Market overview

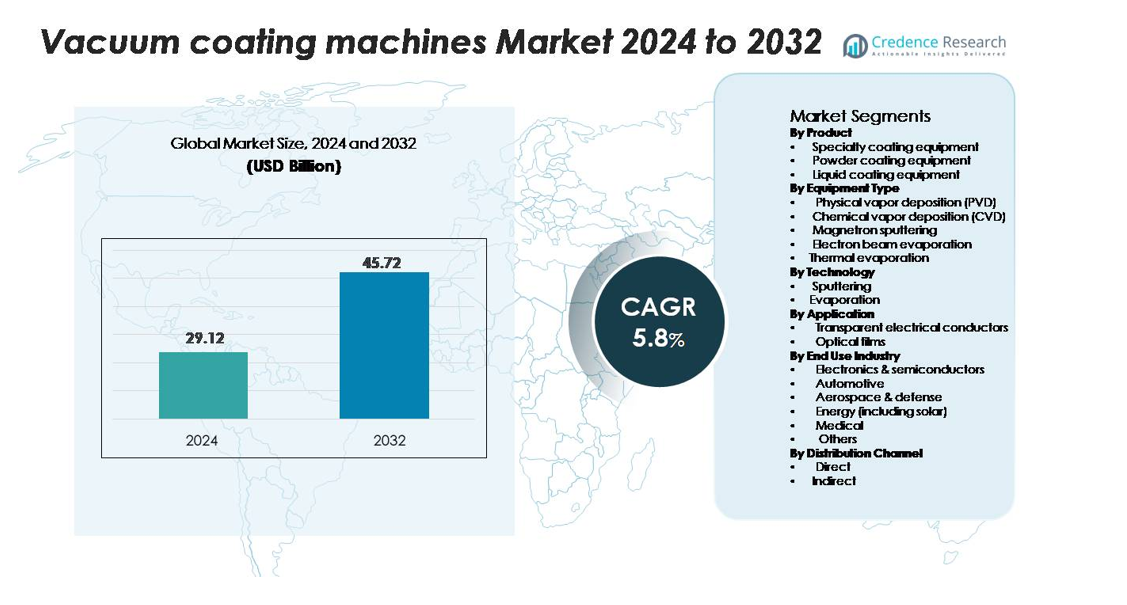

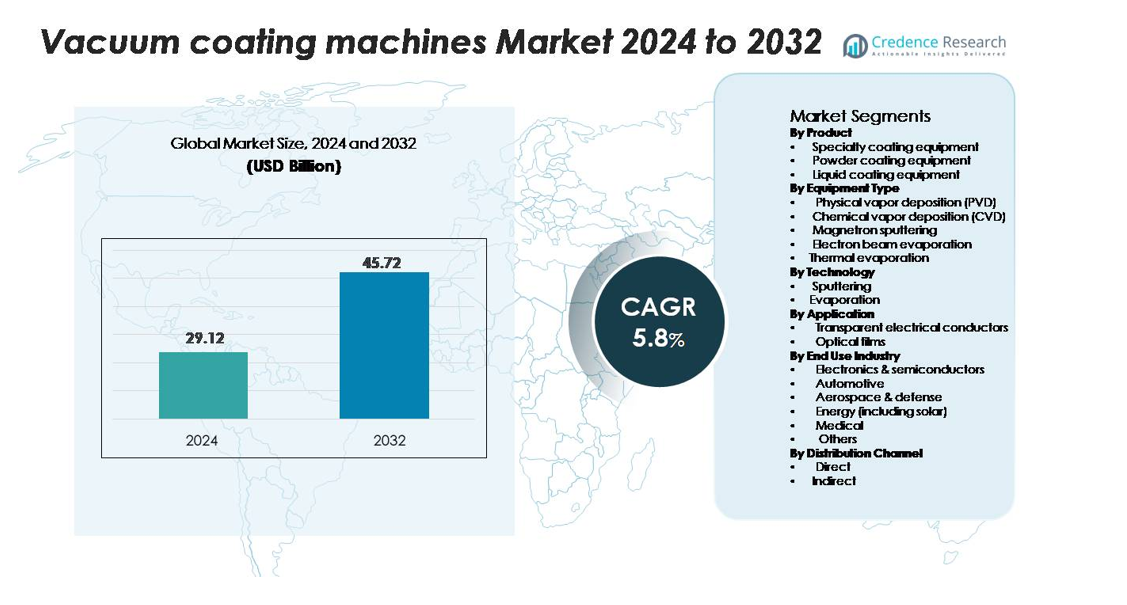

Vacuum coating machines market size was valued at USD 29.12 billion in 2024 and is projected to reach USD 45.72 billion by 2032, registering a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vacuum Coating Machines Market Size 2024 |

