Market Overview

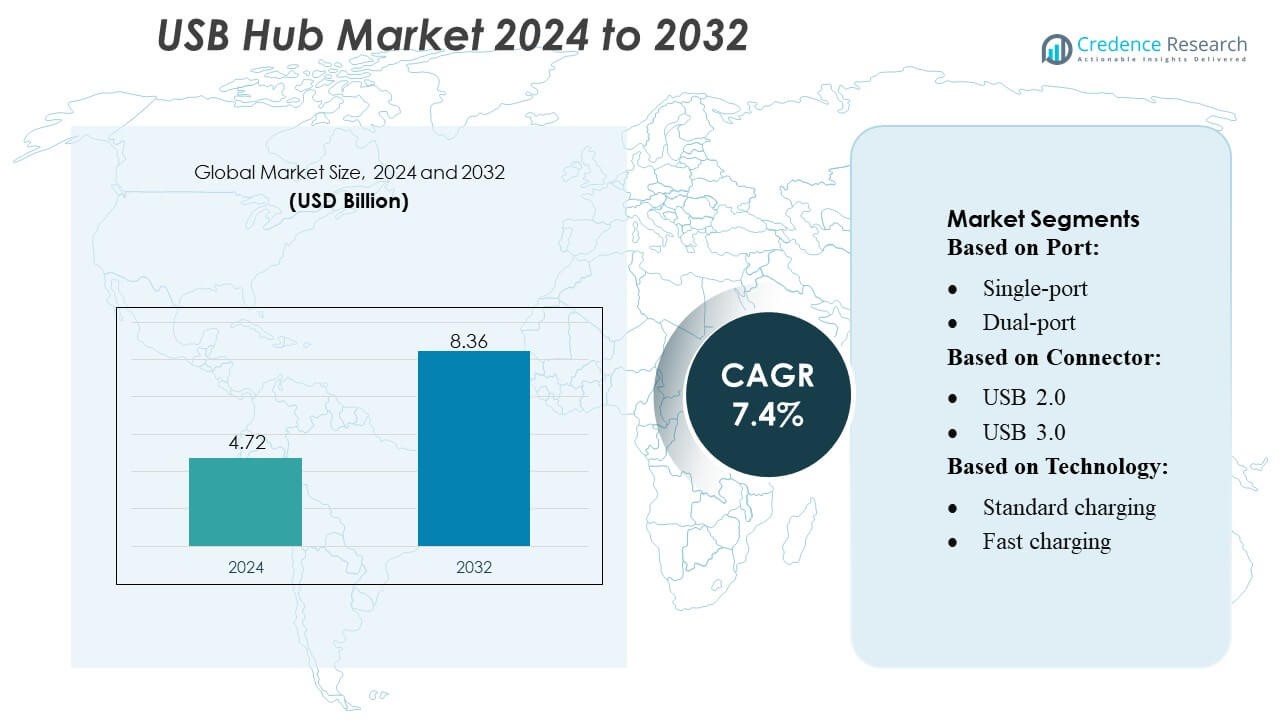

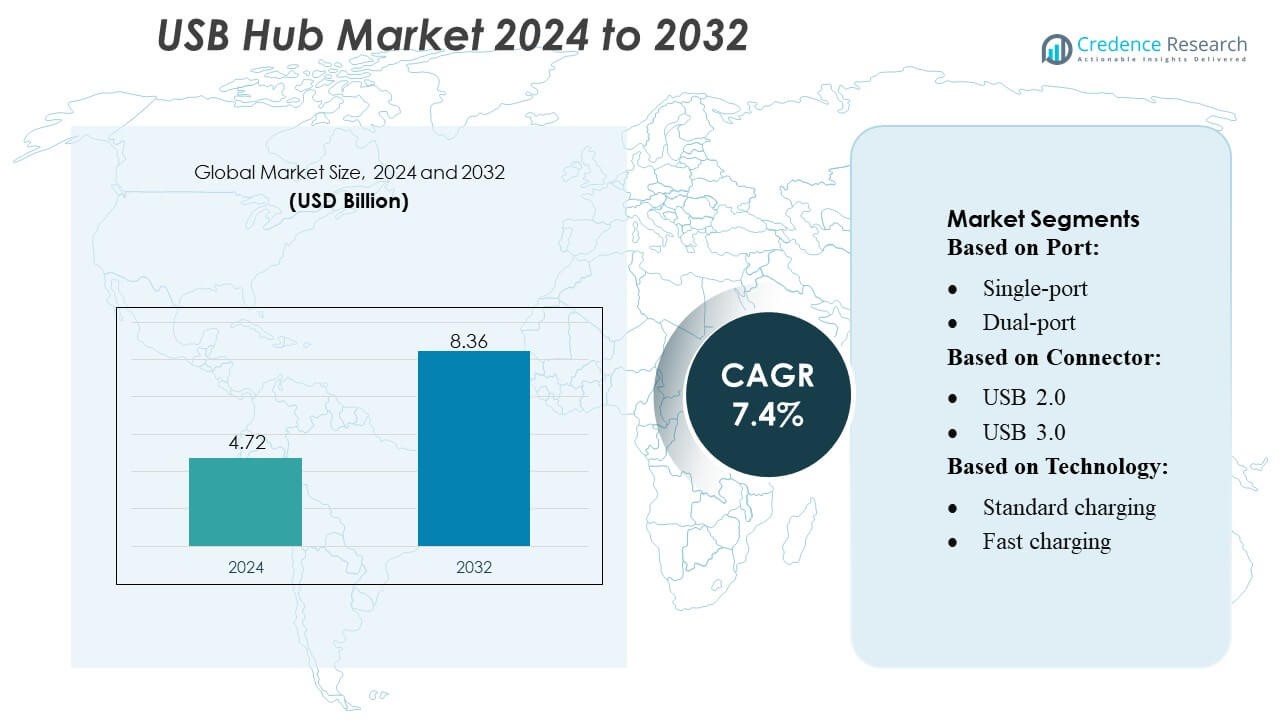

USB Hub Market size was valued USD 4.72 billion in 2024 and is anticipated to reach USD 8.36 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| USB Hub Market Size 2024 |

USD 4.72 Billion |

| USB Hub Market, CAGR |

7.4% |

| USB Hub Market Size 2032 |

USD 8.36 Billion |

The USB Hub Market is shaped by a diverse group of global manufacturers that focus on high-speed connectivity, Type-C integration, and multifunctional expansion solutions to support growing multi-device usage across consumer and commercial environments. Companies strengthen competitiveness through product innovation, enhanced power-delivery capabilities, and broader compatibility with laptops, tablets, and gaming devices. The market also benefits from rising demand for compact docking stations, fast-charging hubs, and rugged industrial hubs. Asia Pacific leads the global market with approximately 35–37% share, driven by large-scale electronics manufacturing, strong consumer adoption, and rapid expansion of digital infrastructure across key economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The USB Hub Market was valued at USD 4.72 billion in 2024 and is projected to reach USD 8.36 billion by 2032, growing at a CAGR of 7.4% during the forecast period.

- Strong market growth is driven by rising multi-device usage, increasing adoption of Type-C ports, and demand for high-speed connectivity across consumer, commercial, and gaming environments.

- Market trends highlight expanding preference for multi-port hubs, fast-charging solutions, and compact docking stations that integrate display, storage, and network functions.

- Competition intensifies as manufacturers focus on product innovation, power-delivery enhancements, and broader OS and device compatibility, while price sensitivity in low-cost markets acts as a restraint.

- Asia Pacific leads with 35–37% share, supported by large-scale electronics manufacturing, while multi-port hubs dominate the segment with over 55% share, reflecting strong adoption in hybrid workspaces and digital lifestyles.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Port

The USB hub market by port type is dominated by multi-port hubs, accounting for over 55% of global share, driven by the rising need for simultaneous connectivity across laptops, gaming consoles, smart TVs, and workstations. Their ability to support peripherals such as keyboards, external storage, charging devices, and display adapters positions them as the preferred option for productivity and entertainment setups. Dual-port hubs hold a moderate share, supported by compact device users, while single-port hubs remain niche, primarily catering to minimalistic or legacy device applications where limited expansion is required.

- For instance, Energous Corporation’s WattUp®-based wireless power solutions achieved full FCC certification for their “2W PowerBridge” transmitter system, a level recognized as compliant for over-the-air wireless charging deployments.

