Market Overview:

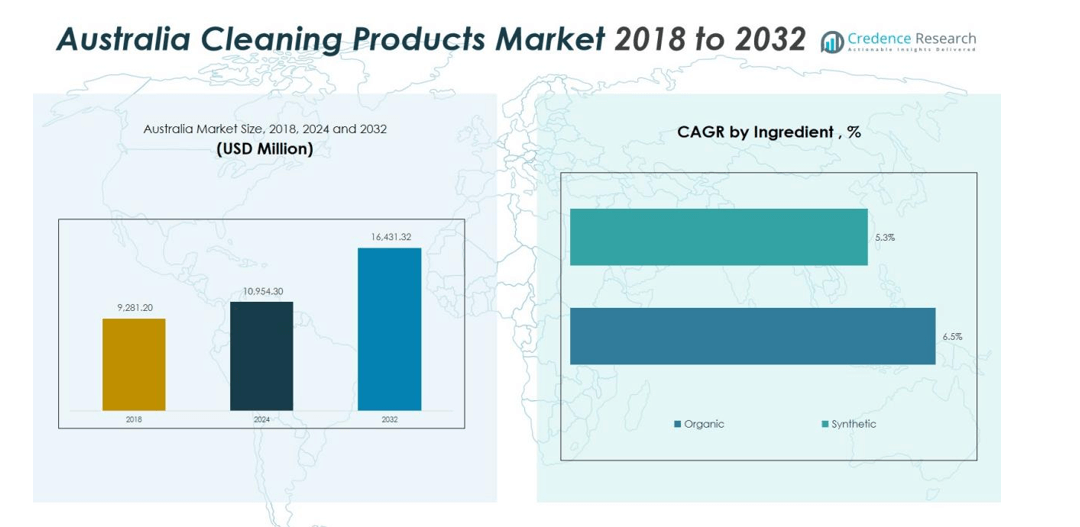

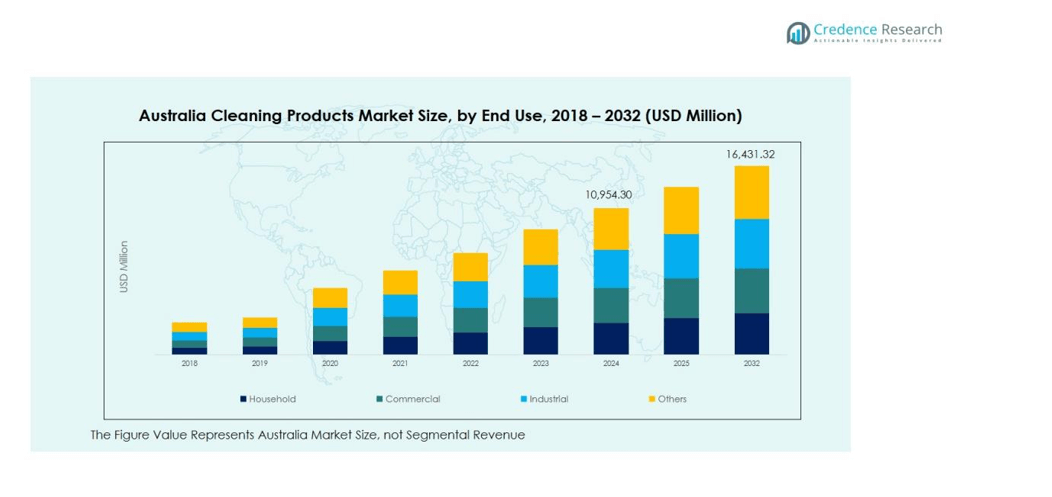

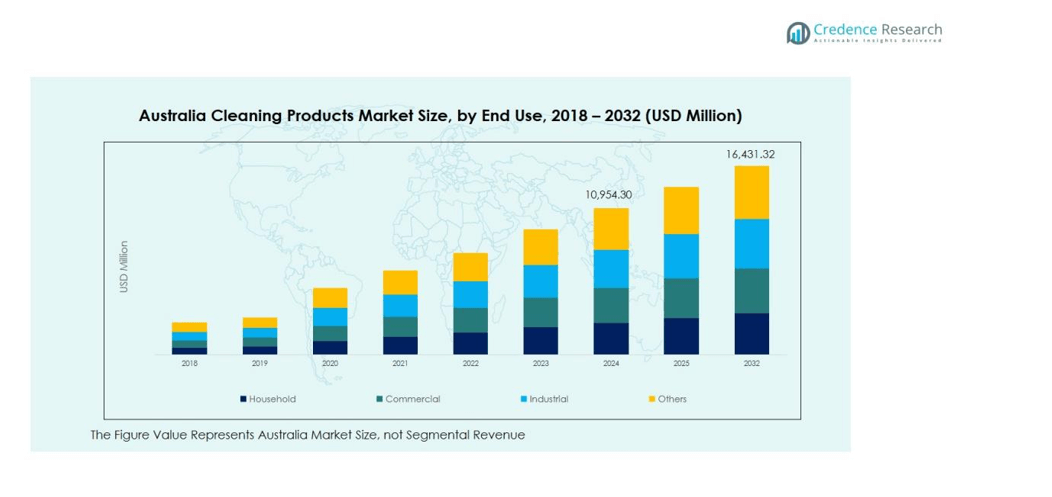

The Australia Cleaning Products Market size was valued at USD 9,281.20 million in 2018 to USD 10,954.30 million in 2024 and is anticipated to reach USD 16,431.32 million by 2032, at a CAGR of 5.20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Cleaning Products Market Size 2024 |

USD 10,954.30 million |

| Australia Cleaning Products Market, CAGR |

5.20% |

| Australia Cleaning Products Market Size 2032 |

USD 16,431.32 million |

Growing focus on health, safety, and sanitation remains a primary driver of demand. Consumers actively seek products that provide antibacterial protection, reduced chemical exposure, and environmental sustainability. Manufacturers enhance product portfolios with biodegradable ingredients, allergen-free compositions, and advanced disinfecting properties to meet evolving expectations. Expansion of e-commerce platforms further accelerates category growth by improving convenience, enabling price transparency, and supporting the rise of niche and premium brands. Institutional demand also strengthens as healthcare, hospitality, and commercial sectors maintain strict hygiene standards.

Regionally, urban centers such as Sydney, Melbourne, and Brisbane lead market consumption due to higher disposable incomes, dense populations, and rapid adoption of innovative cleaning solutions. Regional and semi-urban areas show increasing uptake driven by improving retail distribution, rising awareness campaigns, and broader access to affordable cleaning products. Rural markets exhibit gradual but consistent growth supported by expanding supply chains and enhanced hygiene education initiatives.