USD 29.12 billion |

| Vacuum Coating Machines Market, CAGR |

5.8% |

| Vacuum Coating Machines Market Size 2032 |

USD 45.72 billion |

The vacuum coating machines market is highly competitive, with major players such as Lam Research, CVD Equipment Corporation, Canon Tokki, Oerlikon Balzers, ASM International, Jusung Engineering, Kurt J. Lesker Company, Applied Materials, AIXTRON, and the Bühler Group delivering advanced thin-film and surface engineering solutions. These companies expand portfolios through high-precision PVD, sputtering, and evaporation systems tailored for electronics, solar, medical, and automotive applications. Asia-Pacific leads the market with 34% share, supported by large-scale semiconductor and display manufacturing, while North America and Europe follow with strong demand from aerospace, automotive, and research-grade production. Continuous investment in automation and energy-efficient coating technologies strengthens competition across global production lines.

Market Insights

- The vacuum coating machines market reached USD 29.18 billion in 2024 and will grow to USD 45.72 billion by 2032, registering a 5.8% CAGR.

- Rising demand from electronics and semiconductor manufacturing boosts adoption of PVD, sputtering, and magnetron systems, as industries require precise, durable thin films for chips, sensors, optical modules, and EV batteries.

- Key trends include automation, Industry 4.0 integration, and increased use of multi-functional coatings for OLED displays, low-emissivity glass, AR/VR devices, and solar modules.

- Competitive activity remains high, led by Lam Research, Canon Tokki, Oerlikon Balzers, Applied Materials, and AIXTRON, while high capital cost and skilled labor shortages remain key restraints for new manufacturers.

- Asia-Pacific holds the largest regional share at 34%, North America follows with 32%, and Europe accounts for 26%; by equipment type, PVD systems dominate the segment due to high throughput, strong bonding quality, and versatility across industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Specialty coating equipment holds the largest share in the vacuum coating machines market due to rising demand from electronics, automotive, optics, and semiconductor manufacturing. These machines support advanced surface modification, corrosion resistance, optical enhancement, and micro-layer precision. Higher adoption of anti-reflective films, scratch-resistant surfaces, OLED displays, and semiconductor wafers strengthens this segment. Powder coating and liquid coating equipment continue to grow, but their penetration remains lower compared to specialty systems used for high-value components. Increasing investment in thin-film technologies and miniaturized electronic devices keeps specialty coating machines dominant across global production lines.

- For instance, Oerlikon Balzers BALIQ® TISINOS PRO coating has a hardness of approximately 38 GPa and maintains thermal stability up to 1,000 °C (similar to CBN cutting materials), as documented in the company’s product specifications, enabling use on high-speed cutting tools for hard machining applications up to 70 HRC.

By Equipment Type

Physical vapor deposition (PVD) accounts for the largest market share among equipment types. PVD systems are widely preferred due to uniform thin-film formation, excellent adhesion, low environmental impact, and compatibility with metals, ceramics, plastics, and glass substrates. Industries such as semiconductors, automotive, and optical electronics rely on PVD for hardness coatings, solar cells, reflective layers, and decorative finishes. Magnetron sputtering and electron beam evaporation also gain traction for precision coatings, but PVD leads due to versatility and large-scale industrial integration. Growing adoption of wear-resistant and energy-efficient surfaces supports sustained demand for PVD units.

- For instance, Oerlikon Balzers’ INNOVENTA kila PVD system is a high-volume system used for coating cutting tools and precision components. It offers a 20% to 25% higher loading capacity than its predecessor, the INNOVA, and can achieve shorter batch times of up to five batches per day.

By Technology

Sputtering technology dominates the vacuum coating machines market with the highest share. Sputtering delivers consistent film thickness, strong bonding, and superior mechanical durability, making it suitable for semiconductor wafers, data storage media, and optical films. Manufacturers choose sputtering for high throughput, improved coating control, and material efficiency. Evaporation technology also sees demand in optical lens production, decorative layers, and packaging films, but its share remains lower than sputtering due to material limitations and slower deposition rates. Continuous growth in microelectronics, solar photovoltaics, and display manufacturing ensures sputtering remains the preferred commercial vacuum coating process.

Key Growth Drivers

Rising Demand from Electronics and Semiconductor Manufacturing

Electronics and semiconductor companies require precise, durable, and ultra-thin coatings for chips, sensors, storage components, printed circuit boards, and optical modules. Vacuum coating machines support uniform layer deposition, strong adhesion, and advanced surface performance that meets strict industry standards. Growth in smartphones, wearables, EV battery systems, and data centers continues to increase semiconductor production, which directly boosts equipment demand. Miniaturization of consumer electronics and rapid adoption of 5G also push manufacturers toward high-precision coating technologies, especially PVD and sputtering systems. Thin-film coatings improve electrical conductivity, corrosion resistance, and thermal management, which strengthens device reliability. Many chipmakers expand fabrication plants and adopt automated vacuum coating systems for high-volume output. As countries invest in wafer-level packaging and advanced integrated circuits, vacuum coating machines remain essential, keeping the electronics sector as the strongest commercial driver.

- For instance, Lam Research’s VECTOR® plasma deposition tool is engineered for dielectric film formation on 300-mm wafers, and its quad station module (QSM) architecture supports high-volume wafer output documented in Lam’s technical specifications.

Expansion of Solar Energy and Energy-Efficient Solutions

Growing renewable energy installations create strong demand for vacuum coating machines, especially in thin-film solar cells, photovoltaic panels, reflective coatings, and low-emissivity glass. Solar manufacturers use sputtering and evaporation technologies to boost panel efficiency and improve thermal control. Government incentives, clean energy policies, and falling solar costs keep investment high in utility-scale and rooftop solar projects. Vacuum coatings also support energy-efficient building materials, such as coated architectural glass that reduces heat loss while maintaining visibility. Industrial users prefer vacuum-based techniques because they form consistent optical layers without harmful emissions. As global focus shifts toward net-zero, industries seek durable, lightweight, and high-performance surfaces to cut energy use and extend product life. This trend ensures long-term demand for advanced coating systems in both renewable energy and energy-saving consumer products.

- For instance, Applied Materials’ AKT PECVD platform is designed for thin-film solar and glass coating applications and supports large substrates as wide as 2,200 mm, as documented in the company’s technical specifications.

Increased Use in Automotive, Aerospace, and Medical Components

Automotive and aerospace producers rely on vacuum coating machines to meet strict quality, durability, and safety requirements. Thin-film layers improve scratch resistance, wear protection, reflectivity, and corrosion strength for metal and composite parts. Modern vehicles use coated sensors, mirrors, headlights, engine parts, EV battery materials, and decorative trims. The shift toward autonomous and electric vehicles increases the need for coated optical sensors, camera lenses, and electronic control units. Aerospace manufacturers also apply coatings to turbine blades, cockpit displays, and structural components to withstand extreme temperature and friction. In healthcare, vacuum coatings support biocompatible implants, surgical tools, and protective films for medical devices. As all three industries focus on lightweight materials and longer service life, the requirement for high-precision vacuum coating continues to rise.

Key Trends & Opportunities

Shift Toward High-Performance and Multifunctional Coatings

Manufacturers increasingly seek multifunctional coatings that provide electrical conductivity, anti-reflective properties, chemical resistance, and improved mechanical strength in a single layer. Thin-film deposition systems using sputtering and magnetron technologies deliver highly controlled finishes for optical films, transparent conductors, and semiconductor wafers. Demand for OLED displays, flexible screens, AR/VR devices, and advanced camera modules supports wider adoption of complex multi-layer coatings. Growth in smart consumer devices and IoT products opens fresh opportunities for compact, automated vacuum coating units. Companies also introduce eco-friendly coatings with lower emissions and improved material use. This trend supports innovation across both equipment upgrades and aftermarket parts supply.

