strict emission compliance. Electric boilers support rapid steam generation, load sharing with renewable grids, and peak-shaving during high power availability. Utilities deploy them to stabilize grid frequency and absorb excess wind and solar power, turning heat production into a flexible grid asset. Industrial plants replace gas and oil boilers with electric units to avoid fuel price volatility and upgrade to clean heat technologies. Key sectors such as chemicals, pulp and paper, metal refining, and food processing expand capacity to meet sustainability standards and improve workplace safety. As district heating expands in Europe, North America, China, and South Korea, the demand for high-capacity electric boilers accelerates.

Key Trends & Opportunities

Integration of Electric Boilers with Renewable Energy and Heat Pumps

A major trend involves pairing electric boilers with renewable power sources and heat pump systems to create hybrid, low-carbon heating solutions. When solar and wind power produce excess electricity, electric boilers convert it into thermal energy for storage or heating distribution. Many utilities invest in thermal energy storage tanks, enabling operators to store heat and release it during peak demand. Commercial buildings and campuses adopt heat-pump-boiler combinations to reduce running costs and maintain efficient heating in cold seasons. This trend opens opportunities for technology providers that supply smart controls, predictive analytics, and flexible grid connectivity. As renewable capacity grows, electric boilers become central to balancing power supply and heat loads.

- For instance, Bosch Industriekessel demonstrated a hybrid setup combining the ELHB electric boiler with a heat pump system using a 1,000-liter buffer tank, enabling continuous heat supply even when renewable output fluctuates.

Growing Adoption in Commercial Infrastructure and Public Facilities

Commercial spaces, including offices, hospitals, educational institutions, lodgings, and retail outlets, increasingly install electric boilers to comply with emission standards and improve indoor safety. These systems eliminate fuel leakage, exhaust emissions, and on-site storage risks, making them preferable for dense urban environments. Facility owners also value quiet operation, rapid response heating, and minimal service interruptions. Government procurement programs, public-sector retrofits, and green-building certifications create strong purchase volumes. As cities invest in clean infrastructure and energy-efficient heating, vendors gain opportunities to supply modular, scalable boiler systems across municipal buildings and commercial projects.

Key Challenges

High Operational Costs in Regions with Expensive Electricity

In areas where electricity prices remain high, electric boilers pose a cost challenge compared to natural gas or biomass systems. Industrial buyers with large steam demand evaluate operating budgets closely and sometimes delay electrification because energy tariffs increase production costs. Small and medium manufacturers may find it difficult to justify the transition even with maintenance savings. Peak-hour electricity pricing further raises concern, especially in regions with unstable power grids. While renewable-powered operations reduce long-term cost pressure, upfront investment in grid upgrades and electrical infrastructure can slow adoption in cost-sensitive markets.

Requirement for Grid Capacity and Electrical Infrastructure Upgrades

Large-scale electric boilers require sufficient grid capacity, stable voltage, and upgraded wiring, which poses challenges for older industrial zones and commercial buildings. Many regions lack the electrical backbone to support high-load heating systems, forcing operators to invest in transformers, switchgear, and distribution upgrades. These additions increase project costs and lengthen installation time. In developing countries, power fluctuations can interrupt heating processes, limiting industrial confidence in full electrification. Utilities must also manage demand surges during winter or industrial peak hours. Until grid modernization progresses, adoption may grow unevenly across regions.

Regional Analysis

North America

North America accounts for over 28% market share, supported by strict emission rules, electrification policies, and rapid replacement of fuel-based boilers in commercial and industrial facilities. The United States leads installations across hospitals, schools, data centers, and municipal heating networks. Utilities adopt electric boilers to balance renewable energy and meet decarbonization targets. Industrial segments such as food processing, chemicals, and metal manufacturing shift to electric steam systems for safety, automation, and long-term cost control. Canada expands installations through cold-climate heat demand and grid-integrated heating projects, boosting regional deployment.

Europe

Europe remains the dominant regional market with over 42% share, driven by strong clean-energy mandates, carbon tax policies, and rapid adoption in district heating. Countries such as Germany, the U.K., the Netherlands, and Nordic nations invest in high-capacity electric boilers to replace coal and gas units. Industrial electrification accelerates as manufacturers commit to net-zero targets and switch to renewable-powered steam systems. Government incentives and heating modernization programs support adoption in commercial buildings and public infrastructure. Thermal storage integration and flexible load management create additional growth opportunities across utilities and industrial users.

