Market Overview

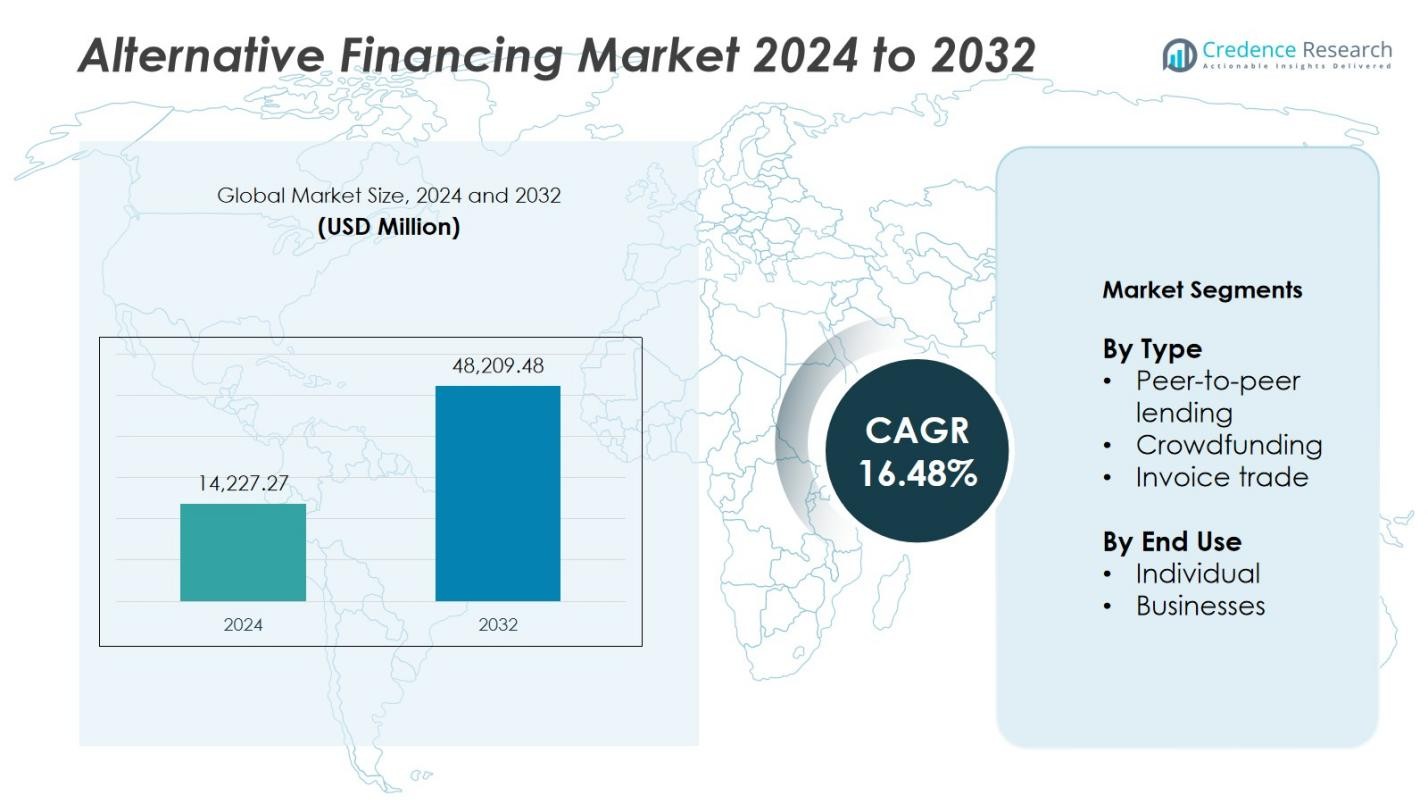

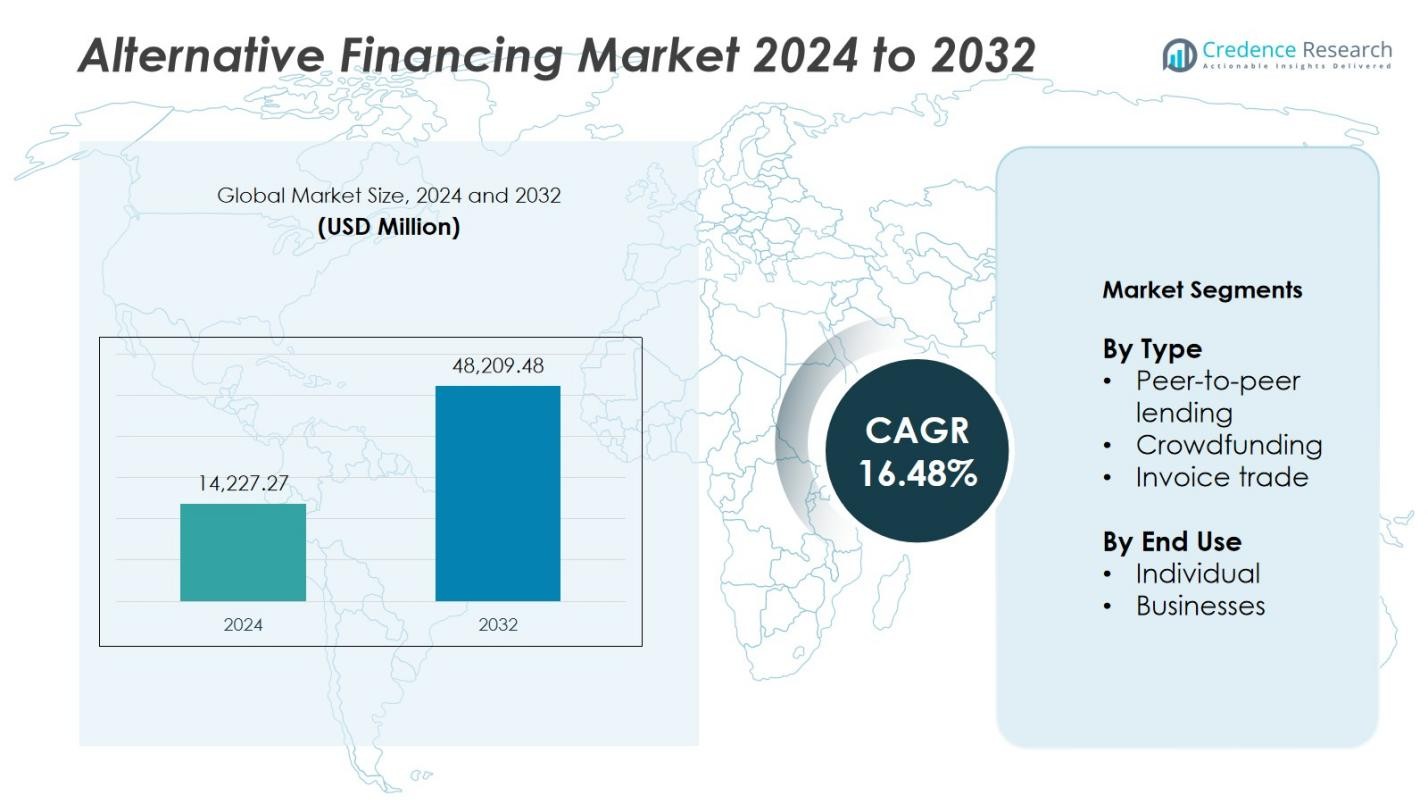

The Global Alternative Financing Market size was valued at USD 14,227.27 million in 2024 and is anticipated to reach USD 48,209.48 million by 2032, growing at a CAGR of 16.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Alpha Lipoic Acid Market Size 2024 |

