Market Overview

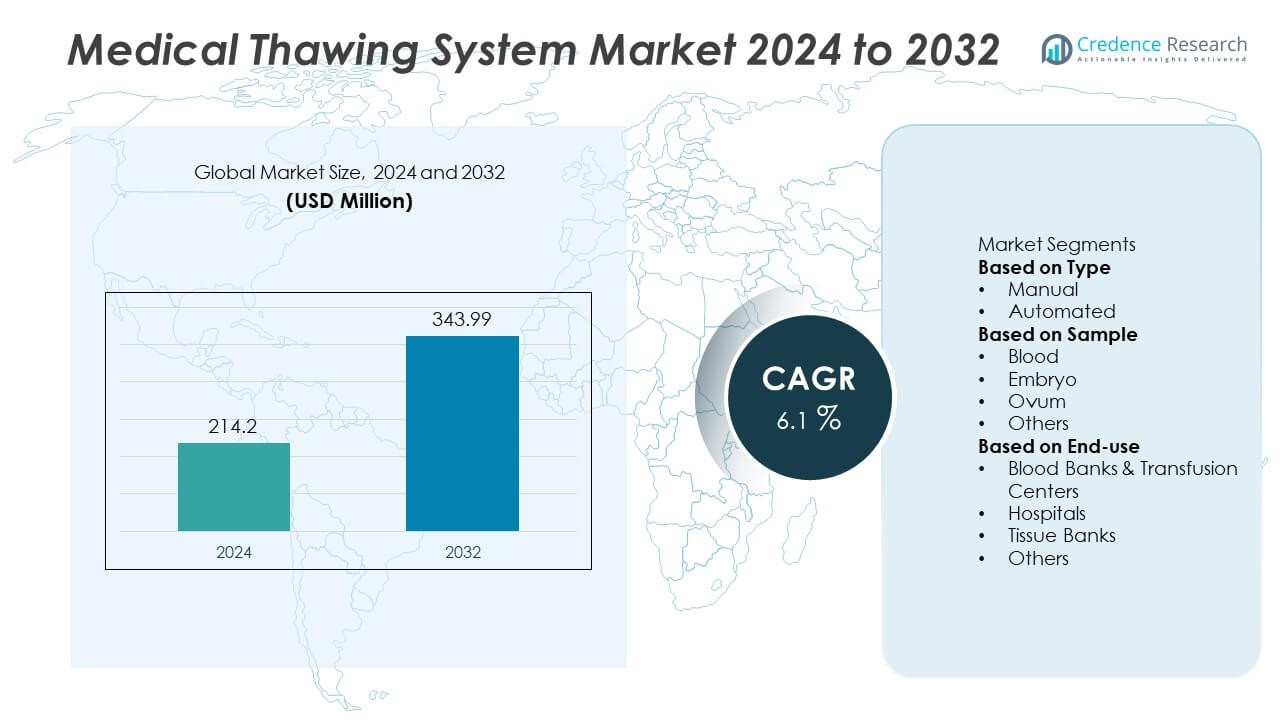

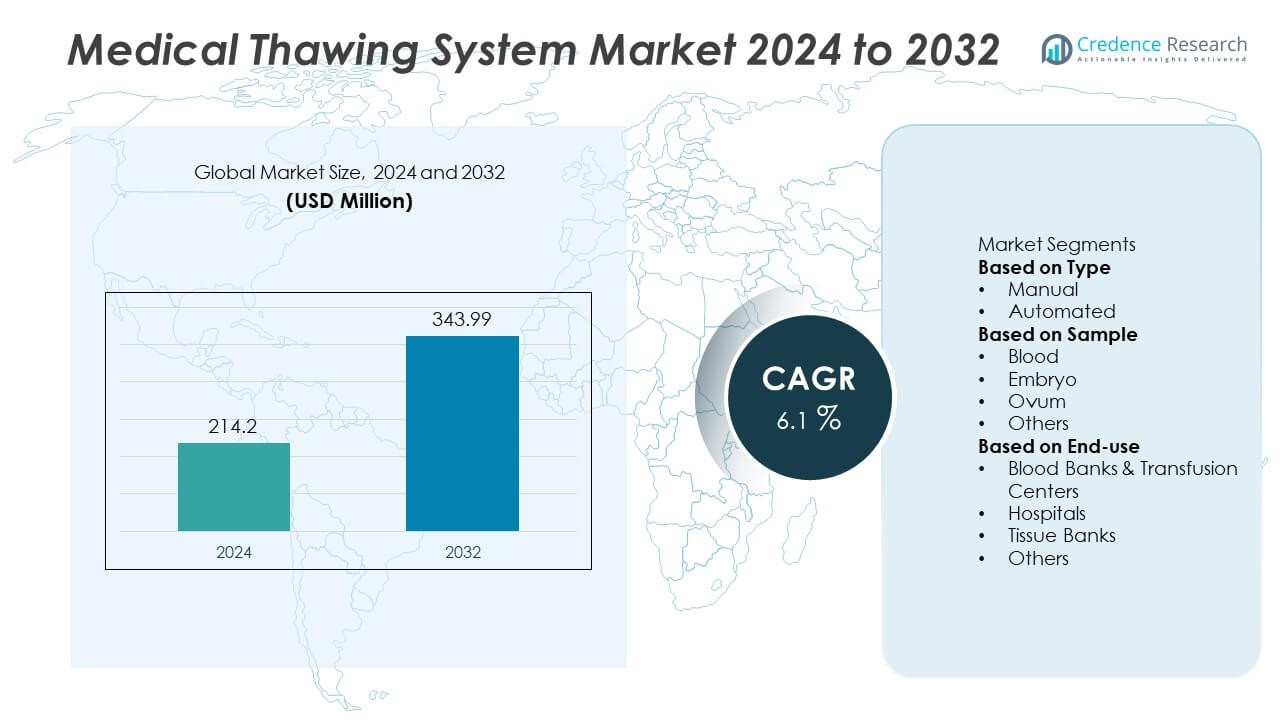

The Medical Thawing System Market was valued at USD 214.2 million in 2024 and is projected to reach USD 343.99 million by 2032, registering a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medical Thawing System Market Size 2024 |

USD 214.2 Million |

| Medical Thawing System Market, CAGR |

6.1% |

| Medical Thawing System Market Size 2032 |

USD 343.99 Million |

The Medical Thawing System market includes key players such as Helmer Scientific, Barkey GmbH & Co. KG, Cytiva, Sartorius AG, Boekel Scientific, Thermo Fisher Scientific Inc., Cardinal Health, Biomedical Solutions Inc., Sarstedt AG & Co. KG, and BioLife Solutions, Inc., all focusing on precise and automated thawing technologies for blood components, cell therapies, and reproductive samples. North America leads the market with a 37% share, supported by advanced biobanking, strong transfusion infrastructure, and widespread adoption of automated thawing devices. Europe follows with a 33% share, driven by stringent regulatory protocols and expanding cell therapy research. Asia-Pacific holds a growing 21% share, supported by investments in IVF, trauma care, and regenerative medicine programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Medical Thawing System market reached USD 214.2 million in 2024 and is projected to reach USD 343.99 million by 2032, registering a CAGR of 6.1% during the forecast period.

- Demand grows as hospitals, blood banks, and cell therapy centers require controlled thawing for blood, plasma, and cryopreserved biologics. Automated systems hold a 64% share due to accuracy and contamination prevention, while blood samples lead with 52% driven by transfusion needs.

- Key trends include integration of digital tracking, barcode identification, and cloud-based temperature monitoring. Increasing use in IVF clinics and regenerative medicine accelerates adoption of precise thawing platforms.

- Competitive landscape includes Helmer Scientific, Barkey GmbH & Co. KG, Cytiva, Sartorius AG, Boekel Scientific, Thermo Fisher Scientific Inc., and others focusing on automated multi-chamber devices and compliance-ready thawing solutions. Product differentiation relies on thawing speed, uniform temperature control, and connectivity features.

- North America leads with 37%, followed by Europe at 33% supported by biobanking and cell therapy programs. Asia-Pacific holds 21% due to IVF and trauma-care expansion, while Latin America and Middle East & Africa account for the remaining regional share.