- For instance, AIXTRON’s OVPD® (Organic Vapor Phase Deposition) system enables uniform organic layer coating on substrates up to 200 mm in width, with evaporation sources engineered for nanometer-level thickness control, as disclosed in AIXTRON’s published technical specifications.

Industry Adoption of Automation and Smart Manufacturing

Factories now integrate sensors, robotics, and automated handling systems into vacuum coating lines to increase accuracy and reduce human error. Smart controllers allow real-time monitoring of temperature, pressure, film thickness, and material flow, helping users cut waste and improve consistency. Automated cleaning, target replacement, and batch processing make machines suitable for high-volume semiconductor, automotive, and solar production. Digital twin simulations and predictive maintenance also reduce downtime and maintenance costs. Many manufacturers now offer modular systems that scale production without rebuilding infrastructure, creating strong opportunities for small and medium-sized producers. This shift toward Industry 4.0 supports faster adoption of advanced vacuum coating machines globally.

- For instance, the Bühler Group’s Leybold Optics FLC 1600 system incorporates automated substrate handling and supports coating widths up to 1,650 mm (referencing the FLC series which offers a 1600 mm width), as documented in the company’s technical specifications.

Key Challenges

High Capital Investment and Maintenance Costs

Vacuum coating machines require heavy upfront investment for installation, cleanroom integration, power supply, and process monitoring equipment. Small manufacturers often struggle with high setup costs, making it difficult to enter the market. Routine maintenance, consumables, target materials, and specialized technicians add ongoing expense. Semiconductor and aerospace applications demand precise environmental control, which increases total operational cost. Manufacturers also face long approval cycles before use in medical or aerospace components. These factors often slow expansion for new entrants and create a strong barrier to market adoption. Vendors respond by offering financing models, modular systems, and automation to lower long-term ownership cost, but pricing remains a challenge.

Technical Complexity and Skilled Labor Shortage

Vacuum deposition systems require trained engineers to manage chamber pressure, coating thickness, material selection, and substrate preparation. Errors in process control can lead to coating defects or wasted batches, raising production cost. Many regions lack skilled operators, slowing adoption in developing industries. Integrating coating lines with semiconductor tools or optical production also demands specialized knowledge of electronics, software calibration, and material science. Rapid innovation pushes companies to update technology frequently, raising training needs and transition cost. To overcome this challenge, manufacturers provide automated controls, user-friendly interfaces, remote diagnostics, and training support. However, workforce shortages remain a key hurdle for large-scale deployment.

Regional Analysis

North America

North America leads the vacuum coating machines market with around 32% share, driven by strong semiconductor production, aerospace innovation, and medical device manufacturing. The U.S. houses advanced electronics and defense industries that require high-precision thin-film deposition for sensors, optics, chips, and protective coatings. Automotive OEMs also integrate vacuum-coated components to enhance durability and energy efficiency. Increased deployment of solar technologies and low-emissivity glass in infrastructure projects further boosts equipment demand. Continuous R&D investment, automation adoption, and the presence of major technology companies keep North America a stable, high-value market for vacuum coating machinery.

Europe

Europe holds close to 26% market share, supported by automotive, aerospace, renewable energy, and industrial manufacturing sectors. Germany, France, and the U.K. expand the use of PVD and sputtering systems in precision engineering, turbine parts, architectural glass, and semiconductor devices. The region benefits from strict environmental regulations, making vacuum coatings more attractive due to lower emissions and cleaner processing. Solar panel production and lightweight automotive materials increase thin-film coating requirements. Strong innovation capabilities, technical workforce, and partnerships between equipment suppliers and research centers help Europe maintain a strong competitive position in high-performance coatings.

Asia-Pacific

Asia-Pacific holds the largest share at nearly 34%, driven by rapid electronics manufacturing in China, South Korea, Japan, and Taiwan. Semiconductor fabrication, display panels, smartphones, EV batteries, and optical films create sustained demand for sputtering, magnetron systems, and PVD equipment. Government incentives for solar capacity expansion increase adoption of thin-film vacuum coatings in utility-scale projects. Rising automotive production and industrial automation also strengthen the market. Localized manufacturing, lower production costs, and the presence of leading electronics brands keep Asia-Pacific the fastest-growing region, attracting major global suppliers to set up new plants and joint ventures.

Latin America

Latin America represents around 4% share, with gradual growth supported by automotive, packaging, and energy industries. Brazil and Mexico expand use of vacuum coatings in automotive parts, reflective surfaces, and consumer electronics assembly. Industrial modernization improves adoption of sputtering and evaporation systems in metal finishing and optical lenses. Solar power investments across Chile and Brazil also create demand for thin-film coatings used in photovoltaic modules. However, high capital cost, limited technical expertise, and slower industrial automation restrict penetration. International suppliers collaborate with regional manufacturers to deliver modular and mid-capacity coating systems suited to local production needs.

Middle East & Africa

The Middle East & Africa accounts for about 3% share, but adoption continues to rise due to solar power expansion and growth in medical and industrial manufacturing. Countries like UAE, Saudi Arabia, and South Africa deploy vacuum-coated architectural glass for energy-efficient infrastructure. Solar PV plants also require thin-film coatings for improved efficiency and durability in harsh climates. Defense and aerospace investments contribute to demand for PVD and sputtering technologies in precision components. Limited industrial base and reliance on imports remain challenges, but rising clean-energy policies and infrastructure growth create future opportunities for coating equipment suppliers.

Market Segmentations:

By Product

- Specialty coating equipment

- Powder coating equipment

- Liquid coating equipment

By Equipment Type

- Physical vapor deposition (PVD)

- Chemical vapor deposition (CVD)

- Magnetron sputtering

- Electron beam evaporation

- Thermal evaporation

By Technology

By Application

- Transparent electrical conductors

- Optical films

By End Use Industry

- Electronics & semiconductors

- Automotive

- Aerospace & defense

- Energy (including solar)

- Medical

- Others

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the vacuum coating machines market features a mix of global equipment manufacturers and specialized technology providers focused on thin-film deposition, sputtering, and PVD solutions. Leading companies compete through product innovation, precision automation, and advanced process control to meet the needs of semiconductor, automotive, solar, and medical device industries. Many suppliers expand their portfolios with modular coating systems, high-vacuum chambers, faster deposition technologies, and energy-efficient designs. Strategic partnerships with electronics and solar OEMs help secure long-term supply contracts. Companies also invest in R&D for high-performance coatings used in microelectronics, AR/VR displays, and EV batteries. Asia-Pacific players strengthen regional production with cost-efficient systems, while North American and European firms maintain leadership in high-end research-grade equipment. After-sales services, training support, and remote diagnostics have become essential differentiators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, the company received the 2025 SEMI Award for North America for its cryogenic etch technology advancing 3D NAND manufacturing.

- In October 2025, CVD Equipment Corporation (CVDE) announced that it had received an order for two PVT150™ Physical Vapor Transport systems from the new onsemi Silicon Carbide Crystal Growth Center at Stony Brook University.

Report Coverage

The research report offers an in-depth analysis based on Product, Equipment type, Technology, Application, End use industry, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as semiconductor and electronics manufacturers expand chip and display production.

- Growth in EV batteries, sensors, and onboard electronics will increase coating system adoption in automotive plants.

- Solar power expansion will boost thin-film coating requirements for photovoltaic modules and low-emissivity glass.

- Manufacturers will shift toward modular coating systems that support faster scaling and lower operating cost.

- Automation, robotics, and AI-based quality monitoring will improve process accuracy and reduce waste.

- Sustainable coatings and energy-efficient vacuum systems will gain preference due to stricter environmental goals.

- Medical device production will adopt more biocompatible and wear-resistant coatings for implants and surgical tools.

- Investments in AR/VR displays and flexible electronics will raise demand for precision sputtering and PVD machines.

- Localization of semiconductor fabrication will create new equipment installations in Asia, North America, and Europe.

- Service-based models, predictive maintenance, and aftermarket upgrades will become key revenue sources.