Market Overview

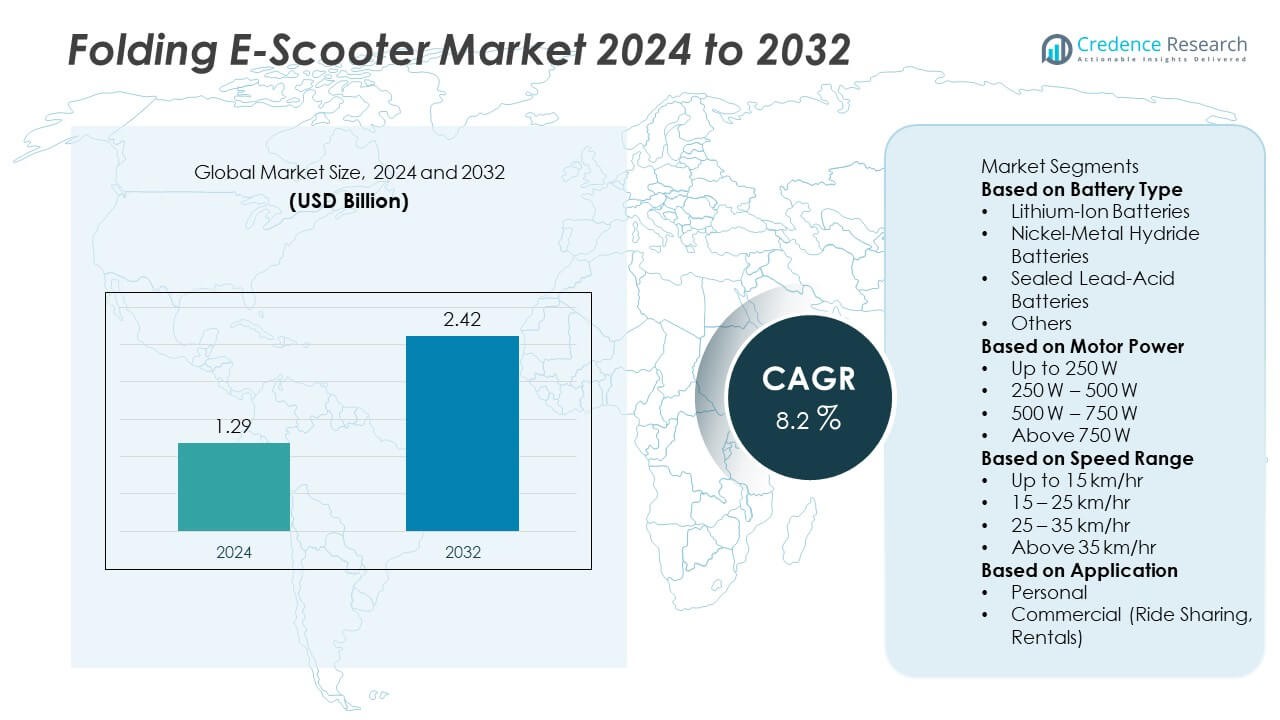

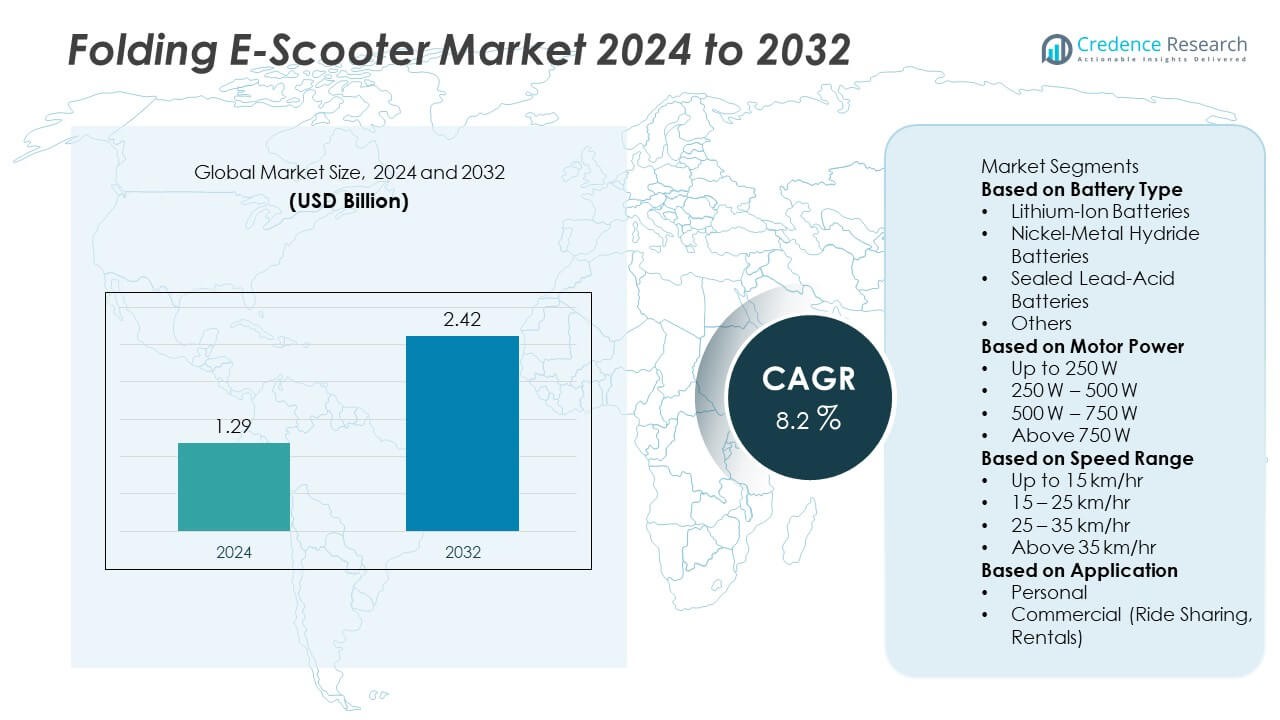

The Folding E-Scooter Market was valued at USD 1.29 billion in 2024 and is projected to reach USD 2.42 billion by 2032, growing at a CAGR of 8.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Folding E-Scooter Market Size 2024 |

USD 1.29 Billion |

| Folding E-Scooter Market, CAGR |

8.2% |

| Folding E-Scooter Market Size 2032 |

USD 2.42 Billion |

The Folding E-Scooter Market is led by major companies including Xiaomi Corporation, Segway-Ninebot, Razor USA LLC, Turboant, Glion, Megawheels, Swagtron, Unagi Scooters, GoTrax, and EcoReco. These manufacturers emphasize innovation in design, lightweight materials, and improved battery performance to meet rising urban commuting needs. North America dominated the market with a 35% share in 2024, supported by strong adoption of personal mobility devices and growing e-scooter sharing networks. Europe followed with 32%, driven by sustainability policies and widespread acceptance of electric transportation. Asia-Pacific held 27% share, emerging as the fastest-growing region due to large-scale production and government incentives for green mobility adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Folding E-Scooter Market was valued at USD 1.29 billion in 2024 and is projected to reach USD 2.42 billion by 2032, growing at a CAGR of 8.2%.

- Rising demand for compact, eco-friendly urban mobility solutions and increasing government incentives for electric vehicles are driving market growth.

- Integration of smart connectivity features, lightweight materials, and improved lithium-ion battery technology are key trends shaping product innovation.

- Leading players such as Xiaomi Corporation, Segway-Ninebot, Razor USA LLC, and Unagi Scooters focus on expanding product portfolios and forming partnerships with shared mobility platforms.

- North America led the market with 35% share in 2024, followed by Europe with 32% and Asia-Pacific with 27%, while the 250 W–500 W motor power segment dominated with 47% share, driven by its efficiency and suitability for daily urban commuting.

Market Segmentation Analysis:

By Battery Type

Lithium-ion batteries dominated the Folding E-Scooter Market with a 63% share in 2024. Their higher energy density, faster charging, and longer lifespan make them ideal for lightweight and portable scooters. Growing demand for sustainable and high-performance battery solutions supports their use in both personal and commercial scooters. Nickel-metal hydride and sealed lead-acid batteries remain secondary due to higher weight and lower efficiency. Advancements in lithium battery technology and declining production costs continue to drive this segment’s dominance in electric mobility applications.

- For instance, Segway-Ninebot’s Max G2 model employed a 551 Wh battery that recharges in approximately 6 hours with its built-in charger. An external 5A fast charger, which is sold separately, can halve the charge time. The scooter’s battery management system is designed to promote longevity.

By Motor Power

The 250 W – 500 W motor power segment held a 47% share in 2024, making it the leading category in the Folding E-Scooter Market. These models balance performance, portability, and affordability, ideal for urban commuters seeking efficient short-distance travel. They offer moderate speed, good climbing ability, and energy efficiency suited for daily use. Models above 500 W are gaining traction in premium and shared mobility segments, while low-power models serve entry-level users. Increasing urban traffic congestion and the need for compact transport drive this segment’s expansion.

- For instance, the Unagi Model One Voyager uses dual 250 W motors delivering a combined peak output of 1,000 W and a top speed of 32 km/h (20 mph). The TurboAnt M10 Lite employs a 350 W brushless motor enabling ascent on 15% gradients and reaching a top speed of 26 km/h (16 mph).

By Speed Range

The 25–35 km/hr speed range dominated the market with a 42% share in 2024. This category offers the best balance between performance, safety, and battery efficiency for city commutes. It meets regulatory limits in most urban regions while offering sufficient speed for short and mid-distance travel. The segment benefits from strong consumer preference for reliable and comfortable rides. Higher-speed models above 35 km/hr are seeing gradual adoption in specialized commercial and recreational uses, supported by improvements in motor control, braking systems, and safety standards.

Key Growth Drivers

Rising Urban Commuting Demand

The growing need for compact, eco-friendly, and cost-efficient commuting solutions is a major driver of the Folding E-Scooter Market. Urban populations are increasingly adopting foldable electric scooters for short-distance travel due to traffic congestion and limited parking space. Their portability and low maintenance make them ideal for city environments. Governments promoting electric mobility and shared transportation systems further strengthen market adoption across developed and emerging regions.

- For instance, GoTrax introduced its Apex LE model weighing 14.5 kg, enabling daily commuters to integrate micro-mobility with public transport systems efficiently.

Technological Advancements in Battery and Motor Systems

Continuous improvements in lithium-ion battery efficiency and compact motor design are boosting the performance of folding e-scooters. These advancements have increased mileage, reduced charging time, and enhanced scooter durability. Lightweight frames and regenerative braking systems also contribute to longer operating life and better user convenience. Manufacturers are investing in integrating smart connectivity features such as Bluetooth tracking and app-based controls to attract tech-savvy urban consumers.

- For instance, Xiaomi’s Electric Scooter 5 Max uses a regenerative braking system and features a motor with a maximum power output of 1,000 W. While the system can be configured through the Xiaomi Home app to recover energy, the manufacturer does not specify an exact percentage of energy recovery.

Environmental Regulations and Green Mobility Initiatives

Global efforts to reduce carbon emissions are fueling demand for electric two-wheelers, including folding e-scooters. Governments are introducing incentives, tax benefits, and infrastructure support for electric mobility adoption. Urban policies favoring low-emission zones and sustainable transportation have increased consumer preference for e-scooters over conventional fuel vehicles. The rising environmental awareness among younger commuters continues to accelerate the market’s shift toward clean, efficient urban transport options.

Key Trends & Opportunities

Integration of Smart and Connected Technologies

Smart folding e-scooters equipped with IoT features, GPS tracking, and mobile app connectivity are gaining traction. These systems allow users to monitor performance metrics, battery status, and navigation in real time. Fleet operators and shared mobility providers are leveraging these technologies for remote management and maintenance. The growing demand for connected mobility and digital convenience presents a major opportunity for manufacturers to enhance customer experience and brand differentiation.

- For instance, Segway-Ninebot integrates its proprietary Segway App with Bluetooth, enabling features such as speed tracking, riding statistics, and diagnostics. Unagi Scooters utilize OTA (Over-the-Air) firmware updates through its Unagi App, providing remote software updates and fault detection.

Growth of Shared Mobility and Last-Mile Delivery Applications

The increasing adoption of folding e-scooters in ride-sharing and last-mile delivery services is creating new market opportunities. Their portability and low operating cost make them ideal for dense urban environments. Delivery companies and micromobility startups are deploying compact e-scooter fleets to enhance service efficiency and reduce emissions. The trend is further supported by partnerships between e-scooter manufacturers and mobility platforms seeking sustainable last-mile transport solutions.

- For instance, Lime operates over 200,000 e-scooters across 280 cities worldwide, supported by its fleet of swappable-battery models developed with Segway. The company reported completing 500 million rides using its shared micromobility fleet, reducing CO₂ emissions by approximately 90,000 metric tons through electric last-mile operations.

Key Challenges

Safety and Durability Concerns

Safety issues related to battery overheating, braking performance, and limited visibility remain key concerns for users. Frequent wear and tear in folding mechanisms and tires also affect long-term reliability. Manufacturers are working to enhance structural integrity and incorporate advanced safety systems. However, lack of standardized safety regulations across regions continues to challenge market growth and consumer confidence.

Infrastructure Limitations and Charging Availability

Limited charging infrastructure in urban areas hinders large-scale adoption of folding e-scooters. Many cities still lack dedicated parking and charging stations, reducing convenience for commuters. Inconsistent electricity access in developing regions further restricts growth. Expanding fast-charging networks and integrating portable battery systems are critical to overcoming this challenge and ensuring sustained market development.

Regional Analysis

North America

North America held the largest share of 35% in the Folding E-Scooter Market in 2024. The region’s growth is driven by increasing adoption of eco-friendly personal mobility solutions and supportive government policies promoting electric vehicles. The United States dominates due to strong urban commuting demand, high purchasing power, and expanding e-scooter rental networks. Leading manufacturers are introducing lightweight and connected models tailored for city travel. Investments in charging infrastructure and sustainable transport initiatives are further strengthening market penetration across metropolitan areas such as New York, Los Angeles, and Toronto.

Europe

Europe accounted for 32% of the Folding E-Scooter Market in 2024, supported by stringent emission regulations and widespread electric mobility adoption. Countries such as Germany, France, and the United Kingdom are leading users, driven by dense urban populations and strong environmental awareness. The presence of advanced manufacturing facilities and smart city projects boosts the deployment of folding e-scooters in shared mobility programs. Government subsidies for low-emission vehicles and dedicated cycling lanes continue to encourage e-scooter commuting, positioning Europe as a major hub for sustainable urban transportation development.

Asia-Pacific

Asia-Pacific captured a 27% share of the global Folding E-Scooter Market in 2024 and is projected to grow fastest through 2032. Rapid urbanization, rising fuel costs, and increasing demand for affordable mobility solutions drive adoption. China, Japan, and India dominate regional growth, supported by large-scale production, growing e-commerce penetration, and government incentives for electric vehicles. Expanding urban infrastructure and the availability of compact, low-cost models strengthen market expansion. Asia-Pacific’s dominance in battery manufacturing and component supply also provides a competitive edge in global production and distribution.

Latin America

Latin America accounted for a 4% share of the Folding E-Scooter Market in 2024. The region’s growth is driven by increasing urban congestion and rising awareness of eco-friendly mobility options. Brazil and Mexico lead demand due to expanding ride-sharing services and growing interest in sustainable personal transport. However, limited charging infrastructure and high import costs hinder large-scale adoption. Governments are promoting electric vehicle incentives to reduce emissions, which is expected to enhance market opportunities in the coming years, especially within urban centers with improving road networks.

Middle East & Africa

The Middle East & Africa held a 2% share of the Folding E-Scooter Market in 2024. Growth is primarily fueled by smart city projects and government-led sustainability initiatives in GCC countries. The UAE and Saudi Arabia are early adopters, with strong investments in urban mobility innovation and e-transport infrastructure. Rising youth populations and growing awareness of personal electric vehicles are supporting gradual adoption. In Africa, market penetration remains low due to affordability and infrastructure limitations, but increasing interest in micro-mobility and renewable transport solutions is driving early development.

Market Segmentations:

By Battery Type

- Lithium-Ion Batteries

- Nickel-Metal Hydride Batteries

- Sealed Lead-Acid Batteries

- Others

By Motor Power

- Up to 250 W

- 250 W – 500 W

- 500 W – 750 W

- Above 750 W

By Speed Range

- Up to 15 km/hr

- 15 – 25 km/hr

- 25 – 35 km/hr

- Above 35 km/hr

By Application

- Personal

- Commercial (Ride Sharing, Rentals)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Folding E-Scooter Market features key players such as Xiaomi Corporation, Segway-Ninebot, Razor USA LLC, Turboant, Glion, Megawheels, Swagtron, Unagi Scooters, GoTrax, and EcoReco. These companies focus on innovation, lightweight design, and enhanced battery efficiency to meet rising urban mobility demands. Market leaders are investing in advanced lithium-ion batteries, smart connectivity, and foldable frame technologies to improve portability and performance. Strategic partnerships with ride-sharing platforms and retail distributors help expand market reach globally. North American and European manufacturers emphasize quality and compliance with safety standards, while Asia-Pacific players dominate production through cost-effective manufacturing. Continuous R&D in compact motor systems, IoT integration, and sustainability-driven materials is shaping competition and driving differentiation in this rapidly evolving micro-mobility market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Segway-Ninebot launched the Ninebot Max G3 featuring RideyLONG battery optimization and enhanced safety locking. The model’s presale began on March 6 with full release on March 25, marking its latest folding-scooter upgrade.

- In January 2024, Cambridge-based Riley Scooter launched a new RS3 e-scooter in the United States. It is considered the world’s first-ever compact and foldable e-scooter.

- In October 2023, Unagi Scooter opened its first flagship showroom in New York City, offering customers a hands-on experience with its folding e-scooter models and emphasizing its direct-to-consumer retail strategy.

Report Coverage

The research report offers an in-depth analysis based on Battery Type, Motor Power, Speed Range, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for folding e-scooters will continue to rise with growing urbanization and traffic congestion.

- Advancements in battery technology will enhance range, charging speed, and overall performance.

- Lightweight and compact designs will gain preference among daily commuters.

- Integration of IoT and smart connectivity will improve safety and user convenience.

- Shared mobility and rental services will expand adoption in major cities.

- Asia-Pacific will experience the fastest growth due to mass production and affordability.

- Governments will strengthen regulations supporting electric mobility and green transport.

- Manufacturers will focus on sustainability through recyclable materials and energy-efficient systems.

- Online retail and direct-to-consumer sales channels will boost market accessibility.

- Continuous innovation in foldable frame technology and motor efficiency will drive competitiveness.