Market overview

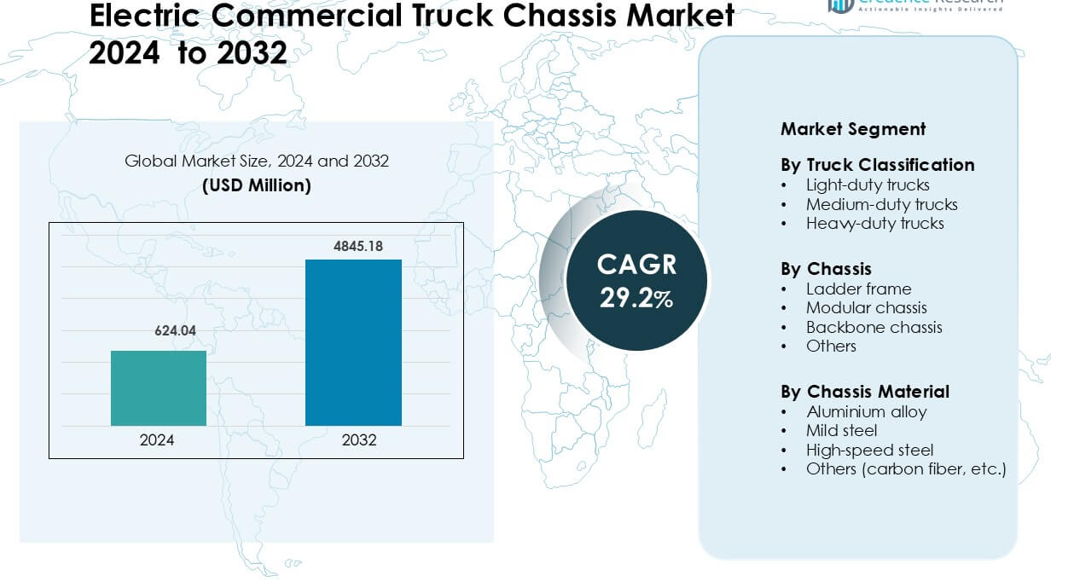

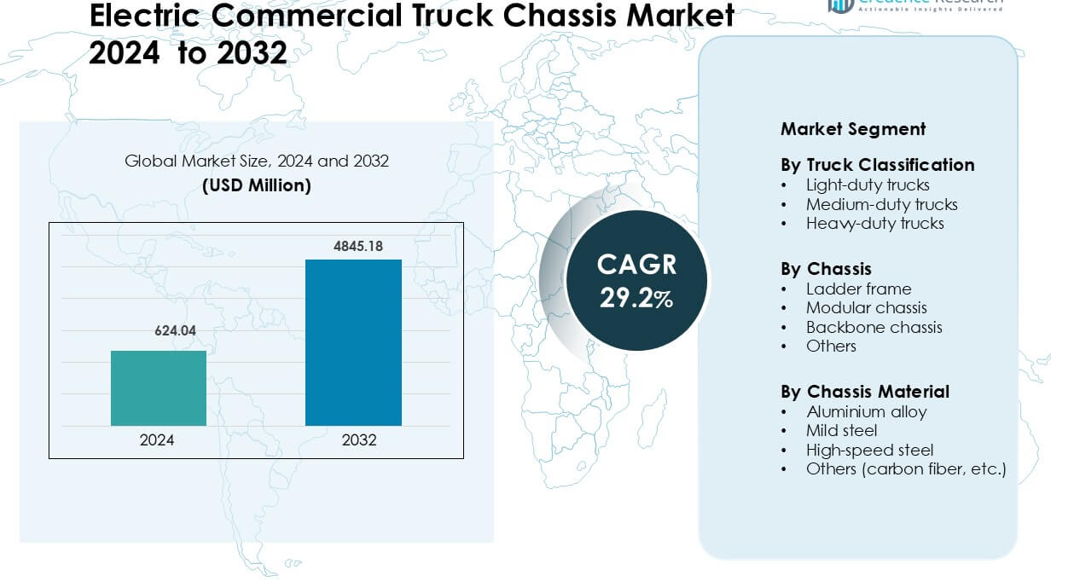

Electric Commercial Truck Chassis Market was valued at USD 624.04 million in 2024 and is anticipated to reach USD 4845.18 million by 2032, growing at a CAGR of 29.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Commercial Truck Chassis Market Size 2024 |

USD 624.04 million |

| Electric Commercial Truck Chassis Market, CAGR |

29.2% |

| Electric Commercial Truck Chassis Market Size 2032 |

USD 4845.18 million |

The Electric Commercial Truck Chassis Market is shaped by leading manufacturers such as Scania AB, Ford Motor Company, Tata Motors, Tesla, Inc., Navistar International Corporation, Hyundai Motor Company, Volvo Trucks, Paccar Inc., Mercedez (Daimler), and Isuzu Motors Limited. These companies compete through lightweight chassis designs, modular skateboard platforms, and improved battery-integration structures that support higher payload efficiency and lower operating costs. North America stands as the leading region, holding 37% market share in 2024, supported by strong fleet electrification, government incentives, and fast-growing charging-infrastructure deployment across logistics and municipal applications.

