Market Overview:

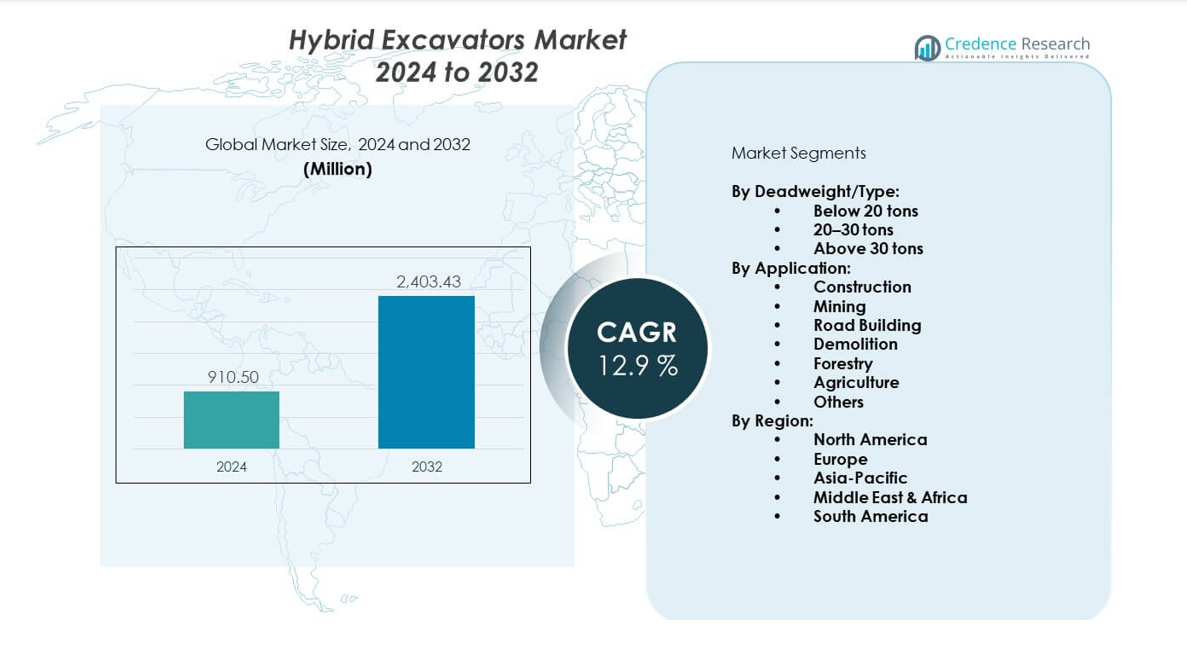

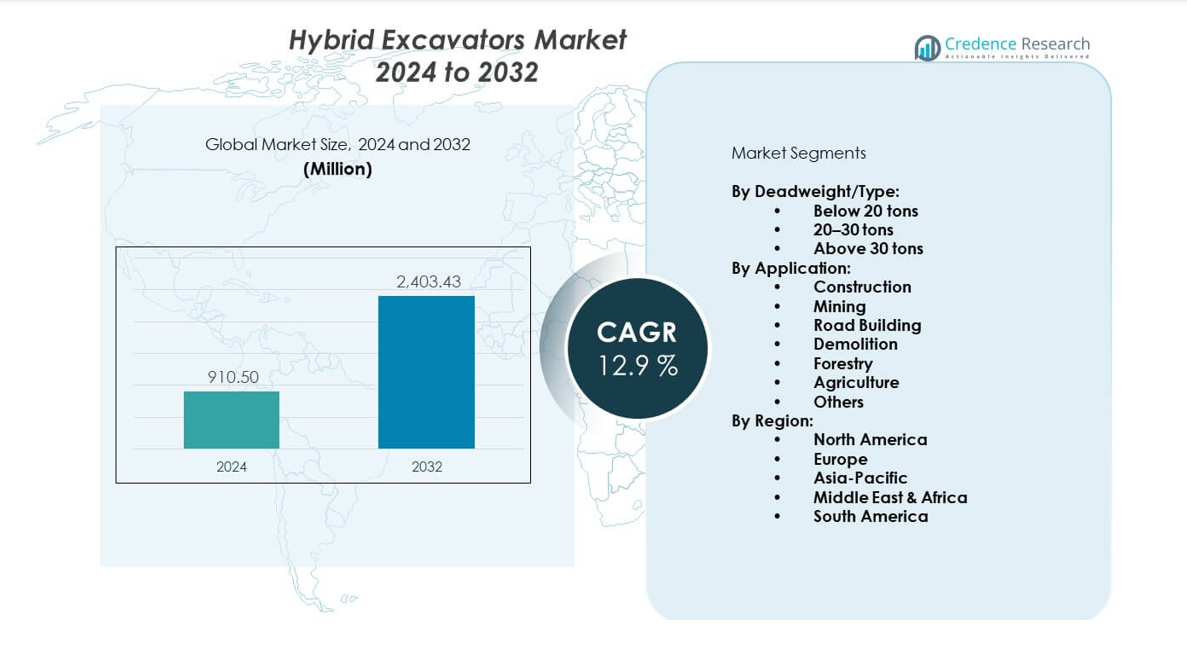

The Hybrid excavators market is projected to grow from USD 910.5 million in 2024 to an estimated USD 2,403.43 million by 2032, with a compound annual growth rate (CAGR) of 12.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hybrid Excavators Market Size 2024 |

USD 910.5 million |

| Hybrid Excavators Market, CAGR |

12.9% |

| Hybrid Excavators Market Size 2032 |

USD 2,403.43 million |

Demand rises due to wider focus on fuel savings, cleaner job sites, and stronger carbon-reduction goals. Builders select hybrid excavators to cut fuel burn during long working cycles. Engine-motor systems support smoother performance in urban zones with noise limits. Project owners prioritize machines that reduce downtime and improve return on investment. Manufacturers push new hybrid platforms to meet sustainability targets. Contractors adopt smart monitoring tools to boost fleet efficiency. Public infrastructure upgrades also lift equipment use. Green policies reinforce industry confidence.

Asia Pacific leads due to rapid construction growth, large fleet replacement needs, and firm sustainability targets. China and Japan adopt advanced hybrid machinery early due to strong domestic production and strict emission norms. Europe shows steady traction as contractors shift toward greener fleets to meet environmental standards. North America records healthy uptake through smart city programs and rising urban redevelopment work. Emerging markets in Southeast Asia and Latin America gain pace as infrastructure spending expands and hybrid options become more accessible

