Market Overview:

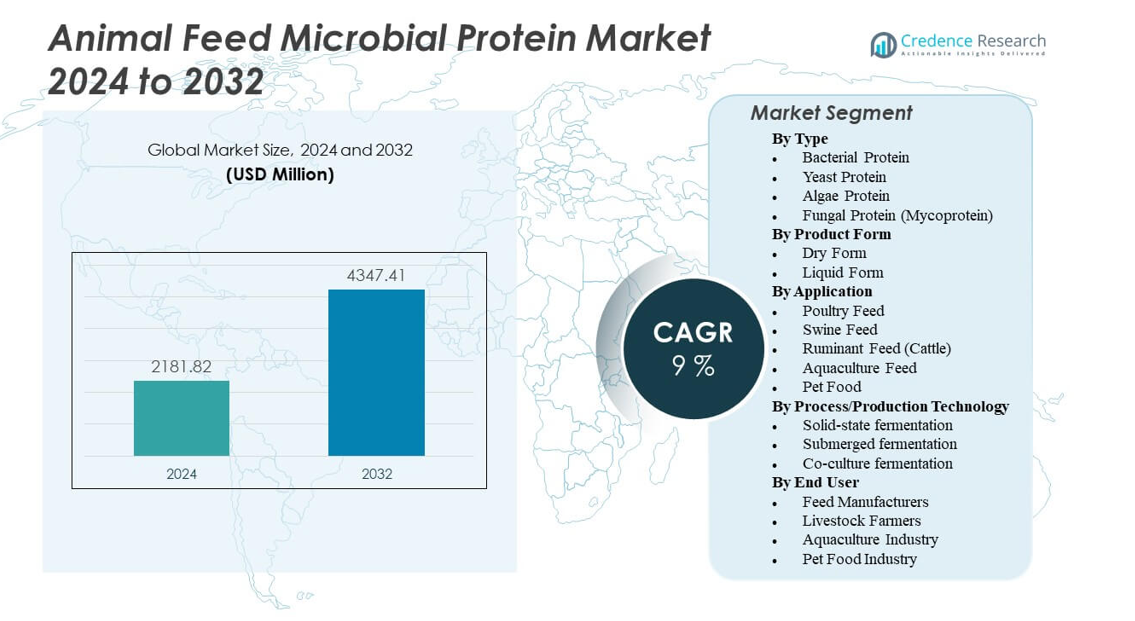

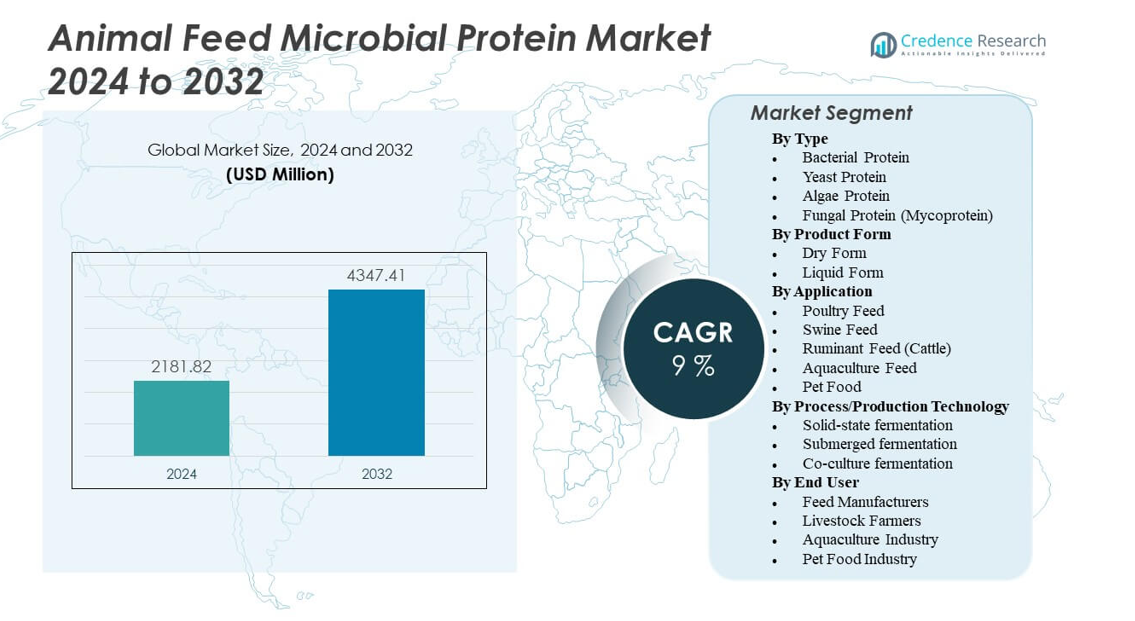

The Animal Feed Microbial Protein Market is projected to grow from USD 2,181.82 million in 2024 to an estimated USD 4,347.41 million by 2032, with a compound annual growth rate (CAGR) of 9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Animal Feed Microbial Protein Market Size 2024 |

USD 2,181.82 Million |

| Animal Feed Microbial Protein Market, CAGR |

9% |

| Animal Feed Microbial Protein Market Size 2032 |

USD 4,347.41 Million |

Growth is driven by rising demand for sustainable and high-quality protein sources in livestock nutrition. Feed manufacturers increasingly adopt microbial proteins to reduce dependence on fishmeal and soybean meal while improving feed conversion efficiency. Advances in fermentation and biotechnology enhance nutrient yield and production scalability. Government policies promoting sustainable agriculture and circular economy models further support market expansion across animal feed sectors.

Europe leads due to strict sustainability standards, strong biotech infrastructure, and government support for alternative proteins. North America follows with major investments in microbial fermentation technologies and large-scale feed manufacturing. Asia-Pacific is emerging rapidly, driven by growing meat and aquaculture industries in China, India, and Southeast Asia, where local producers expand capacity to meet rising protein demand.

Market Insights:

- The Animal Feed Microbial Protein Market is projected to grow from USD 2,181.82 million in 2024 to USD 4,347.41 million by 2032, registering a CAGR of 9%.

- Rising demand for sustainable and high-quality protein sources drives strong adoption across feed industries.

- Advancements in fermentation and biotechnology improve nutrient yield and enable large-scale production efficiency.

- Increasing government support for eco-friendly farming encourages microbial protein integration in animal feed.

