Market Overview:

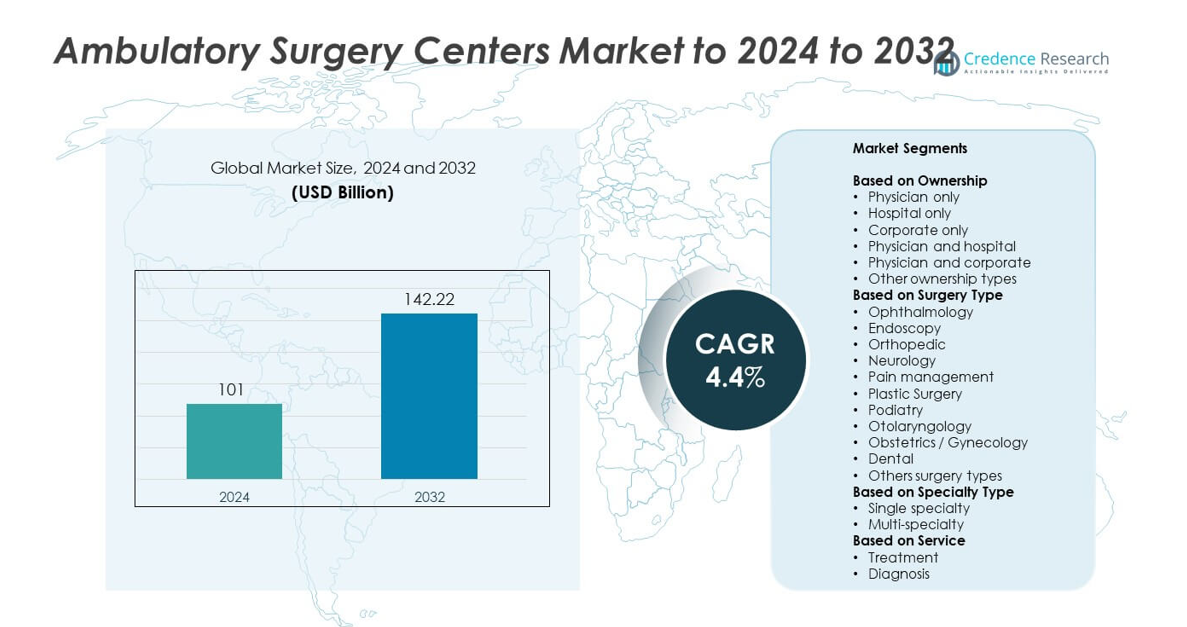

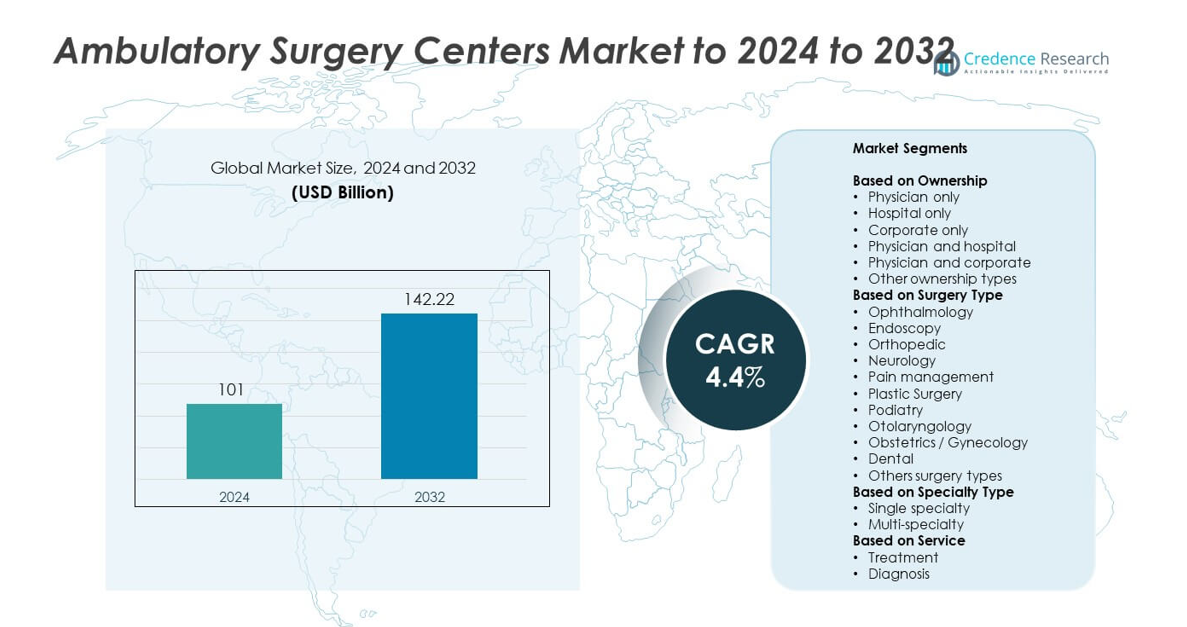

The Ambulatory Surgery Centers Market size was valued at USD 101 Billion in 2024 and is anticipated to reach USD 142.22 Billion by 2032, at a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ambulatory Surgery Centers Market Size 2024 |

USD 101 Billion |

| Ambulatory Surgery Centers Market, CAGR |

4.4% |

| Ambulatory Surgery Centers Market Size 2032 |

USD 142.22 Billion |

The ambulatory surgery centers market is led by major players such as Surgery Partners, AMSURG, Cura Day Surgery, Endeavor Health, CHSPSC, LLC., ASD Management, and Ramsay Sante. These companies dominate through extensive surgical networks, technological integration, and partnerships with healthcare providers to enhance outpatient care efficiency. North America leads the global market with a 39.6% share in 2024, supported by advanced healthcare infrastructure, favorable reimbursement frameworks, and high adoption of minimally invasive procedures. Europe follows with 27.8% share, while Asia Pacific emerges as the fastest-growing region due to expanding private healthcare investment and rising demand for cost-effective surgical services.

Market Insights

- The ambulatory surgery centers market was valued at USD 101 Billion in 2024 and is projected to reach USD 142.22 Billion by 2032, expanding at a CAGR of 4.4%.

- Growing demand for outpatient and minimally invasive surgeries drives market growth, supported by shorter recovery times and reduced hospital costs

- The market is witnessing strong trends toward multi-specialty centers and digital integration, enhancing procedural efficiency and patient experience.

- Competition remains high as key players expand surgical networks and form strategic partnerships to strengthen service capacity and technology adoption.

- North America leads with 39.6% share in 2024, followed by Europe with 27.8%, while Asia Pacific shows the fastest growth. Among segments, physician-only ownership and ophthalmology surgeries dominate, contributing the largest revenue share globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Ownership

Physician-only ambulatory surgery centers dominate the market with about 37.2% share in 2024. Their leadership is driven by increased preference among independent physicians to retain control over operational efficiency, clinical outcomes, and patient experience. These centers often provide specialized and cost-effective services, enhancing profitability compared to hospital-owned facilities. Hospital-only and corporate-owned centers are expanding as large health systems and investors focus on integrated outpatient care models to reduce inpatient costs and improve accessibility.