By Connector

In the connector segment, USB 3.0 hubs lead with approximately 48–50% share, supported by widespread adoption in laptops, desktops, and industrial devices requiring high-speed data transfer. Their backward compatibility and strong presence in consumer and enterprise electronics continue to accelerate deployment. Type-C hubs are the fastest-growing category due to increasing penetration of Type-C ports in ultrabooks, tablets, and smartphones, offering reversible connectivity and higher power delivery. USB 2.0 hubs maintain a declining yet relevant share for low-bandwidth peripherals such as keyboards, mice, and barcode scanners.

- For instance, Anker Innovations Technology Co., Ltd. recently released a Qi2-certified wireless car charger that supports up to 25 W output — a major upgrade over older 7.5 W Qi chargers — enabling substantially faster charging compatible with modern electric‑vehicle accessories.

By Technology

The technology segment is led by standard charging USB hubs, contributing over 52% share, anchored by broad compatibility across personal electronics and cost-efficient integration in consumer and commercial environments. Fast-charging hubs are expanding rapidly as demand grows for power-intensive devices, especially smartphones, tablets, wearables, and portable accessories requiring quicker turnaround times. Wireless charging USB hubs represent a smaller but emerging niche, gaining interest from premium product users seeking cable-free convenience in home offices, hospitality settings, and workspace modernizations.

Key Growth Drivers

1. Expansion of Multi-Device Ecosystems

The USB hub market grows rapidly as consumers and professionals increasingly rely on multi-device ecosystems involving laptops, tablets, smartphones, wearables, gaming consoles, and cameras. Work-from-home adoption and hybrid office models intensify the need for efficient connectivity and peripheral consolidation. Multi-port hubs support simultaneous data transfer, charging, and peripheral integration, strengthening their presence across consumer electronics and corporate IT environments. This expansion significantly boosts demand for versatile USB hubs across digital workspaces, education, and entertainment setups.

- For instance, Powerharvester® RF‑to‑DC converter chips which achieve conversion efficiencies of over 75%, enabling remote power-over-distance charging of embedded electronics and sensors without direct contact.

2. Rising Adoption of Type-C and High-Speed Interfaces

The accelerated shift toward USB Type-C and high-speed USB 3.0/3.2 interfaces drives market momentum by enabling faster data throughput, higher power delivery, and universal compatibility. Manufacturers of laptops, ultrabooks, and mobile devices incorporate Type-C ports as the default standard, creating strong demand for complementary hubs. Growth in content creation, cloud computing, and data-intensive tasks further increases the need for high-bandwidth connectivity solutions. This transition reinforces consumer preference for advanced hubs that support multi-functionality and high-speed performance.

- For instance, InductEV’s in-ground wireless charging technology offers a scalable power range, with current systems providing from 75 kW up to 450 kW of power output.

3. Increasing Proliferation of Portable and Mobile Devices

A surge in smartphone, tablet, and portable accessory ownership continues to drive uptake of USB hubs that offer charging, synchronization, and peripheral connectivity. Modern lifestyles centered around mobility and digital productivity require compact, travel-friendly hubs that extend device capabilities. Rising use of mobile accessories such as external storage, audio interfaces, controllers, and docking attachments strengthens market demand. The growing consumer habit of carrying multiple gadgets further supports adoption, especially in travel, education, photography, and remote-work environments.

Key Trends & Opportunities

1. Growth of Fast-Charging and Power Delivery (PD) Hubs

One of the strongest trends is the accelerating transition toward fast-charging USB hubs integrated with Power Delivery (PD) technology. As modern devices demand higher wattage and quicker charging cycles, PD-enabled hubs become a preferred choice across smartphones, laptops, and gaming accessories. Manufacturers increasingly offer combined fast-charging and data-transfer capabilities, creating multifunctional value. This trend opens opportunities for premium, high-margin hubs targeted at professionals, creators, and power users requiring both power efficiency and high-speed connectivity.

- For instance, Plugless Power’s third‑generation system supports an air gap of up to 12 inches, enabling charging even under trucks and SUVs.

