Market Overview

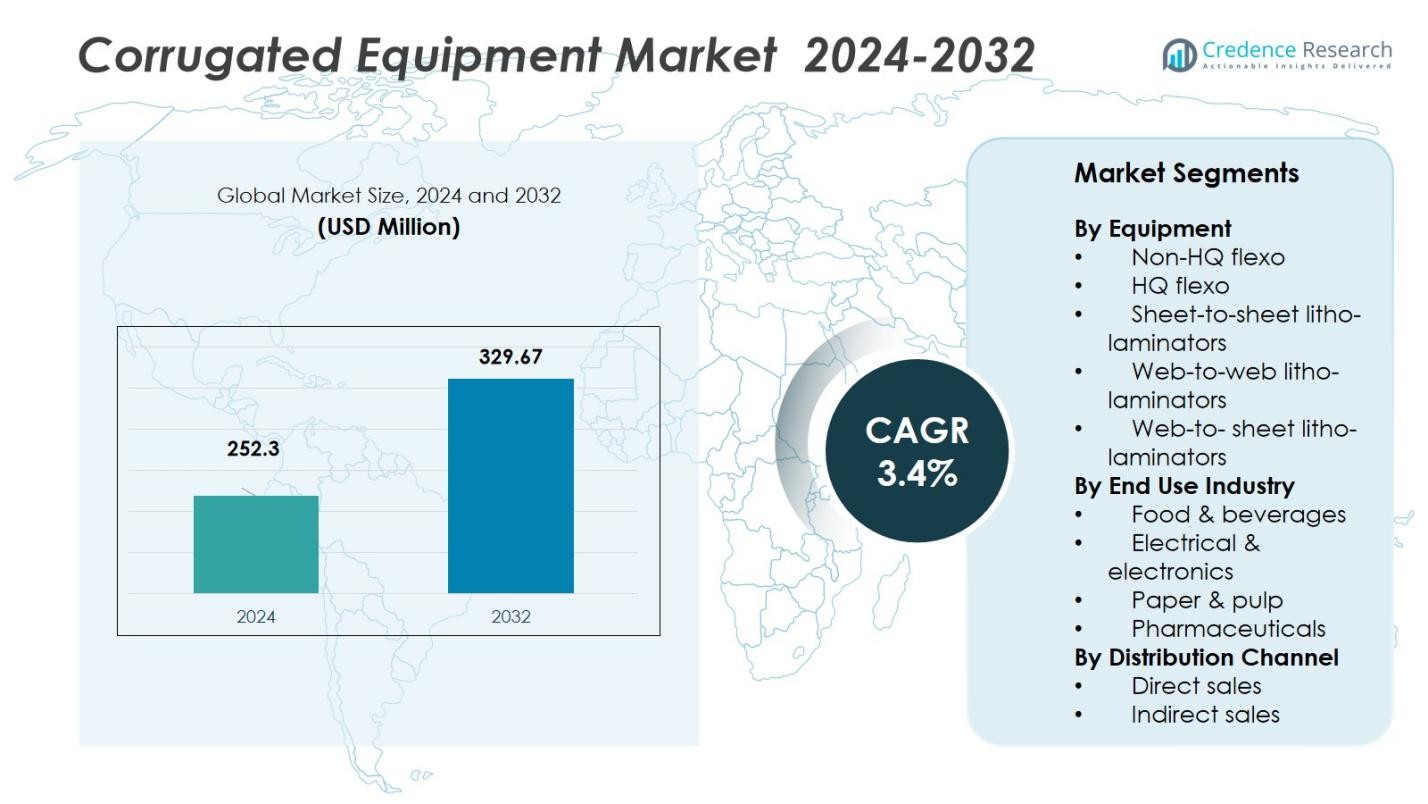

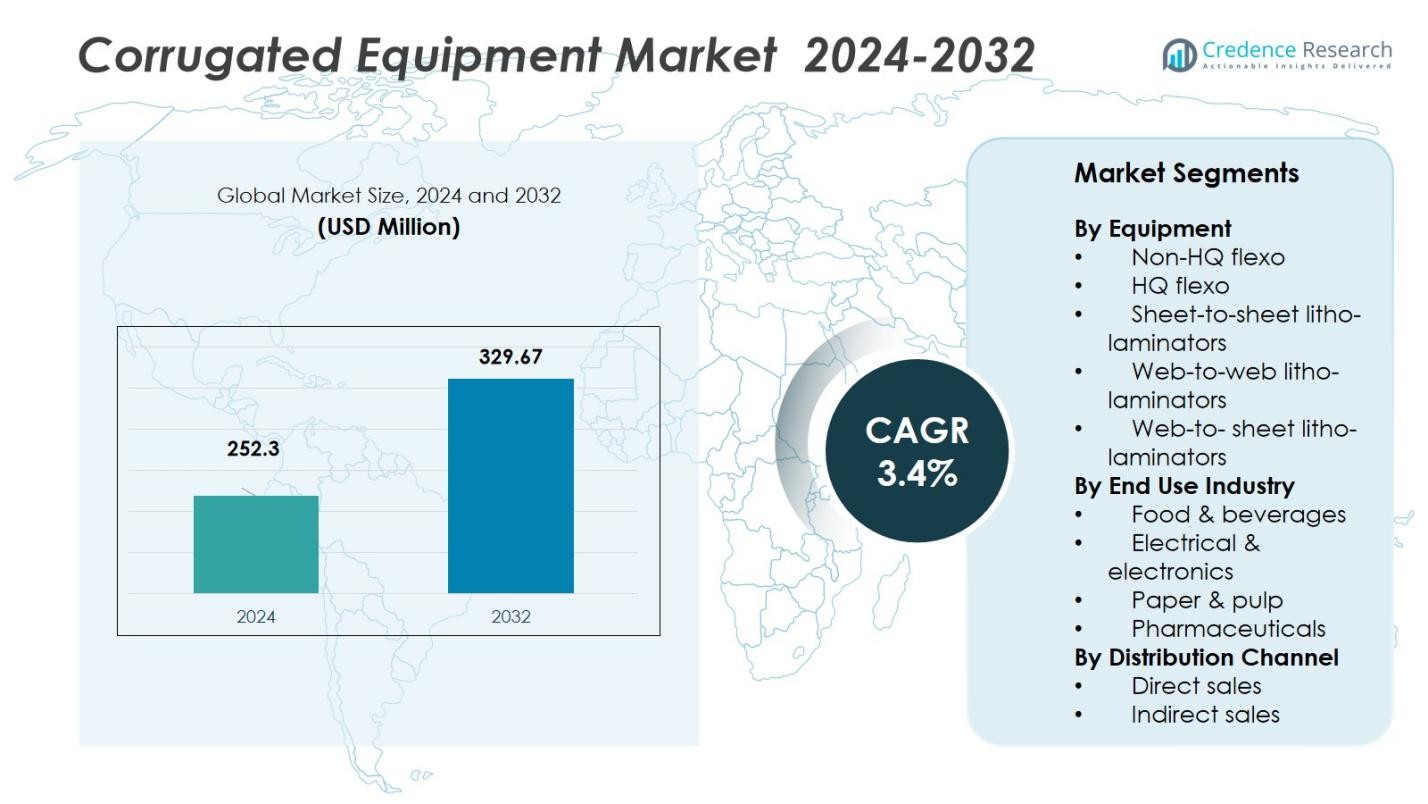

The Corrugated Equipment Market size was valued at USD 252.3 Million in 2024 and is anticipated to reach USD 329.67 Million by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Corrugated Equipment Market Size 2024 |

USD 252.3 Million |

| Corrugated Equipment Market, CAGR |

3.4% |

| Corrugated Equipment Market Size 2032 |

USD 329.67 Million |

The Corrugated Equipment Market is dominated by key players such as Automatan, Barry-Wehmiller, BHS Corrugated, Bobst Group, Edale UK, EMBA, Heidelberger Druckmaschinen, Lamina System, Manroland, and Mark Andy. These companies lead the market by offering innovative, high-performance equipment and establishing strong customer relationships across various industries. The Asia Pacific region commands the largest market share at 39.8%, driven by rapid industrialization, the growing demand for corrugated packaging in e-commerce, and the expansion of manufacturing sectors in China and India. North America follows with a market share of 22%, supported by high demand for sustainable packaging solutions and technological advancements in corrugated production. Europe holds a 19.3% market share, with strong industrial bases and increased automation in packaging systems. The competitive landscape reflects a trend toward automation, smart technologies, and energy-efficient solutions, enabling players to capture value from emerging markets while maintaining leadership in established regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market size for Corrugated Equipment Market stood at USD 252.3 Million in 2024 and is projected to grow at a CAGR of 3.4 % through the forecast period.

- Rising demand for sustainable packaging solutions is driving investment in corrugated machinery, as companies shift from plastics toward recyclable fibre‑based packaging.

- The growing e‑commerce sector is pushing demand for corrugated equipment that supports high‑volume, protective box production, supporting growth especially in the food & beverages segment which holds about 35 % share.

- The Non‑HQ flexo equipment segment dominates with about 40 % share of the equipment type market, due to its cost‑effectiveness and suitability for large‑scale corrugated box production.

- Among regions, Asia Pacific leads with around 39.8 % share, followed by North America at 22 % and Europe at 19.3 %, reflecting faster industrial growth and packaging demand in emerging markets.

Market Segmentation Analysis:

By Equipment

The Corrugated Equipment Market is segmented by equipment type, with Non-HQ Flexo dominating the market due to its cost-effectiveness and efficiency in high-volume printing. Non-HQ Flexo is widely used in large-scale corrugated box production, accounting for the largest market share of 40%. This segment is driven by the increasing demand for packaging in industries like food & beverages and e-commerce. The demand for higher printing quality and operational efficiency continues to support the growth of the non-HQ Flexo segment, ensuring its dominance over other types like HQ Flexo and litho-laminators.

- For instance, corrugated equipment manufacturers like Nagpal Industries produce 1400MM high-speed corrugated box plants with advanced pneumatic controls, variable speeds of 35-40 m/min with steam heating capabilities, and thin blade technology achieving precise cuts and smooth creases for professional-quality boxes across multiple ply configurations.

By End-Use Industry

The Food & Beverages sector holds the largest share in the Corrugated Equipment Market, with a significant market share of 35%. This segment is driven by the growing global demand for food packaging solutions, particularly in e-commerce and retail. Corrugated packaging provides excellent durability and protection for perishable items, making it highly preferred. As consumer trends favor sustainable and eco-friendly packaging, the demand for corrugated boxes in the food & beverages sector is expected to remain strong, further solidifying its position as the dominant end-use industry.

- For instance, Mondi Group’s BCoolBox solution demonstrates verified performance for online grocery delivery, utilizing corrugated panels with thermo-insulation technology to maintain fresh food below 7°C for 24 hours without requiring refrigerated trucks, achieving this with entirely recycled materials.

By Distribution Channel

In the distribution channel segment, Direct Sales holds a dominant position, accounting for 60% of the market share. The preference for direct sales is primarily driven by the need for customized solutions, closer customer relationships, and better post-sales support. Manufacturers often engage directly with end-users to offer tailored corrugated equipment solutions, especially for large-scale operations. This channel’s growth is further supported by the increasing demand for automation and advanced technologies in corrugated packaging, driving businesses to work directly with suppliers for optimal performance.

Key Growth Drivers

Rising Demand for Sustainable Packaging Solutions

The increasing global focus on sustainability is a major growth driver for the Corrugated Equipment Market. Consumers and businesses are prioritizing eco-friendly packaging, especially in sectors like food and beverages, which account for a significant share of corrugated packaging demand. Corrugated boxes, known for their recyclability and biodegradability, are replacing plastic and other non-sustainable packaging materials. As governments and consumers alike push for reduced environmental impact, the demand for corrugated packaging is expected to surge, propelling growth in the market for corrugated equipment.

- For instance, Stora Enso provides tailored corrugated packaging solutions that help customers reduce CO2 emissions and replace plastics with renewable fiber-based options, supporting corporate sustainability goals.

- commerce and Retail Sector Expansion

The rapid growth of the e-commerce sector has significantly contributed to the expansion of the Corrugated Equipment Market. As online shopping continues to increase, the need for durable and protective packaging to ship products safely is paramount. Corrugated packaging is ideal for protecting a wide variety of products during transportation. The surge in online retail sales, along with the increased reliance on home delivery services, is driving demand for corrugated boxes, further enhancing the market for packaging equipment used to produce them.

- For instance, Alibaba integrates advanced automation technologies in packaging systems, including automatic bag filling and sealing machines, which ensure consistent packaging quality with higher throughput, catering to the growing e-commerce logistics demands efficiently.

Technological Advancements in Corrugated Equipment

Technological innovation in corrugated equipment is accelerating market growth. The adoption of automation, smart features, and high-efficiency printing technologies, such as HQ flexo and advanced litho-laminators, has significantly improved operational efficiency. These innovations allow manufacturers to meet the growing demand for high-quality, custom packaging with faster production times and lower operational costs. As companies continue to integrate advanced technologies into their corrugated equipment, the market is expected to see sustained growth, driven by increased efficiency and the ability to meet diverse customer needs.

Key Trends & Opportunities

Shift Toward Smart Packaging

A growing trend in the corrugated equipment market is the rise of smart packaging solutions. This trend includes the integration of sensors and digital technology into packaging to monitor product conditions, such as temperature and humidity, during transportation. These innovations provide valuable data for businesses, ensuring that products are delivered in optimal condition. The increasing need for smart packaging in industries like pharmaceuticals and electronics presents significant growth opportunities for corrugated equipment manufacturers, driving demand for high-tech solutions.

- For instance, packaging sensor technology from firms like Masitek, which uses smart sensors to measure impact, pressure, and other forces during shipping. This data allows manufacturers to optimize packaging design for maximum protection with minimal material, reducing waste and improving sustainability.

Customization and Personalization of Packaging

Customization in corrugated packaging is gaining popularity as businesses look to differentiate their products and enhance brand identity. Companies are increasingly seeking unique packaging solutions that reflect their brand image while offering functional benefits. The demand for tailored packaging designs, such as personalized prints and sizes, is expanding rapidly in industries like food & beverages, textiles, and consumer goods. This growing interest in customized packaging presents a significant opportunity for the corrugated equipment market, as manufacturers invest in equipment that can produce highly specific, custom-printed packaging solutions.

- For instance, Packlane provides a digital-first platform allowing businesses to design and order custom packaging with full CMYK color printing and on-demand fulfillment, supporting brand imagery with visually vibrant, tailored corrugated boxes.

Key Challenges

Rising Raw Material Costs

One of the key challenges facing the Corrugated Equipment Market is the fluctuation in the cost of raw materials, particularly paper and cardboard. As raw material prices rise, the overall production cost for corrugated packaging also increases, which can negatively impact profitability for manufacturers. This challenge is especially concerning for smaller companies that may struggle to absorb the rising costs. While the shift to sustainable materials could help reduce long-term environmental costs, short-term price volatility remains a significant hurdle for industry players.

High Initial Investment in Equipment

The high capital investment required for advanced corrugated equipment is a significant challenge in the market. Many businesses, especially smaller enterprises, may find it difficult to afford the upfront costs of purchasing high-end machinery, such as HQ flexo and litho-laminators. Although these machines offer long-term efficiency gains, the initial financial burden can be a barrier to entry for some companies. As a result, manufacturers must weigh the cost of investment against the potential for long-term gains, which could limit the adoption of advanced equipment in certain segments.

Regional Analysis

North America

The North America region held a market share of 22 % in 2024 and exhibits robust growth potential driven by rising e‑commerce volumes and packaging innovation. The region’s demand is boosted by the adoption of automated corrugated equipment, increasing reshoring of manufacturing operations, and stringent sustainability regulations favoring fibre‑based solutions. Strong uptake in the US for high‑throughput corrugated lines underscores this trend. Nevertheless, the market also faces pressure from raw‑material cost fluctuations and mature infrastructure, requiring manufacturers to emphasize productivity and cost‑efficiency to maintain competitiveness.

Europe

Europe accounted for 19.3 % of the global corrugated equipment market in 2023 and remains a significant region for advanced packaging solutions. Growth in the region is underpinned by well‑established industrial bases, increased automation in packaging lines, and strong end‑use demand in sectors such as home & personal care and pharmaceuticals. European manufacturers are placing emphasis on energy‑efficient machinery and high‑print‑quality systems, aligning with sustainability imperatives and premium packaging trends. The region’s comparatively slow overall growth underscores the need for technology differentiation to capture further value.

Asia Pacific

Asia Pacific emerged as the largest regional market with a share of 39.8 % in 2024, driven by rapid industrialisation, booming e‑commerce, and infrastructure expansion. Countries such as China and India are significant adopters of corrugated equipment, particularly automated and high‑speed flexo systems, supporting the region’s dominance. The growth is stimulated by rising demand in food & beverage, home & personal care, and consumer electronics segments. Manufacturers targeting this region must focus on scalability, localisation of service and parts, and cost‑effective automation to capitalise on the strong growth momentum.

Latin America & Middle East & Africa (MEA)

While specific figures are less commonly reported, together Latin America and MEA represent the remaining 19 % of the global market. These regions are characterised by emerging demand for corrugated equipment, driven by infrastructure growth, increasing FMCG and e‑commerce activity, and regulatory shifts toward sustainable packaging. Market opportunities exist particularly for entry‑level automated systems and retrofits of existing lines. However, challenges such as weaker industrial base, volatile economic conditions, and inconsistent supply‑chain infrastructure may temper accelerated growth and require tailored strategies for equipment suppliers.

Market Segmentations:

By Equipment

- Non-HQ flexo

- HQ flexo

- Sheet-to-sheet litho-laminators

- Web-to-web litho-laminators

- Web-to- sheet litho-laminators

By End Use Industry

- Food & beverages

- Electrical & electronics

- Paper & pulp

- Pharmaceuticals

By Distribution Channel

- Direct sales

- Indirect sales

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global corrugated equipment market features leading participants such as Automatan, Barry‑Wehmiller, BHS Corrugated, Bobst Group, Edale UK, EMBA, Heidelberger Druckmaschinen, Lamina System, Manroland and Mark Andy. These firms compete primarily on technological innovation, global service networks, and end‑user responsiveness. The market is moderately consolidated, with the top players capturing a sizeable share due to their scale, R&D capabilities, and established distribution channels. Strategic initiatives such as digital automation, smart manufacturing integration and energy‑efficient equipment are now standard competitive levers. Mid‑sized and niche suppliers largely differentiate through modular, cost‑effective solutions tailored to smaller manufacturers or regional markets. Partnerships, acquisitions and regional expansion drive further competitive intensity, as players aim to capitalize on rising demand for high‑quality, efficient corrugated equipment.

Key Player Analysis

- Mark Andy

- BHS Corrugated

- Lamina System

- Bobst Group

- Manroland

- Edale UK

- Heidelberger Druckmaschinen

- Automatan

- Barry-Wehmiller

- EMBA

Recent Developments

- In July 2025, UniPack Corrugated acquired Congzhou Machinery to enter the Indian corrugated board‑equipment market.

- In February 2025, SUN Automation Group announced a strategic partnership with Kolbus Group, making SUN the exclusive U.S. and Canada agent and distributor for Kolbus corrugated machinery, parts and service.

- In October 2023, BHS Corrugated entered a strategic partnership with Highcon Systems Ltd. to accelerate digitisation of corrugated packaging equipment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Equipment, End Use Industry, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing steadily as manufacturers invest in automated, high‑throughput machinery to meet rising packaging demands.

- Sustainable and recycled‑fibre‑based corrugated solutions will drive equipment upgrades, prompting suppliers to develop energy‑efficient and low‑waste systems.

- The surge of e‑commerce and direct‑to‑consumer logistics will increase demand for corrugated packaging equipment tailored for volume, flexibility and fast turnaround.

- Customised and short‑run packaging solutions will become standard, pushing converters to adopt smaller footprint, flexible equipment models.

- Digital integration such as IoT monitoring, predictive‑maintenance and real‑time quality inspection will become core capabilities in new corrugated‑equipment offerings.

- Emerging markets, especially in Asia‑Pacific and Latin America, will represent major growth zones as industrialisation and packaging infrastructure expand.

- Suppliers will increasingly offer modular and scalable machine platforms, enabling converters to upgrade gradually and manage capital investment more effectively.

- Retrofitting and upgrading existing production lines will become a significant opportunity, as older equipment is replaced or enhanced to meet newer standards.

- Equipment financing models, rental‑or‑lease schemes and service‑based contracts will gain traction, lowering entry barriers for small and mid‑sized converters.

- Supply‑chain resilience and geopolitical shifts will influence equipment localisation strategies, prompting manufacturers to establish regional service hubs and local production of key components.