- For instance, Tenet’s USPI held interests in 518 ASCs and 25 surgical hospitals across 37 states as of Dec 31, 2024, demonstrating large-scale physician-partnered networks.

By Surgery Type

Ophthalmology leads the ambulatory surgery centers market with around 21.5% share in 2024. The segment’s dominance is supported by a high volume of cataract and refractive surgeries, which require minimal hospital stay and advanced surgical precision. Rising adoption of laser-assisted and minimally invasive procedures further strengthens growth. Orthopedic and endoscopy surgeries are also growing rapidly due to the shift toward outpatient joint replacements and gastrointestinal diagnostics.

- For instance, an estimated over 20 million cataract surgeries are performed worldwide each year, with approximately 3.8 million occurring annually in the United States alone, reflecting the high prevalence and effective treatment of cataracts globally.

By Specialty Type

Multi-specialty ambulatory surgery centers hold the largest share, accounting for about 63.4% in 2024. Their leadership comes from the ability to offer diverse surgical procedures under one roof, improving resource utilization and patient convenience. Multi-specialty centers benefit from cost-sharing among departments and growing demand for integrated outpatient services. Single-specialty centers remain significant in high-volume areas like ophthalmology and orthopedic care but face competition from larger, diversified facilities offering advanced technology and broader care options.

Key Growth Drivers

Rising Demand for Outpatient Surgical Procedures

The growing preference for outpatient surgical settings is a major driver of market growth. Patients increasingly choose ambulatory surgery centers due to shorter recovery times, lower treatment costs, and reduced risk of hospital-acquired infections. Advances in minimally invasive and robotic-assisted techniques have expanded the range of surgeries performed outside hospitals. This shift aligns with healthcare systems’ focus on improving cost efficiency and patient throughput, driving sustained adoption of ASCs across orthopedic, ophthalmic, and gastrointestinal specialties.

