Market Overview

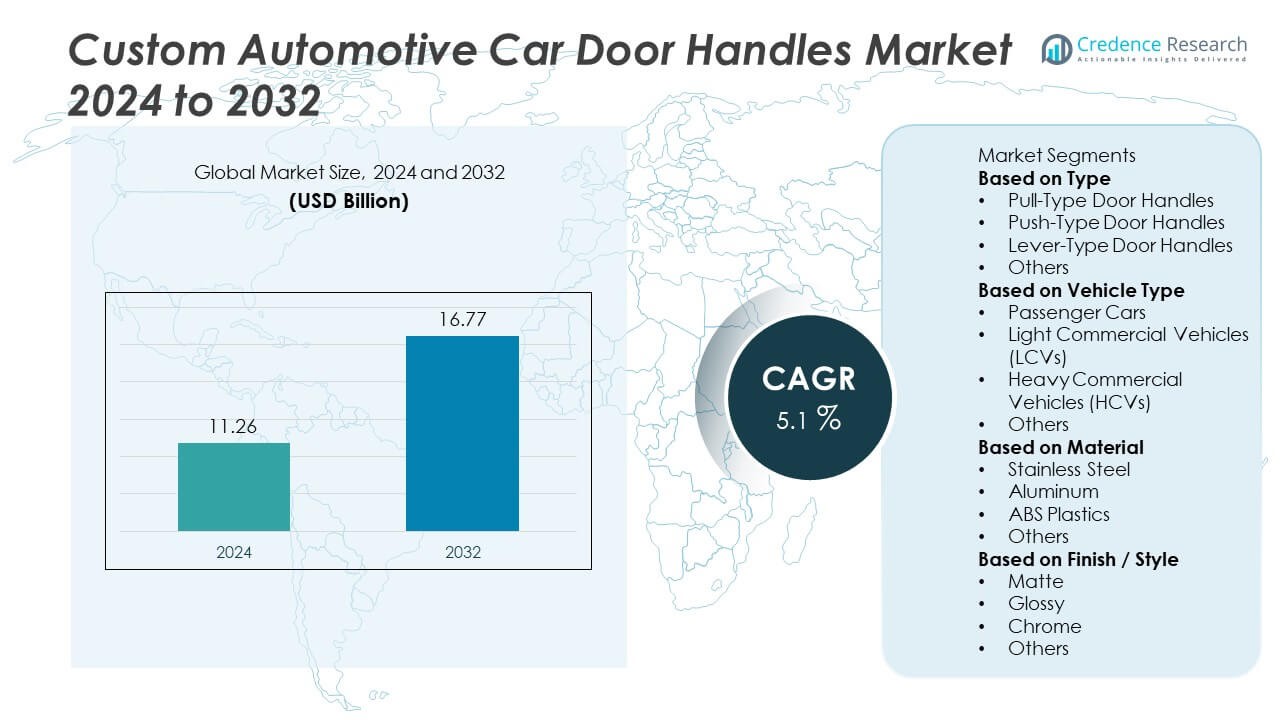

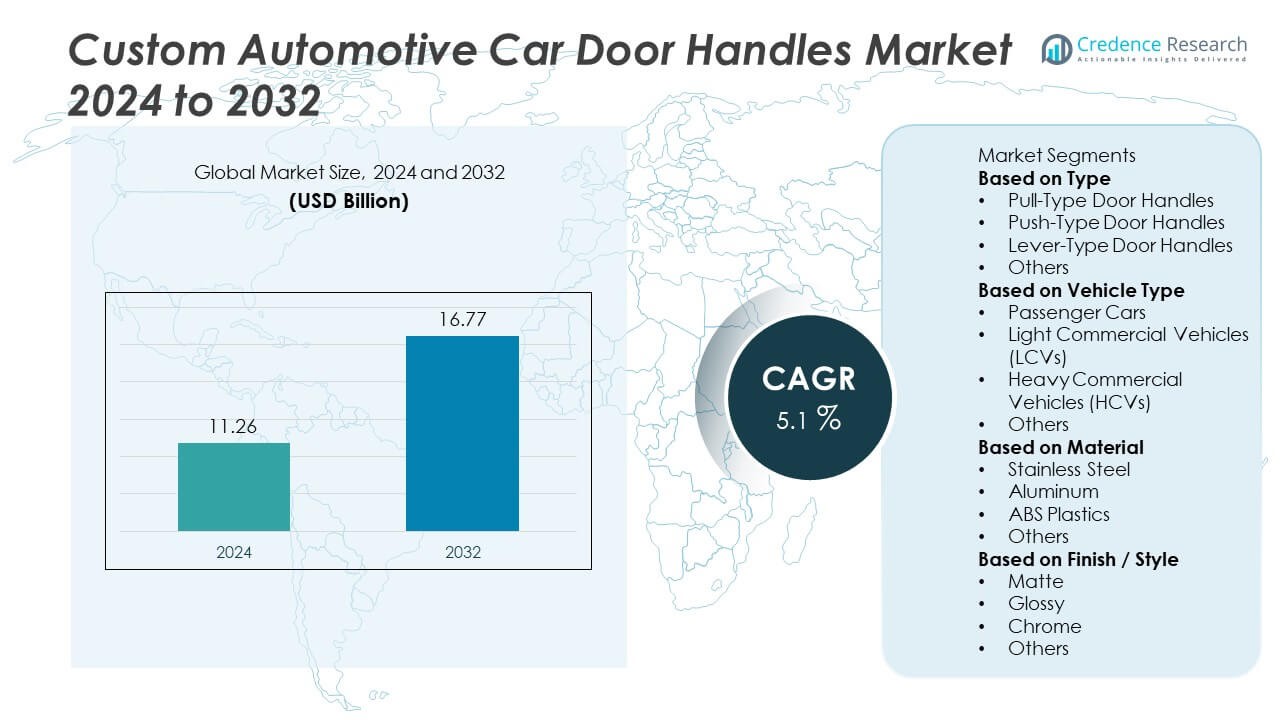

Custom Automotive Car Door Handles market size reached USD 11.26 billion in 2024 and is projected to rise to USD 16.77 billion by 2032, supported by a 5.1% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Custom Automotive Car Door Handles Market Size 2024 |

USD 11.26 Billion |

| Custom Automotive Car Door Handles Market, CAGR |

5.1% |

| Custom Automotive Car Door Handles Market Size 2032 |

USD 16.77 Billion |

The Custom Automotive Car Door Handles market is driven by leading players such as Huf Hülsbeck & Fürst, ITW Automotive, Aisin Corporation, Magna International, Valeo, Witte Automotive, Toyota Boshoku Corporation, Grupo Antolin, Hyundai Mobis, and Mitsui Kinzoku. These companies expand their presence through advanced materials, improved ergonomic designs, and integration of smart entry technologies that enhance vehicle aesthetics and functionality. Their focus on lightweight components, corrosion-resistant finishes, and customization options supports strong adoption across passenger and premium vehicles. North America leads the market with a 36% share, supported by high demand for advanced styling features, while Europe follows with a 29% share driven by strong luxury car production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Custom Automotive Car Door Handles market reached USD 11.26 billion in 2024 and is projected to reach USD 16.77 billion by 2032 at a 5.1% CAGR, driven by rising vehicle customization demand.

- Growth is supported by strong adoption of pull-type handles with a 46% share and increasing use of ABS plastic materials holding a 48% share, as automakers seek lightweight and durable components.

- Key trends include the shift toward smart, flush-mounted, and sensor-based door handles, driven by EV expansion and rising demand for premium exterior styling.

- Competition intensifies as leading players focus on advanced materials, corrosion-resistant finishes, and OEM partnerships to strengthen global presence, while cost pressures challenge high-end customization.

- Regionally, North America leads with a 36% share, followed by Europe at 29% and Asia Pacific at 27%, supported by strong automotive production, aftermarket customization, and rapid EV growth.

