| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Industrial Catalyst Market Size 2024 |

USD 9386.44 Million |

| Asia Pacific Industrial Catalyst Market, CAGR |

7.44% |

| Asia Pacific Industrial Catalyst Market Size 2032 |

USD 16,666.16 Million |

Market Overview:

The Asia Pacific Industrial Catalyst Market is projected to grow from USD 9386.44 million in 2024 to an estimated USD 16,666.16 million by 2032, with a compound annual growth rate (CAGR) of 7.44% from 2024 to 2032.

Several factors contribute to the robust growth of the industrial catalyst market in the Asia Pacific region. The increasing demand for petrochemical products, including polymers and synthetic materials, necessitates efficient catalytic processes to enhance production yields and process efficiency. Additionally, stringent environmental policies aimed at reducing emissions and promoting cleaner production processes have led industries to adopt advanced catalysts that facilitate compliance with these regulations. Continuous research and development efforts have resulted in the creation of high-performance catalysts with improved activity, selectivity, and durability, further driving market growth. Moreover, the region’s focus on sustainable practices and cleaner technologies has increased the demand for catalysts in renewable energy applications, such as biofuel production and hydrogen generation. The burgeoning automotive industry, particularly in countries like China and India, also drives the demand for catalysts used in emission control systems to meet stringent vehicular emission standards.

Within the Asia Pacific region, several countries play pivotal roles in the industrial catalyst market. As a major manufacturing hub, China dominates the market with significant investments in petrochemical and chemical industries, driving the demand for various catalysts. Rapid industrialization and government initiatives promoting domestic manufacturing in India have bolstered the demand for industrial catalysts, particularly in sectors like petroleum refining and chemical synthesis. With its advanced technological infrastructure, Japan focuses on developing high-performance catalysts, especially for environmental applications and sustainable energy solutions. Nations such as Thailand, Vietnam, and Malaysia are experiencing growth in manufacturing activities, leading to increased consumption of catalysts in various industrial processes. The ASEAN region’s strategic initiatives to attract foreign direct investments have further enhanced its manufacturing capabilities, thereby amplifying the demand for industrial catalysts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Asia Pacific industrial catalyst market is projected to grow from USD 9,386.44 million in 2024 to approximately USD 16,666.16 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.44% during this period.

- The global industrial catalyst market is projected to grow from USD 31.56 billion in 2024 to USD 51.15 billion by 2032, with a CAGR of 6.22% from 2024 to 2032.

- Increasing demand for petrochemical products, such as polymers and synthetic materials, necessitates efficient catalytic processes to enhance production yields and optimize efficiencies.

- Stringent environmental regulations aimed at reducing emissions and promoting cleaner production processes are compelling industries to adopt advanced catalysts to ensure compliance.

- Continuous research and development efforts have led to the creation of high-performance catalysts with improved activity, selectivity, and durability, further stimulating market expansion.

- The region’s focus on sustainable practices and cleaner technologies has heightened the demand for catalysts in renewable energy applications, including biofuel production and hydrogen generation.

- The burgeoning automotive industry, particularly in countries like China and India, is driving the need for catalysts used in emission control systems to meet stringent vehicular emission standards.

- Within the region, China dominates the market with significant investments in petrochemical and chemical industries, while rapid industrialization and supportive government initiatives in India have bolstered demand for industrial catalysts, especially in petroleum refining and chemical synthesis sectors.

- Japan’s advanced technological infrastructure emphasizes the development of high-performance catalysts for environmental applications and sustainable energy solutions.

- Emerging manufacturing activities in nations such as Thailand, Vietnam, and Malaysia are also contributing to increased consumption of catalysts across various industrial processes.

Market Drivers:

Market Drivers:

Expansion of the Petrochemical Industry

The Asia Pacific region has experienced substantial growth in its petrochemical sector, driven by escalating demand for polymers and synthetic materials across various industries. This surge necessitates the adoption of efficient catalytic processes to enhance production yields and optimize process efficiencies. Industrial catalysts play a pivotal role in facilitating complex chemical reactions essential for producing high-value petrochemical products. Consequently, the burgeoning petrochemical industry serves as a primary driver for the industrial catalyst market in the region. For instance, China’s oil consumption is projected to increase by 1.1% in 2025, reaching 765 million metric tons, driven by better-than-expected economic growth and heightened demand for petrochemicals.

Stringent Environmental Regulations

Governments across the Asia Pacific are implementing rigorous environmental policies aimed at reducing industrial emissions and promoting sustainable manufacturing practices. Industries are compelled to adopt advanced catalyst technologies to comply with these stringent regulations, as catalysts are instrumental in minimizing harmful emissions and enhancing process efficiency. This regulatory landscape significantly propels the demand for industrial catalysts, positioning them as essential components in achieving environmental compliance and sustainability goals. For instance, the Asia-Pacific stationary catalytic systems market is projected to exhibit growth, driven by growing energy requirements and stringent efficiency standards.

Technological Advancements in Catalyst Development

Continuous research and development efforts have led to notable advancements in catalyst technologies, resulting in products with improved activity, selectivity, and longevity. These innovations enable industries to achieve higher efficiency and cost-effectiveness in their processes. The introduction of novel catalysts tailored for specific applications has expanded their utilization across diverse sectors, further stimulating market growth in the Asia Pacific region. For example, the Asia Pacific refinery catalyst market is expected to reach projected revenue, reflecting the impact of technological advancements in catalyst development.

Shift Towards Renewable Energy Sources

The Asia Pacific region is increasingly focusing on sustainable practices and cleaner technologies, leading to a heightened demand for catalysts in renewable energy applications. For instance, Sarawak, Malaysia, aims to become ASEAN’s green hydrogen hub by leveraging hydropower resources and international collaborations to develop a low-carbon hydrogen supply chain. Catalysts are crucial in processes such as biofuel production and hydrogen generation, facilitating the transition towards greener energy sources. This shift not only aligns with global sustainability trends but also opens new avenues for the industrial catalyst market, as industries seek efficient solutions to support renewable energy initiatives. The Asia Pacific renewable energy market is projected to grow, underscoring the region’s commitment to renewable energy adoption.

Market Trends:

Diversification of Feedstock Sources

The Asia Pacific industrial catalyst market is experiencing a notable shift towards utilizing a broader range of feedstock sources, including renewable materials. Refineries are increasingly incorporating bio-based feedstocks, such as used cooking oil, into their processes to produce cleaner fuels. This transition necessitates advanced catalysts capable of efficiently processing these varied inputs, thereby driving innovation and demand within the catalyst sector. Maurits van Tol, CEO of Johnson Matthey, emphasized the growing need for catalysts and additives to remove impurities from bio-feedstocks, highlighting the market’s adaptation to sustainable practices.

Strategic Expansion of Refining Capacities

To meet the escalating demand for petrochemical products, countries in the Asia Pacific region are strategically expanding their refining capacities. For instance, Bharat Petroleum Corporation Limited (BPCL) in India plans to construct a new refinery in Andhra Pradesh with a significant processing capacity. This development aims to substantially increase BPCL’s petrochemical output, marking a considerable rise from its current production levels. Such initiatives are poised to elevate the demand for industrial catalysts essential in refining processes, thereby propelling market growth.

Impact of Trade Policies on the Petrochemical Sector

Recent trade policies, particularly the introduction of new U.S. import tariffs, are exerting additional pressure on the already struggling global petrochemical sector. These tariffs are anticipated to raise costs for goods such as electronics, appliances, and packaging, potentially reducing consumer demand and downstream petrochemical usage. Asian refining margins for key feedstocks like naphtha have already experienced a decline, reflecting the sector’s vulnerability to geopolitical developments. This scenario underscores the need for adaptive strategies within the industrial catalyst market to navigate evolving trade dynamics.

Technological Advancements in Catalyst Development

Continuous research and development efforts are leading to significant advancements in catalyst technologies within the Asia Pacific region. For instance, Johnson Matthey has invested in advanced testing facilities to accelerate the development of fluid catalytic cracking (FCC) additives that optimize yields and enable refiners to process renewable feedstocks with greater precision. Innovations focus on enhancing catalyst efficiency, selectivity, and lifespan, enabling industries to achieve higher productivity and cost-effectiveness. The introduction of novel catalysts tailored for specific applications, such as processing renewable feedstocks and improving emission controls, is expanding their utilization across diverse sectors. These technological strides are instrumental in driving the industrial catalyst market forward, aligning with the region’s commitment to sustainability and environmental compliance.

Market Challenges Analysis:

Volatility in Raw Material Prices

The industrial catalyst market in Asia Pacific faces challenges due to the fluctuating prices of precious metals like platinum, palladium, and rhodium, which are key components in catalyst production. the costs of which can vary based on global supply-demand dynamics, geopolitical tensions, and mining outputs. Such volatility can lead to increased production costs, thereby squeezing profit margins for manufacturers and potentially elevating prices for end-users. For instance, platinum-based catalysts are widely used for their superior catalytic properties but come with high costs that impact affordability for manufacturers.

Stringent Environmental Regulations

Governments across the Asia Pacific are implementing rigorous environmental policies aimed at reducing industrial emissions and promoting sustainable manufacturing practices. While these regulations drive demand for advanced catalysts, they also pose challenges for manufacturers to continually innovate and produce catalysts that meet evolving standards. Compliance necessitates substantial investment in research and development, which can be resource-intensive and time-consuming.

Supply Chain Disruptions

The Asia Pacific industrial catalyst market is susceptible to supply chain disruptions, which can arise from various factors including geopolitical tensions, natural disasters, and global pandemics. Such disruptions can hinder the timely procurement of essential raw materials and components, leading to production delays and increased operational costs. The COVID-19 pandemic exemplified how unforeseen events can significantly impact supply chains, emphasizing the need for robust contingency planning.

Competition from Alternative Technologies

The emergence and adoption of alternative technologies present a challenge to the traditional industrial catalyst market. Innovations in process optimization and the development of non-catalytic methods for industrial processes can reduce the reliance on conventional catalysts. To remain competitive, catalyst manufacturers must invest in continuous improvement and differentiation of their products, ensuring they offer superior performance and cost-effectiveness compared to emerging alternatives.

Market Opportunities:

The Asia Pacific industrial catalyst market is poised for significant expansion, driven by rapid industrialization and the escalating demand for petrochemical products. Countries such as China, India, and Southeast Asian nations are witnessing substantial growth in their manufacturing and chemical sectors, necessitating efficient catalytic processes to enhance production yields and optimize efficiencies. This industrial surge presents a robust opportunity for catalyst manufacturers to cater to the increasing needs of these burgeoning economies.

Furthermore, the region’s commitment to environmental sustainability and stringent emission regulations is propelling the adoption of advanced catalyst technologies. Industries are increasingly seeking catalysts that facilitate cleaner production processes and compliance with environmental standards. Additionally, the shift towards renewable energy sources, such as biofuels and hydrogen, is creating new avenues for catalyst applications, as these processes rely heavily on specialized catalysts to improve efficiency and output. Collectively, these factors underscore a promising landscape for the industrial catalyst market in the Asia Pacific region.

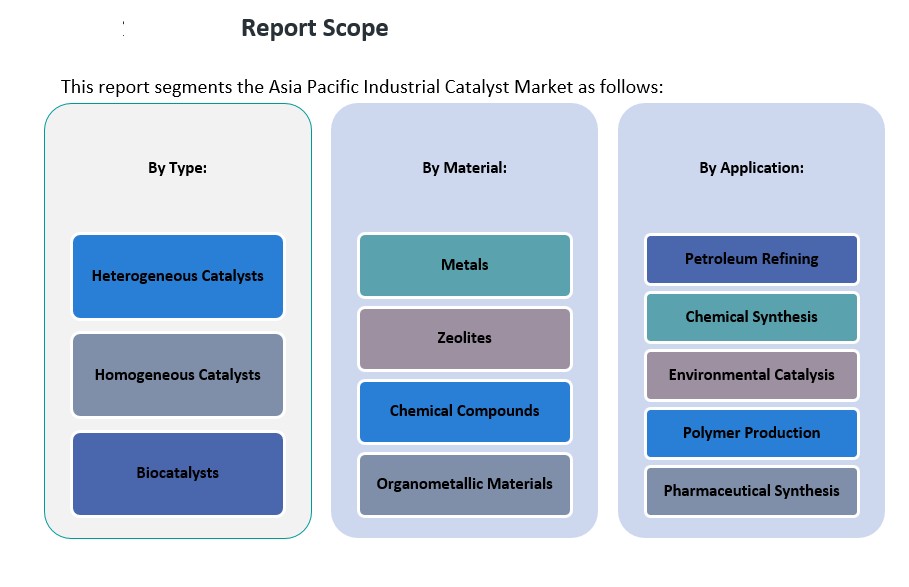

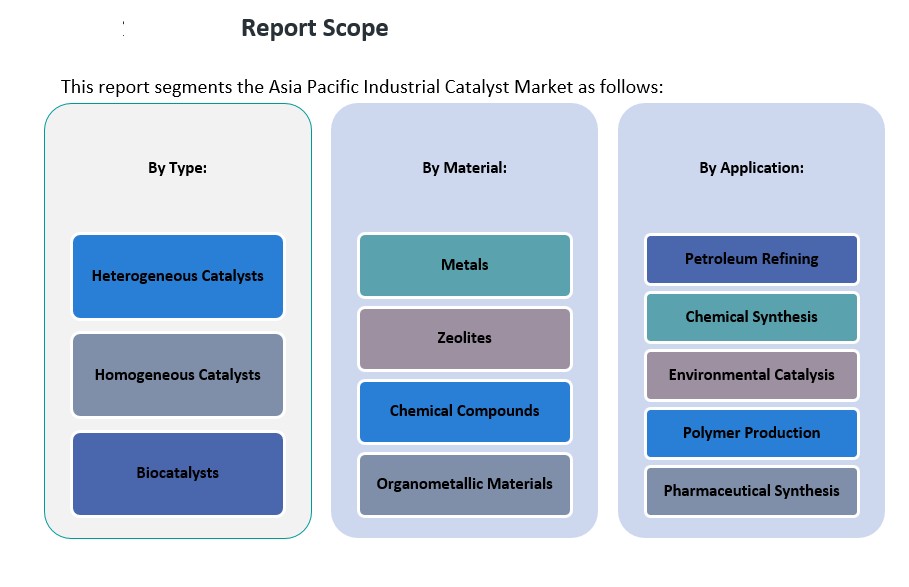

Market Segmentation Analysis:

By Type

In the Asia Pacific industrial catalyst market, heterogeneous catalysts hold a dominant position. These catalysts, existing in a different phase than the reactants, are extensively utilized in processes such as petroleum refining and chemical synthesis due to their ease of separation and reusability. Homogeneous catalysts, which share the same phase as the reactants, are also significant, particularly in specialized chemical applications requiring high selectivity. Biocatalysts, derived from natural sources like enzymes, are gaining traction, especially in the pharmaceutical and environmental sectors, driven by a shift towards sustainable and green chemistry practices.

By Application

Petroleum refining emerges as a primary application segment, with catalysts playing a crucial role in processes like fluid catalytic cracking and hydroprocessing to enhance fuel quality and yield. Chemical synthesis is another vital segment, where catalysts facilitate the production of a wide array of chemicals and intermediates. Environmental catalysis is witnessing increased attention, driven by stringent regulations aimed at reducing industrial emissions; catalysts are employed in treatments such as catalytic converters and effluent management. Polymer production relies heavily on catalysts for polymerization processes, essential for manufacturing plastics and synthetic materials. The pharmaceutical synthesis segment is expanding, with catalysts enabling efficient and selective synthesis of complex pharmaceutical compounds.

By Material

Metals, including base and precious metals, are widely used in catalyst formulations due to their effective catalytic properties in various industrial reactions. Zeolites, known for their porous structures, are predominantly utilized in petroleum refining and petrochemical processes for their shape-selective catalytic abilities. Chemical compounds, encompassing acids, peroxides, and other inorganic substances, serve as catalysts or catalyst supports in multiple applications. Organometallic materials, comprising metal-organic frameworks, are increasingly explored for their unique properties, offering potential in applications like polymerization and fine chemical synthesis.

Segmentation:

By Type Segment

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

By Application Segment

- Petroleum Refining

- Chemical Synthesis

- Environmental Catalysis

- Polymer Production

- Pharmaceutical Synthesis

By Material Segment

- Metals

- Zeolites

- Chemical Compounds

- Organometallic Materials

Regional Analysis:

The Asia Pacific region holds a prominent position in the global industrial catalyst market, driven by rapid industrialization, expansive petrochemical activities, and technological advancements across several key countries.

China

China stands as the dominant player in the Asia Pacific industrial catalyst market, underpinned by its vast manufacturing base and substantial investments in the petrochemical sector. The nation’s focus on expanding refining capacities and chemical production has led to an increased demand for industrial catalysts. Government initiatives aimed at enhancing domestic manufacturing capabilities further bolster this demand, positioning China as a central hub for catalyst consumption and production.

India

India is experiencing robust growth in the industrial catalyst market, propelled by rapid industrialization and supportive government policies promoting domestic manufacturing. The country’s expanding petroleum refining and chemical synthesis sectors are significant consumers of industrial catalysts. Initiatives such as “Make in India” have attracted foreign investments, leading to the establishment of new manufacturing facilities and, consequently, a heightened demand for catalysts.

Japan

Japan’s industrial catalyst market is characterized by advanced technological infrastructure and a strong emphasis on research and development. The country focuses on producing high-performance catalysts, particularly for environmental applications and sustainable energy solutions. Japan’s commitment to innovation and quality positions it as a key contributor to the regional market, catering to both domestic needs and export demands.

Southeast Asia

Countries in Southeast Asia, including Thailand, Vietnam, and Malaysia, are witnessing significant growth in manufacturing activities. This upsurge is driven by favorable government policies, competitive labor costs, and increasing foreign direct investments. The burgeoning industrial landscape in these nations has led to a rising consumption of industrial catalysts, essential for various chemical and refining processes.

Key Player Analysis:

- Mitsubishi Chemical Corporation

- LG Chem

- R. Grace (Asia-Pacific operations)

- BASF SE (Regional)

- Reliance Industries Limited

- Sinopec Catalyst Co., Ltd.

- Johnson Matthey (Asia-Pacific operations)

- China National Petroleum Corporation (CNPC)

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

Competitive Analysis:

The Asia Pacific industrial catalyst market is characterized by the presence of several key players who leverage advanced technologies and strategic initiatives to maintain a competitive edge. Prominent companies in this sector include BASF SE, Johnson Matthey Plc, Clariant AG, Albemarle Corporation, and Haldor Topsoe A/S. These organizations focus on continuous research and development to introduce innovative catalyst solutions that cater to diverse industrial applications. Their strategies encompass expanding production capacities, forming strategic partnerships, and emphasizing sustainability to meet the evolving demands of industries such as petrochemicals, chemical synthesis, and environmental applications. The competitive landscape is further influenced by regional players who contribute to market dynamics through localized expertise and tailored solutions. Companies such as Mitsui Chemicals in Japan and various emerging firms in China and India are enhancing their market positions by investing in technology and expanding their product portfolios. This competitive environment fosters innovation and drives the development of catalysts that improve process efficiencies and adhere to stringent environmental regulations. As a result, the Asia Pacific industrial catalyst market remains vibrant, with companies striving to address the growing needs of industrial sectors through advanced and sustainable catalyst technologies.