- For instance, Surgery Partners’ Q4-2024 results for same-facility metrics showed a 5.6% increase in revenue and a 5.1% increase in cases year over year, driven by a 0.5% increase in revenue per case, reflecting steady outpatient throughput.

Technological Advancements in Surgical Equipment

Rapid integration of advanced surgical technologies supports market expansion. The adoption of precision tools, digital imaging, and AI-driven diagnostic systems enhances procedural safety and accuracy. Modern anesthesia delivery and remote monitoring systems improve patient outcomes and operational efficiency. These innovations allow more complex surgeries to be safely performed in outpatient settings, broadening the ASC service scope and attracting partnerships between device manufacturers and healthcare providers for customized surgical solutions.

- For instance, Intuitive Surgical placed a total of 1,526 da Vinci surgical systems in 2024, which included 1,430 da Vinci multiport systems and 96 da Vinci SP systems.

Growing Investments and Strategic Partnerships

Increased investments by healthcare corporations, private equity firms, and hospitals strengthen ASC infrastructure. Strategic collaborations between physicians and corporations enhance scalability and streamline operations. Partnerships enable shared access to resources, technology upgrades, and specialized staff, fostering clinical excellence and financial sustainability. Expanding multi-specialty networks and mergers among regional operators also contribute to market consolidation, improving patient access and optimizing capacity utilization across healthcare systems.

Key Trends and Opportunities

Shift Toward Multi-specialty Centers

The growing establishment of multi-specialty ASCs represents a major market trend. These centers offer diverse surgical options under one facility, improving efficiency and convenience for patients and physicians. Integration of various specialties enhances patient volume and profitability, supporting long-term growth. Healthcare providers are leveraging this model to meet rising demand for comprehensive outpatient services, particularly in orthopedics, ophthalmology, and pain management.

- For instance, AMSURG partners with nearly 2,000 physicians across 250+ facilities in 34 states, scaling multi-specialty ASC footprints.

Adoption of Digital Health and Telemonitoring Solutions

Digital transformation creates new opportunities in ASC operations. The adoption of electronic health records, teleconsultation tools, and AI-driven scheduling systems improves workflow efficiency and patient care coordination. Remote monitoring and digital post-operative follow-ups enhance recovery management, reducing readmission rates. The integration of data analytics also supports performance tracking and outcome-based reimbursement models, further boosting the digitalization of ambulatory surgery services.

- For instance, Philips’ ePatch studies found 2× more clinically actionable findings at 7 days and >2.5× at 14 days versus 24-hour Holter, supporting remote postoperative monitoring pathways.

Key Challenges

Regulatory and Compliance Complexities

Stringent healthcare regulations pose significant challenges for ASC operators. Compliance with varying state and federal guidelines, accreditation standards, and data protection laws increases administrative burdens. Frequent updates to reimbursement policies and quality reporting requirements also raise operational costs. Maintaining high clinical standards while ensuring cost efficiency demands continuous investment in training and compliance systems, limiting smaller centers’ ability to compete effectively.

Shortage of Skilled Healthcare Professionals

A limited pool of trained surgeons, anesthesiologists, and nursing staff hampers ASC capacity expansion. High demand for skilled professionals across hospitals and specialized clinics creates staffing competition, driving up labor costs. Recruiting and retaining qualified personnel is critical to maintaining service quality and operational safety. Workforce shortages, if unaddressed, may slow the establishment of new centers and restrict the range of complex surgical procedures offered.

Regional Analysis

North America

North America leads the ambulatory surgery centers market with a 39.6% share in 2024. The region’s dominance is driven by advanced healthcare infrastructure, strong reimbursement frameworks, and the widespread use of minimally invasive surgical procedures. The United States contributes the majority of revenue due to a high concentration of multi-specialty ASCs and increasing Medicare participation. Canada is also witnessing steady growth supported by expanding outpatient surgery programs and technological advancements in surgical care delivery. The presence of major healthcare corporations and favorable insurance coverage continues to boost regional market expansion.

Europe

Europe accounts for around 27.8% share of the ambulatory surgery centers market in 2024. Growth is supported by the rising shift toward outpatient care and the adoption of cost-efficient surgical models. Countries such as Germany, the United Kingdom, and France are expanding ASC networks to reduce hospital burdens and waiting times. Government initiatives promoting same-day surgeries and quality healthcare standards have accelerated the transition from inpatient to ambulatory care. Technological integration and growing collaborations between private healthcare providers and public hospitals are strengthening regional growth across major European economies.