Asia-Pacific

Asia-Pacific captures around 21% market share, with increasing installations in China, Japan, South Korea, and Australia. Industries adopt electric steam systems to reduce emission intensity and comply with safety standards. China and Japan expand district heating and electrified building systems to support clean urban development, while South Korea integrates electric boilers with smart grids and storage. Japan’s aging boiler fleet drives replacement of oil-fired units with digital, automated electric systems. Industrial sectors such as chemicals, food processing, and electronics reinforce demand due to high process efficiency and minimal downtime.

Latin America

Latin America holds nearly 5% share, supported by expanding industrial activity and cleaner heating initiatives in countries such as Brazil, Argentina, and Chile. The region sees rising demand across food processing, chemical manufacturing, and commercial infrastructures like hotels, lodgings, and healthcare facilities. Import of European and Asian equipment increases as end-users seek efficient, low-maintenance systems. However, high electricity tariffs in some areas slow adoption in cost-sensitive industries. Government incentives for energy efficiency and renewable-powered operations are expected to improve the region’s long-term growth.

Middle East & Africa

Middle East & Africa account for around 4% market share, driven by deployments in refineries, petrochemical plants, and desalination facilities that value clean, consistent steam output. The UAE, Saudi Arabia, and South Africa adopt electric boilers in commercial buildings to meet green-building standards and reduce fuel consumption. Integration with solar power and large heat storage systems supports wider adoption in district heating and industrial processes. However, limited grid capacity in parts of Africa restricts market expansion. Ongoing industrial diversification and renewable investments present emerging opportunities for suppliers.

Market Segmentations:

By Capacity

- 10 – 50 MMBtu/hr

- 50 – 100 MMBtu/hr

- 100 – 250 MMBtu/hr

- 250 MMBtu/hr

By Voltage Rating

- Low Voltage

- Medium Voltage

By Application

- Residential

- Commercial

- Offices

- Healthcare Facilities

- Educational Institutions

- Lodgings

- Retail Stores

- Industrial

- Food Processing

- Pulp & Paper

- Chemical

- Refinery

- Primary Metal

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Boiler market includes global and regional manufacturers competing through product efficiency, installation flexibility, automation, and digital monitoring features. Companies focus on low-maintenance designs, compact systems, and fast response heating solutions for industrial and commercial use. Leading suppliers expand portfolios with high-capacity and medium-voltage units to meet demand in food processing, chemicals, district heating, and metal production. Many players invest in smart controls, remote diagnostics, and renewable integration to support energy-transition goals. Partnerships with utilities and engineering firms help secure long-term supply contracts for industrial steam systems and grid-connected heating applications. Competitive strategies also include modular boiler designs, after-sales service networks, and turnkey installation packages to win large customers. As emission standards tighten, vendors that offer zero-emission heating with digital optimization gain a competitive edge across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Bradford White introduced the AeroTherm® Series G2 hybrid electric-heat pump water heater for residential use (189 L to 303 L).

- In March 2025, Bosch launched the ELHB electric boiler (250 kW to 5.5 MW output) at the ISH event in Frankfurt, enabling integration with green electricity and offering up to 99.6% efficiency.

- In February 2025, Danstoker completed an electric boiler project for Ege Carpets converting from gas to electric steam (4 t/h at 10 barg), achieving ~0 % CO₂ emissions and 99% efficiency.

Report Coverage

The research report offers an in-depth analysis based on Capacity, Voltage rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as industries replace fuel-based boilers to meet decarbonization goals.

- District heating networks will adopt high-capacity electric units for clean urban heat supply.

- Integration with renewable power and thermal storage will improve grid flexibility.

- Medium-voltage systems will expand in factories needing continuous steam output.

- Commercial buildings will upgrade to electric boilers to comply with green-building rules.

- Smart controls, automation, and remote monitoring will become standard features.

- Heat-pump and electric-boiler hybrids will grow in cold-climate regions.

- Manufacturers will invest in modular designs to support fast installation and retrofits.

- Government incentives for clean heating will boost public-sector procurement.

- Falling electricity emissions intensity will make electric boilers more attractive for long-term operations.