Market Overview

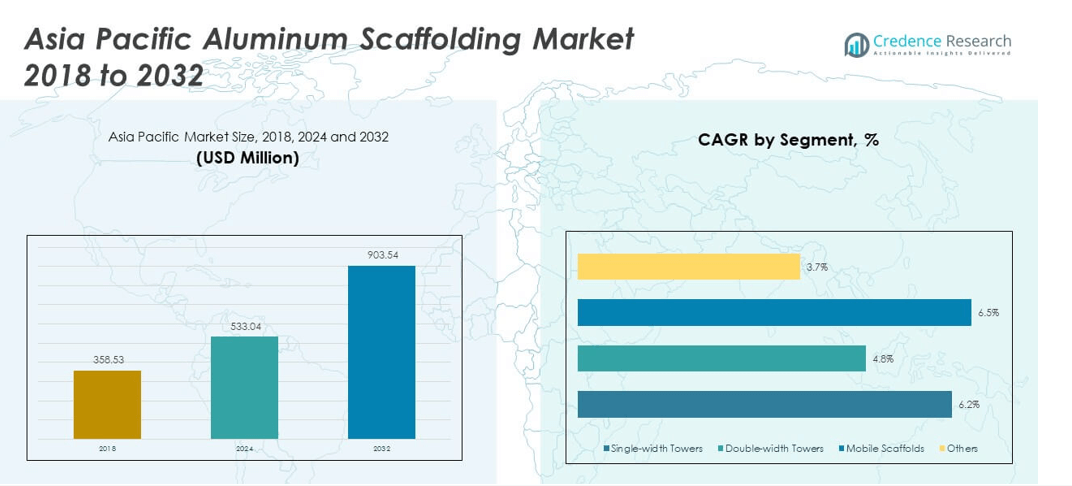

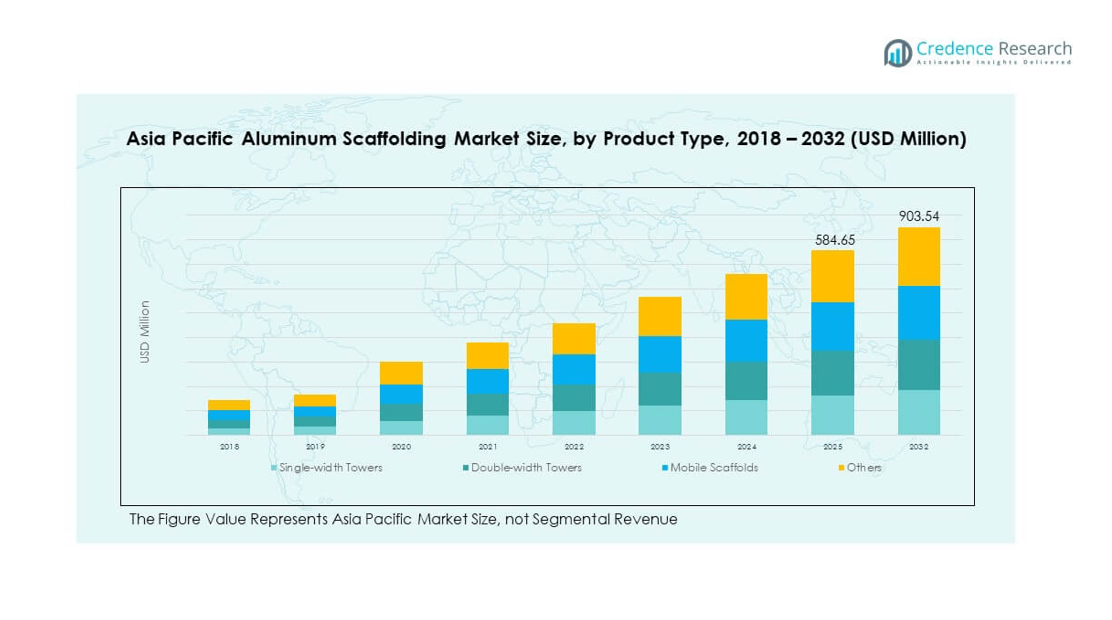

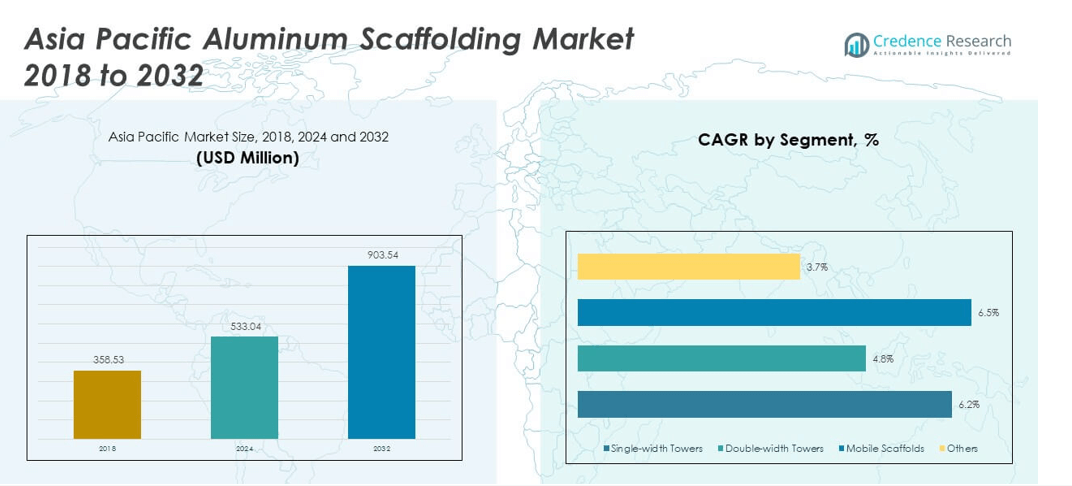

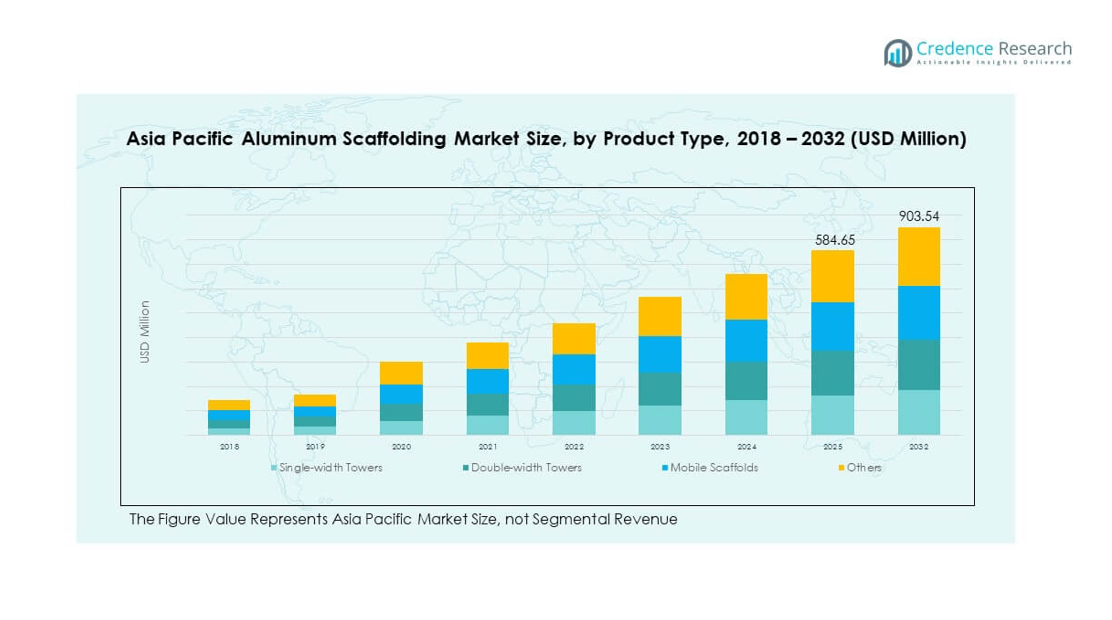

The Asia Pacific Aluminum Scaffolding Market size was valued at USD 358.53 million in 2018 to USD 533.04 million in 2024 and is anticipated to reach USD 903.54 million by 2032, at a CAGR of 6.40% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Aluminum Scaffolding Market Size 2024 |

USD 533.04 million |

| Asia Pacific Aluminum Scaffolding Market, CAGR |

6.40% |

| Asia Pacific Aluminum Scaffolding Market Size 2032 |

USD 903.54 million |

The market growth is primarily driven by the expanding construction and infrastructure development across key economies such as China, India, and Southeast Asia. Increasing urbanization and rising investments in residential, commercial, and industrial projects are fueling the demand for safe and efficient scaffolding systems. Aluminum scaffolding is gaining preference due to its lightweight, corrosion-resistant properties and ease of assembly, especially in high-rise and time-sensitive construction environments. Furthermore, the adoption of advanced safety standards and regulatory compliance is pushing construction firms toward modern, modular scaffolding solutions.

Regionally, China remains the dominant market due to its vast infrastructure expansion and government-led urban redevelopment programs. India is emerging rapidly, supported by growing real estate investments, smart city projects, and government infrastructure schemes. Southeast Asian nations such as Vietnam, Indonesia, and the Philippines are also witnessing increased adoption of aluminum scaffolding, owing to rising construction activity, a growing industrial base, and foreign direct investments. These countries are becoming hotspots for industrial and commercial development, contributing significantly to the region’s aluminum scaffolding market expansion.

Market Insights:

- The Asia Pacific Aluminum Scaffolding Market was valued at USD 533.04 million in 2024 and is projected to reach USD 903.54 million by 2032, growing at a CAGR of 6.40%.

- The Global Aluminum Scaffolding Market size was valued at USD 1,221.32 million in 2018 to USD 1,721.17 million in 2024 and is anticipated to reach USD 2,678.48 million by 2032, at a CAGR of 5.29% during the forecast period.

- Strong demand from urban infrastructure projects and high-rise construction continues to drive market expansion across key economies.

- Rising safety regulations and the shift toward compliant, lightweight systems support the transition from traditional steel scaffolds to aluminum.

- High initial costs and limited awareness in emerging regions act as barriers to broader adoption across smaller construction firms.

- China leads the market with 41% share due to government-led development programs and a mature manufacturing base.

- India and Southeast Asia are emerging growth zones, supported by real estate activity, industrialization, and smart city projects.

- Uneven workforce training and low scaffold handling expertise in developing countries challenge safe deployment and scalability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rapid Urban Infrastructure Expansion Across Major Economies Driving Aluminum Scaffold Adoption

The Asia Pacific Aluminum Scaffolding Market is experiencing strong growth due to increasing infrastructure development across urban centers. Governments across the region are investing in transportation, commercial complexes, and public facilities to support rising urban populations. These projects demand efficient, safe, and lightweight access systems, positioning aluminum scaffolding as a preferred choice. Construction firms require easy-to-assemble platforms that can adapt to diverse site conditions. The material’s resistance to corrosion and low maintenance cost further enhances its value. Demand is especially high in megacities undergoing vertical growth and redevelopment. Government initiatives like India’s Smart Cities Mission and China’s Belt and Road Initiative continue to fuel market expansion. Contractors benefit from reduced setup times and improved safety compliance using aluminum scaffolding systems.

- For instance, Technocraft Industries India Limited established a new manufacturing facility in Maharashtra with a capacity of 600,000 square meters dedicated to aluminum scaffolding and formwork systems, directly supporting large-scale high-rise and metro projects in India.

Construction Sector Compliance with Evolving Safety Standards Boosting Equipment Modernization

Stricter regulatory frameworks in the construction industry are encouraging the adoption of advanced scaffolding technologies. Companies must comply with safety standards that emphasize structural integrity and fall protection. Aluminum scaffolding addresses these needs by offering high strength-to-weight ratios and stable configurations. Lightweight frames reduce worker fatigue and minimize site accidents during setup and disassembly. The Asia Pacific Aluminum Scaffolding Market reflects this shift toward durable and compliant solutions. Site engineers and safety officers increasingly specify certified scaffolding systems for ongoing projects. Equipment providers also innovate to meet updated safety norms. This alignment with compliance standards accelerates replacement of traditional steel scaffolds with modular aluminum systems.

Growing Industrial and Maintenance Activities Across Emerging Markets Supporting Usage

Beyond construction, industrial facilities and manufacturing plants contribute significantly to scaffolding demand. Routine maintenance, inspections, and facility upgrades often require elevated work platforms. Aluminum scaffolding provides a reusable, adjustable solution across oil refineries, factories, and logistics hubs. It withstands chemical exposure better than steel alternatives in many environments. The Asia Pacific Aluminum Scaffolding Market benefits from recurring use cases in sectors requiring minimal downtime. Industrial contractors seek solutions that allow safe and quick assembly without disrupting operations. Aluminum scaffolds allow for flexible height adjustments and compact storage. Businesses investing in automation and facility modernization continue to rely on these systems. The region’s industrialization directly reinforces equipment demand.