Market Insights:

- The Australia Cleaning Products Market reached USD 10,954.30 million in 2024 and is projected to hit USD 16,431.32 million by 2032 at a 20% CAGR, supported by strong hygiene consciousness and expanding institutional demand.

- Sydney, Melbourne, and Brisbane collectively hold the highest regional share at around 58–60%, driven by dense populations, higher spending capacity, and faster adoption of innovative and eco-friendly cleaning solutions.

- Regional and semi-urban locations account for roughly 28–30% share, supported by better retail access, growing awareness campaigns, and increasing preference for branded products.

- The fastest-growing region remains semi-urban belts with an approximate 6–7% growth share, propelled by expanding supermarkets, affordability improvements, and rising adoption of green cleaning alternatives.

- Segment share distribution shows household cleaning accounting for about 48–50% of total demand, while institutional and commercial cleaning products represent roughly 32–34%, supported by healthcare, hospitality, and corporate procurement cycles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Shift Toward Eco-Friendly and Low-Chemical Formulations

Growing environmental sensitivity drives accelerated adoption of biodegradable, plant-based, and low-toxicity products. The market experiences rising interest in green alternatives that minimize residue and improve indoor air quality. It encourages manufacturers to innovate with sustainable ingredients and recyclable packaging. Premium eco-certified brands gain wider acceptance across both households and commercial facilities.