USD 14,227.27 Million |

| Alpha Lipoic Acid Market, CAGR |

16.48% |

| Alpha Lipoic Acid Market Size 2032 |

USD 48,209.48 Million |

The Alternative Financing Market is led by major players including Kiva Microfunds, Funding Circle, Prosper Funding LLC, LendingCrowd, Credoc, GoFundMe, LendingClub, Borrowers First, Finastra, and Kickstarter. These companies focus on expanding digital lending, crowdfunding, and peer-to-peer platforms through advanced technologies like AI, blockchain, and data analytics. Strategic collaborations with banks and fintech startups strengthen their market presence and improve accessibility for SMEs and individuals. North America emerged as the leading region with a 37% market share in 2024, supported by strong fintech infrastructure, regulatory support, and high digital adoption, followed by Europe and the rapidly growing Asia-Pacific region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Alternative Financing Market was valued at USD 14,227.27 million in 2024 and is projected to reach USD 48,209.48 million by 2032, growing at a CAGR of 16.48%.

- Rising demand for quick, flexible, and low-cost funding options among individuals and SMEs drives market growth globally.

- Technological advancements in AI, blockchain, and digital lending platforms enhance transparency and efficiency, boosting adoption across sectors.

- The market is moderately competitive, with players like Kiva Microfunds, Funding Circle, and LendingClub focusing on platform innovation and partnerships.

- North America leads with a 37% share, followed by Europe at 28% and Asia-Pacific at 24%; peer-to-peer lending holds the dominant 52% segment share due to its accessibility and low-cost financing benefits.

Market Segmentation Analysis:

By Type

The alternative financing market is segmented into peer-to-peer (P2P) lending, crowdfunding, and invoice trade. Peer-to-peer lending dominated the market in 2024 with a share of 52%, driven by increasing consumer preference for fast, accessible, and lower-cost borrowing options. P2P platforms enable direct connections between lenders and borrowers, reducing reliance on traditional banks. Crowdfunding follows with a rising share due to startup funding demand, while invoice trade continues to expand among small enterprises seeking improved cash flow and liquidity management.

For instance, Oculus VR raised $2.4 million on Kickstarter in 2012, ultimately leading to its acquisition by Meta in 2014.

By End Use

Based on end use, the market is categorized into individuals and businesses. The business segment accounted for the largest share of 61% in 2024, supported by the growing need for alternative funding sources among startups and small to medium-sized enterprises (SMEs). Businesses increasingly turn to digital financing platforms for working capital, expansion, and invoice factoring. The individual segment, holding the remaining share, is growing steadily due to rising adoption of P2P lending and crowdfunding for personal loans, education, and creative ventures.

For instance, Biz2Credit, a technology-driven lending platform, supports small businesses by providing tailored funding options through its Biz2X platform, which is also adopted by major financial institutions like HSBC.

Key Growth Drivers

Rising Demand for Accessible Financing Solutions

The growing limitations of traditional banking systems have fueled the need for faster and more flexible financing options. Alternative financing platforms, such as P2P lending and crowdfunding, offer quick loan approvals and minimal documentation, attracting individuals and SMEs. Increasing internet penetration and smartphone use further enable easy access to these platforms. This accessibility, coupled with lower interest rates and transparent digital interfaces, drives adoption among underserved borrowers, making alternative financing a preferred choice for diverse funding needs worldwide.

For instance, Prosper, a US-based P2P lending platform, approves around 70% of loan applications, offering borrowers flexible loan terms and faster approvals compared to traditional banks.

Growth of Small and Medium Enterprises (SMEs)

SMEs increasingly rely on alternative financing to overcome limited credit availability from conventional lenders. Digital lending and invoice trading platforms help businesses access capital efficiently, supporting operational liquidity and growth initiatives. Governments in emerging markets are promoting SME financing through fintech collaborations and digital transformation policies. As a result, alternative financing platforms are expanding their customer base, offering customized products for small enterprises. This trend continues to strengthen market growth by addressing the unmet credit demands of the global SME sector.

For instance, India’s invoice discounting platforms like KredX have helped numerous SMEs access working capital without waiting for client payments, improving cash flow management.

