Market overview

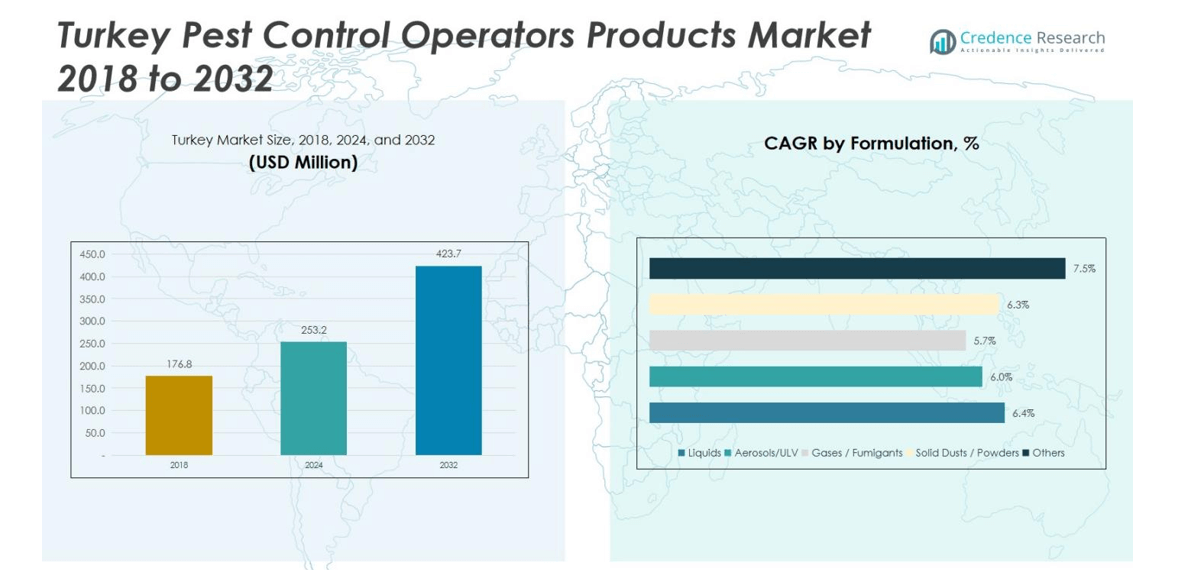

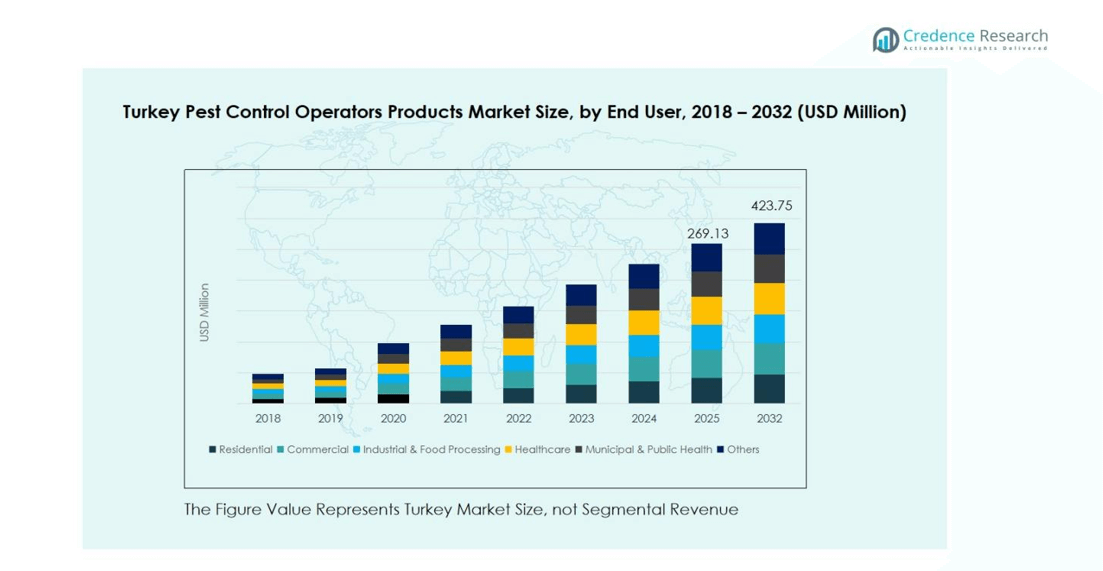

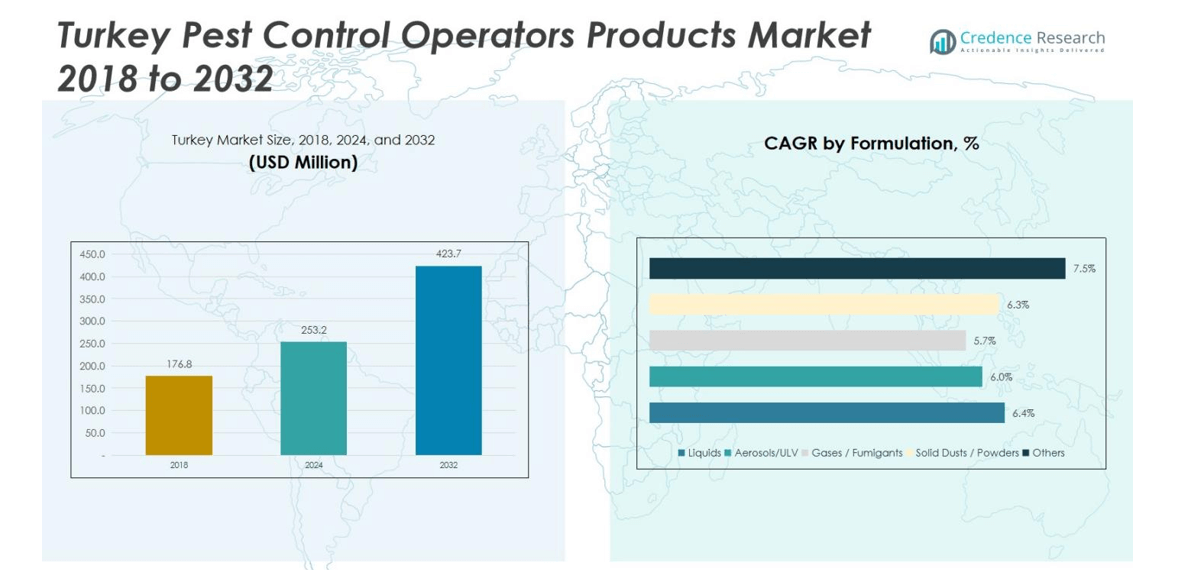

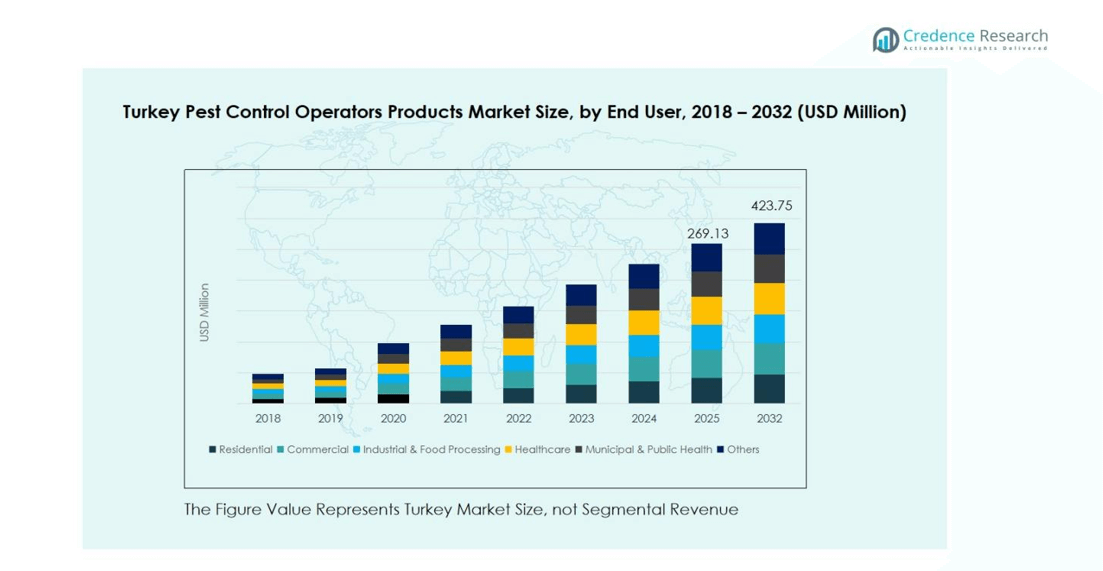

Turkey Pest Control Operators Products Market size was valued at USD 176.8 Million in 2018, increased to USD 253.2 Million in 2024, and is anticipated to reach USD 423.7 Million by 2032, at a CAGR of 6.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Turkey Pest Control Operators Products MarketSize 2024 |

USD 253.2 Million |

| Turkey Pest Control Operators Products Market, CAGR |

6.70% |

| Turkey Pest Control Operators Products Market Size 2032 |

USD 423.7 Million |

The Turkey Pest Control Operators Products Market features key players such as Rentokil Turkiye, Kluh Turkiye and Fital Fumigasyon ve İlaçlama, all advancing product