Market Overview:

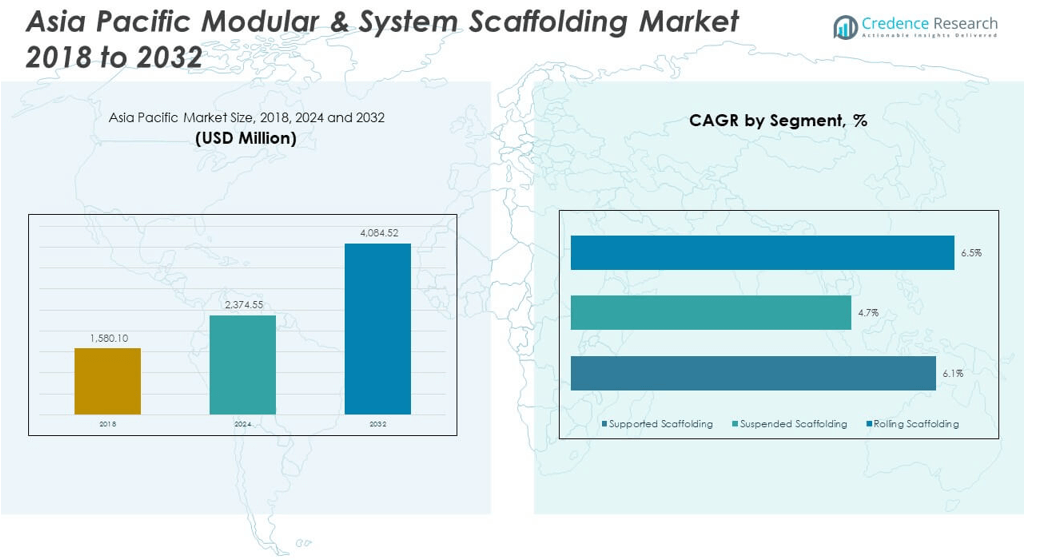

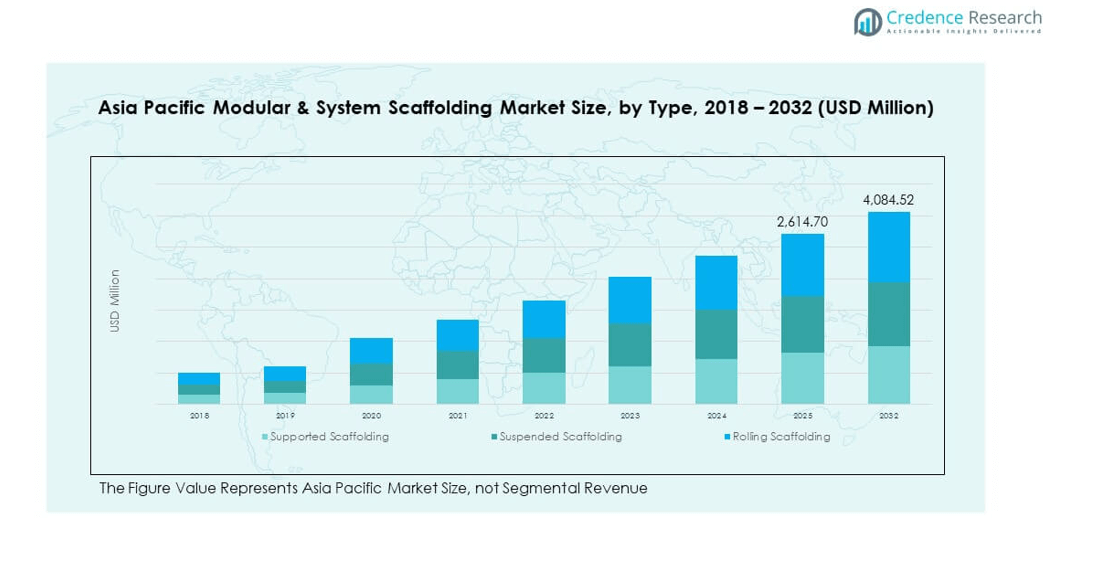

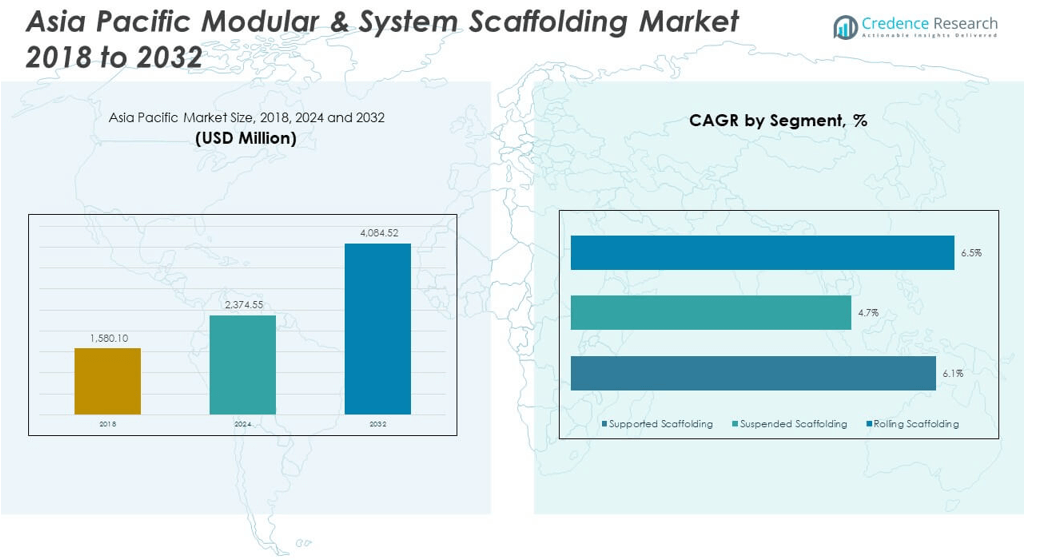

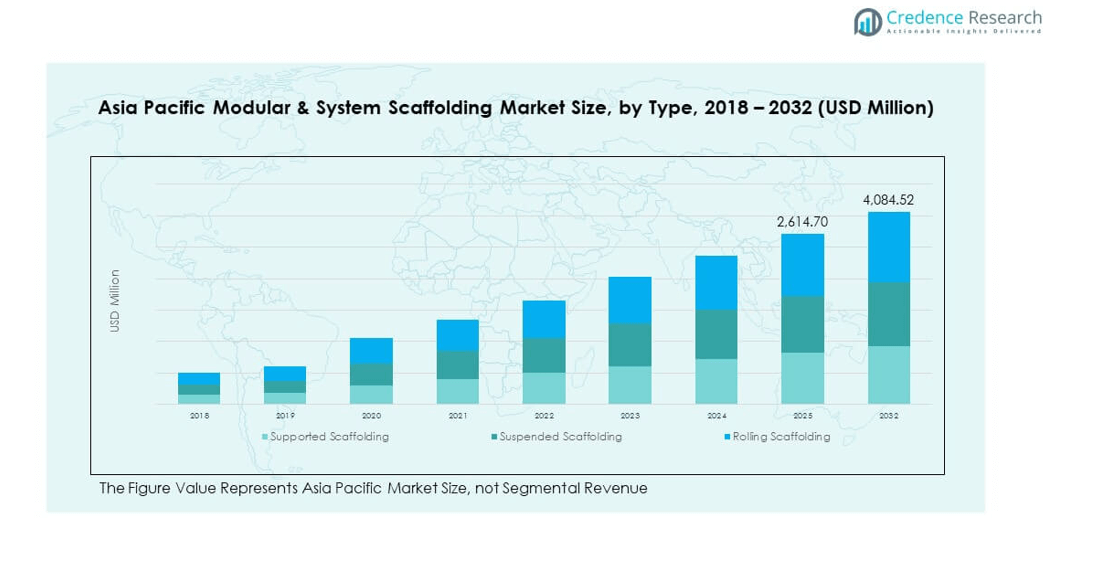

The Asia Pacific Modular & System Scaffolding Market size was valued at USD 1,580.10 million in 2018 to USD 2,374.55 million in 2024 and is anticipated to reach USD 4,084.52 million by 2032, at a CAGR of 6.60% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Modular & System Scaffolding Market Size 2024 |

USD 2,374.55 million |

| Asia Pacific Modular & System Scaffolding Market, CAGR |

6.60% |

| Asia Pacific Modular & System Scaffolding Market Size 2032 |

USD 4,084.52 million |

The Asia Pacific Modular & System Scaffolding Market is witnessing substantial growth due to the expanding construction sector, driven by urbanization and infrastructural development across emerging economies. Increased investments in commercial and residential construction, along with rising demand for renovation and maintenance of aging structures, are fueling market expansion. Government-led smart city initiatives and industrial corridor projects further support the adoption of modular scaffolding for safe, efficient, and flexible access solutions. The market also benefits from a shift toward time-saving construction technologies and growing awareness of worker safety regulations.

In regional terms, China dominates the Asia Pacific Modular & System Scaffolding Market owing to its massive construction output and infrastructure modernization projects. India is emerging rapidly due to large-scale urban housing schemes and public infrastructure developments. Southeast Asian nations like Indonesia, Vietnam, and the Philippines are also becoming notable markets, supported by foreign investments and economic growth. Developed countries such as Japan and South Korea show stable demand, driven by refurbishment projects and technological advancements in scaffolding systems. Overall, the market shows a dynamic mix of mature and emerging regions, each contributing to sustained growth.

Market Insights:

- The Asia Pacific Modular & System Scaffolding Market was valued at USD 2,374.55 million in 2024 and is projected to reach USD 4,084.52 million by 2032, growing at a CAGR of 6.60%.

- The Global Modular & System Scaffolding Market size was valued at USD 3,638.85 million in 2018 to USD 5,272.51 million in 2024 and is anticipated to reach USD 8,544.92 million by 2032, at a CAGR of 5.79% during the forecast period.

- Rapid urbanization and government-funded infrastructure projects are fueling demand for safe and efficient scaffolding systems.

- Rising safety regulations and labor shortages are pushing contractors toward modular, pre-engineered scaffolding solutions.

- High raw material costs and price volatility, especially in steel and aluminum, limit profit margins for manufacturers.

- China leads the market with over 42% share due to large-scale construction output and industrial activity.

- India and Southeast Asia are emerging markets driven by urban development and foreign investment in public infrastructure.

- Market growth is tempered by fragmented regulations and inconsistent certification standards across countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Government Infrastructure Programs and Public Sector Investment Push Market Expansion

Large-scale public infrastructure programs in emerging nations continue to drive demand for modular scaffolding systems. Governments in countries such as China, India, and Indonesia are funding transport, housing, and energy projects that require extensive scaffolding. The Asia Pacific Modular & System Scaffolding Market is benefiting from these infrastructure investments. Urban development plans and economic corridors like India’s Bharatmala and China’s Belt and Road Initiative stimulate sustained scaffold usage. It supports time-sensitive construction timelines and provides enhanced worker safety, aligning with new building regulations. Regulatory bodies are mandating safer and standardized construction practices, further boosting demand. Public-private partnerships are also on the rise, expanding the addressable market. The modular nature of scaffolding systems provides flexibility that aligns with modern construction needs.

Surge in High-Rise and Commercial Real Estate Development Fuels Adoption

The proliferation of high-rise buildings, commercial complexes, and mixed-use developments creates consistent demand for modular scaffolding solutions. Urban land scarcity is pushing construction vertically, especially in metropolitan hubs like Tokyo, Seoul, Mumbai, and Shanghai. It elevates the need for secure, lightweight, and efficient access systems. The Asia Pacific Modular & System Scaffolding Market is evolving to meet the scale and complexity of such projects. Developers and contractors are adopting prefabricated modular scaffolding to minimize time and labor costs. Rising incomes and business growth have encouraged more commercial construction, driving the market forward. Retail chains, tech campuses, and office parks require rapid construction cycles, which scaffolding systems support. The shift toward premium architectural designs demands greater customization, which modular scaffolding can provide.

Industrial Growth and Maintenance of Aging Facilities Require Scalable Solutions

Ongoing industrialization across Asia Pacific is stimulating the need for scaffolding in factories, refineries, power plants, and processing units. It enables timely plant expansions, shutdown maintenance, and equipment installation. The Asia Pacific Modular & System Scaffolding Market supports industrial compliance with worker safety and access standards. As industrial infrastructure ages, maintenance and retrofitting become crucial. Scaffolding plays a central role in equipment replacement and facility upgrades. Many industries, including oil and gas, chemicals, and manufacturing, depend on scaffolding for both construction and operational continuity. Prefabricated modular systems provide a fast, scalable, and safe solution. Investments in energy and mining are also creating steady demand for such platforms.

- For example, BrandSafway’s QuickDeck Suspended Access System is a modular platform solution capable of supporting live loads between 25–75 psf, assembled without tools and suitable for confined or live environments such as oil rigs and power plant maintenance campaigns.

Construction Safety and Labor Efficiency Encourage Product Innovation

The growing emphasis on construction site safety has increased the appeal of modular scaffolding systems that ensure structural stability. Fatalities and injuries in conventional scaffolding setups have pressured firms to seek modern alternatives. It has led to innovations in lightweight, corrosion-resistant materials, and faster assembly methods. The Asia Pacific Modular & System Scaffolding Market is shifting toward automated and system-based scaffolding components. These developments reduce dependency on skilled labor, addressing workforce shortages across many countries. Built-in safety features like guardrails and locking mechanisms offer a competitive advantage. Contractors now favor solutions that meet both safety audits and performance targets. Market participants are actively investing in R&D to develop safer, easier-to-deploy systems.

- For instance, Altrad’s Metrix Plettac modular scaffolding system includes aluminum frame and decking options with integrated guardrails and toeboards compliant with EN 12810/12811 standards. These systems enhance on-site safety and assembly ergonomics.

Market Trends

Integration of Digital Platforms for Scaffolding Design and Project Management

The construction sector is integrating Building Information Modeling (BIM) and other digital tools to plan, simulate, and manage scaffolding operations. It improves accuracy and safety while reducing downtime. The Asia Pacific Modular & System Scaffolding Market is aligning with digital trends by offering compatible, pre-engineered systems. Scaffolding planning software now enables visualization of site conditions and optimizes material use. It helps contractors reduce operational risk and waste. Demand for real-time project tracking and asset management tools is influencing product offerings. Companies are developing smart components embedded with sensors for structural monitoring. Automation in logistics and scaffolding deployment is gaining attention across the region.

- For instance, PERI UP Flex scaffolding was deployed at BASF Ludwigshafen for the new acetylene plant project, where BIM-driven, cross-trade 3D planning enabled efficient design of access structures up to 90 m in height using a 25 cm modular grid and self-locking deck technology.

Use of Lightweight and Sustainable Materials Enhances Market Positioning

Manufacturers are increasingly using aluminum, composite polymers, and galvanized steel to reduce scaffold weight and improve corrosion resistance. Sustainability goals are guiding procurement decisions, particularly in government-led projects. The Asia Pacific Modular & System Scaffolding Market is responding by introducing recyclable and longer-lasting components. It allows construction companies to reuse materials across multiple projects, lowering lifecycle costs. Lightweight scaffolding eases transportation and installation, increasing productivity. Demand for low-maintenance systems with high strength-to-weight ratios is growing. These innovations support green building certifications and reduce environmental impact.

- For instance, aluminum scaffolding components often weigh 50–70% less than mild steel equivalents sometimes as little as one-third the mass enabling much easier handling and faster, labor-efficient assembly.

Rental Business Models Gain Traction Across Small and Mid-Sized Contractors

Smaller firms are shifting from scaffold ownership to rental due to cost-efficiency, flexibility, and access to advanced systems. It reduces capital expenditure while ensuring quality and safety compliance. The Asia Pacific Modular & System Scaffolding Market is witnessing growth in scaffold leasing and equipment-as-a-service models. Rental providers are expanding offerings to include logistics, installation, and dismantling. Urban projects with shorter timelines often favor temporary scaffolding solutions. Rental scaffolding aligns with the need for rapid project turnover and reduced storage costs. Market players are forming strategic alliances with construction firms to offer tailored rental packages.

Growing Preference for Aesthetic and Cladding-Compatible Scaffolding

Architectural complexity and aesthetic considerations are impacting scaffolding design in modern projects. Builders demand systems that accommodate facade work and integrated cladding. The Asia Pacific Modular & System Scaffolding Market is innovating to serve this trend. Demand for modular cladding-compatible scaffolds has increased in commercial real estate and public buildings. Projects now require access systems that blend function with visual presentation. It drives the adoption of sleek, modular solutions with fewer exposed joints. Design-centric scaffolding solutions also enhance branding and public perception during project execution. This trend is reshaping both design and marketing strategies in the scaffolding industry.

Market Challenges Analysis

Compliance with Safety Standards and Certification Delays Create Market Friction

Stringent regional safety standards and regulatory frameworks delay project execution when scaffolding systems fail certification or inspection. The Asia Pacific Modular & System Scaffolding Market faces challenges from inconsistent certification processes across countries. It increases compliance costs and project risks for manufacturers and contractors. Differences in local standards create operational hurdles for multinational companies. Standardizing product offerings to meet multiple regional codes demands additional investment. Repeated inspections due to non-compliance hinder productivity. Training labor to meet safety norms requires continuous upskilling. This regulatory complexity often deters small and mid-sized entrants from expanding regionally.

Volatile Raw Material Prices and Supply Chain Disruptions Limit Growth Prospects

Steel and aluminum, key components in scaffolding systems, face price volatility due to global demand fluctuations and geopolitical factors. It constrains profitability and deters long-term procurement planning. The Asia Pacific Modular & System Scaffolding Market experiences delays and cost overruns during raw material shortages. Supply chain disruptions caused by natural disasters or shipping constraints add further instability. Regional dependencies on imports for certain alloy grades complicate inventory management. Contractors pass cost burdens onto clients, impacting project affordability. Unstable exchange rates and rising freight charges also reduce competitiveness for exporters. These issues affect delivery timelines and project budgeting.

Market Opportunities

Smart City Initiatives and Urban Redevelopment Unlock Long-Term Potential

Rising investments in smart cities and urban revitalization programs are creating new scaffolding demand across residential and commercial sectors. The Asia Pacific Modular & System Scaffolding Market can expand by targeting infrastructure upgrades, metro projects, and green building developments. It supports projects requiring modular, scalable, and reusable access systems. Increased funding for transit hubs, mixed-use buildings, and cultural centers enhances its long-term relevance. Companies that offer digital scaffolding solutions with compliance guarantees can tap into these public-private development zones.

Export Potential and Regional Partnerships Encourage Market Diversification

The market offers significant export potential to neighboring economies with rising construction activity. Partnerships between manufacturers and regional distributors can broaden geographic reach. It benefits the Asia Pacific Modular & System Scaffolding Market by reducing entry barriers and logistic challenges. Demand from Africa and the Middle East also provides cross-border sales opportunities. Localizing production and offering region-specific product variants can enhance competitiveness. Companies investing in multilingual technical support and regional training programs gain first-mover advantage.