2. Rising Demand for Type-C Docking Stations and Workstation Hubs

USB hubs are evolving into advanced docking stations that support HDMI/DisplayPort output, Ethernet connectivity, SD card readers, and high-wattage charging. The shift toward compact laptops with fewer physical ports intensifies demand for multifunctional hubs that transform Type-C laptops into full workstations. This trend creates substantial opportunities in corporate IT procurement, education institutions, and creative industries requiring expanded peripheral connectivity. The growth of remote and hybrid work further accelerates adoption of these integrated docking solutions.

- For instance, Belkin has indeed secured official certification under the latest Qi2.2 standard for its new line of chargers, which are capable of delivering up to 25W output for compatible devices.

3. Integration of Hubs Into IoT, Smart Homes, and Industrial Use-Cases

USB hubs increasingly gain relevance in IoT gateways, smart home devices, and industrial automation systems requiring peripheral connectivity and stable power distribution. Adoption expands across sensors, security cameras, robotics, 3D printers, and POS systems. This broadening industrial footprint creates opportunities for durable, high-reliability hubs designed for continuous operation and controlled environments. The evolution of edge computing and connected infrastructure further strengthens demand for robust USB hubs supporting data acquisition and device orchestration.

Key Challenges

1. Rising Competition and Product Commoditization

The USB hub market faces intensifying competition as numerous global and regional manufacturers offer similar low-cost products, reducing differentiation and compressing margins. Commoditization makes it harder for brands to stand out without aggressive pricing or added features. This environment pressures suppliers to invest in product innovation, build quality assurance, and strengthen distribution networks. At the same time, consumers increasingly prioritize affordability, making it difficult for premium manufacturers to capture share without clear technological or functional advantages.

2. Compatibility Issues and Power Delivery Limitations

Despite advancements, USB hubs often encounter compatibility concerns across devices, operating systems, and charging standards. Variability in power delivery, bandwidth allocation, and driver support can reduce performance for certain peripherals or restrict the use of multiple high-power devices simultaneously. These limitations challenge user experience and increase return rates, particularly for low-quality hubs. As device manufacturers continue to diversify port standards and features, ensuring seamless interoperability remains a significant market hurdle for hub producers.

Regional Analysis

North America

North America holds approximately 32–34% of the global USB hub market, supported by strong consumer electronics adoption, high PC penetration, and widespread use of multi-device workstations across corporate, educational, and remote-working environments. The region benefits from early adoption of USB 3.0, Type-C, and fast-charging technologies, driving demand for advanced multi-port hubs and docking solutions. Growth is reinforced by the presence of major technology brands and a mature e-commerce ecosystem that accelerates product availability. Expanding gaming, entertainment, and creator communities further stimulate uptake of high-performance hubs designed for data-intensive and multi-screen setups.

Europe

Europe accounts for around 25–27% of the global market, driven by strong technology infrastructure, high laptop usage, and expanding digitization across SMEs and public-sector institutions. The region witnesses consistent demand for Type-C hubs and workstation docking solutions as consumers shift to lightweight ultrabooks with fewer native ports. Growing emphasis on remote work, online education, and digital workflows increases multi-port connectivity requirements. Strict quality and safety standards in the EU encourage adoption of certified, durable hubs. Additionally, rising interest in smart offices and home-office enhancements sustains long-term demand for multifunctional USB hubs.

Asia Pacific

Asia Pacific leads the market with approximately 35–37% share, driven by rapid expansion of consumer electronics manufacturing, large laptop and smartphone user base, and strong penetration of gaming, content creation, and digital-learning ecosystems. Countries such as China, South Korea, Japan, and India drive mass adoption of USB 3.0 and Type-C hubs due to increasing device miniaturization and high demand for multi-device productivity setups. Lower-cost manufacturing capabilities strengthen supply availability, while growing enterprise digitization and IT infrastructure development accelerate commercial usage. APAC also experiences the fastest growth rate, supported by high PC replacement cycles and rising urban digital lifestyles.

Latin America

Latin America captures about 7–8% of the global USB hub market, supported by growing digital penetration, increasing laptop use among students and professionals, and gradual adoption of multi-port connectivity solutions. Demand rises as more households integrate laptops, tablets, and gaming consoles, creating a need for efficient device expansion. Brazil and Mexico lead regional consumption due to large consumer bases and growth in e-commerce distribution. However, price sensitivity shapes purchasing behavior, favoring cost-effective USB 2.0 and basic USB 3.0 hubs. Government-led digital education programs and expanding SMB digitalization further support steady market growth.