Private Real Estate Investment and Remodeling Trends Encouraging Scaffold Deployment

Real estate developers across the region continue to fund large-scale residential and commercial projects. Luxury apartments, retail malls, and urban redevelopment sites require continuous scaffolding usage for external and internal works. Developers prefer aluminum scaffolding to meet fast-paced construction schedules and aesthetic goals. The Asia Pacific Aluminum Scaffolding Market gains traction due to increasing renovation activities, especially in high-income urban areas. Builders refurbish old structures using scaffold platforms that offer worker mobility and minimal footprint. Private capital inflows into real estate markets in Southeast Asia and Oceania expand application scope. Property management firms also use aluminum scaffolding for repainting, window repair, and structural improvements. Market growth aligns with real estate cycles and redevelopment intensity.

- For instance, Aathaworld Sdn Bhd, a multidisciplinary construction and engineering service provider in Malaysia, offers supply and installation of various scaffolding systems, including aluminum options, for commercial and residential projects across urban centers such as Kuala Lumpur.

Market Trends

Rising Demand for Single-Person Quick-Build Towers Across Urban Job Sites

Contractors are showing increased preference for compact, single-operator scaffold systems in dense workspaces. These mobile towers enhance productivity in commercial interiors and small construction zones. The trend aligns with labor shortages and the need for rapid deployment tools. Manufacturers in the Asia Pacific Aluminum Scaffolding Market now offer pre-assembled modules that one worker can erect without extra labor. These systems improve operational efficiency for maintenance firms and electrical contractors. Their foldable design supports tight storage and transport conditions. Urban job sites favor minimal disruption and swift turnaround, making mobile scaffold towers ideal. Demand continues to rise in cities where access limitations restrict traditional scaffold setups.

- For instance, Altrex introduced the MiTOWER single-person quick‑build mobile scaffold that a single worker can assemble in about 10 minutes, and it complies with EN 1004 Class 3 and TÜV‑certified strength and stability standards with a working height up to approximately 6 meters.

Integration of Digital Design and Load Simulation in Scaffold Planning

Design optimization tools are increasingly used to plan scaffolding structures before deployment. Engineering software helps simulate load conditions, material tolerances, and structural limits. The Asia Pacific Aluminum Scaffolding Market now includes service providers offering digital scaffold layout and risk assessments. Contractors gain visibility into safe load capacities and stress points during configuration. These advancements reduce material waste and enhance worker safety. Project managers integrate scaffold design with building information modeling (BIM) for better coordination. The trend toward digitization transforms conventional scaffolding logistics into smarter workflows. Real-time adjustment capabilities help adapt scaffolds to changing site requirements.

- For example, ScaffPlan™ has integrated millimeter-accurate 3D scaffold modeling and built-in structural calculations that generate color-coded Pass or Fail safety reports instantly, based on manufacturer data.

Increased Adoption of Non-Conductive and Flame-Resistant Scaffold Variants

Construction activity in sectors like electrical utilities and oil refining requires safety-rated scaffolding. Companies now seek aluminum scaffolding variants with non-conductive finishes or added insulation properties. The Asia Pacific Aluminum Scaffolding Market supports this trend through specialized product lines for hazardous environments. Demand arises from industries needing enhanced worker protection in energized zones. Flame-resistant coatings further expand scaffold use in welding, chemical handling, and thermal works. Manufacturers tailor scaffolds for sector-specific challenges without compromising mobility or weight. Contractors gain flexibility while maintaining safety compliance. These customizations align with stricter operational standards in sensitive sectors.

Shift Toward Scaffold Rental and Subscription-Based Access Solutions

Construction firms increasingly favor scaffold rental models to reduce capital expenditures. Flexible leasing agreements allow companies to scale scaffold usage per project duration. The Asia Pacific Aluminum Scaffolding Market reflects this transition from asset ownership to service-based access. Rental companies provide logistics, on-site setup, and certified inspection services. The approach lowers upfront investment for small and mid-sized builders. Clients benefit from the availability of updated equipment without maintenance responsibilities. This model also supports temporary needs for events, exhibitions, and short-term infrastructure jobs. The trend broadens market access beyond large-scale contractors.

Market Challenges Analysis

High Price Sensitivity in Emerging Countries Affecting Aluminum Scaffold Adoption

While aluminum scaffolding offers clear benefits, its initial cost remains a barrier in cost-conscious regions. Contractors in developing countries often prefer cheaper steel scaffolds or wooden alternatives. The Asia Pacific Aluminum Scaffolding Market faces resistance from buyers prioritizing affordability over safety or durability. Limited awareness of long-term savings and safety improvements contributes to slower adoption. Smaller construction firms operate on thin profit margins and avoid capital-intensive upgrades. Rental penetration is also uneven, limiting access to quality scaffolding for remote projects. The cost of aluminum alloy production and import duties can raise local selling prices. Affordability remains a key concern in expanding market reach.

Limited Skilled Workforce and Assembly Knowledge Slowing Safe Implementation

Deploying aluminum scaffolding correctly requires trained personnel and strict procedural adherence. Many job sites in the region lack the expertise to ensure safe erection and dismantling. The Asia Pacific Aluminum Scaffolding Market encounters delays and safety risks where training is insufficient. Inconsistent safety enforcement across jurisdictions amplifies this challenge. Without proper oversight, incorrect setup leads to structural instability or accidents. Equipment misuse undermines product reputation and user confidence. Workforce fragmentation and informal hiring practices further reduce scaffold safety outcomes. Developing structured training and certification programs becomes essential to bridge this gap.

Market Opportunities

Infrastructure Boom in Tier-2 Cities Creating Fresh Demand for Modular Systems

Smaller cities across Asia Pacific are witnessing infrastructure growth due to decentralization policies and industrial relocation. Public-private partnerships in these regions generate demand for adaptable scaffolding systems. The Asia Pacific Aluminum Scaffolding Market benefits from modular designs that suit diverse project scales. Builders in emerging cities need scaffolding that can be transported easily and reused across sites. These applications include commercial buildings, public schools, hospitals, and transit facilities. Aluminum scaffolding meets these evolving needs with quick-assembly features and compact storage. The regional construction ecosystem supports its expansion into untapped urban clusters.

Focus on Sustainable Construction Encouraging Lightweight Material Adoption

Environmental sustainability now influences procurement decisions across the construction sector. Builders and contractors evaluate material lifecycle, recyclability, and carbon footprint. The Asia Pacific Aluminum Scaffolding Market aligns well with green building goals. Aluminum is highly recyclable and retains structural integrity over multiple uses. Project owners favor equipment that reduces environmental impact without compromising safety. Government incentives for eco-friendly construction create additional tailwinds. This trend opens opportunities for manufacturers promoting low-emission, durable scaffolding alternatives. Sustainable practices continue to shape purchasing behavior in modern infrastructure development.

Market Segmentation Analysis:

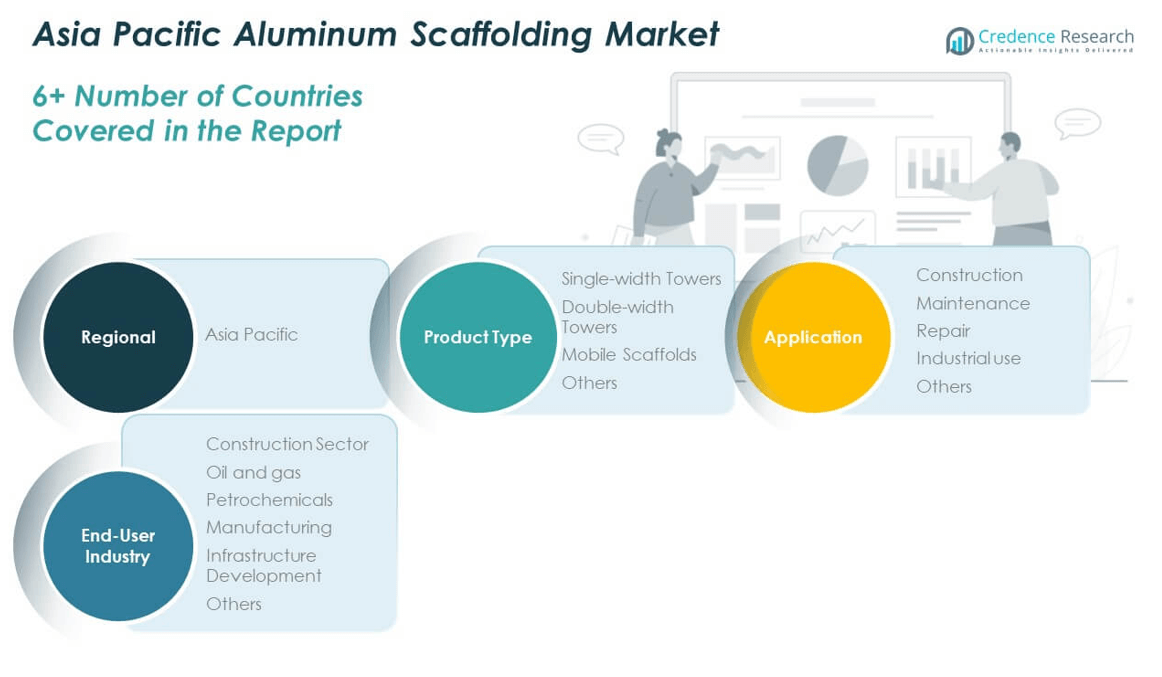

The Asia Pacific Aluminum Scaffolding Market is segmented by product type, application, and end-user industry, each offering distinct growth opportunities and usage patterns.

By product types, mobile scaffolds hold a significant share due to their flexibility, ease of transport, and widespread use in dynamic construction environments. Single-width and double-width towers serve indoor and outdoor applications respectively, with the latter gaining traction in high-rise construction. The “others” category includes specialized or modular systems tailored for custom site conditions.

By application, construction dominates the market due to continuous infrastructure and real estate development across the region. Maintenance follows as the second-largest segment, supported by recurring demand in industrial facilities and commercial buildings. Repair and industrial use segments reflect steady growth, particularly where downtime reduction and worker safety are priorities. It offers adaptive solutions for inspection and facility upgrades in sectors requiring non-intrusive access methods.

- For instance, Layher’s Allround scaffolding system facilitated construction of a mobile gantry over tunnels on the Pacific Highway infrastructure project, enabling crews to complete waterproofing operations more safely and efficiently.

By end-user industries, the construction sector leads due to its scale and project diversity, followed by oil and gas where corrosion resistance and safe access are critical. The petrochemicals and manufacturing industries utilize aluminum scaffolds for operational continuity and maintenance routines. Infrastructure development contributes through public projects in transport and utilities. The Asia Pacific Aluminum Scaffolding Market continues to evolve as each segment demands specific performance, compliance, and durability metrics from scaffold systems.

- For instance, Layher’s Allround scaffolding played a key role in the restoration of the Adolphe Bridge in Luxembourg, supporting high-load and precision access tasks

Segmentation:

By Product Type

- Single-width Towers

- Double-width Towers

- Mobile Scaffolds

- Others

By Application

- Construction

- Maintenance

- Repair

- Industrial Use

- Others

By End-User Industry

- Construction Sector

- Oil and Gas

- Petrochemicals

- Manufacturing

- Infrastructure Development

- Others

Regional Analysis:

China dominates the Asia Pacific Aluminum Scaffolding Market with a market share of 41%, driven by large-scale infrastructure projects and sustained investment in urban redevelopment. The government’s push for modernization across transportation, energy, and housing sectors continues to generate steady demand for aluminum scaffolding. Construction firms in China prioritize materials that offer faster installation and improved safety. High-rise developments and industrial construction support recurring purchases of modular aluminum scaffolds. Local manufacturers benefit from economies of scale and government-backed subsidies. The availability of raw materials and a mature manufacturing base further strengthen China’s leadership in this market.

India holds the second-largest share in the region at 28%, supported by rapid urbanization and expanding real estate and industrial sectors. Government initiatives such as Smart Cities Mission and AMRUT encourage construction in tier-1 and tier-2 cities. The Asia Pacific Aluminum Scaffolding Market in India benefits from increasing awareness of workplace safety and modern construction practices. Builders in metropolitan regions are shifting from traditional bamboo and steel scaffolds to aluminum-based systems. The rental market is growing steadily, giving access to scaffolding for smaller contractors. Demand is rising in commercial complexes, transportation infrastructure, and residential high-rises.

