Market Overview:

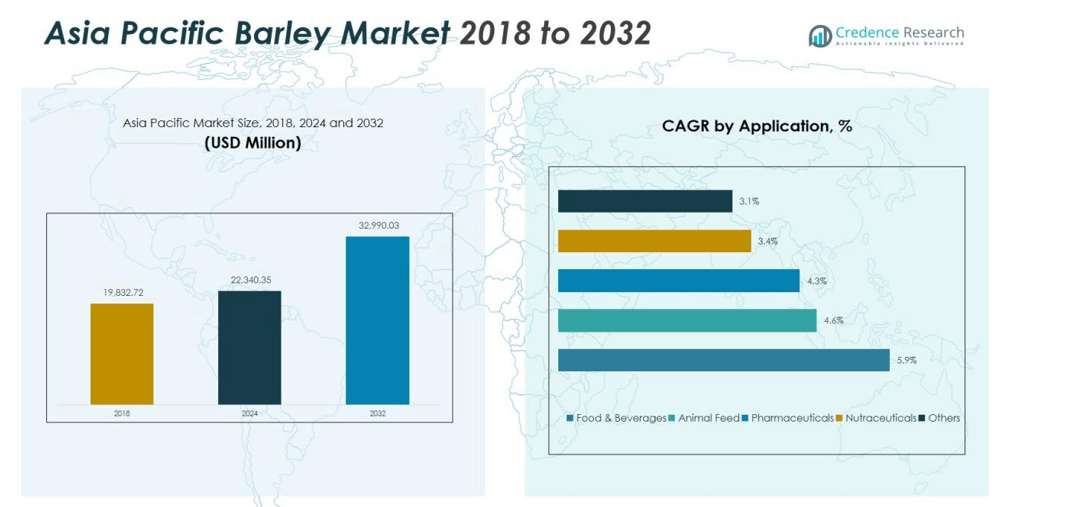

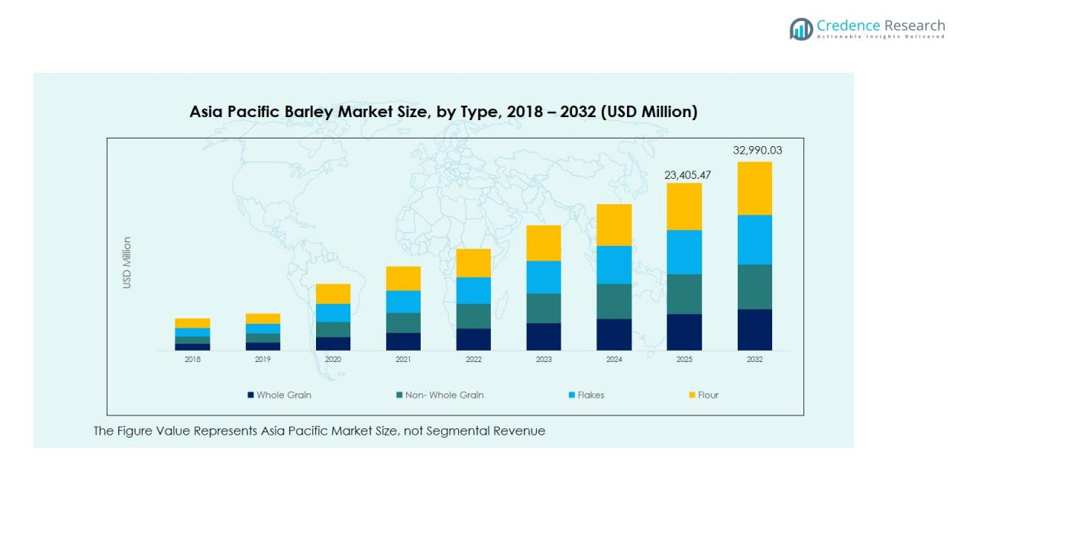

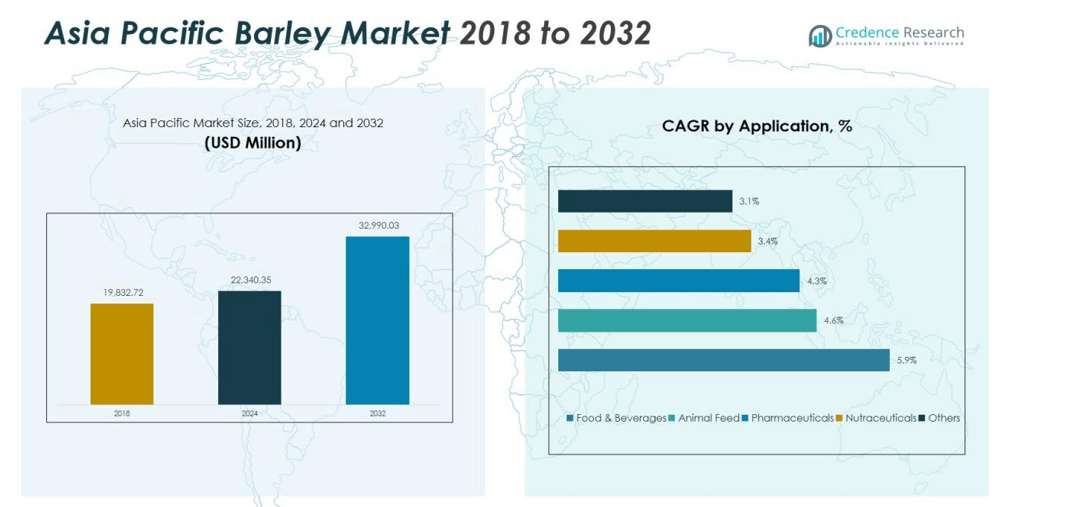

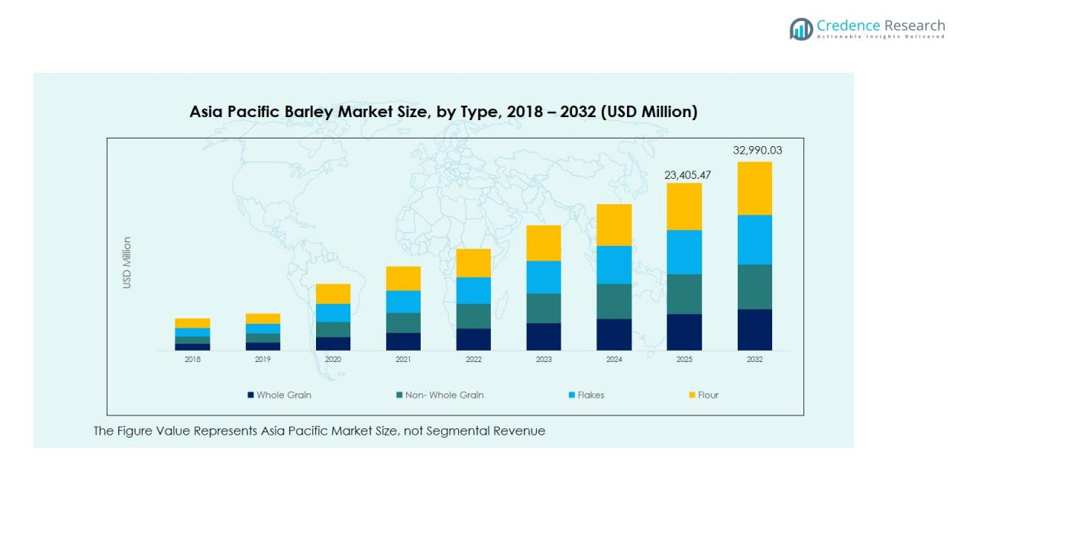

The Asia Pacific Barley Market size was valued at USD 19,832.72 million in 2018 to USD 22,340.35 million in 2024 and is anticipated to reach USD 32,990.03 million by 2032, at a CAGR of 28.97%% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Barley Market Size 2024 |

USD 22,340.35 million |

| Asia Pacific Barley Market, CAGR |

28.97% |

| Asia Pacific Barley Market Size 2032 |

USD 32,990.03 million |

Strong market drivers reinforce growth momentum across the region. Expanding beer production, particularly in emerging economies, strengthens demand for malt barley. Rising consumer preference for health-focused food products accelerates the use of barley in cereals, snacks, and functional foods. The livestock sector adds another layer of demand, as feed barley remains essential for cattle, poultry, and swine nutrition. Investments in improved crop varieties, sustainable farming techniques, and modern processing facilities further enhance production efficiency and product consistency.

