| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Off the Road Tire Market Size 2023 |

USD 135.29 Million |

| Australia Off the Road Tire Market, CAGR |

4.78% |

| Australia Off the Road Tire Market Size 2032 |

USD 206.22 Million |

Market Overview:

Australia Off the Road Tire Market size was valued at USD 135.29 million in 2023 and is anticipated to reach USD 206.22 million by 2032, at a CAGR of 4.78% during the forecast period (2023-2032).

The primary drivers of the OTR tire market in Australia include robust mining and construction activities. Australia’s rich mineral resources, particularly coal, gold, and iron ore, necessitate the use of heavy-duty machinery equipped with reliable OTR tires to ensure operational efficiency and safety. Additionally, large-scale infrastructure projects, such as the development of roads, highways, and commercial buildings, further propel the demand for OTR tires. Technological advancements in tire manufacturing, focusing on durability, fuel efficiency, and environmental performance, also contribute to market growth. The increasing demand for fuel-efficient and longer-lasting tires also aligns with global sustainability trends, pushing the industry toward greener alternatives.

The OTR tire market in Australia is influenced by regional factors, including the concentration of mining and construction activities in specific areas. States like Western Australia, Queensland, and New South Wales are central to mining operations, driving the demand for OTR tires. Infrastructure development initiatives, such as road upgrades and urban expansion, are more prominent in metropolitan regions, further increasing the need for heavy-duty vehicles and, consequently, OTR tires. The market is also shaped by environmental regulations and sustainability efforts, prompting the adoption of eco-friendly tire solutions across various regions. Furthermore, government incentives for infrastructure projects and mining initiatives further stimulate market growth, particularly in regional areas with high industrial activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Australia Off-the-Road (OTR) tire market was valued at USD 135.29 million in 2023 and is projected to reach USD 206.22 million by 2032, growing at a CAGR of 4.78%.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Key drivers of market growth include the strong demand from Australia’s mining industry, driven by mineral resources such as coal, iron ore, and gold, which require durable OTR tires for heavy-duty machinery.

- Infrastructure development, including road construction and urban expansion, further boosts the need for OTR tires as heavy construction vehicles require high-performance tires to operate effectively.

- Technological advancements in tire performance, including improvements in durability, fuel efficiency, and environmental impact, are fostering innovation and contributing to market growth.

- Regulatory pressures focused on sustainability and environmental concerns are pushing industries to adopt eco-friendly OTR tire solutions, aligning with global trends for greener alternatives.

- Mining operations in regions like Western Australia, Queensland, and New South Wales are key regional drivers of the OTR tire market, with heavy machinery essential to these activities.

- Challenges include the high initial cost of OTR tires, their performance in harsh environmental conditions, and increasing regulatory pressure for sustainability, which may hinder market growth for smaller businesses.

Market Drivers:

Growth in Mining and Natural Resource Extraction

One of the most significant drivers of the Australia Off-the-Road (OTR) tire market is the country’s expansive mining sector. Australia is rich in mineral resources, including coal, iron ore, gold, and natural gas, which are key contributors to the nation’s economic growth. The demand for OTR tires is closely linked to mining activities, as the heavy machinery used in extraction, transport, and processing requires durable and high-performance tires to navigate challenging terrains. As mining operations expand and new mining projects are initiated, the demand for specialized OTR tires continues to rise. Tires used in mining must be capable of handling high loads, rough surfaces, and extreme conditions, further driving their adoption across the sector.

Infrastructure Development and Construction

The growth of infrastructure projects across Australia, particularly in urban centers and regional areas, is another crucial factor propelling the demand for OTR tires. As the country undertakes large-scale development projects, including road construction, mining site expansions, and urbanization, the need for heavy-duty machinery, such as earth movers and construction vehicles, has surged. For instance, the METRONET Morley–Ellenbrook Line in Perth involved the construction of 21 kilometers of new rail, five new stations, two major rail viaducts, and multiple bridges and underpasses, showcasing the scale of infrastructure projects requiring heavy-duty OTR tires. These vehicles require robust OTR tires that can handle the strain of heavy loads and prolonged use. Additionally, Australia’s investment in transport infrastructure, such as roads, railways, and ports, provides further impetus for the growth of the OTR tire market. As construction equipment and machinery are integral to these projects, the need for reliable and efficient tires is expected to grow steadily.