- For instance, Unilever has launched premium Sunlight dishwashing liquid products featuring a patented biosurfactant technology called RhamnoClean.

Expansion of E-Commerce and Digital Retail Channels

Rapid digital transformation reinforces market growth by improving accessibility and product diversity. Online platforms offer consumers greater visibility into pricing, specifications, and reviews, which supports informed purchasing decisions. It enables smaller and niche brands to compete with established players. Subscription models and doorstep delivery options further strengthen recurring purchase cycles.

- For instance, Amazon’s Subscribe & Save program continues to be a significant driver of customer retention, a core part of its approximately $44.38 billion in subscription services revenue in 2024.

Growing Institutional and Commercial Demand

Healthcare facilities, hospitality establishments, and corporate environments uphold stringent cleanliness protocols that boost large-volume consumption. The market benefits from rising investments in professional-grade cleaning solutions with superior disinfection and durability features. It expands through new product lines tailored for high-traffic and high-risk environments. Consistent procurement cycles from institutional buyers stabilize long-term market demand.

Market Trends:

Premiumization and Product Differentiation Accelerate Market Evolution

The Australia Cleaning Products Market observes a clear trend toward premium formulations that offer superior performance and added functional benefits. Consumers choose specialized products that target specific surfaces, allergens, or disinfection needs while seeking convenience and efficiency. It encourages brands to introduce concentrated liquids, multi-action sprays, and advanced antibacterial solutions that promise faster results. Demand for fragrance-free, hypoallergenic, and dermatologically tested products rises due to growing sensitivity toward chemicals. Smart packaging innovations, including refill systems and dosing controls, gain wider acceptance among sustainability-focused households. E-commerce visibility amplifies this trend by enabling customers to compare advanced products and evaluate premium claims with greater confidence.

- For instance, Reckitt’s Dettol offers a ‘Power & Pure Advance’ range of cleaning sprays in markets including the UK and Australia, which boast a claim of eliminating 99.9% of bacteria

Sustainability Integration and Digital Influence Shape Consumer Choices

Market participants prioritize eco-friendly materials, biodegradable ingredients, and low-carbon manufacturing processes to align with evolving environmental expectations. It strengthens the appeal of plant-based cleaners, refill pouches, and recyclable containers that support reduced waste generation. Brands highlight transparency through ingredient disclosure and sustainability certifications to build trust among informed buyers. Digital channels influence purchase patterns through targeted ads, product education, and influencer-driven recommendations. Subscription models gain traction due to predictable consumption patterns and convenience-driven purchasing behavior. Retailers expand online assortments to support niche, green, and innovative cleaning brands, reinforcing the shift toward conscious consumption.

- For instance, Puracy introduced 64-ounce refill pouches that have saved over 200 tons of plastic since 2016, using 90% less plastic, water, and energy compared to traditional bottles.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Constraints

The Australia Cleaning Products Market faces persistent pressure from fluctuating raw material prices, which directly affects production costs and profit margins. It must manage volatility in chemicals, packaging materials, and logistics expenses that disrupt planning and pricing strategies. Global supply chain delays create uncertainty for manufacturers that rely on imported inputs. Competition among brands intensifies margin pressure, particularly within mass-market categories where price sensitivity remains high. Efforts to balance affordability and quality become more complex in a cost-driven environment. Retailers reinforce this challenge through competitive pricing structures that limit flexibility for manufacturers.

Regulatory Compliance and Sustainability Expectations Intensify Operational Burden

Evolving regulations related to chemical safety, environmental standards, and labeling requirements increase operational complexity for market participants. It demands continuous investment in reformulation and compliance audits to meet stringent guidelines. Rising expectations for sustainable packaging and reduced environmental impact challenge companies that operate with legacy systems or cost-driven models. Consumer scrutiny around ingredient transparency places pressure on brands to disclose detailed information. Shifts toward eco-friendly alternatives require advanced technology and higher capital allocation. These combined factors create barriers for smaller companies that lack resources to adapt quickly.

