Market Overview:

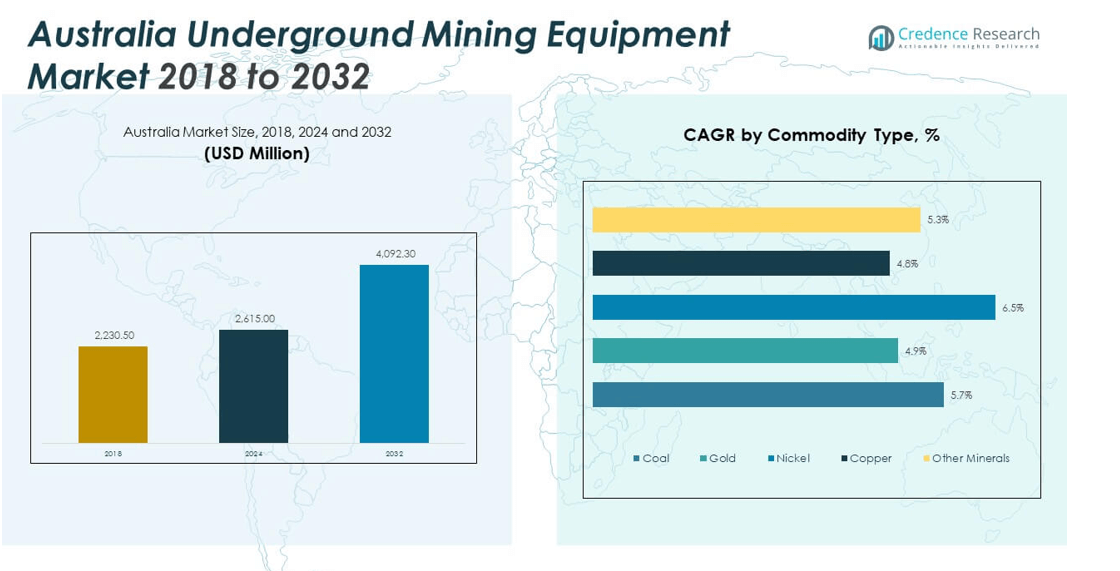

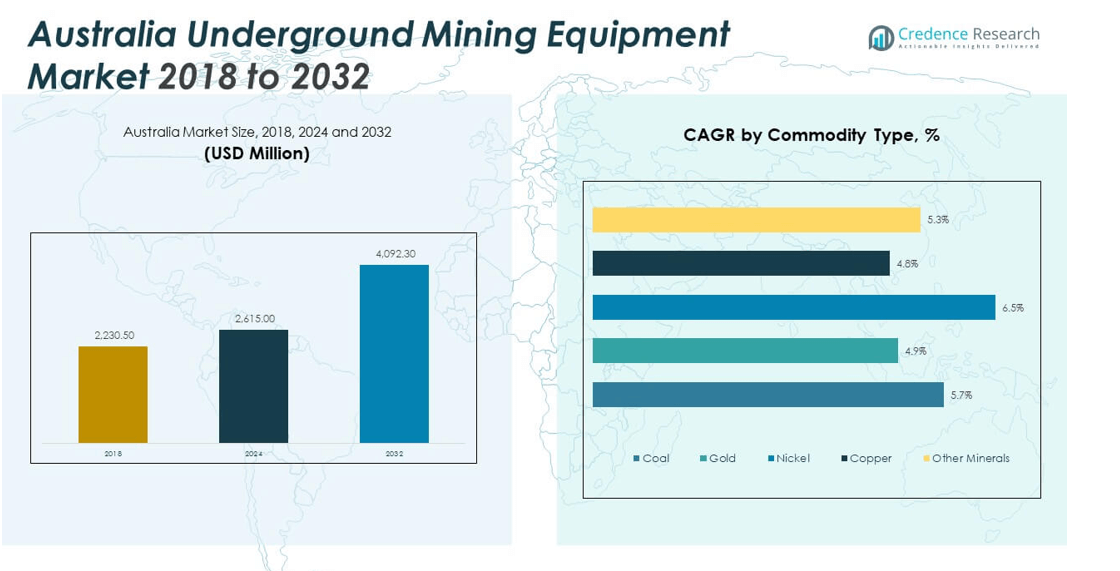

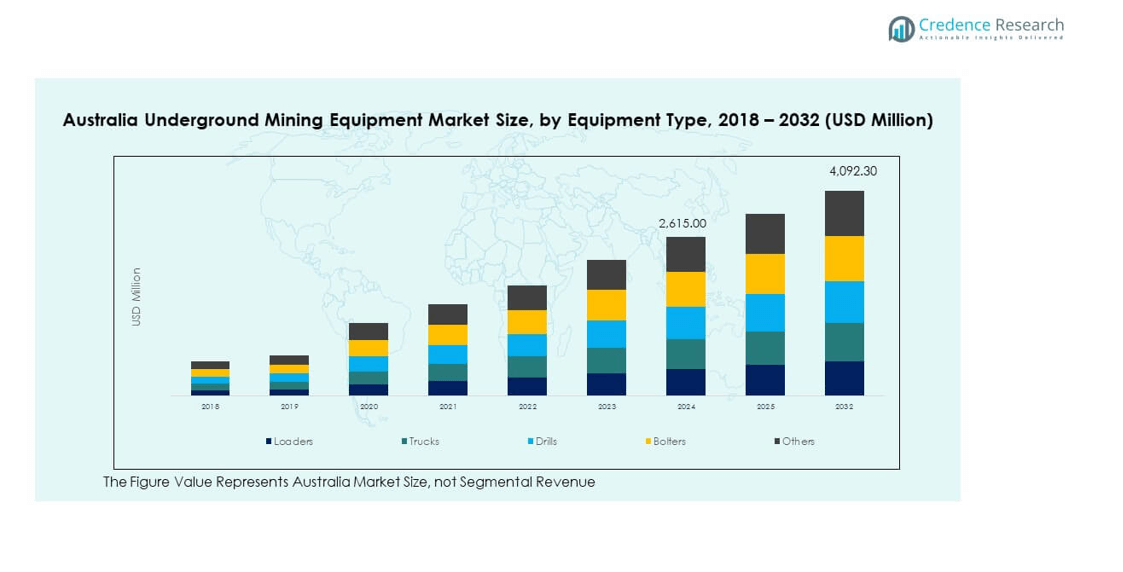

The Australia Underground Mining Equipment Market size was valued at USD 2,230.50 million in 2018 to USD 2,615.00 million in 2024 and is anticipated to reach USD 4,092.30 million by 2032, at a CAGR of 7.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Underground Mining Equipment Market Size 2024 |

USD 2,615.00 million |

| Australia Underground Mining Equipment Market, CAGR |

7.70% |

| Australia Underground Mining Equipment Market Size 2032 |

USD 4,092.30 Billion |

Demand strengthens due to the growing shift toward advanced technology that improves productivity and ensures safer operations. Mining firms adopt electric loaders, continuous miners, and longwall systems to manage deeper and more complex deposits. Strong investment in modernization supports wider use of real-time monitoring tools and autonomous equipment. Rising focus on lowering emissions pushes sites to replace aging diesel fleets. Expansion in hard-rock mining improves demand for durable gear that supports consistent production rates. Miners also upgrade fleets to reduce downtime and extend operational life.

Western Australia leads due to its large iron ore and gold operations that rely heavily on underground fleets. Queensland follows through strong coking coal output supported by stable project pipelines. New South Wales remains important due to its mix of metal and coal mines seeking fleet renewal. Emerging sites across the Northern Territory show gradual progress as companies explore new mineral blocks. South Australia gains traction through interest in copper projects supported by long-term resource potential. Regional diversification continues as producers expand activities into deeper and more remote zones.

Market Insights:

- The Australia Underground Mining Equipment Market grew from USD 2,230.50 million in 2018 to USD 2,615.00 million in 2024 and is projected to reach USD 4,092.30 million by 2032, supported by a 7.70% CAGR driven by deeper mining operations and stronger equipment renewal cycles.

- Western Australia leads with 45% share, supported by extensive iron ore and gold operations; Queensland holds 30% share due to strong coking coal activity; New South Wales follows with 15% share, driven by metal and coal extraction supported by ongoing fleet upgrades.