Technological Advancements in Tire Performance

Technological advancements in tire manufacturing and design are significantly influencing the OTR tire market in Australia. Manufacturers are focusing on improving tire performance through innovations in material science and engineering. For instance, the development of tires that offer improved durability, reduced wear, and enhanced fuel efficiency is becoming increasingly important in the market. Moreover, the shift towards environmentally friendly and sustainable tire solutions has led to innovations in tire materials, such as the use of bio-based compounds and more efficient manufacturing processes. These technological improvements not only extend the life of the tires but also contribute to cost reductions for businesses in the mining and construction sectors, thus driving the overall demand for OTR tires.

Regulatory Pressures and Sustainability Trends

As environmental concerns continue to grow, regulatory frameworks aimed at reducing the environmental impact of industrial activities are becoming more stringent. In Australia, the mining and construction industries face increasing pressure to comply with sustainability standards, including regulations related to carbon emissions and waste management. These regulations are encouraging the adoption of eco-friendly and energy-efficient OTR tires, which can reduce fuel consumption and minimize environmental impact. Additionally, tire recycling programs and the growing focus on circular economy principles are pushing companies to opt for tires that meet higher environmental standards. For instance, in November 2023, Rio Tinto partnered with Carroll Engineering Services to recover 800 tonnes of used OTR tires and conveyor belts from the Argyle Diamond Mine. As businesses and industries seek to align with global sustainability goals, the demand for environmentally responsible OTR tire solutions is expected to rise, further contributing to the market’s growth.

Market Trends:

Increasing Adoption of Radial Tires

One of the notable trends in the Australia OTR tire market is the increasing adoption of radial tires over bias tires. Radial tires offer superior performance compared to bias tires, particularly in terms of fuel efficiency, durability, and load-bearing capacity. As the demand for fuel-efficient machinery grows, particularly in sectors such as mining and construction, radial tires have gained popularity due to their ability to reduce rolling resistance and improve vehicle stability. This trend is particularly prominent in the mining industry, where large-scale trucks and machinery need to operate under demanding conditions. Radial tires are also preferred for their extended lifespan and reduced maintenance costs, which contribute to lower operational expenses for companies.

Shift Towards Larger Tire Sizes

A significant trend in the Australian OTR tire market is the shift towards larger tire sizes, driven by the need for higher load-bearing capacity and enhanced stability in heavy machinery. Larger tires are increasingly being used in mining trucks, earth-moving equipment, and construction vehicles, as they are better equipped to handle extreme weight and rough terrains. These larger tire sizes provide greater flotation, reducing the risk of tire wear and improving the vehicle’s efficiency in harsh working environments. This trend is closely aligned with the growth of large-scale mining operations, which require equipment capable of transporting substantial loads across mining sites, further increasing the demand for oversized OTR tires.

Technological Integration in Tire Monitoring Systems

The integration of advanced tire monitoring systems (TMS) in OTR tires is another emerging trend in the Australian market. These systems allow for real-time monitoring of tire pressure, temperature, and wear patterns, providing operators with critical data to enhance operational efficiency. For instance, LSM Technologies’ TMS enables real-time monitoring of tire pressure and temperature, allowing operators to detect issues remotely even during severe weather events thereby reducing the risk of accidents and costly downtime. By using sensors and telematics, businesses can optimize tire performance, extend the lifespan of their tires, and prevent premature failure. This trend is gaining traction in industries like mining and construction, where tire failure can result in costly downtime and safety risks. As more OTR tire manufacturers incorporate these technologies into their products, businesses are increasingly adopting smart tires to improve their operational capabilities and reduce overall maintenance costs.

Focus on Sustainability and Eco-friendly Solutions

Sustainability is becoming a central theme in the Australian OTR tire market, with increasing emphasis on developing eco-friendly and energy-efficient tires. Environmental concerns are driving the adoption of tires made from sustainable materials, as well as innovations aimed at reducing the environmental impact of tire production and disposal. For instance, companies such as Bridgestone Mining Solutions, Goodyear, Kal Tire, Michelin, and Yokohama joining Tyre Stewardship Australia’s voluntary Tire Product Stewardship Scheme to improve resource recovery and recycling of OTR tires. Companies are looking for ways to reduce their carbon footprints, which has led to a rise in demand for OTR tires that are designed with longer lifespans and better fuel efficiency. In addition, the rise of tire recycling programs and the push for circular economy practices are encouraging businesses to invest in tires that can be repurposed and reused, further aligning with global sustainability trends.

Market Challenges Analysis:

High Initial Cost of OTR Tires

One of the primary restraints facing the Australia OTR tire market is the high initial cost of purchasing and installing OTR tires. These tires are designed to withstand extreme operating conditions, which results in a higher price compared to standard tires. For instance, the initial investment for mining dump truck tires in Australia can range from $5,000 to over $20,000 per tire, depending on size and specifications. In some cases, large mining tires average around $45,000 each, representing a significant upfront cost for operators. For industries such as mining and construction, where large fleets of heavy machinery are in use, the cost of acquiring and maintaining these tires can be significant. While OTR tires offer long-term cost benefits through durability and reduced maintenance, the upfront investment can be a barrier, particularly for smaller companies with limited capital. This challenge may slow the rate of adoption for new businesses entering these industries.

Tire Performance in Harsh Environmental Conditions

Another challenge facing the market is the performance of OTR tires in Australia’s diverse and often harsh environmental conditions. The country’s rugged terrain, combined with extreme weather, can lead to tire damage and reduced operational efficiency. Mining and construction equipment often operate in remote locations with limited access to support services, which can exacerbate tire wear and increase the likelihood of tire failure. Although advancements in tire technology have improved durability, the need for constant monitoring and maintenance in such environments remains a key challenge. Companies operating in these conditions must invest in regular tire maintenance and replacements, increasing operational costs.

Regulatory Compliance and Environmental Pressures

The Australian OTR tire market also faces challenges stemming from increasing regulatory pressure related to environmental sustainability. Governments and regulatory bodies are enforcing stricter standards on tire disposal and emissions, which adds complexity to tire management processes. Additionally, the need for sustainable and eco-friendly tire solutions is pushing manufacturers to innovate continuously. While this trend is creating new opportunities, the higher cost of producing eco-friendly tires can strain profit margins for manufacturers and increase costs for end-users.

Market Opportunities:

The Australian Off-the-Road (OTR) tire market presents significant growth opportunities, particularly in the mining and construction sectors. With the country’s mining industry continuing to thrive, driven by the extraction of valuable natural resources such as coal, gold, and iron ore, the demand for high-performance OTR tires remains strong. Mining companies require durable and reliable tires to ensure the smooth operation of their heavy machinery, which is exposed to harsh and rugged terrains. As mining operations expand and new projects emerge, the need for specialized OTR tires that can withstand extreme conditions offers manufacturers an opportunity to capitalize on a growing market. Additionally, infrastructure development across urban and regional areas further enhances the demand for OTR tires as large-scale construction projects require reliable machinery for earth-moving and material handling tasks.

In addition to the steady demand from traditional sectors, there is a growing opportunity for OTR tire manufacturers to innovate in response to the increasing emphasis on sustainability and environmental responsibility. The market is witnessing a rise in demand for eco-friendly and energy-efficient tire solutions, which presents an opportunity for manufacturers to develop tires with longer lifespans and lower environmental impact. Integrating advanced technologies such as tire monitoring systems and improving fuel efficiency through tire design can create a competitive edge for companies in the market. With regulatory frameworks pushing for greener alternatives, the shift toward sustainability opens up new avenues for growth, particularly for businesses that can meet both performance and environmental standards.

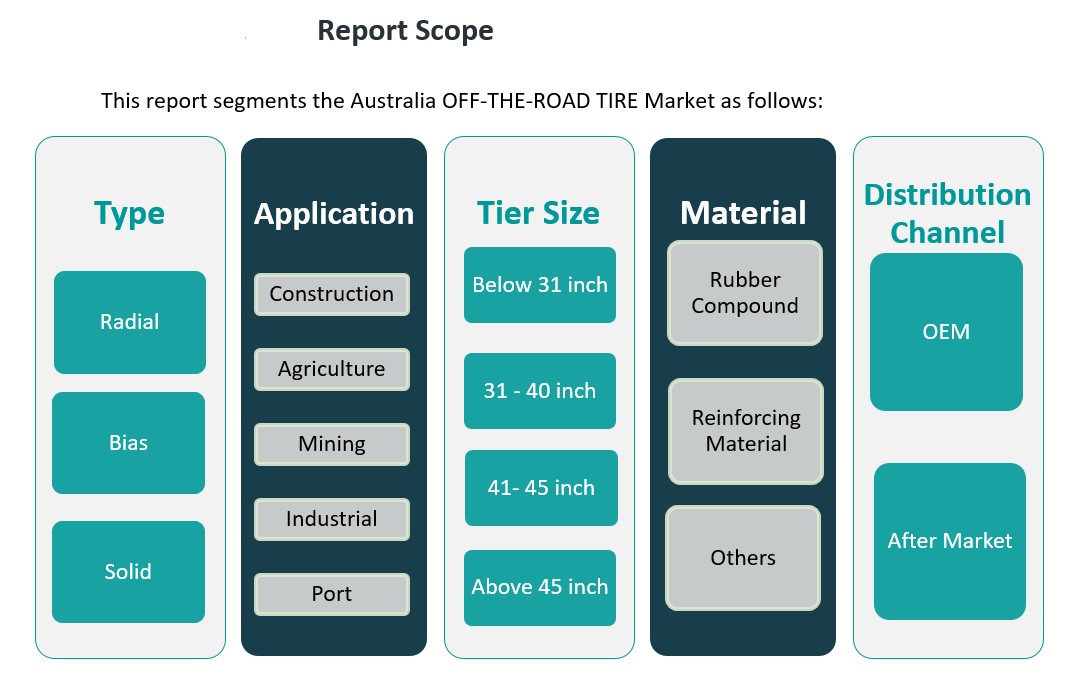

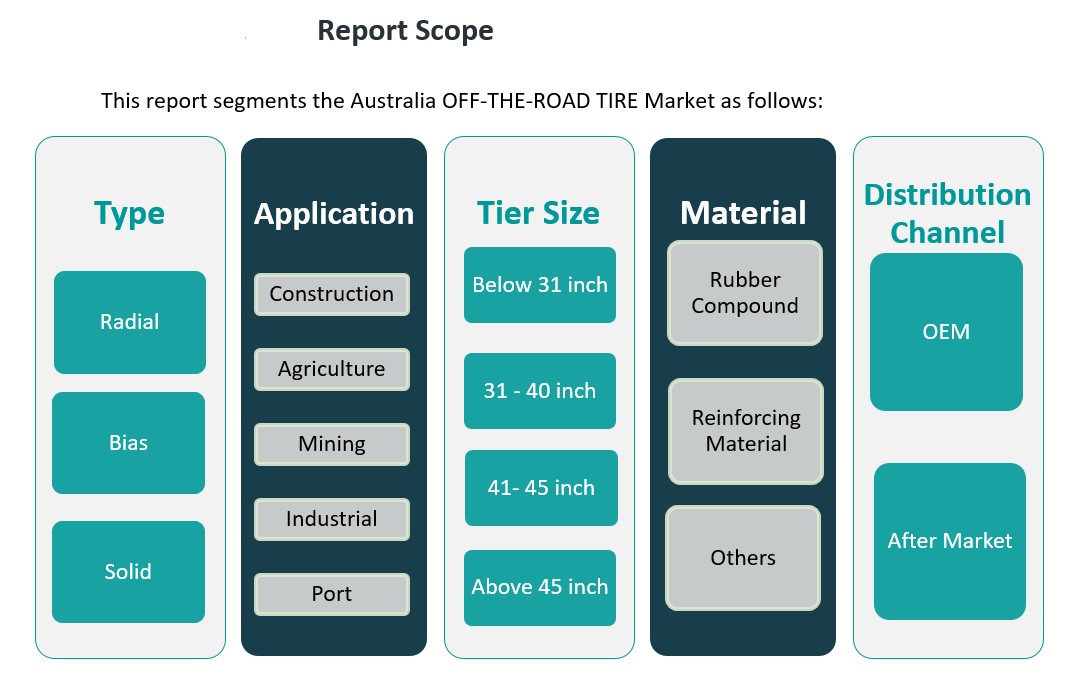

Market Segmentation Analysis:

The Australian Off-the-Road (OTR) tire market can be segmented based on type, application, tire size, material, and distribution channel, each contributing uniquely to market growth.

By Type Segment

The OTR tire market is primarily divided into radial, bias, and solid tires. Radial tires dominate the market due to their superior durability, fuel efficiency, and load-bearing capacity. Bias tires are still used in certain applications but have been largely replaced by radial tires in industries requiring high performance. Solid tires are gaining traction in industrial and port applications due to their durability and ability to withstand extreme operating conditions without the risk of punctures.

By Application Segment

The key applications for OTR tires in Australia include construction, agriculture, mining, industrial, and port sectors. Mining and construction are the largest contributors to demand, driven by the need for heavy machinery and equipment that operates in harsh environments. Agriculture and industrial sectors also require OTR tires for machinery used in earth-moving and material handling, while the port sector’s growth is driving demand for specialized tires for material handling equipment.

By Tire Size Segment

OTR tires are available in various sizes, with tires below 31 inches and in the 31-40 inch range being most commonly used. Larger tire sizes (41-45 inches and above 45 inches) are gaining prominence in mining operations, where machinery requires heavy-duty tires capable of supporting substantial loads.

By Material Segment

Rubber compounds and reinforcing materials dominate the material segment, offering enhanced tire durability and performance. These materials are key to improving tire lifespan and reducing operational costs in demanding industries.

By Distribution Channel Segment

The OTR tire market is segmented into OEM and aftermarket channels. OEM sales are driven by direct partnerships with manufacturers of heavy machinery, while aftermarket sales offer replacement and service options, supporting the ongoing demand for tire maintenance in industrial sectors.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The Australian Off-the-Road (OTR) tire market is influenced by regional dynamics, with key areas of growth driven by the demand in the mining, construction, and agriculture sectors. The market is dominated by several key regions, each contributing uniquely to the overall demand for OTR tires.

Western Australia

Western Australia holds the largest market share within the Australian OTR tire market, accounting for over 40% of the total demand. This region is a major hub for the mining industry, particularly in the extraction of iron ore, gold, and coal, where the need for durable OTR tires is essential for mining trucks, earth-moving machinery, and transport vehicles. The growth of mining operations and ongoing exploration projects in this region are expected to continue driving tire demand in the coming years. Additionally, Western Australia’s robust infrastructure development projects further bolster the demand for OTR tires in construction and heavy machinery applications.

Queensland

Queensland follows closely with a significant share of the market, contributing approximately 25% to the overall OTR tire market. Mining, particularly in coal and other minerals, is a major driver in this region. In addition to mining, the construction sector’s expansion, especially in urban and regional areas, increases the demand for OTR tires used in construction machinery. Queensland’s focus on developing critical infrastructure such as roads, bridges, and railways contributes to the rising demand for heavy-duty tires.

New South Wales

New South Wales (NSW) contributes around 20% to the market share, driven by a combination of mining, agriculture, and industrial applications. The state’s agricultural activities, including large-scale farming and mechanized operations, demand reliable OTR tires for machinery used in planting, harvesting, and transport. The industrial sector, particularly in urban centers like Sydney, also plays a role in driving demand for OTR tires used in earth-moving and material handling equipment.

South Australia and Victoria

South Australia and Victoria together account for the remaining 15% of the OTR tire market. South Australia is known for its mineral resource extraction, while Victoria’s demand is driven by its agriculture and construction sectors. Both regions are witnessing growth in infrastructure projects, which, along with the need for reliable tires for agricultural machinery, continue to foster demand for OTR tires.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Focus on OTR tires

Competitive Analysis:

The Australian Off-the-Road (OTR) tire market is highly competitive, with several prominent global and regional players dominating the market. Key manufacturers include Michelin, Bridgestone, Goodyear, and Continental, which offer a wide range of high-performance OTR tires for mining, construction, and agricultural machinery. These companies focus on technological innovations, such as durable tire designs and eco-friendly solutions, to enhance their market presence. Additionally, local players such as Trelleborg and Tyreplus have strengthened their foothold by providing customized solutions to meet the specific demands of the Australian market. The competition is primarily driven by product quality, technological advancements, and strong distribution networks. Major players invest in research and development to improve tire longevity, fuel efficiency, and performance in challenging environments. Strategic partnerships with OEMs and expansion of aftermarket services are key strategies employed by companies to maintain market share in this growing sector.

Recent Developments:

- In March 2022, OTR Tyres acquired Titan International’s Australian wheel business for AUD 23 million. The integration of Titan Australia with OTR Tyres has created a stronger, Australia-wide provider of wheel, tire, and axle solutions, enhancing service capabilities for mining, construction, and agriculture customers across the country. This move consolidated Titan’s presence under the OTR Tyres brand, reinforcing its commitment to the Australian OTR tire market.

- In January 2025, Maxam Tire expanded its product portfolio by launching three new rubber tracks the MT130, MT150, and MT170 designed for construction and off-road equipment, further strengthening its OTR offerings. These tracks are engineered for durability, cut resistance, and versatility across various terrains and are supported by new features in the Maxam Mobile App to assist with fitment and ground pressure calculations. While the launch is global, it aligns with Australia’s demand for robust OTR solutions in mining and construction.

- In 2024, Michelin launched its X Mine D2 tire in Australia’s mining sector, specifically targeting iron ore operations. This new product demonstrated a 15% increase in service life compared to previous models, now exceeding 12,000 hours of use in demanding environments. The X Mine D2’s enhanced durability directly addresses the needs of Australian mining companies, where tire longevity and reliability are paramount due to the high costs and logistical challenges of frequent replacements.

Market Concentration & Characteristics:

The Australia Off-the-Road (OTR) tire market is moderately concentrated, with a few large global players holding a significant market share. Companies such as Michelin, Bridgestone, Goodyear, and Continental dominate the market due to their extensive product portfolios, global presence, and strong distribution networks. However, the market also features a range of regional and local players that cater to niche segments and specific industry needs, allowing for a degree of fragmentation. The market is characterized by high entry barriers due to the substantial capital investment required for manufacturing and research and development. Product differentiation, driven by tire durability, performance, and technological innovations such as eco-friendly designs and tire monitoring systems, plays a critical role in competition. Additionally, the aftermarket segment, focused on replacement tires and maintenance services, remains a key revenue driver for market players, alongside original equipment manufacturing (OEM) partnerships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Australian OTR tire market is expected to experience steady growth due to continued expansion in mining and infrastructure development.

- Increasing demand for fuel-efficient, durable, and eco-friendly tires will drive technological advancements in tire design and manufacturing.

- The shift toward larger tire sizes for heavy-duty mining trucks and construction machinery will contribute to the market’s growth.

- Growing environmental regulations will push manufacturers to develop sustainable tire solutions and recycling technologies.

- The rise in remote and autonomous mining operations will boost the demand for advanced OTR tire monitoring systems.

- Regional infrastructure projects, particularly in Western Australia and Queensland, will create additional demand for heavy-duty tires.

- Local manufacturers will increasingly focus on providing customized solutions tailored to Australia’s specific industrial needs.

- Aftermarket services and replacement tire sales will continue to represent a significant portion of market revenues.

- The expansion of electric mining vehicles may introduce new opportunities for OTR tire manufacturers.

- Competitive pressures will lead to increased mergers, acquisitions, and partnerships among global and local players.