Middle East & Africa

The Middle East & Africa region accounts for around 5–6% of the global market, driven by increasing urbanization, expanding IT infrastructure, and rising adoption of smartphones, laptops, and tablets. Demand strengthens in GCC countries where corporate digital transformation and smart office adoption are accelerating. Educational institutions and government modernization initiatives also contribute to rising USB hub usage. While high-performance USB 3.0 and Type-C hubs gain traction in premium markets, affordability remains a key factor across developing economies, leading to stable demand for standard charging and lower-cost connectivity hubs.

Market Segmentations:

By Port:

By Connector:

By Technology:

- Standard charging

- Fast charging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The USB Hub Market features a competitive landscape influenced by connectivity and cabling specialists such as LS Cable & System Ltd., Finolex Cables, NKT A/S, Furukawa Electric Co., Ltd., Belden Inc., Encore Wire Corporation, LEONI AG, Fujikura Ltd., Nexans, and KEI Industries Limited. the USB Hub Market is shaped by a growing focus on high-speed connectivity, enhanced power delivery, and multifunctional hub architectures designed to support modern digital ecosystems. Manufacturers compete by integrating Type-C interfaces, fast-charging capabilities, and high-bandwidth USB 3.0/3.2 standards to address rising multi-device usage across consumer, commercial, and enterprise environments. Product differentiation increasingly depends on durability, thermal efficiency, and compatibility with diverse operating systems and hardware platforms. Market players strengthen their positioning through continuous R&D, supply-chain optimization, and expansion of e-commerce and retail channels. Additionally, partnerships with PC, smartphone, and peripheral brands further accelerate innovation and broaden adoption of advanced USB hub solutions globally.

Key Player Analysis

- LS Cable & System Ltd.

- Finolex Cables

- NKT A/S

- Furukawa Electric Co., Ltd.

- Belden Inc.

- Encore Wire Corporation

- LEONI AG

- Fujikura Ltd.

- Nexans

- KEI Industries Limited

Recent Developments

- In February 2025, Sumitomo Electric showcased its Thunderbolt 5 cables at ISE 2025 to highlight how they boost high-speed data transfer for modern AV and IT equipment. These cables leverage the new Thunderbolt 5 standard to provide up to 80 Gbps bidirectional bandwidth and up to 120 Gbps in one direction, twice the speed of Thunderbolt 4. This enables higher-resolution video and faster data transfer for demanding applications.

- In June 2024, Nexans, a leader in the global energy transition, today announces the completion of its acquisition of La Triveneta Cavi, one of the European. This acquisition marks a major advancement in Nexans’ strategy to establish itself as a dedicated electrification player.

- In April 2024, Finolex Cables launched its FinoGreen line of eco-safe, halogen-free, flame-retardant industrial cables, which are designed to improve safety by reducing fire risks. The new product is expected to make up about 5% of the company’s wire business and is a part of their sustainability strategy.

- In September 2023, Southwire Company, LLC announced its acquisition of Resideo’s Genesis Wire & Cable business. The deal, which closed in October 2023, is expected to strengthen Southwire’s position in the low-voltage wires and cables market by adding Genesis’s product offerings for applications such as security, entertainment, and fire safety.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Port, Connector, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as multi-device ecosystems become standard across personal, professional, and educational environments.

- Type-C hubs will gain stronger dominance as device manufacturers continue shifting to universal and reversible port standards.

- Fast-charging and Power Delivery hubs will experience rising adoption driven by power-intensive mobile and computing devices.

- USB hubs will increasingly evolve into compact docking stations supporting displays, Ethernet, storage, and charging.

- Demand for high-speed data hubs will grow as content creation, cloud workflows, and gaming ecosystems continue to expand.

- Manufacturers will integrate smarter power management and thermal control features to improve performance and reliability.

- Portable and travel-friendly hubs will witness strong uptake among mobile professionals and hybrid workers.

- Industrial and IoT applications will adopt rugged USB hubs to support sensors, automation systems, and connected devices.

- Sustainability-driven designs will rise, with emphasis on durable materials and long-life electronics.

- E-commerce and direct-to-consumer channels will continue to strengthen market accessibility and global penetration.

Market Segmentation Analysis:

Market Segmentation Analysis: