Market Overview

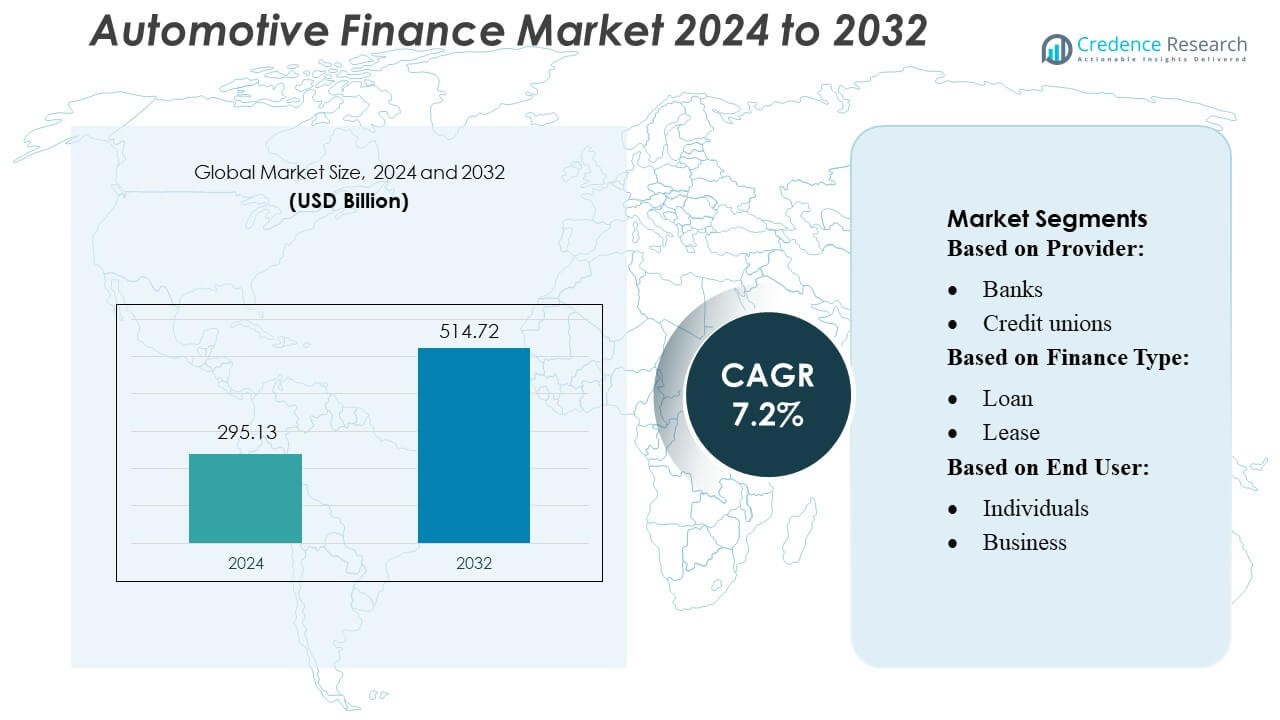

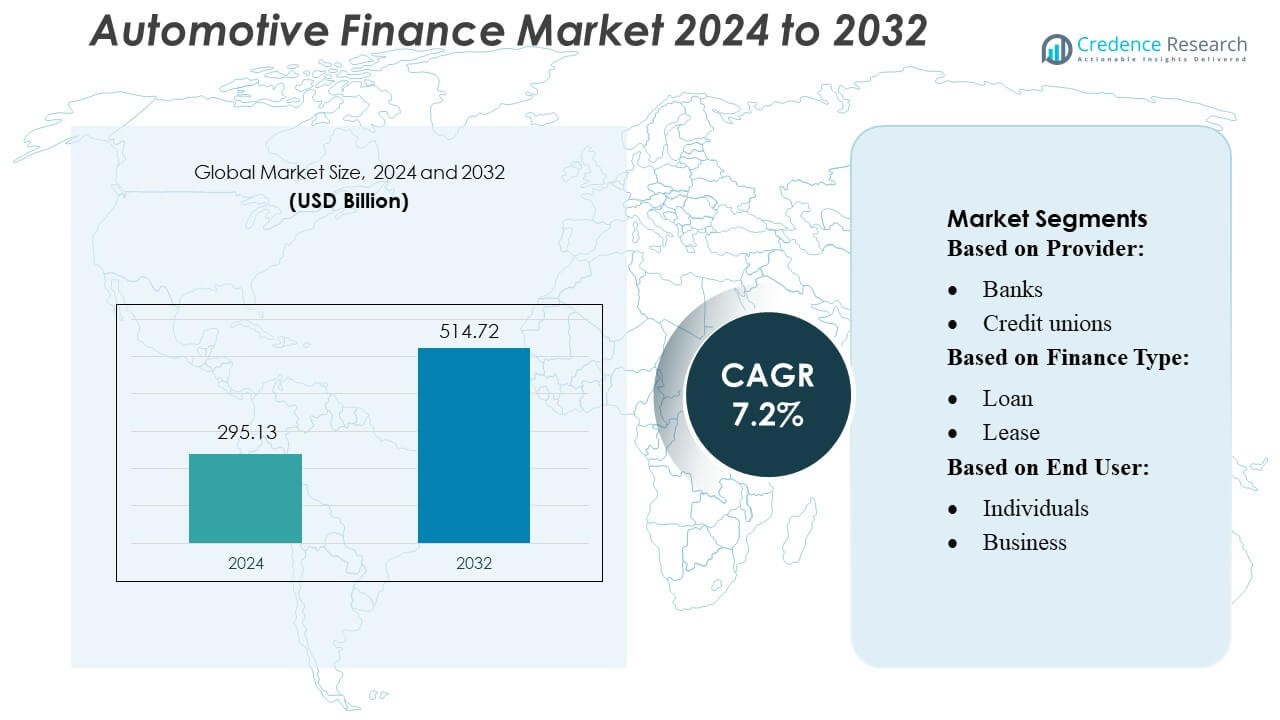

Automotive Finance Market size was valued USD 295.13 billion in 2024 and is anticipated to reach USD 514.72 billion by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Finance Market Size 2024 |

USD 295.13 Billion |

| Automotive Finance Market, CAGR |

7.2% |

| Automotive Finance Market Size 2032 |

USD 514.72 Billion |

The Automotive Finance Market is increasingly influenced by partnerships across OEM captive lenders, traditional banks, and fintech providers, with top players leveraging synergies in brand reach, risk management, and customer engagement. Market leaders are developing integrated digital platforms to deliver seamless financing experiences tied closely to vehicle purchases, especially from established automotive manufacturers’ finance arms. The competitive landscape is also undergoing transformation as institutions adopt AI-driven underwriting, predictive scoring, and data-powered credit models to serve a broader demographic. Regionally, North America holds the largest share of the global automotive finance market at approximately 34 %, driven by its mature financial infrastructure and high vehicle-financing penetration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Finance Market was valued at USD 295.13 billion in 2024 and is projected to reach USD 514.72 billion by 2032, growing at a 7.2% CAGR, supported by rising vehicle ownership and stronger digital financing adoption.

- Growing collaboration among OEM captive lenders, banks, and fintechs drives market expansion as integrated digital platforms enable faster approvals, improved credit scoring, and seamless point-of-sale financing.

- Key trends include the rapid shift toward AI-driven underwriting, predictive analytics for risk assessment, and increased demand for online loan processing as consumers prefer fully digital journeys.

- Market restraints include tightening regulatory frameworks, rising interest rates, and credit risks in emerging markets, which challenge lenders’ ability to maintain affordability and limit penetration in price-sensitive segments.

- Regionally, North America leads with a 34% share, while segment-wise, loans remain dominant due to widespread preference for fixed-term financing and strong adoption among individual buyers seeking structured repayment options.

Market Segmentation Analysis:

By Provider

Banks dominate the automotive finance market with an estimated 45–50% share, driven by their extensive branch networks, competitive interest rates, and strong risk-assessment capabilities. Credit unions hold a moderate share as they attract customers with lower fees and member-centric lending terms. Captive finance companies continue to expand by offering promotional rates and bundled incentives that boost new vehicle sales. NBFCs strengthen their position by serving high-risk and underserved borrowers with flexible underwriting. Online lenders grow rapidly due to digital onboarding and quick approvals, appealing particularly to tech-savvy and first-time borrowers.

- For instance, Piaggio Vehicles has partnered with Manba Finance, which operates across 71 locations with 29 branches, to provide tailored e-3W financing, and their joint network includes more than 1,100 dealers—over 190 of which are EV-3W dealers.

By Finance Type

Loans account for the dominant position with roughly 75–80% market share, supported by consumer preference for long-tenure repayment structures, ownership benefits, and predictable EMIs. Lenders further accelerate loan adoption through competitive interest rates, customized repayment schedules, and higher approval rates across vehicle categories. Leasing, although smaller, grows steadily among corporate fleets and premium-segment customers due to lower upfront costs, tax advantages, and reduced maintenance expenses. Automakers and captive finance companies increasingly promote leasing to stimulate recurring purchases and enhance customer retention.

- For instance, Hyundai Motor India has sold over 675,000 connected cars since 2019 using its Bluelink telematics platform, which now supports more than 70 features, and in 2025 introduced an In-car Payment platform that enables payments for EV charging at about 1,500 charging stations via its infotainment system.

By End User

Individual buyers represent the leading end-user segment with an approximate 65–70% share, driven by rising personal mobility needs, expanding middle-class income levels, and attractive retail financing schemes. Banks, NBFCs, and online lenders target this segment with pre-approved offers and digital loan processing for faster turnaround. The business segment continues to grow as companies invest in fleet expansion and operational vehicles, opting for both loans and leases to optimize cash flow and asset utilization. Captive finance firms and leasing providers particularly benefit from demand in logistics, mobility services, and corporate transportation.

Key Growth Drivers

- Rising Vehicle Ownership and Expanding Middle-Class Population

The automotive finance market benefits significantly from growing vehicle ownership, particularly in emerging economies where rising disposable incomes and expanding middle-class populations fuel demand. As consumers shift toward personal mobility solutions, the need for accessible financing options strengthens. Banks, NBFCs, and captive finance companies leverage this trend to increase loan and lease portfolios. The market also gains momentum from OEM-driven promotional financing schemes that make vehicle purchases more affordable, resulting in higher penetration of financing across passenger and commercial vehicle segments.

- For instance, Mercedes-Benz is accelerating its electrification: by early 2024, its Cars portfolio included nine all-electric models, and it is launching its first MMA-based EV in 2025, which is built on an 800-volt architecture and achieves up to 93 percent efficiency from battery to wheels.

- Digital Transformation and Advancements in FinTech Integration

Digitalization drives substantial growth as lenders adopt automated credit scoring, AI-driven underwriting, and digital KYC processes to accelerate loan approvals and enhance customer experience. FinTech platforms provide seamless end-to-end workflows—from application to disbursement—reducing operational costs and improving transparency. Online marketplaces and digital lending apps broaden consumer access, while real-time data analytics enhances risk management. The shift toward paperless transactions and instant approvals encourages higher consumer adoption, enabling lenders to scale operations efficiently and expand their customer base.

- For instance, Mahindra & Mahindra Financial Services has implemented a modular “Udaan” loan-processing platform that supports full lifecycle digitization, with its customer app achieving over 1.12 million users and digital collections exceeding ₹10,562 crore in the latest reported year.

- Growing Leasing Models and Subscription-Based Mobility

The rising popularity of vehicle leasing and subscription models accelerates market expansion, especially among urban consumers and businesses seeking cost-efficient and flexible mobility solutions. Lower upfront costs, predictable monthly payments, and end-of-term upgrade options make leasing attractive. Automakers and captive finance providers increasingly promote subscription-based offerings to strengthen customer retention and recurring revenues. Fleet operators also adopt leasing to optimize working capital and reduce asset management burdens. This structural shift from ownership to “usership” creates strong long-term growth potential for automotive finance providers.

Key Trends & Opportunities

- Integration of AI, ML, and Telematics for Risk-Based Pricing

Automotive financiers increasingly adopt AI, machine learning, and telematics data to refine credit assessments and personalize loan terms. Usage-based risk profiling enables lenders to extend credit to previously underserved segments while maintaining portfolio quality. Telematics-enabled insights—such as driving behavior and vehicle condition—open opportunities for dynamic pricing and lower default rates. These technologies also streamline fraud detection and optimize collection strategies, positioning lenders to improve margins through intelligent, data-driven decision-making.

- For instance, Ashok Leyland’s iAlert connected-vehicle platform now covers over 160,000 vehicles, monitoring more than 110 parameters per vehicle.

- Expansion of Green Vehicle Financing and EV-Focused Loan Products

The shift toward electric vehicles (EVs) creates new financing opportunities as governments promote sustainable mobility through incentives and subsidies. Financial institutions introduce EV-specific loans featuring lower interest rates, extended tenures, and bundled services like charging solutions. Captive finance arms collaborate with OEMs to support EV adoption through flexible leasing and battery-as-a-service models. As EV infrastructure expands, lenders gain new avenues to finance charging equipment and fleet electrification, thereby accelerating market diversification.

- For instance, Tata Motors has established more than 25,000 public chargers for its EV small commercial vehicles across over 150 cities, all of which are integrated into its Fleet Edge connected-vehicle platform to offer real-time navigation and charger availability.

- Growth of Online Marketplaces and Embedded Finance Ecosystems

Online vehicle marketplaces and embedded finance solutions enable lenders to integrate loan offers directly within automotive purchase journeys. Consumers can compare financing options instantly, complete digital documentation, and receive approvals within minutes. OEMs, e-commerce platforms, and FinTech companies increasingly collaborate to provide embedded loan and insurance products, improving customer convenience. This ecosystem expansion enhances lender visibility, reduces acquisition costs, and supports higher financing penetration across both new and used vehicle categories.

Key Challenges

- Rising Credit Risk and Delinquencies in Sensitive Segments

Increasing economic uncertainty and fluctuating income levels in certain consumer groups contribute to heightened credit risk. Subprime borrowers and small businesses remain particularly vulnerable to defaults during inflationary cycles or market slowdowns. Lenders must allocate higher provisions and adopt robust risk-mitigation frameworks to protect asset quality. Although digital credit assessments reduce risk, inconsistent data availability and fraud attempts remain persistent challenges, potentially constraining growth in high-risk segments.

- Regulatory Compliance Burden and Capital Requirement Pressures

Automotive finance providers face stringent regulatory frameworks related to consumer protection, interest rate transparency, data privacy, and capital adequacy norms. Compliance requirements increase operational complexity and raise administrative costs for banks, NBFCs, and captive finance units. Frequent regulatory updates demand continuous system upgrades and employee training. Moreover, tighter capital requirements restrict lending flexibility, especially for smaller and mid-sized lenders, creating barriers to competitive expansion and slowing market responsiveness.

Regional Analysis

North America

North America holds around 34% of the global automotive finance market, supported by strong credit systems and high vehicle ownership. Banks, credit unions, and captive finance companies dominate lending, while digital loan processing continues to increase approval speed and customer convenience. The region also benefits from mature leasing markets, especially for electric vehicles and premium cars. Stable economic conditions and advanced risk-assessment tools maintain high financing penetration. Overall, North America remains a leading and highly structured automotive finance hub.

Europe

Europe accounts for approximately 28% of the global automotive finance market, driven by strong captive finance operations and widespread adoption of leasing. Consumers increasingly choose flexible mobility solutions, including subscription and long-term rental models. Environmental policies and incentives also encourage financing for electric and hybrid vehicles. The region benefits from sophisticated financial regulations and strong banking networks, which support stable financing environments. Although growth is steady rather than rapid, Europe remains a major global contributor due to its well-established automotive ecosystem.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, holding about 30–40% of the global automotive finance market. Expanding middle-class populations, rising disposable incomes, and increasing vehicle sales significantly boost financing demand. Digital lending platforms and mobile-based applications improve access to credit in markets such as China, India, and Southeast Asia. Government incentives for electric vehicles further support financing growth. Despite differences in financial maturity across countries, Asia-Pacific continues to outpace other regions due to scale, rapid urbanization, and technology-driven lending models.