Southeast Asia collectively accounts for 19% of the regional market, with countries like Indonesia, Vietnam, and the Philippines showing strong growth. Investments in tourism infrastructure, airports, and manufacturing hubs fuel demand for mobile and lightweight scaffolding. The Asia Pacific Aluminum Scaffolding Market continues to expand in this subregion due to foreign direct investment and the emergence of mid-size developers. Local governments prioritize affordable and safe construction practices, promoting the use of compliant scaffolding systems. Australia and South Korea represent the remaining 12%, with demand centered around commercial and industrial maintenance activities. These mature markets focus on product innovation, safety upgrades, and sustainable construction technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Step Up Scaffold

- BrandSafway

- BSL Scaffolding Ltd

- Rizhao Fenghua Scaffoldings Co., Ltd

- Tianjin Wellmade Scaffold

- Layher Holding GmbH & Co. KG

- PERI Group

- ADTO Industrial Group Co. Ltd.

- KHK Scaffolding & Formwork LLC

- Waco Kwikform Limited

Competitive Analysis:

The Asia Pacific Aluminum Scaffolding Market features a competitive landscape with both global manufacturers and strong regional players. Key companies include Altrex, Instant UpRight, Layher, PERI, and Youngman, each offering specialized aluminum scaffolding systems suited for diverse construction needs. It continues to attract new entrants focused on mobile towers, modular systems, and quick-assembly designs. Players differentiate through product innovation, safety certifications, and rental service models. Strategic partnerships with local distributors and contractors strengthen market presence. Companies invest in expanding production facilities and enhancing after-sales support to maintain competitiveness. Regulatory compliance and cost-efficiency remain critical factors influencing procurement decisions. Leading firms also focus on digital solutions for scaffold design and risk management to add value beyond physical products.

Recent Developments:

- In October 2024, Scafom Holding B.V. entered into a strategic partnership with India’s Kirtanlal Scaffolding and Formwork Private Limited to strengthen its presence in the rapidly developing construction sector across Asia. This collaboration brings together Scafom-RUX’s advanced modular scaffolding technology and Kirtanlal’s extensive in-market expertise, aiming to deliver improved efficiency and enhanced safety for large-scale infrastructure projects in India.

- In Feb 2024, Doka completed acquisition of Malaysia‑based MFE Formwork Technology

Doka finalized acquisition of MFE Formwork Technology in May 2025, strengthening its foothold across Asia Pacific scaffolding markets. It solidifies regional sourcing capabilities and enhances Doka’s modular and system scaffolding offerings. The move supports its strategy to integrate local expertise and accelerate project delivery in emerging Asian economies.

Market Concentration & Characteristics

The Asia Pacific Aluminum Scaffolding Market remains moderately fragmented, with regional players catering to country-specific construction demands. It shows a balanced mix of multinational brands and local manufacturers offering tailored solutions. The market favors suppliers who meet international safety standards while maintaining cost-effectiveness. Growth is strongest in urban infrastructure, industrial maintenance, and commercial projects. It reflects a shift toward modern materials and compliance-driven procurement. Demand for rental-based services is increasing, encouraging service-oriented competition. Innovation, quality, and scalability define market success.

Report Coverage:

The research report offers an in-depth analysis based on product type, application, and end-user industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Urban infrastructure expansion across major cities will continue to drive strong demand for lightweight and modular aluminum scaffolding systems.

- Increasing adoption of safety-compliant scaffolding solutions will shape procurement strategies across private and public sector projects.

- The shift toward sustainable construction practices will favor recyclable and reusable scaffolding materials like aluminum.

- Technological integration in scaffold planning and load simulation will enhance design precision and on-site performance.

- Growth in scaffold rental services will enable wider access for small and mid-sized contractors in emerging markets.

- Rising construction activity in tier-2 and tier-3 cities will open new growth avenues for mobile and quick-assembly scaffolding platforms.

- Investment in industrial maintenance and facility upgrades will support recurring demand across manufacturing and logistics sectors.

- Expansion of multinational scaffold manufacturers into Southeast Asia will intensify competition and improve product availability.

- Development of customized scaffold variants for hazardous and restricted work zones will address evolving safety needs.

- Growing collaboration between equipment suppliers and digital construction platforms will support smarter project execution and asset tracking.