portfolios and service models to capture rising demand. Rentokil Turkiye leverages global expertise in digital pest‑control platforms and high‑end commercial contracts, while Kluh Turkiye and Fital focus on regional networks and cost‑efficient service delivery in residential and small commercial segments. The West & North‑West region leads in performance, accounting for a 28.0% market share, driven by dense urbanisation, industrial clusters and tourism infrastructure. Together, these firms and their regional focus shape the market’s growth trajectory through innovation, service diversification and regional penetration.

Market Insights

- The Turkey Pest Control Operators Products Market was valued at USD 253.2 Million in 2024 and is projected to reach USD 423.7 Million by 2032, growing at a CAGR of 6.70% during the forecast period.

- Rising urbanisation and climate change are driving demand for pest control products across residential, commercial, and industrial sectors, with increased focus on health and hygiene following the pandemic.

- The adoption of Integrated Pest Management (IPM) and technological advancements such as smart monitoring systems present key growth opportunities.

- Regulatory constraints on pesticide use and growing resistance to chemical treatments are significant market challenges, prompting innovation in eco-friendly solutions.

- The West & North-West region holds the largest market share at 28.0%, followed by Mediterranean & South region with 23.2% share, driven by high pest activity in coastal and agricultural zones. Insecticides dominate the market with a 37.4% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