Technological Integration and Fintech Expansion

Technological innovation is a core growth driver in the alternative financing market. The integration of artificial intelligence, blockchain, and advanced data analytics has streamlined credit assessment, risk management, and fraud detection. Fintech companies leverage these technologies to enhance transparency and build investor trust. Additionally, digital identity verification and automated lending systems improve efficiency and security. This technology-driven evolution not only reduces operational costs but also promotes financial inclusion, attracting both investors and borrowers to alternative financing platforms.

Key Trends and Opportunities

Emergence of Hybrid Financing Models

A growing trend in the alternative financing market is the rise of hybrid models combining P2P lending, crowdfunding, and traditional finance. These models offer diversified funding sources and greater risk control for investors. Businesses increasingly adopt hybrid systems to access both equity and debt capital through digital platforms. The combination of fintech and institutional partnerships creates new opportunities for cross-sector investments, expanding reach in developing regions and enhancing the market’s overall resilience and scalability.

For instance, the collaboration between ICICI Bank and fintech Paytm in India led to the launch of “Paytm-ICICI Bank Postpaid,” which combines digital credit with traditional banking services to provide flexible financing options.

Expansion Across Emerging Economies

Emerging economies represent a major growth opportunity for alternative financing platforms. Countries in Asia-Pacific, Latin America, and Africa are witnessing rapid fintech adoption due to digital infrastructure improvements and supportive regulations. Rising smartphone penetration and government-backed financial inclusion programs encourage individuals and SMEs to explore nontraditional funding options. The growing awareness of digital credit solutions and cross-border investment platforms is expected to further accelerate market expansion in these high-potential regions.

For instance, in Latin America, Brazil’s instant payment system, Pix, saw 77% consumer adoption in 2023, helping fuel widespread digital payment use.

Key Challenges

Regulatory Uncertainty and Compliance Risks

Varying regulations across regions remain a major challenge for the alternative financing market. The absence of uniform policies for P2P lending, crowdfunding, and digital credit platforms increases compliance complexities. Frequent changes in government rules regarding consumer protection, interest caps, and data privacy can restrict operations and delay platform approvals. Companies must continuously adapt to evolving standards, increasing legal costs and operational risks. These regulatory inconsistencies hinder market expansion, particularly for new entrants seeking cross-border growth opportunities.

Data Security and Fraud Concerns

With increased digitization, cybersecurity and fraud prevention have become critical concerns. Alternative financing platforms handle vast amounts of sensitive financial data, making them potential targets for cyberattacks and identity theft. Insufficient encryption or weak verification systems can lead to financial losses and damage consumer trust. Maintaining data integrity through robust cybersecurity frameworks and AI-based monitoring systems is essential. Failure to ensure data protection can undermine investor confidence and limit the market’s long-term credibility and growth potential.

Regional Analysis

North America

North America dominated the alternative financing market in 2024 with a market share of 37%, driven by strong fintech adoption and favorable regulatory frameworks. The U.S. leads the region due to high digital penetration, growing SME financing needs, and investor confidence in peer-to-peer lending and crowdfunding platforms. Canada also shows notable growth, supported by supportive policies and rising venture capital participation. The region’s mature financial ecosystem, coupled with advanced data analytics and blockchain integration, enhances transparency and trust, positioning North America as a key global hub for alternative lending innovation.

Europe

Europe held a market share of 28% in the alternative financing market in 2024, supported by widespread fintech integration and transparent regulatory policies. The United Kingdom remains the largest market, driven by high adoption of P2P lending and crowdfunding platforms. Germany and France also contribute significantly through SME-focused credit platforms and government-backed digital finance initiatives. Strong investor participation and growing awareness of nonbank financing models support the region’s expansion. The emphasis on sustainable and ethical investment models further enhances Europe’s competitiveness in the global alternative financing landscape.

