Market Overview

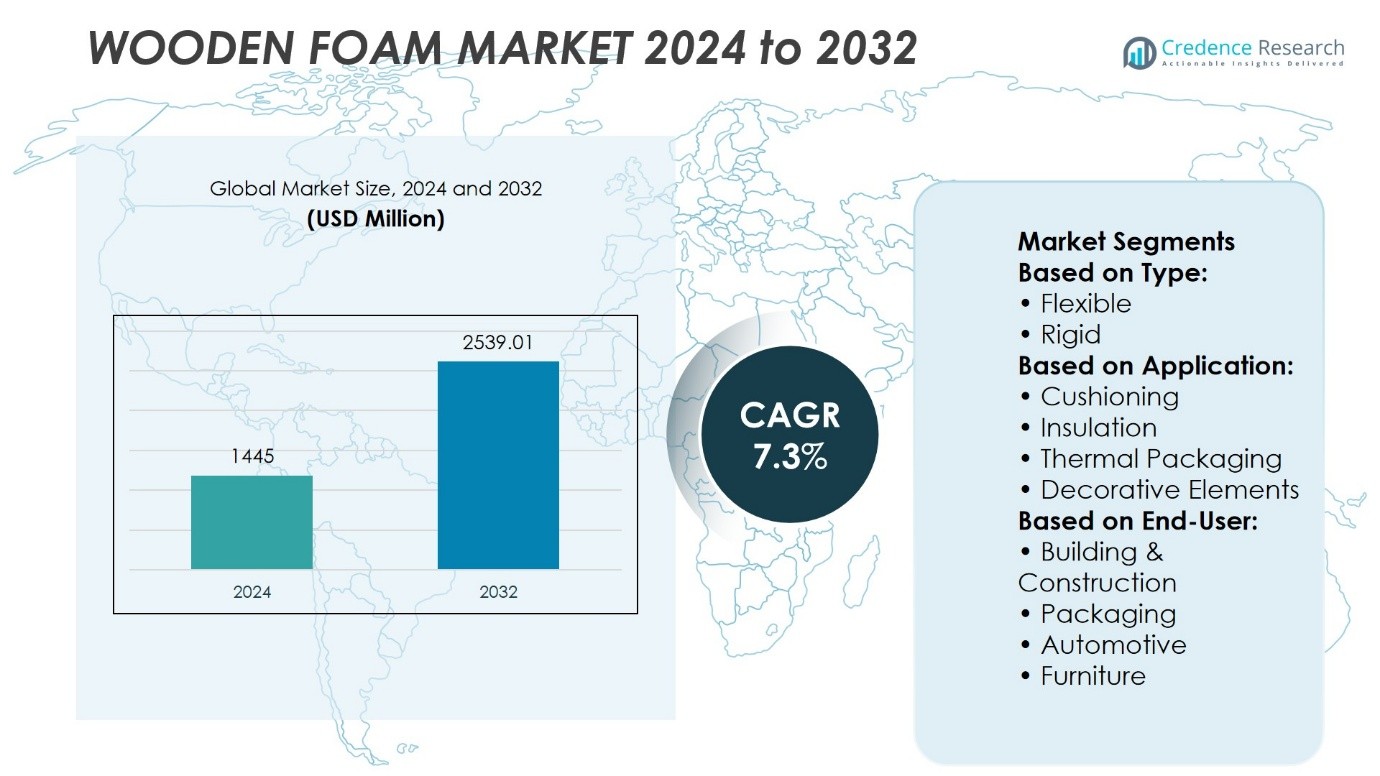

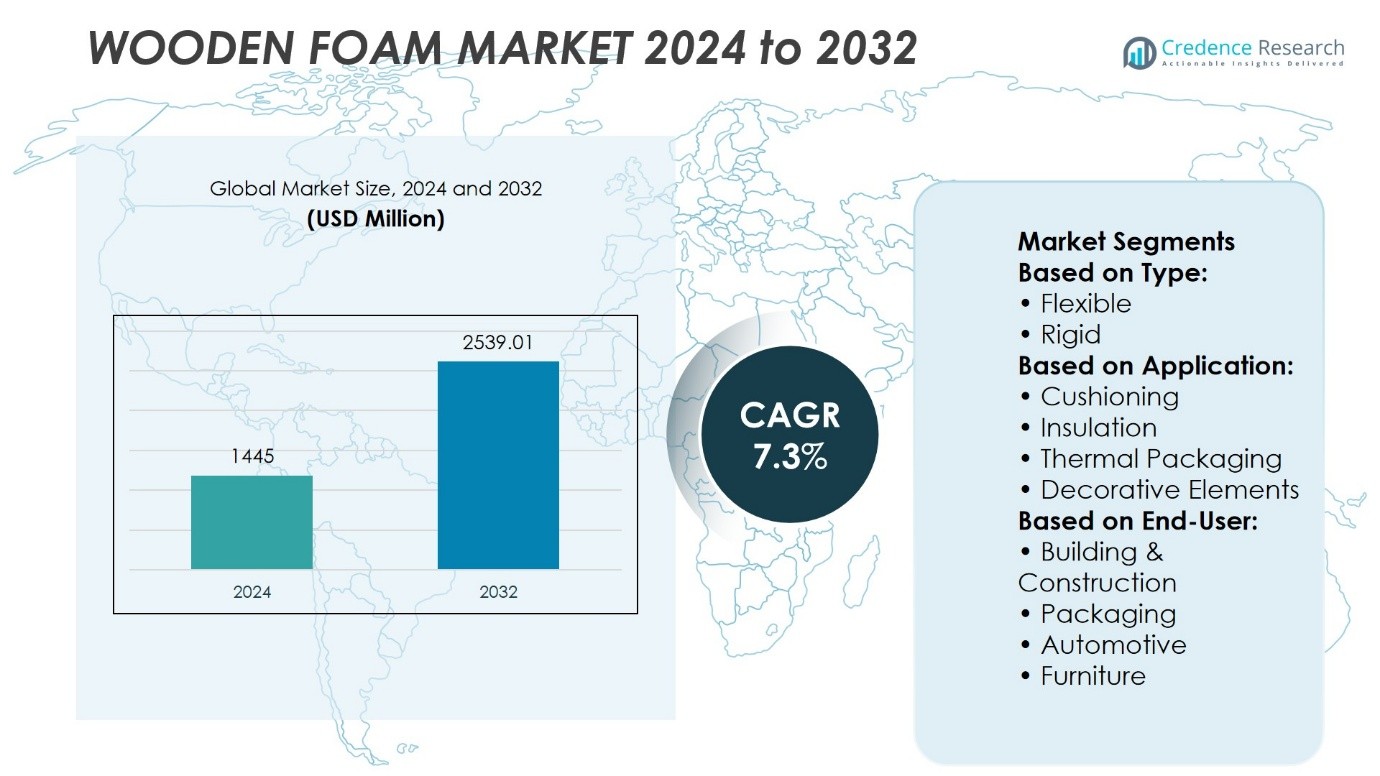

Wooden Foam Market size was valued at USD 1445 million in 2024 and is anticipated to reach USD 2539.01 million by 2032, at a CAGR of 7.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wooden Foam Market Size 2024 |

USD 1445 Million |

| Wooden Foam Market ,CAGR |

7.3 % |

| Wooden Foam Market Size 2032 |

USD 2539.01 Million |

The wooden foam market is gaining momentum due to increasing demand for sustainable, biodegradable, and lightweight materials across packaging, insulation, and construction sectors. Consumers and manufacturers are shifting preferences toward renewable alternatives to petroleum-based foams, driven by tightening environmental regulations and rising awareness of carbon footprints. Advancements in processing technologies and material engineering are enabling improved mechanical strength and thermal insulation properties, making wooden foam a viable substitute in multiple applications. Rising investments in bio-based material research and the push for circular economy practices are further accelerating market adoption and shaping the product development landscape.