- Market growth faces restraints from high production costs and limited industrial-scale facilities.

- Europe leads due to strict sustainability standards, while North America benefits from advanced biotech infrastructure.

- Asia-Pacific is emerging rapidly, fueled by rising meat and aquaculture production in China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Sustainable Protein Sources in Livestock Nutrition

The Animal Feed Microbial Protein Market benefits from the global transition toward sustainable animal nutrition. Producers face increasing pressure to reduce environmental impacts linked to traditional protein sources such as soybean and fishmeal. Microbial proteins provide an efficient alternative that requires less land and water. It supports circular economy models by using waste substrates or renewable feedstocks. Farmers adopt microbial-based feed to meet sustainability goals and consumer expectations. Growing interest in ethical meat and dairy production further strengthens this shift. Governments encourage sustainable agriculture practices through supportive policies. These combined forces drive industry-wide adoption of microbial protein feed.

Advancement in Fermentation and Biotechnology Processes Enhancing Yield Efficiency

Fermentation technologies evolve rapidly, improving microbial protein yield and quality. Biotechnology firms invest heavily in optimizing strains of bacteria, yeast, and algae for higher amino acid content. It allows consistent production at industrial scale with minimal resource use. Continuous process innovations reduce production costs, making microbial proteins more competitive. Enhanced bioengineering techniques ensure superior digestibility and nutrient balance for livestock. Companies expand bioreactor capacities to meet rising feed demands globally. Improved fermentation reduces byproduct waste and strengthens sustainability credentials. Such advances make microbial proteins a reliable substitute in large-scale animal feed systems.