Market Insights

- The Electric Commercial Truck Chassis Market reached USD 624.04 million in 2024 and is projected to hit USD 4845.18 million by 2032, growing at a CAGR of 29.2% during the forecast period.

- Demand grows as fleet operators shift to electric light-duty trucks, which held the largest share at 46% in 2024, driven by last-mile delivery expansion and lower operating costs.

- Key trends include rapid adoption of modular skateboard chassis and increased use of lightweight aluminium platforms that improve range and payload efficiency across commercial fleets.

- Competition intensifies among Scania AB, Tata Motors, Tesla, Hyundai Motor Company, and Volvo Trucks as they focus on advanced battery integration, telematics, and scalable chassis architectures.

- North America leads with 37% regional share in 2024, followed by Europe at 31%, while Asia Pacific expands steadily due to large-scale manufacturing and rising urban logistics demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Truck Classification

Light-duty trucks hold the dominant share at about 46% in 2024, driven by strong adoption in urban logistics, last-mile delivery, and municipal fleet transitions. Fleet operators prefer light-duty electric platforms because they offer lower battery capacity needs, faster charging, and better maneuverability in congested zones. E-commerce companies expand demand by shifting to compact chassis formats that reduce operating costs. Medium-duty trucks grow in regional distribution roles, while heavy-duty platforms advance slower due to high battery weight, limited fast-charging access, and longer return-on-investment cycles.

- For instance, Mercedes-Benz’s eSprinter, a light commercial van, uses a 113kWh battery and supports DC fast-charging at 115 kW, allowing a 10% → 80% top-up in around 42 minutes.

By Chassis Type

The ladder frame chassis segment leads the market with roughly 57% share in 2024, supported by its high load-bearing capability and structural rigidity, which suit delivery vans, utility trucks, and mid-capacity cargo carriers. Manufacturers retain this architecture because it supports diverse body configurations and simplifies integration of large battery packs. Modular chassis platforms gain traction as OEMs adopt skateboard designs for scalable production. Backbone chassis and other niche configurations remain limited, as operators prioritize proven durability and easier fleet maintenance offered by ladder-type frameworks.

- For instance, Stellantis’ new STLA Frame platform is a body-on-frame architecture built from high-strength steel, designed to house liquid-cooled battery packs from 159 kWh to over 200 kWh, and supports 800-volt DC charging at up to 350 kW, which enables adding 100 miles of range in just 10 minutes.

By Chassis Material

Aluminium alloy remains the dominant chassis material with around 49% share in 2024, driven by rising demand for lightweight structures that extend driving range and improve energy efficiency. OEMs favor aluminium platforms due to corrosion resistance, manufacturing flexibility, and high strength-to-weight balance. Mild steel retains presence in cost-sensitive fleets, while high-strength steel expands in heavy-duty electric models needing enhanced crash performance. Advanced composites such as carbon fiber grow slowly due to higher production costs and limited large-scale adoption, despite offering significant weight-reduction benefits.

Key Growth Drivers

Growing Fleet Electrification Across Logistics and Municipal Services

Fleet operators shift rapidly toward electric commercial trucks as governments tighten emission norms and expand urban clean-mobility programs. This shift boosts demand for electric truck chassis that support higher payload efficiency, optimized battery placement, and rigid structural geometry for daily commercial use. Major logistics companies integrate electric fleets in last-mile and short-haul routes to lower running costs and comply with zero-emission delivery commitments. Municipal bodies also adopt electric waste collection trucks, maintenance fleets, and utility vehicles. These transitions push OEMs to scale high-strength, lightweight chassis architectures that enhance energy efficiency, support modular battery packs, and increase fleet uptime.

- For instance, Amazon’s partnership with Rivian is part of a larger commitment to have 100,000 EDVs on the road by 2030 to achieve net-zero carbon emissions by 2040. Amazon has also installed over 32,000 chargers at more than 180 delivery stations across the U.S. to support this fleet.

Advances in Lightweight Materials and Modular Chassis Engineering

The market grows as manufacturers invest in aluminium alloys, high-strength steels, and composite materials that improve strength while reducing vehicle weight. Lightweight chassis structures extend range per charge and support higher payload ratios without compromising durability, which helps fleet owners maximize revenue per trip. Modular skateboard-style chassis designs enable flexible configurations for delivery vans, cargo bodies, and utility builds. This design evolution accelerates platform sharing across classes, reduces production cost, and speeds up model launches. OEMs use these engineering upgrades to address diverse fleet needs and meet efficiency, safety, and performance standards.