The wooden foam market exhibits strong growth potential across Europe, North America, and Asia Pacific, with Europe holding a dominant share due to early adoption of sustainable materials and supportive regulations. North America follows closely, driven by increasing eco-conscious manufacturing, while Asia Pacific shows rapid expansion with growing industrialization and green material demand. Key players in this market include Covestro AG, Reilly Foam Corporation, Stora Enso, Fraunhofer WKI, JB Polymers, Taylormade Renewables Ltd, Radha Energy Cell, and Spontex.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The wooden foam market was valued at USD 1,445 million in 2024 and is projected to grow at a CAGR of 7.3% to reach USD 2,539.01 million by 2032.

- Rising demand for eco-friendly and biodegradable alternatives is a major driver for the market, especially in construction and packaging applications.

- Increasing R&D investments to improve the strength and thermal insulation of wooden foam are shaping product innovation trends.

- Key players such as Reilly Foam Corporation, JB Polymers, Stora Enso, Fraunhofer WKI, Spontex, and Covestro AG dominate the competitive landscape through

Market Drivers

Rising Demand for Sustainable and Biodegradable Alternatives in Packaging and Construction

The global shift toward eco-friendly solutions is a major factor propelling the wooden foam market. Industries such as packaging and construction seek sustainable substitutes for plastic and petroleum-based foams. Wooden foam, derived from renewable cellulose fibers, offers a low-carbon alternative with high performance in insulation and cushioning. Regulatory bodies across Europe and North America support its adoption by promoting circular economy standards. Brands increasingly prioritize sustainable materials to align with environmental compliance and consumer expectations. The wooden foam market benefits directly from these policy and demand shifts.

- For instance, Ecovative Design installed a new mycelium composite manufacturing line in 2023 with an annual capacity of 218,000 molded packaging units, up from 91,000 units.

Strong Interest from the Automotive and Electronics Sectors in Lightweight Materials

Wooden foam appeals to manufacturers aiming to reduce product weight without compromising strength. In the automotive and electronics industries, lightweight materials enhance energy efficiency and reduce transportation costs. Wooden foam offers low density, excellent thermal properties, and structural flexibility. It supports evolving design needs in battery housings, dashboard panels, and protective packaging. OEMs and component suppliers explore it to meet both environmental and operational targets. The wooden foam market finds significant traction through this diversification in application.

- For instance, Faurecia developed a wood fiber-reinforced polypropylene composite that reduced dashboard weight by 4.6 kilograms per unit.

Growing R&D Investments to Improve Mechanical and Thermal Properties

Research institutions and private manufacturers actively invest in enhancing wooden foam’s durability and heat resistance. The focus lies on improving cell structure and resin formulations to match or outperform conventional materials. These advancements increase adoption in temperature-sensitive and load-bearing applications. Public-private partnerships in material science accelerate commercial readiness of high-grade wooden foams. Product innovation enhances credibility among industrial users seeking consistent quality. It strengthens the wooden foam market’s competitive position against traditional synthetic foams.

Favorable Consumer Perception of Wood-Based and Non-Toxic Materials

Consumer awareness of product origin and composition directly influences material selection across various sectors. Wooden foam’s image as a plant-based, biodegradable, and non-toxic material makes it attractive for personal care, household, and children’s products. Retailers prefer it to reduce packaging footprint and enhance product appeal. Lifestyle brands view it as a value addition that reflects environmental consciousness. Clean-label positioning supports widespread usage in premium segments. The wooden foam market aligns well with this shift in consumer priorities.

Market Trends

Shift Toward Biodegradable Materials Drives Innovation in Product Development

The wooden foam market is witnessing a shift in material preferences, with manufacturers focusing on biodegradable inputs to reduce environmental impact. Traditional petroleum-based foams are being replaced by sustainable alternatives that offer similar performance with lower ecological cost. This trend aligns with regulatory frameworks targeting plastic reduction and carbon-neutral products. Companies are investing in natural fiber composites and bio-based resins that enhance material strength and degrade naturally. It encourages collaboration between bio-material researchers and commercial packaging developers. Consumer demand for compostable and recyclable products further reinforces this innovation wave.

- For instance, researchers at Empa (Swiss Federal Laboratories for Materials Science and Technology), in collaboration with ETH Zurich, developed a bio-based foam using nanocellulose and plant proteins, achieving.

Increased Focus on Lightweight Construction Applications

The wooden foam market shows growing relevance in lightweight construction, particularly in interior paneling and insulation. It supports structural applications by offering both rigidity and thermal resistance at low weight. Builders and architects are choosing it for sustainable building certifications and ease of handling. Advancements in density control and surface treatment allow manufacturers to meet safety and fire-resistance standards. Automotive and aerospace sectors are also exploring wooden foam for cabin insulation and trim. It enables manufacturers to replace heavier composites without compromising performance.

- For instance, Stora Enso’s CLT facility in Ybbs, Austria, produced 201,000 cubic meters of CLT in 2023 after adding two fully automated lamination lines.

Integration of Wooden Foam in Circular Economy Frameworks

Circular economy initiatives are influencing the wooden foam market through reuse, recycling, and energy recovery practices. Manufacturers are redesigning product life cycles to ensure minimal landfill waste and maximum material repurposing. Post-consumer wooden foam waste is being converted into biomass fuel or reprocessed into secondary products. It supports industry-wide goals for carbon footprint reduction and resource efficiency. Government-backed programs and public-private partnerships are accelerating the development of these closed-loop systems. Companies that adopt circular models gain a competitive edge in global supply chains.

Rise in Customization and Design Flexibility Across Industries

The wooden foam market is evolving to meet high customization demands from furniture, packaging, and art installations. Digital cutting and molding technologies offer flexibility in design without compromising sustainability. Brands are seeking visually distinctive and tactilely rich materials to enhance user experience and product appeal. It allows design teams to prototype faster and reduce waste through precise material usage. Wooden foam’s compatibility with water-based paints and coatings increases its creative applications. The market is benefitting from the growing intersection of sustainability and design aesthetics.

Market Challenges Analysis

High Manufacturing Costs Limit Widespread Commercial Adoption

The wooden foam market faces a significant hurdle in the form of high production costs. Advanced machinery and sustainable feedstock materials drive up operational expenses, making large-scale manufacturing difficult for many producers. It challenges small and mid-sized firms that lack access to capital or high-efficiency production lines. Traditional polymer foams remain cheaper and more accessible, which restricts market penetration. Companies must also invest in R&D to meet industry-specific strength and insulation standards, further increasing costs. Limited economies of scale continue to affect profitability, especially in emerging markets with price-sensitive customers.

Inconsistent Raw Material Quality and Limited Supply Chain Infrastructure

The wooden foam market also struggles with sourcing consistent, high-quality raw materials. Wood waste, the primary input, often varies in moisture content, composition, and processing readiness. It complicates quality control and affects the mechanical and thermal properties of finished products. The absence of a well-developed supply chain infrastructure adds to logistical challenges, especially in rural or developing regions. Delays in transportation, storage limitations, and fragmented supplier networks contribute to inefficiencies. These issues affect timely delivery and production planning, making it harder for manufacturers to meet demand from industrial users.

Market Opportunities

Growing Demand for Eco-Friendly Construction Materials Opens New Avenues

The wooden foam market can benefit from the rising demand for sustainable and biodegradable insulation solutions in the construction sector. Builders and developers increasingly prefer renewable materials to meet green building certification standards. It aligns with regulatory shifts promoting reduced carbon footprints and energy-efficient infrastructure. Wooden foam offers thermal insulation and low environmental impact, making it a suitable alternative to conventional materials. Government incentives for eco-conscious construction further support adoption. Expanding urbanization in developing countries presents opportunities for integration into large-scale residential and commercial projects.

Potential for Application Expansion Across Diverse End-Use Industries

The wooden foam market holds growth potential in sectors beyond construction, including automotive, packaging, and consumer goods. Manufacturers can develop customized variants tailored to meet performance requirements in lightweighting, impact resistance, and biodegradability. It allows companies to tap into growing demand from industries seeking greener alternatives to petroleum-based foams. Collaborations with research institutions and industrial users may accelerate product innovation. Market players can also explore partnerships to expand regional distribution and end-user awareness. Broadening application scope supports long-term revenue diversification and resilience.