- South Australia is the fastest-growing region with 7% share, supported by rising copper exploration and reinforced investment in high-strength drilling and loading systems.

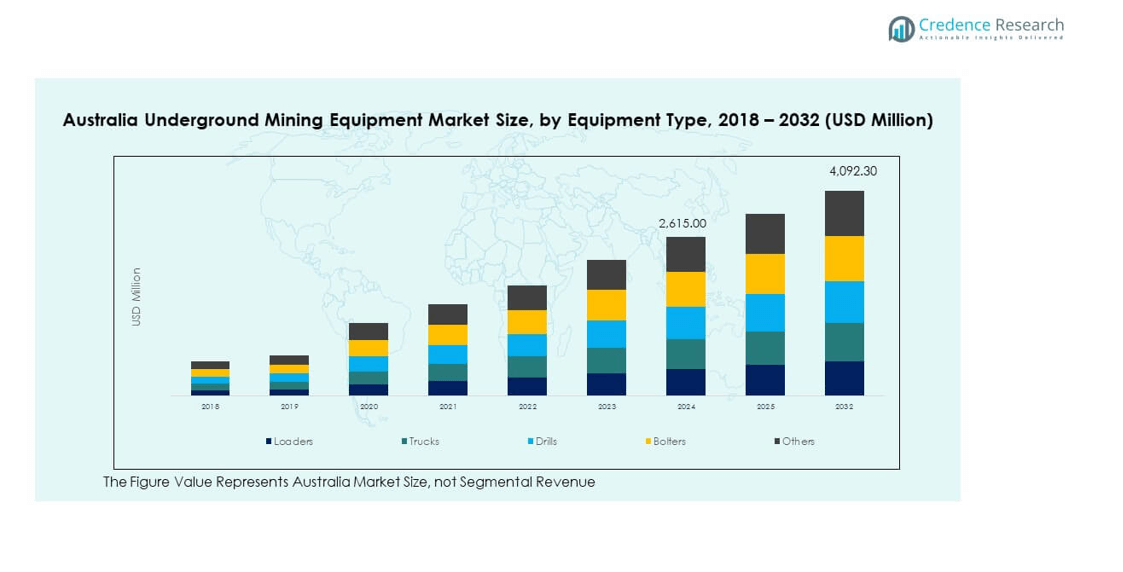

- In 2024, Drills accounted for roughly 25% of equipment share, making them the largest category due to high penetration across hard-rock and coal operations.

- Loaders and Trucks together represented around 40% share, reflecting their critical role in material movement and continuous production across multi-level underground zones.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Shift Toward High-Productivity Mining Systems

Strong demand for deeper resource extraction lifts interest in high-performance fleets across sites. Mining operators prefer systems that raise output while reducing technical stoppage. Automation upgrades support steady demand for advanced control units across major deposits. Companies replace outdated fleets to improve precision during complex tunnel development. Modern machinery offers better load capacity and stable performance across longer shifts. The Australia Underground Mining Equipment Market benefits from investment in systems that cut operational risks. It helps operators maintain dependable extraction rates across varied geological zones. Higher ore demand across major mines supports rapid uptake of efficient fleets.

- For instance, Sandvik’s AutoMine Fleet system enables multi-machine automation that boosts productivity by up to 15% in underground operations.

Rising Focus on Worker Safety and Hazard Reduction

Strict rules encourage miners to adopt safer machinery for large underground sections. Operators procure advanced sensors that track temperature, gas levels, and machine health. Smart alerts support safer navigation across congested or low-visibility tunnel areas. Firms invest in equipment that reduces exposure to dust, noise, and collision risk. Remote control systems lower human presence in hazardous locations. Strong enforcement of workplace safety norms drives more interest in intelligent gear. Companies use structured training programs to maximize safe handling of high-capacity systems. Steady compliance needs keep investment firm across complex mining zones.

- For instance, Dräger’s X-am 2800 multi-gas detector provides real-time monitoring for up to four gases and integrates with cloud reporting tools used widely in underground mines.

Expansion of Hard-Rock and Metal Mining Operations

Growing metal demand supports fresh investments in underground development blocks. Operators expand into deeper sections that require reinforced machinery built for high stress. Demand for loaders, drills, and longwall units rises with strong exploration targets. Firms adopt equipment that offers improved torque and enhanced penetration in tight rock structures. High-grade metal prospects support rapid fleet deployment across new shafts. New operational licenses push miners to upgrade handling systems at a faster pace. Rising exploration in gold and copper zones sustains strong equipment replacement cycles. Steady metal consumption rates motivate operators to strengthen underground capabilities.

Stronger Adoption of Digital and Remote-Enabled Technologies

Mining operators deploy digital systems that lift speed, visibility, and scheduling accuracy. Real-time data platforms help teams monitor drilling depth, machine condition, and workflow gaps. Remote operation cabins allow skilled staff to control heavy fleets from safe spaces. Predictive tools help reduce unscheduled downtime that disrupts production targets. Integration of telematics supports efficient tracking across long tunnel networks. The Australia Underground Mining Equipment Market gains from faster adoption of connected fleets. It improves consistency across multi-shift cycles and lowers maintenance delays. Miners benefit from stronger reliability during demanding extraction programs.

Market Trends:

Growing Penetration of Electric and Hybrid Underground Fleets

Interest in electric machinery rises due to pressure to cut emissions inside enclosed tunnels. Operators reduce reliance on diesel units that raise ventilation costs. Battery-powered loaders support cleaner cycles and reduce harmful exhaust presence. Hybrid equipment improves performance consistency across long-distance haul sections. Lower heat output from electric fleets supports safer working passages. The Australia Underground Mining Equipment Market reflects a shift toward cleaner machines. Companies study total cost advantages linked with reduced fuel dependence. Strong interest in sustainable mining practices strengthens this trend across large deposits.

- For instance, Epiroc’s Scooptram ST14 Battery loader delivers a 14-ton capacity and reduces underground heat and emissions compared to diesel units.

Increasing Deployment of Advanced Ventilation and Airflow Management Tools

Mines invest in ventilation systems that improve air purity and reduce humidity concentration. Smart fans help maintain airflow balance across deeper and narrower shafts. New digital modules track oxygen levels and manage fresh air intake in real time. Operators pair ventilation upgrades with energy-efficient motors to reduce power waste. Airflow mapping tools support better design planning before expansion phases. Ventilation modernization helps teams handle deeper excavations without higher risk. These upgrades elevate long-term safety and operational stability across large sites. Rising concern about worker comfort fuels steady technology adoption.

- For instance, Howden’s Ventsim CONTROL system enables real-time fan automation and has demonstrated ventilation energy reductions of up to 40% in deployed mines.

Growing Use of Modular, Scalable, and Customizable Mining Platforms

Mining operators choose modular equipment that adapts to rapid changes in tunnel layout. Scalable assemblies support quick repositioning across variable-depth mining stages. Customizable systems reduce downtime during configuration adjustments. Lightweight structural frames improve maneuvering inside confined sections. Operators enhance asset flexibility by pairing modular units with digital monitoring. The Australia Underground Mining Equipment Market sees strong traction for scalable machinery. Platforms support better integration with automation and sensing tools. Rising design complexity across deposits accelerates demand for adaptable solutions.

Stronger Use of AI, Analytics, and Predictive Insights

AI adoption grows as miners study ways to reduce operational waste and improve planning. Predictive analytics optimize drilling paths for higher precision at reduced costs. Machine learning tools guide teams toward better fleet assignment and cycle timing. Anomaly detection systems prevent critical breakdowns across high-load components. Operators analyze large data sets to improve extraction forecasts across long-term plans. Real-time dashboards enhance visibility across multiple underground segments. Data-driven planning supports faster recovery during technical disruptions. Growing digital maturity strengthens strategic decision-making across mining clusters.

Market Challenges Analysis:

High Operational Costs and Capital-Intensive Procurement Cycles

Mining companies face steep budgets for new machinery and related technology upgrades. Equipment replacement requires long-term planning that slows procurement action. Complex underground conditions raise maintenance needs across older fleets. Ventilation, power supply, and structural support systems increase operational burden. The Australia Underground Mining Equipment Market encounters cost pressure during expansion phases. Firms manage tight margins when commodity prices move unpredictably. Reliability issues in aging tunnels raise repair frequency and resource use. Operators balance safety needs with capital limits during fleet renewal cycles.

Shortage of Technical Skills and Slow Workforce Transition

Mining operators face a limited pool of talent skilled in advanced fleet handling. Digital machinery demands stronger technical training programs across all job levels. Slow transition toward automated systems delays progress in certain zones. High turnover rates create operational gaps during key production phases. Remote regions struggle to attract trained workers for multi-shift schedules. Knowledge gaps reduce speed during troubleshooting and complex tunneling activities. Skill shortages weaken efficiency in predictive maintenance adoption. The industry works toward long-term talent development to reduce risk.

Market Opportunities:

Expansion of Automation, Electrification, and Smart Fleet Modernization

Growing interest in autonomous drills and driverless loaders opens fresh investment windows. Electric machinery supports lower emissions and improves workflow inside tight passages. Operators plan digital upgrades that improve reporting accuracy across long tunnel networks. The Australia Underground Mining Equipment Market benefits from interest in modernization paths. Smart diagnostics allow better planning across maintenance-heavy environments. Demand rises for electrified units that reduce heat and noise levels. Remote operation tools create safer working patterns across deeper blocks. This shift encourages new suppliers to enter high-growth segments.

Rising Investment in New Mineral Blocks and Hard-Rock Exploration

New exploration zones strengthen prospects for advanced equipment deployment. Operators target deeper reserves that need reinforced drilling structures. Hard-rock expansion projects bring demand for high-strength cutters and loaders. Modern tunneling units help reduce time during early development phases. Fleet suppliers expand support services to match rising exploration intensity. It lifts long-term demand for specialized design formats. Strong government focus on resource development supports industry opportunity growth. Newer mines adopt flexible systems that match evolving geological conditions.

Market Segmentation Analysis:

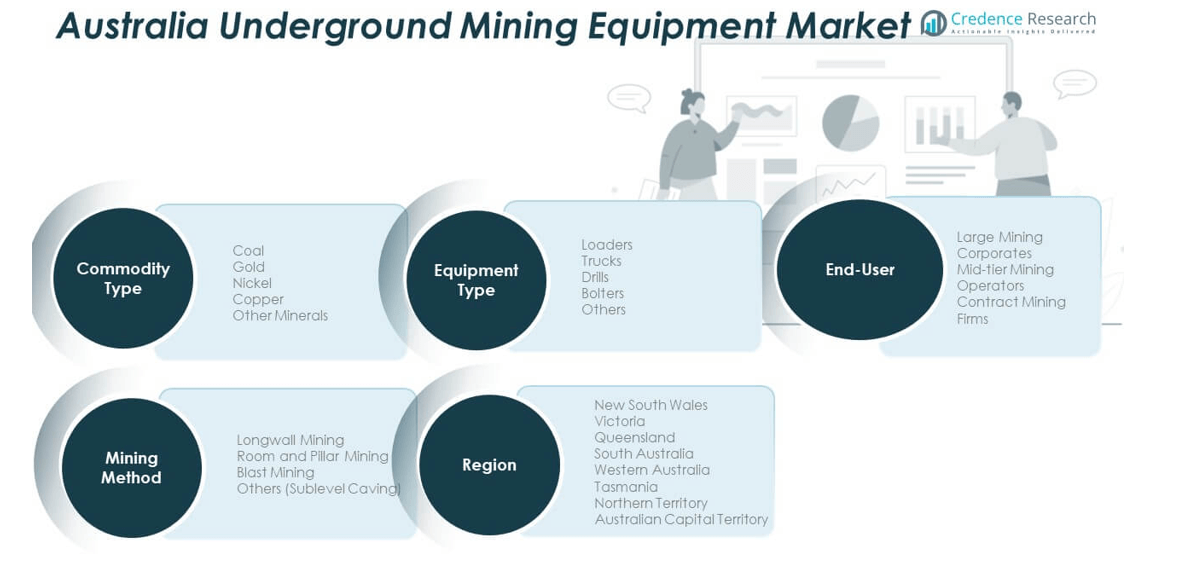

By Commodity Type

The Australia Underground Mining Equipment Market aligns closely with commodity-specific demand across major mineral classes. Coal and gold operations drive strong fleet upgrades due to deeper extraction zones. Copper and nickel sites adopt high-strength rigs that support sustained drilling cycles. Iron ore activity relies on heavy-duty loaders and trucks designed for hard-rock mobility. Other mineral segments use compact machines to manage selective extraction tasks. The distribution reflects broad adoption patterns across regions with diverse mineral output. It highlights the need for reinforced systems across long-term mining corridors.

- For instance, Caterpillar’s R1700 XE electric loader, with a 15-ton payload, is deployed across several hard-rock mines to support high-intensity iron ore and copper operations.

By End-User

End-user demand varies according to operational scale and equipment intensity within the Australia Underground Mining Equipment Market. Mining companies remain the primary buyers due to continuous fleet renewal programs. Contract mining firms rely on versatile machines that support rapid deployment across multiple sites. OEM service providers invest in diagnostic tools that support high-uptime performance. Processing plants require stable units for material movement near underground entries. Exploration companies focus on drilling platforms that support early-stage development. Government and regulatory bodies use specialized systems for inspection and safety programs.

- For instance, Epiroc’s Boomer M2 drilling rig is widely adopted by exploration contractors and features dual drill arms capable of delivering high-precision face drilling across complex geological zones.

By Equipment Type

The Australia Underground Mining Equipment Market shows wide equipment adoption across loaders, trucks, and drilling platforms. Underground loaders and trucks support heavy material movement across multi-level tunnels. Drill rigs and continuous miners improve extraction speed across hard-rock and coal environments. Bolters and roof support systems strengthen structural safety. Longwall systems hold strong demand across coal regions. Utility vehicles and other machines support maintenance and rapid transport tasks. It reflects an ecosystem that values durability, precision, and performance stability.

By Mining Method

Mining method selection shapes equipment needs across the Australia Underground Mining Equipment Market. Longwall mining uses advanced cutting systems and high-capacity support units. Room-and-pillar sites depend on loaders, bolters, and mobile rigs. Cut-and-fill operations favor maneuverable machines suited for variable cavity designs. Block caving demands powerful haulage units and controlled drilling systems. Sublevel stoping and sublevel caving rely on precise drilling and strong ground support. Retreat mining and other techniques require equipment that adapts to shifting geology. It supports diverse underground development strategies.

Segmentation:

By Commodity Type

- Coal

- Gold

- Copper

- Nickel

- Iron Ore

- Other Minerals

By End-User

- Mining Companies

- Contract Mining Firms

- OEM Service Providers

- Processing Plants

- Exploration Companies

- Government & Regulatory Bodies

By Equipment Type

- Underground Loaders (LHDs)

- Underground Trucks

- Drill Rigs

- Continuous Miners

- Bolters

- Longwall Systems

- Roof Support Systems

- Utility Vehicles

- Other Underground Machines

By Mining Method

- Longwall Mining

- Room-and-Pillar Mining

- Cut-and-Fill Mining

- Block Caving

- Sublevel Stoping

- Sublevel Caving

- Retreat Mining

- Other Underground Techniques

By Region

- Western Australia

- Queensland

- New South Wales

- South Australia

- Northern Territory

- Tasmania

- Victoria

Regional Analysis:

Western Australia and Queensland

Western Australia leads the Australia Underground Mining Equipment Market with an estimated 45% share, supported by deep iron ore and gold operations that rely on high-performance machinery. Large mining belts across the Pilbara region adopt advanced fleets to manage complex geological layers. Strong investment in automation and fleet renewal lifts equipment turnover across major sites. Queensland follows with roughly 30% share, driven by sustained coking coal extraction and steady expansion across underground coal basins. Companies deploy high-capacity drills, loaders, and longwall units to maintain production stability. The region benefits from new development blocks that require durable machines. It maintains strong demand for technology-enabled systems across critical shafts.