Market Segmentation Analysis:

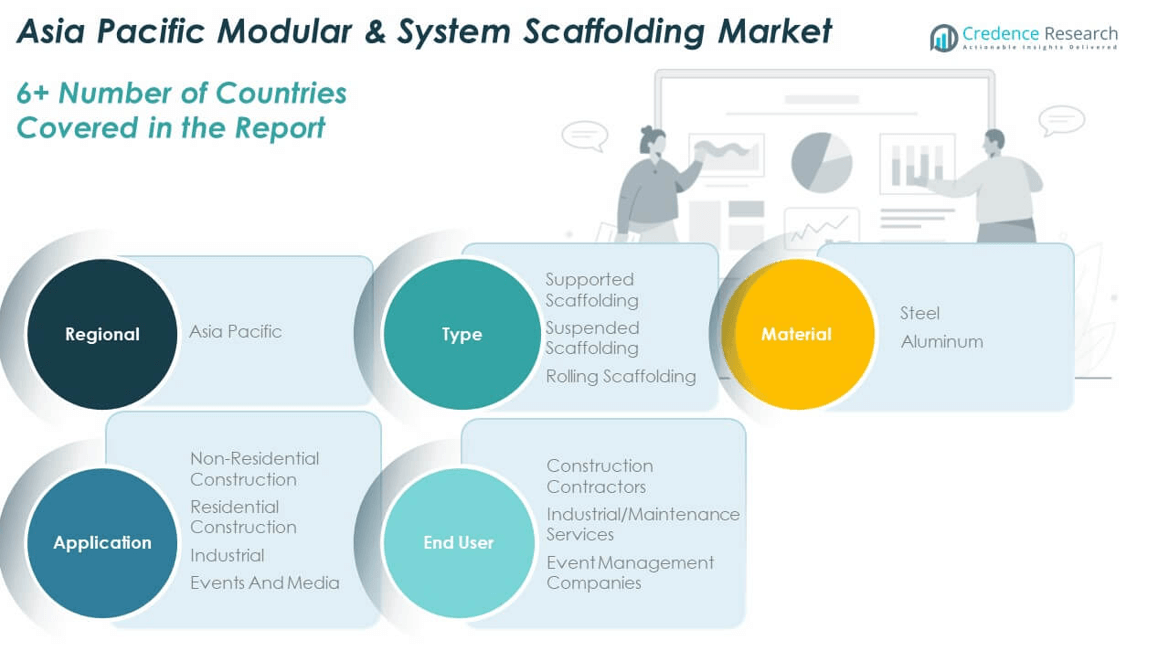

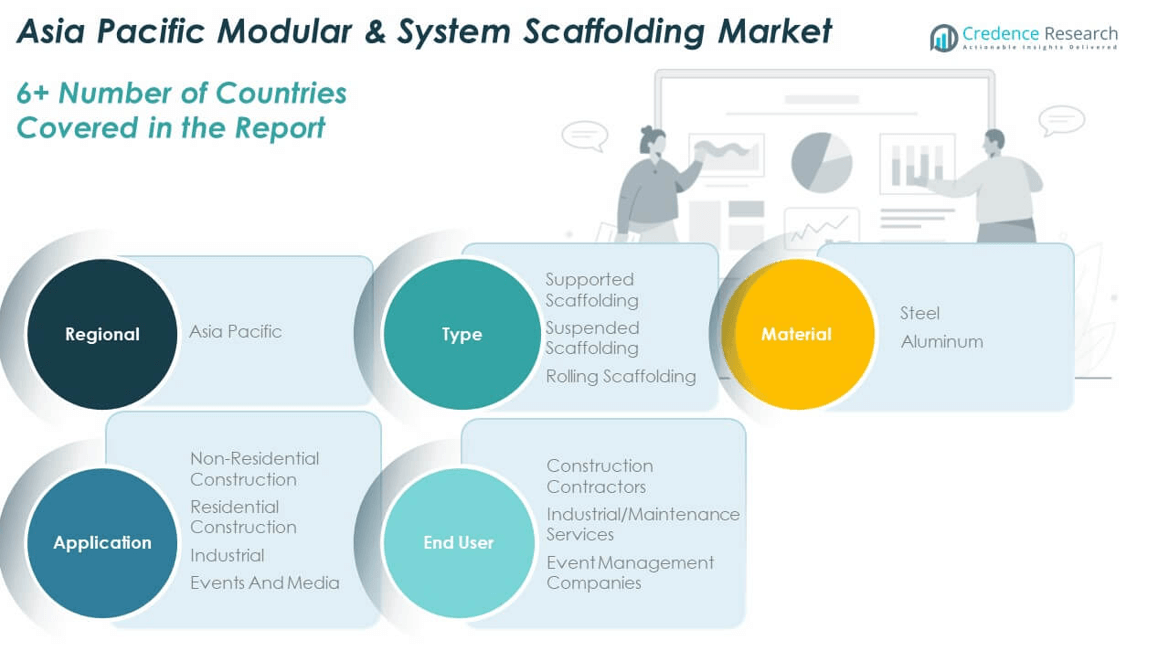

The Asia Pacific Modular & System Scaffolding Market is segmented by type, material, application, and end user, reflecting diverse construction and industrial demands.

By type Supported scaffolding leads the type segment due to its wide applicability in large-scale building and infrastructure projects. Suspended scaffolding finds use in high-rise maintenance and facade work, while rolling scaffolding gains popularity in indoor and smaller commercial jobs for its mobility and ease of use.

- For instance, Instant Upright’s Span 400 is a Class 3 compliant aluminum tower system certified to EN 1004 and Work‑At‑Heights standards, capable of platform heights of up to approximately 6 m, assembled via intuitive Rib‑Grip joints and snap-lock frames for quick setup and repositioning.

By material, steel dominates due to its strength, durability, and suitability for heavy-duty applications across urban and industrial construction. Aluminum scaffolding is growing in demand where lightweight and corrosion-resistant solutions are required, especially in event setups and interior renovation work. It aligns with the trend toward modular, portable, and reusable systems.

By application, non-residential construction holds the largest share, supported by expanding commercial and infrastructure developments. Residential construction is growing steadily with urban housing projects. Industrial use remains strong for plant maintenance and equipment access, while events and media drive demand for temporary and customized scaffolding configurations.

By end users, construction contractors represent the largest group, consistently driving demand across public and private projects. Industrial and maintenance service providers rely on scaffolding for periodic facility upgrades and compliance work. Event management companies contribute to niche demand, using modular systems for stages, platforms, and public access structures. The Asia Pacific Modular & System Scaffolding Market continues to diversify across all these segments, adapting to regional project scales, safety standards, and material preferences.

- For instance, Samsung C&T constructed Tower 2 of the Petronas Twin Towers as part of a Korean-led consortium, while PERI delivered its ACS self-climbing formwork system not scaffold for vertical concrete execution and floor cycle acceleration.

Segmentation:

By Type:

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

By Material:

By Application:

- Non-Residential Construction

- Residential Construction

- Industrial

- Events and Media

By End User:

- Construction Contractors

- Industrial/Maintenance Services

- Event Management Companies

By Region:

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia Pacific

Regional Analysis:

China holds the largest share of the Asia Pacific Modular & System Scaffolding Market, accounting for 42.5% of the regional revenue in 2024. It benefits from ongoing megaprojects, rapid urban expansion, and significant government infrastructure investments. Demand for modular scaffolding is high across residential, industrial, and transportation sectors. The presence of major local manufacturers supports competitive pricing and innovation. Regulatory focus on construction safety standards is reinforcing the transition to system-based scaffolding solutions. It continues to lead in terms of scale, deployment volume, and export potential across Asia Pacific.

India represents the second-largest market, contributing 21.7% of the regional share in 2024. Urbanization initiatives, including Smart Cities Mission and affordable housing schemes, are driving scaffold demand. Modular scaffolding is gaining traction due to labor efficiency and flexibility in congested urban environments. The shift from traditional bamboo and pipe scaffolding to modular systems is accelerating. India’s growing private construction sector and infrastructure funding are fueling the need for safer, faster erection systems. It is emerging as a critical growth engine within the Asia Pacific Modular & System Scaffolding Market.