Market Segmentation Analysis:

By Type

Pull-type door handles lead this segment with a 46% share, driven by their wide use in passenger cars and strong compatibility with both traditional and modern door designs. Automakers prefer pull-type handles because they offer better grip, simple mechanics, and higher durability in daily usage. Push-type and lever-type handles gain steady adoption in commercial fleets that prioritize functional and cost-efficient hardware. Custom and specialty designs rise in premium models as styling becomes a key differentiator. Growing demand for enhanced aesthetics, improved ergonomics, and personalization supports stronger interest in high-end custom handle types.

- For instance, Huf Hülsbeck & Fürst is a global automotive supplier that develops and produces passive entry systems, including door handles with integrated capacitive touch sensors, for numerous global car manufacturers such as Daimler, BMW, and Ford.

By Vehicle Type

Passenger cars dominate this segment with a 61% share, supported by rising customization demand across sedans, SUVs, and hatchbacks. Manufacturers invest in customized door handle designs to meet growing consumer preference for premium looks, improved comfort, and advanced entry systems. Light commercial vehicles adopt sturdy and functional handle designs that tolerate frequent use, while heavy commercial vehicles emphasize operational durability and safety. Growth in electric and luxury vehicles increases adoption of sleek, lightweight, and flush-mounted designs. Rising global vehicle production and personalization trends further strengthen segment performance.

- For instance, Valeo supplies a gear shift actuator with a response time of less than 60 milliseconds (< 60 ms) for automatic transmissions, or a park lock actuator with a typical response time of 300 milliseconds. Valeo also produces flap actuators with a response time of less than 100 milliseconds (< 100 ms).

By Material

ABS plastics hold the dominant position with a 48% share, driven by their cost efficiency, light weight, and strong moldability for custom designs. Automakers favor ABS due to its durability, corrosion resistance, and ability to support complex shapes and finishes. Stainless steel remains popular in premium and high-wear applications where strength and long-term reliability are key. Aluminum grows due to rising demand for lightweight components in fuel-efficient and electric vehicles. Custom finishes, chrome coatings, and color-matched designs boost adoption across multiple vehicle categories, supporting wider material diversification in the market.

Key Growth Drivers

Rising Demand for Vehicle Customization

Growing consumer interest in personalized vehicle styling drives strong demand for custom automotive door handles. Buyers seek unique finishes, sculpted designs, and premium looks that enhance both aesthetics and brand identity. Automakers and aftermarket suppliers respond with wider customization options, including chrome, matte, carbon fiber, and color-matched variants. The trend is strongest in passenger cars and luxury vehicles where visual differentiation influences purchase decisions. Online customization platforms and accessory marketplaces further boost adoption by offering easy access to tailored designs.

- For instance, Mitsui Kinzoku produces zinc alloys used in various automotive components, which are subjected to general endurance and material performance testing to meet industry standards.

Expansion of Electric and Premium Vehicles

Electric vehicles and premium car segments accelerate growth as manufacturers adopt sleek, lightweight, and modern door handle designs. EV makers integrate flush-fit and aerodynamic handles to improve efficiency and align with futuristic styling. Premium brands demand high-quality materials such as aluminum, stainless steel, and carbon fiber to enhance user experience. Smart entry systems, including sensor-based and automatic pop-out handles, become more common. This shift toward advanced exterior components increases the need for custom solutions tailored to high-tech vehicle architectures.

- For instance, automotive suppliers like the Huf Group have developed flush door handles for electric cars (such as the Porsche Taycan) which include features like an “ice breaking function” to ensure reliable access even in extreme cold.

Increasing Adoption of Durable and Lightweight Materials

Demand for lightweight components pushes manufacturers to invest in advanced materials for custom door handles. ABS plastics, aluminum, and composite materials gain traction due to their low weight, high strength, and design flexibility. These materials support fuel-efficiency goals and improve long-term durability in both passenger and commercial vehicles. Automakers seek custom solutions that offer improved corrosion resistance, better grip comfort, and compatibility with modern door mechanisms. Material innovation also supports broader adoption of premium finishes and ergonomic designs.