Market Segmentation Analysis:

By Type

Automated medical thawing systems dominate this segment with a market share of 64%, driven by demand for precise temperature control and reduced risk of sample contamination. Automated platforms support uniform thawing of blood products, cell therapies, and reproductive materials, improving laboratory efficiency and patient safety. Manual thawing systems remain relevant in smaller facilities and low-resource settings where cost sensitivity influences procurement decisions. Growth in the automated category is supported by increasing adoption of advanced biobanking practices, regulatory focus on sample integrity, and rising usage across stem cell research and transfusion medicine. Integration of digital monitoring and alarms further strengthens adoption in high-volume clinical environments.

- For instance, Barkey GmbH & Co. KG’s Plasmatherm device thaws up to four 250ml Fresh Frozen Plasma (FFP) bags in approximately 15 to 20 minutes. The device works with a closed water circuit to provide a controlled dry-tempering process that helps preserve coagulation factors and reduces the risk of protein denaturation.

By Sample

Blood represents the leading sample category with a market share of 52%, supported by continuous demand from transfusion services, emergency care units, and surgical procedures. Medical thawing systems ensure controlled thawing of plasma, red cells, and cryopreserved components to maintain safety and biological functionality. Embryo and ovum thawing applications are expanding as IVF procedures and fertility preservation programs grow across specialized clinics. Other samples, including cell therapies and tissue grafts, benefit from improved cryogenic logistics in regenerative medicine. Growth in the blood segment is accelerated by rising trauma cases, chronic disease prevalence, and expanded blood bank networks requiring standardized thawing protocols.

- For instance, Helmer Scientific’s QuickThaw DH4 system enables thawing of up to 4 plasma units in as little as 10 to 18 minutes using an agitated warm-water bath design and an internal sensor array that performs numerous temperature checks per cycle, which helps maintain stability of coagulation factors before transfusion.

By End-use

Blood banks and transfusion centers lead the market with a market share of 47%, driven by the need for reliable thawing solutions that support emergency transfusions and rapid response workflows. Hospitals follow with strong adoption due to rising surgical volumes and critical care requirements. Tissue banks increase usage as regenerative medicine and organ preservation practices advance. Other users include specialized fertility clinics and biotechnology laboratories involved in cell-based research. Demand is propelled by regulatory standards for sterility, increasing cryopreservation of biologics, and the shift toward automated systems that minimize human error, ensure traceability, and enhance throughput in clinical and laboratory operations.

Key Growth Drivers

Rising Demand for Blood and Plasma Transfusions

Increasing trauma cases, chronic disease treatments, and surgical interventions drive higher usage of thawed blood components in hospitals and transfusion centers. Medical thawing systems support controlled temperature management to preserve the quality of plasma, cryoprecipitate, and packed red cells. Expansion of blood banks and emergency care units strengthens demand for rapid and safe thawing equipment. Automation further reduces human error and enhances sample traceability. With healthcare providers prioritizing faster transfusion readiness and higher patient safety, adoption of advanced thawing systems grows across both developed and emerging healthcare markets.

- For instance, the SARSTEDT SAHARA 4 warming/thawing system can thaw up to four units of frozen blood products, including Fresh Frozen Plasma (FFP), in a dry environment at a target temperature of around 37°C (98.6°F), with typical thawing times ranging from approximately 35 to 45 minutes for multiple bags.

Expansion of Cell Therapy and Regenerative Medicine

The growing application of stem cell therapies, CAR-T treatments, and tissue grafting increases the need for precise thawing of cryopreserved biologics. Medical thawing systems ensure viable recovery of cells and prevent structural damage caused by improper warming. Biopharmaceutical companies and research institutions rely on automated thawing platforms during clinical manufacturing and distribution processes. As regenerative medicine advances and clinical trials increase, laboratories require standardized thawing protocols for consistent outcomes. This growth driver accelerates investments in intelligent thawing devices with enhanced temperature monitoring, batch processing, and compliance features.

- For instance, Cytiva’s ThawSTAR CFT2 system supports automated thawing of cryogenic vials containing up to 2 mL of cell therapy material and reaches controlled thaw completion in 7 to 9 minutes, using more than 300 micro temperature adjustments per cycle to help maintain cell viability during CAR-T and MSC processing.