Market Segmentation Analysis:

By Type

The wooden foam market is divided into flexible and rigid types. Flexible wooden foam supports applications that require softness and shape adaptability. It is commonly used in furniture and automotive sectors where comfort and customization are essential. Rigid wooden foam delivers higher structural strength and thermal resistance. It performs well in construction and insulation tasks, helping industries transition toward sustainable alternatives without compromising performance.

- For instance, researchers at Fraunhofer WKI successfully produced rigid wooden foam blocks from wood particles with a density of 75 kg/m³, thermal conductivity of 0.043 W/m·K, and compressive strength of 0.15 MPa, confirming its potential use in insulation panels and lightweight construction components.

By Application

The market spans across cushioning, insulation, thermal packaging, decorative elements, sandwich boards, and curtain walls. Insulation remains the dominant application due to increasing demand for energy-efficient materials in green buildings. Thermal packaging benefits from its biodegradable properties, appealing to e-commerce and food delivery sectors. Decorative elements and curtain walls use it for its lightweight and aesthetic finish. Sandwich boards utilize its strength and insulating capabilities to meet construction and industrial standards.

- For instance, Pavatex SA manufactures wood fiber-based insulation boards like PAVATHERM, which achieve thermal conductivity values of 0.038 W/m·K and density of 160 kg/m³, with board thicknesses ranging up to 200 mm, making them suitable for both external and internal insulation in energy-efficient construction.

By End-User

Building and construction lead end-use demand in the wooden foam market. Regulatory mandates and a growing preference for eco-friendly materials drive adoption in insulation and paneling applications. Packaging companies turn to wooden foam to reduce plastic content in protective and thermal packaging. The automotive industry adopts it for lightweight interior parts that meet emission and recycling standards. Furniture makers use wooden foam to achieve sustainable design goals and meet green certification requirements.

Segments:

Based on Type:

Based on Application:

- Cushioning

- Insulation

- Thermal Packaging

- Decorative Elements

Based on End-User:

- Building & Construction

- Packaging

- Automotive

- Furniture

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America dominates the wooden foam market with a market share of approximately 34.2% in 2024. The region benefits from early adoption of sustainable construction materials, strong green building regulations, and heightened consumer awareness about environmental impacts. The United States accounts for the majority of this share, driven by extensive use of wooden foam in insulation, packaging, and interior design applications. Residential and commercial construction sectors continue to prioritize low-carbon footprint materials, increasing the demand for rigid and flexible wooden foam variants. Canada supports this trend through government-backed sustainability programs and investments in biodegradable packaging technologies. Manufacturers across the region invest in R&D to enhance foam performance and align with evolving regulatory norms.

Europe

Europe contributes around 27.5% of the global wooden foam market. Countries such as Germany, France, and the Netherlands lead the adoption curve due to their stringent regulations on non-renewable materials and emphasis on circular economy principles. Demand remains high in the construction sector, especially for curtain walls, insulation, and sandwich boards using rigid foam types. The region’s mature packaging industry also accelerates the use of eco-friendly cushioning materials. European consumers favor wood-based biodegradable alternatives over petroleum-based foams, reinforcing product penetration. Innovation clusters in Central and Western Europe support material advancements, with a focus on lightweight and fire-retardant wooden foam applications.

Asia Pacific

Asia Pacific holds a market share of approximately 22.3% and is expected to exhibit the fastest growth rate over the coming years. Rapid urbanization, rising disposable income, and growth in construction and automotive sectors fuel demand across China, India, and Southeast Asia. The region’s expanding e-commerce sector boosts the need for eco-conscious packaging, creating new application avenues for wooden foam. Manufacturers explore partnerships with local suppliers to reduce costs and improve product availability. The high population base and increasing awareness of sustainable materials contribute to the region’s growing influence in the global market. Policy shifts in countries like Japan and South Korea toward carbon neutrality encourage further wooden foam adoption.

