Market Overview

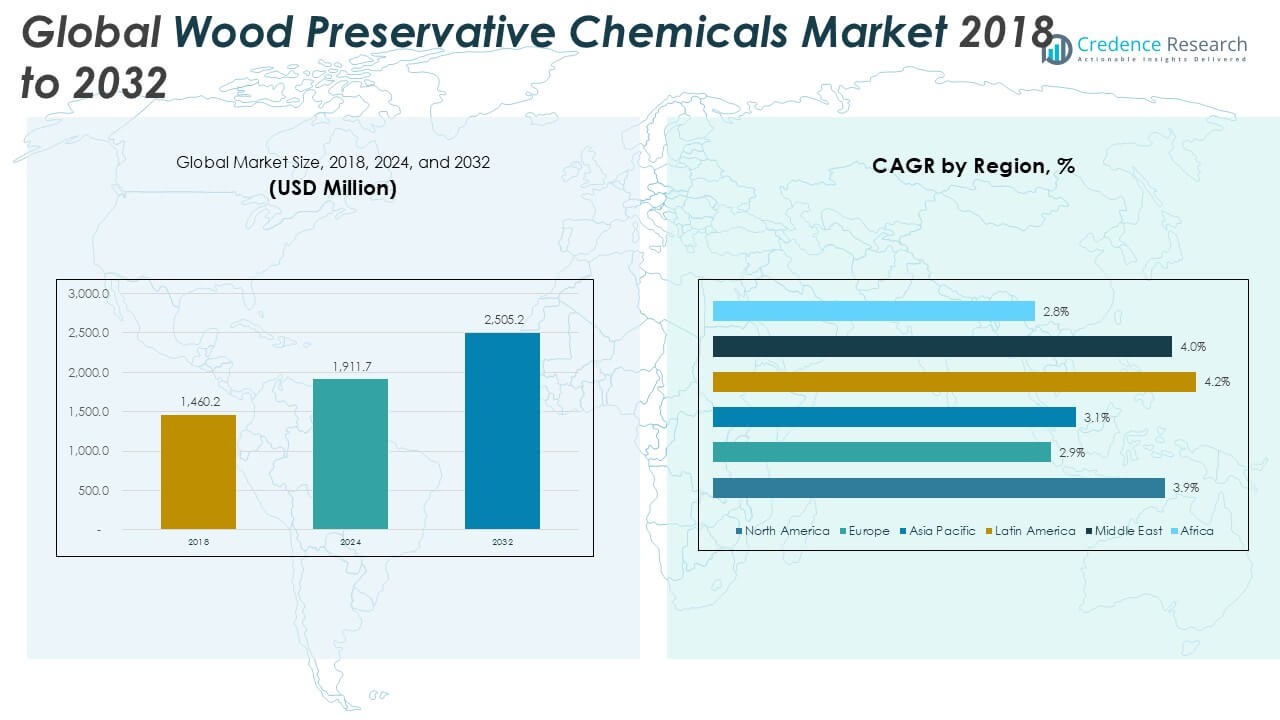

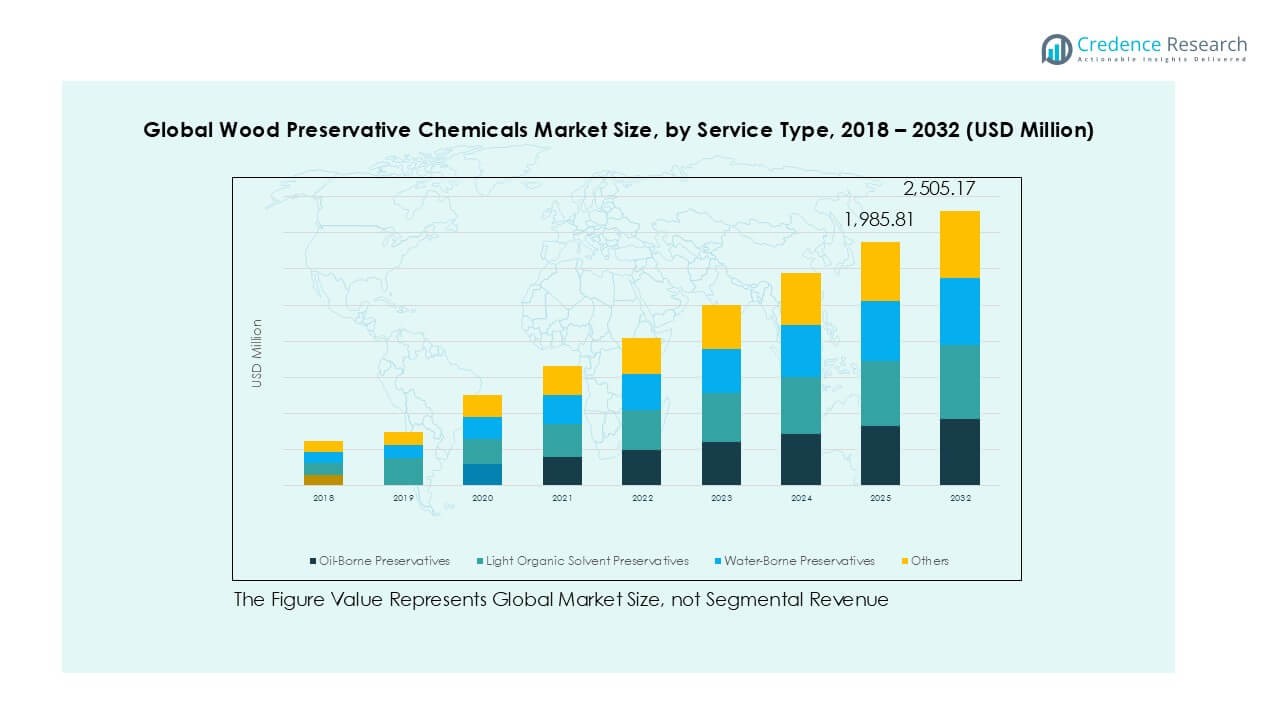

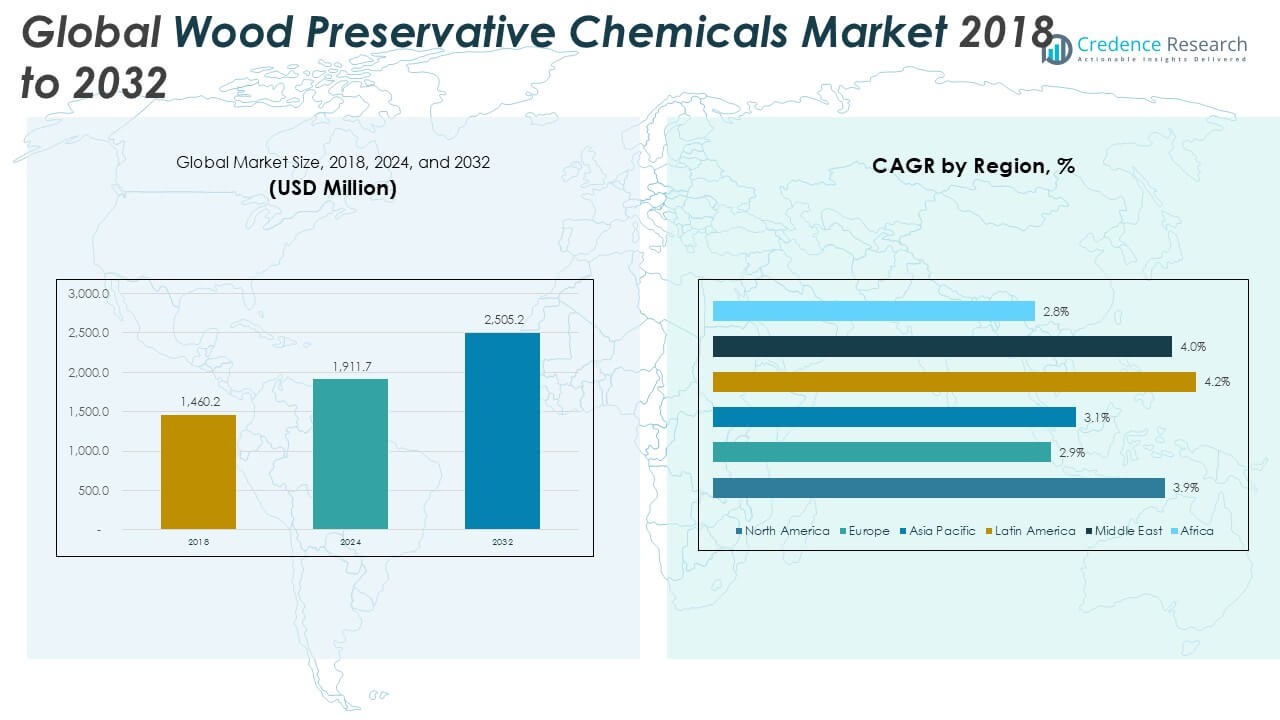

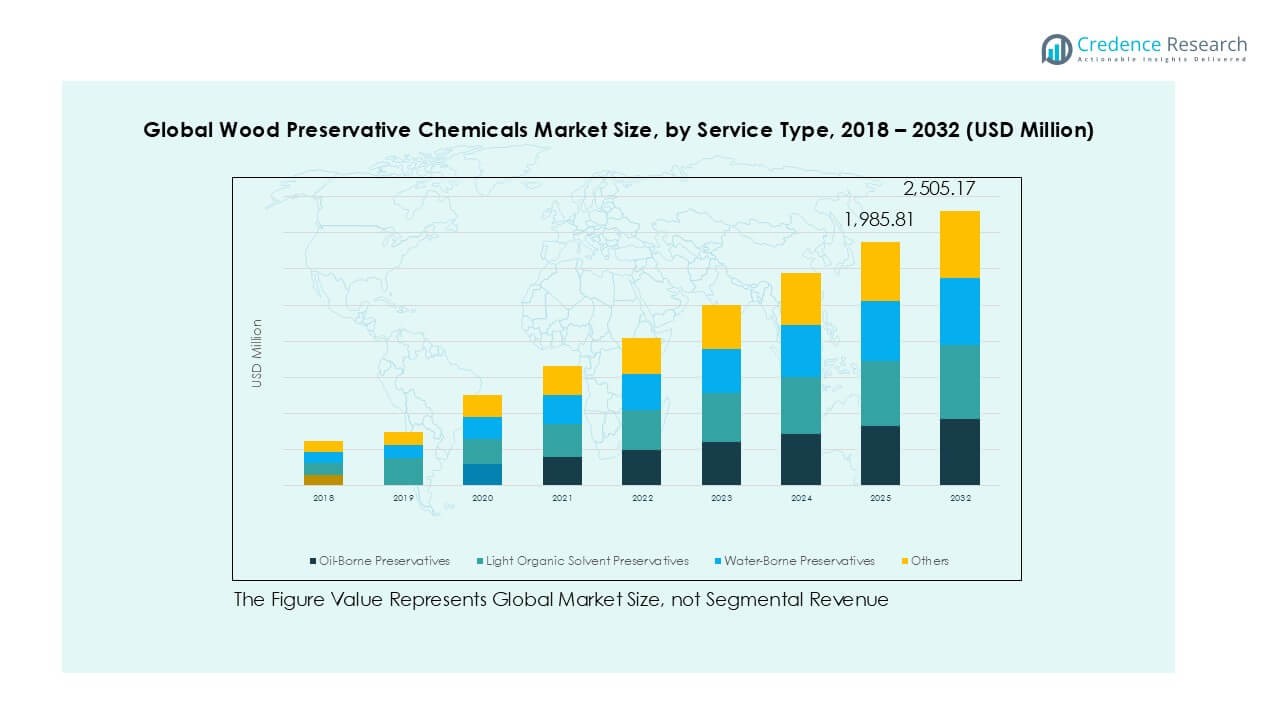

The Wood Preservative Chemicals Market size was valued at USD 1,460.2 million in 2018, increased to USD 1,911.7 million in 2024, and is anticipated to reach USD 2,505.2 million by 2032, at a CAGR of 3.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wood Preservative Chemicals Market Size 2024 |

USD 1,911.7 Million |

| Wood Preservative Chemicals Market , CAGR |

3.37% |

| Wood Preservative Chemicals Market Size 2032 |

USD 2,505.2 Million |

The wood preservative chemicals market is led by key players such as KMG Chemicals Inc., Lonza Group, Viance LLC, Kop-Coat Incorporated, and Osmose Inc., all of which maintain strong market positions through extensive product portfolios, global distribution networks, and a focus on innovation. These companies prioritize eco-friendly and high-performance formulations to align with regulatory trends and customer demand. Regionally, Asia Pacific dominates the market with a 35.2% share in 2024, driven by robust construction activity, rapid urbanization, and increasing demand for treated wood in infrastructure and furniture applications. North America and Europe follow, supported by advanced wood treatment technologies and stringent building standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wood preservative chemicals market was valued at USD 1,911.7 million in 2024 and is projected to reach USD 2,505.2 million by 2032, growing at a CAGR of 3.37% during the forecast period.

- Rising demand from the construction sector and increased focus on durability and pest resistance in wood applications are major growth drivers for the market.

- Water-borne preservatives dominate the product segment due to their low toxicity and regulatory compliance, while the construction sector holds the largest share among end users.

- The market is competitive with key players like KMG Chemicals Inc., Lonza Group, and Viance LLC focusing on eco-friendly innovations, though high costs of sustainable alternatives and stringent environmental regulations act as restraints.

- Asia Pacific leads with a 35.2% share in 2024, followed by Europe at 26.1% and North America at 19.3%, driven by urbanization, infrastructure development, and growing awareness of wood protection solutions.

Market Segmentation Analysis:

By Product Type

The water-borne preservatives segment dominates the wood preservative chemicals market, accounting for the largest market share in 2024. This dominance is driven by their lower environmental impact, cost-effectiveness, and superior penetration into wood fibers, making them ideal for both indoor and outdoor applications. These preservatives are widely adopted in residential and commercial construction due to their compatibility with various wood species and enhanced safety profile. Additionally, regulatory restrictions on toxic substances in oil-borne and solvent-based preservatives have further accelerated the shift toward water-borne alternatives, reinforcing their leading position in the global market.

- For instance, Lonza Wood Protection developed Tanalith E 8000, a water-borne wood preservative that achieved a field testing performance rating of 9.6 out of 10 in fungal and termite resistance under AWPA E7 and E16 test protocols, covering over 24 months of real-world exposure in tropical climates.

By End User:

The construction segment holds the largest share in the wood preservative chemicals market, driven by rising infrastructure development and increasing demand for treated wood in residential, commercial, and industrial buildings. Treated wood is preferred for structural applications due to its durability and resistance to decay, termites, and fungal attacks. Rapid urbanization and government investments in housing projects, especially in emerging economies, have significantly boosted the use of preservative-treated wood in construction. This segment continues to lead due to consistent demand for long-lasting, low-maintenance building materials in various climatic conditions.

- For instance, Koppers Inc. supplied preservative-treated wood for the Kansas City Streetcar Extension Project, delivering more than 4,800 linear feet of treated structural wood that met ASTM D1758 standards for decay resistance in ground contact and wet-use conditions.

Key Growth Drivers

Rising Demand from the Construction Sector

The construction industry is a primary driver of the wood preservative chemicals market, with treated wood increasingly used in residential, commercial, and infrastructure projects. Growing urbanization and population expansion are fueling the need for durable, pest-resistant wood products for structural applications, decking, and outdoor installations. Government investments in housing and infrastructure—particularly in developing nations—are further contributing to this demand. As untreated wood deteriorates quickly under exposure to moisture and insects, the use of preservatives becomes essential, thereby stimulating consistent market growth.

- For instance, Viance LLC, through its Ecolife® Stabilized Wood preservative system, has been adopted in more than 14 million board feet of residential deck installations across the U.S. since its launch, driven by its proven resistance to termites and fungal decay under AWPA UC3B classification.

Increasing Focus on Longevity and Durability of Wood Products

Consumers and industries alike are prioritizing long-lasting and low-maintenance wood products, which has significantly driven the uptake of preservative chemicals. These chemicals enhance wood resistance to decay, fungi, termites, and other biological threats, extending product life in various environmental conditions. This trend is especially prominent in regions with high humidity and rainfall, where untreated wood degrades rapidly. The demand for durable wood is also growing in furniture, marine, and outdoor applications, making preservative treatment a critical step in wood processing and supporting market expansion.

- For instance, BASF introduced the Preventol® range of fungicidal wood preservatives, where the Preventol A6 formulation demonstrated a fungus growth inhibition rate of 99.8% in laboratory trials conducted according to EN 113 standards, enabling enhanced durability in marine and coastal installations.

Environmental Shifts Toward Sustainable Wood Protection Solutions

Growing environmental awareness and stricter regulations are pushing manufacturers to develop eco-friendly and low-toxicity preservative solutions. Water-borne and bio-based preservatives are gaining traction as viable alternatives to traditional oil- and solvent-based chemicals. The transition aligns with green building standards and global sustainability goals. Innovations in low-VOC and non-metallic formulations are not only reducing environmental impact but also unlocking new market opportunities. This shift is encouraging investment in R&D and broadening the appeal of wood preservatives across environmentally conscious industries and consumers.

Key Trends & Opportunities

Technological Advancements in Preservative Formulations

The market is witnessing continuous innovation in preservative formulations to improve efficacy, safety, and environmental compatibility. Advanced technologies are enabling deeper wood penetration, faster drying times, and lower toxicity levels, thereby enhancing product performance and compliance with regulatory norms. These developments support wider adoption across applications such as decking, fencing, and marine structures. Furthermore, tailored formulations for different wood species and use environments are creating new revenue streams for manufacturers and presenting a competitive edge in product differentiation.

- For instance, Arch Wood Protection launched BARamine® Technology, integrated into Wolman® E products, which achieved penetration depths exceeding 12 mm in Douglas fir—one of the most difficult-to-treat wood species—under pressure treatment cycles verified by AWPA T1 protocol.

Expansion in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa are providing substantial growth opportunities for wood preservative chemical manufacturers. Rapid urbanization, infrastructure development, and a growing middle class are fueling demand for treated wood in construction and consumer goods. Additionally, increasing awareness of termite prevention and wood preservation practices is leading to wider adoption in regions previously reliant on untreated wood. These markets offer untapped potential, particularly for water-based and low-toxicity preservatives, positioning them as key regions for future expansion and strategic investments.

- For instance, Nippon Paint’s wood protection division partnered with local distributors in India and Indonesia, resulting in deployment of 3,200+ metric tons of water-borne preservative solutions across 460 residential and government construction projects between 2021 and 2023.

Key Challenges

Environmental and Regulatory Compliance

One of the primary challenges in the wood preservative chemicals market is adhering to stringent environmental and safety regulations. Many traditional preservatives, especially those containing arsenic or heavy metals, face restrictions or bans in several countries. Compliance with REACH, EPA, and other regional standards demands continuous innovation and reformulation, increasing production costs. The pressure to transition toward eco-friendly alternatives while maintaining efficacy is creating a complex regulatory landscape for manufacturers to navigate.

Health and Safety Concerns

The use of certain wood preservative chemicals poses potential health risks for workers and end-users, especially during application and handling. Prolonged exposure to toxic compounds can lead to respiratory issues, skin irritation, or more severe health effects. As a result, there is growing scrutiny from occupational safety authorities and public health advocates. These concerns necessitate investments in protective equipment, safety training, and improved chemical handling procedures, adding operational burdens to manufacturers and distributors.

High Costs of Sustainable Alternatives

While demand for environmentally friendly preservatives is rising, the higher costs associated with sustainable and low-toxicity formulations remain a barrier, particularly in cost-sensitive markets. Bio-based and water-borne solutions often require advanced technologies and more expensive raw materials. This cost gap limits their adoption, especially in developing regions where price competitiveness remains critical. Bridging the cost-performance balance will be essential for manufacturers aiming to scale eco-friendly products and capture broader market share.

Regional Analysis

North America

North America accounted for approximately 19.3% of the global wood preservative chemicals market in 2024, with a market size of USD 368.64 million, up from USD 272.62 million in 2018. The region is projected to reach USD 503.54 million by 2032, expanding at a CAGR of 3.9%. Growth is driven by rising residential construction, advanced wood treatment technologies, and stringent building codes promoting long-lasting materials. The United States remains a key contributor due to strong demand for decking, fencing, and outdoor structures made from treated wood. Sustainable formulations are gaining traction in alignment with environmental regulations.

Europe

Europe represented 26.1% of the global market in 2024, with a market value of USD 499.10 million, rising from USD 391.04 million in 2018. The market is expected to reach USD 631.55 million by 2032, growing at a CAGR of 2.9%. Growth is fueled by increasing adoption of eco-friendly preservatives in response to strict EU regulations. Demand remains strong in Germany, France, and the Nordic countries, where construction activities and timber usage remain high. Technological advancements in water-borne and solvent-free solutions are helping Europe maintain its focus on sustainability and indoor air quality in residential and commercial buildings.

Asia Pacific

Asia Pacific held the largest regional share of 35.2% in 2024, with the market rising from USD 520.85 million in 2018 to USD 672.82 million. By 2032, it is projected to reach USD 865.79 million, growing at a CAGR of 3.1%. Rapid urbanization, population growth, and booming construction activity in China, India, and Southeast Asia are the primary drivers. The region’s preference for treated wood in infrastructure, marine applications, and furniture is expanding due to awareness of pest control and durability. Favorable government initiatives in affordable housing and smart cities are further supporting long-term market growth.

Latin America

Latin America captured 8.9% of the global wood preservative chemicals market in 2024, growing from USD 123.39 million in 2018 to USD 169.73 million. It is anticipated to reach USD 236.74 million by 2032, registering the highest CAGR among all regions at 4.2%. Market expansion is fueled by increasing investments in residential housing, tourism infrastructure, and public projects. Brazil and Mexico lead regional demand, with a rising need for termite-resistant wood in tropical environments. Additionally, growing awareness about the benefits of treated wood is boosting uptake in both industrial and commercial applications across the region.

Middle East

The Middle East accounted for 6.7% of the global market in 2024, with a market size of USD 127.81 million, up from USD 94.18 million in 2018. The market is projected to grow at a CAGR of 4.0%, reaching USD 175.36 million by 2032. Construction activity in the UAE, Saudi Arabia, and Qatar—driven by Vision 2030 and other urban development programs—is a major growth catalyst. Demand for treated wood is increasing in outdoor applications such as pergolas, gazebos, and waterfront structures due to the region’s harsh climate. Water-borne preservatives are gaining preference for sustainability and performance.

Africa

Africa represented 5.1% of the global wood preservative chemicals market in 2024, with the market increasing from USD 58.12 million in 2018 to USD 73.63 million. It is projected to reach USD 92.19 million by 2032, growing at a CAGR of 2.8%. Market growth is driven by ongoing urbanization, infrastructure development, and increasing construction activities in sub-Saharan countries. However, limited awareness of advanced wood preservation techniques and affordability constraints restrict faster adoption. Despite these challenges, the region holds long-term potential due to its large wood-consuming population and rising demand for durable, termite-resistant wood in both rural and urban applications.

Market Segmentations:

By Product Type:

- Oil-Borne Preservatives

- Light Organic Solvent Preservatives

- Water-Borne Preservatives

- Others

By End User:

- Construction

- Marine

- Furniture & Decking

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the wood preservative chemicals market is characterized by the presence of several established players focusing on product innovation, strategic partnerships, and regional expansion. Companies such as KMG Chemicals Inc., Lonza Group, Viance LLC, and Kop-Coat Incorporated lead the market through diversified product portfolios and strong distribution networks. These firms are investing in research and development to formulate eco-friendly and high-performance preservative solutions that comply with evolving environmental regulations. Mergers and acquisitions are also common, allowing companies to enhance their market reach and technological capabilities. Emerging players, especially in Asia-Pacific and Latin America, are gaining traction by offering cost-effective alternatives and targeting niche applications. Competitive intensity remains high as firms strive to differentiate based on product efficacy, sustainability, and service offerings. The market is also witnessing a gradual shift toward sustainable practices, prompting key players to focus on green chemistry and bio-based preservatives to meet growing consumer and regulatory demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KMG Chemicals Inc.

- Kop-Coat Incorporated

- Kurt Obermeier GmbH & Co. KG

- Lapeyre SA

- Osmose Inc.

- Lonza Group

- Rio Tinto Borax

- RUTGERS Organic

- Viance LLC.

Recent Developments

- In October 2022, Koppers Inc., a global chemical and materials company, announced a significant market share expansion in industrial and commercial wood preservation technology markets.

- In January 2022, Arxada announced the completion of the merger with Troy Corporation, a global leader in microbial control solutions and performance additives. The combination creates a comprehensive and innovative offering in Arxada’s Microbial Control Solutions (‘MCS’) business, enabling the delivery of new solutions and value-added services to customers.

- In January 2022, LANXESS and Matrìca, a joint venture between Versalis (Eni) and Novamont, partnered to produce sustainable biocide preservatives from renewable raw materials. With this partnership, both companies aim to significantly advance the production of sustainable preservatives and address the markets’ growing demand.

Market Concentration & Characteristics

The Wood Preservative Chemicals Market displays moderate to high market concentration, with a few established players holding significant global share. Companies like Lonza Group, KMG Chemicals Inc., and Viance LLC dominate through strong distribution networks, diversified product portfolios, and sustained R&D efforts. It remains technology-driven, with continuous innovation in low-toxicity and eco-friendly formulations to meet evolving regulatory and consumer demands. The market features a mix of large multinational corporations and regional suppliers, creating a competitive environment where pricing, performance, and environmental compliance determine positioning. It is characterized by steady demand from the construction and infrastructure sectors, supported by regulatory mandates for treated wood in specific applications. Growth varies by region, with mature markets focusing on product upgrades and sustainability, while emerging economies prioritize cost efficiency and basic wood protection. Companies actively pursue mergers, acquisitions, and strategic collaborations to expand geographic reach and improve technological capabilities. Demand patterns shift based on seasonal construction trends, economic conditions, and regulatory developments.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The wood preservative chemicals market is expected to witness steady growth driven by rising construction and infrastructure activities globally.

- Demand for eco-friendly and water-borne preservatives will continue to increase due to stricter environmental regulations.

- Technological advancements in bio-based and low-toxicity formulations will gain momentum across developed and emerging markets.

- The construction sector will remain the dominant end-use industry, especially in residential and commercial applications.

- Asia Pacific will maintain its leading position, supported by urbanization, industrial growth, and government housing initiatives.

- Latin America and the Middle East will emerge as high-growth regions due to rising awareness and infrastructure investments.

- Market players will focus on expanding product portfolios and enhancing distribution networks through strategic alliances.

- Sustainability and green building certifications will drive demand for safer wood treatment solutions.

- Regulatory compliance will push manufacturers to invest more in R&D for environmentally safe preservatives.

- Cost-effective and high-performance products will remain key differentiators in competitive market positioning.