Regionally, major producers such as China, Australia, and India shape overall market dynamics. Australia remains a leading exporter, supported by advanced agronomic practices and large-scale cultivation. China maintains strong consumption levels due to its brewing, feed, and food-processing sectors. India experiences gradual growth driven by rising feed demand and growing interest in malt-based beverages. Collectively, these markets drive Asia Pacific’s position as an influential global participant in the barley industry.

Market Insights:

- The Asia Pacific Barley Market stands at USD 22,340.35 million in 2024 and is projected to reach USD 32,990.03 million by 2032, advancing at a CAGR of 28.97%, driven by strong demand from brewing, health-focused foods, and feed applications.

- China, Australia, and India collectively hold the top three regional shares—China (~34–36%), Australia (~28–30%), and India (~12–14%)—due to large-scale consumption in beer production, Australia’s export dominance, and India’s rising feed usage.

- Southeast Asia emerges as the fastest-growing regional cluster (~10–12% share) supported by expanding livestock industries, growing malt-based beverage uptake, and increasing reliance on barley imports to meet processing demand.

- Malting barley represents the largest segment (~45–48%), driven by strong brewing activity across China, Japan, India, and Australia that prioritizes high-quality grain inputs.

- Feed barley accounts for ~32–35% share, supported by poultry, cattle, and swine production growth across emerging Asia Pacific markets, ensuring stable baseline demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Malt-Based Beverages Strengthens Market Momentum

The Asia Pacific Barley Market gains steady traction from the expanding brewing industry across key economies. Rising consumption of beer and flavored malt beverages supports sustained demand for high-quality malting barley. It benefits from large-scale brewing operations in China, Japan, India, and Southeast Asia that prioritize consistent grain quality. Investments in modern malting facilities further improve supply capability. Growing preferences for premium and craft beverages reinforce long-term market stability.

- For instance, Tsingtao Brewery in China reported a total sales volume of approximately 7.538 million kiloliters (75.38 million hectoliters) of beer in 2024, relying substantially on high-grade malted barley and advanced quality control measures to maintain consistent product quality

Expanding Use of Barley in Health-Focused Food Products Enhances Growth

Health-conscious consumers drive wider adoption of barley in food applications. Its high fiber, beta-glucan content, and nutritional value support rising use in breakfast cereals, bakery items, and functional foods. Food manufacturers integrate barley to meet rising demand for clean-label and digestive-health products. It enables product innovation across major retail channels. Strong interest in plant-based and whole-grain diets boosts market expansion.

- For Instance, The Alaska Flour Company, a family-owned commercial flour mill in Delta Junction, produces 100% whole-grain, stone-ground barley cereal. Their products are described as non-GMO, high in both soluble and insoluble fiber, and made from hulless barley.

Steady Growth in Animal Feed Demand Supports Volume Uptake

Feed barley remains a crucial input for livestock production across the region. Poultry, cattle, and swine sectors rely on barley for energy-rich and cost-effective feed formulations. The Asia Pacific Barley Market benefits from rising meat consumption and expanding commercial farming operations. It gains further support from government programs that encourage balanced feed strategies. Stable feed demand ensures consistent baseline market volume.

Advancement in Agronomic Practices and Supply Chain Efficiency Drives Reliability

Improved seed varieties, irrigation methods, and soil management techniques strengthen regional production. Farmers adopt precision agriculture tools that enhance yield reliability and crop resilience. It benefits from modern storage, logistics, and grading systems that maintain grain quality from farm to processor. National research programs promote climate-smart cultivation methods. Strong supply chain efficiency reinforces long-term market competitiveness.

Market Trends:

Growing Shift Toward Premium Malt and Specialty Barley Grades Shapes Product Differentiation

The Asia Pacific Barley Market experiences a noticeable trend toward premium malting varieties driven by rising demand for craft beer, specialty beverages, and high-quality malt extracts. Brewers seek grains with superior enzyme activity, uniformity, and flavor profiles, which encourages producers to enhance quality standards. It supports investment in advanced malting technologies that improve consistency and customization. Specialty barley grades such as hulled, hull-less, and high-beta-glucan variants gain stronger traction in food and nutraceutical segments. Producers adopt contract farming models to secure traceable and reliable supplies. The trend elevates the region’s competitive position by shifting focus from volume-based production to value-driven output. Strong interest in differentiated grain types strengthens innovation pipelines across major markets.