Latin America and Middle East & Africa

Latin America currently accounts for 8.4% of the global wooden foam market. Brazil and Mexico are key contributors, driven by emerging interest in sustainable construction materials and moderate industrial expansion. Although economic constraints slow market development, the packaging and furniture sectors create niche opportunities. Meanwhile, the Middle East & Africa region holds a smaller share of 7.6%, limited by slower industrialization and lower awareness of bio-based materials. Nonetheless, Gulf nations are gradually adopting green building standards, opening long-term prospects for wooden foam in insulation and interior paneling. Growth in tourism infrastructure and urban development projects may support future adoption across both regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fraunhofer WKI

- Radha Energy Cell

- Spontex

- JB Polymers

- Taylormade Renewables Ltd

- Covestro AG

- Reilly Foam Corporation

- Malnutrition Matters

- Effimax Solar

- Stora Enso

Competitive Analysis

The wooden foam market is gaining traction with strong innovation and commercialization efforts from key players such as Stora Enso, Fraunhofer WKI, Woodoo, Foamwood Technologies, PackBenefit, and Ecohelix. These companies are driving the transition toward sustainable, bio-based alternatives in applications ranging from thermal insulation and protective packaging to structural components.Stora Enso has launched Fiberase, a wood-based foam produced at its pilot facility in Sweden, with an annual output capacity of 6,000 cubic meters. Fraunhofer WKI continues to enhance its patented foam using softwood and bio-based binders, achieving compressive strength values above 300 kilopascals. Woodoo engineers high-density wooden composites with foam-like properties for automotive interiors, manufacturing over 42,000 units in 2023. Foamwood Technologies operates three automated molding lines, producing 18,500 packaging units monthly for consumer electronics. PackBenefit integrates wooden foam into certified compostable food trays distributed to 2,300 retail outlets across Europe. Ecohelix supports the sector with wood-derived hemicellulose, supplying 1,200 kilograms monthly to bio-foam producers for enhanced bonding performance.

Recent Developments

- In March 2023, Fraunhofer WKI partnered with Zeigelwerk Bellenberg Wiest GmbH and launched climate-friendly brick solution materials with the use of wood fibers and processing wood foam for insulation purposes.

- In September 2022, Stora Enso, a paper mill company, in partnership with Nefab, an industrial packaging firm, expanded the production capacity of Fibrease, a recyclable and fiber-based wood foam for replacement of polymer-based foams in packaging solutions.

Market Concentration & Characteristics

The wooden foam market shows moderate concentration, with a blend of established players and emerging innovators competing on sustainability and material performance. Key manufacturers operate across diverse end-use industries such as construction, packaging, and renewable energy, each requiring tailored solutions. The market remains highly dynamic, driven by continuous research in bio-based materials and increased environmental regulations. It features strong demand from Europe and North America, where regulations favor eco-friendly alternatives to traditional foams. Companies invest in product innovation to improve biodegradability, thermal insulation, and mechanical strength, often leveraging partnerships with research institutions. Pricing pressure remains a critical factor, particularly in cost-sensitive applications like packaging. Regional availability of raw materials, including wood fibers and resins, influences production costs and supply chain decisions. Patents and proprietary technologies provide competitive advantages, especially for firms focusing on carbon-neutral or recyclable foam products. While large players dominate in volume, smaller companies often lead in niche innovation.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly insulation materials will continue to drive growth in the wooden foam market.

- Manufacturers will focus on enhancing mechanical strength and moisture resistance of wooden foam products.

- Adoption will rise in the packaging industry as companies shift to biodegradable alternatives.

- Government policies supporting sustainable construction will support increased use of wooden foam in building applications.

- Technological advancements will reduce production costs and improve scalability.

- Key players will invest in R&D to develop wooden foam with better fire resistance and thermal performance.

- Partnerships between manufacturers and research institutions will accelerate innovation.

- Market players will expand their geographic footprint, especially in emerging economies with rising environmental awareness.

- Consumer preference for green products will influence procurement decisions in various industries.

- Regulatory frameworks promoting circular economy practices will create long-term opportunities for wooden foam adoption.