Key Trends & Opportunities

Growth of Smart and Touchless Door Handle Technologies

Smart entry systems create new opportunities as automakers shift toward electronic and touchless handles. Keyless access, proximity sensors, and auto-present mechanisms gain popularity in high-end vehicles and EVs. This transition increases demand for customizable electronic housings, integrated lighting, and branded illuminated handles. Aftermarket players explore opportunities in retrofitting older vehicles with advanced handle systems. The rise of connected vehicle platforms also encourages the development of handles that integrate sensors and security features, expanding the market for premium electronic components.

- For instance, Tesla integrated door release buttons on the Cybertruck that are part of a full 48-volt electronic architecture, a departure from the traditional 12-volt systems used in most other vehicles.

Expansion of Aftermarket Customization Channels

The aftermarket sector grows rapidly as consumers seek personalized upgrades beyond OEM offerings. E-commerce platforms enable buyers to access a wide range of finishes, materials, and custom designs at competitive prices. Vehicle enthusiasts drive strong demand for themed, engraved, and performance-inspired door handles. Workshops and custom garages offer installation services that support wider adoption. The trend is strengthened by rising disposable income, growing automotive modification culture, and increased availability of high-quality third-party components.

- For instance, Aisin Corporation supplied aluminum front suspension towers for vehicles like the new Toyota Crown to enhance body rigidity and reduce weight. They use aluminum die-casting for various components, including transmission cases and water pump housings, and perform high-precision machining with tolerances down to the micron level for parts like manual transmission gears.

Key Challenges

High Cost of Premium Materials and Advanced Mechanisms

Premium materials such as aluminum, stainless steel, and carbon fiber increase production costs, limiting adoption in budget vehicles. Smart electronic door handles also require sensors, actuators, and control modules that raise manufacturing expenses. These components demand strict quality testing to ensure durability and safety. Price-sensitive customers in developing markets often prefer standard options, slowing growth for advanced custom designs. OEMs face cost pressures in balancing aesthetics, performance, and affordability across different vehicle segments.

Compatibility and Installation Constraints in Aftermarket Products

Aftermarket door handles often face challenges related to fitting, wiring compatibility, and alignment with factory door mechanisms. Variations in vehicle models and door structures create installation complexity. Incorrect fitting may affect door functionality, security, or weather sealing. Advanced electronic handles require proper integration with vehicle electronics, increasing installation difficulty. These constraints limit adoption among non-expert users and require skilled technicians, slowing market expansion in some regions.

Regional Analysis

North America

North America leads the Custom Automotive Car Door Handles market with a 36% share, driven by strong demand for premium vehicles and high adoption of advanced door handle technologies. Consumers favor customized finishes, smart entry systems, and durable materials across SUVs, trucks, and luxury cars. The region benefits from mature automotive manufacturing, rising EV adoption, and strong aftermarket activity. OEMs focus on lightweight and ergonomic designs that align with safety and styling needs. Growing customization culture and higher disposable income further strengthen market expansion across the U.S. and Canada.

Europe

Europe holds a 29% share, supported by strong production of luxury cars and a growing shift toward advanced design features. Automakers in Germany, Italy, and the UK invest heavily in premium materials such as aluminum, carbon fiber, and chrome-enhanced finishes. Rising EV adoption accelerates demand for flush-fit and aerodynamic handle designs. Strict safety regulations encourage manufacturers to incorporate durable mechanisms with enhanced user comfort. The aftermarket sector also expands due to high interest in personalization. Increasing focus on lightweight components supports wider use of ABS plastics and composite materials.

Asia Pacific

Asia Pacific accounts for a 27% share, driven by large-scale vehicle production and rising consumer interest in customization. China, Japan, and South Korea lead the region with strong OEM manufacturing and high adoption of modern styling features. Growing sales of passenger cars and EVs increase demand for lightweight, durable, and visually appealing door handles. Expanding aftermarket networks support rising modification trends among younger consumers. Rapid urbanization and rising income levels drive demand for premium finishes and ergonomic designs. Local suppliers also boost production capacity, improving accessibility across multiple vehicle categories.