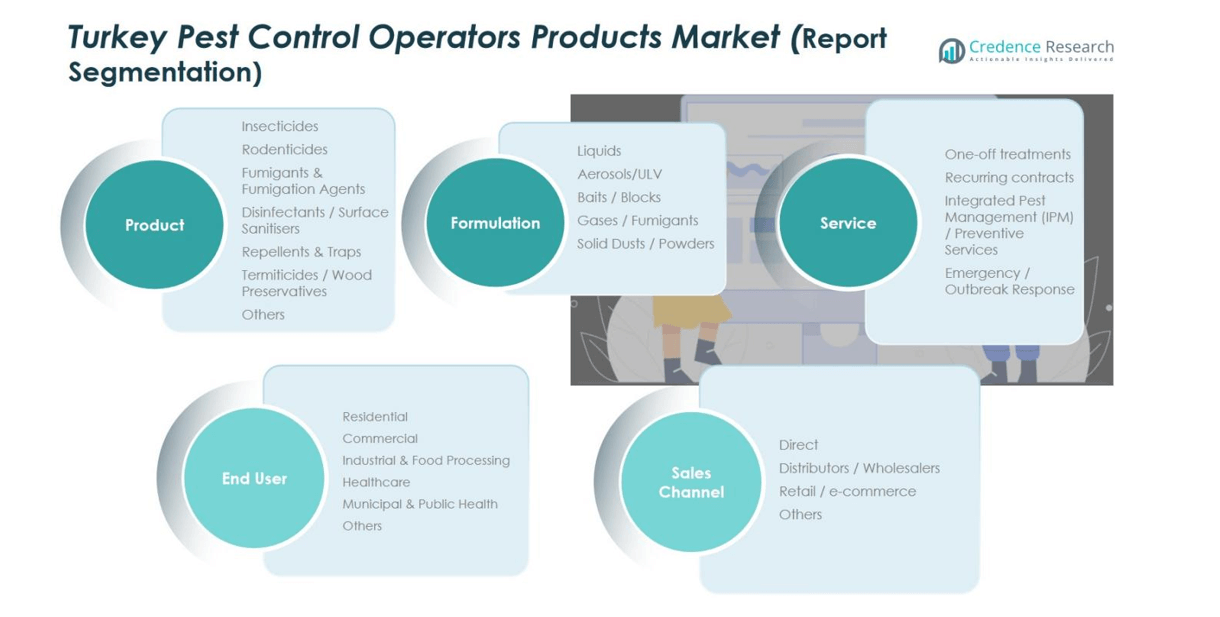

Market Segmentation Analysis:

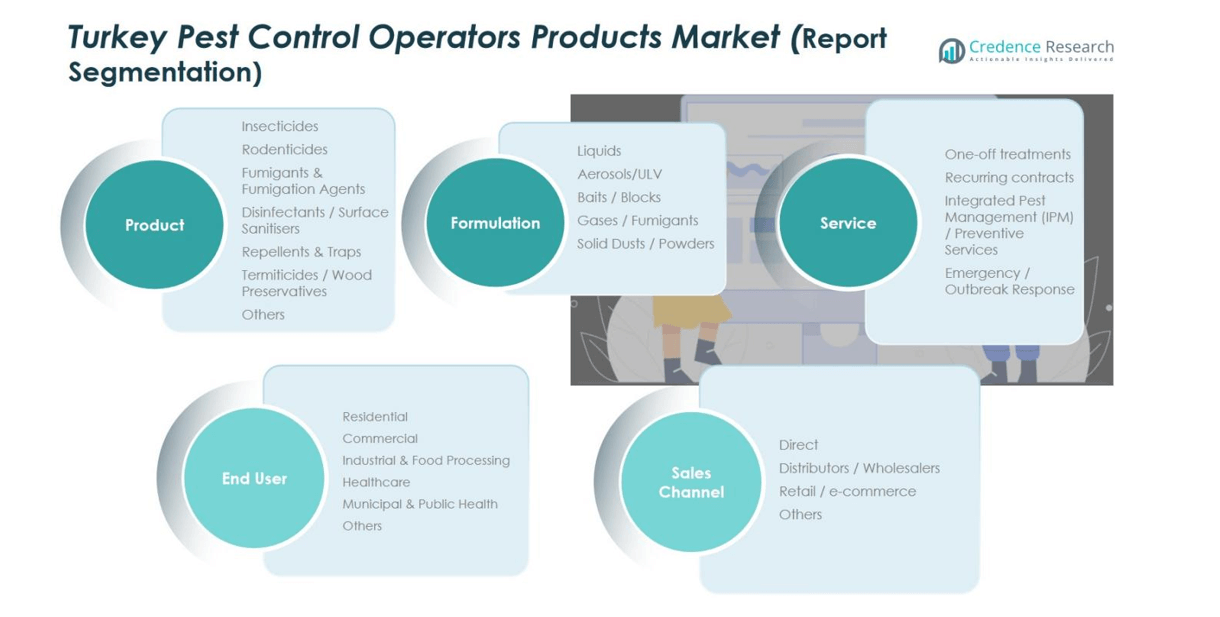

By Product

The Turkey Pest Control Operators Products Market is led by insecticides, holding 37.4% share, driven by high prevalence of cockroaches, mosquitoes, flies, and stored-product insects in residential, commercial, and food-processing environments. Demand intensifies due to rapid urbanization, warm climatic conditions, and rising vector-borne disease risks. Rodenticides account for a growing portion of demand in industrial zones, while disinfectants and surface sanitisers contribute significantly following heightened sanitation awareness. Fumigants, traps, repellents, and wood preservatives also support market expansion as operators diversify treatment portfolios to address complex infestation patterns across regions.

- For instance, DOGAL AS. formulates and distributes over 200 registered pesticides and plant growth regulators, servicing Turkish agriculture and horticulture sectors and providing certified products for large-scale fumigation and disinfection projects.

By Formulation

Liquid formulations dominate the market with 44.1% share, driven by their ease of application, strong residual effectiveness, and broad suitability across insecticides, disinfectants, and termiticides. Liquids are widely preferred by professional operators for precision spraying and compatibility with modern application equipment. Aerosols and ULV formulations follow due to their essential role in rapid knockdown treatments for flying insects in hotels, restaurants, and warehouses. Baits and blocks maintain strong penetration in rodent control programs, while gases and solid dust powders remain critical for fumigation, grain storage protection, and difficult-to-access infestation sites.

- For instance, Godrej Consumer Products integrates Renofluthrin, a patented molecule, into its liquid vaporiser lineup, which doubles the effectiveness compared to previous solutions and provides six to eight years of exclusive product innovation for residential mosquito control.

By Service

Recurring contracts lead the service segment with 52.6% share, supported by long-term demand from commercial establishments, food processors, industrial facilities, and residential apartment complexes that require continuous pest monitoring and prevention. Operators increasingly bundle integrated reporting, compliance documentation, and periodic inspection services within these contracts. One-off treatments remain relevant for seasonal infestations, while IPM services gain traction due to rising regulatory focus on chemical reduction and preventive methods. Emergency and outbreak response services also see growing demand, particularly in cases of sudden rodent surges, termite outbreaks, or food-storage pest incidents.

Key Growth Drivers

Rising Urbanization and Population Growth

Urbanization is a significant driver in the Turkey Pest Control Operators Products Market. As cities expand and the population increases, there is a greater need for pest control solutions in residential, commercial, and public spaces. High-density living environments, such as apartments, often face higher risks of pest infestations, necessitating regular pest management services. The growing population in urban areas results in more food consumption, waste, and ideal breeding grounds for pests, pushing the demand for effective pest control solutions across various sectors.

- For instance, Profgrup Pest Eliminasyon Sistem ve Teknolojileri Ltd. Şti. provides integrated pest management solutions, including fumigation and disinfection, addressing pest risks in high-density residential and commercial areas with advanced reporting systems.

Climate Change and Favorable Conditions for Pests

Climate change is another crucial driver impacting the market. Warmer temperatures and shifting weather patterns have extended the breeding seasons for pests, especially mosquitoes, rodents, and cockroaches. This has led to more frequent infestations in urban and rural areas alike. The longer pest breeding seasons create an increased need for pest control products and services year-round. Furthermore, climate-related changes have facilitated the movement of pests to new areas, increasing the demand for advanced pest control strategies to combat emerging threats.

- For instance, companies like Rovensa Next have developed biosolutions such as Phylgreen biostimulants that help plants resist climate-induced pest stress and diseases, highlighting the innovation driven by these new pest challenges.

Increased Focus on Health and Hygiene

The growing awareness of hygiene and health, especially after the COVID-19 pandemic, has significantly influenced the Turkey Pest Control Operators Products Market. Consumers and businesses alike are more focused on maintaining cleanliness and preventing the spread of disease-carrying pests such as rodents, cockroaches, and mosquitoes. This has increased the demand for disinfectants, surface sanitisers, and other pest control products that help reduce the risks of infections and contaminants. Additionally, the rise in public health consciousness has led to stricter regulations, further fueling the market’s growth.

Key Trends & Opportunities

Adoption of Integrated Pest Management (IPM)

One of the key trends in the market is the growing adoption of Integrated Pest Management (IPM). IPM focuses on using environmentally friendly and sustainable methods to control pests while minimizing the use of chemical treatments. As consumers and businesses become more eco-conscious, IPM has gained popularity as it reduces chemical exposure and integrates multiple pest control strategies such as biological controls, physical barriers, and cultural practices. This trend provides significant growth opportunities for pest control operators offering comprehensive, eco-friendly services that align with sustainability goals.

- For instance, an Israeli company effectively controls Mediterranean fruit flies using sterile insect technology that neutralizes males released into the environment, reducing pesticide reliance.

Technological Advancements in Pest Control Products

Advancements in pest control technology, including the development of smart monitoring systems and AI-powered diagnostics, present notable opportunities for market growth. Smart sensors and IoT-connected devices allow pest control operators to monitor infestations in real time, predict pest behavior, and optimize treatment plans. These technological innovations are improving the efficiency and effectiveness of pest control measures. Moreover, the integration of automated systems and drone-based spraying solutions for large-scale applications in agriculture and industrial settings offers new avenues for pest control services, enhancing market prospects.

- For instance, Rentokil Initial uses its PestConnect system with IoT-based infrared sensors to monitor facilities 24/7, issuing real-time alerts that enable rapid pest control responses in sensitive environments.

Key Challenges

Regulatory and Environmental Constraints

One of the key challenges in the Turkey Pest Control Operators Products Market is navigating the stringent regulatory and environmental standards. As the demand for sustainable pest control increases, operators must comply with regulations that limit the use of certain chemical pesticides and ensure the safety of treatments. These regulations require significant investment in research and development to create safer, more eco-friendly alternatives. Failure to meet these requirements can lead to legal complications, higher operational costs, and reduced market access for pest control products and services.

Rising Resistance to Pesticides

Another significant challenge faced by the market is the growing resistance of pests to chemical pesticides. Over time, pests have developed immunity to commonly used pesticides, making pest control efforts less effective. This resistance requires constant innovation and the development of new, more powerful formulations. Pest control operators must also adopt integrated approaches and diversify their pest management strategies to overcome this issue. The need for continuous research to find solutions to pesticide resistance presents both a challenge and an opportunity for the market, demanding higher investment in technology and product development.

Regional Analysis

West & North‑West Region

The West & North‑West region commands 28.0% market share in Turkey’s pest control operators products market. This region includes the Marmara and Aegean zones, where dense urbanisation, industrial clusters and tourism infrastructure drive high demand for both preventive and reactive pest control services. The significant presence of commercial real‑estate, food‑processing units and multi‑unit residential complexes underpins elevated usage of insecticides, baits and recurring service contracts. Operators expand network coverage and deploy localised formulations and IPM (Integrated Pest Management) strategies to serve this large share while adapting to stringent hygiene regulations in this economically dynamic region.

Central Anatolia Region

The Central Anatolia region holds 18.5% market share, fuelled by its mixed industrial and agricultural base and expanding suburban growth. Key cities in this region have growing commercial and healthcare infrastructure, which raises the demand for surface sanitisers, termite‑control solutions and recurring service agreements. The region’s relatively stable climate and increasing public‑health awareness support adoption of IPM services and preventive contracts by pest‑control operators. Operator firms leverage the central location’s logistics advantages and regional distribution hubs to supply liquids and solid dust formulations efficiently, catering to both urban and peri‑urban end‑users.

Mediterranean & South Region

In the Mediterranean & South region, operators account for 23.2% market share, driven by warm coastal climate, tourism facilities and strong agricultural activities. The high incidence of mosquitoes, rodents and wood‑boring pests in resort properties and food‑processing plants creates robust demand for fumigants, liquids and ULV/aerosol treatments. Pest‑control firms capitalise on seasonal variations and integrated contracts combining one‑off treatments during peak seasons with recurring preventive services year‑round. The tourism‑driven hygiene expectations and food‑safety regulations further propel uptake of disinfectants and surface sanitisers across hospitality and municipal segments.

East & Southeast Anatolia Region

The East & Southeast Anatolia region captures 16.3% market share, reflecting its mix of agricultural landscapes, emerging urban centres and public‑health‐driven initiatives. In this region, the rapid spread of pests into new areas due to climate variation elevates demand for rodenticides, baits/blocks and gas/solid dust fumigation solutions. Operators increasingly offer emergency/outbreak response services to cater to sudden infestation events alongside recurring preventive contracts for municipal and public‑health clients. Logistics and infrastructure challenges persist, but tailored regional strategies and mobile service units help firms secure this regional share and growth potential.