Latin America

Latin America captures approximately 5–6% of the global automotive finance market, with Brazil and Mexico serving as the largest contributors. Growing vehicle sales, increasing participation of banks, and rising involvement of captive finance companies support market activity. However, credit accessibility, economic instability, and fluctuating interest rates limit overall financing penetration. Despite these challenges, the region shows steady progress as more digital lending solutions emerge. Expanding middle-income demographics and gradual improvements in financial infrastructure continue to strengthen long-term growth prospects.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for roughly 8–10% of the global automotive finance market. Growth is driven by rising urbanization, increasing demand for commercial vehicles, and expanding dealer-led financing programs. Some markets also benefit from the use of Islamic finance structures, which support broader credit adoption. However, limited credit bureau coverage and regulatory fragmentation constrain financing penetration. Despite these challenges, MEA offers strong potential as digital financial services expand, vehicle ownership increases, and infrastructure development continues across key countries.

Market Segmentations:

By Provider:

By Finance Type:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automotive Finance Market, led by major OEM-linked players such as Piaggio & C. SpA, Hyundai Motor India, Mercedes-Benz Group AG, Mahindra & Mahindra Ltd., Ashok Leyland, Tata Motors, Bajaj Auto Ltd., Eicher Motors Limited, Maruti Suzuki India Limited, and Honda Motor Co., Ltd. the Automotive Finance Market features a rapidly evolving mix of traditional lenders, captive finance companies, and digital-first financing platforms that compete by enhancing customer experience, improving credit assessment models, and expanding product flexibility. Financial institutions focus on lowering turnaround times through automated underwriting, AI-driven risk evaluation, and omni-channel service integration. Captive finance providers strengthen competitiveness by offering tailored schemes, bundled maintenance packages, and loyalty-driven benefits that support vehicle sales. Meanwhile, fintech players intensify market disruption by introducing fully digital loan journeys, instant approvals, and alternative credit scoring for underserved segments. As vehicle electrification, online retailing, and subscription-based mobility expand, market participants continuously innovate financing structures to meet shifting consumer expectations.

Key Player Analysis

- Piaggio & C. SpA

- Hyundai Motor India

- Mercedes-Benz Group AG.

- Mahindra & Mahindra Ltd.

- ASHOK LEYLAND

- Tata Motors

- Bajaj Auto Ltd.

- EICHER MOTORS LIMITED

- MARUTI SUZUKI INDIA LIMITED

- Honda Motor Co., Ltd.

Recent Developments

- In May 2025, Tata Motors has launched the All-New Altroz in India at a starting price of around positioning it as a premium hatchback with a bold design, luxurious interiors, and advanced features.

- In April 2025, Mercedes-Benz India has achieved a significant milestone by rolling out its locally produced car from its manufacturing facility in Chakan, Pune. This landmark unit was the EQS SUV, the brand’s flagship electric vehicle.

- In January 2024, AutoFi’s platform into the showroom, offering an all-in-one, cloud-based solution that integrates previously disconnected sales and finance functions. This enhancement is part of a broader initiative to streamline the sales process and improve efficiency for both dealers and customers.

- In February 2023, Solifi and One Auto API partnered to combine their expertise, enhancing Solifi’s DataDirect™ vehicle data offering for the UK’s automotive finance sector. This collaboration provides lenders and dealers with comprehensive, real-time vehicle data solutions to improve decision-making.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Provider, Finance Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly adopt fully digital loan ecosystems that streamline approvals and enhance customer experience.

- AI-driven credit assessment models will strengthen risk prediction and broaden access for new-to-credit consumers.

- Captive finance companies will expand customised financing programs to support rising demand for electric and hybrid vehicles.

- Fintech–bank partnerships will grow as institutions leverage technology to accelerate underwriting and reduce processing time.

- Subscription-based mobility and flexible ownership models will prompt lenders to redesign financing structures.

- Telematics-enabled data insights will improve loan pricing accuracy and reduce default risks.

- Online vehicle retailing will drive demand for integrated, real-time financing solutions at the point of purchase.

- Regulatory focus on consumer protection and transparency will shape product offerings and compliance frameworks.

- Used-vehicle financing will expand as buyers seek cost-efficient mobility options with structured repayment terms.

- Green financing products and incentives will gain prominence as sustainability priorities influence lending strategies.