New South Wales and South Australia

New South Wales accounts for nearly 15% share, supported by mixed metal and coal deposits that depend on consistent equipment replacement cycles. Operators upgrade fleets to manage deeper zones that require sustainable workflow planning. The region uses advanced sensing tools to support safer tunnel conditions. Strong compliance norms encourage miners to adopt modern platforms with higher precision. South Australia holds close to 7% share, driven by copper-focused activity across established mining corridors. Firms invest in heavy-duty loaders and reinforced drilling platforms to support long-term exploration targets. It shows gradual growth linked with rising interest in high-value mineral projects.

Northern Territory and Tasmania

The Northern Territory maintains about 3% share, supported by targeted exploration across remote mineral blocks. New investments improve prospects for deeper underground development in select zones. Operators trial modern equipment to handle challenging terrain and limited infrastructure. The region benefits from government-backed exploration programs that encourage equipment upgrades. Tasmania contributes roughly 2% share, driven by niche metal mines that depend on compact and specialized machinery. Sites prioritize units that support efficient navigation through narrow tunnel systems. It maintains steady equipment demand linked with stable metal extraction patterns.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sandvik AB

- Epiroc AB

- Macmahon Holdings

- Caterpillar

- Atlas Copco

- Caterpillar Inc.

- Komatsu Limited

- Gears Mining

- Jacon Equipment

- Eickhoff Australia Pty Ltd

- MacLean Engineering

- PPK Mining Equipment Pty Ltd

Competitive Analysis:

The Australia Underground Mining Equipment Market features strong competition among global OEMs and regional suppliers that target diverse mining conditions. Leading players compete through advanced drilling systems, high-capacity loaders, and automation-enabled fleets that support deeper and more complex operations. Companies focus on reliability, equipment life, and digital integration to secure recurring contracts with large mining groups. Local distributors strengthen their role by offering faster service cycles and tailored support across remote regions. New entrants study opportunities in electrified machinery that reduce heat output and improve tunnel safety. It continues to push manufacturers to upgrade sensing, diagnostics, and remote-control capabilities. The landscape reflects steady innovation driven by rising demand for safer and more productive underground platforms.

Recent Developments:

- Epiroc AB completed its full acquisition of Radlink, an Australian wireless connectivity solutions provider, in April 2025. In January 2025, Epiroc announced that two Australian mining companies had ordered Long-Term Evolution (LTE) and digital connectivity solutions valued at over MSEK 250, which included telecommunications towers, huts, and power systems designed to strengthen safety and productivity by providing remotely located mines with reliable, secure, and high-speed bandwidth for enabling automation, fleet management, and real-time data applications. Additionally, Epiroc secured its largest contract ever in April 2025 with Fortescue Metals Group for autonomous and electric-powered mining equipment valued at MAUD 350 (SEK 2.2 billion) over five years, with operations planned in Western Australia’s Pilbara region.

- Atlas Copco extended its mining equipment portfolio in 2024 by launching new WEDA electric submersible pump models in July 2024 to meet increased requirements for dewatering pump wear resistance and autonomous operation capabilities in mining and construction applications. The company continues to provide complementary packages and services dedicated to both surface and underground mining operations through its Australian rental division.

Report Coverage:

The research report offers an in-depth analysis based on By Commodity Type, By End-User, By Equipment Type, and By Mining Method. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Automation demand will expand as miners adopt remote-control platforms to improve underground safety.

- Electrified fleets will gain wider interest due to lower heat output and reduced ventilation load.

- Digital monitoring tools will grow across deeper shafts to support real-time visibility and faster decision-making.

- Hard-rock exploration will drive stronger demand for reinforced drilling and high-torque cutting systems.

- Modular platforms will rise in adoption due to flexible deployment across multi-level tunnel networks.

- Predictive maintenance solutions will strengthen reliability across high-load machinery and shorten repair cycles.

- OEM partnerships will deepen to support technology integration for complex underground zones.

- Longwall upgrades will expand as operators target higher output in coal-producing regions.

- New mineral block development will lift demand for specialized machines suited for emerging shafts.

- Workforce skill development will accelerate to support transition toward digital and autonomous equipment operations.