Black Sea & Northern Region

The Black Sea & Northern region accounts for 14.0% market share, reflecting its forested coastal belt, moderate urban density and expanding food‐processing clusters. The region’s high humidity and wood‑based industries heighten demand for termiticides, wood preservatives and fumigation agents. Pest‑control operators focus on integrated service models combining one‑off treatments for wood pests and recurring protocols for residential properties and public‑sector buildings. The logistic advantage of coastal transit and growing awareness of pest risks in food logistics and timber storage support market penetration of specialised formulations and service contracts in this region.

Market Segmentations:

By Product

- Insecticides

- Rodenticides

- Fumigants & Fumigation Agents

- Disinfectants / Surface Sanitisers

- Repellents & Traps

- Termiticides / Wood Preservatives

- Others

By Formulation

- Liquids

- Aerosols / ULV

- Baits / Blocks

- Gases / Fumigants

- Solid Dusts / Powders

By Service

- One-off Treatments

- Recurring Contracts

- Integrated Pest Management (IPM) / Preventive Services

- Emergency / Outbreak Response

By End User

- Residential

- Commercial

- Industrial & Food Processing

- Healthcare

- Municipal & Public Health

- Others

By Sales Channel

- Direct

- Distributors / Wholesalers

- Retail / e-commerce

- Others

By Geography

- West & North‑West Region

- Central Anatolia Region

- Mediterranean & South Region

- East & Southeast Anatolia Region

- Black Sea & Northern Region

Competitive Landscape

In the Turkey Pest Control Operators Products Market, prominent players such as Rentokil Turkiye, Kluh Turkiye and Fital Fumigasyon ve İlaçlama are establishing strong footprints through diversified offerings across insecticides, rodenticides and fumigants, backed by service portfolios that integrate recurring contracts and IPM‑based preventive solutions. Rentokil Turkiye leverages global R&D and digital pest‑control platforms to differentiate its service delivery and appeal to high‑end commercial and industrial customers. Meanwhile, local operators such as Kluh Turkiye and Fital are capitalising on regional networks and cost‑efficient service models to capture residential and small‑commercial segments. The competitive dynamic is characterised by consolidation trends, a shift toward eco‑friendly formulations and expanded service contracts, ramping up margin pressures for smaller players while enabling larger players to scale selectively into underserved regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Rentokil Turkiye

- Kluh Turkiye

- Fital Fumigasyon ve İlaçlama

- FUMITEC & Fumigation

- Antalya Saglam İlaçlama

- Kassar Group

- Matsan Group

- DOGAL AS

- BASF

- Other Key Players

Recent Developments

- In January 2024, Biobest Group NV acquired the remaining 40 % share of Biobest Antalya from Antilsan, thereby taking full ownership of the Turkish business.

- In May 2024, the Turkish Food Safety and Control Authority issued Notification No. 568 proposing new plant‑quarantine regulations for imports/exports in Turkey.

Report Coverage

The research report offers an in-depth analysis based on Product, Formulation, Service, End User, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growth in urban‐megaregions will drive increased demand for integrated pest control services across residential and commercial segments.

- Expansion of food‐processing and cold‐chain logistics facilities will raise the requirement for specialised termiticides, fumigants and rodenticides.

- Regulatory emphasis on lower toxicity and sustainable solutions will accelerate adoption of bio‐pesticides and IPM protocols.

- Rising climate variability and warmer seasons will extend pest activity periods and boost year‑round service needs.

- Digital monitoring platforms and IoT‑enabled sensors will gain traction among operators for proactive pest management.

- Online retail channels will increasingly support rapid delivery of do‑it‑yourself pest‑control kits, complementing operator services.

- Consolidation among mid‑sized operators will increase as larger national players seek geographic expansion and service bundling.

- Demand for recurring maintenance contracts over one‑off treatments will strengthen as businesses prioritise continuity and compliance.

- Emergence of smart sensors, drone‑spraying and AI‑driven analytics will transform service models and driving value‑added offerings.

- Municipal and public‑health programmes will invest more in preventive pest‑control partnerships, especially in underserved regions.