- For instance, Volvo Trucks SuperTruck research vehicle uses a chassis that is almost entirely made of aluminum, bringing down body weight by about 1,450 kg (3,200 lb).

Expansion of Charging Infrastructure and Battery Innovations

Growth accelerates with improved fast-charging networks, depot charging systems, and high-capacity ultra-rapid chargers designed for commercial fleets. Energy companies and logistics hubs set up dedicated charging yards that shorten charging downtime and support predictable route planning. Battery innovations—such as LFP chemistries, structural battery packs, and higher-density modules—allow longer ranges, stable thermal behavior, and improved cycle life. These advances enable OEMs to design chassis with integrated battery housings and lower-center-of-gravity layouts. Greater infrastructure availability and battery efficiency strengthen adoption across regional delivery, e-commerce logistics, and urban freight operations.

Key Trend & Opportunity

Rising Adoption of Modular Skateboard Chassis Platforms

A strong trend in the market is the scaling of skateboard-based chassis designs that integrate motors, electronics, and battery packs into a single flat platform. This architecture supports multiple vehicle bodies—cargo vans, box trucks, utility carriers—allowing OEMs to reduce development costs and speed up model replacements. The flat, low-floor design enhances stability, improves cargo accessibility, and increases interior volume, which helps fleet operators improve route productivity. As digital integration expands, these platforms support advanced telematics, OTA updates, and ADAS technologies, creating a versatile ecosystem for electric logistics fleets.

- For instance, Rivian’s skateboard platform integrates its battery, quad-motor drive units, and in-house digital architecture (including its telematics and vehicle-dynamics ECUs), enabling its R1T, R1S, and EDV vans to use the same base chassis.

Growing Use of Lightweight Composites in High-Load Applications

Manufacturers explore carbon fiber blends and advanced composites to build ultra-light chassis that deliver greater energy efficiency and longer operational range. These materials reduce structural weight while maintaining rigidity needed for heavy-duty use, creating opportunities in long-haul and high-load electric trucks. As production costs decline, composites enable chassis with better corrosion resistance, longer component life, and reduced maintenance needs. This shift opens growth prospects in premium logistics fleets, refrigerated transport, and specialized utility trucks that require strong structural frames without compromising battery range.

- For instance, Carbon Truck & Trailer GmbH (CarbonTT) has developed pultruded carbon-fiber-reinforced polymer (CFRP) chassis beams that save about 300 kg per vehicle compared to standard steel beams.

Key Challenges

High Initial Costs and Slow Return on Investment for Fleets

Electric commercial truck chassis involve higher upfront costs due to battery packs, advanced materials, and integrated power electronics. Many fleet operators hesitate because payback periods remain longer in regions with limited charging infrastructure or higher electricity tariffs. Small logistics companies face financial barriers in upgrading to electric fleets, slowing adoption outside major cities. Although operational savings exist, concerns around battery replacement, depreciation, and resale value persist. These cost pressures restrict rapid scaling and force OEMs to balance advanced engineering with affordability in high-volume commercial segments.

Limited Charging Infrastructure for Mid- and Heavy-Duty Routes

Infrastructure gaps remain a major bottleneck, especially for medium-duty and heavy-duty commercial trucks that need higher charging power and frequent top-ups along regional routes. Many logistics corridors lack megawatt charging systems, making long-distance operations difficult. Depot charging can support local fleets, but fast-charging availability outside urban clusters remains inconsistent. This restricts adoption in intercity freight, construction fleets, and utility transport. Until high-capacity chargers scale nationwide, operators face range anxiety and scheduling challenges, slowing the integration of electric truck chassis in wider commercial applications.

Regional Analysis

North America

North America leads the Electric Commercial Truck Chassis Market with about 37% share in 2024, supported by strong fleet electrification programs, government incentives, and early adoption by e-commerce logistics operators. The U.S. invests heavily in depot charging, fast-charging corridors, and urban clean-mobility zones, which boost demand for light- and medium-duty electric truck chassis. Canada expands interest through provincial emission regulations and clean-transport grants. Major OEMs and startups operate regional assembly plants that improve supply chain stability. Growth strengthens as retailers, parcel operators, and municipal fleets shift toward low-maintenance and energy-efficient chassis architectures.