Asia-Pacific

Asia-Pacific accounted for a market share of 24% in 2024 and is expected to register the fastest growth through 2032. Rapid digitalization, increasing smartphone use, and the rise of fintech startups in China, India, and Southeast Asia fuel this momentum. Governments across the region are promoting financial inclusion and encouraging digital lending frameworks. SMEs are increasingly leveraging crowdfunding and invoice trading for operational liquidity. Expanding online payment ecosystems, along with strong investor interest in emerging markets, strengthens Asia-Pacific’s position as a high-growth region in the alternative financing industry.

Latin America

Latin America captured a market share of 6% in 2024, driven by rising fintech innovation and unmet credit demand among small businesses. Brazil and Mexico are key markets benefiting from improving regulatory clarity and increasing consumer trust in digital platforms. Alternative financing models are filling the credit gap left by traditional banking institutions, particularly in the SME segment. Mobile-based lending and micro-investment solutions are gaining popularity, supporting regional financial inclusion. As digital adoption accelerates, Latin America presents growing opportunities for cross-border collaborations and new platform expansions.

Middle East & Africa

The Middle East and Africa region held a market share of 5% in 2024, with growth driven by fintech startups and government-led digital transformation programs. The United Arab Emirates and South Africa are emerging as regional leaders due to supportive fintech ecosystems and investment-friendly regulations. Alternative financing platforms are addressing gaps in SME and consumer lending, especially where traditional credit systems remain underdeveloped. Increasing mobile connectivity, coupled with expanding blockchain-based financial solutions, is expected to accelerate market growth across the region over the forecast period.

Market Segmentations:

By Type

- Peer-to-peer lending

- Crowdfunding

- Invoice trade

By End Use

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Alternative Financing Market features key players such as Kiva Microfunds, Funding Circle, Prosper Funding LLC, LendingCrowd, Credoc, GoFundMe, LendingClub, Borrowers First, Finastra, and Kickstarter. These companies compete through technological innovation, product diversification, and platform scalability to capture a growing global customer base. Leading firms focus on improving digital lending platforms using AI and blockchain to enhance transparency, credit scoring, and fraud detection. Strategic partnerships with financial institutions and fintech startups are expanding market presence and accessibility across regions. Moreover, increased investor participation and government support for digital finance are intensifying competition. Players are also emphasizing sustainable and inclusive financing models to attract both retail and institutional investors, reinforcing their leadership in a rapidly evolving financial ecosystem.

Key Player Analysis

- Borrowers First

- Credoc

- Finastra

- Funding Circle

- GoFundMe

- Kickstarter

- Kiva Microfunds

- LendingClub

- LendingCrowd

- Prosper Funding LLC

Recent Developments

- In July 2025, Länsförsäkringar Bank agreed to acquire Stockholm-based savings marketplace SAVR, adding more than 100,000 digital investors to its Nordic footprint.

- In June 2025, Ant International announced plans to seek stablecoin-issuer licenses in Hong Kong and Singapore once each jurisdiction’s new framework is enacted, signaling a regional digital asset expansion.

- In October 2024, Upstart introduced the T-Prime lending program for borrowers with credit scores above 720, partnering with 14 lenders to deliver AI-driven approvals at competitive prime rates.

- In March 2024, Viva.com rolled out its Merchant Advance revenue-based lending package in Belgium, Germany, the Netherlands, and Spain, using acquiring data to prescore for automated repayments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The alternative financing market will expand rapidly with rising global fintech adoption.

- Peer-to-peer lending platforms will continue to dominate due to ease of access and lower borrowing costs.

- Crowdfunding will gain traction as startups and creative ventures seek flexible capital sources.

- Integration of AI, blockchain, and big data will enhance risk assessment and transparency.

- SMEs will remain the primary beneficiaries of alternative financing solutions worldwide

- Emerging markets in Asia-Pacific and Latin America will drive the next growth phase.

- Regulatory frameworks will become more standardized to support cross-border digital lending.

- Institutional investors will increase participation, boosting liquidity across lending platforms.

- Sustainable and ethical financing models will attract environmentally conscious investors.

- Partnerships between fintech firms and traditional banks will strengthen hybrid financing ecosystems.