Southeast Asia, comprising countries like Indonesia, Vietnam, Thailand, and the Philippines, holds a combined 18.4% share of the regional market. Infrastructure expansion, foreign direct investments, and economic zone developments are increasing scaffold requirements. Countries are prioritizing roads, ports, and industrial park construction. The availability of imported modular scaffolding systems supports regional adoption. It is becoming a key destination for international scaffold suppliers aiming to serve medium-scale commercial and infrastructure projects. Japan and South Korea together represent 11.3% of the market, driven by ongoing refurbishments, stringent safety standards, and high-tech adoption in scaffold design and materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Step Up Scaffold

- Catari Industria, S.A.

- BrandSafway

- Rizhao Fenghua Scaffoldings Co., Ltd

- BSL Scaffolding Ltd.

- Tianjin Wellmade Scaffoldings

- ADTO Industrial Group

- Altrad Group

- KHK Scaffolding & Formwork LLC

- Waco Kwikform

Competitive Analysis:

The Asia Pacific Modular & System Scaffolding Market features a mix of global manufacturers and regional players competing on innovation, pricing, and service integration. Leading companies such as PERI Group, Layher, and Altrad dominate through product quality, extensive distribution, and rental service offerings. Regional firms focus on cost efficiency and tailored solutions for local regulations and labor conditions. It reflects a shift toward safety-certified and quick-assembly systems that align with modern construction demands. Strategic partnerships, mergers, and capacity expansions are common among key players to strengthen regional presence. Companies are investing in digital tools, lightweight materials, and automation to stay competitive. The market rewards firms that offer both scaffolding products and project execution services. Growth is strongest among players who combine technical support, safety compliance, and adaptable design features.

Recent Developments:

- In February 2025, Altrad Group completed the acquisition of Stork’s UK business (Stork TS Holdings Limited), strengthening its continental European and Asia-Pacific presence and enhancing its ability to deliver integrated onshore and offshore access and maintenance solutions.

- In September 2024, BrandSafway announced the acquisition of Covan’s Insulation Company, a well-established South Carolina-based contractor specializing in industrial insulation, thereby strengthening BrandSafway’s service offerings and market reach in the southeastern United States.

Market Concentration & Characteristics:

The Asia Pacific Modular & System Scaffolding Market exhibits moderate to high market concentration, with a few multinational brands holding significant shares. It remains fragmented at the regional level due to the presence of numerous small and medium-sized local providers. The market is characterized by high product standardization, recurring demand across infrastructure and industrial sectors, and strong regulatory oversight. It demands fast delivery cycles, modularity, and safety certifications across varying project sizes. Customer preferences are shifting toward leasing models and turnkey service offerings. Technological adaptability and material innovation define competitive advantage. The market continues to favor players who deliver integrated, compliant, and cost-efficient scaffolding systems.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Urbanization and vertical construction trends will drive sustained demand for modular scaffolding across major Asia Pacific cities.

- Government-led infrastructure investments will continue to expand market scope across transportation, energy, and public housing projects.

- Rising safety regulations will accelerate the shift from traditional scaffolding to engineered modular systems.

- Demand for scaffolding rentals and turnkey service models will grow among small and mid-sized contractors.

- Technological integration such as BIM compatibility and digital monitoring will become standard across product lines.

- Lightweight and sustainable materials will see increased adoption, supporting eco-compliant construction practices.

- Cross-border collaborations and regional distribution partnerships will help companies expand geographic reach.

- Industrial sectors will continue to use modular scaffolding for maintenance, shutdowns, and equipment upgrades.

- Emerging markets in Southeast Asia will offer new growth opportunities through economic development zones.

- Innovation in cladding-compatible and customizable designs will cater to modern architectural demands.