Shift Toward Reducing Dependence on Conventional Feed Ingredients

Growing concern over fluctuating soy and fishmeal prices prompts manufacturers to diversify protein inputs. The market responds to these pressures with stable and scalable microbial alternatives. It ensures predictable supply, reducing exposure to raw material volatility. Livestock producers appreciate the ability to maintain feed consistency across seasons. Feed formulators integrate microbial proteins to enhance amino acid balance and nutrient absorption. Reduced reliance on conventional sources also mitigates risks tied to overfishing and deforestation. The approach aligns with global food security and environmental sustainability priorities. This transition strengthens market resilience and long-term growth potential.

- For example, Unibio operates a facility in Kalundborg, Denmark, utilizing its patented U-Loop® reactor technology to convert natural gas or biogas into UniProtein®, a microbial protein approved for animal feed use in Europe. The company focuses on sustainable protein production through large-scale fermentation.

Growing Focus on Nutritional Quality and Feed Performance Enhancement

Livestock farmers prioritize protein quality to improve animal growth, immunity, and product yield. The Animal Feed Microbial Protein Market responds with formulations rich in essential amino acids and digestible nutrients. It supports improved feed conversion ratios and reduced nutrient wastage. Enhanced animal health outcomes translate into higher productivity for farms. Producers leverage microbial proteins to improve gut microbiota balance, reducing dependency on antibiotics. The focus on nutritional performance drives integration into poultry, swine, and aquaculture feeds. Companies promote these products as high-value nutritional supplements. Market players capitalize on this trend to gain competitive advantage.

- For example, KnipBio Meal (KBM), produced from the bacterium Methylobacterium extorquens, has been evaluated in aquafeed studies showing its suitability as a partial replacement for traditional protein sources in species like rainbow trout. Peer-reviewed research and FDA GRAS approval confirm KBM’s safety and effectiveness as a sustainable feed ingredient.

Market Trends

Integration of Circular Bioeconomy Models in Feed Production Systems

The Animal Feed Microbial Protein Market aligns with global bioeconomy initiatives aimed at recycling and resource efficiency. Companies adopt processes that convert agricultural or industrial residues into protein-rich biomass. It contributes to a closed-loop production model with minimal waste generation. Circular models enhance profitability by lowering raw material costs. Governments and sustainability organizations support circular feed projects through incentives. Such integration appeals to feed manufacturers seeking carbon-neutral solutions. Investment in circular bio-refineries strengthens regional supply chains. The trend ensures that microbial protein remains central to green feed innovations.

Adoption of Precision Fermentation and Synthetic Biology for Protein Optimization

Precision fermentation transforms the way microbial proteins are developed and scaled. Synthetic biology enables precise control over amino acid composition and nutrient density. It allows manufacturers to tailor feed proteins to specific animal requirements. Technological innovation enhances consistency and reduces variability in final products. Research collaborations between biotech firms and feed producers accelerate commercialization. Precision processes also improve scalability without compromising feed safety. Cost efficiency improves through optimized microbial strains and energy-efficient bioreactors. These technological advances define a new era in sustainable feed protein production.

Expansion of Alternative Protein Startups in Feed Industry Ecosystem

A surge in biotechnology startups accelerates innovation across feed ingredient segments. Many emerging firms focus on microbial protein derived from algae, fungi, or methanotrophic bacteria. It introduces competitive diversity and stimulates research funding in feed biotechnology. Strategic partnerships between startups and major feed corporations expand commercialization networks. Venture capital inflows signal strong investor confidence in sustainable feed solutions. New entrants explore niche markets, such as aquaculture and pet nutrition. Their innovation contributes to improved production efficiency and lower carbon footprints. Such entrepreneurial activity strengthens the global microbial protein ecosystem.

- For example, Deep Branch’s Proton™ microbial protein is produced using carbon dioxide captured from industrial emissions. The company’s Carbon Craft project in Rotterdam demonstrated its potential to cut CO₂ emissions by up to 90% compared to traditional feed proteins, with pilot validation supported by BioMar and AB Agri.

Rising Regulatory and Consumer Focus on Sustainable Feed Labeling Standards

Governments worldwide emphasize transparency and traceability in animal feed sourcing. The Animal Feed Microbial Protein Market aligns with new sustainability labeling requirements. It enables manufacturers to communicate low-carbon credentials and ethical sourcing to buyers. Feed certification programs gain prominence, promoting industry credibility. Consumer awareness of sustainability drives demand for certified microbial protein products. Regulatory clarity ensures smoother market entry for innovative feed solutions. Companies invest in compliance and third-party validation to strengthen brand trust. This focus enhances overall accountability across the animal feed value chain.

- For instance, Alltech’s Feed Verified program is accredited by IMI Global, enabling producers and feed companies to certify feed products for claims including traceability, non-GMO status, and compliance with international market access requirements.

Market Challenges Analysis

High Production Cost and Limited Industrial-Scale Manufacturing Infrastructure

Despite strong demand, the Animal Feed Microbial Protein Market faces challenges from high operational costs. Industrial fermentation requires advanced bioreactors and sterile processing conditions, increasing capital intensity. It limits participation from small and medium feed manufacturers. Energy and substrate costs also constrain profitability for large producers. The need for continuous process optimization adds technical complexity. Limited access to low-cost raw materials affects scalability in emerging economies. Many firms struggle to achieve cost parity with traditional protein sources. Overcoming these barriers requires focused investment in technological efficiency and supply chain localization.

Regulatory Complexity and Market Acceptance Barriers Among End Users

Regulatory frameworks for novel microbial feed ingredients vary widely across regions. It complicates approval processes and delays market entry for producers. End users remain cautious due to limited awareness of safety and nutritional performance. Feed formulators often rely on conventional proteins with established certifications. Achieving consistent product quality and traceability is critical for acceptance. Uncertainty regarding labeling and regional import standards creates trade friction. Consumer concerns about genetically modified inputs also affect perception. Continuous education and harmonized global standards are necessary to enhance industry confidence and adoption rates.

Market Opportunities

Rising Investments in Biotech Infrastructure and Research Collaboration Networks

Increased public and private investments open new pathways for scaling microbial protein production. Governments support sustainable agriculture programs that fund bioreactor and fermentation facility expansion. The Animal Feed Microbial Protein Market benefits from cross-sector research collaborations. It drives innovation through partnerships among academia, biotech companies, and feed manufacturers. These alliances focus on cost reduction, strain optimization, and regulatory standardization. Expanding infrastructure in Asia and Europe creates regional production hubs. Investors recognize microbial protein as a viable long-term growth area. Strengthened R&D ecosystems are expected to accelerate commercialization and global reach.

Growing Opportunities in Aquaculture and Pet Food Segments

Emerging applications beyond livestock feed present strong growth potential. Aquaculture industries seek consistent and sustainable protein sources to replace fishmeal. It positions microbial proteins as ideal solutions for aquatic nutrition due to their digestibility. Pet food manufacturers integrate microbial proteins for hypoallergenic and nutrient-rich formulations. Rising pet ownership and premium product demand further support this expansion. Companies target species-specific formulations to capture niche segments. Collaboration between aquafeed and pet food producers accelerates adoption. These evolving segments promise stable revenue streams and diversified market opportunities.

