| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Compression Sportswear Market Size 2024 |

USD 37.69 Million |

| Australia Compression Sportswear Market, CAGR |

7.65% |

| Australia Compression Sportswear Market Size 2032 |

USD 67.95 Million |

Market Overview

Australia Compression Sportswear Market size was valued at USD 37.69 million in 2024 and is anticipated to reach USD 67.95 million by 2032, at a CAGR of 7.65% during the forecast period (2024-2032).

The Australia Compression Sportswear Market is experiencing significant growth, driven by increasing health consciousness, rising participation in fitness activities, and the growing popularity of professional and amateur sports. Technological advancements in fabric design, including moisture-wicking, temperature regulation, and muscle support, are enhancing product appeal. Additionally, the expanding e-commerce sector and strategic brand collaborations with athletes and influencers are fueling market expansion. Trends indicate a shift toward eco-friendly and sustainable materials as consumers prioritize ethical fashion choices. The integration of smart textiles with biometric tracking capabilities is also gaining traction, catering to the demand for performance monitoring. Moreover, the rising prevalence of sports-related injuries is driving demand for compression wear, which aids in muscle recovery and injury prevention. As consumer preferences evolve, manufacturers are focusing on product innovation, personalized fits, and stylish yet functional designs to maintain a competitive edge in the dynamic market landscape.

The Australia Compression Sportswear Market is witnessing strong growth across key regions, including New South Wales, Victoria, Queensland, and Western Australia, driven by increasing participation in sports, fitness activities, and athleisure trends. Major cities like Sydney and Melbourne serve as hubs for sports and outdoor activities, fueling the demand for high-performance compression wear. The market benefits from a well-established retail infrastructure and a growing e-commerce sector, enabling brands to reach a broader consumer base. Leading companies driving competition in this market include Adidas AG, Nike, Tommie Copper, BodyMate, Mojo, Danish, Rikedom, Zareus, 2XU, Abco Tech, Run Forever Sports, BeVisible Sports, Thirty 48, Camden Gear, and Zensah. These brands focus on innovation, sustainability, and advanced fabric technologies to enhance product performance and meet consumer expectations. As demand for compression wear grows, companies are leveraging digital marketing, influencer collaborations, and online retail platforms to expand their presence in Australia’s evolving sportswear landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Compression Sportswear Market was valued at USD 37.69 million in 2024 and is projected to reach USD 67.95 million by 2032, growing at a CAGR of 7.65% during the forecast period.

- Rising health consciousness and increased participation in fitness activities, sports, and gym workouts are driving the demand for compression sportswear.

- The growing trend of athleisure and stylish performance wear is attracting a broader consumer base, including non-athletes.

- Leading brands such as Adidas, Nike, Tommie Copper, and 2XU are focusing on innovation, sustainability, and smart fabric technologies to maintain their competitive edge.

- High product costs and limited consumer awareness in rural areas are key challenges affecting market penetration.

- New South Wales and Victoria together account for nearly 60% of the market share, with strong demand from urban fitness enthusiasts.

- The expansion of e-commerce platforms and digital marketing strategies is helping brands reach a wider audience and drive sales growth.

Report Scope

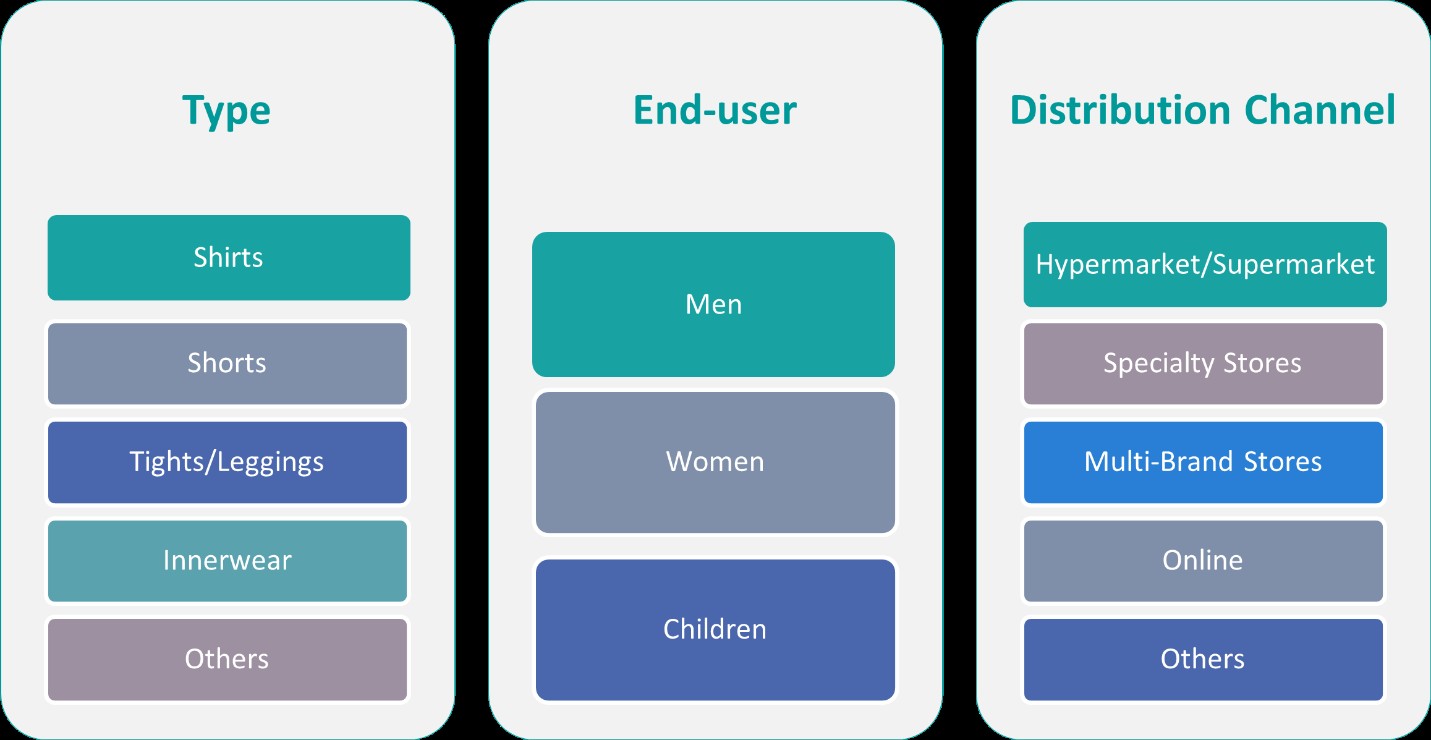

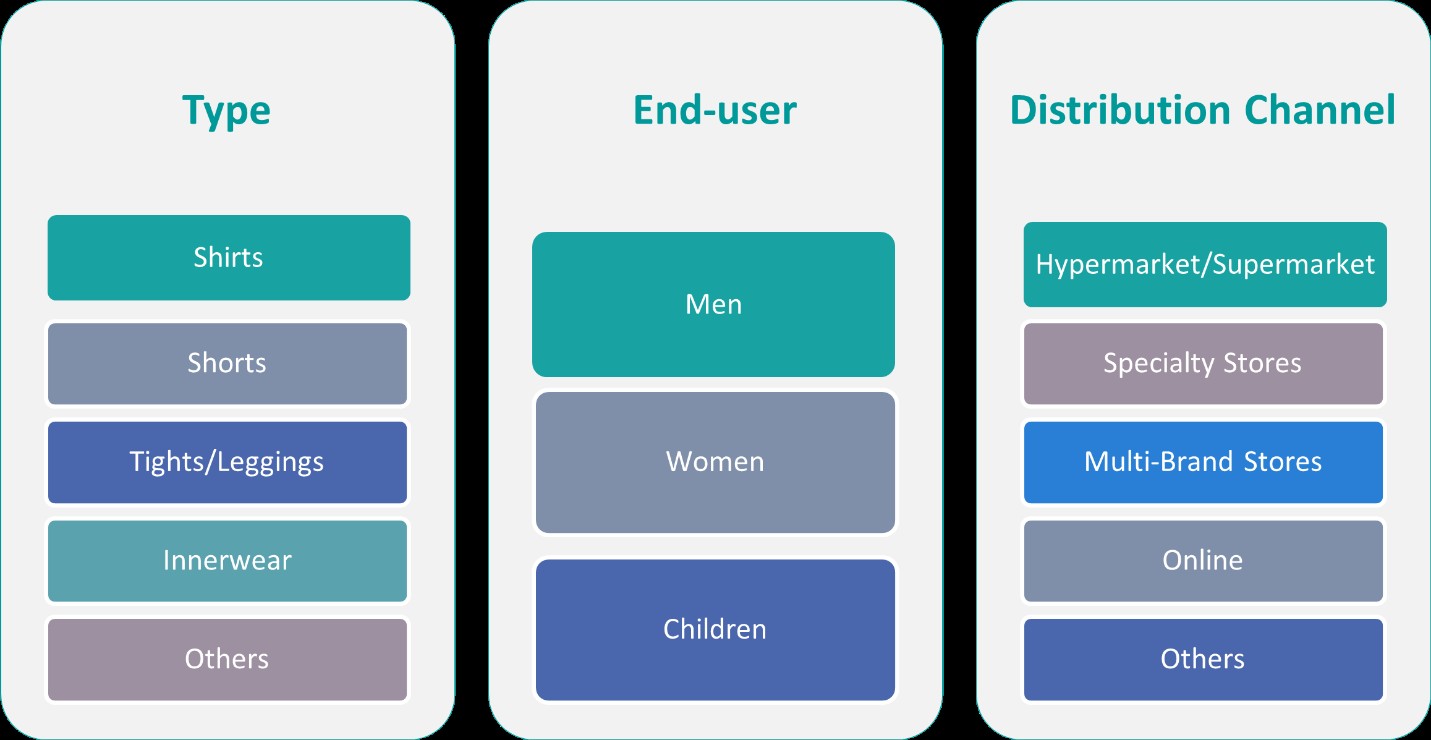

This report segments the Australia Compression Sportswear Market as follows:

Market Drivers

Rising Health Awareness and Fitness Trends

The increasing emphasis on health and wellness is a key driver of the Australia Compression Sportswear Market. Consumers are actively engaging in fitness routines, sports, and outdoor activities to maintain a healthy lifestyle, fueling the demand for high-performance sportswear. For instance, the Australian Institute of Health and Welfare notes that there has been a significant decrease in the proportion of adults not meeting physical activity guidelines, indicating a broader societal shift toward active lifestyles. Government initiatives promoting physical fitness and awareness about the benefits of an active lifestyle further encourage participation in sports and exercise. Additionally, the growing number of fitness influencers and social media campaigns advocating for a healthier lifestyle has significantly contributed to the rising demand for compression wear. This trend is particularly strong among millennials and Gen Z consumers who prioritize fitness as part of their daily routine. The ability of compression sportswear to enhance performance, reduce muscle fatigue, and accelerate recovery makes it a preferred choice among athletes and fitness enthusiasts, further driving market growth.

Technological Advancements in Fabric and Performance Enhancement

Innovations in textile technology and fabric engineering are playing a crucial role in boosting the adoption of compression sportswear. Manufacturers are investing in advanced materials with moisture-wicking, temperature-regulating, and anti-bacterial properties to improve comfort and performance. Compression garments designed with graduated pressure technology help enhance blood circulation, reduce muscle soreness, and provide better support during intense physical activities. Additionally, the integration of smart textiles with biometric tracking capabilities is gaining traction, offering real-time monitoring of body metrics such as heart rate, muscle activity, and hydration levels. These advancements are attracting professional athletes and fitness enthusiasts who seek scientifically backed solutions to improve endurance and prevent injuries. The focus on lightweight, breathable, and eco-friendly materials further aligns with consumer preferences, making technologically advanced compression sportswear a dominant force in the market.

Growing Popularity of E-Commerce and Brand Collaborations

The expansion of e-commerce and digital marketing strategies has significantly influenced the growth of the compression sportswear market in Australia. Consumers increasingly prefer online shopping due to the convenience, variety, and exclusive discounts offered by e-commerce platforms. Leading brands are capitalizing on this trend by strengthening their online presence, launching direct-to-consumer (DTC) channels, and leveraging social media marketing to engage with their target audience. Moreover, collaborations between sportswear brands and professional athletes, fitness influencers, and sporting events are enhancing product visibility and credibility. Limited-edition collections and co-branded products endorsed by sports personalities are gaining popularity, further driving market penetration. The rise of omnichannel retailing, including a mix of physical stores and online platforms, is ensuring greater accessibility to compression sportswear, thereby boosting overall market demand.

Increasing Demand for Sustainable and Ethical Sportswear

Consumer preferences are shifting toward sustainable and eco-friendly sportswear, creating new opportunities for the compression wear market in Australia. With rising environmental concerns, many brands are introducing products made from recycled materials, biodegradable fabrics, and sustainable manufacturing processes. For example, brands in Australia are using materials like Econyl and Repreve, which are made from recycled plastic waste, to create high-performance activewear. Ethical fashion is gaining traction, with consumers seeking transparency in sourcing and production practices. Companies investing in responsible production methods and sustainable packaging solutions are experiencing higher brand loyalty and positive consumer perception. Additionally, the use of organic dyes, water-efficient manufacturing techniques, and waste reduction strategies are becoming key selling points. As consumers become more conscious of their purchases, brands that align with sustainability initiatives are expected to gain a competitive edge, reinforcing the long-term growth of the compression sportswear market in Australia.

Market Trends

Rising Demand for Performance-Enhancing Sportswear

Consumers in Australia are increasingly prioritizing performance-oriented sportswear that enhances endurance, reduces muscle fatigue, and improves overall athletic performance. Compression garments designed with graduated pressure technology are gaining traction as they improve blood circulation and reduce recovery time. For instance, brands like Cape Bionics are offering custom-fit compression garments that provide specific compression regimes tailored to different activities, enhancing physiological benefits such as blood flow and fluid drainage. Athletes and fitness enthusiasts are actively seeking apparel that provides muscle stabilization, minimizes the risk of injuries, and offers support during high-intensity workouts. The growing popularity of activities such as running, cycling, and weight training is further fueling the adoption of compression sportswear. Additionally, advancements in material technology, including moisture-wicking and temperature-regulating fabrics, are enhancing consumer satisfaction, reinforcing the demand for high-performance compression wear.

Shift Toward Sustainable and Eco-Friendly Compression Wear

Sustainability is becoming a key focus in the compression sportswear industry, with brands introducing eco-friendly materials and ethical manufacturing practices. Consumers are actively seeking compression garments made from recycled fabrics, organic cotton, and biodegradable materials to minimize their environmental impact. For example, brands like Kartiana are using recycled polyester from PET bottles to produce sustainable activewear, reducing waste and promoting eco-friendly practices. Companies are responding by adopting water-efficient production methods, reducing carbon footprints, and implementing transparent sourcing policies. Additionally, the demand for long-lasting, durable sportswear is driving innovation in fabric engineering, ensuring that compression garments maintain their performance properties over time. As sustainability continues to influence consumer purchasing decisions, brands investing in green technologies and ethical production will gain a competitive advantage in the Australian market.

Integration of Smart Textiles and Wearable Technology

The adoption of smart textiles in compression sportswear is a significant trend transforming the industry. Manufacturers are integrating biometric tracking capabilities into garments, allowing users to monitor vital statistics such as heart rate, muscle activity, and hydration levels in real time. This trend aligns with the increasing use of wearable fitness technology, as consumers look for data-driven insights to optimize their training routines. Compression wear embedded with nanotechnology and conductive fibers is also gaining attention, providing enhanced breathability and adaptive compression based on body movements. As demand for technologically advanced sportswear grows, brands are expected to invest further in research and development to stay competitive.

Growing Influence of E-Commerce and Direct-to-Consumer Channels

The expansion of e-commerce and direct-to-consumer (DTC) sales is revolutionizing the distribution of compression sportswear in Australia. Consumers prefer online shopping due to its convenience, access to a broader product range, and exclusive discounts. Major sportswear brands are strengthening their digital presence by leveraging social media marketing, influencer collaborations, and personalized advertising to reach their target audience. The rise of subscription-based fitness apparel services is also contributing to market growth, offering consumers the flexibility to try new products with minimal commitment. Additionally, the adoption of omnichannel retailing, which integrates physical stores with online platforms, is enhancing the overall shopping experience and expanding market reach.

Market Challenges Analysis

High Competition and Market Saturation

The Australia Compression Sportswear Market is facing intense competition from both established global brands and emerging local players. Major sportswear companies dominate the market with extensive product portfolios, strong brand recognition, and aggressive marketing strategies, making it difficult for smaller brands to establish a foothold. For instance, the rise of direct-to-consumer (DTC) brands has disrupted traditional distribution channels, forcing established companies to adapt their marketing strategies and product offerings to remain competitive. Additionally, the rise of private-label compression wear from online retailers and fitness brands is further intensifying competition. Consumers have access to a wide variety of options, leading to price wars and reduced profit margins for manufacturers. To differentiate themselves, companies must invest heavily in product innovation, strategic collaborations, and targeted marketing efforts. However, these efforts require substantial financial resources, posing a challenge for new entrants and small-scale manufacturers trying to compete in this dynamic market.

High Production Costs and Sustainability Challenges

The production of high-quality compression sportswear involves advanced fabric technology, performance-enhancing features, and sustainable materials, all of which contribute to high manufacturing costs. As consumer demand for eco-friendly and ethically produced sportswear rises, companies must invest in recycled fabrics, biodegradable materials, and responsible manufacturing practices. However, adopting these sustainable solutions often increases production expenses, making it difficult to maintain competitive pricing. Additionally, ensuring durability and long-lasting performance in sustainable sportswear requires further research and development, adding to operational costs. Supply chain disruptions and fluctuating raw material prices also pose significant challenges, affecting profit margins and product availability. Brands must balance affordability, sustainability, and product performance while navigating these financial and logistical constraints in a highly competitive market.

Market Opportunities

The Australia Compression Sportswear Market presents substantial growth opportunities driven by the rising consumer focus on fitness and wellness. As more individuals engage in sports, gym workouts, and outdoor activities, the demand for high-performance compression wear continues to expand. The increasing awareness of the benefits of compression garments, such as improved blood circulation, muscle recovery, and injury prevention, is further driving adoption. Additionally, the growing interest in athleisure, where consumers seek stylish yet functional apparel, is opening new avenues for market players. Brands that combine fashion-forward designs with advanced performance features can tap into a broader customer base beyond professional athletes, catering to everyday fitness enthusiasts and lifestyle-conscious consumers. Moreover, the aging population seeking muscle support and enhanced mobility is an emerging segment contributing to the market’s long-term growth potential.

The shift toward sustainable and innovative product development presents another key opportunity for brands in the compression sportswear sector. Consumers are increasingly favoring eco-friendly and ethically sourced materials, encouraging manufacturers to invest in recycled fabrics and biodegradable alternatives. Companies that adopt transparent sourcing and sustainable production methods can strengthen their brand loyalty and gain a competitive edge. Additionally, the integration of smart textiles and wearable technology is opening doors for innovation, with compression garments offering biometric tracking and performance insights. The expansion of e-commerce and direct-to-consumer sales channels is also driving market growth, providing brands with greater access to tech-savvy consumers who prefer online shopping. By leveraging digital marketing, influencer collaborations, and personalized product offerings, companies can enhance customer engagement and expand their market reach in Australia’s evolving sportswear landscape.

Market Segmentation Analysis:

By Product Type:

The Australia Compression Sportswear Market is segmented into shirts, shorts, tights/leggings, innerwear, and others, with each category catering to specific athletic and lifestyle needs. Compression shirts are gaining popularity among athletes and fitness enthusiasts due to their ability to provide muscle support, enhance posture, and regulate body temperature during workouts. Similarly, compression shorts are widely used in high-intensity sports like running, cycling, and weight training, offering improved blood circulation and reduced muscle fatigue. Tights and leggings are in high demand, particularly among runners and gym-goers, as they provide enhanced flexibility, muscle compression, and a fashionable yet functional fit. The growing trend of athleisure has further boosted the adoption of compression leggings in everyday wear. Innerwear compression garments, such as base layers and socks, are also seeing increased demand due to their ability to improve muscle recovery and reduce swelling. Other compression wear, including arm sleeves and calf supports, is becoming popular among individuals seeking targeted muscle support, expanding the market’s overall scope.

By End- User:

The market is further segmented based on end users, including men, women, and children, each with distinct preferences and purchasing behaviors. Men’s compression sportswear dominates the market, driven by high participation in sports, gym workouts, and outdoor activities. Male athletes and fitness enthusiasts seek compression garments that enhance endurance, provide muscle stabilization, and offer moisture-wicking properties. Meanwhile, the women’s segment is experiencing rapid growth, fueled by the increasing popularity of yoga, pilates, and high-performance training. The demand for stylish yet functional compression leggings, sports bras, and tops is rising as more women integrate fitness into their daily routines. Additionally, the children’s segment is emerging as a promising category, with parents increasingly investing in compression wear for young athletes engaged in school sports and recreational activities. The rising awareness of muscle support and injury prevention among younger age groups is expected to drive further demand, making this segment an essential contributor to the market’s future expansion.

Segments:

Based on Product Type:

- Shirts

- Shorts

- Tights/Leggings

- Innerwear

- Others

Based on End- User:

Based on Distribution Channel:

- Hypermarket/Supermarket

- Specialty Stores

- Multi-Brand Stores

- Online

- Others

Based on the Geography:

- New South Wales

- Victoria

- Queensland

- Western Australia (WA)

- South Australia

Regional Analysis

New South Wales

New South Wales (NSW) holds the largest market share of approximately 32% in the Australia Compression Sportswear Market, driven by its high concentration of fitness-conscious individuals, professional athletes, and sports institutions. The state’s capital, Sydney, is home to a thriving sports culture, with widespread participation in running, cycling, and gym workouts fueling the demand for compression wear. Additionally, NSW has a strong presence of retail outlets and e-commerce platforms offering premium sports apparel, making compression sportswear easily accessible to consumers. The increasing popularity of marathons, triathlons, and fitness events further strengthens the adoption of compression garments, particularly among endurance athletes. Additionally, the state’s growing focus on sustainable and high-performance athletic apparel is encouraging brands to introduce innovative products that align with consumer preferences, solidifying NSW’s position as the leading market in Australia.

Victoria

Victoria accounts for around 27% of the market share, making it the second-largest region for compression sportswear in Australia. Melbourne, known as the country’s sporting capital, hosts a variety of national and international sports events, contributing to high consumer demand for advanced athletic apparel. The city’s strong fitness culture, with a growing number of gyms, yoga studios, and outdoor fitness groups, has significantly boosted the adoption of compression wear. Additionally, Victoria’s diverse weather conditions create a demand for compression apparel with thermoregulatory and moisture-wicking properties, catering to athletes training in various climates. The rise of women’s fitness participation and athleisure trends is further driving market growth, encouraging brands to introduce compression leggings, tights, and sports bras tailored to the evolving consumer landscape. As digital shopping continues to expand, online sales of compression sportswear in Victoria are expected to increase, reinforcing the region’s substantial market contribution.

Queensland

Queensland holds approximately 20% of the market share, benefiting from its outdoor-oriented lifestyle and high participation in sports such as surfing, running, and triathlons. The state’s warm climate increases demand for breathable, moisture-wicking compression wear that enhances performance and recovery in hot and humid conditions. Brisbane and the Gold Coast serve as key hubs for fitness and recreational activities, with a growing number of individuals incorporating compression apparel into their daily workouts. Additionally, Queensland’s fitness industry is witnessing a surge in boutique gyms, personal training programs, and endurance sports events, driving the need for high-performance athletic gear. The expanding e-commerce landscape is further contributing to market growth, with brands leveraging digital platforms to reach active consumers seeking premium sportswear solutions. As sustainability gains importance, demand for eco-friendly compression garments made from recycled materials and ethically sourced fabrics is expected to increase, creating opportunities for brands catering to environmentally conscious buyers.

Western Australia

Western Australia (WA) accounts for around 12% of the market share, with steady growth fueled by increasing participation in fitness activities and organized sports. Perth, the state’s largest city, has a strong athletic community that actively engages in activities such as running, cycling, and strength training, supporting demand for compression apparel. Additionally, the rise of corporate wellness programs and workplace fitness initiatives is encouraging more individuals to invest in high-quality sportswear, including compression garments. WA’s expanding e-commerce presence is making premium brands more accessible to consumers, driving online sales of performance-driven apparel. Although the market is smaller than NSW or Victoria, the rising health consciousness and adoption of athleisure trends are creating long-term growth opportunities. Manufacturers focusing on affordability, durability, and innovative designs tailored to local climate conditions will likely gain a competitive edge in this region.

Key Player Analysis

- Adidas AG

- Nike

- Tommie Copper

- BodyMate

- Mojo

- Danish

- Rikedom

- Zareus

- 2XU

- Abco Tech

- Run Forever Sports

- BeVisible Sports

- Thirty 48

- Camden Gear

- Zensah

Competitive Analysis

The Australia Compression Sportswear Market is highly competitive, with leading players focusing on product innovation, performance enhancement, and sustainability to maintain market dominance. Companies such as Adidas AG, Nike, Tommie Copper, BodyMate, Mojo, Danish, Rikedom, Zareus, 2XU, Abco Tech, Run Forever Sports, BeVisible Sports, Thirty 48, Camden Gear, and Zensah compete by introducing advanced compression fabrics that offer superior breathability, muscle support, and moisture-wicking capabilities. Leading brands continuously introduce advanced compression fabrics that offer superior breathability, muscle support, and moisture-wicking properties to cater to athletes and fitness enthusiasts. Established players leverage their strong brand presence and extensive marketing strategies, including celebrity endorsements and digital campaigns, to drive consumer engagement. Meanwhile, emerging brands emphasize specialized compression technology tailored for professional sports and active lifestyles. The growing demand for sustainable and eco-friendly sportswear has also led to the development of products made from recycled and ethically sourced materials. Additionally, the increasing shift toward e-commerce and direct-to-consumer sales models has intensified competition, with companies expanding their digital footprint and optimizing online retail channels to capture a larger share of the market.

Recent Developments

- In February 2025, Adidas AG launched several new products, including the Lightblaze shoe and the Mystic Victory pack for football boots. Adidas continues to focus on innovative designs and collaborations.

- In January 2025, Nike showcased innovative recovery footwear at CES 2025, featuring compression and heat technology, and is also developing a compression and heat vest as part of its wearable line, collaborating with Hyperice to boost athlete warm-up and recovery.

Market Concentration & Characteristics

The Australia Compression Sportswear Market exhibits a moderate to high market concentration, with a mix of established global brands and emerging domestic players competing for market share. Leading companies dominate through strong brand recognition, extensive distribution networks, and continuous product innovation, while smaller brands focus on specialized offerings and niche markets. The market is characterized by high consumer demand for performance-enhancing, moisture-wicking, and compression-fit apparel, primarily driven by professional athletes, fitness enthusiasts, and the growing athleisure trend. Sustainability is becoming a key characteristic, with brands increasingly incorporating eco-friendly materials and ethical manufacturing practices to align with evolving consumer preferences. Additionally, the rise of e-commerce and direct-to-consumer sales models has significantly reshaped market dynamics, enabling brands to expand their reach beyond traditional retail channels. As competition intensifies, companies are investing in technological advancements, digital marketing strategies, and influencer collaborations to maintain a competitive edge in this growing industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Australia Compression Sportswear Market is expected to grow steadily, driven by increasing fitness awareness and sports participation.

- The athleisure trend will continue to influence consumer preferences, boosting demand for stylish yet functional compression wear.

- Advancements in fabric technology will enhance moisture-wicking, breathability, and muscle support, improving overall product performance.

- Sustainability initiatives will gain momentum, with brands incorporating recycled materials and ethical production methods.

- E-commerce and direct-to-consumer sales channels will expand, offering consumers greater accessibility and personalized shopping experiences.

- Growing investment in digital marketing, influencer collaborations, and athlete endorsements will drive brand visibility and customer engagement.

- The demand for gender-specific and customized compression wear will rise, catering to diverse consumer needs and preferences.

- Emerging domestic brands will challenge established players by introducing innovative and cost-effective products.

- Regulatory standards and product quality certifications will play a crucial role in maintaining consumer trust and market credibility.

- Increasing participation in extreme sports and outdoor activities will fuel demand for high-performance compression apparel.