Asia Pacific

Asia Pacific holds approximately 21.4% share in the ambulatory surgery centers market in 2024. The region’s expansion is fueled by growing healthcare investments, rising medical tourism, and increasing adoption of minimally invasive procedures. China, India, and Japan are leading contributors, supported by expanding private healthcare infrastructure and a growing middle-class population seeking affordable surgical care. Government support for healthcare modernization and rising physician-owned centers are improving access to outpatient surgery. Technological integration and the introduction of high-quality surgical equipment are further enhancing the efficiency and safety of procedures across the region.

Latin America

Latin America captures about 6.3% share of the ambulatory surgery centers market in 2024. The region is experiencing gradual growth as healthcare systems expand outpatient capabilities to improve accessibility and reduce hospital congestion. Brazil and Mexico dominate the market due to ongoing healthcare reforms and investments in private surgical centers. The demand for cost-effective and quality surgical services is encouraging international partnerships and local infrastructure upgrades. Despite limited reimbursement policies, the increasing focus on patient-centered care and technological adoption is expected to support steady regional growth over the forecast period.

Middle East and Africa

The Middle East and Africa region represents nearly 4.9% share of the ambulatory surgery centers market in 2024. Growth is driven by expanding private healthcare facilities, rising healthcare expenditure, and increasing demand for specialized surgical services. The United Arab Emirates and Saudi Arabia lead the market with growing investments in advanced outpatient surgery centers. In Africa, urbanization and improvements in healthcare infrastructure are gradually enhancing surgical accessibility. However, limited trained professionals and uneven regulatory frameworks continue to restrain faster adoption, though ongoing government initiatives aim to strengthen regional healthcare capabilities.

Market Segmentations:

By Ownership

- Physician only

- Hospital only

- Corporate only

- Physician and hospital

- Physician and corporate

- Other ownership types

By Surgery Type

- Ophthalmology

- Endoscopy

- Orthopedic

- Neurology

- Pain management

- Plastic Surgery

- Podiatry

- Otolaryngology

- Obstetrics / Gynecology

- Dental

- Others surgery types

By Specialty Type

- Single specialty

- Multi-specialty

By Service

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The ambulatory surgery centers market is characterized by strong competition among leading providers such as Surgery Partners, AMSURG, Cura Day Surgery, Endeavor Health, CHSPSC, LLC., ASD Management, and Ramsay Sante. These companies focus on expanding surgical capacity, enhancing patient experience, and integrating advanced technologies to strengthen their market positions. Industry participants are increasingly adopting multi-specialty models, leveraging data-driven scheduling, and investing in precision surgical tools to improve efficiency and outcomes. Strategic alliances with healthcare systems, physician groups, and investors are becoming common to enhance scalability and regional presence. Continuous investment in minimally invasive and robotic-assisted surgery solutions supports procedural diversification, while the growing emphasis on cost-effective care and outpatient services fuels consolidation and acquisition activities across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Ascension entered into an agreement to acquire AMSURG, which operates more than 250 ambulatory surgery centers across 34 states.

- In 2025, Ramsay Santé has been advancing its “Yes We Care 2025” strategy, focusing on integrated, personalized care and digital innovation.

- In 2023, SurgNet Health Partners, a major player related to SurgCenter, completed acquisitions of Executive Ambulatory Surgery Center and Lippy Surgery Cente, strengthening its position in ambulatory healthcare management.

Report Coverage

The research report offers an in-depth analysis based on Ownership, Surgery Type, Specialty Type, Service and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ambulatory surgery centers market will expand with growing demand for outpatient surgeries.

- Multi-specialty centers will continue to dominate due to higher procedural diversity and efficiency.

- Advancements in minimally invasive and robotic-assisted surgery will enhance service capabilities.

- Strategic partnerships between hospitals and physicians will strengthen operational networks.

- Increasing healthcare investments will improve infrastructure and patient care quality.

- Digital health integration will optimize scheduling, monitoring, and post-operative recovery.

- Aging populations and chronic disease prevalence will raise surgical procedure volumes.

- Favorable reimbursement policies will support the transition from inpatient to outpatient care.

- The Asia Pacific region will emerge as the fastest-growing market with rising healthcare spending.

- Continued innovation in anesthesia and pain management will expand eligible surgical procedures.