Recent Developments:

- In January 2025, Mitsubishi Chemical Group announced plans to expand its operations in India’s green specialty sector, focusing on semiconductor and EV supply chain materials. The company is exploring new business opportunities in mono methyl acrylate (MMA) production and may collaborate with partners or establish greenfield units for these ventures.

- On October 29, 2024, W.R. Grace partnered with Nayara Energy Limited to successfully launch a new 450 KTA polypropylene process technology plant in Vadinar, Gujarat. Utilizing Grace’s non-phthalate CONSISTA catalysts and UNIPOL process technology, the plant aims to produce high-quality polypropylene resins for pharmaceutical, health, and hygiene applications.

- In November 2024, Clariant launched its Plus series syngas catalysts, including ReforMax LDP Plus, ShiftMax 217 Plus, and AmoMax 10 Plus. These advanced catalysts were designed as drop-in solutions to enhance plant economics and reduce carbon emissions in hydrogen, ammonia, and methanol production.

- In April 2022, SABIC completed the acquisition of Clariant’s 50% stake in Scientific Design, granting SABIC full ownership of this catalyst leader. This move strengthens SABIC’s position in high-performance process technologies and catalysts, enabling it to meet growing catalyst demands and drive innovation in the sector.

- On February 26, 2025, Johnson Matthey launched state-of-the-art Advanced Cracking Evaluation (ACE) units for catalyst testing in fluid catalytic cracking (FCC) additives. This investment enhances JM’s innovation capabilities by enabling faster development timelines and higher precision in catalyst optimization for renewable feedstock processing.

Market Concentration & Characteristics:

The Asia Pacific industrial catalyst market is characterized by a moderate to high level of concentration, with several key multinational corporations and regional players contributing to its competitive landscape. Prominent companies such as BASF SE, Albemarle Corporation, Haldor Topsoe A/S, and Sinopec (China Petroleum & Chemical Corporation) hold substantial market shares, leveraging their extensive product portfolios and technological expertise to meet the diverse demands of industries including petrochemicals, chemical synthesis, and environmental applications. This market is distinguished by rapid industrialization, particularly in emerging economies like China and India, which drives the demand for efficient catalytic processes. Additionally, a strong emphasis on research and development fosters continuous innovation, leading to the introduction of advanced catalyst technologies. The market also reflects a growing commitment to sustainability, with increasing adoption of catalysts that facilitate cleaner production methods and compliance with stringent environmental regulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type Segment, Application Segment and Material Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Asia Pacific industrial catalyst market is projected to experience steady growth, driven by increasing industrialization and urbanization in emerging economies.

- Advancements in catalyst technologies are anticipated to enhance efficiency and selectivity, meeting the evolving needs of industries such as petrochemicals and environmental applications.

- The shift towards renewable energy sources, including biofuels and hydrogen, is expected to create new opportunities for catalyst applications in the region.

- Stringent environmental regulations are likely to drive the demand for catalysts that facilitate cleaner production processes and emission reductions.

- China is projected to maintain its dominance in the market, supported by its expansive manufacturing base and ongoing investments in the chemical sector.

- India’s market share is expected to grow, fueled by rapid industrialization and government initiatives promoting domestic manufacturing.

- The increasing adoption of alternative feedstocks, such as bio-based materials, may necessitate the development of specialized catalysts to accommodate diverse processing requirements.

- Collaborations between regional and global companies are likely to intensify, aiming to leverage technological expertise and expand market presence.

- Investments in research and development are anticipated to focus on creating cost-effective and sustainable catalyst solutions to remain competitive in the market.

- The market may face challenges from fluctuating raw material prices and the need for continuous innovation to meet the dynamic demands of end-use industries.

Market Drivers:

Market Drivers: