Market overview

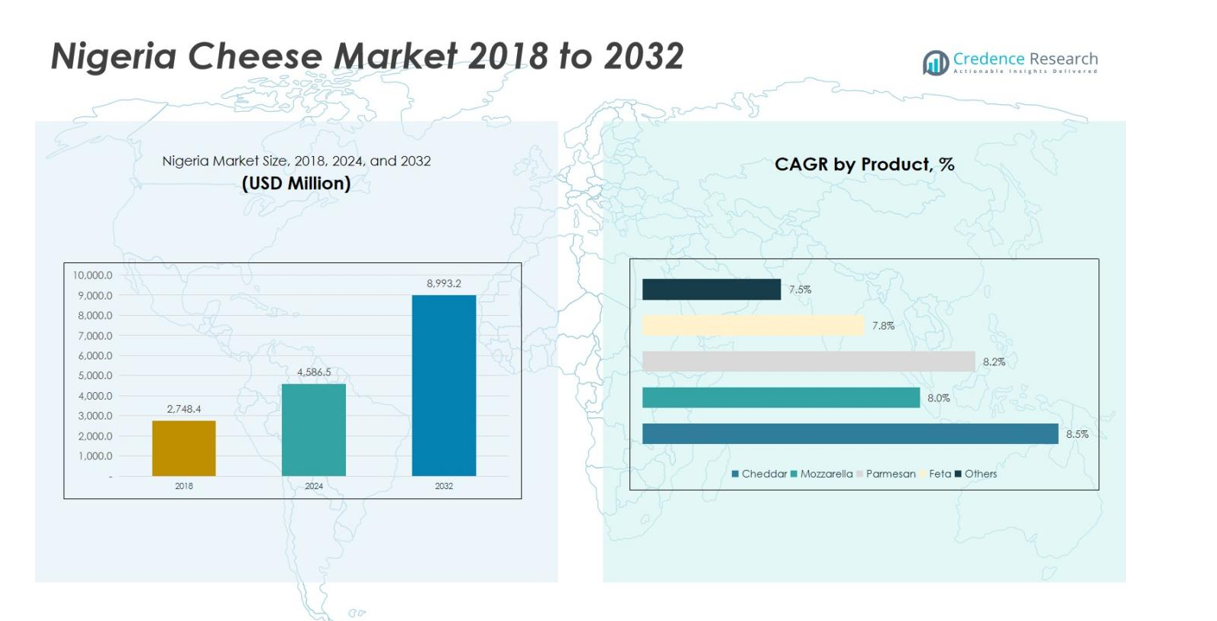

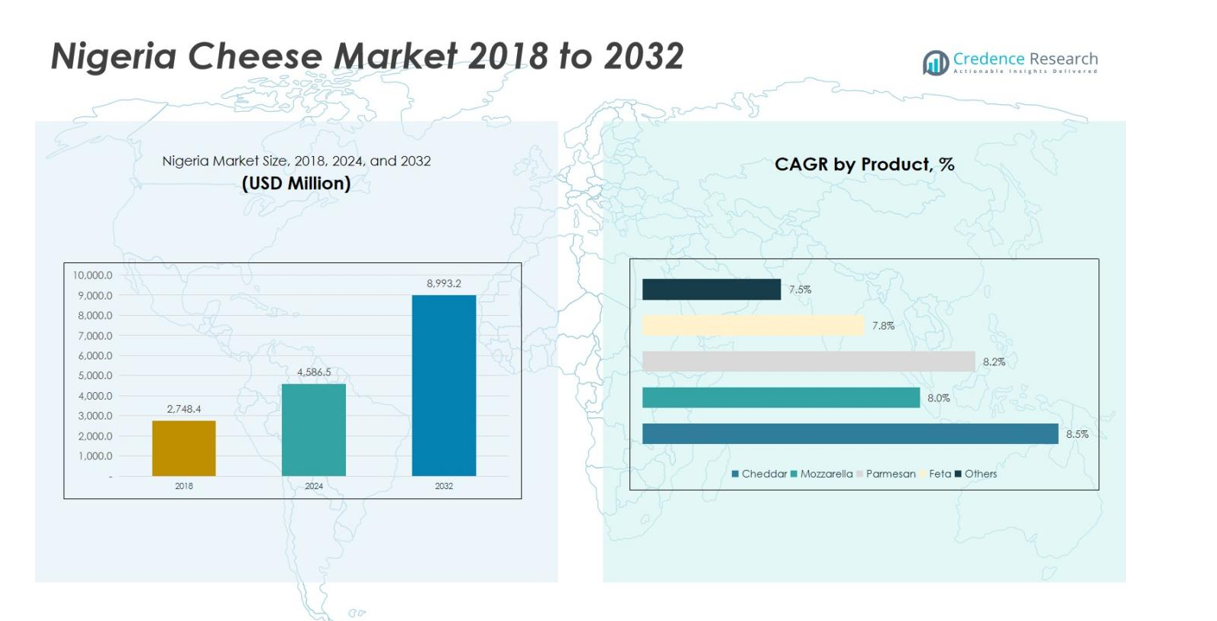

The Nigeria Cheese Market size was valued at USD 2,748.4 million in 2018, growing to USD 4,586.5 million in 2024, and is anticipated to reach USD 8,993.2 million by 2032, at a CAGR of 8.81% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nigeria Cheese Market Size 2024 |

USD 4,586.5 million |

| Nigeria Cheese Market, CAGR |

8.81% |

| Nigeria Cheese Market Size 2032 |

USD 8,993.2 million |

The Nigeria Cheese Market is served by prominent players such as Landor Group and FrieslandCampina WAMCO Nigeria plc, which jointly lead the market through strong brand presence and wide distribution. Landor Group has leveraged local production and premium positioning, while FrieslandCampina WAMCO Nigeria plc benefits from an extensive manufacturing and supply‑chain network across Nigeria. Regionally, the Lagos region commands the largest share of 37.8% of the market, underpinned by its dense urban population and high‑income consumers, followed by the South‑Western region with 29.2% and the South‑Eastern region with 16.5%.

Market Insights

- The Nigeria Cheese Market size reached USD 4,586.5 million in 2024 and is projected to grow at a CAGR of 8.81%.

- Urbanization and rising middle‑class incomes propel demand for processed cheese, with the Processed Cheese segment holding a 50.2% share in 2024 and the Cheddar product segment capturing 42.5%.

- Consumers increasingly favour gourmet and artisanal varieties and switch to online purchasing, with the South‑Western region taking a 29.2% share while Lagos leads with 37.8%.

- Key players such as Landor Group and FrieslandCampina WAMCO Nigeria plc are expanding local production and distribution networks and enhancing product portfolios to gain market share.

- High import costs and weak dairy infrastructure pose significant restraints, particularly as goat and sheep milk sources hold just 11.3% and 5.4% shares respectively while cow milk dominates at 68.1%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product:

In the Nigeria Cheese Market, the Cheddar cheese segment dominates with the largest market share, accounting for 42.5% in 2024. This dominance is driven by the high consumption of Cheddar in both household and commercial sectors due to its versatility in various dishes such as sandwiches, burgers, and snacks. The Mozzarella segment follows closely with a share of 29.3%, driven by the growing demand in pizza and pasta dishes. Parmesan and Feta account for 14.8% and 10.7% of the market, respectively, with increasing usage in gourmet and Mediterranean cuisines.

- For instance, Saputo, a major cheese producer, plans to introduce a new spicy mozzarella cheese variety in 2025 targeting pizza and foodservice sectors.