Market Segmentation Analysis:

By Type

Bacterial protein dominates the Animal Feed Microbial Protein Market due to its balanced amino acid composition and fast production rate. It supports efficient feed conversion and consistent quality, making it ideal for poultry and aquaculture feed. Yeast protein gains traction for its immune-boosting properties and natural probiotics. Algae protein offers high digestibility and omega-rich nutrients suited for aquatic species. Fungal protein or mycoprotein contributes to sustainable livestock nutrition with superior fiber content. Each type enhances feed efficiency while reducing environmental impact and reliance on conventional protein sources.

- For instance: Lallemand’s Levucell® SB live yeast was shown in a large-scale French trial involving 27,000 pigs to reduce feed conversion ratio by 0.06 points, increase average daily gain by 2.6%, and enable pigs to reach market weight three days faster compared to controls. These results are authenticated by both company reports and independent farm trials.

By Product Form

Dry form leads the segment due to its stability, long shelf life, and easy transport. It allows feed manufacturers to store and blend ingredients efficiently across multiple feed types. The liquid form finds growing use in precision feeding systems for aquaculture and pet food. It enables uniform nutrient dispersion and better digestibility. The Animal Feed Microbial Protein Market continues to expand product form diversification to meet operational flexibility and nutritional performance targets.

By Application

Poultry feed dominates the segment owing to high global demand for poultry meat and eggs. It supports rapid growth and better feed efficiency in broilers and layers. Swine and ruminant feed segments benefit from enhanced nutrient absorption and reduced methane emissions. Aquaculture feed gains importance due to declining fishmeal supplies, driving microbial protein adoption. Pet food applications grow rapidly with rising consumer preference for sustainable and hypoallergenic protein ingredients.

- For instance: Calysta’s FeedKind® is commercialized as a direct fishmeal alternative, validated in salmon and trout trials by Calysseo and covered in industry press; the Chongqing facility’s 20,000-ton annual output supports global aquafeed markets.

By Process/Production Technology

Solid-state fermentation remains cost-effective for large-scale production, while submerged fermentation ensures high purity and yield. Co-culture fermentation gains momentum for improving nutrient profile and protein synthesis efficiency. The Animal Feed Microbial Protein Market witnesses continuous innovation in fermentation technology to lower production costs and increase scalability. These processes ensure consistent quality and safety standards across animal feed categories.

By End User

Feed manufacturers account for the largest share, integrating microbial proteins into compound feed formulations for better nutritional outcomes. Livestock farmers increasingly adopt these proteins to enhance growth rates and disease resistance in animals. The aquaculture industry relies on microbial protein to offset fishmeal shortages and improve feed sustainability. The pet food industry adopts it for premium formulations focusing on health and eco-friendly sourcing. Each end user segment strengthens market expansion through innovation and sustainability-driven adoption.

Segmentation:

By Type

- Bacterial Protein

- Yeast Protein

- Algae Protein

- Fungal Protein (Mycoprotein)

By Product Form

By Application

- Poultry Feed

- Swine Feed

- Ruminant Feed (Cattle)

- Aquaculture Feed

- Pet Food

By Process/Production Technology

- Solid-state fermentation

- Submerged fermentation

- Co-culture fermentation

By End User

- Feed Manufacturers

- Livestock Farmers

- Aquaculture Industry

- Pet Food Industry

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America leads the Animal Feed Microbial Protein Market with a 34% share, driven by high adoption of sustainable feed solutions and strong biotechnology infrastructure. The region benefits from established animal feed industries in the United States and Canada. It promotes microbial protein integration to reduce reliance on imported soy and fishmeal. Regulatory agencies support microbial innovations through safety certifications and sustainability programs. Feed manufacturers invest in advanced fermentation facilities to enhance production efficiency. Growing consumer awareness of animal welfare and sustainable farming fuels long-term demand.