Market Opportunities:

Expansion of Eco-Friendly and Specialty Product Portfolios

The Australia Cleaning Products Market presents strong opportunities in the development of green, biodegradable, and low-toxicity formulations that align with rising sustainability expectations. It benefits from growing consumer willingness to adopt plant-based cleaners, refill systems, and recyclable packaging solutions. Brands that introduce specialty products for sensitive skin, pet care, or allergen reduction can tap into emerging niche segments. Retailers support this opportunity by allocating more shelf space to eco-certified and premium alternatives. Government focus on environmental responsibility strengthens demand for compliant and low-impact cleaning products. Innovation in concentrated formulations and water-efficient products also opens new growth avenues.

Digital Engagement and Institutional Partnerships Strengthen Market Reach

Opportunities grow through deeper integration with e-commerce channels that enable diversified product placement, targeted personalization, and subscription-driven recurring sales. It gains traction through digital education efforts that highlight product efficacy, sustainability, and safety attributes. Brands that collaborate with healthcare, hospitality, and commercial sectors can scale adoption through bulk and long-term supply agreements. Smart dispensing systems and professional-grade solutions create new revenue streams within institutional cleaning programs. Regional expansion into semi-urban and rural communities offers potential through affordable SKUs and improved distribution. These opportunities support sustained market growth across multiple value segments.

Market Segmentation Analysis:

By Product Type

The Australia Cleaning Products Market shows strong diversity across product categories, driven by distinct household and commercial hygiene needs. Surface cleaners hold a dominant share due to frequent usage across residential and workplace environments. Toilet cleaners and floor cleaners maintain steady demand supported by rising sanitation awareness. It benefits from growing adoption of specialized solutions such as glass and metal cleaners, fabric care products, and high-performance dishwashing formulations. Niche segments, including personal care and building cleaners, gain traction as consumers and institutions seek targeted cleaning outcomes.

- For instance, Ecolab launched its Apex dishwashing system in 2007 (with the Apex2 system following in 2012), which can help conserve up to 27,500 litres of water annually per commercial kitchen in foodservice and hospitality locations.

By Ingredient

Ingredient preferences continue to shift toward safer and more sustainable formulations. Synthetic ingredients retain a substantial share due to their effectiveness, affordability, and wide applicability across cleaning categories. The market experiences rising momentum in organic ingredients, supported by increasing consumer interest in plant-based, low-toxicity, and biodegradable products. It creates opportunities for brands that invest in transparent labeling and environmentally responsible compositions. Demand accelerates across both household and commercial sectors, where reduced chemical exposure remains a priority.

- For instance, Croda developed Incromine BD, a biodegradable conditioning agent that achieved 88% biodegradation according to OECD 301B guidelines, offering plant-derived content of 73% as measured by ISO 16128, while maintaining performance equivalent to traditional synthetic quaternary ammonium compounds in conditioning applications.

By End-use

End-use segmentation reflects broad consumption across household, commercial, industrial, and other application areas. The Australia Cleaning Products Market benefits from strong household demand driven by routine cleaning habits and heightened hygiene expectations. Commercial establishments, including hospitality, healthcare, and retail, contribute significantly through large-volume procurement. Industrial users adopt specialized cleaning and maintenance solutions that address heavy-duty requirements. It experiences steady expansion within emerging segments where safety and operational efficiency influence product selection.

Segmentations:

By Product Type

- Surface cleaners

- Toilet cleaners

- Glass & metal cleaners

- Floor cleaners

- Fabric cleaners

- Dishwashing products

- Others (personal care cleaners, building cleaners, etc.)