Growth of IVF, Fertility Preservation, and Biobanking Programs

Rising infertility rates and increased acceptance of assisted reproductive technologies support demand for thawing systems used for embryos, oocytes, and reproductive tissue. Fertility centers rely on specialized thawing units to protect genetic integrity and improve success rates. Biobanking initiatives also store reproductive cells and clinical specimens for future therapeutic use, expanding equipment requirements. Advancements in cryopreservation methods, patient-centered fertility programs, and genetic screening accelerate adoption. Stronger clinical focus on specimen safety and regulatory oversight drives uptake of automated thawing platforms with strict environmental control and documentation capabilities.

Key Trends & Opportunities

Integration of Smart, Automated, and Connected Thawing Platforms

The market is witnessing rapid adoption of automated systems integrated with digital interfaces, barcode tracking, and cloud-based data logging. Connected thawing platforms support real-time monitoring, remote operation, and temperature audit trails that improve compliance in blood banks and clinical laboratories. These capabilities enable faster decision-making and standardized operating procedures across multi-site healthcare networks. IoT integration and AI-enabled temperature prediction create opportunities for advanced product development. Vendors offering interoperable solutions compatible with laboratory information systems gain a competitive advantage.

- For instance, Azenta Life Sciences reported that its CryoThaw Smart System performs 240 temperature recordings per thawing cycle and supports encrypted data transfer to laboratory information management platforms, allowing multi-site blood centers to review thawing records and reduce manual documentation time by 48 minutes per batch.

Rising Adoption in Decentralized and Point-of-Care Settings

Growing use of thawed biologics in emergency care, ambulatory centers, and mobile transfusion units expands demand for compact, portable thawing devices. Point-of-care thawing reduces transfer time between storage and administration, improving patient outcomes in critical situations. Manufacturers see opportunities to develop durable, low-maintenance, and battery-operated systems suited for resource-limited regions. Decentralized usage also supports military medical operations and disaster response. This trend enables broader healthcare access, particularly in regions expanding trauma care and maternal health services.

- For instance, the Helmer Scientific QuickThaw DH2 Plasma Thawing System is a benchtop device that processes up to 2 frozen plasma units at a time using a controlled temperature circulating water bath.

Key Challenges

High Equipment Costs and Limited Affordability in Low-Resource Healthcare Systems

Advanced automated thawing systems require significant capital investment, limiting adoption in smaller hospitals, rural clinics, and emerging markets. Maintenance requirements, staff training, and calibration further increase total ownership cost. Many facilities continue using manual, less standardized thawing techniques due to budget constraints, slowing technology penetration. Vendors must address cost barriers through leasing models, tiered pricing, and compact system designs to expand global reach.

Strict Regulatory Requirements and Risk of Sample Compromise

The medical thawing process demands robust validation to prevent contamination, overheating, or loss of biological integrity. Compliance with blood safety, laboratory quality, and biobanking standards increases development and certification complexity for manufacturers. Any deviations in thawing conditions may compromise therapeutic outcomes, creating liability concerns for providers. Ensuring consistency across varied clinical environments remains a challenge, increasing the need for standardized protocols, staff training, and device reliability.

Regional Analysis

North America

North America holds a market share of 37%, supported by strong demand from blood banks, transfusion centers, and advanced cell therapy programs. The United States leads the region due to high surgical volumes, well-established biobanking networks, and rapid adoption of automated thawing systems. Hospitals and research facilities prioritize temperature-controlled thawing to maintain sample integrity in critical care and clinical trials. Government funding for regenerative medicine and cancer immunotherapy further increases usage of controlled thawing technology. Expanding trauma care infrastructure, strong IVF service penetration, and continuous product innovation strengthen regional growth.

Europe

Europe accounts for a market share of 33%, driven by stringent regulatory standards for blood and tissue handling and a large biopharmaceutical research base. Germany, the United Kingdom, France, and Italy invest in automated thawing systems to support blood transfusion safety and advanced cryopreservation requirements. Growing adoption in fertility clinics and tissue banks supports system deployment across public and private healthcare settings. The region benefits from expanding cell therapy manufacturing and cross-border biobanking collaboration. Focus on quality assurance, digital laboratory systems, and training programs accelerates market expansion.

Asia-Pacific

Asia-Pacific holds a market share of 21%, fueled by expanding trauma centers, rising surgical volumes, and increasing investment in cell therapy and IVF services. China, Japan, South Korea, and India strengthen demand through growing biobanking programs and supportive healthcare modernization policies. Hospitals and fertility centers adopt automated thawing systems to improve workflow efficiency and ensure sample viability. Aging populations and increasing chronic disease burdens drive blood and plasma usage, supporting stronger procurement of thawing equipment. Smart hospital initiatives and rising investment in biotechnology research contribute to long-term growth.