Europe

Europe holds about 31% share in 2024, driven by strict CO₂ regulations, urban zero-emission delivery mandates, and strong adoption of modular electric truck platforms. Countries including Germany, France, the Netherlands, and the Nordics lead deployment as fleet operators respond to congestion-zone restrictions and rising carbon taxes. European OEMs accelerate production of lightweight aluminium and modular skateboard chassis to enhance payload efficiency. Supportive policies and high fuel prices increase demand for electric commercial fleets across regional logistics networks. Infrastructure expansion and large municipal procurement programs continue to strengthen market momentum across major EU economies.

Asia Pacific

Asia Pacific accounts for nearly 26% share in 2024, supported by rapid urbanization, large manufacturing capacity, and expanding commercial EV programs in China, Japan, and South Korea. China drives the region through strong policy support, large-scale battery production, and wide deployment of electric logistics fleets. India increases interest through clean-transport incentives and last-mile delivery electrification. Regional OEMs scale lightweight steel and aluminium chassis platforms to meet cost-sensitive fleet needs. Rising e-commerce activity and improved charging access accelerate adoption of light-duty electric truck chassis across dense metropolitan areas.

Latin America

Latin America holds close to 4% share in 2024, with demand growing in logistics hubs across Brazil, Mexico, and Chile. Adoption remains slower compared with major markets due to high upfront vehicle pricing and limited public charging infrastructure. However, fleet electrification gains momentum as governments introduce tax reductions, clean-mobility incentives, and city-level emission rules. E-commerce expansion encourages operators to explore electric light-duty platforms for shorter routes. Regional assemblers partner with global OEMs to introduce cost-efficient chassis options suited to local operating conditions, gradually improving market penetration.

Middle East & Africa

The Middle East & Africa region captures about 2% share in 2024, driven by early adoption in the UAE, Saudi Arabia, and South Africa. Growth is supported by national decarbonization strategies, fleet modernization programs, and investments in electric mobility zones. Logistics companies test electric chassis platforms for controlled urban routes, while government fleets pilot electric utility and maintenance trucks. Infrastructure limitations and high initial costs slow broader adoption, but rising interest in sustainable transport and regional EV manufacturing partnerships begin to strengthen long-term market prospects.

Market Segmentations

By Truck Classification

- Light-duty trucks

- Medium-duty trucks

- Heavy-duty trucks

By Chassis

- Ladder frame

- Modular chassis

- Backbone chassis

- Others

By Chassis Material

- Aluminium alloy

- Mild steel

- High-speed steel

- Others (carbon fiber, etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Commercial Truck Chassis Market features strong competition among global manufacturers such as Scania AB, Ford Motor Company, Tata Motors, Tesla, Inc., Navistar International Corporation, Hyundai Motor Company, Volvo Trucks, Paccar Inc., Mercedez (Daimler), and Isuzu Motors Limited. These companies expand portfolios with lightweight aluminium and high-strength steel chassis designed for improved range, payload capacity, and battery integration. Many OEMs invest in modular skateboard architectures that support multiple commercial body types, helping fleets reduce procurement complexity. Strategic partnerships with battery suppliers, charging infrastructure firms, and telematics providers strengthen product performance and operational reliability. Manufacturers also scale regional assembly networks to cut logistics costs and meet local regulatory targets. Continuous R&D spending focuses on structural rigidity, thermal safety, and energy-efficient chassis layouts, ensuring competitive differentiation in a rapidly electrifying commercial transport sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Scania AB

- Ford Motor Company

- Tata Motors

- Tesla, Inc.

- Navistar International Corporation

- Hyundai Motor Company

- Volvo Trucks

- Paccar Inc.

- Mercedez (Daimler)

- Isuzu Motors Limited

Recent Developments

- In November 2025, Tesla revealed a refreshed Semi with new aero design and lighting. The update targets higher efficiency and keeps the platform positioned for long-range, autonomy-ready freight operations

- In October 2023, Scania redesigned its Södertälje chassis assembly plant for electric trucks. The new building, line system, and layout handle heavier battery packs and modular frames

Report Coverage

The research report offers an in-depth analysis based on Truck Classification, Chassis, Chassis Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of electric commercial truck chassis will rise as fleet operators accelerate decarbonization plans.

- Lightweight aluminium and high-strength steel chassis will gain wider use to improve range and payload.

- Modular skateboard platforms will expand across light-, medium-, and heavy-duty truck categories.

- Battery-integrated chassis designs will become standard as OEMs seek better thermal control and safety.

- Regional assembly hubs will grow to reduce logistics costs and meet local regulatory targets.

- Fast-charging and depot-charging expansion will support broader commercial fleet transitions.

- Digital telematics and OTA integration will enhance chassis performance and fleet management efficiency.

- Partnerships between OEMs, battery suppliers, and charging providers will increase.

- Heavy-duty electric chassis adoption will accelerate as energy-dense batteries mature.

- Fleet demand for low-maintenance and long-life chassis systems will shape future product development.