By Category:

The Processed Cheese segment holds the largest share of the Nigerian cheese market, contributing 50.2% of total revenue in 2024. This is primarily due to the rising demand for convenient and ready-to-use products in both domestic and commercial applications. Spreadable Cheese follows with a 25.8% share, benefiting from its increasing use in spreads and dips for quick meal preparations. Flavoured Cheese holds a 16.4% market share, driven by consumer interest in new flavors. Others contribute the remaining 7.6%, with niche cheese products gaining gradual traction.

- For instance, Savencia Fromage & Dairy, which innovates with reduced-fat and lactose-free varieties to meet health-conscious consumer preferences.

By Source:

The Cow Milk segment leads the Nigerian cheese market, holding a dominant share of 68.1% in 2024. This is due to the widespread availability and affordability of cow milk, making it the preferred choice for cheese production. Buffalo Milk follows with a share of 15.2%, primarily used in specialized cheeses like mozzarella. Goat Milk and Sheep Milk hold 11.3% and 5.4% of the market, respectively, with increasing interest in their nutritional benefits and use in artisanal and premium cheese products. Others represent 0.5% of the market.

Key Growth Drivers

Rising Demand for Processed and Convenience Foods

The growing demand for processed and convenience foods in Nigeria is a major driver of the cheese market. With a rapidly urbanizing population, busy lifestyles, and changing dietary habits, consumers are increasingly seeking easy-to-prepare food options. Processed cheeses, such as slices and spreads, offer convenience and versatility, making them highly popular in both household and food service sectors. This shift towards convenience foods is expected to fuel the continued growth of the Nigerian cheese market in the coming years.

- For instance, Alifood offers processed cheese slices and spreadable creamy cheeses made from 100% Italian milk, designed for use in sandwiches, pasta, and snacks, emphasizing convenience and versatility in cooking.

Expanding Middle-Class and Urbanization

The expansion of the middle class in Nigeria is contributing to increased consumption of dairy products, including cheese. As disposable incomes rise, consumers are willing to spend more on premium food products, including cheese varieties like Cheddar, Mozzarella, and Parmesan. Furthermore, rapid urbanization is leading to an increase in demand for ready-to-eat and fast food, where cheese plays a central role. This demographic shift supports the growth of both domestic and imported cheese products, boosting the market further.

- For instance, Nigeria aims to double its milk production from 700,000 metric tonnes in 2024 to 1.4 million metric tonnes by 2030, reflecting a rising domestic demand for dairy products that likely includes cheese varieties like Cheddar and Mozzarella.

Increasing Awareness of Nutritional Benefits

Rising awareness of the nutritional benefits of cheese is another key growth driver in the Nigerian cheese market. Cheese is considered a rich source of protein, calcium, and essential vitamins, making it an attractive option for health-conscious consumers. The promotion of cheese as a healthy snack or meal ingredient, particularly in urban areas, is gaining traction. This shift in consumer preferences toward healthier food options is expected to drive demand for various cheese types, contributing to the overall market expansion.

Key Trends & Opportunities

Growing Popularity of Gourmet and Artisanal Cheeses

There is a noticeable trend towards the growing popularity of gourmet and artisanal cheeses in Nigeria. Consumers, especially the urban middle class, are becoming more adventurous in their food choices and are increasingly looking for unique and high-quality cheese varieties. This trend is being driven by the rise of food culture and an appreciation for international cuisines, particularly Mediterranean and European. As a result, artisanal cheese producers have an opportunity to tap into a niche but expanding market segment, offering specialized products with unique flavors.

- For instance, Delis Supermarket in Victoria Island now reports heightened demand for imported goat cheese and brie, driven by the city’s growing fine dining and hospitality scene.

Growth of Online Retail and E-commerce

The rise of e-commerce and online retail channels presents a significant opportunity for the Nigerian cheese market. With the increase in internet penetration and smartphone usage, more consumers are turning to online platforms to purchase groceries, including dairy products like cheese. E-commerce offers the advantage of providing a wider range of cheese options, including imported and specialty cheeses, which may not be available in traditional retail outlets. This trend presents opportunities for brands to expand their reach and cater to the growing demand for online grocery shopping.