Europe

Europe holds a 31% share, supported by stringent sustainability standards and strong government incentives for circular bioeconomy models. Countries such as Germany, France, and the Netherlands lead due to extensive R&D initiatives and strict feed regulations. The region emphasizes replacing conventional protein sources with low-carbon microbial alternatives. It also benefits from the presence of leading biotech firms and a well-developed feed manufacturing base. European feed producers focus on reducing greenhouse gas emissions through microbial protein integration. The market growth aligns closely with the European Green Deal and animal nutrition modernization goals.

Asia-Pacific

Asia-Pacific accounts for a 27% share and represents the fastest-growing regional market. Rising demand for meat, dairy, and aquaculture feed drives microbial protein adoption in China, India, and Southeast Asia. It benefits from increasing investments in biotechnology and fermentation infrastructure. Governments encourage local protein production to improve food security and reduce import dependency. Expanding aquaculture operations in coastal economies strengthen microbial protein use. Emerging startups and public-private collaborations further stimulate market penetration in developing nations. Latin America and the Middle East & Africa collectively contribute the remaining 8%, showcasing growing interest in sustainable feed technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Calysta, Inc.

- ENOUGH (3F Bio Ltd.)

- Mycorena AB

- Quorn Foods (Marlow Ingredients)

- Alltech

- Avecom

- KnipBio

- Arbiom

- Roquette Frères

- Lonza Group

- Nutreco N.V.

- Biomin Holdings GmbH

- Devenish Nutrition Limited

- Quality Liquid Feeds

- IPK Gatersleben (AG CHEMI Group)

Competitive Analysis:

The Animal Feed Microbial Protein Market features strong competition among biotechnology firms, feed manufacturers, and ingredient suppliers focused on sustainable nutrition. Key players such as Calysta, Unibio, KnipBio, and Innovafeed lead through advanced fermentation and single-cell protein technologies. It emphasizes innovation in microbial strain development, production scalability, and cost optimization. Strategic partnerships between feed producers and biotech companies accelerate commercial adoption and product standardization. Companies focus on expanding regional production capacities and improving nutrient profiles for species-specific feed. Continuous investment in R&D and regulatory compliance strengthens market credibility. The competitive environment favors firms offering high-quality, low-carbon, and traceable protein solutions.

Recent Developments:

- In October 2025, Lonza Group signed a significant multi-year commercial supply agreement for bioconjugates at its Vacaville site and announced the acquisition of Redberry SAS to expand rapid microbiology testing solutions and strengthen its product portfolio for animal and human nutrition, including notable launches in cell and gene therapy manufacturing.

- In May 2025, Roquette Frères successfully completed the acquisition of IFF Pharma Solutions, integrating their expertise and product portfolio to strengthen Roquette’s offerings in health, nutrition, and animal feed markets. This acquisition solidifies Roquette’s position as a partner in drug delivery and nutrition solutions worldwide.

- In February 2025, Calysta, Inc. partnered with Marsapet to launch the first complete dog food made with FeedKind Pet protein, a fermented alternative protein produced without arable land or animal components. This collaboration marks a significant commercial rollout for microbial proteins in the pet and animal feed sector.

Report Coverage:

The research report offers an in-depth analysis based on Type, Product Form, Application, Process/Production Technology and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for microbial protein will accelerate with the global shift toward sustainable livestock feed systems.

- Biotechnology advancements will enhance fermentation efficiency, improving nutrient yield and scalability.

- Feed manufacturers will increasingly replace fishmeal and soybean with microbial protein alternatives.

- Rising investments in circular bioeconomy projects will strengthen production infrastructure and innovation.

- Strategic collaborations between feed companies and biotech firms will speed up market commercialization.

- Regulatory harmonization will promote faster adoption of microbial protein across feed applications.

- Aquaculture and pet food industries will emerge as high-potential segments for market expansion.

- Continuous R&D in strain optimization will lead to customized, species-specific feed formulations.

- Adoption of automation and AI in fermentation will reduce production costs and improve consistency.

- Growing consumer demand for sustainable animal products will sustain long-term growth momentum.