By Ingredient

By End-use

- Household

- Commercial

- Industrial

- Others

By Price Range

Regional Analysis:

Strong Demand Concentration Across Major Metropolitan Regions

The Australia Cleaning Products Market records its highest consumption in metropolitan hubs such as Sydney, Melbourne, and Brisbane. These cities maintain strong hygiene expectations influenced by dense populations, higher disposable incomes, and rapid lifestyle shifts. It benefits from the widespread adoption of premium, specialty, and eco-conscious cleaning solutions within urban households. Modern retail networks, including supermarkets, hypermarkets, and online channels, further strengthen product accessibility. Commercial sectors in these regions, particularly hospitality and healthcare, reinforce consistent large-volume purchases. Regional policies supporting cleanliness and public health also enhance category penetration.

Steady Expansion in Regional and Semi-Urban Markets

Regional towns and semi-urban areas show sustained growth driven by rising awareness of hygiene and improved retail distribution. Consumers in these regions increasingly adopt branded cleaning products as affordability improves and product availability widens. It gains traction through government hygiene campaigns that influence purchasing behavior and encourage safe sanitation practices. Expanding supermarkets and convenience stores boost the visibility of both mass-market and eco-friendly products. Growth accelerates in emerging commercial zones where small businesses and service facilities prioritize reliable cleaning solutions. Manufacturers strengthen engagement through regional promotions and tailored pack sizes.

Gradual Uptake Across Rural Communities Supported by Distribution Improvements

Rural markets continue to progress at a moderate pace, influenced by expanding supply chains and increased consumer exposure to branded cleaning solutions. The Australia Cleaning Products Market reaches deeper into remote areas through partnerships with wholesalers, local retailers, and digital platforms. It benefits from educational initiatives that highlight product safety, hygiene value, and proper cleaning practices. Affordability remains a key factor that shapes product selection and drives preference for economy and medium-priced categories. Rural households adopt essential cleaners at a steady rate as incomes rise and retail penetration improves. This segment offers long-term potential for companies that invest in localized strategies and cost-effective offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Australia Cleaning Products Market features a competitive landscape driven by global multinationals and strong regional brands that focus on innovation, distribution strength, and brand equity. Key players include Hindustan Unilever Limited (HUL), Procter & Gamble (Australia) Private Limited (P&G Australia), Reckitt Benckiser, Colgate-Palmolive Company, and Henkel AG & Co. KGaA. These companies maintain leadership through diversified product portfolios, strong retail partnerships, and continuous investments in marketing and product performance. It gains momentum from rapid innovation in antibacterial solutions, eco-friendly formulations, and specialized cleaning categories that address evolving consumer expectations. Competitive rivalry intensifies as brands enhance visibility across supermarkets, e-commerce platforms, and convenience stores. Sustainability, ingredient transparency, and packaging efficiency shape differentiation strategies, pushing companies to adopt greener technologies and advanced formulations. Market leaders strengthen their positions through new product launches, regional expansion efforts, and customer-targeted innovation.

Recent Developments:

- In November 2025, Hindustan Unilever Limited (HUL) confirmed that it expects to complete the demerger of its ice cream business by December 2025, with a separate listing planned for Q4 FY2025, subject to regulatory approvals.

- In February 2025, HUL signed a Partnership Growth Charter with trustea, committing to sustainable sourcing through the year 2028.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Ingredient, End-use and Price Range. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Australia Cleaning Products Market will advance through rising demand for eco-friendly and low-toxicity formulations that align with evolving consumer preferences.

- It will experience stronger traction for refill packs and concentrated formats as sustainability expectations intensify.

- Smart packaging and dosing technologies will gain wider adoption across both household and commercial applications.

- Digital retail channels will strengthen category growth through personalized recommendations and subscription-based purchasing.

- Premium and specialized cleaners for allergy control, pet care, and targeted surfaces will expand their presence.

- Institutional demand will rise as healthcare, hospitality, and corporate sectors reinforce strict hygiene protocols.

- Brands will invest more in ingredient transparency and clean-label formulations to build consumer trust.

- Automation and advanced manufacturing processes will enhance product consistency and production efficiency.

- Rural and semi-urban markets will contribute more significantly as distribution networks expand and affordability improves.

- Strategic collaborations, regional innovation centers, and localized product development will support long-term competitiveness.