- For instance, Jumia, a leading Nigerian e-commerce platform, offers a variety of imported and artisanal cheeses, enabling wider consumer access beyond traditional stores.

Key Challenges

High Cost of Imported Cheese

A major challenge facing the Nigerian cheese market is the high cost of imported cheese, which limits its accessibility to a wider consumer base. Due to the reliance on imports, factors such as currency fluctuations, high import duties, and transportation costs significantly affect the price of cheese. This makes premium cheese varieties, especially imported ones, less affordable for the average consumer. As a result, domestic cheese production must be ramped up to reduce dependency on imports and help make cheese more affordable for the broader population.

Limited Dairy Farming Infrastructure

Another key challenge in the Nigerian cheese market is the underdeveloped dairy farming infrastructure. Although Nigeria has vast agricultural potential, the dairy sector faces challenges related to poor farming practices, lack of modern processing facilities, and limited access to quality feed and veterinary care. These infrastructure gaps hinder the supply of quality milk for cheese production, thereby limiting the growth of the local cheese industry. Improving dairy farming infrastructure is essential to boost milk production, improve cheese quality, and reduce dependence on imports.

Regional Analysis

Lagos Region

The Lagos region leads the Nigeria cheese market, commanding a substantial market share of 37.8% in 2024. As the commercial and financial hub of the country, Lagos benefits from a large, diverse population with a high disposable income. The growing demand for processed and gourmet cheeses is driven by a rising middle class, urbanization, and a vibrant foodservice industry. Lagos also has well-developed retail and distribution networks, making it the primary consumer base for premium and imported cheese varieties. The region’s strong demand for convenient, ready-to-eat food options further propels the market growth.

South-Western Nigeria

South-Western Nigeria holds a significant share of 29.2% in the cheese market in 2024. This region is characterized by a high urbanization rate and a growing middle class with an increasing appetite for dairy products, including cheese. The demand for processed and flavored cheeses is particularly strong in metropolitan cities such as Ibadan and Akure. Additionally, South-Western Nigeria’s proximity to Lagos supports distribution and availability, making it a key market for both local and imported cheese brands. With the rise in the foodservice sector, the region continues to experience steady growth in cheese consumption.

South-Eastern Nigeria

The South-Eastern region of Nigeria accounts for 16.5% of the overall cheese market in 2024. The region’s growing population, coupled with rising consumer awareness of the nutritional benefits of cheese, drives demand. The market is fueled by both retail and foodservice channels, with a noticeable preference for processed and spreadable cheeses. Key urban centers such as Enugu, Aba, and Owerri show a growing trend toward incorporating cheese into daily diets. Despite the region’s relatively smaller market share, it remains an important area for both local producers and importers targeting emerging middle-class consumers.

Northern Nigeria

Northern Nigeria represents 12.1% of the total cheese market in 2024. While traditionally less inclined toward dairy consumption compared to the southern regions, cheese is gaining traction due to changing dietary habits and increased urbanization. The region’s larger rural population poses challenges for market penetration; however, the growing influence of urban centers such as Kano, Kaduna, and Abuja is driving demand for processed and flavored cheeses. The northern market is expected to expand gradually, particularly in metropolitan areas, as dairy awareness increases and more convenient cheese options are introduced.

South Nigeria

The South-South region holds 4.4% of the cheese market share in Nigeria in 2024. While the region has a smaller market compared to others, it shows promising growth potential due to a rise in the urban population and increasing interest in dairy-based products. The demand for cheese in the South-South region is primarily driven by urban centers like Port Harcourt and Uyo, where consumers are becoming more familiar with international food trends. Although the market is still developing, it presents an opportunity for niche cheese products as consumer preferences evolve toward more diverse food options.

Market Segmentations:

By Product

- Cheddar

- Mozzarella

- Parmesan

- Feta

- Others

By Category

- Processed Cheese

- Spreadable Cheese

- Flavoured Cheese

- Others

By Source

- Cow Milk

- Buffalo Milk

- Goat Milk

- Sheep Milk

- Others

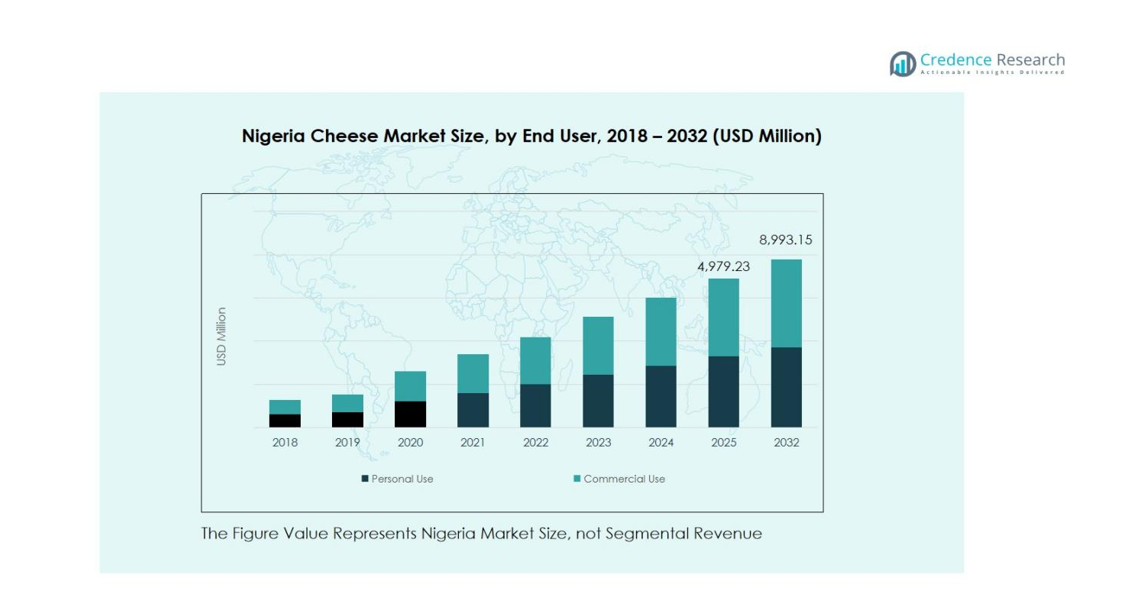

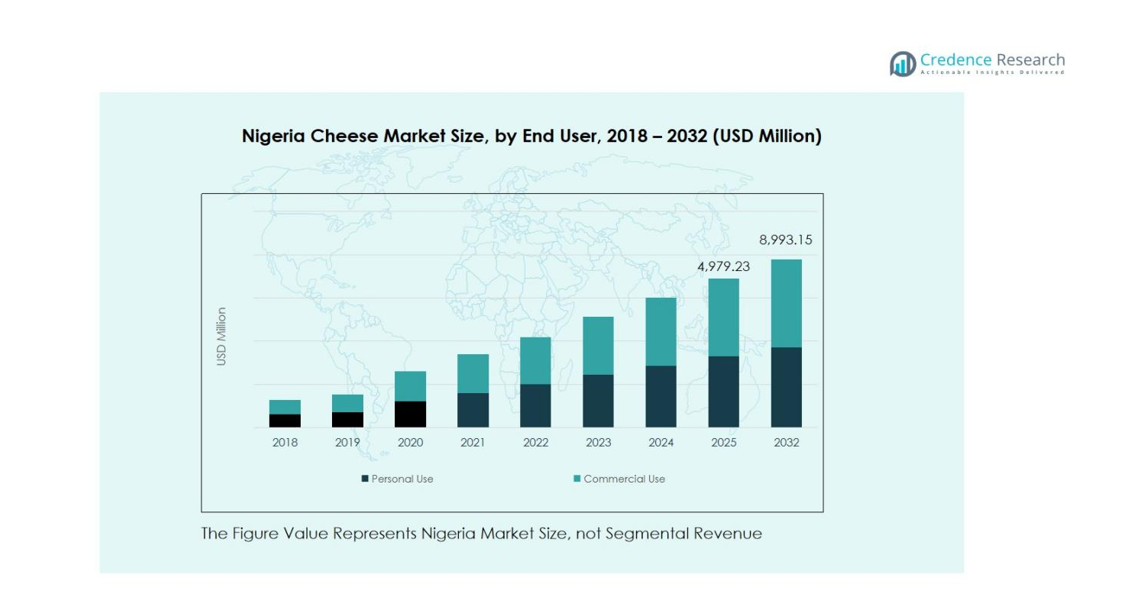

By End User

- Personal Use

- Commercial Use:

- Restaurants and Hotels

- Food Manufacturers

- Cafes

- Others

By Sale Channel

- Supermarkets/Hypermarkets

- Specialty Stores & Convenience Stores

- Direct Sales (B2B)

- Others

By Geography

- Lagos Region

- South-Western Nigeria

- South-Eastern Nigeria

- Northern Nigeria

- South Nigeria

Competitive Landscape

The competitive landscape of the Nigeria Cheese Market features key players such as Landor Group, L&Z Integrated Farms, Cheese House Limited, Sensine Milk and Cheese, and FrieslandCampina WAMCO Nigeria plc. The market is characterized by a mix of domestic producers and multinational dairy companies competing on product quality, pricing, distribution reach, and brand positioning. Local players are strengthening their presence through affordable cheese varieties tailored to regional tastes, while multinational brands leverage advanced processing technologies and strong supply chains to offer premium products. The rise of processed and spreadable cheeses has intensified competition, prompting companies to expand product portfolios and introduce innovative flavors. Retail partnerships with supermarkets, specialty stores, and online platforms are becoming critical to widening market access. Additionally, investments in dairy farming and local sourcing are emerging as strategic priorities to reduce reliance on imports and stabilize pricing. Overall, competition continues to deepen as consumer demand shifts toward convenience, nutrition, and product diversity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Baladna announced plans to establish a multi‑million‑dollar dairy and food‑processing facility in Ogun State, Nigeria, marking a significant investment in local dairy infrastructure and signaling a strategic move to bolster domestic cheese production.

- In 2024, Fan Milk PLC partnered with Obasanjo Farms Nigeria Limited to develop a 2,500‑hectare dairy farm in Oyo State, supporting local milk production.

- In April 2025, Lactalis Group announced that it is considering building a dairy production and processing plant in Nigeria.

Report Coverage

The research report offers an in-depth analysis based on Product, Category, Source, End User, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Nigeria cheese market is expected to witness steady growth driven by increasing demand for processed and convenience foods.

- Rising consumer awareness of the nutritional benefits of cheese will contribute to higher consumption, especially in urban areas.

- Urbanization and the expanding middle class will continue to propel the demand for premium and imported cheese varieties.

- The growing foodservice sector, including restaurants, hotels, and cafes, will create significant opportunities for cheese consumption.

- Online retail channels will become a key distribution avenue, allowing easier access to a wider variety of cheese products.

- Local cheese production will increase as companies invest in dairy farming infrastructure and reduce dependency on imports.

- The popularity of gourmet and artisanal cheeses will continue to rise, particularly among the younger, more adventurous consumer demographic.

- Flavored, spreadable, and processed cheeses will remain key product segments due to their convenience and versatility.

- Manufacturers will focus on introducing innovative cheese varieties and packaging to meet evolving consumer preferences.

- Despite challenges like high import duties and limited dairy farming infrastructure, the Nigerian cheese market is poised for continued expansion in the coming years.