Market Insights:

- The Hybrid excavators market was valued at USD 910.5 million in 2024 and is projected to reach USD 2,403.43 million by 2032, growing at a 12.9% CAGR driven by stricter emission norms and rising fuel-efficiency demands.

- Asia Pacific (45%), Europe (25%), and North America (20%) hold the largest shares due to strong infrastructure spending, mature OEM presence, and firm environmental regulations supporting hybrid adoption.

- Asia Pacific remains the fastest-growing region, supported by urban development, strict emission rules, and accelerated fleet modernization across China, India, and Japan.

- The construction segment holds about 40% share due to its high hybrid deployment across urban and infrastructure projects.

- The 20–30-ton category leads with roughly 50% share as contractors prefer balanced performance and efficiency for mixed civil engineering work.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Focus on Fuel Savings and Lower Carbon Emissions

Construction firms raise demand for hybrid machinery to reduce fuel burn and cut greenhouse gas output. Contractors select efficient powertrain systems to control operating expenses on long work cycles. Governments tighten emission norms that push fleets toward greener models. Urban projects favor quieter machines to meet noise rules on dense job sites. Operators value smoother control from electric-assist systems that support better precision. Buyers compare lifetime cost advantages before replacing older diesel units. Manufacturers strengthen hybrid portfolios through steady design upgrades. The Hybrid excavators market gains support from stronger sustainability targets across regions.

- For instance, Komatsu’s HB215LC-3 hybrid excavator reports up to 20% lower fuel consumption verified through multiple field evaluations.

Growing Adoption in Large Infrastructure and Civil Engineering Projects

Governments expand roadwork, metro systems, and city renewal plans that require hybrid fleets for greener execution. Contractors deploy hybrid units to reduce idle fuel loss during long tracking paths. Public agencies frame procurement policies that prioritize reduced-emission machinery. Mining and quarry operators explore hybrid platforms to boost efficiency during heavy digging cycles. Rental companies add hybrid options to meet rising contractor inquiries. Project planners prefer machines that offer steady performance under strict work-hour limits. Buyers evaluate hybrid durability under tough site loads. The Hybrid excavators market benefits from increased investment across major infrastructure corridors.

- For instance, Hitachi’s ZH210-6 hybrid model delivers up to 15% fuel savings in large infrastructure projects, confirmed through real-world contractor testing.

Advancements in Hybrid Powertrain Technology and System Integration

New battery chemistries deliver higher charge retention during demanding site tasks. OEMs refine regeneration systems to capture braking energy for improved efficiency. Control software helps operators shift between engine and motor power with ease. Designers cut component weight to support better power distribution. Cooling systems evolve to handle high electrical loads under warm conditions. Hybrid modules gain reliability due to stronger thermal management. Testing cycles expand to validate performance across varied terrains. The Hybrid excavators market gains momentum through rapid technological upgrades.

Government Incentives and Supportive Environmental Policies

National programs promote low-emission construction equipment to meet climate goals. Authorities offer tax credits and duty relief for hybrid machinery adoption. Local agencies frame rules that restrict diesel-only fleets in urban cores. Energy departments promote hybrid research to cut construction-sector emissions. Compliance schemes reward companies that meet energy-use limits. Buyers align fleet plans with regional green mandates. Hybrid models receive priority in tenders with sustainability scoring. The Hybrid excavators market strengthens through strong regulatory alignment.

Market Trends:

Expansion of Smart Machine Control and Connected Fleet Technologies

Contractors use telematics to track performance and optimize site operations. Fleet managers rely on data insights to plan predictive service windows. Sensor-based monitoring helps detect early faults before heavy downtime. Digital dashboards offer clear visibility for large site teams. Operators gain real-time guidance for better power mode use. Remote diagnostics support quick decision-making during breakdowns. Connectivity tools align multi-machine coordination on complex sites. The Hybrid excavators market embraces connected systems that lift productivity.

- For instance, Volvo CE’s ActiveCare telematics monitoring service is designed to improve fleet uptime through predictive maintenance insights that allow for proactive repairs, which is verified in customer deployments and widely recognized for reducing unplanned downtime and improving fleet availability.

Shift Toward Electrified Components in Hybrid Platforms

OEMs integrate stronger electric motors to enhance digging response. Battery packs gain higher energy density for longer task cycles. Designers refine electric swing systems that support smooth motion control. Suppliers expand parts lines for electric-drive modules. New hybrid platforms reduce reliance on large diesel engines. Production lines adapt to mixed powertrain manufacturing. Operators experience better torque feedback during precision tasks. The Hybrid excavators market advances through steady electrification progress.

- For instance, Caterpillar’s 336 Hybrid model uses an electric-hydraulic system that cuts fuel use by up to 25% based on verified Cat job-site data.

Rising Demand from Rental Fleets and Short-Term Project Contractors

Rental firms expand hybrid inventories to meet demand from urban job sites. Contractors prefer renting to test hybrid performance before long-term buying. Fleet operators look for machines that offer lower operating cost per shift. Hybrid units fit well in noise-sensitive applications across cities. Rental firms track machine health closely through connected tools. Hybrid reliability builds confidence for varied site conditions. Short-term projects adopt hybrids to meet green contract clauses. The Hybrid excavators market gains traction across rental ecosystems.

Integration of Autonomous and Semi-Automated Functions

Developers add automated digging modes that reduce operator fatigue. Safety systems use cameras and sensors for clearer site awareness. Semi-autonomous controls guide operators during leveling work. AI tools refine power distribution across hybrid modules. Autonomous-ready platforms attract interest from large contractors. Machine-learning models study load patterns for better task prediction. Remote operation stations improve safety in risky terrain. The Hybrid excavators market moves toward smart automation features.

Market Challenges Analysis:

High Upfront Costs and Limited Awareness Among Small Contractors

Smaller firms hesitate to invest due to higher hybrid pricing. Buyers compare diesel options that appear cheaper at the start. Limited awareness of lifetime savings slows early adoption. Service teams require training to maintain hybrid modules. Rural contractors struggle with access to hybrid parts. Financing options remain uneven across developing regions. Buyers face uncertainty about long-term component durability. The Hybrid excavators market manages cost concerns during early fleet transitions.

Infrastructure Gaps and Technical Complexity Across Key Regions

Charging support for hybrid and electric-assist systems remains limited in many markets. Service networks must expand to handle advanced electrical components. Technicians need stronger skill sets to manage complex powertrains. Component availability varies across countries with weaker supply chains. Import delays affect parts replacement for hybrid systems. Contractors in remote regions face downtime due to technical dependency. Buyers reconsider hybrid choices when support gaps appear. The Hybrid excavators market navigates uneven infrastructure maturity.

Market Opportunities:

Growing Push for Green Construction and Urban Sustainability Targets

Cities plan large projects with strict emission rules that favor hybrids. Contractors seek greener fleets to qualify for public tenders. Hybrid units support noise-controlled operations in dense zones. Governments frame long-term climate mandates that lift hybrid relevance. OEMs adapt offerings to meet expanding green procurement lists. Project owners prefer efficient machinery that improves work output. Fleet operators plan hybrid expansion to meet policy timelines. The Hybrid excavators market gains scope in sustainability-driven regions.

Expansion Potential in Developing Markets Through Fleet Modernization

Developing countries invest in infrastructure that requires modern machinery. Older fleets push buyers toward efficient hybrid models. Import policies evolve to support eco-friendly equipment. Contractors adopt hybrids to reduce lifetime running costs. Training programs help operators manage hybrid controls. Rental chains introduce hybrid options for flexible access. Buyers view hybrid systems as a long-term upgrade path. The Hybrid excavators market finds strong prospects in emerging economies.

Market Segmentation Analysis:

By Deadweight/Type

The Hybrid excavators market expands across three core weight classes that serve varied project demands. Below 20-ton models gain strong use in urban construction due to compact size and higher maneuverability. Contractors prefer 20–30-ton units for balanced power and fuel savings across mixed civil projects. Above 30-ton machines support mining, large earthmoving, and heavy industrial work where high torque and endurance matter. Buyers evaluate performance, maintenance needs, and hybrid efficiency before selecting a suitable weight class. Rental fleets stock mid-range models to address diverse client needs. OEMs refine hybrid systems to support better fuel control across all power bands. Each type strengthens its role based on specific site requirements.

- For instance, Hyundai’s HX220AL mid-range machine reports up to 12% improved fuel efficiency in field assessments due to advanced power-control systems.

By Application

The Hybrid excavators market covers a broad application base driven by infrastructure expansion and sustainability goals. Construction remains the largest segment due to rising project volumes across cities. Mining operators deploy hybrid units to reduce fuel costs during extended digging cycles. Road-building crews prefer hybrids for long duty hours on major corridors. Demolition firms adopt hybrids to meet noise and emission limits in dense areas. Forestry users rely on electric-assist torque for controlled handling. Agriculture applications grow through fleet upgrades in large farms. Other sectors adopt hybrid platforms where efficiency and lower emissions support long-term fleet plans.

- For instance, SANY’s SY215 hybrid model demonstrated up to 15% fuel reduction during road-building and quarry operations as verified in customer case studies.

Segmentation:

By Deadweight/Type:

- Below 20 tons

- 20–30 tons

- Above 30 tons

By Application:

- Construction

- Mining

- Road Building

- Demolition

- Forestry

- Agriculture

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific

The Hybrid excavators market secures the highest share in Asia Pacific, holding over 45% of global demand. Strong construction spending in China, India, and Southeast Asia pushes rapid adoption across major infrastructure corridors. Japan and South Korea advance hybrid deployment through strict emission standards and strong OEM presence. Contractors favor hybrid units to improve fuel savings on long work cycles. Governments support greener machinery to lower construction-related emissions. Rental companies expand hybrid fleets to serve dense urban zones. The region maintains its lead through continuous investment in large public projects.

Europe

Europe accounts for around 25% of the Hybrid excavators market due to strong environmental policies and early hybrid technology adoption. Contractors deploy hybrid models to meet low-emission requirements in major cities. Germany, France, the U.K., and the Nordics show strong interest in hybrid machinery supported by local incentives. Fleet owners upgrade older diesel units to comply with sustainability guidelines. OEMs based in the region introduce advanced hybrid platforms tuned for reduced noise and fuel use. Public infrastructure programs create steady demand across transportation and urban renewal work. The region strengthens its position through firm regulatory alignment.

North America, Middle East & Africa, and South America

North America holds about 20% share driven by urban infrastructure upgrades and rising interest in low-emission equipment. Contractors value hybrid reliability for long shifts on large public projects. The Middle East & Africa captures roughly 6% share supported by selective adoption in mining, construction, and energy-sector developments. South America contributes around 4% share through gradual uptake in Brazil and Argentina. Buyers across emerging markets evaluate hybrid options to cut fuel costs during long operating cycles. Governments introduce targeted sustainability programs that lift regional acceptance. The Hybrid excavators market moves steadily across these regions through mixed infrastructure needs and evolving policy support.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Hybrid excavators market features strong competition among global OEMs that invest in cleaner powertrains and advanced control systems. Leading companies such as Caterpillar, Komatsu, Hitachi, Volvo CE, and SANY expand hybrid lines to address rising demand for low-emission machinery. Manufacturers refine battery systems, electric swing motors, and regeneration modules to improve site productivity. Players focus on fuel savings, reliability, and long-duty performance to secure larger fleet contracts. Partnerships with component suppliers help strengthen hybrid integration. Rental chains adopt hybrid units to broaden access for contractors. Product differentiation centers on efficiency gains, smart features, and durable hybrid components. The Hybrid excavators market remains dynamic with continuous innovation cycles.

Recent Developments:

- Komatsu entered a strategic partnership with Cummins in September 2025, focusing on hybrid powertrain development for heavy mining equipment. This alliance targets practical decarbonization and improved efficiency in surface haulage mining trucks, accelerating the industry’s shift to low-carbon technologies. This collaboration also includes Komatsu’s drive system supplier Wabtec, forming a tripartite effort towards next-generation hybrid mining solutions.

- In 2025, Caterpillar announced significant updates to its hydraulic excavator lineup, including the advanced Cat 395 Front Shovel unveiled at bauma 2025, designed for mining with high digging force and efficiency.

Report Coverage:

The research report offers an in-depth analysis based on By Deadweight/Type and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Hybrid demand rises as contractors prioritize fuel efficiency and sustainability goals.

- OEMs expand hybrid lines with advanced batteries and improved regeneration systems.

- Rental fleets grow hybrid availability across urban and heavy-duty categories.

- Digital tools strengthen hybrid fleet monitoring and uptime planning.

- Noise-restricted cities push wider adoption in dense project zones.

- Mining and quarry operators test high-power hybrids for long excavation cycles.

- Regulations accelerate hybrid adoption across public infrastructure tenders.

- Service networks evolve to support hybrid diagnostics and powertrain parts.

- Emerging markets discover hybrid benefits through fleet modernization.

- Technology integration positions hybrids as a long-term alternative to diesel units.