Latin America

Latin America maintains a market share of 5%, supported by selective adoption in regional blood banks, transplant centers, and fertility clinics. Brazil and Mexico lead market growth due to expanding emergency care infrastructure and rising awareness of regulated thawing processes. Limited presence of advanced biobanking facilities slows adoption, yet partnerships with global medical equipment providers improve access to automated systems. Growth is encouraged by public health efforts addressing maternal care, trauma response, and oncology treatment. Training programs and technology upgrades in urban medical centers gradually reinforce demand.

Middle East & Africa

The Middle East & Africa region holds a market share of 4%, led by the United Arab Emirates, Saudi Arabia, and South Africa. Investments in modern hospitals, organ transplant services, and reproductive medicine drive adoption of controlled thawing systems. Research centers and specialized clinics require reliable thawing equipment for cryopreserved biologics and cell-based therapies. Limited infrastructure in some African nations restricts broader deployment, however international healthcare collaborations improve availability. Growth is further supported by national healthcare modernization plans and rising private sector investment in advanced laboratory equipment.

Market Segmentations:

By Type

By Sample

By End-use

- Blood Banks & Transfusion Centers

- Hospitals

- Tissue Banks

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis in the Medical Thawing System market features key players including Helmer Scientific, Barkey GmbH & Co. KG, Cytiva, Sartorius AG, Boekel Scientific, Thermo Fisher Scientific Inc., Cardinal Health, Biomedical Solutions Inc., Sarstedt AG & Co. KG, and BioLife Solutions, Inc. Companies compete by advancing thawing precision, enhancing automation, and integrating digital monitoring capabilities to ensure sample integrity across blood, tissue, and cell therapy applications. Leading manufacturers focus on developing systems with uniform temperature control, barcode tracking, and connectivity to laboratory information systems, supporting compliance with transfusion and biobanking standards. Strategic partnerships with hospitals, blood banks, fertility clinics, and biopharmaceutical research centers strengthen product adoption. Continuous investments in research, compact device engineering, and multi-sample thawing chambers reinforce competitive positioning. Market players also expand global distribution networks and provide training, validation support, and after-sales services to address rising demand for safe, traceable, and rapid thawing solutions in critical care, IVF programs, and regenerative medicine workflows.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Helmer Scientific

- Barkey GmbH & Co. KG

- Cytiva (GE Healthcare Life Sciences)

- Sartorius AG

- Boekel Scientific

- Thermo Fisher Scientific Inc.

- Cardinal Health

- Biomedical Solutions Inc.

- Sarstedt AG & Co. KG

- BioLife Solutions, Inc.

Recent Developments

- In May 2024, BioLife Solutions, Inc. released the ThawSTAR CSV vial thawing system compatible with its CellSeal® vials, capable of thaw cycles under three minutes.

- In February 2023, Barkey GmbH & Co. KG launched its vialguard pro automated thawing system designed for vertical thawing of multiple small-volume vials in cell & gene therapy workflows.

- In 2023, Barkey launched the Vialguard Pro, an automated solution designed to thaw multiple small volume vials vertically, building on their expertise in fluid warming for the cell and gene therapy sector.

Report Coverage

The research report offers an in-depth analysis based on Type, Sample, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as blood banks and hospitals increase adoption of automated thawing systems.

- Advanced cell therapy and regenerative medicine programs will drive higher usage of precision thawing devices.

- IVF clinics and fertility preservation services will strengthen demand for embryo and ovum thawing solutions.

- Multi-sample and high-throughput thawing platforms will support large biobanking and clinical research operations.

- Integration with digital monitoring, barcode tracking, and cloud-based data systems will enhance compliance and traceability.

- Portable and point-of-care thawing units will grow in emergency care, military medicine, and remote healthcare settings.

- Manufacturers will focus on energy-efficient systems and improved thermal control technologies.

- Strategic partnerships between medical device makers and biopharma companies will accelerate innovation in thawing solutions.

- Training and validation support services will increase to ensure safe and standardized thawing workflows.

- Regulatory alignment across global health agencies will facilitate broader market adoption and device certification.