Latin America

Latin America holds a 5% share, influenced by rising automotive production in Brazil and Mexico and increasing adoption of cost-effective custom accessories. Consumers show growing interest in visual upgrades such as chrome finishes, matte designs, and branded custom handles. OEM demand focuses on durable and affordable materials suited for varied environmental conditions. Aftermarket channels gain traction as vehicle owners invest in personalization and replacement components. Economic variability limits high-end adoption but steady growth continues due to expanding vehicle ownership and improving availability of customized products.

Middle East & Africa

Middle East & Africa represent a 3% share, supported by demand for customized and premium automotive styling across the Gulf countries. High adoption of luxury SUVs and off-road vehicles drives interest in durable, corrosion-resistant door handle designs. UAE and Saudi Arabia lead the region with strong preference for chrome, brushed metal, and engraved finishes. The aftermarket sector expands as consumers invest in personalization trends. In Africa, adoption grows slowly due to cost sensitivity, but rising vehicle imports support steady demand. Increasing urbanization and automotive upgrades strengthen long-term market potential.

Market Segmentations:

By Type

- Pull-Type Door Handles

- Push-Type Door Handles

- Lever-Type Door Handles

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Others

By Material

- Stainless Steel

- Aluminum

- ABS Plastics

- Others

By Finish / Style

- Matte

- Glossy

- Chrome

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Custom Automotive Car Door Handles market features key players such as Huf Hülsbeck & Fürst, ITW Automotive, Aisin Corporation, Magna International, Valeo, Witte Automotive, Toyota Boshoku Corporation, Grupo Antolin, Hyundai Mobis, and Mitsui Kinzoku. These companies strengthen their positions by expanding product portfolios that include pull-type, flush-mounted, lever-style, and electronic smart handles tailored for modern vehicle platforms. Leading manufacturers invest in lightweight materials such as ABS plastics, aluminum, and carbon fiber to improve durability and fuel efficiency. Innovation focuses on integrating touchless sensors, illumination modules, and aerodynamic shapes that align with EV and luxury vehicle design trends. Partnerships with global OEMs help enhance supply chain reach and customization capabilities. Companies also expand manufacturing capacity in Asia Pacific to meet rising demand from high-volume automakers. Continuous advancements in ergonomics, anti-corrosion coatings, and design aesthetics further support competitive differentiation across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Huf Hülsbeck & Fürst

- ITW Automotive

- Aisin Corporation

- Magna International

- Valeo

- Witte Automotive

- Toyota Boshoku Corporation

- Grupo Antolin

- Hyundai Mobis

- Mitsui Kinzoku (Mitsui Mining & Smelting)

Recent Developments

- In May 2025, Huf Hülsbeck & Fürst underwent a strategic investment when Sodecia Group acquired an initial 30 % stake, strengthening its access-and-authorization system business (which includes door-handle systems).

- In August 2024, Aisin Corporation was granted a patent for a vehicle-door-handle apparatus featuring a rotatable grip with an integrated switch device.

- In March 2023, Magna International launched its “SmartAccess™” power door system, including integrated handle-actuator and software capability, for luxury applications (e.g., the Ferrari Purosangue).

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle Type, Material, Finish / Style and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for customized and visually enhanced door handle designs will continue to rise across passenger vehicles.

- Smart and touchless door handle technologies will gain wider adoption as EV sales increase.

- Lightweight materials such as ABS plastics, aluminum, and composites will see higher usage to support fuel efficiency.

- OEMs will invest more in aerodynamic and flush-mounted handle designs that improve vehicle styling.

- The aftermarket sector will expand as consumers seek affordable personalization and replacement options.

- Integration of LED lighting and sensor modules will become more common in premium handle designs.

- Automation in manufacturing will increase production efficiency and improve product consistency.

- Global suppliers will expand operations in Asia Pacific to meet rising demand from high-volume automakers.

- Partnerships between handle manufacturers and EV brands will strengthen adoption of advanced mechanisms.

- Improved corrosion-resistant coatings and ergonomic designs will shape product innovation across all vehicle segments.