- For Instance, Malteurop inaugurated a new malthouse in Meoqui, Mexico, in October 2023, with an annual production capacity of 120,000 metric tons to serve the growing local beer industry and move toward a 100% local supply chain

Expansion of Sustainable Farming and Climate-Resilient Cultivation Practices Influences Production Patterns

Sustainability becomes a central trend, with growers adopting practices that lower water use, enhance soil health, and reduce environmental risk. The Asia Pacific Barley Market benefits from national programs that promote resource-efficient agriculture, especially in regions affected by variable climate conditions. Farmers integrate drought-tolerant seed varieties that maintain yield reliability during extreme weather. It gains further momentum from investments in digital farming tools that optimize input use and improve crop monitoring accuracy. Renewable energy use and low-carbon logistics gain increasing importance within the supply chain. Food and beverage companies place stronger emphasis on sustainable sourcing, which encourages wider adoption of climate-resilient practices. These shifts reinforce long-term supply stability and support the region’s commitment to environmentally responsible production.

- For instance, Asahi Group Holdings secured multi-year barley contracts with sustainability-certified farms in Australia, sourcing 40,000 metric tons from growers using regenerative agriculture methods in the 2024 harvest.

Market Challenges Analysis:

Climate Variability and Production Instability Limit Supply Reliability

The Asia Pacific Barley Market faces persistent challenges tied to weather uncertainties and shifting climate patterns. Droughts, irregular rainfall, and heat stress disrupt planting cycles and reduce yield consistency. Farmers struggle to maintain grain quality when extreme temperatures affect protein levels and moisture balance. It places pressure on producers to adopt resilient seed varieties and advanced irrigation systems, which raise operational costs. Regional disparities in climate impact create uneven production across major barley-growing countries. Limited access to modern farming infrastructure in developing areas further heightens supply vulnerability. These factors collectively hinder predictable output and market stability.

Price Volatility and Import Dependence Create Competitive Constraints

Significant price fluctuations remain a major challenge for buyers and processors. The Asia Pacific Barley Market depends heavily on imports in several countries, which increases exposure to global market swings. Currency variations and international trade policies influence procurement costs for breweries, feed manufacturers, and food processors. It also becomes difficult for smaller producers to compete with large-scale exporters that supply premium malting grades. Domestic supply gaps reduce bargaining power and limit long-term contract stability. Rising logistic expenses and port congestion add further cost burdens. These issues restrict market fluidity and complicate strategic planning for regional stakeholders.

Market Opportunities:

Rising Demand for Functional Foods and Nutraceutical Ingredients Expands Growth Prospects

The Asia Pacific Barley Market gains strong opportunity through increasing demand for high-fiber and functional food products. Barley’s beta-glucan content aligns well with consumer interest in digestive health, heart wellness, and clean-label nutrition. Food manufacturers explore barley-based ingredients for cereals, bakery items, beverages, and plant-based formulations. It enables product differentiation in premium and health-focused categories. Growing urban incomes and heightened awareness of nutritional benefits strengthen market penetration across retail channels. Regional R&D initiatives that promote innovative barley derivatives such as concentrates and isolates enhance commercial potential. These factors create a high-value pathway for long-term market expansion.

Expansion in Sustainable Agriculture and High-Quality Export Supply Strengthens Regional Competitiveness

Sustainable farming presents a significant opportunity for producers seeking to supply global markets with traceable and eco-friendly barley. The Asia Pacific Barley Market benefits when growers adopt low-carbon cultivation practices and precision agriculture tools that improve yield efficiency. Export-oriented countries such as Australia can further elevate their position through premium malting varieties and climate-resilient crops. It supports new trade partnerships with breweries, food processors, and feed manufacturers worldwide. Government incentives for water-efficient irrigation and soil-enhancement programs create favorable conditions for scale expansion. Growing interest in contract farming and identity-preserved supply systems enhances reliability for international buyers. These developments position the region to strengthen its role in the global barley value chain.

Market Segmentation Analysis:

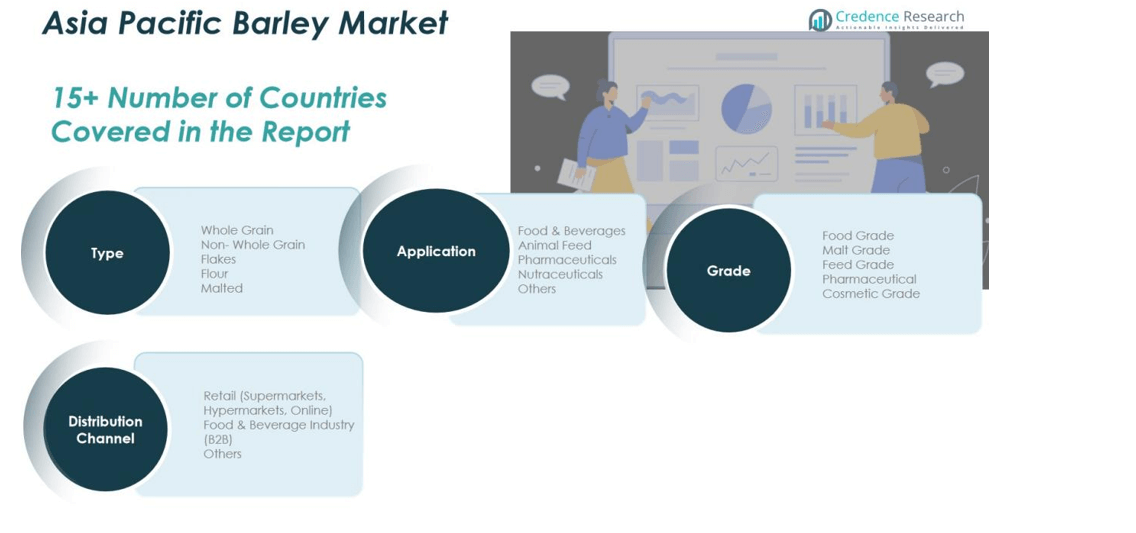

By Type

The Asia Pacific Barley Market reflects strong demand across Whole Grain, Non-Whole Grain, Flakes, Flour, and Malted variants. Malted barley secures a dominant share due to its essential role in brewing and distilling. Whole grain and flour segments gain traction from rising interest in high-fiber and clean-label food products. It benefits from the expanding use of flakes in breakfast cereals and ready-to-eat formulations. Diverse product formats support broad adoption across food, feed, and industrial applications.

- For instance, Asahi Group Holdings’ Asahi Super Dry beer relies on malted barley (along with rice, corn, starch, and hops) and has achieved massive sales volumes since its launch, making it the top-selling beer brand in Japan. In fact, it was the number one best-selling Japanese beer brand globally in 2020, with worldwide sales of over 10 million hectoliters that year, highlighting the significant scale of industrial use in brewing.

By Application

Food & Beverages lead the application landscape, supported by the region’s expanding brewing sector and rising demand for nutritious grain-based foods. Animal Feed forms a substantial share, driven by ongoing growth in poultry, cattle, and swine production. Pharmaceuticals and Nutraceuticals show steady expansion due to increasing use of barley-derived beta-glucan in wellness products. It also finds niche demand in specialty applications under the Others category. These varied uses reinforce the market’s multi-industry relevance.

- For Instance, Kerry Group owns Wellmune®, a natural yeast beta-glucan postbiotic ingredient used in immune support formulations. It has been available globally in food, beverages, and supplements for many years and is supported by over 50 clinical studies demonstrating its efficacy in supporting immune health and overall well-being.

By Grade

Food Grade and Malt Grade dominate due to high consumption in packaged foods, bakery products, and alcoholic beverages. Feed Grade maintains strong volume contributions, supported by the region’s large livestock base. Pharmaceutical and Cosmetic Grades expand at a moderate pace, driven by interest in natural, plant-based ingredients. The Asia Pacific Barley Market benefits from rising investments in quality enhancement and traceability across all grades. Grade-based diversification strengthens supply chain flexibility and market adaptability.

Segmentations:

By Type

- Whole Grain

- Non-Whole Grain

- Flakes

- Flour

- Malted

By Application

- Food & Beverages

- Animal Feed

- Pharmaceuticals

- Nutraceuticals

- Others

By Grade

- Food Grade

- Malt Grade

- Feed Grade

- Pharmaceutical

- Cosmetic Grade

By Distribution Channel

- Retail (Supermarkets, Hypermarkets, Online)

- Food & Beverage Industry (B2B)

- Others

By Country

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Regional Analysis:

Strong Production Presence in Australia Supports Regional Supply Stability

Australia remains the leading producer within the Asia Pacific Barley Market and maintains a strong export position due to advanced agronomic practices and large-scale cultivation. The country supplies premium malting and feed barley to major brewing and livestock industries across the region. It benefits from consistent quality, well-developed logistics, and modern storage systems that preserve grain integrity. Government support for sustainable farming strengthens long-term output reliability. Strong global demand for Australian barley reinforces its role as a strategic supplier in the regional value chain.

Growing Consumption in China and Japan Drives Import Demand

China represents one of the largest consumers, driven by strong demand from breweries, food processors, and feed manufacturers. The Asia Pacific Barley Market gains significant volume momentum through China’s reliance on imports to meet rising domestic consumption. Japan maintains steady demand for malt barley, supported by its well-established beer industry and preference for high-quality grains. It also sustains a stable feed barley market due to the region’s livestock needs. Trade partnerships with major exporters ensure continuous supply flow to these high-consumption economies.

Expanding Market Opportunities in India, South Korea, and Southeast Asia Strengthen Regional Diversity

Emerging markets such as India, South Korea, and Southeast Asia show rising adoption across food, beverage, and feed sectors. India’s expanding brewing industry and growing interest in barley-based foods create new commercial opportunities. The Asia Pacific Barley Market receives additional support from Southeast Asia’s expanding livestock sector, which increases feed-grade demand. South Korea sustains stable malt barley consumption through its strong beer production base. It benefits from heightened awareness of functional foods and growing regional investment in grain-processing capabilities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- GrainCorp Limited

- Boortmalt (Axereal Group)

- Malteurop Groupe S.A.

- Soufflet Group

- Asahi Group Holdings, Ltd.

- Kirin Holdings Company, Limited

- Tsingtao Brewery Group

- San Miguel Corporation

- United Breweries Group

- Rahr Corporation (Asia operations)

- Carlsberg Asia

- Heineken Asia Pacific

- Diageo Asia Pacific

Competitive Analysis:

The Asia Pacific Barley Market features a competitive landscape shaped by major malt producers, leading breweries, and integrated agribusiness companies that influence supply, processing capacity, and product quality. GrainCorp Limited, Boortmalt (Axereal Group), Malteurop Groupe S.A., Soufflet Group, Asahi Group Holdings, Kirin Holdings Company, Tsingtao Brewery Group, and San Miguel Corporation anchor competition through strong regional presence and diversified portfolios. These companies invest in advanced malting technologies, sustainable sourcing programs, and strategic partnerships to secure high-quality barley supplies. It benefits from continuous capacity expansion and contract farming models that ensure consistent grain quality for brewing and food applications. Breweries strengthen their market position by aligning with reliable suppliers and optimizing procurement strategies across regional markets. Competitive differentiation relies on supply chain efficiency, product consistency, and the ability to meet rising demand for premium malt grades.

Recent Developments:

- In March 2025, Soufflet Malt (Soufflet Group) partnered with HEINEKEN Beverages in South Africa, announcing a €100 million investment to construct a new malting facility near Johannesburg, set to be operational by mid-2027.

- In August 2024, Sanders finalized the acquisition of Soufflet Agriculture’s animal nutrition operations, enhancing its animal nutrition presence in France.

Report Coverage:

The research report offers an in-depth analysis based on Type,Application, Grade, Distribution Channel and Country. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Asia Pacific Barley Market is set to strengthen its role in global barley supply through rising emphasis on premium malting varieties.

- Sustained demand from breweries and beverage manufacturers will drive long-term consumption across key economies.

- Food manufacturers will expand the use of barley in health-oriented products, supported by rising interest in fiber-rich and clean-label ingredients.

- Animal feed demand will remain stable, supported by growth in poultry, cattle, and swine production across developing markets.

- Producers will invest in climate-resilient seed varieties to manage increasing weather variability and protect yield stability.

- Advancements in digital farming and precision agriculture will improve production efficiency and grain quality.

- Trade partnerships will expand as regional buyers seek reliable and traceable barley supplies from established exporters.

- Processing industries will adopt modern malting and milling technologies to meet evolving product specifications.

- Government initiatives promoting sustainable agriculture will create supportive conditions for long-term cultivation.

- Rising interest in plant-based nutrition and functional ingredients will open new commercial opportunities for barley derivatives.